Global Loop-mediated Isothermal Amplification Market By Product Type (Instruments (Turbidimeters, Incubation Systems, Fluorescence Measuring Systems, and Agarose Gel Electrophoresis) and Kits & Reagents (Primer Mix, Dyes, DNA Polymerase & Primer Mix, DNA Polymerase, and Other Reagents)), By Technology (Microfluidic Technology, Modern Microsystem Technology, and Advanced Infrared Optical Technology), By Application (Diagnostic Purposes and Research Purposes), By End-user (Diagnostic Centers, Research & Academic Institutes, and Hospital Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165226

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

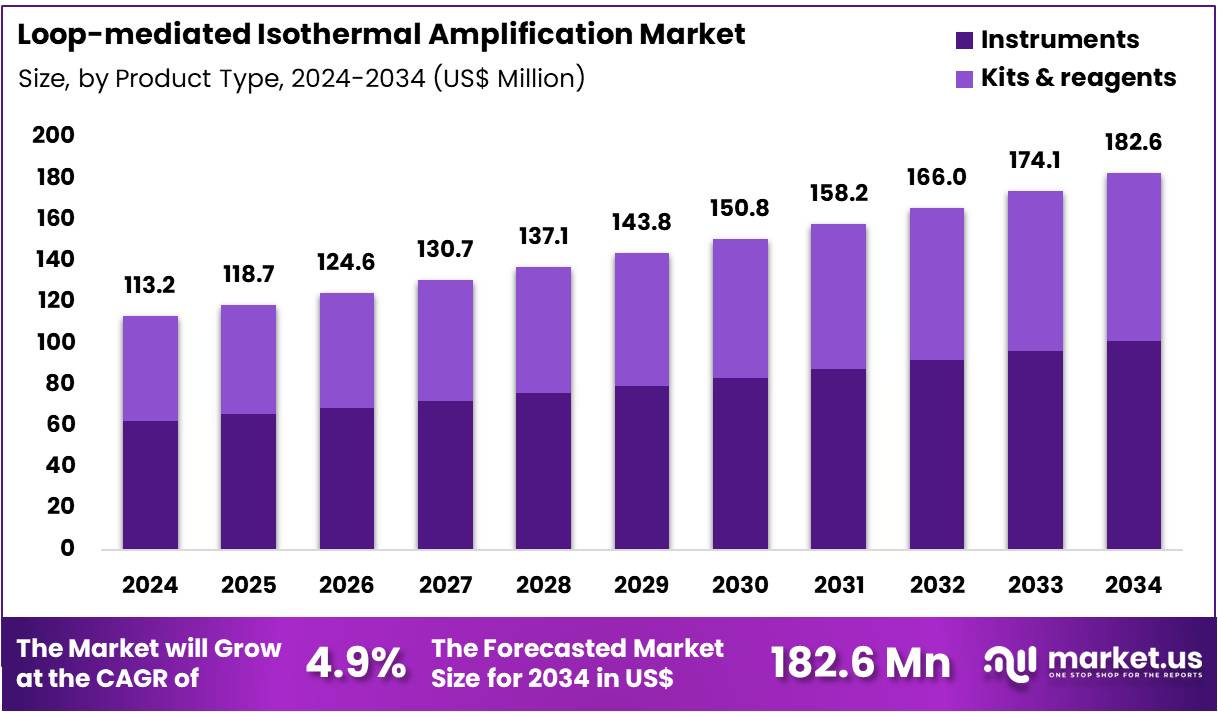

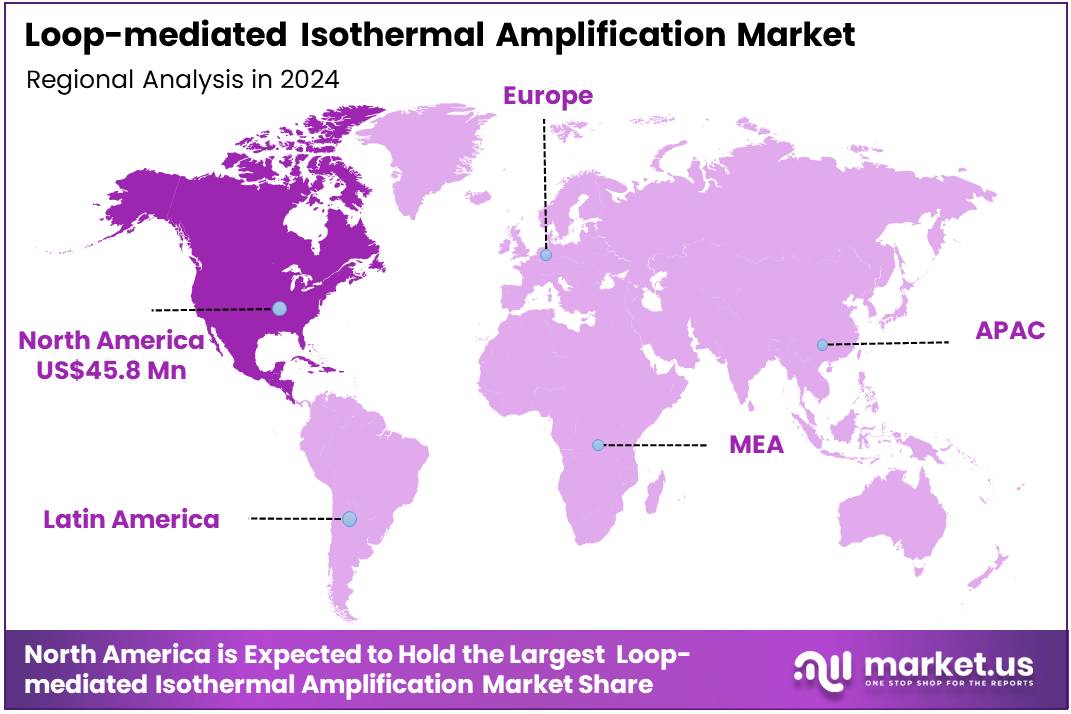

The Global Loop-mediated Isothermal Amplification Market size is expected to be worth around US$ 182.6 Million by 2034 from US$ 113.2 Million in 2024, growing at a CAGR of 4.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.5% share with a revenue of US$ 45.8 Million.

Increasing demand for rapid infectious disease diagnostics drives the Loop-mediated Isothermal Amplification Market, as LAMP technology enables swift pathogen detection without thermal cycling. Clinicians deploy RT-LAMP assays for SARS-CoV-2 screening in symptomatic patients, delivering results in under 30 minutes at point-of-care. These tests support tuberculosis management by identifying Mycobacterium tuberculosis DNA in sputum, facilitating early treatment initiation.

Veterinary laboratories apply LAMP to detect avian influenza in poultry swabs, controlling outbreaks efficiently. In 2023, Bath University researchers developed the LoCKAmp RT-LAMP test, achieving one of the fastest COVID-19 diagnostics with high portability and accuracy. This breakthrough accelerates market growth by optimizing LAMP for speed in clinical and field applications.

Growing integration of artificial intelligence creates opportunities in the Loop-mediated Isothermal Amplification Market, as AI enhances result interpretation and multi-pathogen detection. Public health officials utilize AI-coupled LAMP platforms to differentiate respiratory viruses in syndromic panels, streamlining triage during seasonal epidemics. These systems aid food safety by screening Salmonella and Listeria in processing environments, ensuring compliance with standards.

Portable LAMP devices with AI algorithms enable real-time data upload for epidemiological surveillance. In 2023, a multi-university collaboration including Surrey, Brunel, and Lancaster developed the VIDIIA Hunter platform, combining RT-LAMP with AI for precise, versatile infectious agent detection. This advancement drives market expansion through improved diagnostic reliability and adaptability.

Rising need for high-throughput screening propels the Loop-mediated Isothermal Amplification Market, as automated LAMP systems scale for mass testing scenarios. Emergency response teams employ robotic LAMP workflows for pandemic surveillance, processing thousands of samples daily. These platforms support malaria control by detecting Plasmodium in blood spots from field collections, aiding elimination programs.

Trends toward multiplex LAMP expand pathogen panels in single reactions, optimizing resource use. In November 2024, the Foundation TOMi presented SMART-LAMP in Biology Methods and Protocols, automating over 40,000 daily tests with proven scalability. This innovation positions the market for sustained growth in large-scale preparedness and routine diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 113.2 Million, with a CAGR of 4.9%, and is expected to reach US$ 182.6 Million by the year 2034.

- The product type segment is divided into instruments and kits & reagents, with instruments taking the lead in 2023 with a market share of 55.3%.

- Considering technology, the market is divided into microfluidic technology, modern microsystem technology, and advanced infrared optical technology. Among these, microfluidic technology held a significant share of 49.6%.

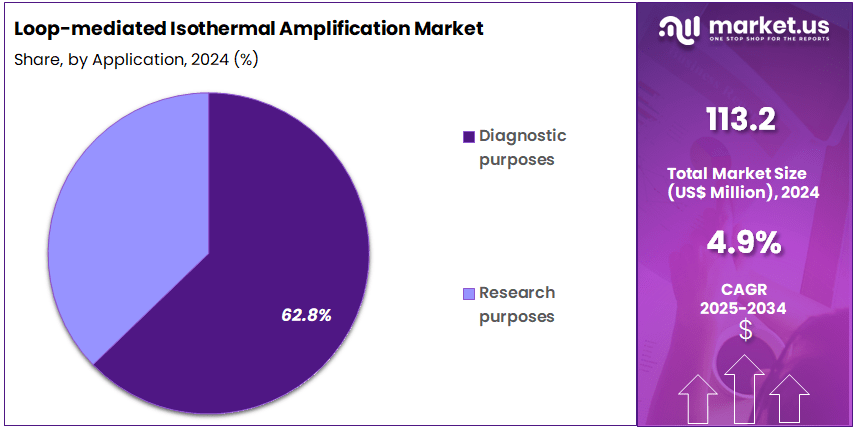

- Furthermore, concerning the application segment, the market is segregated into diagnostic purposes and research purposes. The diagnostic purposes sector stands out as the dominant player, holding the largest revenue share of 62.8% in the market.

- The end-user segment is segregated into diagnostic centers, research & academic institutes, and hospital laboratories, with the diagnostic centers segment leading the market, holding a revenue share of 46.1%.

- North America led the market by securing a market share of 40.5% in 2023.

Product Type Analysis

Instruments account for 55.3% of the Loop-mediated Isothermal Amplification (LAMP) market and are expected to maintain dominance due to increasing adoption of portable and automated systems for rapid molecular testing. These instruments are integral to enabling real-time nucleic acid amplification without complex thermal cycling, making them highly suitable for field and point-of-care diagnostics. The growing demand for affordable, easy-to-operate equipment in developing regions supports strong instrument sales.

Miniaturization and integration of user-friendly interfaces in new-generation devices enhance testing accessibility across healthcare and veterinary settings. Manufacturers are focusing on developing battery-powered and smartphone-compatible LAMP instruments for decentralized diagnostics. Technological improvements in temperature control precision and fluorescence detection strengthen assay accuracy.

The surge in infectious disease surveillance programs worldwide further drives demand. Expansion of public health initiatives targeting tuberculosis, malaria, and viral infections is projected to sustain growth. As healthcare moves toward fast, portable molecular diagnostics, LAMP instruments are anticipated to remain the most crucial product segment driving market expansion globally.

Technology Analysis

Microfluidic technology holds 49.6% of the LAMP market and is projected to dominate due to its precision, low reagent consumption, and rapid analysis capabilities. The integration of microfluidics into LAMP systems enhances reaction uniformity and reduces sample handling errors, improving overall test efficiency. The technology’s ability to perform multiplexed assays within compact lab-on-a-chip platforms supports its adoption in both clinical and environmental diagnostics.

Researchers and manufacturers are leveraging microfluidic innovation to achieve faster pathogen detection with minimal sample volume. Continuous advancements in microfabrication are allowing cost-effective production of disposable cartridges for large-scale testing. The COVID-19 pandemic accelerated the adoption of microfluidic LAMP devices for decentralized diagnostics. Development of integrated microfluidic LAMP systems compatible with smartphones and cloud-based analysis improves data tracking and accessibility.

Government support for rapid disease screening and surveillance programs enhances implementation in low-resource settings. As demand for portable, real-time molecular testing grows, microfluidic-based LAMP platforms are anticipated to be the primary driver of technological transformation in this market.

Application Analysis

Diagnostic purposes dominate the LAMP market with 62.8% share and are anticipated to remain the key application area due to the technology’s speed, sensitivity, and minimal equipment requirements. LAMP enables rapid detection of pathogens including viruses, bacteria, and parasites within 30 to 60 minutes, making it ideal for clinical diagnostics and outbreak control. Growing demand for early disease detection, particularly for infectious and genetic disorders, supports its clinical relevance.

Hospitals and diagnostic laboratories increasingly favor LAMP-based assays for their operational efficiency and low cost per test. The development of multiplex diagnostic panels enables simultaneous detection of multiple pathogens from a single sample. National public health programs are incorporating LAMP assays for surveillance of malaria, dengue, and respiratory diseases.

Partnerships between biotech firms and healthcare agencies are expanding assay validation across regional pathogen strains. Rising use in veterinary and food safety diagnostics further broadens its clinical footprint. With ongoing innovation in assay automation and digital reporting, LAMP-based diagnostics are projected to shape the future of rapid molecular testing globally.

End-User Analysis

Diagnostic centers contribute 46.1% to the LAMP market and are projected to maintain leadership due to their extensive role in providing molecular diagnostic testing at scale. The rising prevalence of infectious diseases and the need for rapid diagnostic turnaround are driving the adoption of LAMP technology in these facilities. Diagnostic centers benefit from the technology’s ability to deliver accurate results without sophisticated laboratory infrastructure.

The affordability of LAMP instruments and reagents enables widespread implementation across urban and semi-urban healthcare settings. Integration of LAMP systems with digital reporting platforms enhances efficiency and record management. Increasing collaboration between diagnostic chains and test kit manufacturers accelerates technology penetration. These centers often act as validation hubs for new LAMP assays before hospital deployment.

Government-supported diagnostic expansion programs in Asia and Africa are promoting LAMP testing adoption. Continuous staff training and workflow automation strengthen testing precision. As diagnostic centers increasingly focus on high-throughput molecular testing, their reliance on LAMP platforms is anticipated to drive long-term market growth and accessibility.

Key Market Segments

By Product Type

- Instruments

- Turbidimeters

- Incubation Systems

- Fluorescence Measuring Systems

- Agarose Gel Electrophoresis

- Kits & Reagents

- Primer Mix

- Dyes

- DNA Polymerase & Primer Mix

- DNA Polymerase

- Other Reagents

By Technology

- Microfluidic Technology

- Modern Microsystem Technology

- Advanced Infrared Optical Technology

By Application

- Diagnostic Purposes

- Research Purposes

By End-user

- Diagnostic Centers

- Research & Academic Institutes

- Hospital Laboratories

Drivers

Escalating Antimicrobial Resistance is Driving the Market

The intensifying global crisis of antimicrobial resistance has markedly advanced the loop-mediated isothermal amplification market, as this technique provides rapid, field-deployable detection of resistant pathogens to support timely antibiotic stewardship. Loop-mediated isothermal amplification assays amplify DNA at constant temperature, bypassing thermal cycling needs and enabling point-of-care identification of genes like mecA in MRSA or blaNDM in carbapenem-resistant Enterobacteriaceae. This driver is critical in clinical settings, where conventional culture methods delay results by days, allowing LAMP to guide empirical therapy and reduce inappropriate prescribing.

Laboratories are adopting LAMP kits for outbreak investigations, integrating them into surveillance networks to track resistance dissemination. The method’s simplicity suits resource-limited environments, facilitating decentralized testing in hospitals and clinics. Health authorities promote its use to combat superbug proliferation, allocating funds for assay validation and distribution. The Centers for Disease Control and Prevention documented a 20% combined rise in six key antimicrobial-resistant hospital-onset infections during the COVID-19 pandemic versus pre-pandemic baselines, with levels remaining elevated in 2022.

This increase highlights the diagnostic urgency, as LAMP assays enable swift resistance profiling to avert treatment failures. Refinements in primer design enhance specificity, accommodating diverse bacterial strains. Economically, their deployment shortens hospital durations, endorsing investments in scalable kits. International collaborations standardize LAMP protocols, ensuring consistent results across borders. This resistance escalation not only amplifies assay utilization but also reinforces LAMP’s integration in infection control frameworks. Collectively, it spurs innovations in multiplex formats, aligning diagnostics with stewardship imperatives.

Restraints

High Development and Validation Costs is Restraining the Market

The considerable expenses associated with developing and validating loop-mediated isothermal amplification assays continue to impede market growth, particularly for small-scale innovators facing resource limitations. These tests require extensive primer optimization and clinical trials to confirm sensitivity across pathogen variants, often exceeding budgetary thresholds for niche applications. This barrier discourages customization for rare resistance genes, confining offerings to high-volume targets like ESBL producers.

Payer constraints in public systems exacerbate the issue, with coverage favoring established PCR over emerging isothermal methods. Developers navigate prolonged regulatory submissions, diverting funds from scalability to documentation. The outcome sustains reliance on slower alternatives, prolonging diagnostic timelines in urgent scenarios. The U.S. Food and Drug Administration received over 20,700 submissions of all types in 2024, an increase of about 1,600 from 2023, with LAMP-based diagnostics subject to rigorous performance evaluations, contributing to extended approval durations. These filings expose procedural delays, as validation demands comprehensive dossiers.

Clinician preferences for proven technologies marginalize LAMP innovations. Efforts for cost-shared validations advance cautiously, limited by standardization challenges. These financial hurdles not only constrain expansion but also perpetuate access disparities. Thus, they necessitate partnerships to equilibrate affordability with technical advancements.

Opportunities

Expansion of Point-of-Care Infectious Disease Surveillance is Creating Growth Opportunities

The broadening of decentralized monitoring programs has generated substantial prospects for the loop-mediated isothermal amplification market, embedding isothermal assays in community-based networks for outbreak containment. These initiatives, focusing on rapid field testing, utilize LAMP to detect viral loads in respiratory samples, bridging gaps in central lab capacities. Opportunities emerge in subsidized kit procurements for remote sites, where funding supports validations for endemic diseases like tuberculosis.

Public-private alliances underwrite primer libraries, addressing variant detection in low-prevalence areas. This surveillance emphasis counters diagnostic voids, positioning LAMP as a tool for real-time epidemiology. Allocations for sentinel expansions accelerate adoptions, diversifying toward integrated viral-bacterial panels.

The World Health Organization’s Global Tuberculosis Programme reported 10.6 million new tuberculosis cases in 2022, with LAMP endorsed for rapid diagnostics in high-burden settings. This caseload validates extensible models, with programs projecting heightened reagent demands in surveillance. Innovations in battery-powered devices enhance portability, mitigating infrastructural barriers. As data platforms evolve, LAMP outputs unlock geospatial revenue streams. These monitoring enlargements not only diversify application scopes but also interweave the market into resilient public health structures.

Impact of Macroeconomic / Geopolitical Factors

Expanding infectious disease surveillance and public health grants motivate diagnostic firms to scale up loop-mediated isothermal amplification technologies for rapid pathogen detection in remote clinics, allowing field teams to deploy portable kits that curb outbreak spreads and save lives. Prolonged interest rate hikes from monetary tightening, however, squeeze R&D budgets for biotech startups, as investors shift funds to safer assets and delay funding for LAMP reagent optimizations amid uncertain returns.

Geopolitical frictions, including Taiwan Strait naval exercises, bottleneck semiconductor components for thermal cycler alternatives sourced from East Asian hubs, forcing manufacturers to absorb rerouting fees that inflate prototype timelines and expose seasonal flu testing to gaps. Macroeconomic trade barriers escalate procurement expenses for Bst polymerase enzymes from European labs, challenging contract research organizations to renegotiate supplier deals and risk project overruns in academic collaborations.

Even so, these pressures accelerate onshoring of enzyme production in Midwest facilities, spawning rugged, solar-powered LAMP devices that thrive in off-grid environments and slash logistics vulnerabilities. Surging venture capital for point-of-care innovations likewise fuels hybrid assay designs, bridging urban-rural divides and embedding real-time data into global health dashboards.

Latest Trends

Development of Smartphone-Integrated LAMP Assays is a Recent Trend

The integration of mobile technology with isothermal amplification has exemplified a transformative progression in 2024, enabling user-operated detection of pathogens via colorimetric readouts on smartphone cameras. Smartphone-linked LAMP platforms, employing lateral flow strips, provide visual endpoints for nucleic acid amplification, supporting non-lab environments in resource-constrained areas. This trend signifies a maturation toward democratized diagnostics, accommodating multiplex targets like SARS-CoV-2 and influenza in single reactions.

Regulatory validations affirm its simplicity, accelerating endorsements for community surveillance. This mobility aligns with digital health objectives, associating results to apps for remote result sharing. The approach resolves equipment dependencies, favoring setups resilient to ambient variations. Abbott Laboratories released a new version of its ID NOW™ system in June 2024, which is meant for the fast detection of COVID-19, RSV, and Influenza A/B, incorporating LAMP technology for results within 15 minutes. These demonstrations underscore viability, as implementations match molecular standards.

Forecasters anticipate guideline incorporations, elevating its role in frontline protocols. Progressive appraisals reveal discordance declines, refining operational efficiencies. The prospect envisions AI-assisted interpretations, envisioning predictive outbreak alerts. This mobile-centric evolution not only heightens diagnostic accessibility but also coordinates with decentralized surveillance mandates.

Regional Analysis

North America is leading the Loop-mediated Isothermal Amplification Market

The market in North America is anticipated to have held a 40.5% share of the global loop-mediated isothermal amplification landscape in 2024, advanced by CDC’s ongoing surveillance needs for rapid pathogen detection in point-of-care settings, where LAMP assays enable isothermal amplification without thermal cyclers, facilitating field deployment for influenza and SARS-CoV-2 differentiation in rural clinics amid seasonal respiratory threats.

Labs broadened adoption of RT-LAMP kits for nucleic acid amplification, achieving sensitivities comparable to RT-PCR in under 60 minutes for low-viral-load samples, correlating with federal funding through BARDA that supported validations for multiplex respiratory panels in emergency preparedness programs. The FDA’s emergency use authorizations for LAMP-based COVID-19 tests in 2022 extended into 2024 for variant monitoring, aligning with NIH grants for alternative amplification methods that reduced equipment costs by 50% in resource-limited veterinary and environmental applications.

Demographic vulnerabilities, including persistent flu outbreaks in elderly populations, amplified reagent procurement for community-based testing, backed by state health department initiatives for decentralized diagnostics. Technological refinements in primer design enhanced specificity for Mycobacterium tuberculosis, appealing to tuberculosis control efforts in high-immigration areas.

These elements positioned the region as a frontrunner in isothermal molecular tools. The Centers for Disease Control and Prevention documented over 14 million influenza cases in the United States during the 2023-2024 season.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as national health priorities emphasize LAMP for affordable diagnostics in tropical pathogen hotspots with limited infrastructure. Governments in India and Indonesia allocate funds to RT-LAMP kits, equipping border labs to detect dengue RNA in vector control programs for monsoon outbreaks. Diagnostic developers collaborate with regional institutes to optimize primer sets, anticipating faster identifications of malaria parasites in remote agricultural zones.

Regulatory bodies in China and South Korea subsidize portable amplification devices, enabling field teams to amplify Zika viral loads without electricity dependencies. Countrywide efforts estimate merging LAMP outputs into digital surveillance platforms, expediting responses to chikungunya surges in migrant communities.

Area molecular biologists pioneer CRISPR-enhanced variants, coordinating with WHO networks to profile antimicrobial resistance in Salmonella isolates. These measures build a resilient system for nucleic acid detection. The World Health Organization reported 6.2 million dengue cases in the Americas in 2023, with Asia Pacific trends indicating similar escalation into 2024.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the LAMP technology market drive growth by engineering compact, thermocycler-free devices that enable on-site nucleic acid amplification for swift pathogen identification in remote clinics and labs. They establish alliances with global health agencies to co-develop assay kits for emerging infections, such as dengue and Ebola, streamlining validations and expanding distribution channels.

Companies allocate substantial resources to lyophilized reagents that withstand extreme conditions, appealing to field workers in developing regions and boosting adoption rates. Leaders execute acquisitions of molecular tool startups to fuse LAMP with digital readouts, enhancing sensitivity for low-abundance targets in environmental monitoring. They intensify outreach in Latin America and the Middle East, customizing protocols to local disease profiles for subsidized tenders and partnerships. Additionally, they introduce analytics platforms with subscription models for result tracking, cultivating user loyalty and generating stable income.

Eiken Chemical Co., Ltd., founded in 1963 and headquartered in Tokyo, Japan, pioneered LAMP as the inventor of this isothermal method, commercializing Loopamp kits for tuberculosis, COVID-19, and influenza diagnostics worldwide. The firm operates subsidiaries across Asia and Europe, adhering to ISO 13485 quality standards for reliable outputs. Eiken invests in enzyme optimizations and assay expansions, serving over 50 countries with accessible tools.

CEO Hiroyuki Usui guides a dedicated team focused on innovation in point-of-care amplification. The company collaborates with WHO and NGOs to deploy solutions in low-resource settings. Eiken upholds its foundational role by integrating proprietary Bst polymerase with user-centric designs to transform molecular testing.

Top Key Players

- Thermo Fisher Scientific

- QIAGEN N.V

- NIPPON GENE CO., LTD

- New England Biolabs

- Meridian Bioscience, Inc.

- Merck KGaA

- Mast Group Ltd.

- Jena Bioscience GmbH

- HiberGene Diagnostics

- Excellgen, Inc.

Recent Developments

- In November 2024, Eiken Chemical Co., Ltd.—the original developer of LAMP technology—published its Integrated Report outlining a strategic pivot toward multi-target assays capable of detecting several pathogens simultaneously. This focus on multiplex LAMP tests positions the company to meet growing demand for comprehensive diagnostics that improve efficiency in both clinical and public health applications.

- In August 2022, LGC Clinical Diagnostics expanded its collaboration with Stanford Medicine’s Department of Obstetrics and Gynecology and Metabolic Health Center. This partnership emphasized applying LAMP technology in reproductive and metabolic health diagnostics, contributing to broader clinical adoption of molecular amplification tools across new medical disciplines.

Report Scope

Report Features Description Market Value (2024) US$ 113.2 Million Forecast Revenue (2034) US$ 182.6 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments (Turbidimeters, Incubation Systems, Fluorescence Measuring Systems, and Agarose Gel Electrophoresis) and Kits & Reagents (Primer Mix, Dyes, DNA Polymerase & Primer Mix, DNA Polymerase, and Other Reagents)), By Technology (Microfluidic Technology, Modern Microsystem Technology, and Advanced Infrared Optical Technology), By Application (Diagnostic Purposes and Research Purposes), By End-user (Diagnostic Centers, Research & Academic Institutes, and Hospital Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, QIAGEN N.V, NIPPON GENE CO., LTD, New England Biolabs, Meridian Bioscience, Inc., Merck KGaA, Mast Group Ltd., Jena Bioscience GmbH, HiberGene Diagnostics, Excellgen, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Loop-mediated Isothermal Amplification MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Loop-mediated Isothermal Amplification MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- QIAGEN N.V

- NIPPON GENE CO., LTD

- New England Biolabs

- Meridian Bioscience, Inc.

- Merck KGaA

- Mast Group Ltd.

- Jena Bioscience GmbH

- HiberGene Diagnostics

- Excellgen, Inc.