Global Low Cost Airline Market by Product Type (Domestic, International), By Application (Leisure Travel, Business Travel), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Oct 2024

- Report ID: 27577

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

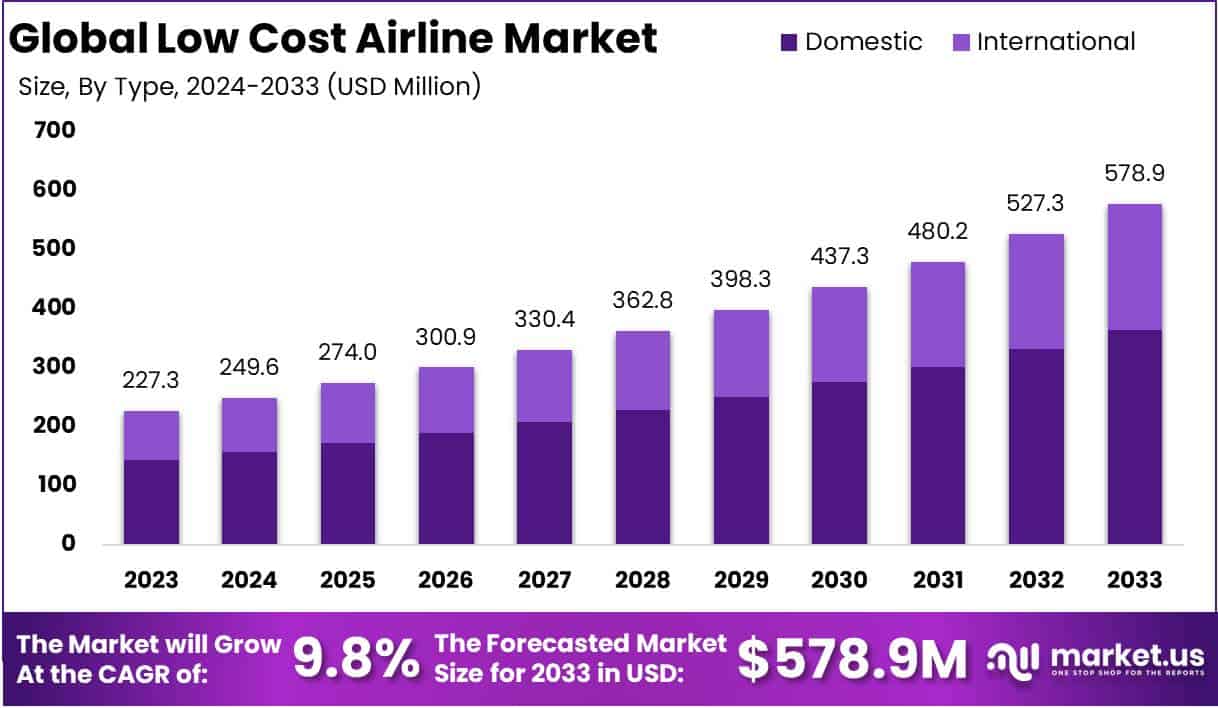

The Global Low Cost Airline Market size is expected to be worth around USD 578.9 Million by 2033, from USD 227.3 Million in 2023, growing at a CAGR of 9.8% during the forecast period from 2024 to 2033.

The low-cost airline market consists of carriers that focus on minimizing operational costs and offering competitive fares. This segment is particularly appealing to budget-conscious leisure and business travelers, driven by a business model that emphasizes cost efficiency through streamlined operations, point-to-point routing, and additional charges for services traditionally included in airfares.

The growth of this market is propelled by several factors: economic efficiency, which attracts price-sensitive customers the expansion of global tourism, especially in emerging markets; deregulation and liberalization of air travel, which allow for increased route and market expansion and technological advancements that streamline booking and marketing processes.

The low-cost airline sector is bolstered by the growing affordability of air travel, which has democratized travel access to a broader audience. Consumers increasingly prioritize budget options for shorter trips, and the trend towards more frequent leisure travel among younger demographics continues to drive demand.

Additionally, low-cost carriers frequently operate in less congested secondary airports, further reducing costs and attracting a segment of travelers who value convenience and speed over other amenities.

The low-cost airline market are significant. Geographic expansion into rapidly growing air travel markets like Asia-Pacific and Africa offers new revenue streams. There’s also potential in capturing a share of the business travel sector by targeting small and medium enterprises (SMEs) with flexible, cost-effective travel options.

Moreover, ancillary revenue streams, such as fees for seat selection, priority boarding, and partnerships for accommodation and transport services, provide substantial growth avenues.

As environmental sustainability becomes increasingly important, low-cost carriers that invest in more fuel-efficient fleets and adopt greener practices can enhance their market appeal, aligning with the preferences of eco-conscious travelers.

This market segment, known for its resilience and adaptability, continues to evolve, presenting ongoing opportunities for innovation and growth in the global airline industry.

According to SpiceJet News on August 14, 2024, SpiceJet recorded its second consecutive profitable quarter, signaling robust resilience and strategic recovery in the low-cost airline market. The carrier achieved a net profit of INR 150 Crore for Q1 FY2025, marking a 26% increase from INR 119 Crore in Q4 FY2024.

Operating profit grew by 27% to INR 393 Crore, compared to INR 310 Crore in the previous quarter, while EBITDA rose to INR 401 Crore from INR 386 Crore. Notably, EBITDAR reached INR 650 Crore, up from INR 616 Crore, reflecting operational efficiency.

With a 91% domestic load factor the highest in the sector SpiceJet also announced a Board-approved capital raise of up to INR 3,000 Crore through a Qualified Institutional Placement, further strengthening its financial position.

According to OAG Aviation, Low-Cost Carriers (LCCs) generate 33% of all scheduled airline seats weekly and operate 30% of flights, making them the fastest-growing segment. Four of the current top ten airlines operate as LCCs.

By the end of 2024, the aviation market will include 5.9 billion seats and 36.7 million flights, offering travelers more airline choices, products, and scheduling options.

According to Wikipedia, as of July 2024, Southwest Airlines operates 816 aircraft, making it the fourth-largest commercial airline fleet globally. All its aircraft are Boeing 737s, highlighting strategic fleet standardization. As the largest operator of the Boeing 737, Southwest exemplifies cost efficiency in the low-cost airline market.

Key Takeaways

- The Global low-cost airline market is projected to experience substantial growth, expanding from USD 227.3 million in 2023 to an estimated USD 578.9 million by 2033, registering a compound annual growth rate (CAGR) of 9.8% from 2024 to 2033.

- The Domestic Segment led the market in 2023, capturing 63% of the share, fueled by the post-pandemic recovery and rising demand for cost-effective, short-haul travel.

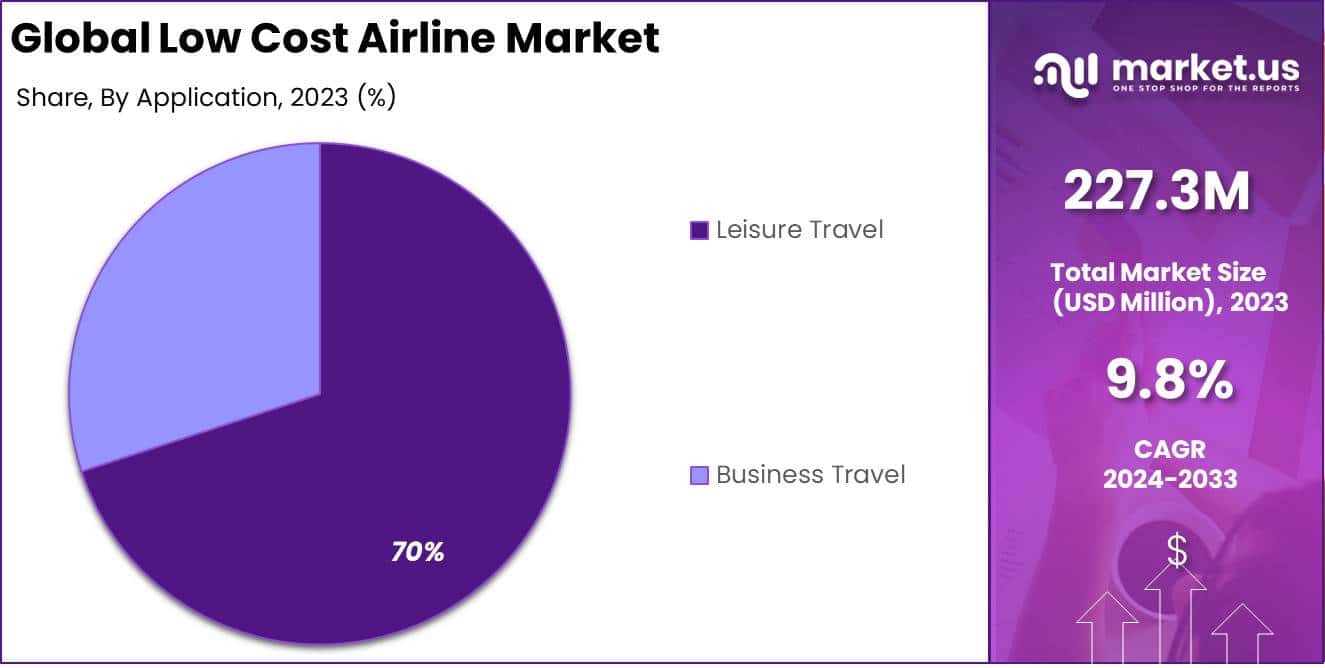

- Leisure Travel dominated with 70% market share in 2023, reflecting strong consumer preference for budget-friendly vacations and spontaneous travel experiences.

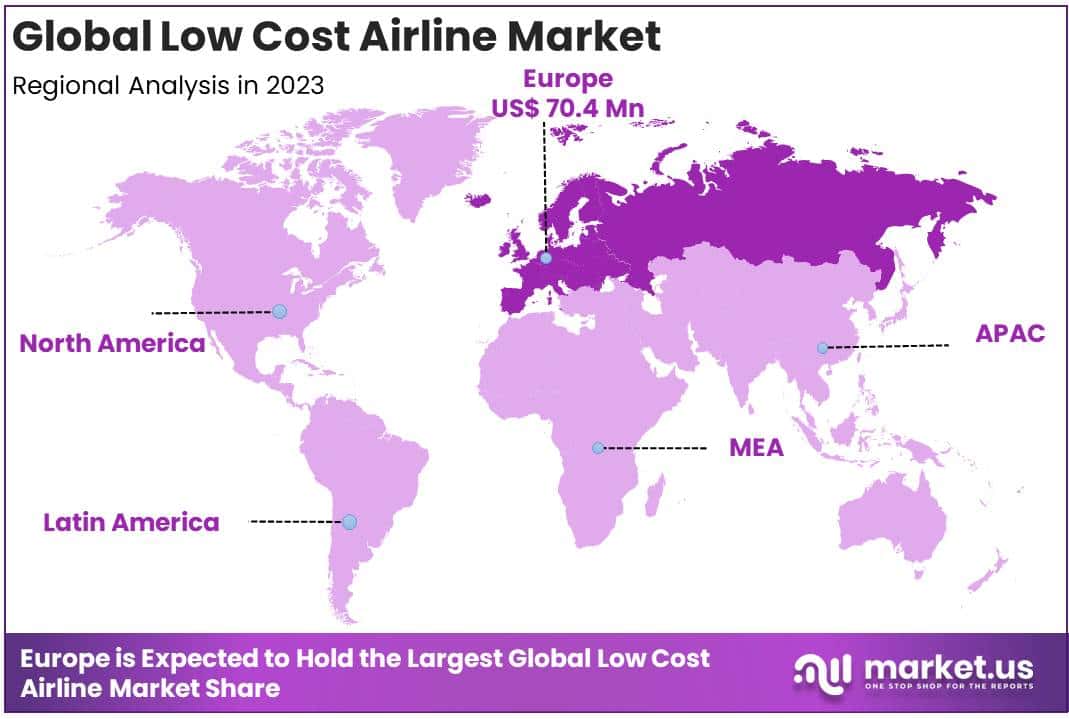

- Europe accounted for 31% of the market share in 2023, driven by well-developed infrastructure, competitive pricing, and extensive low-cost routes.

By Type Analysis

Domestic Segment Leads The Low Cost Airline Market with 63% Market Share in 2023

In 2023, the Domestic segment emerged as the dominant force in the Low Cost Airline Market, accounting for over 63% of the market share in the by Type category. This significant lead is driven by the swift recovery of domestic air travel post-pandemic, as passengers increasingly favored short-haul routes that offer greater affordability and flexibility.

Key factors contributing to this trend include improved regional connectivity, government efforts to enhance infrastructure, and the aggressive expansion of budget airlines into second- and third-tier cities.

Additionally, low-cost carriers have been successful in attracting cost-conscious travelers through competitive pricing and frequent promotions, making domestic flights more appealing than alternative transportation modes.

Meanwhile, the International segment captured the remaining share of the market. While international low-cost travel is steadily rising spurred by relaxed visa policies, emerging routes, and growing demand for budget-friendly vacations its market share remains smaller due to factors such as regulatory complexities and higher operational costs.

Nonetheless, international travel continues to exhibit growth potential, particularly in the Asia-Pacific and European regions. The overall trend underscores a clear consumer preference for domestic air travel, cementing its position as the leading segment in 2023.

By Application Analysis

Leisure Travel Segment Dominates The Low Cost Airline Market with 70% Market Share in 2023

In 2023, Leisure Travel emerged as the leading segment in the by application category of the Low Cost Airline Market, capturing over 70% of the market share. The strong performance of this segment is primarily driven by rising demand for budget-friendly vacations, increased disposable incomes, and changing consumer preferences toward affordable, spontaneous travel experiences.

With a surge in domestic tourism and a growing trend of weekend getaways low-cost carriers have become the preferred choice for travelers seeking economical leisure trips. Moreover, promotional fares, bundled deals, and expanded routes to popular vacation destinations have further propelled this segment’s growth.

Conversely, the Business Travel segment accounted for the remaining market share. While business travel has been recovering steadily, its growth has lagged behind that of leisure travel due to the increased adoption of remote work, virtual meetings, and cost-cutting measures by corporations.

Although low-cost airlines have targeted the business segment with flexible booking options and affordable last-minute fares, the preference for budget carriers among business travelers is still limited compared to leisure travelers.

However, as face-to-face interactions regain importance and companies begin to relax travel budgets, business travel in this segment is expected to witness gradual growth in the coming years.

Key Market Segments

By Type

- Domestic

- International

By Application

- Leisure Travel

- Business Travel

Driver

Rising Tourism Activities

The increasing global tourism activities are significantly driving the demand for low-cost airlines, as travelers seek affordable means of transportation. Tourism has been rebounding rapidly post-pandemic, with many countries actively promoting their destinations to attract international visitors.

In particular, popular tourist regions such as Southeast Asia, Europe, and Latin America have seen a notable surge in tourist arrivals, supported by relaxed visa regulations, better marketing efforts, and rising disposable incomes in key markets like China and India.

As more tourists seek cost-effective travel options, low-cost carriers (LCCs) offer a compelling value proposition by providing point-to-point connections and budget-friendly fares, making them the preferred choice for leisure travelers.

This increase in tourism is not limited to international travel domestic tourism is also a major contributor. Low-cost airlines are leveraging this trend by expanding domestic routes and increasing flight frequencies to popular tourist destinations, further enhancing convenience and accessibility for travelers.

Budget airlines are also focusing on regional connectivity, often introducing flights to smaller airports that are closer to tourist hotspots, thereby capturing a larger share of the tourism-driven passenger base. This strategic alignment with growing tourism patterns not only boosts passenger volumes but also contributes to broader economic growth, creating a positive cycle that sustains the low-cost airline market.

Restraint

High Fuel Costs

High fuel costs represent one of the most significant constraints facing the low-cost airline market. Since fuel expenses account for a large portion of operational costs often up to 30-40% any volatility in fuel prices directly affects the profitability of low-cost carriers.

In recent years, geopolitical tensions, supply chain disruptions, and fluctuating oil production levels have contributed to increased fuel prices, putting additional pressure on operating margins. For budget airlines, which rely on maintaining low fares to attract passengers, absorbing these costs is challenging.

The inability to pass on the entire cost to consumers without affecting demand forces airlines to explore cost-cutting measures in other operational areas. Efforts to mitigate fuel costs include investing in more fuel-efficient aircraft, such as the Boeing 737 MAX and Airbus A320neo, which offer better fuel economy and lower carbon emissions.

Additionally, airlines are implementing fuel hedging strategies to stabilize fuel costs in the short term, providing a buffer against sudden price surges. While these measures offer some relief, the long-term impact of rising fuel costs on the low-cost airline sector remains a critical concern, potentially limiting growth prospects and affecting ticket pricing strategies.

Opportunity

Sustainability Initiatives

The increasing focus on sustainability is emerging as a key opportunity for low-cost airlines to enhance their market positioning and cater to environmentally conscious travelers. With regulatory bodies worldwide pushing for lower carbon emissions, budget carriers are exploring ways to reduce their environmental footprint while maintaining cost efficiency.

Strategies include investing in newer, more fuel-efficient aircraft, adopting sustainable aviation fuels (SAFs), and implementing carbon offset programs. For example, leading LCCs are exploring partnerships with fuel producers to incorporate SAFs into their operations, which can reduce carbon emissions by up to 80% compared to conventional jet fuel.

The emphasis on sustainability not only aligns with regulatory compliance but also offers a competitive edge. Airlines that can demonstrate a commitment to greener operations are more likely to attract a growing segment of eco-conscious passengers, especially millennials and Gen Z travelers.

Additionally, sustainability initiatives can enhance brand reputation, open up new investment opportunities, and even enable access to green financing options. By positioning themselves as environmentally responsible carriers, low-cost airlines can achieve growth while contributing to broader industry sustainability goals, making it a win-win situation.

Trends

Digitalization and Technology Integration

The adoption of digital technologies is playing a crucial role in transforming the low-cost airline sector. From booking platforms and mobile apps to AI-powered customer service and operational automation, digitalization is enhancing both the customer experience and operational efficiency for budget airlines.

Digital tools enable airlines to streamline processes, reduce overhead costs, and improve passenger engagement, all of which are vital for maintaining competitiveness in the cost-sensitive low-cost market.

For instance, mobile check-in, self-service kiosks, and real-time flight updates have become standard features for most budget carriers, reducing dependence on staff and lowering operational expenses.

Furthermore, airlines are increasingly using big data analytics and AI for demand forecasting, dynamic pricing, and route optimization. These technologies allow airlines to better manage capacity, offer personalized services, and adjust prices based on demand patterns, thereby maximizing revenue potential.

Digital innovations are also helping in predictive maintenance, enabling airlines to minimize downtime and improve fleet utilization. As digital transformation continues to evolve, low-cost airlines are likely to see enhanced operational agility, better cost management, and increased passenger satisfaction, contributing positively to market growth.

Regional Analysis

Low-Cost Airline Market Europe Leading with 31% Market Share

The global low-cost airline market demonstrates diverse regional dynamics, with Europe emerging as the leading region, commanding 31% of the market share in 2023. The European low-cost airline sector, valued at USD 70.4 million, has been driven by strong consumer demand for budget-friendly travel options, a well-developed aviation infrastructure, and competitive pricing strategies by regional carriers.

North America also holds a significant share of the market, bolstered by the increasing popularity of no-frills carriers among both leisure and business travelers, alongside the continued expansion of key low-cost operators across major routes.

The Asia Pacific region is witnessing robust growth, supported by a surge in domestic tourism, rising disposable incomes, and a growing middle-class population seeking affordable air travel options.

Meanwhile, the Middle East & Africa region is seeing steady expansion, primarily propelled by an expanding tourism sector, with airlines focusing on budget services to cater to a broader customer base.

Latin America’s low-cost airline market is benefiting from deregulation measures, increased airline competition, and a growing inclination towards cost-effective air travel options among passengers. Europe remains the dominant region due to its mature market, extensive network of low-cost routes, and regulatory frameworks favoring cost-effective air travel solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Low-Cost Airline Market is being shaped by aggressive expansion, cost optimization, and strategic use of technology by key players. AirAsia Group Berhad focuses on expanding its Southeast Asian network while enhancing digitalization and ancillary services to boost revenue.

Meanwhile, Norwegian Air Shuttle ASA is making a strategic return to major European and transatlantic routes following financial restructuring. easyJet plc prioritizes fleet renewal for fuel efficiency, aiming to increase capacity across Europe while maintaining competitive pricing.

Ryanair Holdings plc continues to lead in Europe, utilizing its ultra-low-cost model and expanding its fleet to capture additional market share.

In North America, Alaska Air Group Inc. and JetBlue Airways Corporation focus on enhancing customer experience and expanding their routes, with Alaska reinforcing its West Coast presence and JetBlue pursuing transatlantic growth.

WestJet Airlines Ltd. and SpiceJet Limited are capitalizing on post-pandemic travel demand by enhancing domestic and regional connectivity in North America and India, respectively.

Qantas Airways and Dubai Aviation Corporation (flydubai) are positioned for growth in the Asia-Pacific and Middle East, leveraging the resumption of international travel. Go Airlines Ltd. and GOL Linhas Aéreas Inteligentes S.A. are strengthening their market positions in India and Latin America through network expansion and consolidation.

Overall, cost efficiency, fleet expansion, and strategic penetration into emerging markets are central to the competitive strategies of leading players in 2024.

Top Key Players in the Market

- AirAsia Group Berhad

- Norwegian Air Shuttle ASA

- easyJet plc

- Ryanair Holdings plc

- Alaska Air Group Inc.

- WestJet Airlines Ltd.

- Qantas Airways

- Go Airlines Ltd.

- GOL Linhas Aéreas Inteligentes S.A.

- SpiceJet Limited

- Dubai Aviation Corporation

- JetBlue Airways Corporation

- Other Key Players

Recent Developments

- In 2024, JetBlue Airways Corporation announced that it has abandoned its $3.8 billion acquisition of Spirit Airlines Inc. The decision came after the U.S. District Court for the District of Massachusetts blocked the transaction in January, stating that it violated antitrust laws intended to protect competitive markets in the United States. The court’s decision followed a 17-day trial that began in October 2023. Earlier, in March 2023, the Justice Department, alongside several states, had filed a lawsuit under Section 7 of the Clayton Act to prevent the merger.

- In October 1, 2024, Frontier Airlines, known for its ultra-low fares, unveiled 22 new routes set to launch in December. These routes will expand its network across the United States, offering travelers more budget-friendly options. With fares starting at just $19, Frontier’s announcement marks a significant milestone in the airline’s growth trajectory, providing affordable and eco-friendly travel choices for consumers nationwide.

- In 2024, Wizz Air announced plans to launch its first long-haul routes in 2025. The airline, which is recognized for its no-frills, ultra-low-cost model, will begin flights from London Gatwick to Jeddah in March, followed by a Milan to Abu Dhabi route in June. Despite the longer distance, Wizz Air will maintain its signature cost-effective service with basic amenities, offering additional services for a fee.

- In August 14, 2024, SpiceJet reported its second consecutive profitable quarter, achieving a net profit of INR 150 Crore for Q1 FY2025, a 26% increase compared to the previous quarter. This marks a significant achievement in the airline’s recovery efforts, demonstrating resilience and strategic focus amid ongoing challenges in the aviation sector.

Report Scope

Report Features Description Market Value (2023) USD 227.3 Mn Forecast Revenue (2033) USD 578.9 Mn CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Domestic, International), By Application (Leisure Travel, Business Travel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AirAsia Group Berhad, Norwegian Air Shuttle ASA, easyJet plc, Ryanair Holdings plc, Alaska Air Group Inc., WestJet Airlines Ltd., Qantas Airways, Go Airlines Ltd., GOL Linhas Aéreas Inteligentes S.A., SpiceJet Limited, Dubai Aviation Corporation, JetBlue Airways Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AirAsia Group Berhad

- Norwegian Air Shuttle ASA

- easyJet plc

- Ryanair Holdings plc

- Alaska Air Group Inc.

- WestJet Airlines Ltd.

- Qantas Airways

- Go Airlines Ltd.

- GOL Linhas Aéreas Inteligentes S.A.

- SpiceJet Limited

- Dubai Aviation Corporation

- JetBlue Airways Corporation

- Other Key Players