Global Liquor Confectionery Market By Product (Candies And Gums, and Chocolates), By Application (Specialty Stores, Supermarkets/Hypermarkets, and Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 15488

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

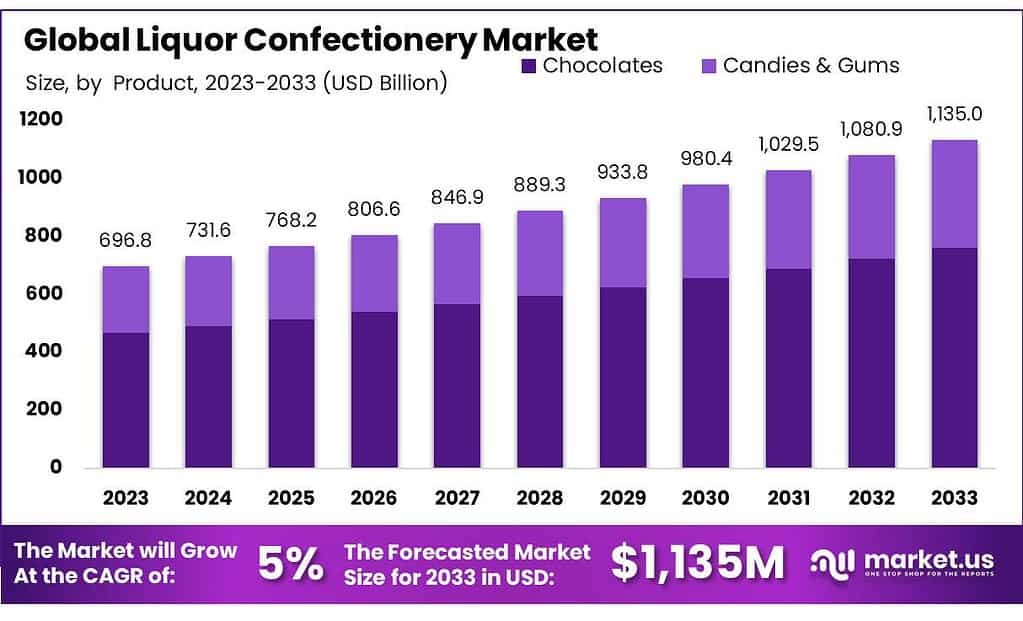

The Liquor Confectionery Market size is expected to be worth around USD 1135.0 Million by 2033, from USD 696.78 Million in 2023, growing at a CAGR of 5% during the forecast period from 2023 to 2033.

There is a rising demand for liquor confectionery due to the changing palates of consumers, especially millennials. The U.K., Belgium, and Germany are among the countries with high levels of liquor consumption. In these countries, chocolates with alcohol are popular. This encourages consumers to experiment with new methods of alcohol consumption. This situation has helped to increase the demand for global markets.

The Liquor Confectionery market is a specialized segment within the broader confectionery and alcoholic beverage industries. It primarily involves the creation and sale of sweets that are infused with various types of liquors or spirits. These confectioneries blend the indulgence of sweet treats with the distinctive flavors of alcoholic beverages, creating unique products that cater to adult tastes.

Key Takeaways

- Liquor Confectionery Market is set to grow at a 5% CAGR, reaching USD 1135.0 Million by 2033 from USD 696.78 Million in 2023.

- Chocolates Dominate: Chocolates claim over 65.4% market share in 2023, making them the favored liquor-infused confectionery.

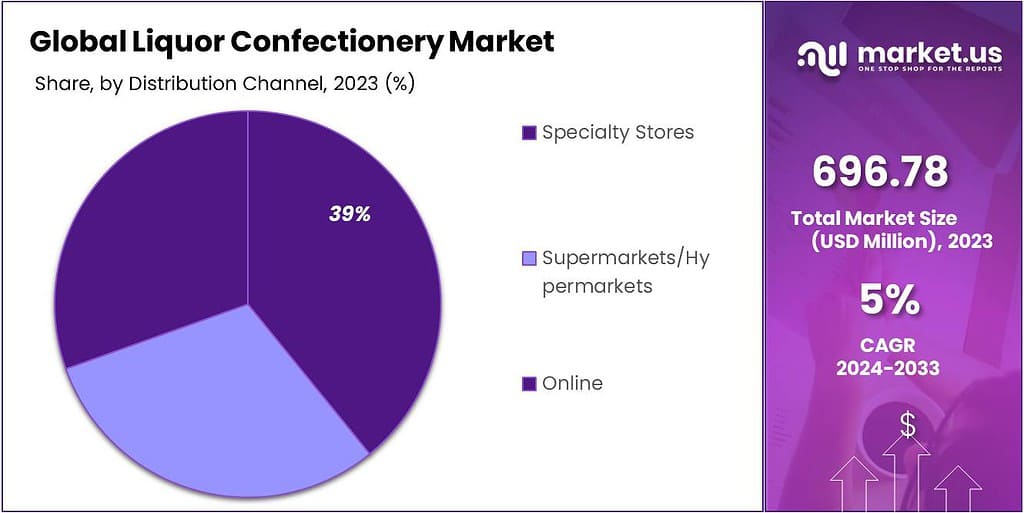

- Distribution Channels: Supermarkets and hypermarkets lead with 39.8% market share in 2023.

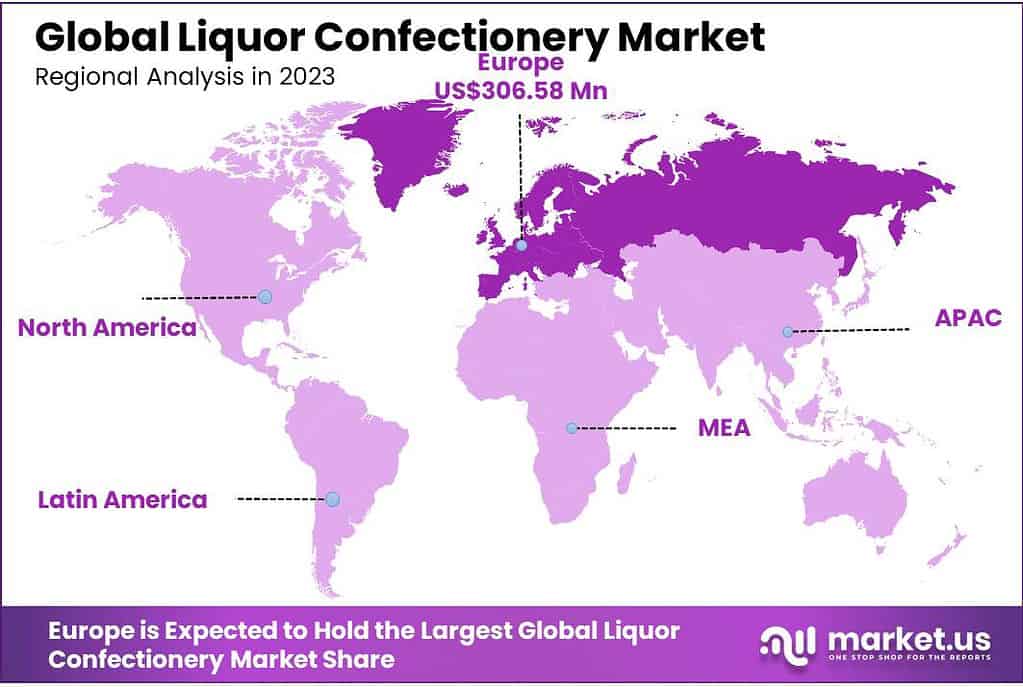

- Regional Dominance: Europe holds the largest revenue share at 49% in 2023, driven by countries like Switzerland and Germany.

- Opportunities: Opportunities lie in innovative flavors, healthier options, online sales, global expansion, and eco-friendly packaging.

- Challenges: Challenges include strict regulations, health concerns, competition saturation, and cultural constraints.

- Emerging Markets: Asia Pacific is the fastest-growing region, with a 5.2% CAGR due to changing preferences and increased awareness.

Product Analysis

In 2023, the confectionery market showcased a sweet landscape with chocolates emerging as the undisputed frontrunner, securing a robust market position by claiming over 65.4% of the overall share. This delectable dominance can be attributed to the universal appeal of chocolates, which have successfully carved a niche in the hearts of consumers across diverse demographics. In 2023, chocolates were the big winners in the world of liquor-flavored treats.

People love them because they bring together the smooth, luxurious feel of chocolate with the kick of alcoholic flavors. Whether you prefer fancy, handcrafted chocolates or the popular ones you find everywhere, these liquor-infused chocolates have become the top choice for folks looking for a delicious, indulgent snack.

On the other hand, candies and gums held their own in the market, but they faced some tough competition from chocolates. This category still had a good chunk of the market in 2023, offering a variety of liquor-infused sweets to suit different tastes. From lively gummies to tasty candies filled with liquor, these treats managed to attract consumers who enjoy a different kind of indulgence compared to chocolate fans.

The battle between chocolates and candies/gums continues, with chocolates currently having the upper hand. People just can’t resist the delightful combination of chocolate and alcohol. However, candies and gums are doing well by offering a diverse range of options to meet the changing preferences of consumers. It’ll be interesting to see how these tasty segments keep evolving and satisfying the sweet tooth of chocolate lovers and those seeking a different kind of treat with candies and gums.

The market dynamics indicate that the chocolate segment is likely to maintain its lead, driven by continuous innovation in flavors, packaging, and marketing strategies. Chocolates, with their inherent ability to create a sensorial experience, are positioned as the go-to choice for consumers looking to savor the harmonious blend of sweetness and alcohol.

However, the candies and gums segment remains a dynamic player, adapting to evolving consumer demands and carving out a distinct space in the liquor confectionery landscape. As the market continues to evolve, it will be fascinating to observe how these segments navigate the ever-changing consumer preferences, ensuring a sweet journey for both chocolate aficionados and those with a penchant for spirited candies and gums.

Distribution Channel Analysis

In 2023, the liquor confectionery market saw Supermarkets and Hypermarkets taking the lead, grabbing more than 39.8% of the total market share. People love these supermarkets and hypermarkets because they have a bunch of liquor sweets all in one place. It’s super handy for customers to grab their favorite chocolates, candies, and other treats while doing their regular grocery shopping.

The shelves are full of choices, making it a breeze for people to check out and pick what they love. Specialty stores also did pretty well in the market. These are the smaller shops that focus on specific kinds of liquor sweets. They attract customers who want something unique, handcrafted, or extra special. Even though they don’t have as much space as the big stores, specialty stores make a special space for people who like a more personal and unique shopping experience.

Whether you’re leisurely strolling down the aisles of a big store or exploring the cozy corners of a specialty shop, there’s a treat for everyone’s sweet cravings in the world of alcohol-infused goodies. But wait, there’s more! Online platforms have become a big deal too. Imagine a virtual candy wonderland at your fingertips! In 2023, online sales became a significant part of the market, grabbing attention from sweet-toothed shoppers. This way, people can chill at home and easily order their favorite liquor-infused treats, getting access to a ton of choices that might not even be in regular stores.

Looking into the future, it seems like big supermarkets and hypermarkets will stay in the lead. They’re super convenient, offering a massive variety that people love. Yet, keep an eye out for specialty stores and online platforms—they’re on the rise. These smaller stores offer unique, special things, and online platforms give you the ultimate candy-shopping experience from your couch. It’s going to be interesting to see how these different ways of getting your treats adapt to what people want in the coming years. The candy world is changing, and it’s going to be a sweet ride.

Key Market Segments

By Product

- Candies & Gums

- Chocolates

By Distribution Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Online

Drivers

People like liquor confectionery these days, and there are some good reasons behind it. One big reason is that people want different and unique flavors, and liquor-infused sweets fit right into that trend. These treats give a special twist for those who want to try something new and exciting. Plus, these goodies are strongly linked to celebrations and special occasions, making them a popular choice to add a bit of joy to different events.

Another interesting thing happening is that people are willing to pay more for really good quality liquor sweets. This trend, called premiumization, means that folks are happy to splurge a bit for top-notch, handcrafted treats. The makers keep things interesting by always coming up with new mixes of alcohol, chocolate, and cool packaging. It keeps the market lively and attractive for people.

And hey, with the rise of online shopping, it’s even easier for people to get their hands on these tasty treats. You can explore and buy a bunch of different liquor confectioneries without leaving your home. It’s all about making things convenient for sweet-toothed folks.

So, with all these factors in play, the liquor confectionery market is getting more popular and exciting! Liquor confectionery’s global appeal, influenced by cultural fusion and a diverse range of alcoholic beverages, has broadened its demographic reach. This cross-cultural aspect attracts consumers with varying taste preferences, contributing to the market’s vibrancy.

The liquor candy market is making sweets healthier for people who care. They’re using natural stuff, organic things, and less sugar in these treats. So, even if you’re watching what you eat, you can still enjoy them.

The ads and cool packaging you see? That’s because of smart marketing. It helps people know about these yummy treats and want to try them. Plus, these candies are a popular choice for gifts. They’re a unique and fancy option for special occasions.

So, if you want to give something cool to someone you care about, these treats could be perfect! The influence of social media, with visually appealing products gaining traction on platforms like Instagram, further solidifies the market’s dynamic growth. As these drivers continue to shape consumer trends and preferences, the liquor confectionery market remains a captivating sector, evolving to meet the demands of a diverse and discerning audience.

Restraints

Even though the liquor candy market is doing well, it faces some problems that slow down its growth. One big issue is following the rules. There are strict rules about making and selling candies with alcohol. Figuring out these rules is hard for makers, making it tricky to bring new candies to the market and limiting how much the market can grow.

Another problem is that some people are thinking more about their health. They worry about what happens if they eat candies with alcohol. This worry might stop some folks from trying these candies, affecting how many people buy them and the choices they make.

Elevated production costs constitute a tangible challenge for market players. Infusing confectionery with high-quality alcohol while ensuring product consistency incurs significant expenses. This cost factor may limit the affordability of liquor confectionery for certain consumer groups, thereby affecting overall market accessibility.

The limited shelf life of liquor confectionery poses logistical challenges. The shorter durability compared to traditional non-alcoholic sweets affects storage, transportation, and inventory management for manufacturers and retailers, potentially leading to product wastage.

Because a lot of people like liquor candies, there are now too many of them in the market. Many companies are making these candies, and this makes it hard for new companies to start. Even the ones already selling candies find it tough to keep their customers because there’s so much competition. This means everyone has to think of new and creative ways to be different and get noticed in the crowded candy world.

It’s a big challenge for companies to stand out and be the ones people choose. Cultural and religious constraints present additional challenges, as beliefs in certain regions may restrict the consumption of alcoholic products. Navigating these cultural contexts becomes crucial for effectively marketing and distributing liquor confectionery.

Perception challenges also come into play, with some consumers viewing liquor confectionery as contradicting a healthy lifestyle. Overcoming these perceptions and positioning these treats as a balanced and occasional indulgence represents a strategic hurdle for market players. When things are not sure about money and jobs, people might not spend as much. Liquor candies are thought of as fancy and special, like a luxury.

So, when times are tough economically, fewer people might want to buy these special candies. This can make the whole market not do as well. When bad things happen, like natural disasters or big problems worldwide, it can mess up how candies are made and sent to stores. This makes it hard for liquor candies to get to people. Having a strong and secure way to get candies from makers to stores becomes super important. Fixing these issues is important for the liquor candy market to keep growing without big problems.

Opportunities

Within the complexities of the liquor confectionery market, several promising opportunities arise, pointing towards avenues for growth and innovation. First and foremost, the exploration of diverse and innovative flavor profiles stands out as a significant opportunity. Manufacturers can leverage emerging taste trends to create distinctive combinations of alcohol and confectionery, offering consumers novel and captivating experiences.

Making healthier liquor candies is a great chance to attract more people who care about their health. This means using natural stuff, less sugar, and organic things. It’s like making sweets that taste good and are good for you, which can bring in more customers who are careful about what they eat.

Another cool opportunity is making fancy and special liquor candies. People who want something unique and don’t mind paying a bit more might love these high-quality, carefully crafted treats. It’s a way to stand out and give customers something extra special.

Going to new places around the world where people might not know about liquor candies is a big chance. If we understand what people in different places like, we can make candies that they’ll enjoy. It’s like making treats that fit into their culture and make them happy.

The internet is like a big helper for selling liquor candies. Putting them up for sale online means people can buy them whenever they want, like having a store open all the time. People can get their favorite candies without going out.

This is a great chance to reach more customers and make candies easy for everyone to get. Working together with other brands or making special, limited candies can make things exciting. Team up with famous alcohol brands or people who are well-known, and it can make more people notice the candies. This is a way to show off the candies and get new people interested.

And you know how people like to give liquor candies as gifts for special times? That’s a good chance too! If we make sure our marketing fits with celebrations, holidays, and times when people give gifts, it can make more people want to buy the candies.

It’s a smart way to sell more and make sure the candies are part of happy moments. Teaching people about how liquor candies are made, how good they are, and what makes them special is a great idea. When people know more about these treats, they like them even more. This helps make the candies stand out and makes people feel a stronger connection to them.

Making the packaging of liquor candies cool and different is also a big chance. If the package looks creative and catches people’s eyes, it can make the candies stand out in the store. This makes more people want to buy them, adding to the overall appeal of the candies. Being kind to the environment is another smart move.

Using eco-friendly packaging and making sure the ingredients are sourced responsibly shows that we care about the planet. This is important to people who want to make eco-friendly choices. It makes the candies even more appealing, creating a sweet and environmentally friendly package. By using these opportunities wisely, everyone involved in the liquor candy business can make sure the future is both sweet and successful.

Challenges

The liquor candy market is pretty tricky because of some challenges. One big issue is all the rules about making and selling candies with alcohol. It takes a lot of time and care for candy makers to follow these strict rules and introduce new candies into the market smoothly. Another challenge comes from people caring more about their health. More folks are thinking about what happens if they eat candies with alcohol.

Candy makers have to figure out how to deal with these health concerns and show that liquor candies can be a good treat, not just an occasional indulgence. Balancing the equation between maintaining high-quality standards and managing production costs is another intricate challenge. The process of infusing confectionery with alcohol, coupled with the necessity for consistent quality, often results in elevated production costs, requiring careful financial considerations.

The limited shelf life of liquor confectionery poses practical challenges for storage, transportation, and inventory management. Managing the logistics efficiently becomes crucial to avoid potential product wastage and maintain product freshness. The market’s increasing popularity has led to saturation and intensified competition among manufacturers.

New entrants find it challenging to establish themselves while existing players must employ innovative strategies to maintain market share amidst the crowded landscape. Cultural and religious constraints present a unique challenge, as beliefs in certain regions may limit the consumption of alcoholic products. Effectively navigating these constraints requires a nuanced approach to global marketing and distribution.

The liquor candy market faces some big challenges. When money is tight and people don’t have a lot to spend, fancy candies like these might not be on the shopping list. Because liquor candies are seen as special and fancy, economic tough times can mean fewer people want to buy them. Also, the way candies are made and sent to stores is at risk.

Things like natural disasters or big problems around the world can mess up the whole process. To make sure the candies keep coming, having a strong and safe way to get them from makers to stores is super important. People’s likes and dislikes are always changing. This is another problem for candy makers because they have to keep up with what people want. Staying ahead of these changes and making candies that people will always enjoy need lots of flexibility and new ideas.

Making people see liquor candies as more than just a sometimes treat is also a challenge. It’s about telling them why these candies are unique and valuable. Smartly doing this through marketing helps the candies stand out in a market where everyone is trying to get attention. By dealing with these challenges smartly, the people involved in the liquor candy business can work through the problems and set themselves up for long-term success in the candy world.

Regional Analysis

Europe held the highest revenue share at over 49% in 2023. This was due to the increase in demand for liquor confectionery from countries like Switzerland and Germany. These products are gaining popularity due to their taste, availability in a variety of flavors, and the practice of eating them on different occasions. European culture has this custom of enjoying these homemade liquor confectioneries at big events, vacations, and celebrations.

Asia Pacific has emerged as the fastest-growing region and is expected to grow at a 5.2% CAGR over the forecast period. This growth can be attributed to increased awareness and changing preferences for alcoholic beverages in confectionery. Because these products can be used for special occasions rather than a heavy alcohol intake, consumers (primarily millennials) are willing to spend more money to try new confectioneries.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Few companies are considering mergers or acquisitions to improve their capabilities and product ranges. Ferrero bought Nestle’s U.S. manufacturing business to make liquor confectioneries. The purchase cost US$ 2.8 million. Barry Callebaut purchased American Almond Products Co. to further expand its product line.

Маrkеt Кеу Рlауеrѕ

- Abtey Chocolate Factory

- Neuhaus

- Mars

- Brookside

- Hershey’s

- Ferrero

- Mondelez

- Toms Gruppen

- Liqueur Fills

- Other Key Players

Recent Developments

2022 Mars Wrigley (Skittles, Starburst): Announced plans to develop alcoholic versions of their popular candies, targeting adults who enjoy playful flavors.

Report Scope

Report Features Description Market Value (2023) USD 696.78 Million Forecast Revenue (2033) USD 1135.0 Million CAGR (2023-2032) 5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Candies & Gums, Chocolates), By Distribution Channel(Specialty Stores, Supermarkets/Hypermarkets, Online) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abtey Chocolate Factory, Neuhaus, Mars, Brookside, Hershey’s, Ferrero, Mondelez, Toms Gruppen, Liqueur Fills, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Liquor Confectionery Market?Liquor Confectionery Market size is expected to be worth around USD 1135.0 Million by 2033, from USD 696.78 Million in 2023

What is the projected CAGR at which the Liquor Confectionery Market is expected to grow at?Liquor Confectionery Market is growing at CAGR of 5% during forecast periode 2024-2033List the key industry players of the Liquor Confectionery Market?Abtey Chocolate Factory, Neuhaus, Mars, Brookside, Hershey’s, Ferrero, Mondelez, Toms Gruppen, Liqueur Fills, Booz Drops

Liquor Confectionery MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Liquor Confectionery MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abtey Chocolate Factory

- Neuhaus

- Mars

- Brookside

- Hershey’s

- Ferrero

- Mondelez

- Toms Gruppen

- Liqueur Fills

- Other Key Players