Global Lip Stain Market Size, Share, Growth Analysis By Type (Shimmer, Gloss, Lip Stain, Others), By Application (Daily Use, Performing Use), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176662

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

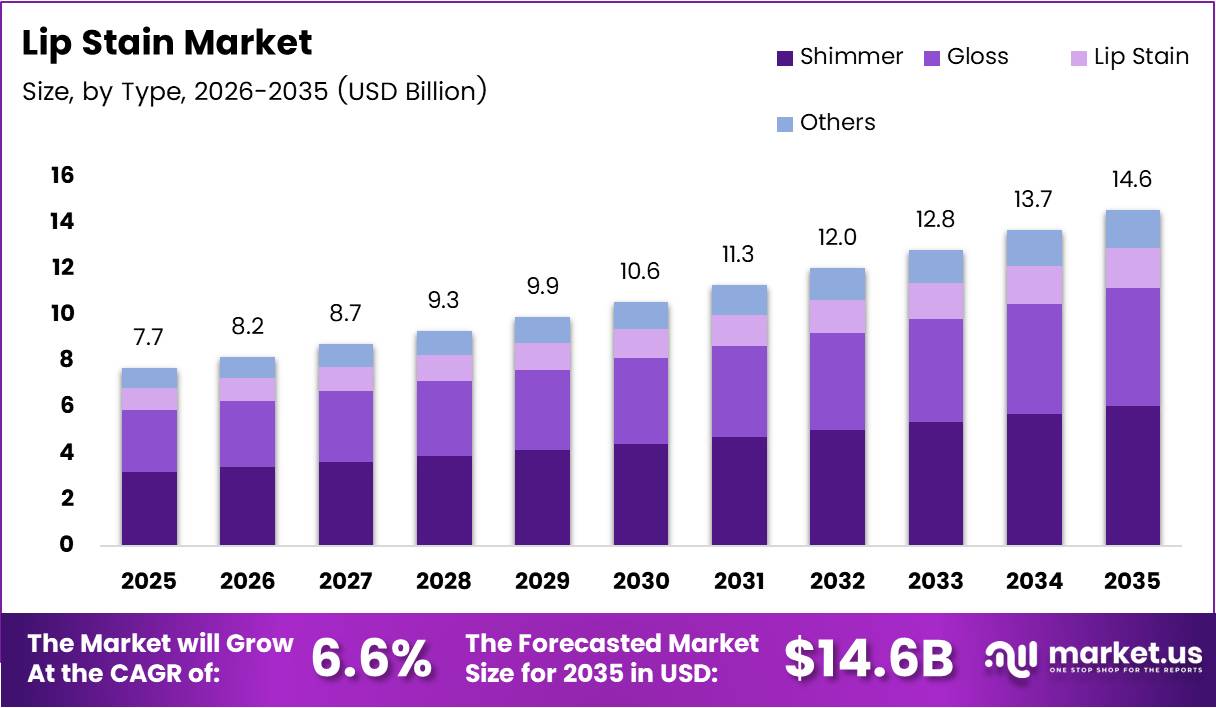

Global Lip Stain Market size is expected to be worth around USD 14.6 Billion by 2035 from USD 7.7 Billion in 2025, growing at a CAGR of 6.6% during the forecast period 2026 to 2035.

Lip stains represent a specialized cosmetic category that delivers semi-permanent color to lips through lightweight, water-based formulations. These products differ from traditional lipsticks by providing transfer-proof wear without heavy texture. Moreover, they appeal to consumers seeking minimal reapplication throughout busy days.

The market gains momentum from shifting beauty preferences toward effortless, long-wear solutions. Urban professionals favor products that withstand extended wear without constant touch-ups. Additionally, dermatologically tested formulations attract health-conscious consumers prioritizing skin-safe ingredients in their cosmetic choices.

Manufacturers invest heavily in hybrid technologies that combine color intensity with lip-care benefits. Companies develop alcohol-free variants to address dryness concerns while maintaining stain longevity. Furthermore, clean-label movements drive brands to reformulate products using vegan and naturally derived pigments.

Digital commerce transforms how consumers discover and purchase lip stains. Brands leverage AI-powered shade-matching tools to reduce online purchase hesitation. Consequently, direct-to-consumer channels expand rapidly, offering niche formulations unavailable through traditional retail networks.

According to Cosmetics Business, searches for “lip stain” on Pinterest UK increased by 20% in 2025 compared to the previous year, demonstrating rising consumer interest in long-lasting lip color solutions. This growth reflects broader demand for transfer-proof makeup that aligns with fast-paced lifestyles.

Strategic partnerships amplify market visibility through collaborative product launches. In July 2025, Chipotle and Wonderskin relaunched the viral ‘Lipotle’ Wonder Blading Peel & Reveal Lip Stain Kit after overwhelming initial demand. The innovative product transforms a metallic green masque into a smudge-proof nude-pink stain, showcasing creative marketing approaches.

Regulatory frameworks increasingly scrutinize cosmetic ingredient safety, prompting manufacturers to prioritize transparency. Brands publish full ingredient lists and conduct third-party testing to build consumer trust. Therefore, companies that demonstrate commitment to clean formulations gain competitive advantages in premium market segments.

Key Takeaways

- Global Lip Stain Market valued at USD 7.7 Billion in 2025, projected to reach USD 14.6 Billion by 2035

- Market grows at CAGR of 6.6% during forecast period 2026-2035

- Shimmer segment dominates By Type category with 45.2% market share in 2025

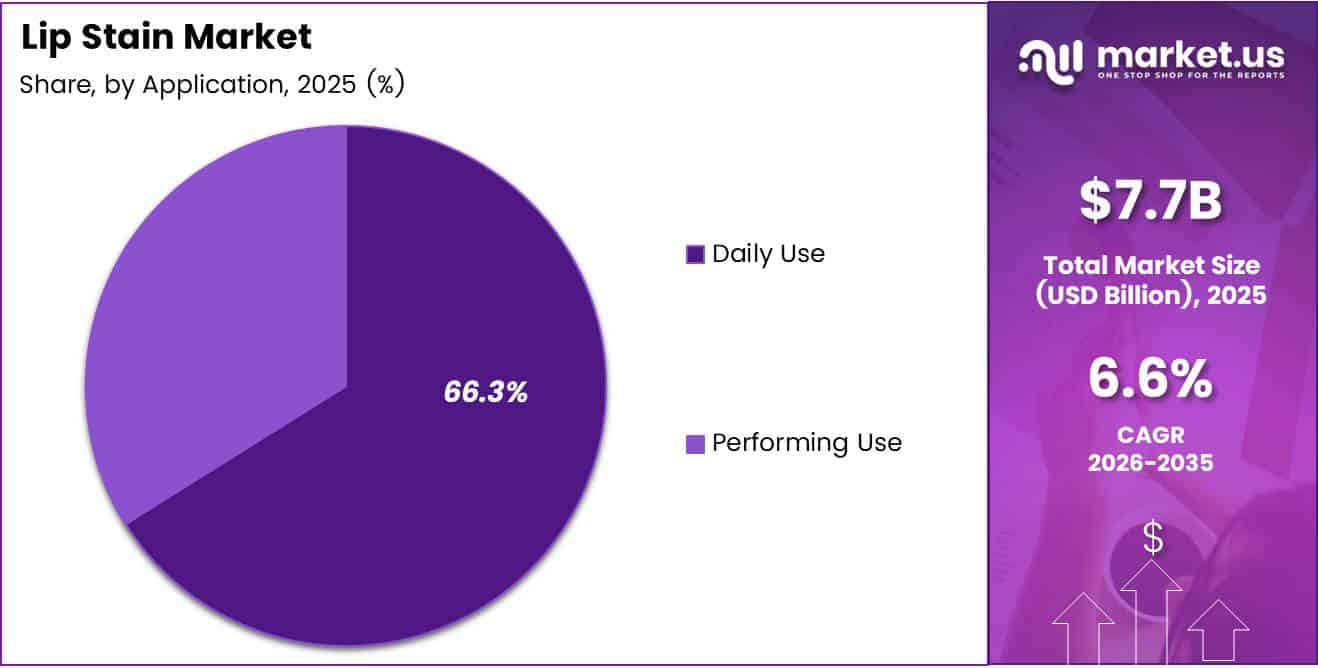

- Daily Use application holds 66.3% share in By Application segment

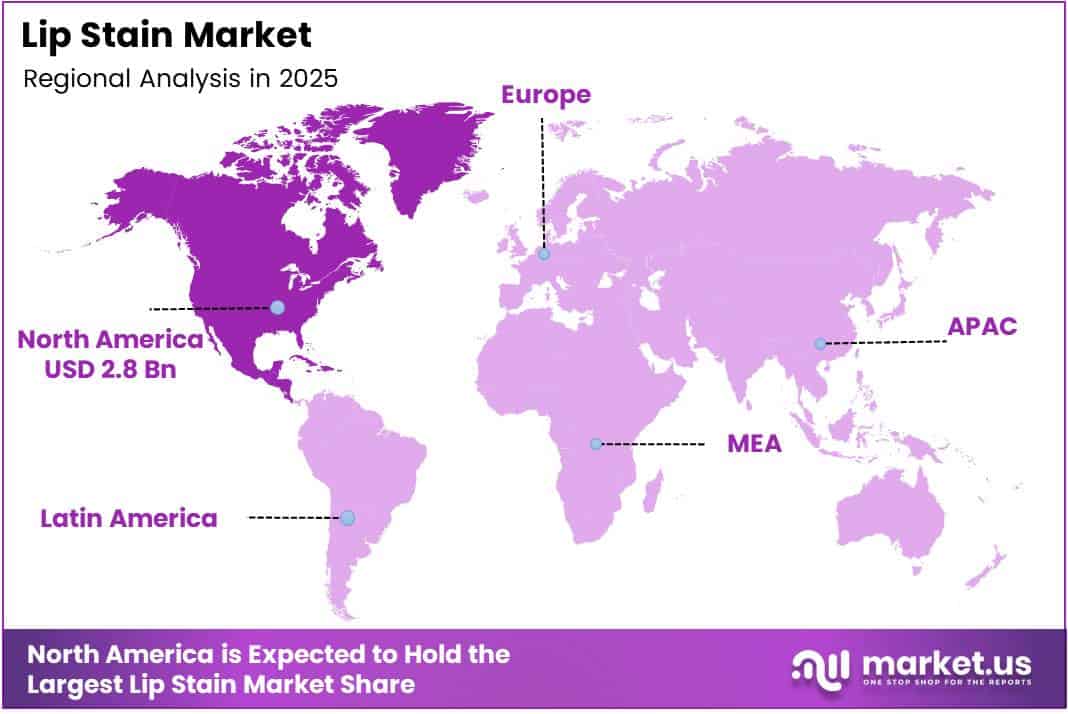

- North America leads regional markets with 37.20% share, valued at USD 2.8 Billion

- Rising consumer demand for transfer-proof, long-lasting lip color drives market expansion

- Product innovation focuses on vegan, clean-label, and hybrid lip-care formulations

Type Analysis

Shimmer dominates with 45.2% due to versatile aesthetic appeal and multi-occasion suitability.

In 2025, Shimmer held a dominant market position in the By Type segment of Lip Stain Market, with a 45.2% share. Shimmer-finish lip stains combine subtle light-reflecting particles with long-wear pigments, creating dimensional color effects. Consumers appreciate how these products transition seamlessly from casual daytime looks to evening glamour. Therefore, shimmer variants achieve strong sales across diverse demographic groups and usage occasions.

Gloss lip stains offer high-shine finishes that mimic traditional glosses while delivering improved wear resistance. These formulations address consumer demand for luminous lips without sticky textures or frequent reapplication. Additionally, gloss variants incorporate moisturizing agents that prevent the dryness commonly associated with conventional stains. Brands position these products as hybrid solutions bridging color cosmetics and lip care.

Lip Stain products in their pure matte format appeal to minimalists seeking understated, natural-looking color. These variants feature lightweight textures that feel barely present on lips throughout extended wear. Moreover, matte lip stains align with clean beauty movements emphasizing skin-like finishes over heavy makeup applications. Professional makeup artists frequently recommend these formulations for clients wanting effortless, modern aesthetics.

Others encompasses specialty formats including satin, cream, and velvet-finish lip stains that cater to niche preferences. This segment includes innovative textures like whipped, mousse, and gel formulations that differentiate brands in competitive markets. Furthermore, limited-edition collaborations and seasonal variants fall within this category, driving experimental purchases among beauty enthusiasts seeking unique product experiences.

Application Analysis

Daily Use dominates with 66.3% due to consumer preference for practical, everyday makeup solutions.

In 2025, Daily Use held a dominant market position in the By Application segment of Lip Stain Market, with a 66.3% share. Consumers increasingly prioritize low-maintenance beauty routines that accommodate busy schedules and multiple daily activities. Lip stains meet this demand by eliminating reapplication needs throughout workdays, commutes, and social engagements. Consequently, these products become staples in everyday makeup collections across working professionals and students alike.

Performing Use addresses specialized requirements of stage performers, media professionals, and special-event attendees needing extended wear guarantees. These applications demand exceptional color longevity under challenging conditions including stage lighting, cameras, and prolonged speaking engagements. Additionally, performing-use variants often feature enhanced pigment concentration to maintain visibility under bright lights. Makeup artists specify these professional-grade formulations for clients in entertainment, broadcasting, and public-speaking industries.

Key Market Segments

By Type

- Shimmer

- Gloss

- Lip Stain

- Others

By Application

- Daily Use

- Performing Use

Drivers

Rising Consumer Preference for Long-Lasting, Transfer-Proof Lip Color Formats

Modern consumers demand cosmetic products that maintain performance throughout extended wear periods without compromising appearance. Lip stains deliver transfer-proof color that withstands eating, drinking, and mask-wearing situations where traditional lipsticks fail. Moreover, this reliability reduces anxiety about color migration during professional meetings or social interactions. Therefore, brands emphasize longevity claims in marketing campaigns to capture quality-focused shoppers.

Busy urban lifestyles accelerate adoption of minimal-touch makeup solutions that simplify daily beauty routines. Professionals working long hours prefer products requiring single morning application rather than frequent touch-ups. Additionally, remote work trends sustain demand for effortless cosmetics suitable for video calls and brief in-person engagements. Consequently, lip stains position themselves as time-saving essentials within streamlined makeup collections.

Brand investments in dermatologically tested formulations address consumer concerns about lip health and ingredient safety. Companies reformulate products to eliminate harsh alcohols and incorporate skin-beneficial ingredients like vitamins and botanical extracts. Furthermore, beauty influencers amplify awareness by demonstrating product performance through real-world wear tests on social platforms. These endorsements build credibility and drive purchase decisions among followers seeking validated product recommendations.

Restraints

Consumer Sensitivity to Lip Dryness and Post-Application Discomfort

Traditional lip stain formulations often contain drying agents that compromise lip moisture and comfort during extended wear. Many consumers report tightness, flaking, or chapped sensations after several hours of product use. Moreover, these side effects discourage repeat purchases despite superior color longevity compared to conventional lipsticks. Therefore, brands face significant pressure to reformulate without sacrificing staining performance.

Limited shade customization restricts consumer ability to achieve precise color matches or create layered effects. Unlike traditional lipsticks that allow gradual color building, lip stains typically deliver fixed intensity from single application. Additionally, removing or adjusting color proves difficult once stains set, reducing flexibility for consumers wanting versatile looks. Consequently, this limitation narrows appeal among makeup enthusiasts who value creative color experimentation.

Price sensitivity impacts adoption rates in emerging markets where premium cosmetic spending remains constrained. Lip stains generally command higher price points than mass-market lipsticks due to specialized formulation technologies. Furthermore, economic uncertainties cause consumers to prioritize essential purchases over discretionary beauty products. These affordability barriers slow market penetration in price-conscious demographic segments and developing regions.

Growth Factors

Technological Advancements Accelerate Market Expansion

Expansion of vegan, clean-label, and alcohol-free lip stain variants opens new consumer segments prioritizing ethical beauty standards. Manufacturers develop plant-based pigments and natural binding agents that match synthetic formulation performance. Moreover, transparent ingredient sourcing appeals to environmentally conscious shoppers willing to pay premium prices. Therefore, brands highlighting sustainability credentials capture growing market share among values-driven consumers.

Emerging beauty markets with young demographics present substantial growth opportunities for innovative cosmetic formats. In May 2025, Blank Beauty raised $6 million in a Series A funding round led by Evolution VC Partners, demonstrating investor confidence in next-generation lip color technologies. Countries across Asia-Pacific and Latin America experience rising disposable incomes and Western beauty trend adoption among millennial and Gen-Z populations.

According to Arbelle, 92% of makeup users report using lip products, confirming the universal relevance of lip cosmetics within comprehensive beauty routines. This widespread adoption creates stable demand foundation for specialized formats like lip stains. Additionally, hybrid lip-care technologies combining color and treatment benefits attract consumers seeking multifunctional products that simplify routines while delivering visible results.

Emerging Trends

Digital Transformation Reshapes Market Landscape

Water-based and serum-texture lip stain launches surge as brands address consumer dryness concerns with innovative formulation approaches. These lightweight textures incorporate hydrating ingredients like hyaluronic acid and glycerin that maintain moisture throughout wear. Moreover, serum-inspired products blur boundaries between cosmetics and skincare, appealing to consumers seeking hybrid benefits. Consequently, texture innovation becomes key differentiation strategy among competing brands.

Multi-use lip and cheek stain products gain popularity by offering versatile color solutions for streamlined makeup routines. These dual-purpose formulations eliminate need for separate products while ensuring color coordination across facial features. Additionally, travel-friendly formats appeal to consumers minimizing luggage and simplifying on-the-go touch-ups. Therefore, brands expand product lines to include convertible cosmetics serving multiple application purposes.

AI-driven shade matching transforms online lip stain sales by reducing purchase hesitation and return rates. Virtual try-on technologies analyze skin tones and recommend complementary colors with increasing accuracy through machine learning. Furthermore, augmented reality applications allow consumers to preview products before purchasing, enhancing confidence in digital transactions. These technological integrations improve customer satisfaction while expanding e-commerce channel growth.

Regional Analysis

North America Dominates the Lip Stain Market with a Market Share of 37.20%, Valued at USD 2.8 Billion

North America leads global lip stain adoption driven by mature beauty markets and high consumer awareness of innovative cosmetic technologies. The region benefits from strong prestige beauty retail infrastructure and widespread digital commerce platforms facilitating product discovery. Moreover, 37.20% market share reflects robust demand across United States and Canadian consumers, with the regional market valued at USD 2.8 Billion. Therefore, North American brands set global trends that influence product development worldwide.

Europe Lip Stain Market Trends

European consumers demonstrate strong preference for clean-label cosmetics aligned with strict regulatory standards governing ingredient safety. Countries including Germany, France, and United Kingdom drive regional demand through sophisticated beauty retail ecosystems. Additionally, European brands emphasize sustainable packaging and ethical sourcing practices that resonate with environmentally conscious shoppers. Consequently, premium lip stain segments achieve substantial market penetration across Western European nations.

Asia Pacific Lip Stain Market Trends

Asia Pacific emerges as fastest-growing regional market fueled by expanding middle-class populations and rising beauty spending. Countries like China, Japan, and South Korea lead innovation in hybrid cosmetic technologies combining skincare and color benefits. Moreover, K-beauty and J-beauty trends influence global product development through unique formulation approaches and packaging aesthetics. Therefore, regional manufacturers capture increasing market share through culturally resonant product offerings.

Latin America Lip Stain Market Trends

Latin American markets experience growing demand for long-wear cosmetics suited to warm climates and active lifestyles. Brazil and Mexico represent primary growth engines driven by young populations embracing international beauty trends. Additionally, expanding middle-class demographics increase discretionary spending on premium cosmetic categories. Consequently, brands tailor product offerings to regional color preferences and humidity-resistant formulation requirements.

Middle East & Africa Lip Stain Market Trends

Middle East and Africa demonstrate emerging interest in transfer-proof cosmetics compatible with cultural practices and climate conditions. GCC nations show particular demand for long-lasting products suitable for extended wear in hot environments. Moreover, South African beauty markets adopt Western cosmetic trends while maintaining distinct regional preferences. Therefore, brands entering these markets adapt formulations for extreme temperature performance and cultural appropriateness.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

LVMH Moët Hennessy Louis Vuitton maintains dominant position through prestigious brand portfolio including Dior, Givenchy, and Benefit Cosmetics offering luxury lip stain collections. The conglomerate leverages extensive retail networks and heritage brand equity to capture premium market segments. Moreover, LVMH invests heavily in innovative formulation technologies that deliver superior performance while maintaining luxury positioning. Their multi-brand strategy allows targeted approaches across diverse consumer demographics and price points.

L’Oréal Group commands significant market presence through extensive brand portfolio spanning mass, masstige, and prestige beauty categories worldwide. The company’s research capabilities enable rapid development of trending formulations including clean-label and hybrid lip-care products. Additionally, L’Oréal’s digital innovation leadership positions brands advantageously within growing e-commerce channels. Their scale advantages facilitate competitive pricing while maintaining quality standards across global markets.

Estée Lauder Companies excels in prestige lip cosmetics through brands like MAC, Clinique, and Bobbi Brown known for professional-quality formulations. The company emphasizes dermatologist-tested products that address consumer health concerns while delivering exceptional color performance. Furthermore, Estée Lauder’s strong presence in travel retail and department stores provides strategic distribution advantages. Their artist-endorsed positioning attracts professional makeup users and beauty enthusiasts seeking expert-validated products.

Chanel Inc. represents ultra-premium segment through iconic beauty products combining luxury aesthetics with innovative cosmetic technologies. The brand’s limited distribution strategy maintains exclusivity while commanding premium pricing across lip stain collections. Moreover, Chanel’s heritage in French luxury cosmetics establishes strong brand equity among affluent consumers globally. Their emphasis on timeless elegance and quality craftsmanship differentiates offerings within competitive prestige markets.

Key Players

- LVMH Moët Hennessy Louis Vuitton

- L’Oréal Group

- Estée Lauder Companies

- Chanel Inc.

- Shiseido Group

- Sephora Collection

- Neutrogena Corp.

- Amorepacific Corporation

- Avon Products Inc.

- Maybelline New York

Recent Developments

- May 2025 – Wonderskin raised $50 million in a Series A funding round led by Insight Partners to fuel retail expansion and product innovation across lip stain categories. The investment enables accelerated growth strategies and technology development for transfer-proof cosmetic formulations.

- May 2025 – Simply Nam secured new funding from the Bhaane Group to expand its product lineup and operations within specialty lip cosmetics markets. This capital infusion supports brand scaling initiatives and distribution network expansion across emerging beauty retail channels.

Report Scope

Report Features Description Market Value (2025) USD 7.7 Billion Forecast Revenue (2035) USD 14.6 Billion CAGR (2026-2035) 6.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Shimmer, Gloss, Lip Stain, Others), By Application (Daily Use, Performing Use) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape LVMH Moët Hennessy Louis Vuitton, L’Oréal Group, Estée Lauder Companies, Chanel Inc., Shiseido Group, Sephora Collection, Neutrogena Corp., Amorepacific Corporation, Avon Products Inc., Maybelline New York Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- LVMH Moët Hennessy Louis Vuitton

- L'Oréal Group

- Estée Lauder Companies

- Chanel Inc.

- Shiseido Group

- Sephora Collection

- Neutrogena Corp.

- Amorepacific Corporation

- Avon Products Inc.

- Maybelline New York