Global Logistics Finance Market Size, Share, Industry Analysis Report By Type (Payment Financing, Working Capital Finance, Asset-based Finance, Inventory Finance, Others), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical (Retail & E-commerce, Food & Beverages, Automotive, Industrial Machinery and Equipment, Consumer Electronics, Healthcare, Aerospace & Defense, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 159239

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Role of Generative AI

- Investment and Business benefits

- China Market Size

- By Type

- By Enterprise Size

- By Industry Vertical

- Key Market Segments

- Emerging Trends

- Growth Factors

- Driver Analysis

- Restraint Analysis

- Opportunities Analysis

- Trends Analysis

- Challenges Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

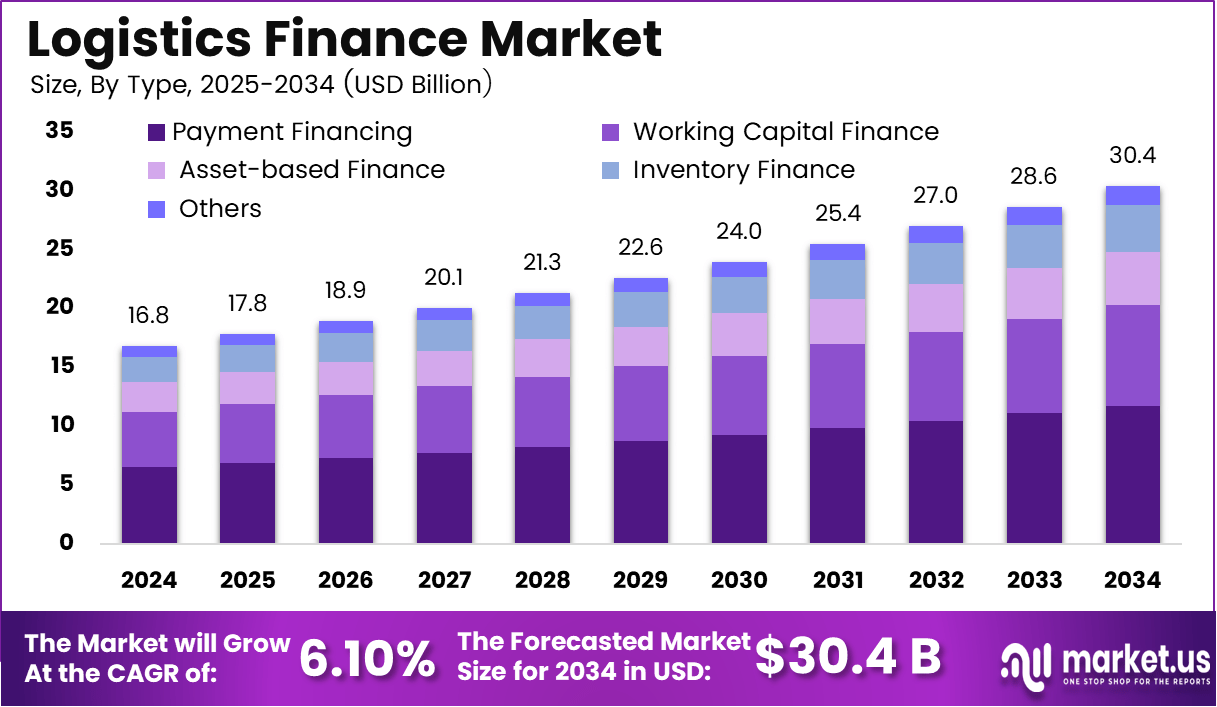

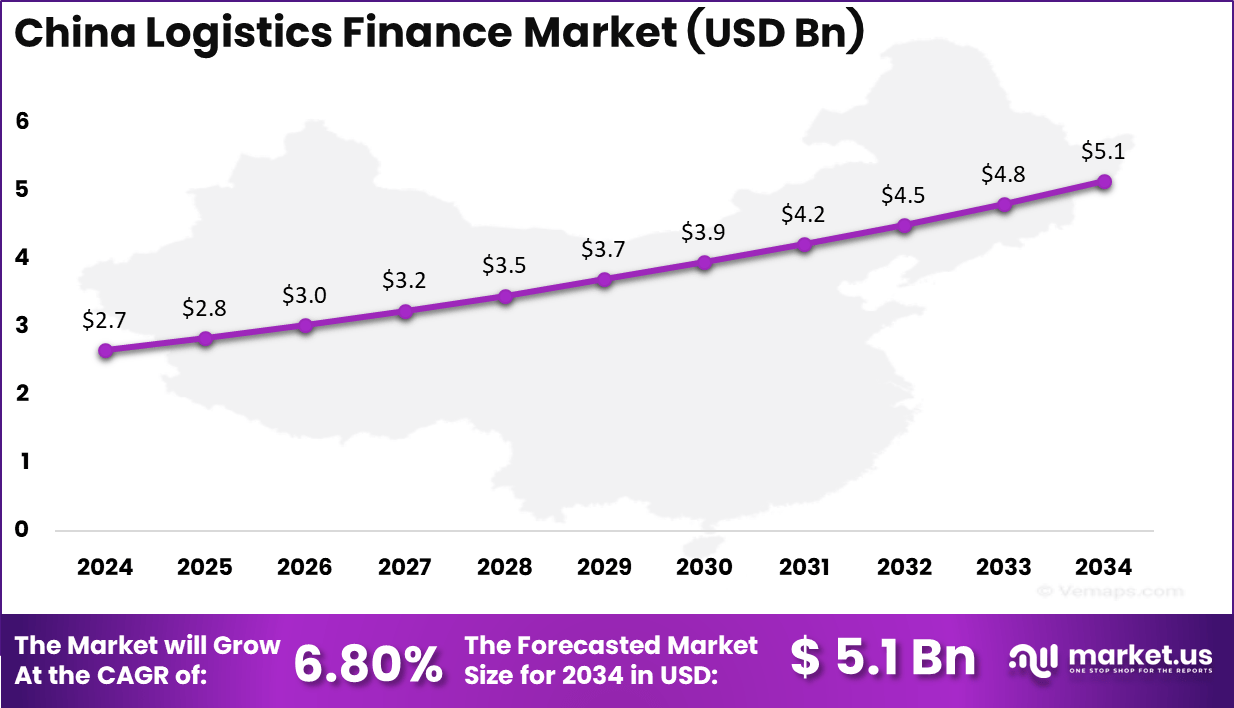

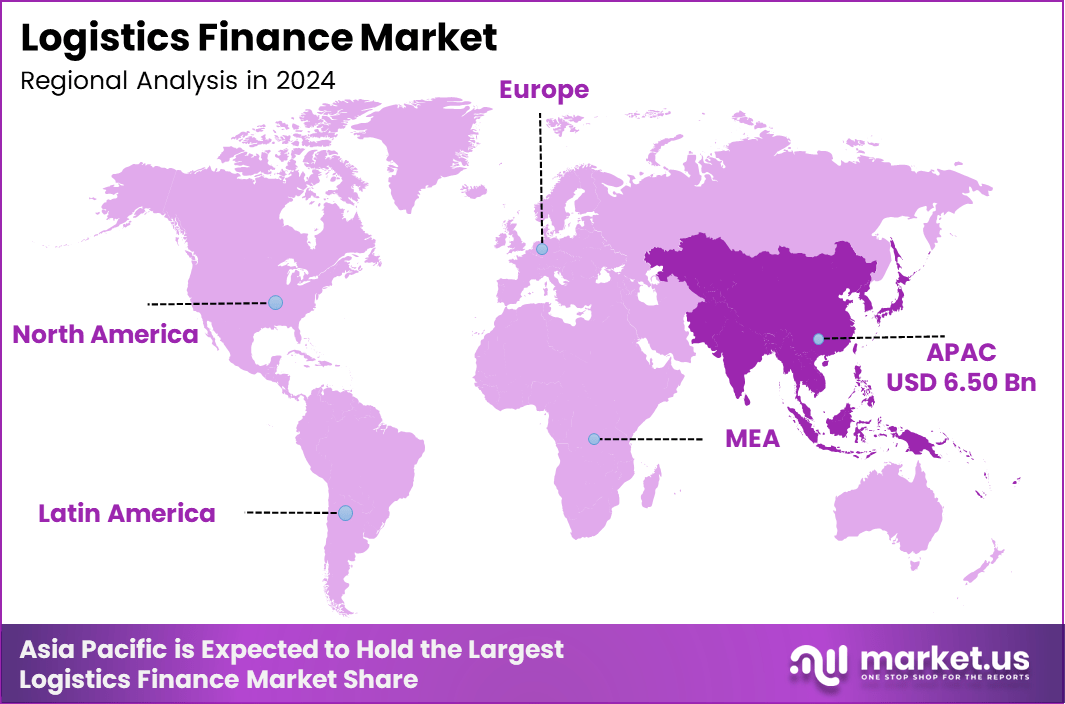

The global Logistics Finance Market is projected to reach USD 30.4 billion by 2034, growing at a CAGR of 6.10% from 2025 to 2034. Asia Pacific is the largest market, contributing USD 6.5 billion in 2024, with North America expected to hold the largest share due to advanced logistics infrastructure and the growing need for payment and asset-based financing. The China Logistics Finance Market is projected to grow at a CAGR of 6.80%, reaching USD 5.1 billion by 2034.

The logistics finance market encompasses financing solutions tailored to logistics operations such as inventory financing, freight settlement finance, warehouse receipt financing and supply chain credit for logistics providers and shippers. These services enable firms to align capital flows with physical flows of goods across supply chains. The market has been gaining attention as supply chains grow in complexity and liquidity demands rise.

Top driving factors for this market include the rapid growth of e-commerce and global trade, which have heightened demand for efficient logistics services and quick financial transactions. Increasing complexity and scale of supply chains push the need for flexible financing models that provide real-time financial insights and risk mitigation.

Additionally, the rise of third-party logistics (3PL) providers fuels the demand for specialized financial products supporting scalable operations. Technological advancements such as automation, blockchain, artificial intelligence (AI), and big data analytics enhance transparency, improve risk assessment, and speed up payment cycles, contributing to the market’s robustness.

Key Takeaways

- Payment Financing dominated with 38.7%, reflecting increased reliance on short-term credit solutions to manage working capital and supply chain liquidity.

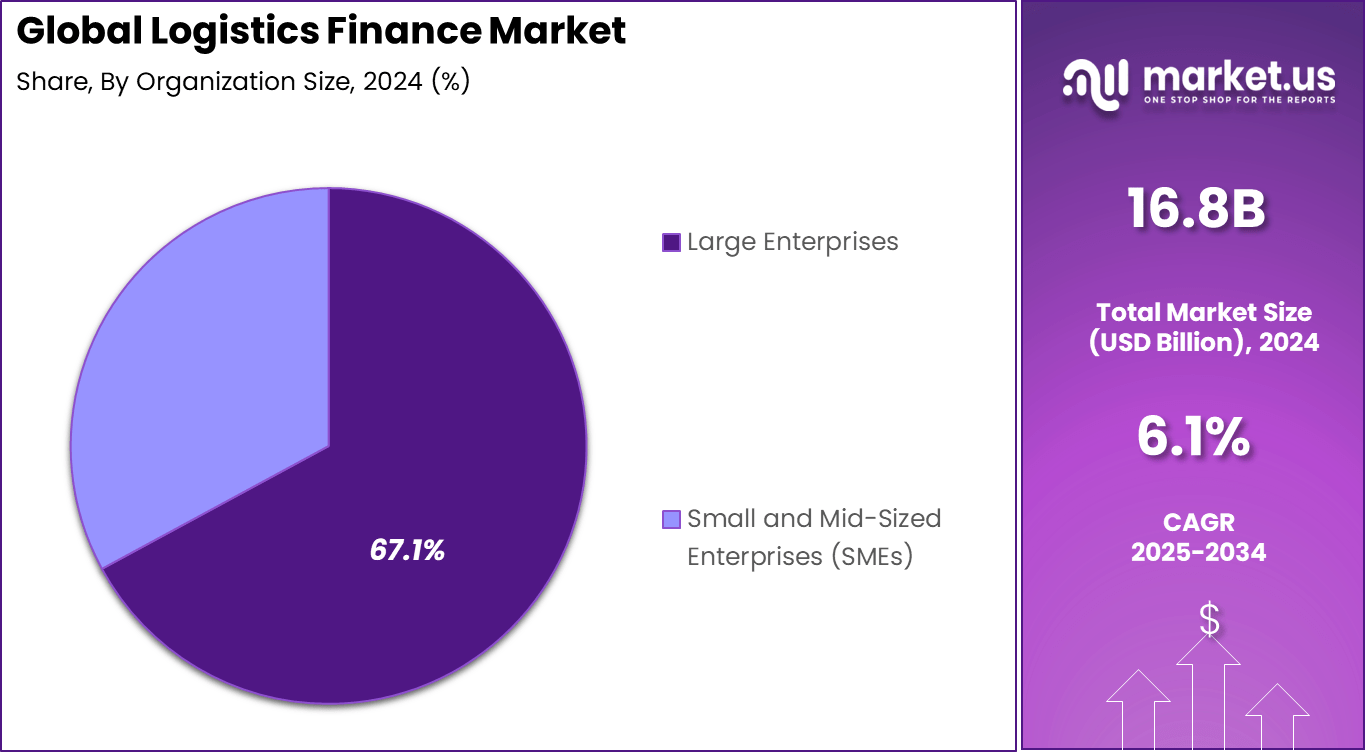

- Large Enterprises held 67.1% of the market, driven by their scale of trade operations and ability to integrate digital financing tools into logistics management.

- The Retail & E-commerce sector accounted for 32.8%, supported by high transaction volumes and the need for flexible payment structures across cross-border trade.

- Asia-Pacific captured 38.7% of the global market, propelled by expanding trade networks and government support for supply chain finance innovation.

- China reached a valuation of USD 2.66 Billion in 2024, growing at a steady 6.8% CAGR, underpinned by rapid digitalization of logistics ecosystems and fintech-led financing platforms.

Analysts’ Viewpoint

A growing preference for digital and automated logistics finance solutions that can address operational complexities and reduce manual errors. More than 70% of logistics firms adopting automated financial systems have reported significant improvements in cash flow management and accuracy in financial reporting.

This shift is driven by the need to reconcile diverse financial transactions across global supply chains, where speed and precision are vital. Moreover, sustainable finance options are gaining traction as logistics companies increasingly pursue eco-friendly practices, supported by green financing models tailored to logistics investments.

The adoption of technologies in logistics finance centers on digital payment platforms, blockchain for secure contract management, real-time risk analytics powered by AI, and integrated supply chain finance tools. These technologies improve operational efficiency by lowering transaction costs, ensuring compliance, and enabling faster settlements. Electronic Data Interchange (EDI) and digital signatures streamline document processing and approvals, contributing to overall efficiency.

Role of Generative AI

Generative AI is significantly transforming logistics finance by improving supply chain predictions and inventory management. It enables companies to stock inventory more efficiently by analyzing demand trends, potentially reducing excessive costs.

Approximately 27% of roles related to inventory management and customer service could be automated with AI, helping logistics firms cut costs and raise service levels by 65% and reduce inventory levels by 35%. This adoption makes logistics operations more productive and profitable while ensuring better financial control.

Generative AI also enhances predictive maintenance by identifying equipment likely to fail, allowing companies to minimize downtime and operate smoothly. The technology supports sophisticated decision-making based on vast data volumes expected to reach approximately 181 zettabytes by 2025.

Investment and Business benefits

Investment opportunities in logistics finance are robust amid ongoing digital transformation and rising demand from logistics SMEs. Emerging markets in Asia-Pacific and Latin America present fertile ground for investments due to increasing urbanization, industrialization, and infrastructure build-out.

Investors are particularly attracted to innovative fintech-logistics solutions offering embedded finance capabilities, dynamic discounting, and supply chain financing platforms. The reemergence of strategic investments in sustainable logistics and supply chain digitization also highlights the business potential in this sphere.

Business benefits realized from logistics finance include improved working capital management, risk reduction, enhanced operational agility, and stronger partnerships between logistics providers and financial institutions. Companies leveraging advanced finance solutions report up to a 30% reduction in invoice processing times and better alignment of finance with logistics operations.

China Market Size

China Market Size, The logistics finance market in China is experiencing significant growth, driven by the expanding e-commerce sector, manufacturing, and increasing demand for supply chain optimization. It is projected to reach USD 5.1 billion by 2034, growing at a CAGR of 6.80%.

China’s logistics infrastructure development, coupled with government incentives and an increasing number of logistics startups, is expected to further propel market growth. As e-commerce continues to thrive in China, logistics finance solutions are essential for streamlining operations and meeting the growing demand for timely deliveries.

APAC Region, The Asia Pacific (APAC) region is set to dominate the global logistics finance market, contributing USD 6.5 billion in 2024. This region is expected to continue expanding due to rapid urbanization, the rise of e-commerce, and the increased adoption of innovative logistics finance solutions.

APAC’s market share is projected to account for approximately 40% of the global logistics finance market by 2034. The region’s continued focus on infrastructure investments, such as the development of new ports and transportation networks, alongside digital financial platforms, will play a crucial role in supporting the logistics finance sector’s growth.

The demand for payment financing and asset-based financing is particularly strong in emerging economies such as China, India, and Southeast Asia, driving this regional growth. Moreover, government-backed initiatives and favorable regulations are expected to further stimulate the demand for logistics finance solutions across the region.

By Type

In 2024, Payment financing holds the leading position in the logistics finance market with about 38.7% share. This type of financing helps logistics companies manage working capital pressures caused by long payment cycles and rising transportation costs. It allows shippers and logistics providers to settle payments faster while maintaining flexibility for suppliers.

The steady rise in cross-border trade volumes has also increased the use of digital payment-based financing models that simplify international settlements. The growth of payment financing is supported by the expansion of fintech platforms offering quick credit access and invoice-based funding.

These solutions improve liquidity flow across logistics networks and enhance trust between carriers, freight forwarders, and suppliers. The push toward digital trade documentation and automated billing further strengthens the adoption of payment financing. With logistics companies seeking faster capital turnover, this segment continues to gain strong industry traction.

By Enterprise Size

In 2024, Large enterprises dominate the logistics finance market with roughly 67.1% share. Their large-scale operations, global presence, and complex supply chains create a continued demand for structured finance solutions. These firms rely on specialized financial instruments for freight payments, insurance, and short-term credit to reduce operational friction.

Their higher transaction volumes also make them more willing adopters of technology-backed financing systems that enhance transparency across the supply chain. Many multinational logistics and retail corporations are integrating financial automation into their enterprise systems, linking banks, suppliers, and customers through one platform.

This integration supports bulk payment processing, real-time credit tracking, and compliance management. As global trade networks expand, large enterprises are expected to deepen their reliance on logistics finance to protect cash flow and minimize trade risks arising from currency fluctuations and shipment delays.

By Industry Vertical

The retail and e-commerce sector contributes around 32.8% of the logistics finance market. Fast delivery expectations, high order volumes, and frequent supplier transactions make this sector heavily dependent on financing solutions. Payment delays in cross-border sales and multiple third-party logistics costs drive retailers to adopt credit and invoice financing products.

Online marketplaces also use embedded financing to ensure seamless payment flow between buyers, sellers, and logistics providers. Strong growth in direct-to-consumer brands and digital trade platforms has accelerated the integration of financing tools in e-commerce logistics.

Companies are leveraging supply chain financing, dynamic discounting, and payer-backed credit models to reduce working capital gaps. As consumers shift toward faster and more transparent shipping options, financing mechanisms help retailers maintain stable cash flow while scaling their logistics operations efficiently.

Key Market Segments

By Type

- Payment Financing

- Working Capital Finance

- Asset-based Finance

- Inventory Finance

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- Retail & E-commerce

- Food & Beverages

- Automotive

- Industrial Machinery and Equipment

- Consumer Electronics

- Healthcare

- Aerospace & Defense

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

One key trend is the rise of real-time freight finance, where payments and financial processes become instantly integrated with shipment verification. This trend shifts the industry away from delayed reconciliations and enables instant payment workflows, improving cash flow transparency and financial efficiency.

About 12% annual growth in logistics finance reflects this increasing digitization trend that ties finance closely with physical logistics. Another emerging pattern is growing regulatory complexity, with logistics finance services needing to address stricter environmental reporting and compliance demands.

This complexity is driving the use of advanced data analytics and audit systems that closely link shipment data with regulatory checks, reducing the risk of fines or delays. As freight finance and logistics evolve, these trends show a more connected and financially integrated supply chain ecosystem.

Growth Factors

A major growth driver is the increasing globalization and complexity of supply chains, which demand advanced financial solutions like accounts receivable and order financing. These services help logistics companies improve liquidity and manage risks more effectively in a competitive market.

The logistics financial services sector is growing at about 12% annually as companies require more supportive financial tools to navigate expanding international trade. Digital transformation is also a strong growth factor, with many logistics firms adopting technology to enhance tracking, visibility, and analytics.

These tools improve financial decision-making and reduce operational risks related to transit damage or theft. The increasing reliance on such digital finance solutions supports steady growth and resilience in the logistics finance market.

Driver Analysis

Growth of E-commerce Boosts Demand

The rapid growth of e-commerce has dramatically increased the demand for efficient and reliable logistics financial services. As online retail continues to expand worldwide, logistics companies need flexible financing solutions to support fast-moving inventories, last-mile deliveries, and large order volumes.

This growth requires capital for warehousing, transportation, and technology adoption, which traditional financing may not adequately support. Agile financial products tailored to the logistics ecosystem are therefore a critical driver for the market’s expansion. In addition, technological advancements such as digital payments, blockchain, and AI-driven cash flow management are gaining traction in logistics finance.

These innovations offer transparency, speed, and reduced risks in transactions, attracting more logistics providers to adopt financial solutions aligned with digital transformation. Together, these factors create strong momentum for market growth, especially in regions with booming e-commerce like North America, Asia-Pacific, and Europe.

Restraint Analysis

Regulatory Complexity and Credit Risks

One major restraint in the logistics finance market is the complexity posed by different regulatory requirements across countries and regions. Logistics finance involves cross-border transactions, and navigating diverse rules on trade compliance, taxation, and financial reporting creates operational challenges.

Companies often face high costs and delays when trying to align with these complex regulations, limiting their ability to scale or access capital efficiently. This regulatory burden is a significant barrier for many small and medium enterprises (SMEs) in logistics. Alongside regulation, credit risk assessment remains a critical concern.

Because logistics firms vary widely in size and financial maturity, lenders must carefully evaluate creditworthiness, especially of smaller players with limited financial history. Incorrect risk assessments can lead to bad debts or financing denials, impeding trust in the market. These risks raise the operational costs for financial providers and may slow market growth if not addressed effectively.

Opportunities Analysis

Digital and Green Finance Solutions

The logistics finance market offers considerable opportunities through the adoption of digital finance platforms and green finance initiatives. Blockchain technology and AI-driven analytics are enabling faster, more secure transaction processing and enhanced risk management. These tools allow logistics companies to optimize working capital, reduce payment cycles, and gain financial insights in real-time, thus improving operational efficiency.

Digital platforms also expand financial inclusion by providing tailored funding solutions to underserved SMEs in emerging markets. Moreover, the trend toward sustainability in logistics operations creates a growing opportunity for green finance. Companies are investing in eco-friendly vehicles, renewable energy, and carbon offset programs that require dedicated financial support.

Green finance products not only attract investors focused on ESG goals but also help logistics firms align with regulatory requirements and consumer expectations. This market segment is expected to grow swiftly as sustainability becomes a strategic priority.

Trends Analysis

The logistics finance market is seeing several emerging trends. The rise of digital platforms is perhaps the most significant trend, as companies increasingly adopt AI and blockchain technologies for payment processing, inventory management, and asset-based financing. In 2024, Payment Financing holds a 38.7% share of the market and is expected to continue leading due to the growing need for secure and swift financial transactions in the logistics space.

Another key trend is the integration of AI into logistics finance solutions, which is expected to increase the automation of financial processes, improving efficiency and reducing costs. Additionally, there is a growing emphasis on sustainability in logistics financing. Businesses are adopting green financing solutions to support eco-friendly transportation and reduce their carbon footprints.

The increasing focus on real-time payment solutions is also a major trend, offering faster and more secure transactions. Cross-border financing solutions are also gaining traction as international logistics operations continue to grow, with significant investments in digital platforms to support global trade.

Challenges Analysis

Supply Chain Volatility and Fragmentation

A key challenge for logistics finance is managing the volatility and fragmentation inherent in global supply chains. Disruptions such as geopolitical conflicts, pandemics, or economic downturns lead to unpredictable cash flows and hinder stable financing.

Logistics providers must navigate fluctuating demand, fuel price changes, and tariff uncertainties, all of which complicate financial planning and risk management efforts. This instability creates caution among lenders and requires agile financial products that can adapt to rapid changes.

Furthermore, the logistics industry’s fragmentation – with numerous small, medium, and large players – makes it difficult to standardize financial services. Smaller firms often struggle to meet lenders’ requirements, limiting their access to financing. The lack of uniformity in financial products tailored to these diverse needs deters widespread market penetration.

Key Players Analysis

The Logistics Finance Market is driven by key global logistics and financial service providers such as Maersk, Logistics Finance, and First Financial, which offer integrated supply chain financing, trade credit, and working capital solutions. Their platforms connect freight operators, shippers, and financiers to improve liquidity and reduce payment delays in global logistics operations.

Prominent regional participants including Equity Release Council, Chinlink, and The Zambian Agricultural Commodity Agency Ltd focus on providing tailored financial products for small and medium enterprises (SMEs) and agricultural exporters. Their services include invoice factoring, trade insurance, and asset-backed financing, which help local businesses manage operational costs and sustain supply chain continuity.

Additional contributors such as CMSTD, Sinotrans, Cosco Shipping Logistics, and other emerging participants integrate logistics and financial technologies to streamline freight financing, digital payments, and trade documentation. Their emphasis on blockchain, digital credit assessment, and AI-powered risk management is transforming how logistics operations are funded and managed, ensuring greater transparency, speed, and financial inclusion within the global logistics ecosystem.

Top Key Players

- Maersk

- Logistics Finance

- First Financial

- Equity Release Council

- Chinlink

- The Zambian Agricultural Commodity Agency Ltd

- CMSTD

- Sinotrans

- Cosco Shipping Logistics

- Others.

Recent Development

- October 2025, Maersk announced a major financial system modernization, transitioning to SAP S/4HANA to enhance operational efficiency starting November 2025. They also updated temporary service changes impacting connections in their logistics network. Additionally, Maersk raised its full-year 2025 financial guidance, expecting underlying EBITDA between USD 8.0 billion and USD 9.5 billion, reflecting resilient global container demand outside North America despite geopolitical risks.

- October 2025, Chainlink highlighted their growing role in tokenized finance and decentralized finance infrastructure with new partnerships, product launches, and ongoing integration efforts. Chainlink’s platform supports secure loan collateralization, automated settlements, and asset servicing widely adopted by global financial institutions, emphasizing their expanding presence in logistics finance ecosystems.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 12.39 Bn CAGR(2025-2034) 14.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Type (Payment Financing, Working Capital Finance, Asset-based Finance, Inventory Finance, Others), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Industry Vertical (Retail & E-commerce, Food & Beverages, Automotive, Industrial Machinery and Equipment, Consumer Electronics, Healthcare, Aerospace & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Maersk, Logistics Finance, First Financial, Equity Release Council, Chinlink, The Zambian Agricultural Commodity Agency Ltd, CMSTD, Sinotrans, Cosco Shipping Logistics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)

-

-

- Maersk

- Logistics Finance

- First Financial

- Equity Release Council

- Chinlink

- The Zambian Agricultural Commodity Agency Ltd

- CMSTD

- Sinotrans

- Cosco Shipping Logistics

- Others