Global Light Duty Vehicle Market By Vehicle type(Passenger cars, Van, Sports Utility Vehicle, Pickup truck), By Fuel type(Diesel, Gasoline, Hybrid, Electric), By Transmission(Manual, Automatic), By Drivetrain(Front-wheel, Rear wheel, Four wheel, All-wheel) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 42447

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

- Light-Duty Vehicle Market Overview:

- Key Takeaways

- Driving Factors

- Restraining Factors

- Vehicle type Analysis

- Fuel type Analysis

- Transmission Analysis

- Drivetrain Analysis

- Key Market Segments

- Growth Opportunities

- Trending Factors

- Regional Analysis:

- Key Players Analysis

- Маrkеt Кеу Рlауеrѕ:

- Recent Developments

- Report Scope

Light-Duty Vehicle Market Overview:

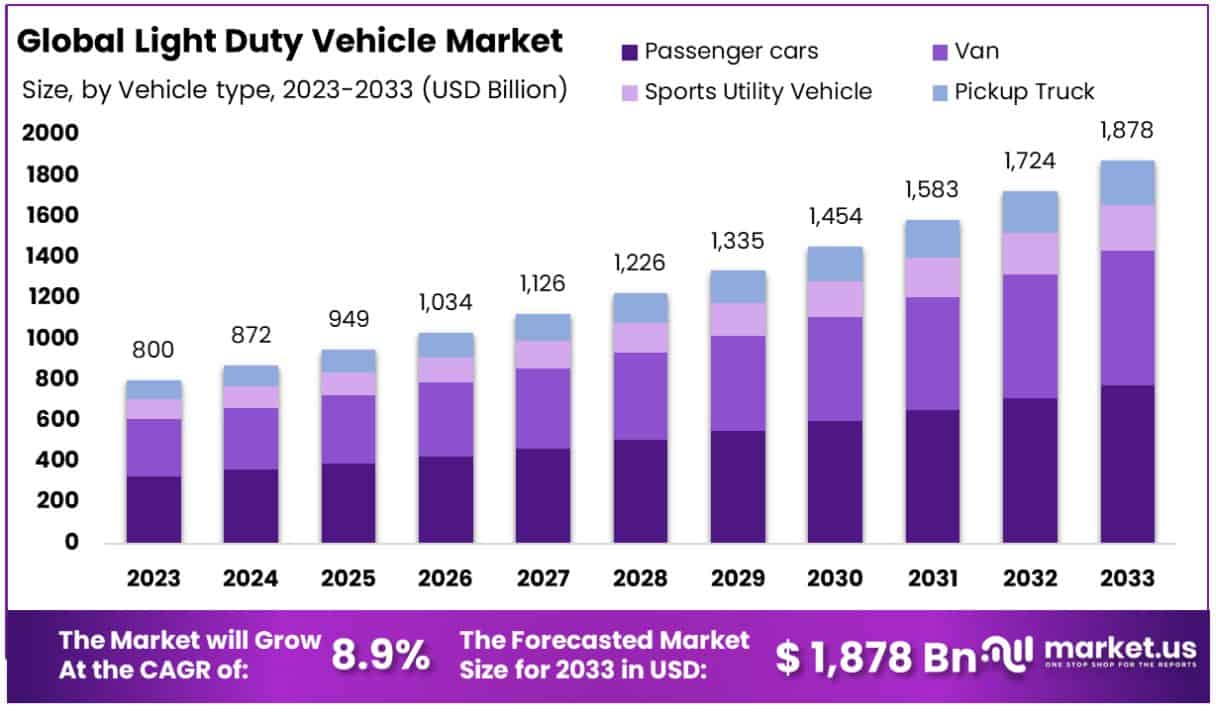

The Global Light Duty Vehicle Market size is expected to be worth around USD 1878 Billion by 2033, from USD 800 Billion in 2023, growing at a CAGR of 8.90% during the forecast period from 2024 to 2033.

The Light Duty Vehicle Market refers to the segment within the automotive industry encompassing vehicles with a gross vehicle weight rating (GVWR) below 8,500 pounds, including passenger cars, sport utility vehicles (SUVs), and light trucks. This dynamic market is characterized by continual innovation, driven by evolving consumer preferences, regulatory requirements, and technological advancements. Key factors influencing this market include fuel efficiency, emission standards, safety features, and advancements in electric and hybrid technologies. Analysis of this market involves a comprehensive examination of production, sales, distribution channels, and competitive landscape, providing valuable insights for stakeholders across the automotive value chain.

A light-duty vehicle is a truck or car that has a GVWR, of less than 8,500 intelligent battery sensors (IBS). Because of the smaller volume of air pollutants that it emits, light-duty vehicles are expected to be in demand. Stringent regulations that aim to reduce vehicular emissions will encourage electric light-duty trucks and drive market growth during the forecast period.

The Light-Duty Vehicle Market is witnessing a notable transformation, largely driven by significant investment initiatives aimed at fostering clean transportation solutions. This year, a substantial portion of investment capital is directed toward addressing key societal concerns, particularly in underserved communities and small truck fleets. California stands out as a pioneer in this regard, with its unprecedented allocation of $2.6 billion for Clean Transportation Incentives in Fiscal Year 2022-23. Impressively, over 70% of this funding is earmarked to benefit priority populations, including low-income communities and those disproportionately affected by environmental pollution.

Governor Gavin Newsom’s endorsement of this initiative underscores its significance in the state’s broader agenda of transitioning towards zero-emission vehicles. The commitment to phasing out new gas-powered cars by 2035, as part of the $54 billion California Climate Commitment, reflects a proactive approach towards sustainable mobility. This substantial investment not only promotes environmental stewardship but also aims to make clean energy solutions more accessible and affordable for communities across California.

Such strategic investments not only drive market growth but also reflect a broader societal shift towards sustainability and environmental responsibility. As the market continues to evolve, stakeholders are urged to capitalize on emerging opportunities within the clean transportation sector, aligning their strategies with the evolving regulatory landscape and consumer preferences. In conclusion, the Light-Duty Vehicle Market presents promising prospects, fueled by substantial investments and a growing emphasis on clean energy adoption.

Key Takeaways

- The Light Duty Vehicle Market is projected to reach USD 800 Billion by 2033, growing at a CAGR of 8.90% from 2024 to 2033.

- Passenger cars held a dominant market position in Vehicle type capturing more than a 41.3% share.

- Gasoline held a dominant market position Fuel type segment capturing more than a 71.3% share.

- Manual transmission held a dominant market position Transmission segment capturing more than a 60.8% share.

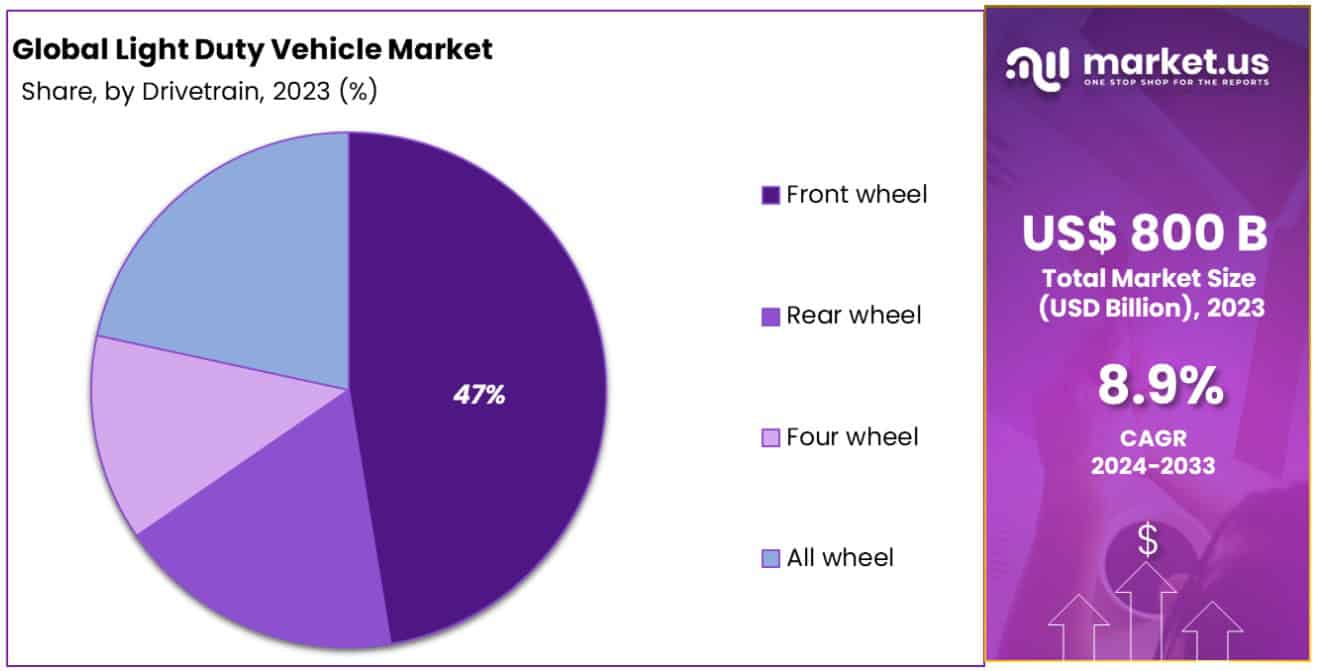

- Front-wheel drive held a dominant market position Drivetrain Segment capturing more than a 47.4% share.

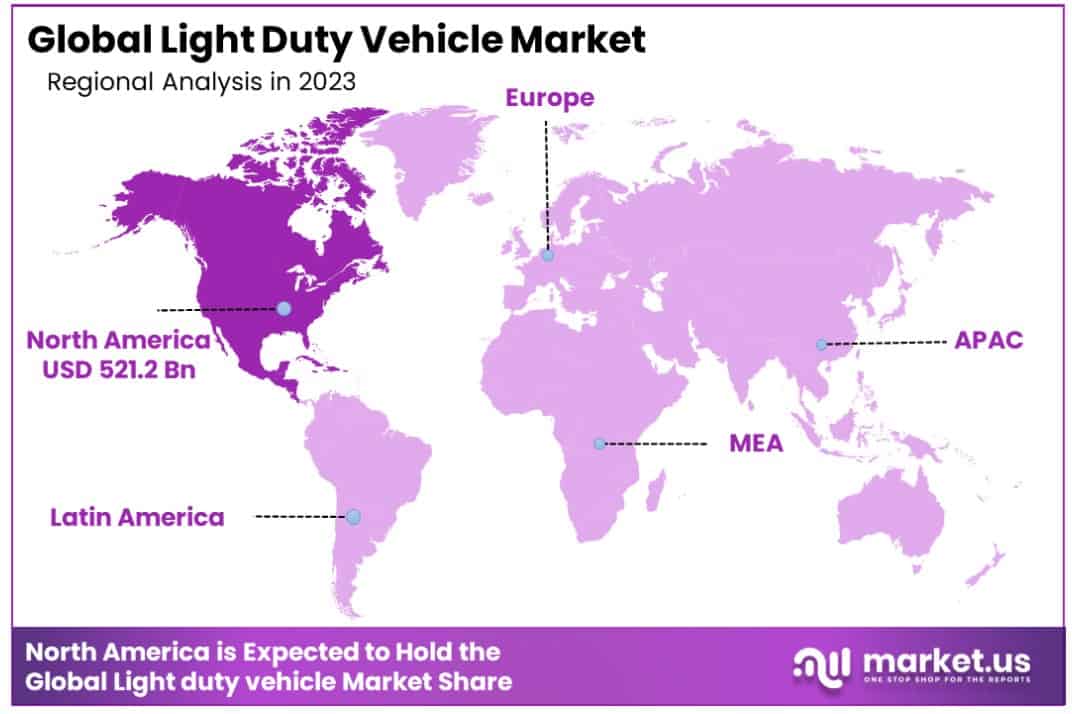

- North America region dominating with a 31.4% market share.

Driving Factors

Consumer Preference for SUVs and Luxury Models:

The burgeoning consumer preference for SUVs and luxury models significantly propels the growth of the Baby Carriers Market. Families opting for spacious SUVs and upscale vehicles often prioritize safety and convenience, making baby carriers an essential accessory. According to recent surveys, SUV sales have surged, with families constituting a substantial portion of buyers. This trend reflects a growing demand for versatile transportation solutions, driving the uptake of baby carriers as a must-have accessory for on-the-go parents.

Increasing Number of Light-Duty Car Models Available:

The proliferation of Light Duty car models plays a pivotal role in fostering the expansion of the Baby Carriers Market. With an increasing variety of vehicles falling within this category, ranging from compact cars to SUVs, manufacturers are catering to diverse consumer needs. This broad spectrum of vehicle options augments the demand for baby carriers, as parents seek compatible solutions tailored to their specific vehicle models. As the market continues to diversify, the accessibility of suitable baby carriers for various car models further stimulates market growth.

Technological Advancements in Vehicle Components:

Technological advancements in vehicle components serve as a catalyst for innovation in the Baby Carriers Market. Integration of advanced safety features such as enhanced seat belt systems, child safety locks, and compatibility with car seat bases heightens the appeal of baby carriers. Moreover, the integration of smart technology, such as sensor-based systems providing real-time monitoring of infant positioning and safety, elevates the functionality and desirability of modern baby carriers. As consumers prioritize safety and convenience, technological innovations in vehicle components drive the adoption of advanced baby carrier solutions.

Increasing Availability of Light Duty Commercial Vehicles:

The increasing availability of light-duty commercial vehicles contributes significantly to the growth trajectory of the Baby Carriers Market. Businesses utilizing Light Duty commercial vehicles, such as delivery services and ride-sharing companies, often require safe and efficient transportation solutions for passengers with infants. Consequently, the demand for baby carriers compatible with commercial vehicles is on the rise. This trend is further fueled by the expanding gig economy and the growing number of families relying on commercial transportation services, underscoring the market’s potential for sustained growth.

Restraining Factors

Increasing Availability of Light Commercial Vehicles:

The increasing availability of light commercial vehicles presents a dual-edged influence on the growth of the Light Duty Vehicle Market. While it expands the overall market by offering more options to consumers and businesses, it also introduces competition within the segment. This heightened competition can lead to pricing pressures and thinner profit margins for manufacturers. However, it also spurs innovation and product differentiation as companies strive to distinguish their offerings amidst a crowded market. Consequently, while the availability of light commercial vehicles may pose challenges, it ultimately drives market growth through increased consumer choice and industry innovation.

Lack of Charging Infrastructure for Light Duty Vehicles:

The lack of adequate charging infrastructure poses a significant restraint on the growth of the Light Duty Vehicle Market, particularly for electric vehicles (EVs). Despite the increasing popularity of EVs due to their environmental benefits and lower operating costs, the limited availability of charging stations hampers widespread adoption. Statistics reveal that a substantial percentage of consumers cite range anxiety and the inconvenience of charging as key deterrents to purchasing EVs. This bottleneck in infrastructure development stifles market growth by limiting consumer confidence and inhibiting the transition to electric-powered light-duty vehicles.

High Initial Cost of Electric Vehicles:

The high initial cost of electric vehicles serves as a formidable barrier to entry for many consumers, impeding the growth of the Light Duty Vehicle Market. While EVs offer long-term savings through reduced fuel and maintenance costs, the upfront investment remains prohibitive for a significant portion of potential buyers. Recent market data indicates that the initial purchase price of EVs can be up to 20% higher than their gasoline-powered counterparts. This price disparity dissuades cost-conscious consumers from embracing electric vehicles, thereby constraining market expansion. Addressing this challenge through incentives, subsidies, and technological advancements to reduce manufacturing costs is crucial to unlocking the full growth potential of the Light Duty Vehicle Market.

Vehicle type Analysis

Passenger cars held a dominant market position, capturing more than a 41.3% share. This segment’s prominence is attributed to its widespread use as a primary mode of transportation for individuals and families alike. Passenger cars offer versatility, fuel efficiency, and comfort, appealing to a broad consumer base seeking practical and economical vehicle options. Additionally, advancements in safety features and interior amenities have further bolstered the appeal of passenger cars, driving their market penetration.

Vans accounted for a significant portion of the market, reflecting a preference for utilitarian vehicles among businesses, organizations, and large families. With their spacious interiors and customizable configurations, vans serve diverse purposes, including commercial transportation, passenger shuttling, and recreational activities. The versatility and adaptability of vans make them a preferred choice for consumers requiring ample cargo space and seating capacity, contributing to their substantial market presence.

Sports Utility Vehicles (SUVs) emerged as a prominent segment in the automotive market landscape, capturing a considerable market share. SUVs’ popularity stems from their rugged design, elevated ground clearance, and all-terrain capabilities, catering to consumers seeking adventure and off-road capabilities. Furthermore, the crossover SUV segment has witnessed exponential growth, appealing to urban dwellers with its blend of SUV styling and car-like handling. As consumers increasingly prioritize lifestyle and outdoor pursuits, SUVs remain a favored choice, driving their market dominance.

Pickup trucks constituted a notable segment of the market, characterized by their robust construction, towing capacity, and versatility. Targeting a diverse consumer base ranging from tradespeople and contractors to outdoor enthusiasts, pickup trucks offer unmatched utility for both personal and professional applications. The ongoing trend of lifestyle-oriented truck models, coupled with innovations in technology and design, has fueled the demand for pickup trucks, solidifying their position within the automotive market.

Fuel type Analysis

Gasoline held a dominant market position, capturing more than a 71.3% share. Gasoline-powered vehicles remain the preferred choice for consumers globally, driven by factors such as affordability, widespread availability of fueling infrastructure, and familiarity with traditional combustion engine technology. The reliability and efficiency of gasoline engines continue to resonate with a broad spectrum of consumers, contributing to their substantial market dominance.

Diesel vehicles constituted a notable segment of the market, albeit with a smaller share compared to gasoline-powered counterparts. Diesel engines are renowned for their torque, fuel efficiency, and longevity, making them a preferred option for consumers with high mileage requirements, such as commercial fleet operators and long-distance commuters. Despite concerns over diesel emissions and regulatory scrutiny, diesel vehicles maintain a loyal customer base in specific market segments, particularly within the commercial and industrial sectors.

Hybrid vehicles emerged as a growing segment within the automotive market, leveraging a combination of internal combustion engines and electric propulsion systems to deliver improved fuel economy and reduced emissions. The hybrid technology offers consumers a transitional solution towards electrification while retaining the convenience and range of traditional gasoline-powered vehicles. As environmental consciousness and fuel efficiency become increasingly prioritized, hybrid vehicles are poised to gain traction among environmentally conscious consumers seeking sustainable transportation options.

Electric vehicles (EVs) represent a nascent yet rapidly expanding segment of the automotive market, characterized by vehicles powered solely by electric motors and rechargeable battery packs. EVs offer zero-emission transportation solutions, aligning with global efforts to mitigate climate change and reduce dependence on fossil fuels. Despite initial concerns over range limitations and charging infrastructure, advancements in battery technology and supportive government policies have accelerated the adoption of electric vehicles. As EV technology continues to evolve and charging infrastructure expands, electric vehicles are poised to revolutionize the automotive industry, challenging the dominance of traditional gasoline-powered vehicles.

Transmission Analysis

Manual transmission held a dominant market position, capturing more than a 60.8% share. Manual transmission vehicles have long been favored by enthusiasts and cost-conscious consumers for their engaging driving experience, fuel efficiency, and lower upfront costs compared to automatic counterparts. Additionally, manual transmissions offer greater control over vehicle performance, making them preferred options for driving enthusiasts seeking a more involved driving experience.

Automatic transmission vehicles constituted a significant segment of the market, albeit with a smaller share compared to manual transmission vehicles. Automatic transmissions offer convenience and ease of use, particularly in stop-and-go traffic and urban driving conditions. Their seamless gear shifts and simplified driving experience appeal to a broad spectrum of consumers, including those seeking comfort and convenience in their daily commute.

Drivetrain Analysis

Front-wheel drive held a dominant market position, capturing more than a 47.4% share. Front-wheel drive vehicles are favored for their efficient packaging, improved fuel economy, and superior traction in inclement weather conditions. This drivetrain configuration appeals to a broad consumer base seeking practical and economical vehicle options for everyday use.

Rear-wheel drive vehicles constituted a significant segment of the market, albeit with a smaller share compared to front-wheel drive counterparts. Rear-wheel drive vehicles are prized for their balanced handling, enhanced performance characteristics, and suitability for high-performance applications. Enthusiasts and performance-oriented consumers often prefer rear-wheel drive vehicles for their dynamic driving experience and sporty handling characteristics.

Four-wheel drive vehicles emerged as a notable segment within the automotive market, leveraging the capability to distribute power to all four wheels for enhanced traction and off-road capability. Four-wheel drive vehicles are popular among outdoor enthusiasts, adventure seekers, and those residing in regions with challenging terrain or inclement weather conditions. This drivetrain configuration offers versatility and confidence-inspiring performance across a variety of driving scenarios, driving its market presence.

All-wheel drive vehicles represented a growing segment within the automotive market, offering seamless power distribution to all four wheels for enhanced traction and stability. All-wheel drive systems automatically adjust power delivery to individual wheels based on driving conditions, providing optimal grip and control in diverse environments. This drivetrain configuration appeals to consumers seeking enhanced safety and confidence in various driving conditions, including snow, rain, and rough terrain.

Key Market Segments

By Vehicle type

- Passenger cars

- Van

- Sports Utility Vehicle

- Pickup truck

By Fuel type

- Diesel

- Gasoline

- Hybrid

- Electric

By Transmission

- Manual

- Automatic

By Drivetrain

- Front-wheel

- Rear wheel

- Four wheel

- All-wheel

Growth Opportunities

Rising Consumer Concerns Regarding Incentives and Exemptions:

Despite the increasing interest in light-duty vehicles, consumer concerns about the limited availability of financial incentives and exemptions present a notable opportunity for market growth. Governments and industry stakeholders have the opportunity to address these concerns through targeted incentives, tax breaks, and regulatory measures that encourage the adoption of Light Duty vehicles. As per recent studies, regions offering substantial incentives have witnessed a significant uptick in light-duty vehicle sales, indicating the potential impact of policy interventions on market expansion.

Surging Demand for SUVs, Pickups, and Luxury Models:

The growing consumer preference for SUVs, pickups, and luxury models represents a lucrative opportunity for the Light Duty Vehicle Market. As consumer lifestyles evolve and preferences shift towards larger, more versatile vehicles, automakers have the opportunity to capitalize on this trend by expanding their offerings in these segments. Recent market data reveals a notable increase in sales of SUVs and luxury models, underscoring the potential for sustained growth in these segments. By aligning product portfolios with consumer preferences and investing in innovative design and technology, automakers can seize the opportunity presented by the growing demand for SUVs, pickups, and luxury vehicles.

Trending Factors

Automobile OEMs are increasing the number of light-duty vehicles that have navigation, safety features, fleet tracking, and other advanced technologies. The future of automated light-duty vehicles is possible thanks to the advancements in location-based services and sensors. The growth of IoT has made it possible to include telematics systems like fleet telematics for tracking light-duty vehicles into cars. As a result, driverless taxis and passenger vehicles have been developed. The tendency to include dynamic shuttles in on-demand passenger services is a significant factor in the rising demand for light-duty vehicles.

Supply chain complexity is increasing in the transportation and logistics industry Delivery within the last mile adapts dynamically to accommodate shifting customer preferences. Last-mile delivery innovations and passenger transport are expected to increase the number of light-duty vehicles that can be used. Throughout the forecast period, the market is anticipated to increase in line with the expanding e-commerce industry and the increasing range of applications for light-duty cars.

Regional Analysis:

North America emerges as a key stronghold in the global Light Duty Vehicle Market, commanding a substantial 31.4% market share.

The region’s dominance is fueled by robust consumer demand, technological innovation, and supportive regulatory frameworks. In the United States and Canada, favorable economic conditions, low interest rates, and a robust automotive industry infrastructure drive steady market growth. Additionally, the growing consumer preference for SUVs, pickups, and electric vehicles contributes to market expansion.

According to industry reports, North America witnessed a significant surge in electric vehicle sales, with a notable increase in hybrid and electric SUVs. Furthermore, advancements in autonomous driving technology and connected vehicle systems bolster market prospects, with major automakers investing heavily in research and development. Despite challenges such as supply chain disruptions and semiconductor shortages, North America remains at the forefront of innovation and market leadership in the Light Duty Vehicle segment.

In Europe, stringent emissions regulations, increasing adoption of electric vehicles, and shifting consumer preferences towards sustainable transportation solutions drive market growth. The region accounts for a significant share of electric vehicle sales globally, with countries like Norway leading in EV adoption rates. In Asia Pacific, rapid urbanization, rising disposable incomes, and government incentives propel market expansion. China emerges as a major market player, with robust sales of electric vehicles and government initiatives promoting clean energy transportation. Middle East & Africa and Latin America exhibit untapped potential, with increasing urbanization, infrastructure development, and rising consumer aspirations driving market demand. While these regions face challenges such as inadequate charging infrastructure and economic volatility, strategic investments and policy support are poised to unlock significant growth opportunities in the Light Duty Vehicle Market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

the global limestone market witnessed significant participation from key players in the automotive industry, including BMW AG, Daimler AG, Fiat Chrysler Automobiles N.V., Ford Motor Company, General Motors Company, Honda Motor Company, Ltd., and Hyundai Motor Company. These companies play a crucial role in shaping market dynamics through their extensive operations, strategic initiatives, and commitment to sustainability.

BMW AG stands out as a leading player in the global limestone market, leveraging its expertise in luxury vehicle manufacturing and commitment to environmental sustainability. The company’s adoption of limestone-based materials in vehicle components underscores its dedication to reducing environmental impact and promoting resource efficiency. BMW’s innovative approaches to limestone utilization set industry benchmarks and drive adoption across the automotive sector.

Daimler AG, with its flagship Mercedes-Benz brand, also commands a significant presence in the global limestone market. The company’s focus on premium vehicle segments and investment in advanced manufacturing processes position it as a key influencer in limestone adoption. Daimler’s emphasis on product differentiation and customer-centric innovation drives the integration of limestone-based materials in its vehicle lineup, enhancing performance, durability, and environmental sustainability.

Fiat Chrysler Automobiles N.V., Ford Motor Company, General Motors Company, Honda Motor Company, Ltd., and Hyundai Motor Company each contribute to the global limestone market through their diverse product portfolios and strategic collaborations. These companies recognize limestone as a vital resource for enhancing product quality, reducing weight, and achieving sustainability targets. By embracing limestone-based solutions, key players in the automotive industry are poised to drive innovation, enhance competitiveness, and contribute to a greener future for the global automotive sector.

For light-duty vehicles, OEMs must source at least 50% of their components from suppliers. To ensure a steady supply of components, OEMs prefer to establish strong partnerships with suppliers. To be able to develop innovative technologies and compete with their competitors, market leaders are investing heavily in research and development. They also partner with government agencies to develop EV charging infrastructure.

Маrkеt Кеу Рlауеrѕ:

- BMW AG

- Daimler AG

- Fiat chrysler Automobiles N.V

- Ford Motor Company

- General Motors Company

- Honda motor company,ltd

- Hyundai motor company

- Nissan Motor Company Ltd

- Subaru Corporation

- Toyota motor corporation

- AB Volvo

- Aston Martin

- Ferrari s.p.a

Recent Developments

In August 2023 Foton a company of electric vehicles and trailers, introduced its first all-electric tipper truck, called the Foton T5 Electric Tipper. The T5 model can be configured in a variety of configurations, with Gross Vehicle Mass (GVM) between 4,500 kg which is suitable for licenses for cars up to a higher capacity of 6,000 kg. Both models are fitted with towing capabilities, which adds flexibility.

In June 2023 Nissan will unveil the new Townstar van that will be available on June 20, 2022. The model will replace the e-NV200. With petrol and fully electric options for engines, the brand-new Townstar offers a broad and competitive option for the small van segment. The all-new Townstar which is completely electric, is designed to speed up the transition to zero-emissions motoring. The brand-new Townstar is the latest version of Nissan’s completely electric compact LCV range and has been built to be an effective and sustainable business partner that can be optimized to meet the requirements of customers who are constantly changing their requirements.

In May 2023 Renault reached an agreement to sell its 100 percent share of Renault Russia to the Moscow City entity.

Report Scope

Report Features Description Market Value (2023) USD 800 Billion Forecast Revenue (2033) USD 1878 Billion CAGR (2024-2033) 8.90% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle type(Passenger cars, Van, Sports Utility Vehicle, Pickup truck), By Fuel type(Diesel, Gasoline, Hybrid, Electric), By Transmission(Manual, Automatic), By Drivetrain(Front-wheel, Rear wheel, Four wheel, All-wheel) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BMW AG, Daimler AG, Fiat Chrysler Automobiles N.V, Ford Motor Company, General Motors Company, Honda Motor Company,ltd, Hyundai Motor Company, Nissan Motor Company Ltd, Subaru Corporation, Toyota Motor Corporation, AB Volvo, Aston Martin, Ferrari s.p.a Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected CAGR at which the Light duty vehicle market is expected to grow at?The Light duty vehicle market is expected to grow at a CAGR of 8.90%

List the segments encompassed in this report on the Light duty vehicle market?Market.US has segmented the Light duty vehicle market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Аutоmаtіс Тrаnѕmіѕѕіоn, Маnuаl Тrаnѕmіѕѕіоn, Соntіnuоuѕ Vаrіаblе Тrаnѕmіѕѕіоn. By Application, the market has been further divided into Fuel Car and Electric Cars.

List the key industry players of the Light duty vehicle market?BMW AG, Fiat Chrysler Automobiles N.V., Ford Motor Company, Daimler AG, General Motors Company, Hyundai Motor Company, Honda Motor Company, Nissan Motor Company Ltd., Other Key Players engaged in the Light duty vehicle market.Name the key areas of business for light duty vehicle market?The U.S., Canada, U.K., Germany, India, China, & Japan, are key areas of operation for Light duty vehicle Market.

-

-

- BMW AG

- Fiat Chrysler Automobiles N.V.

- Ford Motor Company

- Daimler AG

- General Motors Company

- Hyundai Motor Company

- Honda Motor Company

- Nissan Motor Company Ltd.

- Other Key Players