Global Lip Injection Market By Product Type (Hyaluronic Acid Fillers, Collagen Fillers, Calcium Hydroxyapatite Fillers, Poly-L-lactic Acid Fillers, and Others), By Type (Temporary, and Permanent), By Application (Cosmetic Enhancement, and Reconstructive Procedures), By Distribution Channel (Drug Pharmacy & Retail, and Online), By End-user (Specialty & Dermatology Clinics, Hospitals & Clinics, Beauty Salons/Spa Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 156851

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Type Analysis

- Application Analysis

- Distribution Channel Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

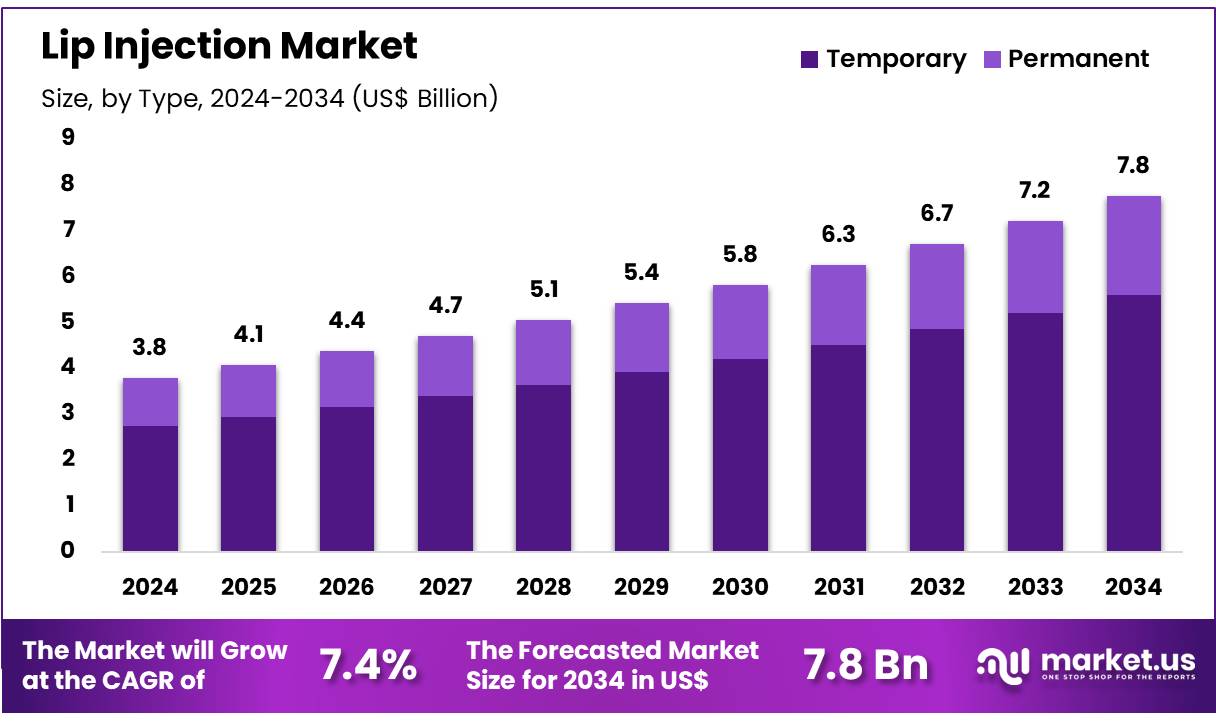

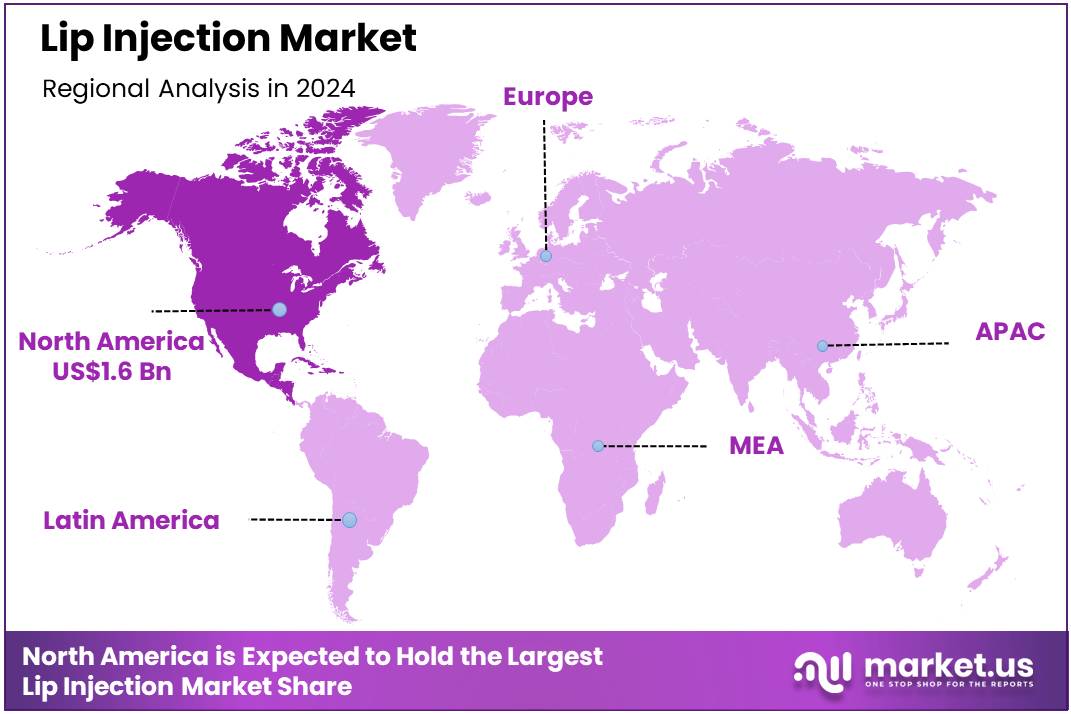

Global Lip Injection Market size is expected to be worth around US$ 7.8 Billion by 2034 from US$ 3.8 Billion in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.2% share with a revenue of US$ 1.6 Billion.

Increasing societal acceptance of aesthetic procedures and a strong consumer preference for minimally invasive treatments are primary drivers of the lip injection market. Lip augmentation, once a niche procedure, has now become a mainstream cosmetic service, particularly as social media platforms and “selfie culture” have amplified the desire for fuller, more symmetrical lips.

The American Society of Plastic Surgeons (ASPS) reports that lip augmentation using injectable materials saw 1.4 million treatments in 2024, reflecting growing demand. This trend is further supported by the fact that these procedures offer immediate, visible results with minimal downtime, making them a popular choice for individuals seeking to enhance their appearance without undergoing surgery.

Growing product innovation and strategic acquisitions are shaping a significant trend in the market. Manufacturers are developing next-generation hyaluronic acid (HA) fillers with improved flexibility, longevity, and natural-looking results. These advancements are not only increasing patient satisfaction but also attracting a wider demographic, including younger consumers seeking subtle enhancements.

For example, in October 2022, Prollenium Medical Technologies acquired SoftFil medical devices, a move focused on innovating advanced tools to deliver optimal results for both practitioners and patients. Such strategic consolidations aim to create comprehensive portfolios that offer everything from the filler itself to the specialized cannulas used for injection, ensuring a complete and high-quality experience.

Rising demand for safer and more effective treatment protocols is creating new opportunities for market expansion. The American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS) notes that approximately 90% of its members routinely offer injectable fillers and neurotoxins, underscoring the widespread availability of these procedures. This has also led to a greater focus on patient safety, with both practitioners and patients favoring hyaluronic acid-based fillers due to their low allergenic risk and reversible nature. The ability to dissolve these fillers with an enzyme provides a crucial safety net, which further boosts consumer confidence and drives market growth. As technology and application techniques continue to evolve, the market is poised to deliver more precise and customizable results.

Key Takeaways

- In 2024, the market for lip injection generated a revenue of US$ 3.8 Billion, with a CAGR of 7.4%, and is expected to reach US$ 7.8 Billion by the year 2034.

- The product type segment is divided into hyaluronic acid fillers, collagen fillers, calcium hydroxyapatite fillers, poly-l-lactic acid fillers, and others, with hyaluronic acid fillers taking the lead in 2023 with a market share of 50.2%.

- Considering type, the market is divided into temporary and permanent. Among these, temporary held a significant share of 72.1%.

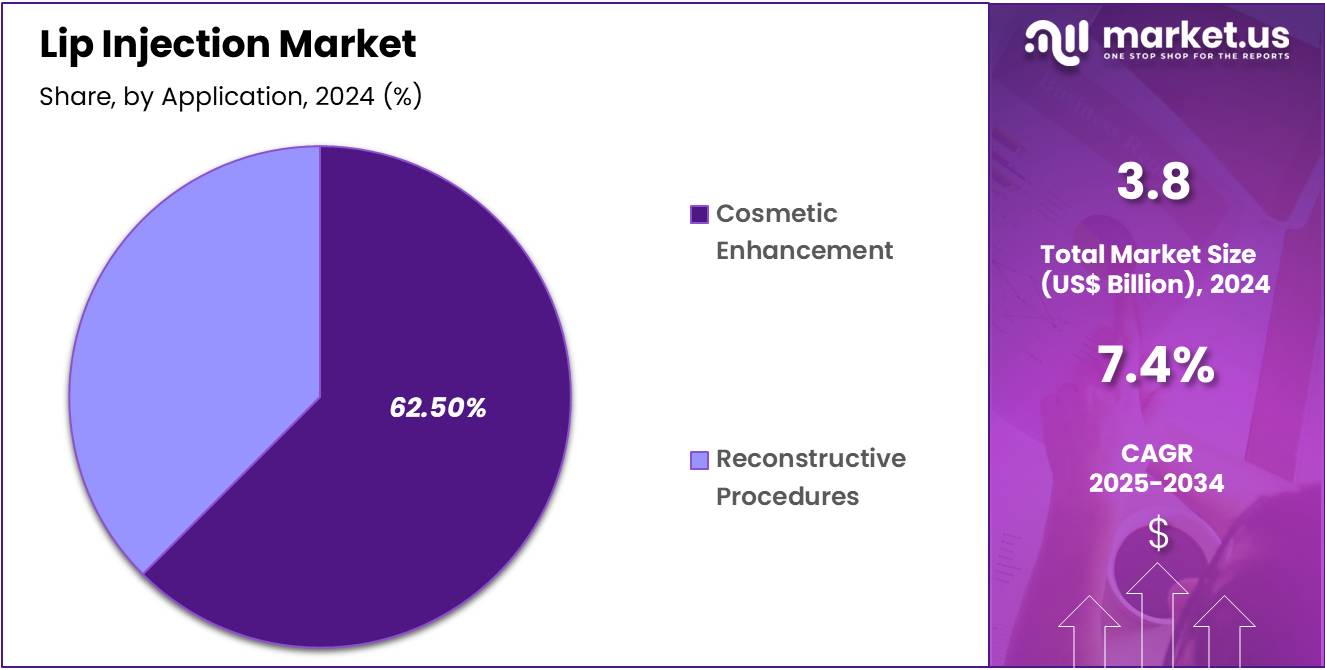

- Furthermore, concerning the application segment, the market is segregated into cosmetic enhancement and reconstructive procedures. The cosmetic enhancement sector stands out as the dominant player, holding the largest revenue share of 62.5% in the lip injection market.

- Considering distribution channel, the market is divided into drug pharmacy & retail and online. Among these, drug pharmacy & retail held a significant share of 51.1%.

- The end-user segment is segregated into specialty & dermatology clinics, hospitals & clinics, beauty salons/spa centers, and others, with the specialty & dermatology clinics segment leading the market, holding a revenue share of 40.3%.

- North America led the market by securing a market share of 42.2% in 2023.

Product Type Analysis

Hyaluronic acid fillers dominate the product type segment in the lip injection market, with a 50.2% market share. This dominance is driven by their ability to provide a natural, plump appearance with minimal risk of complications. Hyaluronic acid, a naturally occurring substance in the body, is favored for its biocompatibility and ability to retain moisture, giving lips a fuller look. The increasing demand for non-surgical cosmetic treatments is expected to fuel the growth of hyaluronic acid fillers, as they are less invasive and require minimal downtime.

Additionally, advancements in formulation and techniques have improved the longevity and effectiveness of hyaluronic acid fillers. These fillers are projected to maintain a significant share as they are widely used in both cosmetic enhancement and reconstructive procedures. The growing acceptance of lip augmentation as a mainstream cosmetic procedure, particularly among younger demographics, will likely continue to drive the demand for hyaluronic acid fillers in the market. The rise in disposable income and the increasing emphasis on aesthetics are anticipated to support further adoption. Regulatory approvals and the continued safety profile of hyaluronic acid-based fillers will also contribute to their sustained market growth.

Type Analysis

Temporary lip injections account for 72.1% of the type segment in the market. These fillers are expected to maintain their dominance due to their reversible nature and lower cost compared to permanent solutions. Temporary fillers, particularly those based on hyaluronic acid, typically last from six months to a year, allowing users to adjust their results as needed. The convenience and lower risk associated with temporary treatments appeal to a broad consumer base, especially those hesitant to commit to long-term changes.

The demand for temporary lip fillers is projected to increase as more people seek to enhance their facial aesthetics with minimal commitment. Additionally, temporary solutions are ideal for those seeking to test the procedure before opting for permanent options. The increasing preference for personalized beauty solutions and the growing trend of “trial and error” in cosmetic procedures are expected to further drive the demand for temporary lip injections. As cosmetic enhancement becomes more accessible and mainstream, temporary fillers are likely to remain the preferred choice, especially in emerging markets where cost sensitivity is a significant factor.

Application Analysis

Cosmetic enhancement holds the largest share of 62.5% in the application segment. This segment’s growth is driven by the increasing demand for lip augmentation as part of broader facial enhancement procedures. The desire for fuller, more youthful lips, particularly among millennials and Gen Z, is expected to continue to rise, making lip injections a common cosmetic treatment. Social media’s influence in promoting beauty standards and self-image is anticipated to drive further demand for non-invasive cosmetic procedures like lip injections.

With advancements in filler technologies, including improved formulations and delivery methods, cosmetic enhancement procedures have become more accessible and safer. The desire for low-maintenance, non-permanent solutions to enhance appearance is likely to fuel the growth of this segment. As people seek minimal downtime and quicker results, the adoption of lip injections for cosmetic enhancement is expected to grow, particularly in urban areas where aesthetic procedures are in high demand. The growing number of beauty-conscious individuals who prefer subtle, natural-looking enhancements rather than invasive surgeries is projected to drive the segment’s continued growth.

Distribution Channel Analysis

Drug pharmacy and retail distribution channels represent 51.1% of the market, with a growing trend towards purchasing lip injection products through pharmacies and retail outlets. This segment is likely to grow due to the increasing availability of lip filler treatments through accessible and reliable channels. Many pharmacies are now offering injectable treatments as part of their beauty and wellness services, providing consumers with convenience and trusted options.

Retail pharmacies are expected to expand their role in offering not only the products but also partnering with medical professionals to administer treatments, making lip augmentation more accessible. The shift towards purchasing beauty products and services in-store, coupled with the growing acceptance of non-invasive cosmetic procedures, will drive further market growth.

As retail chains and pharmacies expand their offerings to include aesthetic treatments, the demand for injectable lip enhancement solutions through these channels is likely to rise. The growing trend of self-care and wellness, particularly in pharmacies that cater to beauty treatments, is anticipated to boost the segment’s market share. Additionally, the increasing number of well-established brands that provide lip filler products at retail outlets will further strengthen the segment.

End-User Analysis

Specialty and dermatology clinics account for 40.3% of the end-user segment in the lip injection market. This segment is expected to grow due to the increasing number of medical professionals offering lip enhancement services as part of their practice. Dermatology clinics are particularly well-suited for administering lip injections, as they have the expertise in facial anatomy and skin health. The demand for professional, customized lip treatments is anticipated to rise as more consumers seek high-quality results.

As consumers prioritize safety and the reputation of their service providers, specialty clinics that offer lip fillers under the guidance of trained medical professionals will see continued demand. Dermatology and specialty clinics are also likely to attract customers seeking both cosmetic enhancement and medically guided treatments, such as lip rejuvenation or reconstructive procedures after injury.

The availability of personalized services and the ability to consult with a specialist is expected to be a key driver of growth in this segment. The increasing awareness of the benefits of professional lip augmentation, coupled with the trust consumers place in certified dermatologists, will likely contribute to the continued dominance of specialty clinics in the lip injection market.

Key Market Segments

By Product Type

- Hyaluronic Acid Fillers

- Collagen Fillers

- Calcium Hydroxyapatite Fillers

- Poly-L-lactic Acid Fillers

- Others

By Type

- Temporary

- Permanent

By Application

- Cosmetic Enhancement

- Reconstructive Procedures

By End-user

- Specialty & Dermatology Clinics

- Hospitals & Clinics

- Beauty Salons/Spa Centers

- Others

By Distribution Channel

- Drug Pharmacy & Retail

- Online

Drivers

The rising influence of social media and the normalization of cosmetic procedures are driving the market.

The lip injection market is experiencing significant growth, primarily driven by the pervasive influence of social media platforms and a broader cultural acceptance of cosmetic procedures. Visual platforms like Instagram, TikTok, and YouTube have become powerful marketing tools, showcasing ideal beauty standards and making aesthetic enhancements seem both accessible and aspirational. This constant exposure has normalized procedures that were once considered taboo, turning them into mainstream beauty maintenance rituals.

A 2023 report from the American Society of Plastic Surgeons highlighted that lip augmentation with injectable materials was performed 1.44 million times in the United States, a 4% increase from 2022. This figure underscores the high demand and consumer comfort with these non-surgical enhancements. The before-and-after photos and testimonials shared online act as a form of social proof, directly encouraging consumers to pursue these procedures to align their physical appearance with the aesthetics they see promoted online.

Restraints

The risk of complications and the proliferation of unlicensed practitioners are restraining the market.

A significant restraint on the market is the inherent risk of complications and the growing number of unlicensed individuals performing these procedures. While minimally invasive, these procedures are still medical treatments that carry risks, including bruising, swelling, and more severe outcomes like vascular occlusion or infection if performed improperly. The lack of stringent regulation in some areas has led to a proliferation of practitioners who lack the necessary medical training and expertise, which increases the likelihood of adverse events.

A 2023 meta-analysis of hyaluronic acid dermal fillers in the facial region, for example, highlighted common complications such as swelling, pain, and bruising. The US Food and Drug Administration (FDA) has also issued warnings and guidance on the safe use of dermal fillers, reflecting the serious concerns associated with their use by unqualified individuals. These safety concerns and the negative publicity from botched procedures can deter potential consumers and undermine trust in the entire industry.

Opportunities

The development of longer-lasting and more natural-looking fillers is creating growth opportunities.

The market is presented with significant opportunities from the continuous innovation in product development, specifically the creation of new fillers that offer more natural-looking, subtle, and longer-lasting results. First-generation fillers often focused on volume, which could lead to an unnatural or “overfilled” appearance. The newest generation of fillers, however, is designed with varying molecular weights and cross-linking to provide a more nuanced result, whether it’s for subtle hydration or for precise shaping.

For example, the FDA’s approval of new dermal filler products demonstrates a clear focus on these advancements. In July 2022, the FDA approved a new dermal filler with a specific indication for jawline definition, showcasing the ongoing expansion of filler uses beyond traditional lip augmentation into new, targeted aesthetic applications. This focus on natural aesthetics and a broader range of uses is appealing to a wider demographic of consumers, from those seeking a preventative “tweakment” to those who desire a subtle, refreshed look.

Impact of Macroeconomic / Geopolitical Factors

The lip injection market faces macroeconomic and geopolitical headwinds that are reshaping the supply chain and consumer behavior. US consumer spending, a key economic indicator, increased to over $16.3 trillion in the second quarter of 2025, which reflects strong consumer demand for goods and services, including discretionary items like aesthetic procedures. However, geopolitical tensions and trade policies introduce significant cost pressures.

A new trade deal between the US and the EU, for instance, has imposed a 15% tariff on a broad range of European exports to the US, including some cosmetic products, directly increasing import costs. Despite these challenges, the market’s long-term outlook remains positive. The FDA has approved several new dermal fillers for various cosmetic applications, providing a wide range of options for providers and consumers. This robust regulatory support and strong consumer spending on discretionary items continue to drive the market forward, ensuring its sustained growth.

Latest Trends

The shift toward preventative and subtle procedures is a recent trend.

A significant trend in 2024 is the accelerating shift in consumer preference away from dramatic, overt transformations and toward subtle, preventative, and natural-looking results. The perception of cosmetic enhancements is moving from a corrective measure to a form of proactive wellness and maintenance. This trend, often referred to as “tweak-ments,” involves using smaller quantities of fillers or targeting earlier signs of aging to maintain a youthful appearance without a drastic change.

A 2024 study on cosmetic procedures revealed that individuals under 30 are a growing consumer segment, with many opting for preventative treatments. For instance, according to the American Society of Plastic Surgeons, lip augmentation with injectable materials was performed 1.58 million times in 2024, with a number of those procedures being for patients seeking to subtly enhance their features rather than dramatically alter them. This emphasis on maintaining a “refreshed” look over a “new” look is reshaping the market and driving demand for smaller, more frequent procedures that deliver a natural and youthful appearance.

Regional Analysis

North America is leading the Lip Injection Market

The North American market for lip injections held a commanding 42.2% share of the global market in 2024. This leadership is directly attributed to a culture of aesthetic consciousness, technological advancements, and a widespread acceptance of minimally invasive cosmetic procedures. The United States, in particular, is a major driver of this growth.

According to the American Society of Plastic Surgeons (ASPS) 2023 Procedural Statistics, there were over 1.4 million lip augmentation procedures performed using injectable materials, a significant indicator of the high and consistent demand. This figure represents a 4% rise from the previous year, demonstrating a sustained interest in the procedure.

Furthermore, the US Food and Drug Administration (FDA) has continued to approve new dermal filler formulations, giving practitioners and patients a wider range of safe and effective products. The accessibility of treatments, coupled with a strong media and social media influence, normalizes and promotes these aesthetic enhancements, solidifying North America’s position as a market leader.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific lip injection market is anticipated to experience robust growth during the forecast period. This is largely a result of rapidly increasing disposable incomes, the rising influence of social media and pop culture, and a growing acceptance of cosmetic procedures. Countries like China and South Korea are key drivers of this growth. The International Society of Aesthetic Plastic Surgery (ISAPS) reported that in 2022, China performed over 1 million aesthetic procedures, demonstrating a significant and expanding patient base.

The market’s expansion is further supported by the high number of certified and skilled practitioners in the region, particularly in South Korea, which has a well-established reputation as a hub for cosmetic innovation. This combination of a large consumer base, a growing acceptance of aesthetic treatments, and a skilled workforce is likely to fuel the market’s growth, allowing it to address the high consumer demand for aesthetic enhancement.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading players in the market for aesthetic injectables are driving growth through several key strategies. They are heavily investing in research and development to create new, longer-lasting products with enhanced safety profiles and to acquire innovative technologies like advanced cross-linking. Companies are also pursuing strategic acquisitions and partnerships to expand their product portfolios and gain access to new therapeutic areas.

Furthermore, they are broadening their market reach by targeting emerging economies and younger demographics through sophisticated digital marketing and social media campaigns that normalize these procedures. This multifaceted approach, combining innovation with aggressive market expansion, is crucial for maintaining a competitive edge.

Galderma, a global leader in medical dermatology, has built a significant presence in this sector. The company’s business model is centered on a unique “Integrated Dermatology Strategy,” which combines a broad portfolio of aesthetic solutions, consumer skincare, and therapeutic dermatology products. Galderma leverages a strong focus on scientific innovation and robust marketing initiatives, including its extensive training programs for healthcare professionals through the Global Aesthetic Injector Network (GAIN). This strategy has resulted in a leading position with flagship brands like Restylane and allows them to address a full spectrum of skin health needs, from rejuvenation to maintenance.

Top Key Players

- Zimmer Aesthetics

- TWL Dermaceuticals

- Teoxane

- Ourself

- Korman

- Galderma Laboratories

- Evolus

- Bohus BioTech AB

- Anika Therapeutics, Inc.

- ALLERGAN

Recent Developments

- In July 2025, the biotech beauty brand Ourself launched an upgraded version of its Replenishing Lip Filler, now featuring patented TRV vesicle technology.

- In February 2025, Evolus received FDA approval for its Evolysse Form and Evolysse Smooth injectable hyaluronic acid gels.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 Billion Forecast Revenue (2034) US$ 7.8 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hyaluronic Acid Fillers, Collagen Fillers, Calcium Hydroxyapatite Fillers, Poly-L-lactic Acid Fillers, and Others), By Type (Temporary, and Permanent), By Application (Cosmetic Enhancement, and Reconstructive Procedures), By Distribution Channel (Drug Pharmacy & Retail, and Online), By End-user (Specialty & Dermatology Clinics, Hospitals & Clinics, Beauty Salons/Spa Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zimmer Aesthetics, TWL Dermaceuticals, Teoxane, Ourself , Korman, Galderma Laboratories, Evolus, Bohus BioTech AB , Anika Therapeutics, Inc., ALLERGAN. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zimmer Aesthetics

- TWL Dermaceuticals

- Teoxane

- Ourself

- Korman

- Galderma Laboratories

- Evolus

- Bohus BioTech AB

- Anika Therapeutics, Inc.

- ALLERGAN