Global Linear Alkyl Benzene Market Size, Share, And Business Benefits By Type (C10-C13, C14-C17, Others), By Application (Linear Alkylbenzene Sulfonates (LAS)(Heavy-duty Laundry Liquids(Laundry Powders)),Light-duty dish-washing Liquids(Industrial Cleaners, Household Cleaners), Others), By Sales Channel (Direct Sale, Indirect Sale), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151741

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

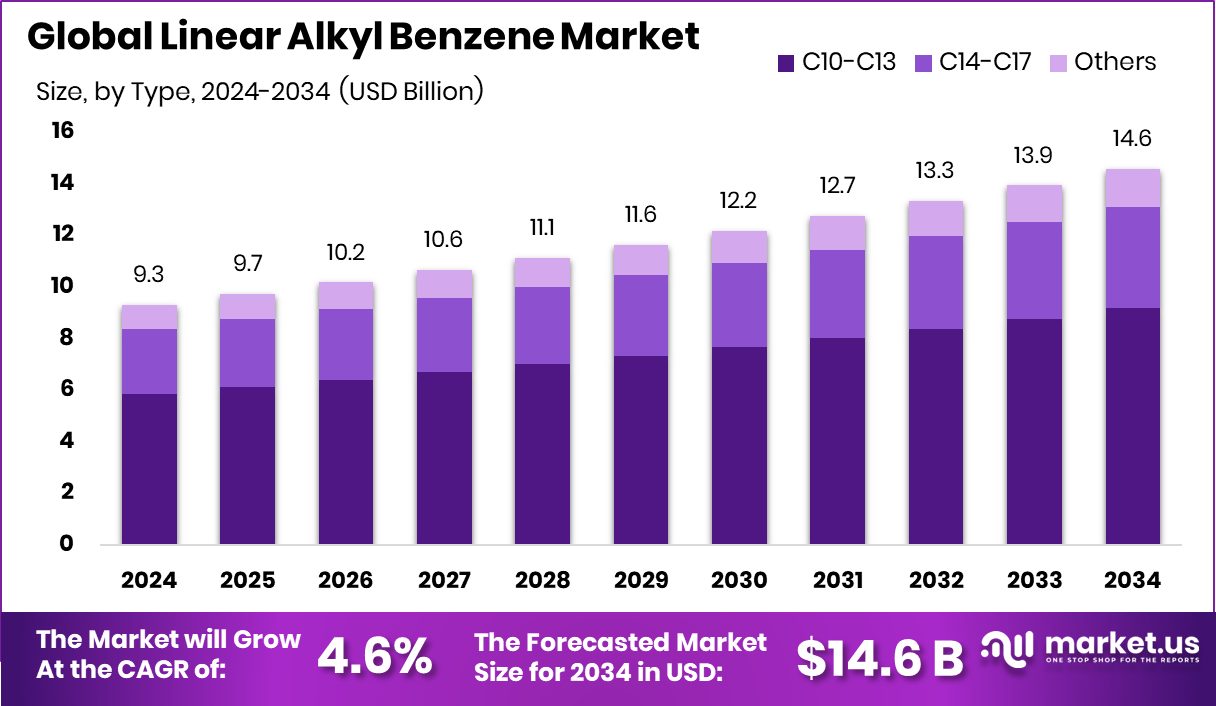

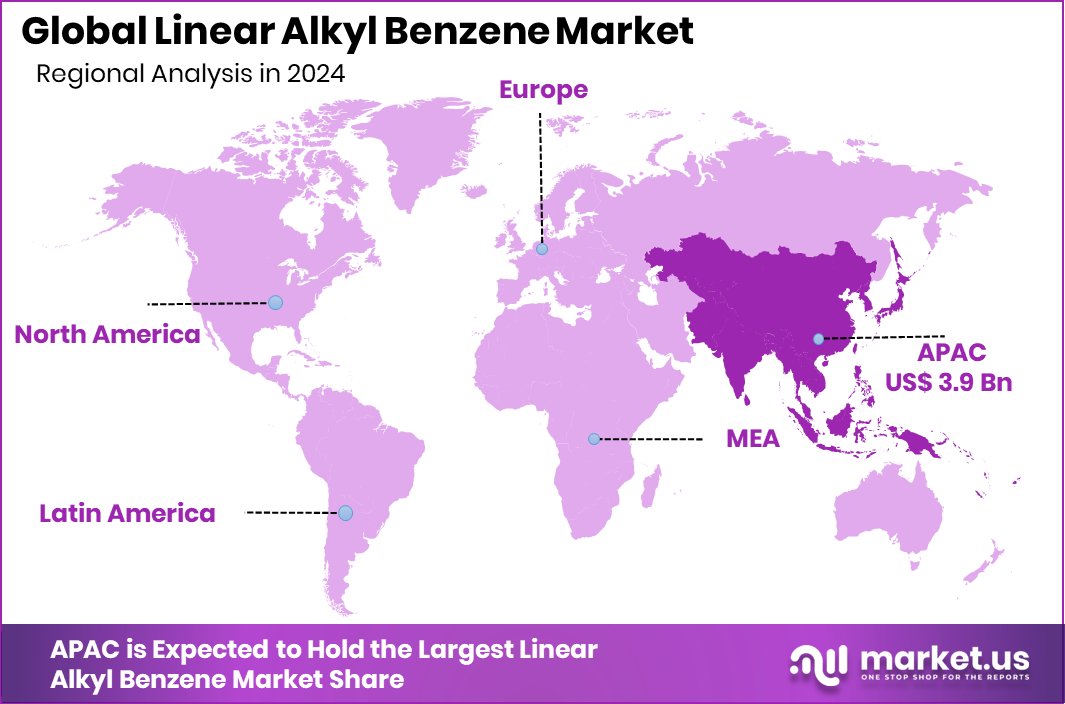

Global Linear Alkyl Benzene Market is expected to be worth around USD 14.6 billion by 2034, up from USD 9.3 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034. Strong detergent demand across Asia-Pacific, 42.9% is boosting LAB consumption and regional market dominance.

Linear Alkyl Benzenes (LAB) are organic chemical compounds primarily used in the production of linear alkylbenzene sulfonate (LAS), a biodegradable surfactant widely utilized in household and industrial detergents. LAB is synthesized through the alkylation of benzene with linear mono-olefins derived from kerosene. The compound is favored over its branched counterparts due to its superior environmental profile, as it breaks down more easily in aquatic ecosystems, making it a more sustainable choice for cleaning applications.

The growth of the LAB market is being driven by the consistent rise in global demand for household and industrial cleaning products. Rapid urbanization, population growth, and increased awareness about hygiene have led to a higher consumption of detergents, especially in emerging economies. The shift toward sustainable and biodegradable ingredients in cleaning formulations further supports the demand for LAB-based surfactants, as they offer an effective cleaning performance with a lower environmental footprint.

Demand is also being supported by the growth of the personal care and cosmetics sectors. LAB-derived surfactants are used in products such as shampoos and face cleansers, contributing to their expanding utility. The expanding middle-class population, especially in Asia and Latin America, is leading to increased consumption of such personal care goods, thereby reinforcing LAB usage.

According to an industry report, Church & Dwight has agreed to a $2.5 million settlement to resolve claims that certain Batiste™ dry shampoo products were contaminated with benzene. The company denies liability but entered the settlement to avoid continued litigation.

Key Takeaways

- Global Linear Alkyl Benzene Market is expected to be worth around USD 14.6 billion by 2034, up from USD 9.3 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- In 2024, C10-C13 type dominated the Linear Alkyl Benzene market, capturing a 62.9% share.

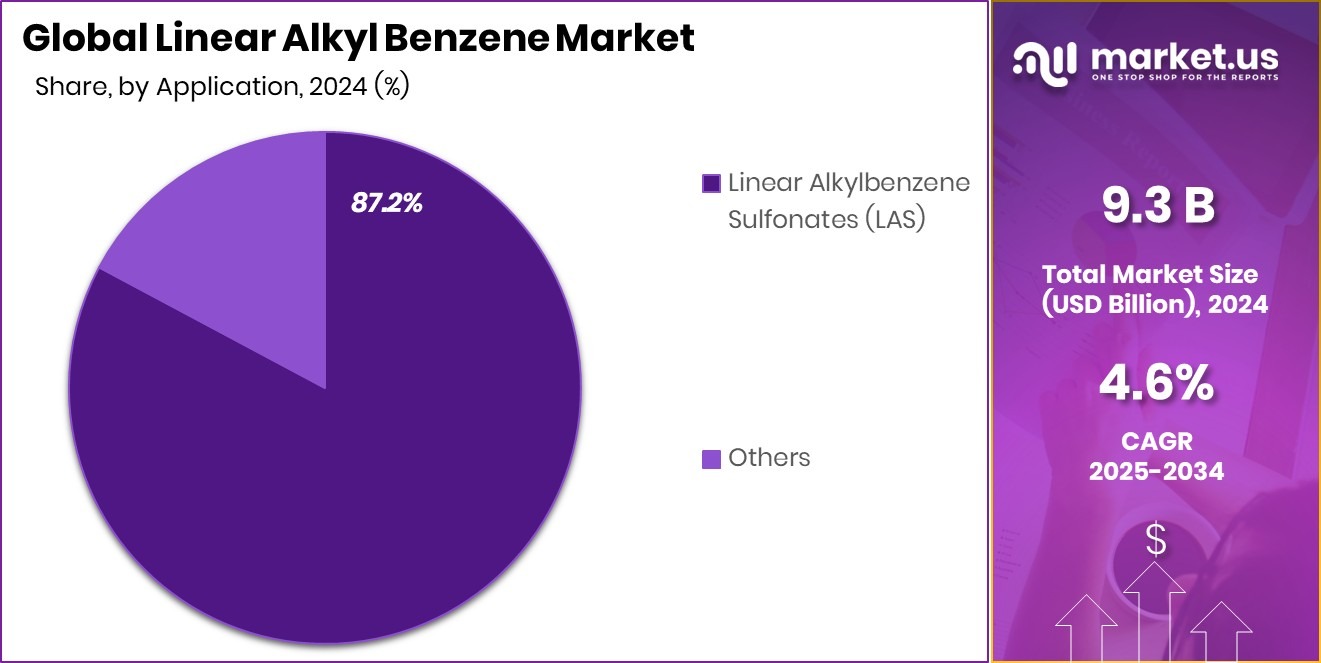

- Linear Alkylbenzene Sulfonates (LAS) held a strong position, accounting for 87.2% of total application demand.

- Direct sales led the Linear Alkyl Benzene market distribution, comprising 69.3% of overall sales in 2024.

- The market value in Asia-Pacific reached approximately USD 3.9 billion in 2024.

By Type Analysis

C10-C13 dominates the Linear Alkyl Benzene market with 62.9% share.

In 2024, C10-C13 held a dominant market position in the By Type segment of the Linear Alkyl Benzene (LAB) market, with a 62.9% share. This specific carbon chain range is highly favored in the production of linear alkylbenzene sulfonate (LAS), a key ingredient in household and industrial cleaning products, due to its effective surfactant properties and superior biodegradability.

The C10-C13 fraction offers an optimal balance between solubility and cleansing efficiency, making it a preferred choice for detergent manufacturers aiming to meet environmental and performance standards.

The dominance of the C10-C13 segment is further supported by its compatibility with automated and high-efficiency washing systems, which require surfactants that perform effectively at lower temperatures and reduced water usage. This aligns well with consumer and industry trends favoring sustainable cleaning practices.

Additionally, regulatory preferences in many countries for surfactants with better environmental profiles have further reinforced demand for LAB derived from the C10-C13 range. As detergent manufacturers focus on performance-driven and eco-friendly formulations, the consistent utility and regulatory alignment of C10-C13 LAB ensures its continued lead in the market.

By Application Analysis

Linear Alkylbenzene Sulfonates (LAS) hold a commanding 87.2% market share globally.

In 2024, Linear Alkylbenzene Sulfonates (LAS) held a dominant market position in the By Application segment of the Linear Alkyl Benzene (LAB) market, with an 87.2% share. This overwhelming share reflects the critical role of LAS as the primary end-use product of LAB, particularly in the formulation of household and industrial detergents.

LAS is valued for its strong detergency, excellent foaming properties, and biodegradability, making it a widely accepted surfactant across global cleaning applications. Its cost-effectiveness and superior cleaning performance have made it the preferred choice for both powder and liquid detergents, especially in regions with high demand for affordable cleaning solutions.

The dominance of LAS also highlights the strong link between LAB production and the growing global emphasis on hygiene and sanitation. With increased consumption of cleaning agents across residential, commercial, and institutional settings, LAS continues to be at the forefront of surfactant use. Its ability to meet environmental safety norms while delivering high-performance results ensures its continued preference in detergent formulations.

As regulatory bodies and consumers push for eco-friendly cleaning products, the use of LAS—derived from LAB—remains integral, supporting its leading market position and reinforcing its importance within the overall LAB value chain.

By Sales Channel Analysis

Direct sales account for 69.3% of the Linear Alkyl Benzene market distribution.

In 2024, Direct Sale held a dominant market position in the By Sales Channel segment of the Linear Alkyl Benzene (LAB) market, with a 69.3% share. This significant market presence can be attributed to the highly specialized nature of LAB as an industrial raw material, which is typically supplied directly to manufacturers of detergents, cleaners, and other chemical products.

Direct sales ensure tighter supply chain control, better pricing negotiations, and consistent product quality—factors that are critical for large-scale industrial buyers who require LAB in bulk volumes and regularly.

The dominance of the direct sale channel also reflects the close business-to-business relationships in the chemical manufacturing ecosystem. Buyers often prefer engaging directly with producers to secure long-term supply contracts, gain technical support, and ensure product traceability. Additionally, direct transactions help reduce intermediary costs and logistics complexities, which is particularly important when dealing with chemicals requiring specific handling and transportation conditions.

The 69.3% share recorded by direct sales indicates strong industry reliance on structured, contract-based procurement, reinforcing the strategic importance of this channel in maintaining operational efficiency and supply reliability for end-users of LAB in various cleaning and industrial formulations.

Key Market Segments

By Type

- C10-C13

- C14-C17

- Others

By Application

- Linear Alkylbenzene Sulfonates (LAS)

- Heavy-duty Laundry Liquids

- Laundry Powders

- Light-duty dish-washing Liquids

- Industrial Cleaners

- Household Cleaners

- Heavy-duty Laundry Liquids

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Driving Factors

Rising Demand for Household Detergents Drives Growth

The key driving factor for the Linear Alkyl Benzene (LAB) market is the rising demand for household detergents across the globe. As more people move to urban areas and standards of living improve, there is a higher focus on hygiene and cleanliness. LAB is a main ingredient used to make linear alkylbenzene sulfonate (LAS), which is a key surfactant in laundry powders and liquid detergents.

The growing population and increased washing frequency in both developed and developing countries are pushing detergent manufacturers to secure steady supplies of LAB. This rising need for cleaning products, especially in fast-growing regions like Asia and Africa, is creating strong, consistent demand for LAB in everyday household applications.

Restraining Factors

Fluctuating Crude Oil Prices Impact LAB Production

One of the major restraining factors in the Linear Alkyl Benzene (LAB) market is the fluctuation in crude oil prices. LAB is produced using raw materials derived from petroleum, such as kerosene and benzene. When crude oil prices rise sharply, the cost of these feedstocks also increases, directly affecting the production cost of LAB. This price volatility creates uncertainty for manufacturers and can reduce profit margins.

In some cases, end-users may look for cheaper or more stable alternatives, which puts additional pressure on LAB demand. These unpredictable raw material costs make long-term planning difficult and can hinder investment in new production facilities or expansion efforts, especially for smaller or cost-sensitive producers in the industry.

Growth Opportunity

Shift Toward Biodegradable Surfactants Creates New Opportunities

A key growth opportunity in the Linear Alkyl Benzene (LAB) market lies in the global shift toward biodegradable and eco-friendly surfactants. With increasing awareness about environmental pollution and stricter regulations on chemical waste, industries are moving away from non-biodegradable detergents. LAB, which is used to produce linear alkylbenzene sulfonate (LAS), is considered more environmentally friendly compared to older, branched alternatives.

This makes it a preferred choice for manufacturers aiming to develop sustainable cleaning products. As both consumers and governments push for greener solutions, the demand for LAB is expected to rise. Companies that focus on enhancing the eco-performance of LAB-based products are well-positioned to benefit from this growing market trend in the years ahead.

Latest Trends

Adoption of Detergent Liquids Boosting LAB Demand

One of the latest trends in the Linear Alkyl Benzene (LAB) market is the growing use of liquid detergents in both household and industrial cleaning. Consumers are increasingly preferring liquid formats over traditional powders due to their ease of use, faster dissolution, and better performance in cold water. LAB plays a crucial role in the formulation of these liquid detergents, as it helps improve cleaning power and foam stability.

This shift toward liquid products is especially visible in urban areas where modern washing machines are commonly used. As liquid detergents gain popularity across different regions, manufacturers are increasing LAB consumption to meet formulation needs, thereby driving a steady and noticeable trend in the global cleaning product industry.

Regional Analysis

In Asia-Pacific, Linear Alkyl Benzene market held a dominant 42.9% share.

In 2024, Asia-Pacific emerged as the dominant region in the global Linear Alkyl Benzene (LAB) market, accounting for a substantial 42.9% share, with a market value reaching USD 3.9 billion. This leadership is driven by the region’s high consumption of household and industrial detergents, supported by growing urbanization, a rising middle-class population, and expanding manufacturing sectors in countries like China and India. The preference for biodegradable surfactants in this region also contributes to sustained LAB demand.

North America and Europe represent mature markets with steady demand, supported by regulatory adherence to environmentally friendly formulations. However, their growth is relatively slower compared to Asia-Pacific. The Middle East & Africa region shows growing potential, especially with increased detergent usage in urban centers and rising investments in local chemical production.

Meanwhile, Latin America continues to witness moderate expansion, fueled by urban development and improving access to consumer goods. Although Asia-Pacific dominates the global landscape, other regions contribute to overall market stability through diverse end-use applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Linear Alkyl Benzene (LAB) market saw consistent activity from key manufacturers, with companies like Sasol, Chevron Phillips Chemical, Deten Quimica, and Fushun Petrochemicals playing significant roles in shaping the industry’s dynamics.

Sasol remained a major force in the LAB sector, supported by its strong production capabilities and integration with upstream feedstock operations. The company’s ability to maintain supply reliability and operational efficiency has helped it secure long-term supply partnerships, especially in regions with rising detergent consumption. Its focus on sustainable production and environmental compliance continues to align with growing demand for biodegradable surfactants.

Chevron Phillips Chemical, with its robust global presence, also retained a strong position in the LAB landscape. The company benefited from its well-established technological infrastructure and strategic presence in North America. In 2024, its emphasis on operational excellence and safe production practices helped reinforce customer trust across key industrial and consumer sectors.

Deten Quimica, recognized for its specialized manufacturing capacity in Latin America, contributed to regional supply stability. Its performance in 2024 reflected stable output and regional integration, particularly in meeting the needs of South American detergent producers.

Fushun Petrochemicals continued to support the LAB market in Asia through a reliable domestic supply. Operating in China, the company’s position benefited from the country’s high LAB consumption levels. Fushun’s role was crucial in meeting internal demand as China remained a core consumer in the global detergent manufacturing space, supporting its market influence in 2024.

Top Key Players in the Market

- Sasol

- Chevron Phillips Chemical

- Deten Quimica

- Fushun Petrochemicals

- Honeywell

- Huntsman Corporation

- ISU Chemical

- Jintung Petrochemical

- Reliance

- Unggul Indah Cahaya

- Aromatics and Petrochemicals Pvt. Ltd

Recent Developments

- In May 2025, Honeywell agreed to acquire Johnson Matthey’s Catalyst Technologies business for £1.8 billion, enhancing its UOP capabilities for petrochemical catalysts—including LAB production—and broadening its process technology offerings.

- In November 2024, Fushun Petrochemical reported a record linear alkylbenzene output increase of 6,135 tons from January to October. The growth was driven by optimized production planning, safety focus, energy efficiency, and cost reduction.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Billion Forecast Revenue (2034) USD 14.6 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (C10-C13, C14-C17, Others), By Application (Linear Alkylbenzene Sulfonates (LAS)(Heavy-duty Laundry Liquids(Laundry Powders)),Light-duty dish-washing Liquids(Industrial Cleaners, Household Cleaners), Others), By Sales Channel (Direct Sale, Indirect Sale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sasol, Chevron Phillips Chemical, Deten Quimica, Fushun Petrochemicals, Honeywell, Huntsman Corporation, ISU Chemical, Jintung Petrochemical, Reliance, Unggul Indah Cahaya, Aromatics and Petrochemicals Pvt. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Linear Alkyl Benzene MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Linear Alkyl Benzene MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sasol

- Chevron Phillips Chemical

- Deten Quimica

- Fushun Petrochemicals

- Honeywell

- Huntsman Corporation

- ISU Chemical

- Jintung Petrochemical

- Reliance

- Unggul Indah Cahaya

- Aromatics and Petrochemicals Pvt. Ltd