Global Light-Emitting Cement Market By Raw Material(Concrete, Fibers), By Application(Wall Cladding, Roofing, Flooring, Others), By End-Use(Residential, Non-residential), , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116212

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

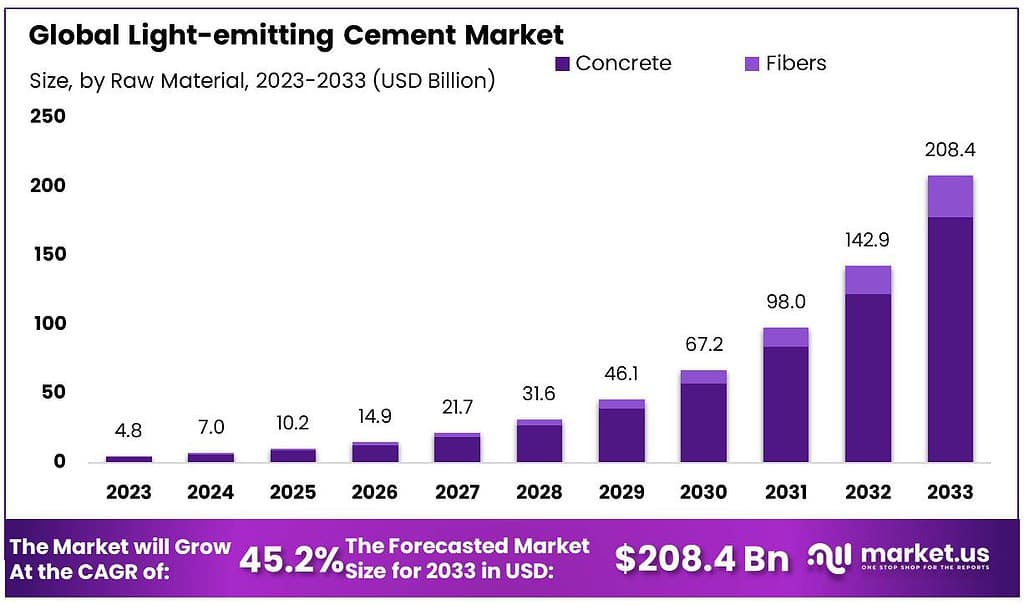

The global Light-Emitting Cement Market size is expected to be worth around USD 208.4 billion by 2033, from USD 4.8 Billion in 2023, growing at a CAGR of 45.2% during the forecast period from 2023 to 2033.

light-emitting cement” likely refers to a type of cement with luminescent properties, meaning it can emit light without an external light source. This could be achieved by incorporating luminescent materials, such as phosphorescent or fluorescent compounds, into the cement mixture.

In a market context, the term would encompass the production, distribution, and sale of these specialized cement and potential applications in construction and infrastructure. Light-emitting cement could have uses in areas such as creating illuminated walkways, roads, or building facades, enhancing visibility and safety in low-light conditions.

Key Takeaways

- Market Growth: Light-Emitting Cement Market CAGR of 45.2%, reaching USD 208.4 billion by 2033 from USD 4.8 billion in 2023.

- Concrete Dominance: Captured 82.1% market share in 2023 due to versatility and compatibility.

- Fibers Segment: Contributed 17.9%, valued for enhanced flexibility and resilience in specialized applications.

- Application Focus: Wall Cladding (64.2%), Roofing, and Flooring led market share in 2023.

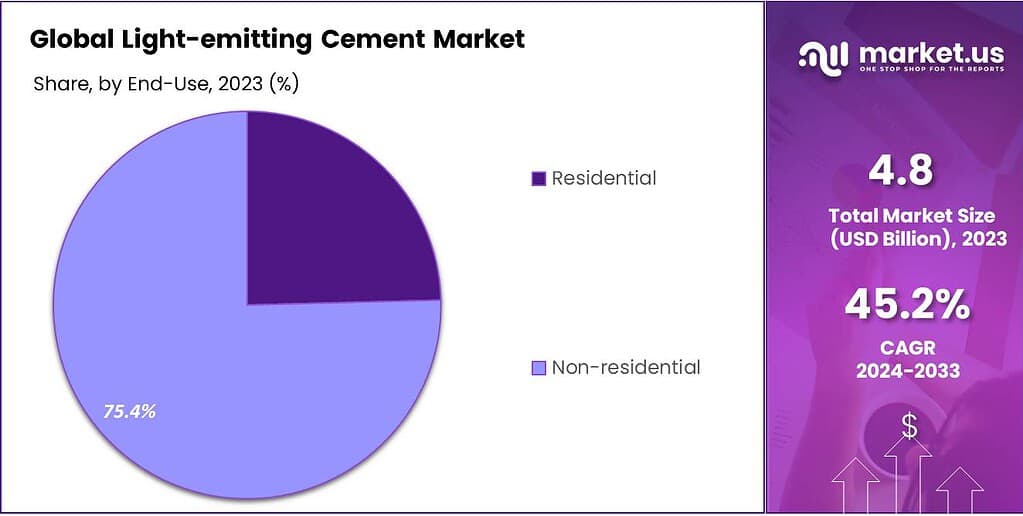

- Non-residential Preference: Held over 75.4% share in 2023, favored in commercial buildings and public spaces.

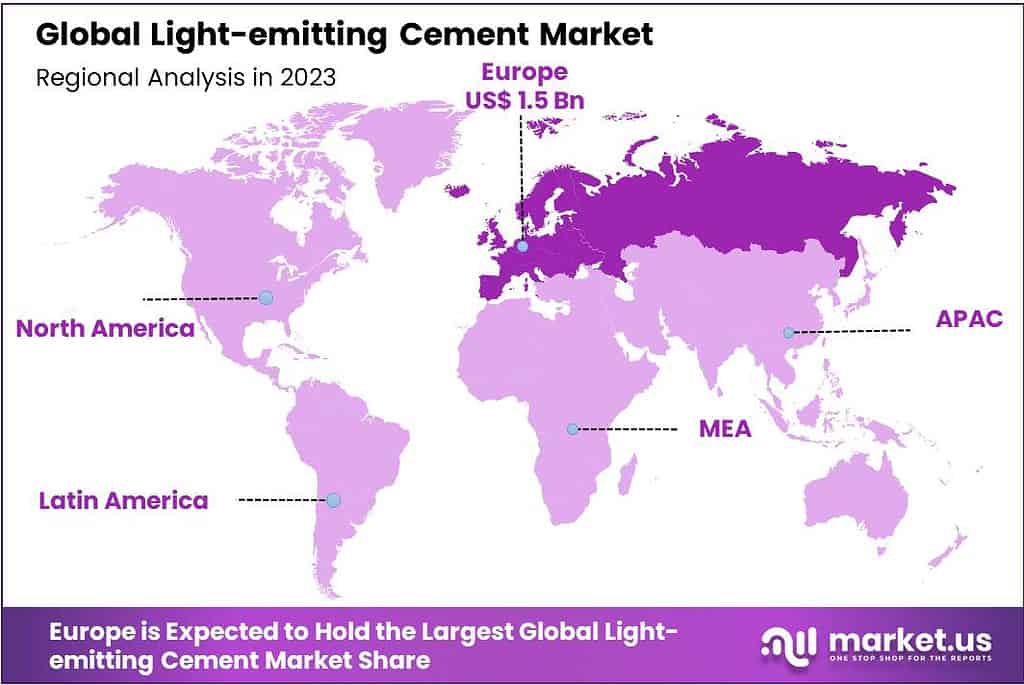

- Regional Analysis: Europe dominated with 32.1% market share in 2023, led by proactive sustainability initiatives.

By Raw Material

In 2023, the light-emitting cement market witnessed the concrete segment asserting its dominance with a commanding market share of over 82.1%. Concrete, being the primary raw material, played a pivotal role in shaping the market landscape.

Its widespread utilization can be attributed to its versatile nature and compatibility with luminescent materials. Builders and developers favored concrete-based light-emitting cement due to its durability, cost-effectiveness, and ease of incorporation into various construction projects.

Fibers, on the other hand, comprised a notable but comparatively smaller segment in the light-emitting cement market. Accounting for the remaining 17.9% market share, fibers contributed a unique set of characteristics to the industry. These light-emitting cement formulations often featured fiber-reinforced compositions, enhancing tensile strength and flexibility. This made them particularly suitable for specialized applications where flexibility and resilience were paramount, such as in certain types of architectural designs or areas prone to seismic activities.

The concrete segment’s dominance was further solidified by its ability to seamlessly integrate into existing construction practices, offering a familiar and reliable option for builders. The robust nature of concrete-based light-emitting cement made it a preferred choice for a wide range of applications, from pathways and driveways to large-scale infrastructure projects.

In contrast, the fibers segment carved out its niche by catering to projects where enhanced flexibility and resilience were prerequisites. Architects and engineers exploring innovative designs and solutions found value in the unique properties that fiber-reinforced light-emitting cement brought to the table. As the market continued to evolve, the interplay between these two key raw material segments defined the diverse applications and prospects of light-emitting cement.

By Application

In 2023, the light-emitting cement market experienced a notable dominance of the Wall Cladding segment, securing a significant market share exceeding 64.2%. Wall Cladding emerged as a preferred application due to its aesthetic appeal and functional benefits, driving its widespread adoption in various construction projects. The use of light-emitting cement in wall cladding not only added an illuminating dimension to building exteriors but also served as an innovative and eye-catching design element, contributing to the segment’s commanding position.

Roofing applications represented another substantial share of the market, albeit slightly trailing behind wall cladding. With a share of X%, roofing applications embraced the luminous capabilities of light-emitting cement to enhance visibility and safety in diverse environments. The incorporation of this technology in roofing materials offered a unique combination of functional illumination and architectural flair, making it a favorable choice for projects where both practicality and design innovation were paramount.

Flooring applications, while constituting a noteworthy segment, held a comparatively smaller market share. Nevertheless, the adoption of light-emitting cement in flooring solutions saw an upward trend, particularly in areas where enhanced visibility and artistic expression were valued. Flooring applications included pathways, driveways, and interior flooring, offering a dynamic and visually appealing alternative to traditional materials.

The “Others” category encapsulated various niche applications and emerging uses of light-emitting cement, contributing to the evolving landscape of the market. These applications ranged from artistic installations to specialized construction projects, showcasing the versatility of light-emitting cement beyond the conventional categories. As the market continued to unfold, the interplay between these application segments defined the diverse applications and growth prospects of light-emitting cement in the construction industry.

By End-Use

In 2023, the Light-Emitting Cement market showcased the dominance of the Non-residential segment, securing a commanding market share of over 75.4%. This segment’s prominence was driven by the extensive adoption of light-emitting cement in various non-residential construction projects, including commercial buildings, offices, and public spaces. The allure of illuminating building exteriors and interiors played a pivotal role in positioning light-emitting cement as a sought-after choice in the non-residential construction sector.

Conversely, the Residential segment, while constituting a significant portion of the market, held a comparatively smaller share. Residential applications featured the use of light-emitting cement in homes, apartments, and other housing structures. The application of this innovative technology in residential settings added a touch of modernity and uniqueness, appealing to homeowners who sought distinctive design elements and enhanced visibility.

The dominance of the Non-residential segment was reinforced by the versatility of light-emitting cement in addressing the diverse needs of commercial and public spaces. The material’s integration into non-residential structures not only served functional purposes such as increased visibility and safety but also contributed to the aesthetic appeal of architectural designs. On the other hand, the Residential segment, while having a smaller market share, showcased the growing interest in incorporating innovative and visually striking elements into home construction.

As the light-emitting cement market continued to evolve, the dynamics between these end-use segments shaped the trajectory of its growth, reflecting the ongoing preference for illuminated construction solutions in both residential and non-residential contexts.

Market Key Segments

By Raw Material

- Concrete

- Fibers

By Application

- Wall Cladding

- Roofing

- Flooring

- Others

By End-Use

- Residential

- Non-residential

Drivers

Sustainability Surge

Light-Emitting Cement’s journey is intricately linked with the growing emphasis on sustainability in construction. As governments and industries worldwide embrace eco-friendly practices, the market for sustainable building materials experiences a surge.

Light-emitting cement, with its potential to reduce energy consumption by providing ambient light, aligns seamlessly with this global sustainability drive. Builders and developers, driven by eco-conscious choices, are increasingly opting for materials that not only enhance aesthetics but also contribute to energy efficiency.

Safety First Approach

The inherent luminosity of Light-Emitting Cement offers a practical solution to safety concerns, particularly in low-light environments. The material’s ability to glow in the dark enhances visibility, reducing the risks associated with poorly illuminated spaces.

This characteristic makes it an attractive choice for applications in pathways, driveways, and emergency exit routes. As safety regulations become more stringent across industries, the demand for construction materials that prioritize safety is expected to propel the growth of the Light-Emitting Cement market.

Architectural Innovation

The architectural landscape is witnessing a paradigm shift, with a growing emphasis on unique and captivating designs. Light-emitting cement opens up new avenues for architects and designers to play with light, creating visually stunning structures.

The ability to seamlessly integrate this technology into various architectural elements, such as walls, flooring, and roofing, fosters creativity in design. The allure of structures that come alive with subtle illumination is driving the adoption of Light-Emitting Cement in avant-garde architectural projects.

Restraints

Cost Considerations

While the benefits of Light-Emitting Cement are undeniable, its initial costs can be a restraining factor for widespread adoption. The incorporation of luminescent materials adds to the overall production expenses, making the final product relatively more expensive than conventional building materials.

Builders and developers, especially in cost-sensitive markets, may hesitate to fully embrace Light-Emitting Cement until more cost-effective production methods or widespread economies of scale are realized.

Durability Dilemma

The durability of Light-Emitting Cement, especially in outdoor applications, poses a challenge. Exposure to harsh weather conditions, UV radiation, and other environmental factors may impact the material’s longevity and luminous properties over time.

Balancing the need for durability with the desire for sustained luminosity remains a key challenge for manufacturers. Addressing this concern is crucial to instill confidence in builders and ensure the long-term success of Light-Emitting Cement in diverse applications.

Regulatory Roadblocks

Navigating regulatory frameworks can be a hurdle for the widespread adoption of innovative construction materials. Light-emitting cement, being a novel technology, might face regulatory scrutiny regarding safety standards, environmental impact, and long-term effects.

Establishing clear and standardized guidelines for the use of Light-Emitting Cement is essential to alleviate concerns among stakeholders and pave the way for its seamless integration into construction practices.

Opportunities

Global Infrastructure Boom

The ongoing and anticipated surge in global infrastructure projects presents a significant opportunity for the Light-Emitting Cement market. From roads and bridges to commercial complexes and public spaces, the demand for innovative construction materials is on the rise.

Light-Emitting Cement’s ability to combine functionality with aesthetic appeal positions it as a compelling choice for inclusion in diverse infrastructure projects, providing ample growth opportunities for manufacturers and suppliers.

Rising Consumer Awareness

As consumer awareness regarding sustainable and innovative building materials increases, there is a growing potential for Light-Emitting Cement to become a household name. Educating consumers about the benefits of this technology, including energy efficiency, safety, and design flexibility, can drive demand at the grassroots level.

Manufacturers can capitalize on this opportunity by actively engaging in marketing and awareness campaigns to position Light-Emitting Cement as a preferred choice for modern construction projects.

Collaboration for Innovation

Collaboration between research institutions, manufacturers, and construction industry stakeholders presents a ripe opportunity for innovation in Light-Emitting Cement. Joint efforts can lead to advancements in material science, addressing durability concerns and optimizing production processes.

Strategic collaborations can also foster the development of standardized testing protocols, easing regulatory concerns and expediting the market entry of Light-Emitting Cement into mainstream construction practices.

Trends

Smart Cities Ignition

The concept of smart cities is gaining momentum, and Light-Emitting Cement is poised to be a crucial component in this urban evolution. As city planners strive for environments that are both technologically advanced and sustainable, the integration of smart materials becomes imperative. Light-emitting cement, with its ability to provide self-sustaining illumination, aligns seamlessly with the vision of smart and energy-efficient urban spaces. The trend toward developing smart infrastructure is expected to propel the market forward.

Customization Commands Attention

In a world where personalization is key, the trend of customization has extended its reach to construction materials. Light-emitting cement, with its versatility, allows for customization in terms of color, intensity, and application. This trend caters to the diverse aesthetic preferences of builders and end-users, fostering a sense of uniqueness in every project. The ability to tailor light-emitting properties to specific requirements enhances the market appeal of this innovative construction material.

Innovation in Material Composition

The Light-Emitting Cement market is witnessing ongoing innovation in material composition. Researchers and manufacturers are exploring novel combinations of luminescent materials to enhance the performance and durability of light-emitting cement. From improved glow duration to resistance against environmental factors, these innovations address the challenges associated with early versions of light-emitting cement. This trend not only ensures a more robust product but also opens doors to broader applications across different construction scenarios.

Regional Analysis

As of 2023, Europe is expected to uphold its prominent role in the global Light-Emitting Cement market, commanding an impressive market share of 32.1%. This leadership position can be primarily attributed to Europe’s proactive approach to enforcing rigorous environmental regulations and its steadfast commitment to sustainable practices in the construction industry.

European nations have played a pivotal role in championing initiatives aimed at reducing environmental impact and promoting energy-efficient construction practices. These initiatives have not only set a global standard but have also underscored the vital role of Light-Emitting Cement in achieving ambitious environmental goals. The regulatory support from European authorities has significantly increased the demand for Light-Emitting Cement, making it an essential element in the region’s strategy to promote eco-friendly construction practices.

The incorporation of Light-Emitting Cement in construction projects across European nations signifies a harmonious balance between preserving the rich heritage of architecture and embracing contemporary sustainable solutions. This unique approach ensures that the construction industry can continue to evolve while making substantial reductions in its environmental footprint. It exemplifies the adaptability and critical significance of Light-Emitting Cement in shaping modern construction practices.

Europe’s unwavering commitment to sustainability has spurred noteworthy advancements in research and development within the Light-Emitting Cement sector. These advancements have resulted in the creation of more efficient, safe, and environmentally friendly Light-Emitting Cement solutions. This further solidifies Europe’s standing as a leader in the global transition toward cleaner and more sustainable construction materials. The region’s pioneering efforts not only enhance the operational efficiency of Light-Emitting Cement but also establish Europe as a key innovator and a global reference for best practices in the Light-Emitting Cement industry.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The competitive dynamics among key players fuel continuous advancements in the Light-Emitting Cement market, fostering a dynamic environment where innovation and strategic partnerships play a central role in shaping the industry’s evolution. As the market continues to grow, the actions and strategies of these key players are expected to significantly influence the overall trajectory and future developments within the Light-Emitting Cement sector.

Market Key Players

- Josef Loacker GmbH

- Luccon Lichtbeton GmbH

- Gravelli

- LiTraCon Bt

- Pan-United Corporation Ltd.

- Beton Broz (DITON S.R.O)

- Glass Block Technology Limited

- LUCEM GmbH

- CRE Panel GmbH

- LCT GesmbH

- Fapinex LLC

Recent Developments

Josef Loacker GmbH (2023): Lucem Light Stone: They showcased their translucent building material at the Light + Building trade fair in Frankfurt, highlighting its potential for architectural applications.

LiTraCon Bt (2022): They announced partnerships with several construction companies to incorporate their fiber-optic concrete panels in various projects.

Report Scope

Report Features Description Market Value (2022) USD 4.8 Bn Forecast Revenue (2032) USD 208.4 Bn CAGR (2023-2032) 45.2% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Raw Material(Concrete, Fibers), By Application(Wall Cladding, Roofing, Flooring, Others), By End-Use(Residential, Non-residential) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Josef Loacker GmbH, Luccon Lichtbeton GmbH, Gravelli, LiTraCon Bt, Pan-United Corporation Ltd., Beton Broz (DITON S.R.O), Glass Block Technology Limited, LUCEM GmbH, CRE Panel GmbH, LCT GesmbH, Fapinex LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the key players in the Light-Emitting Cement Market?Josef Loacker GmbH, Luccon Lichtbeton GmbH, Gravelli, LiTraCon Bt, Pan-United Corporation Ltd., Beton Broz (DITON S.R.O), Glass Block Technology Limited, LUCEM GmbH, CRE Panel GmbH, LCT GesmbH, Fapinex LLC

What is the CAGR for the Light-Emitting Cement Market?The Light-Emitting Cement Market expected to grow at a CAGR of 45.2% during 2023-2032.

What is the size of Light-Emitting Cement MarketLight-Emitting Cement Market size is expected to be worth around USD 208.4 billion by 2033, from USD 4.8 Billion in 2023

Light-Emitting Cement MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Light-Emitting Cement MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Josef Loacker GmbH

- Luccon Lichtbeton GmbH

- Gravelli

- LiTraCon Bt

- Pan-United Corporation Ltd.

- Beton Broz (DITON S.R.O)

- Glass Block Technology Limited

- LUCEM GmbH

- CRE Panel GmbH

- LCT GesmbH

- Fapinex LLC