Global LED Lighting Market Size, Share, Industry Analysis Report By Product Type (LED Lamps, LED Luminaires), By Application (Indoor Lighting, Outdoor Lighting), By Installation Type (New, Retrofit), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159788

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

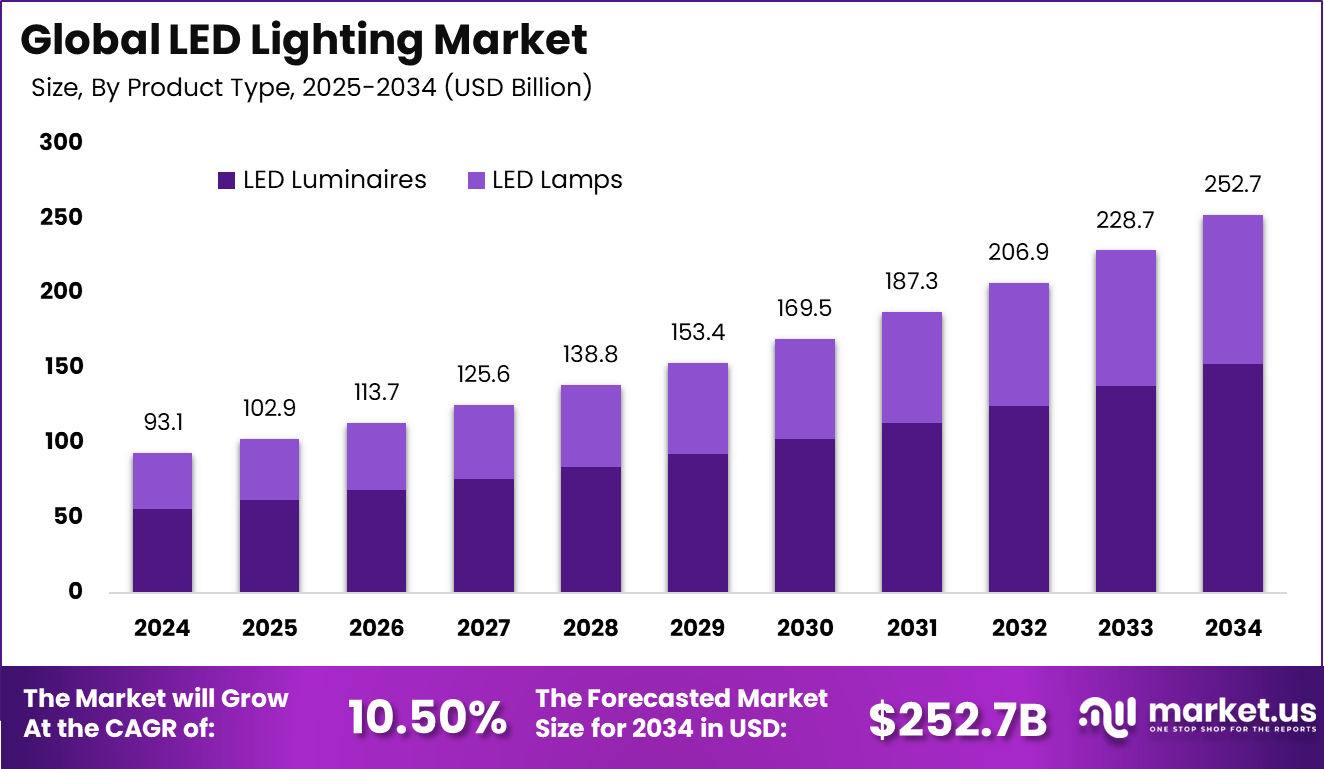

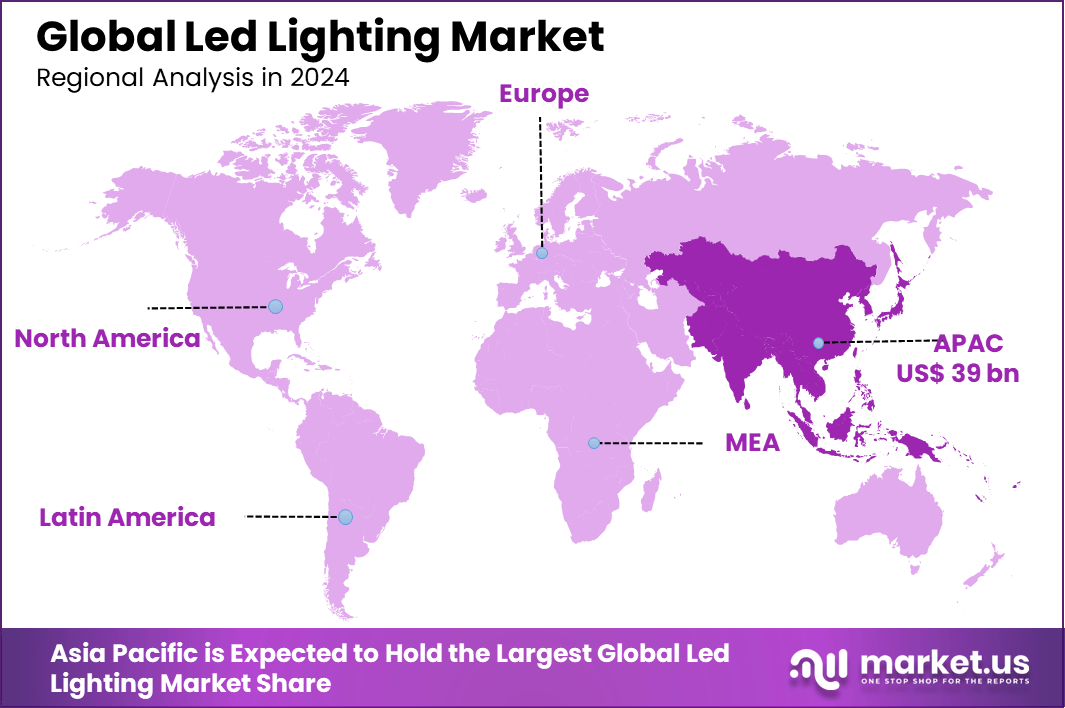

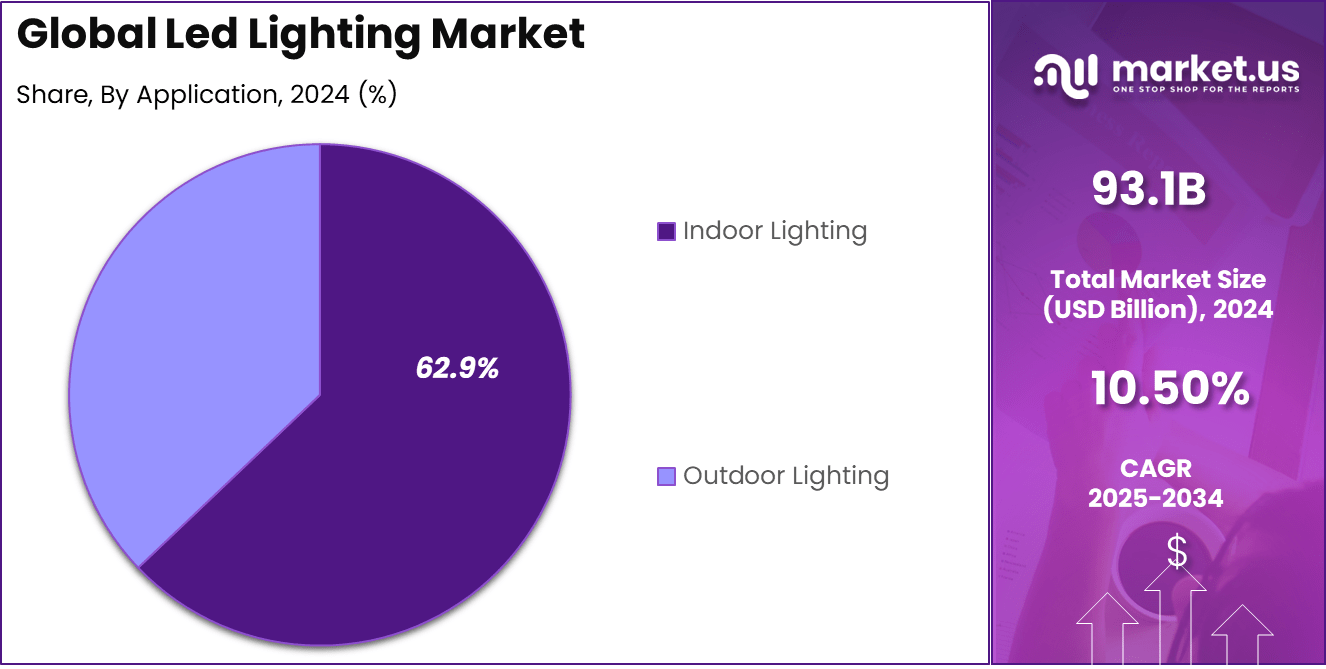

The Global LED Lighting Market size is expected to be worth around USD 252.7 billion by 2034, from USD 93.1 billion in 2024, growing at a CAGR of 10.50% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 39% share, holding USD 36.3 billion in revenue.

The LED lighting market is growing rapidly as more industries and consumers recognize its energy-efficient and long-lasting benefits. LED lights use significantly less electricity than traditional lighting, which leads to lower power bills and reduced maintenance costs. Their lifespan exceeds traditional bulbs by many times, often lasting more than 25,000 hours, which reduces the frequency of replacements.

Key drivers of the LED lighting market include rising demand for cost-effective energy-saving solutions and supportive government programs. Many governments worldwide have implemented regulations and grants that encourage the replacement of older lighting systems with LEDs due to their lower power consumption and contribution to carbon emission reductions.

Urban areas upgrading aging streetlight infrastructure with LED solutions benefit from substantial energy savings, often up to 50% compared to traditional lighting, and lower maintenance expenses over decades of use. This has led to a 42.9% share of LEDs being adopted in residential sectors for outdoor lighting by 2025, boosted also by smart home integration and connected lighting systems powered by advancing 5G networks.

For instance, In September 2025, Honeywell Smart Lighting presented its advanced LED lighting solutions at the Canton Fair. The company highlighted energy-efficient smart lighting systems equipped with IoT features. These solutions offered remote control, automation, and energy management functions, showcasing Honeywell’s focus on enhancing both efficiency and user convenience.

Key Takeaway

- LED luminaires held 60.4%, making them the leading product type as integrated designs are widely adopted for energy efficiency and long lifespan.

- Indoor lighting accounted for 62.9%, showing strong demand across residential, commercial, and industrial spaces where energy savings and cost reduction are priorities.

- New installations captured 70.5%, reflecting rapid replacement of traditional lighting systems with LED solutions in new buildings and infrastructure projects.

- Asia-Pacific led with 39.0% share, highlighting its dominance due to large-scale urbanization, government efficiency programs, and cost-competitive manufacturing hubs.

Analysts’ Viewpoint

The adoption of enabling technologies such as smart lighting systems and the Internet of Things integration further accelerates LED usage. LEDs paired with sensors, adaptive dimming, and remote control capabilities drastically improve energy management while enhancing convenience. These smart systems can adjust lighting based on environmental factors and user behavior, reducing unnecessary consumption.

The availability of compact, modular LED drivers equipped with AI and digital connectivity makes lighting customizable and easy to monitor. This combination is a major reason many commercial and industrial facilities prioritize LED upgrades to improve operational efficiency and lower energy costs.

Investment and Business benefits

Investment opportunities in the LED lighting market are attractive due to increasing urbanization and smart city developments worldwide. Financial incentives provided by governments, along with the growing trend for sustainable and connected infrastructure, present lucrative prospects for LED manufacturers and component suppliers.

Reduced production costs and improving technology also lower barriers for small and medium-scale business setups. Moreover, the expanding demand in Asia-Pacific, driven by rising construction and retrofit projects, offers significant potential. However, businesses must navigate challenges such as fluctuating raw material prices and complex regulatory standards across regions.

Business benefits of LED lighting include considerable cost savings, improved safety, and enhanced productivity in workplaces. LEDs generate better quality and more accurate lighting, which can reduce accidents and improve working conditions.

For instance, some companies report over 100% increase in annual ROI after switching to industrial LED lighting due to these efficiencies. LEDs also reduce greenhouse gas emissions, supporting corporate sustainability goals and compliance with environmental policies. Their reliability and low maintenance requirements contribute to uninterrupted operations, which is critical in industrial and commercial settings.

Regional Insight

In 2024, Asia Pacific held a dominant market position in the Global LED Lighting Market, capturing more than a 39% share, holding USD 36.3 billion in revenue. This dominance is due to rapid urbanization, large-scale infrastructure development, and increasing government initiatives promoting energy-efficient lighting solutions.

Countries like China and India are leading the way with significant investments in smart cities and green building projects, driving demand for LED lighting. Additionally, the region’s large manufacturing base, cost-effective production capabilities, and growing adoption of sustainable technologies further solidified its leadership.

For instance, in June 2025, China made significant advancements in LED lighting with the development of stable perovskite LEDs. Perovskite LEDs promise higher efficiency, longer lifespans, and more cost-effective manufacturing processes. This innovation strengthens the Asia Pacific’s dominance in the global LED lighting industry, driving further adoption of sustainable and advanced lighting solutions.

Product Type Analysis

In 2024, LED luminaires made up 60.4% of the product type share in the LED lighting market. This strong position comes from their widespread adoption in residential, commercial, and industrial setups where integrated fixtures are increasingly preferred over retrofit solutions. Their long lifespan and energy savings continue to drive demand, making them the go-to solution for both large-scale projects and household use.

The popularity of luminaires is also linked to design flexibility. Unlike traditional fixtures, LED luminaires can be tailored to different forms, sizes, and lighting effects, allowing architects and interior planners to focus on aesthetics while maintaining efficiency. This blend of function and style has created a steady pull for luminaires in both modern and replacement projects.

For Instance, In January 2025, Rig-A-Lite introduced heavy-duty LED luminaires for hazardous locations. These lights are built for safety, durability, and energy efficiency, delivering longer lifespan, reliable performance, and greater energy savings than traditional systems.

Application Analysis

In 2024, Indoor lighting represented 62.9% of the application segment. The dominance of this category is led by the rapid replacement of traditional bulbs in homes, offices, retail spaces, and public institutions. Enhanced brightness, energy savings, and durability have made LEDs the preferred choice across all forms of indoor environments.

Another reason for the growth of indoor applications is the rising focus on wellness and ambiance. LEDs can be adjusted for color temperature and intensity, enabling settings that support productivity in offices or create comfort in living spaces. This adaptability continues to push demand for high-quality indoor solutions.

For instance, in April 2022, ByteLight, a cutting-edge indoor LED lighting system, was introduced as an innovative solution for enhancing indoor navigation and energy efficiency. ByteLight utilizes LED lights to transmit data, offering a dual purpose of both providing illumination and enabling location-based services.

Installation Type Analysis

In 2024, the New installations accounted for 70.5% of the market share, showing that LEDs are now the standard option for newly built projects. Architects and contractors prioritize LED technology from the outset, given its efficiency, reliability, and compliance with green building standards. Large infrastructure projects, smart city developments, and new housing expansions are fueling this preference.

The high adoption rate in new builds also highlights the global shift toward sustainability. Governments and private developers are increasingly prioritizing energy-efficient materials in construction, and LEDs naturally fit this trend. The result is a growing gap between new installations and retrofits, with fresh projects driving industry growth.

For Instance, in September 2025, the Telangana government announced the installation of LED lights across major public spaces as part of their efforts to improve urban infrastructure. This initiative focuses on the new installation type of LED lighting, aiming to replace traditional street lighting with energy-efficient LED solutions.

Emerging Trends

Emerging trends in the LED lighting market reflect a clear shift toward smart, connected, and adaptive lighting solutions. A notable trend is the rise of IoT-enabled LED lights with integrated sensors that allow remote control, automated dimming, and real-time diagnostics. These features enable energy savings of up to 50% and offer improved system reliability.

Another important development is the increasing demand for human-centric lighting, which adjusts color temperature and brightness according to the time of day to enhance occupant comfort and productivity. Smart city projects globally are integrating LED lighting systems that adjust to traffic and weather conditions, supporting both sustainability and safety.

Growth factors

Growth factors driving the LED lighting market are strongly tied to energy efficiency, government policies, and urbanization. LEDs offer up to 75% energy savings compared to traditional lighting and have a longer lifespan, reducing maintenance costs. Governments worldwide promote LED adoption through programs supporting energy-efficient infrastructure, contributing to wider LED integration in homes, businesses, and public spaces.

Urbanization intensifies demand as over 56% of the global population lives in cities, boosting adoption of smart LED solutions in street lighting, commercial buildings, and industrial facilities. The rise in smart infrastructure investment, including government funding for smart city initiatives, further propels market growth.

Key Market Segments

Product Type

- LED Lamps

- LED Luminaires

Application

- Indoor Lighting

- Residential

- Commercial

- Industrial

- Outdoor Lighting

- Residential

- Commercial

- Industrial

Installation Type

- New

- Retrofit

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Drivers

Rising Demand for Energy-efficient Lighting

The LED lighting market is chiefly driven by the increasing demand for energy-efficient lighting solutions. LEDs consume far less electricity compared to traditional lighting options, which substantially decreases energy bills and reduces environmental impact. This driver is backed by growing awareness about energy conservation and sustainability goals worldwide.

Government initiatives are actively promoting LED adoption, offering subsidies and mandates to phase out inefficient lighting systems. Cities like Bengaluru are replacing sodium streetlights with smart LED systems, cutting energy use by over 85% and improving public safety as well. This combination of cost savings and environmental benefits is expanding the market rapidly.

For instance, In September 2025, Itron and Current Lighting partnered to expand smart lighting solutions, combining advanced LED technologies with smart city infrastructure to support urban growth, improve efficiency, and deliver data-driven energy insights.

Restraint

High Initial Investment Cost

One significant restraint facing the LED lighting market is the relatively high upfront cost of LED products compared to conventional lighting fixtures. The initial expenses for manufacturing and installing LED systems are higher due to the complexity of their components, including semiconductors and advanced drivers.

Despite the longer lifespan and energy savings, consumers and businesses often hesitate to invest due to the sticker shock. This delay in adoption especially impacts price-sensitive markets and suburban consumers who may prioritize short-term costs over long-term benefits.

For instance, In August 2024, Hykoont highlighted that LED lighting, despite its long-term savings and durability, still carries higher upfront costs than traditional bulbs due to advanced materials and complex components used in manufacturing.

Opportunities

Integration with Smart and IoT Technologies

The LED lighting market holds substantial opportunities in the growing integration of lighting with smart and IoT technologies. Smart LED systems equipped with sensors, Wi-Fi connectivity, and automated controls are gaining traction as they offer users enhanced convenience, energy management, and operational cost savings.

This opportunity is bolstered by the rising demand for smart city infrastructure and connected homes, where intelligent lighting contributes to sustainability and user comfort. For example, automated lighting in offices and streetlights adjusts based on occupancy or daylight, optimizing energy use effectively.

For instance, In September 2025, Signify launched the Philips LightTheatre in India, a plug-and-play smart lighting system that syncs with movies, music, and games to create an immersive home entertainment experience with easy integration and convenience.

Challenges

Market Competition and Supply Chain Volatility

A notable challenge in the LED lighting market is intense competition and supply chain uncertainties. The industry faces fierce price competition, especially in regions such as Asia Pacific, where low-cost manufacturers dominate and profit margins are squeezed.

This race to the bottom on prices limits funds available for innovation and quality improvements, affecting product differentiation. For example, domestic manufacturers in India have experienced margin reductions due to aggressive import competition. Such dynamics pressurize companies to focus on cost over innovation.

For instance, In May 2024, the European Union updated LED lighting safety standards to improve consumer protection and sustainability, requiring manufacturers to meet stricter rules on efficiency, compatibility, and safe operation to retain market access.

Key Players Analysis

The LED Lighting Market is led by global innovators such as Signify Holding, ams-OSRAM AG, and Cree Lighting USA LLC. These companies focus on energy-efficient lighting systems, offering advanced LED technologies for residential, commercial, and industrial applications. Their portfolios include smart lighting, human-centric lighting, and connected controls that align with sustainability goals and building automation standards.

Companies like Acuity Brands, Inc., Legrand Group, Lutron Electronics Co., and Honeywell International Inc. strengthen the market with integrated lighting and control systems. These firms provide IoT-enabled lighting solutions that enhance energy management, indoor ambiance, and safety. Their offerings cater to smart buildings, retail, healthcare, and hospitality sectors, with increasing adoption of wireless and app-based controls.

Regional players such as Wipro Lighting, Havells India Ltd., Panasonic, and Eaton contribute through cost-effective LED luminaires and street lighting systems. Their products support government-led infrastructure upgrades and electrification programs in emerging markets. A wide range of other key players continues to innovate across LED chip manufacturing, modular designs, and circular lighting solutions, further expanding global LED adoption.

Top Key Players in the Market

- Signify Holding

- ams-OSRAM AG

- Savant Systems, Inc.

- Cree Lighting USA LLC

- Legrand Group

- Acuity Brands, Inc.

- Wipro Lighting

- Honeywell International Inc.

- Lutron Electronics Co.

- Panasonic

- Havells India Ltd.

- Eaton

- Other Key Players

Recent Developments

- September 2025: Signify expanded its professional lighting portfolio with new modular, connected solar street lighting and advanced sports lighting products. They also showcased four groundbreaking ultra-efficient product lines at IECGM2025 India, including next-generation LED lighting solutions designed for energy savings, sustainability, and well-being.

- July 2025: ams-OSRAM AG agreed to transfer its industrial and entertainment lamps business to Ushio Inc. The deal, closing by Q4 2025, targets growth in semiconductor specialty lamps and aims to improve production efficiency

- In April 2025, Cree Lighting announced the expansion of its outdoor lighting solutions with the introduction of a new 1900K/50CRI (19K5) LED option. This product is specifically designed for the petroleum and convenience store sectors, providing an energy-efficient and visually comfortable lighting solution that reduces operational costs while maintaining a high-quality customer experience

Report Scope

Report Features Description Market Value (2024) USD 93.1 Bn Forecast Revenue (2034) USD 252.7 Bn CAGR(2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (LED Lamps, LED Luminaires), By Application (Indoor Lighting, Outdoor Lighting), By Installation Type (New, Retrofit) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Signify Holding, ams-OSRAM AG, Savant Systems, Inc., Cree Lighting USA LLC, Legrand Group, Acuity Brands, Inc., Wipro Lighting, Honeywell International Inc., Lutron Electronics Co., Panasonic, Havells India Ltd., Eaton, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-