Global Legal Technology Market Size, Share, Statistics Analysis Report By Component (Software, Services), By End-User (Law Firms, Corporate Legal Departments), By Application (E-discovery, Legal Research, Practice and Compliance Management, Document Management, Billing and Time Tracking, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133732

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

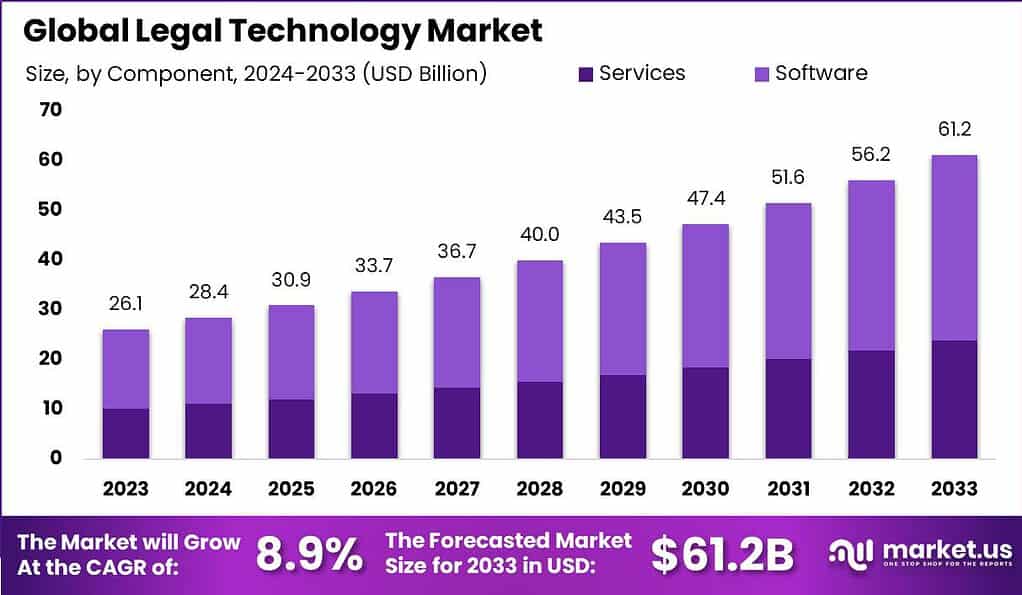

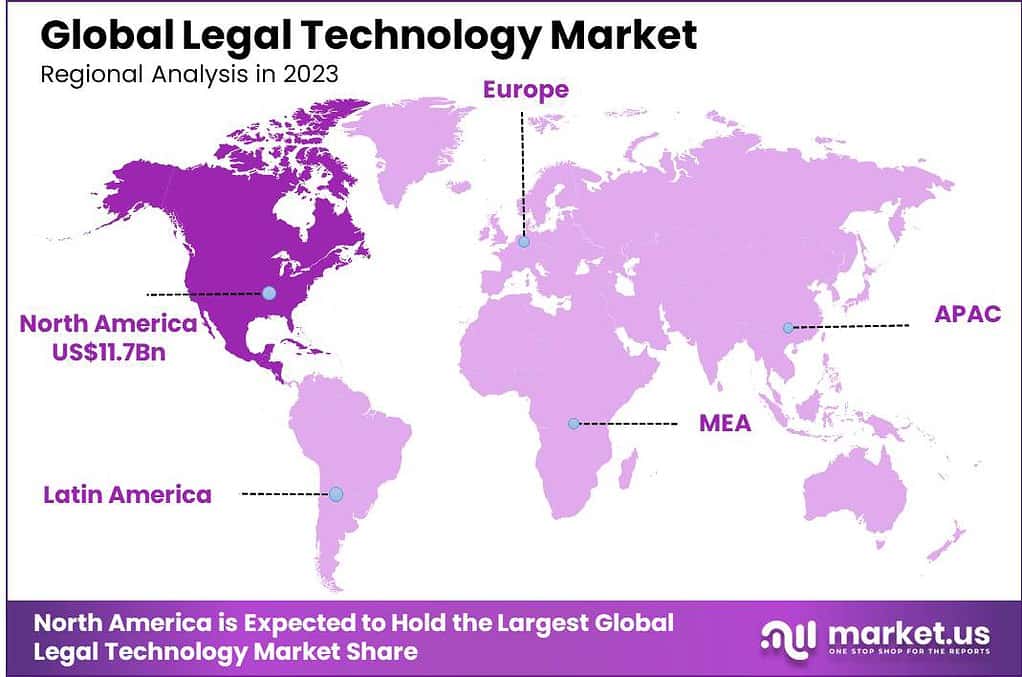

The Global Legal Technology Market size is expected to be worth around USD 61.2 Billion By 2033, from USD 26.09 Billion in 2023, growing at a CAGR of 8.90% during the forecast period from 2024 to 2033. In 2023, North America led the legal technology market, commanding over 45% of the market share and generating a substantial USD 11.7 billion in revenue.

Legal Technology, often referred to as “Legal Tech,” encompasses the use of technology and software to provide legal services and support the legal industry. This includes everything from electronic databases for case management and research, to more advanced software that automates document analysis, improves compliance, and facilitates easier electronic discovery.

Tools like artificial intelligence (AI) and blockchain are becoming increasingly prevalent, offering innovative ways to streamline complex legal processes and reduce the workload on legal professionals. Legal Tech aims to make legal services more efficient, accessible, and affordable, transforming traditional practices in law firms and in-house legal departments.

The Legal Technology Market is experiencing significant growth driven by several key factors. The increasing demand for automation within legal processes to reduce the time and cost associated with routine tasks is a major driver. This includes the automation of document management, due diligence, and even some aspects of litigation and contract review.

Additionally, the expanding need for enhanced security measures and improved compliance solutions is pushing law firms and corporate legal departments towards Legal Tech solutions. Another growth driver is the pressure on legal professionals to improve client satisfaction and service delivery, which tech solutions facilitate by providing more responsive and interactive client service platforms.

Legal technology has gained popularity not only among large law firms but also among solo practitioners and small firms. These groups are finding that legal tech tools provide them with the resources to compete more effectively with larger entities by leveling the playing field, especially in terms of research and document preparation.

One of the most promising opportunities within the legal technology market lies in the development of platforms that enhance access to legal services. Technologies that provide automated legal advice or connect clients with lawyers online are expanding access to legal help, making it more affordable and available.

The market is set to expand further as more legal firms realize the potential of technology to transform their services. Expansion is particularly noticeable in areas such as data security and compliance, where technology offers critical solutions in an increasingly complex legal environment. This trend towards technological adoption indicates a shift towards a more dynamic and digitally-oriented legal industry.

According to wifitalents, about 44% of legal professionals have embraced AI and machine learning within their practice areas, indicating a significant shift towards technology in the legal sector. Notably, 67% of law firms are now utilizing AI specifically for legal research and analytics. This is complemented by the fact that 23% of legal departments have automated over half of their routine tasks, streamlining operations significantly.

Moreover, the adoption of legal project management technology by 40% of law firms reflects a growing trend towards optimizing workflow and project delivery. Cloud-based solutions are also gaining traction, with 38% of lawyers leveraging these technologies to enhance collaboration and manage data more efficiently across their firms.

Looking towards the future, 60% of law firms are planning to invest in technologies aimed at enriching the client experience. This intention is matched by 55% of in-house counsel who anticipate increasing their expenditure on legal tech in the coming year, highlighting a proactive approach towards innovation.

Conversely, a survey by LexisNexis of 900 law firms in the UK presents a slightly different picture. Only 37% of these firms currently use legal technology. For small firms, particularly, 81% acknowledge the challenge of updating working practices and systems over the next year. Despite recognizing the necessity for investment in new technologies, a mere 24% of small firm lawyers have concrete plans to implement such technologies within the next 12 months.

Key Takeaways

Component Analysis

In 2023, the Software segment held a dominant market position in the legal technology market, capturing more than a 61% share. This dominance is largely attributed to the increasing demand for automated legal solutions that streamline workflow, improve accuracy, and reduce the time spent on repetitive tasks.

Legal software tools, including case management systems, e-discovery, legal research, and contract management, are critical for enhancing the efficiency of legal practices. As law firms and corporate legal departments seek to minimize costs and maximize efficiency, the reliance on these software solutions continues to grow.

The surge in remote work trends has also significantly fueled the adoption of legal software. With teams working from dispersed locations, cloud-based legal software solutions have become essential for maintaining collaboration, data integrity, and security. These software solutions ensure that legal professionals can access case files, conduct research, and manage client information securely from any location, thereby enhancing operational flexibility and client service.

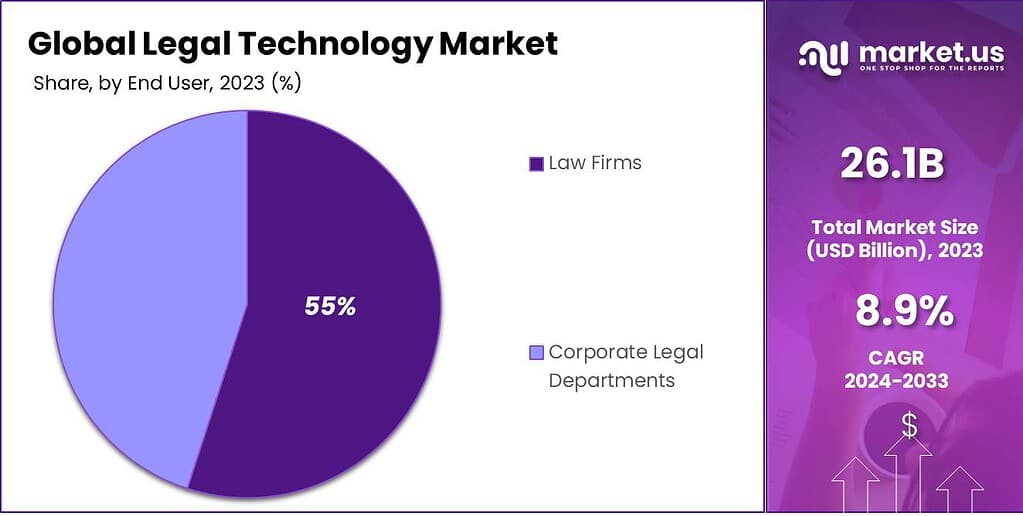

End-User Analysis

In 2023, the Law Firms segment held a dominant market position in the Legal Technology Market, capturing more than a 55% share. This substantial market share can be attributed to several key factors that underscore the unique needs and aggressive adoption of technology solutions by law firms globally.

Legal tech solutions, such as AI-powered legal research tools and case management systems, have become essential in managing vast amounts of data and streamlining operations, making them highly sought after by law firms aiming to maintain competitive advantages.

Client demands for faster, more transparent, and cost-effective legal services have driven law firms to integrate advanced technologies. These technologies not only improve service delivery but also optimize billing practices and client communications, aligning with clients’ expectations for modernized legal services. This client-driven demand has significantly propelled the adoption rate within this segment.

Application Analysis

In 2023, the E-discovery segment held a dominant market position in the Legal Technology Market, capturing more than a 25% share. This leadership is largely due to the critical role that E-discovery plays in the modern legal landscape, where digital data is both voluminous and pivotal in litigation and compliance processes.

E-discovery technology has become indispensable as the volume of electronic data continues to grow exponentially. Law firms and corporate legal departments increasingly rely on E-discovery tools to efficiently manage and sift through large datasets to find information.

Moreover, regulatory environments across the globe are tightening, with more stringent demands for compliance and data handling. E-discovery solutions help organizations navigate these regulations by ensuring that electronic data is processed, reviewed, and produced in a legally compliant manner.

Additionally, technological advancements in E-discovery software, such as the integration of artificial intelligence and machine learning, have improved the capabilities of these tools, making them more attractive to legal professionals.

Key Market Segments

By Component

- Software

- Services

By End-User

- Law Firms

- Corporate Legal Departments

By Application

- E-discovery

- Legal Research

- Practice and Compliance Management

- Document Management

- Billing and Time Tracking

- Others

Driver

Efficiency Enhancement through Automation

The legal industry is experiencing a significant transformation due to the integration of advanced technologies, particularly automation tools. These tools streamline repetitive tasks such as document review, legal research, and contract management, allowing legal professionals to focus on more complex and strategic activities.

Moreover, automation facilitates better resource allocation, enabling law firms to handle a higher volume of cases without proportionally increasing their workforce. This efficiency gain is a compelling driver for the adoption of legal technology, as it enhances productivity and client satisfaction while maintaining or even reducing operational costs.

Restraint

Data Privacy and Security Concerns

Despite the advantages, the adoption of legal technology is hindered by concerns over data privacy and security. Legal professionals handle sensitive client information, and the integration of digital tools raises the risk of data breaches and unauthorized access. The legal sector is bound by strict confidentiality obligations, and any compromise can lead to severe legal and reputational consequences.

Additionally, the increasing sophistication of cyber threats poses a continuous challenge to maintaining robust security measures. Law firms must invest in advanced cybersecurity protocols and ensure compliance with data protection regulations, which can be resource-intensive.

Opportunity

Development of Specialized AI Applications

The evolving landscape of legal technology presents opportunities for the development of specialized AI applications tailored to specific legal domains. For example, AI can be utilized to predict case outcomes by analyzing historical data, assisting lawyers in formulating more effective strategies.

In contract law, AI tools can automate the drafting and review process, ensuring compliance with relevant regulations and identifying potential risks.

Furthermore, AI-driven legal research platforms can provide more accurate and comprehensive insights, enhancing the quality of legal advice. By focusing on niche areas, technology providers can offer solutions that address the unique challenges of different legal practices, thereby adding significant value to legal services.

Challenge

Integration with Existing Legal Frameworks

A significant challenge in the adoption of legal technology is ensuring seamless integration with existing legal frameworks and practices. The legal profession is deeply rooted in tradition, and any technological advancement must align with established procedures and ethical standards.

Implementing new technologies requires comprehensive training for legal professionals to effectively utilize these tools without compromising the quality of legal services. Additionally, there is a need to develop clear guidelines and regulations governing the use of technology in legal practice to prevent misuse and ensure accountability.

Emerging Trends

The legal industry is experiencing a significant transformation due to advancements in technology. One notable trend is the integration of artificial intelligence (AI) into legal practices. AI-powered tools are now capable of automating tasks such as document review, legal research, and contract analysis, which traditionally required substantial time and effort.

Another emerging trend is the adoption of cloud-based solutions. Cloud technology enables legal professionals to access documents and collaborate with colleagues from any location, fostering flexibility and real-time collaboration. This is particularly beneficial in today’s environment, where remote work has become more prevalent.

Additionally, the use of virtual legal assistants is on the rise. These AI-driven assistants can handle routine inquiries, schedule appointments, and manage client communications, allowing lawyers to focus on more complex legal matters.

Business Benefits

The integration of technology into legal practices offers numerous benefits for businesses. It significantly enhances efficiency. Automating repetitive tasks such as document drafting and legal research allows legal professionals to allocate more time to strategic activities, thereby improving overall productivity.

Improved accuracy is also a key advantage. AI-powered tools can analyze legal documents with a high degree of precision, minimizing the risk of errors that could lead to legal complications. This ensures that businesses remain compliant with regulations and reduces the likelihood of costly legal disputes.

Moreover, legal technology enhances client satisfaction. With faster turnaround times and more accurate legal services, clients receive better value, which can lead to increased trust and long-term relationships.

Regional Analysis

In 2023, North America held a dominant market position in the legal technology market, capturing more than a 45% share with USD 11.7 billion in revenue. This prominence is primarily attributed to the region’s robust legal framework and the high demand for efficient legal services driven by a litigious business environment.

North American law firms and corporate legal departments are early adopters of technology, which fuels innovation and growth in this sector. Additionally, the presence of a large number of legal tech startups and well-established companies, such as Thomson Reuters and MyCase, significantly contributes to the dynamic growth and innovation in this market.

The region’s focus on enhancing legal operations through AI, machine learning, and cloud-based technologies further cements its leading position. These technologies offer unprecedented efficiency in case management, document handling, and compliance which are critical needs for North American legal entities dealing with vast amounts of data and complex regulatory requirements.

For instance, In January 2024, Icertis, Inc. partnered with ALPLA, a global leader in packaging solutions, to implement its Contract Intelligence platform. This collaboration aims to enhance ALPLA’s procurement, sales, and legal operations by simplifying and optimizing contract management across the organization. By streamlining these processes, ALPLA can improve efficiency, reduce risks, and focus more on strategic business goals.

Furthermore, the high adoption rate of legal tech in North America is bolstered by supportive regulatory policies that encourage digital transformation in the legal field. This environment facilitates the deployment and scaling of new technologies, making it easier for firms to innovate and for the market to grow.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the landscape of legal technology, several key players have emerged at the forefront, offering innovative solutions that reshape how legal professionals work.

MyCase offers a comprehensive legal practice management solution, tailored to simplify the day-to-day operations of law firms. This platform stands out for its user-friendly interface, which integrates case management, time tracking, and client communication seamlessly.

Thomson Reuters is a heavyweight in the legal technology field, known for its robust offerings that cater to various aspects of legal practice, from research to compliance, and document automation. Their Legal Solutions suite is renowned for integrating advanced technology with vast legal and regulatory insights, which helps legal professionals stay ahead in a fast-evolving landscape.

ProfitSolv, LLC, marks its presence in the legal tech industry by providing billing and payments solutions specifically designed for legal and professional services. Their focus is on streamlining the billing process, making it more efficient and less time-consuming. This specialization in financial aspects of legal services helps firms improve their cash flow and profitability

Top Opportunities Awaiting for Market Players

The LegalTech market presents several burgeoning opportunities for market players, fueled by an increasing emphasis on digital transformation across legal sectors globally. Here are the top opportunities awaiting players in the LegalTech market:

- Cloud-Based Solutions: The cloud-based segment of LegalTech is poised for significant growth. These solutions offer scalability and cost-effectiveness, allowing legal departments and law firms to adjust their resource utilization dynamically. The shift towards cloud-based practice management software enables firms to manage cases, documents, and communications remotely, which has become crucial in the hybrid work environment post-pandemic.

- Advanced Analytics and AI: There is a strong trend towards leveraging artificial intelligence (AI) and analytics within law firms. AI-driven legal research and analytics tools are becoming increasingly popular, as they provide insights that streamline decision-making and offer data-driven legal advice. This shift not only enhances operational efficiency but also allows lawyers to focus on more strategic aspects of their work.

- Regulatory Technology (RegTech): With the complexity of regulatory environments increasing, there is a growing demand for RegTech solutions. These tools help firms navigate and comply with complex legal requirements, particularly in financial and legal sectors. This trend is especially pronounced in regions with stringent regulatory frameworks like North America and Europe.

- Automation Tools: Automation continues to be a critical area of focus. Tools that automate routine tasks such as billing, document drafting, and compliance management not only reduce the time spent on administrative processes but also improve accuracy and reduce costs. This technology allows legal professionals to allocate more time to client service and other high-value tasks.

- Cybersecurity Solutions: As the reliance on digital platforms grows, so does the need for robust cybersecurity measures. Legal firms are prioritizing the enhancement of security measures to protect sensitive client data from cyber threats and to ensure compliance with privacy regulations. This has led to increased adoption of cybersecurity solutions tailored for the legal sector.

- Emerging Markets Focus: The Asia Pacific region is anticipated to exhibit the highest growth rate in the LegalTech market, driven by rapid digital transformation in countries like India, Singapore, and Australia. Market players can find significant opportunities in these emerging markets where digital infrastructure is evolving rapidly.

- Innovative Startups: The LegalTech sector is ripe with innovation driven by startups. These new entrants are introducing disruptive technologies such as AI-enabled contract analysis, smart contract management, and virtual legal assistants. These technologies are designed to simplify the management of complex legal cases and streamline workflows, providing ample opportunities for strategic partnerships and investments

Top Key Players in the Market

- My CaseThomson Reuters

- ProfitSolv, LLC

- Icertis, Inc.

- Filevine Inc.

- Clio

- DocuSign, Inc.

- Mystacks, Inc.

- Casetext Inc.

- Knovos, LLC

- Other Key Players

Recent Developments

- In July 2024, UK-based 2twenty4 Consulting introduced a new AI GDPR assessment tool aimed at helping businesses ensure their AI projects comply with data protection laws. The tool provides insights on minimizing risks associated with processing personal data through AI systems, offering companies a straightforward way to stay compliant and protect sensitive information.

- US-based startup Paxton AI launched its AI Citator in July 2024, designed to help legal professionals find and reference legal precedents quickly. With its focus on accuracy and efficiency, the tool is expected to save lawyers valuable time while ensuring they have access to detailed and reliable legal context for their cases.

- Clio announced its entry into legal accounting in July 2024, unveiling a platform tailored specifically to the needs of law firms. This new solution aims to streamline financial management for legal professionals, offering a comprehensive and user-friendly tool to handle their accounting tasks efficiently.

- In January 2024, Icertis, Inc. partnered with ALPLA, a leading global packaging company, to integrate its Contract Intelligence platform across ALPLA’s operations. This initiative aims to streamline procurement, sales, and legal processes by simplifying contract management at an enterprise level. The collaboration reflects a growing trend among organizations to adopt advanced contract technology to improve operational efficiency.

- In December 2023, LexisNexis Legal & Professional announced expanded access to Lexis+ AI, its cutting-edge generative AI solution, for law schools across the United States. The platform offers tools for conversational search, smart legal drafting, summarization, and document analysis, empowering the next generation of legal professionals. This move underlines the company’s commitment to innovation and widening the reach of transformative legal technology.

Report Scope

Report Features Description Market Value (2023) USD 26.09 Bn Forecast Revenue (2033) USD 61.2 Bn CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By End-User (Law Firms, Corporate Legal Departments), By Application (E-discovery, Legal Research, Practice and Compliance Management, Document Management, Billing and Time Tracking,Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape My CaseThomson Reuters, ProfitSolv, LLC, Icertis, Inc., Filevine Inc., Clio, DocuSign, Inc., Mystacks, Inc., Casetext Inc., Knovos, LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Legal Technology MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Legal Technology MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- My CaseThomson Reuters

- ProfitSolv, LLC

- Icertis, Inc.

- Filevine Inc.

- Clio

- DocuSign, Inc.

- Mystacks, Inc.

- Casetext Inc.

- Knovos, LLC

- Other Key Players