Global Leak Detection And Repair Market By Technology (Optical Gas Imaging (OGI), Laser Absorption Spectroscopy, Acoustic Leak Detection, Vapor Recovery Monitoring, Others), By Component (Hardware, Software, Services), By End-User Industry (Oil & Gas (Upstream, Midstream, Downstream), Chemical & Petrochemical, Refineries, Pharmaceutical, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171571

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

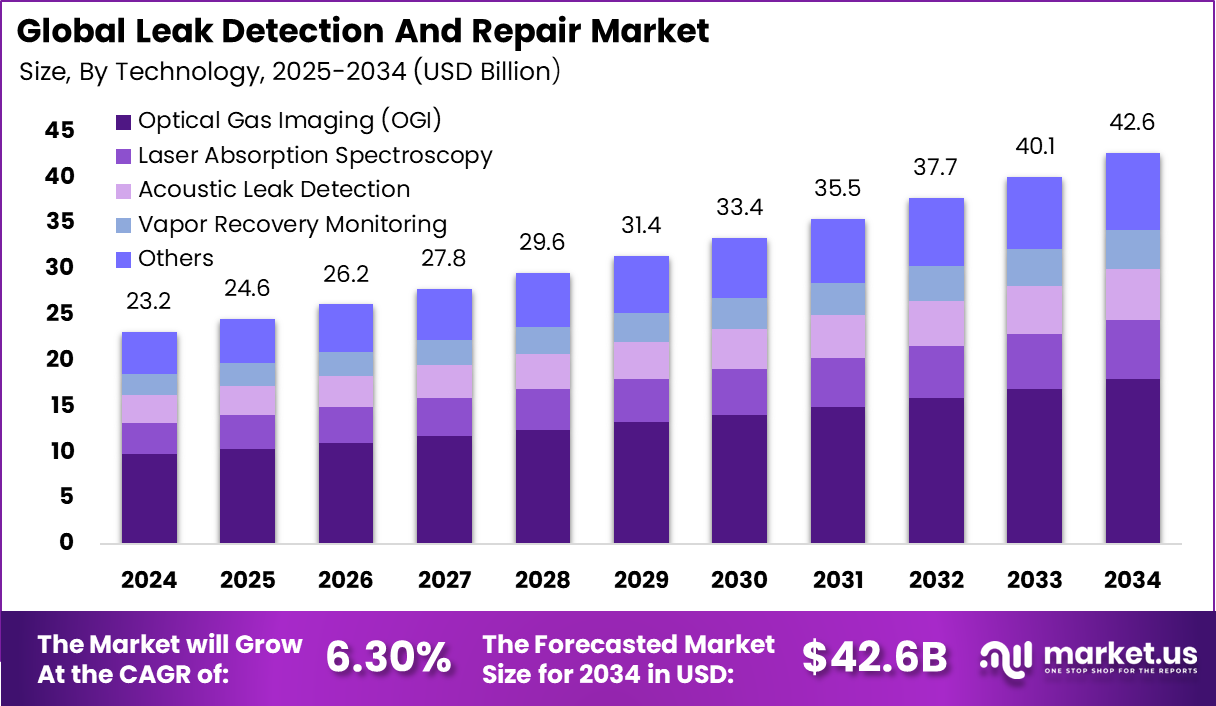

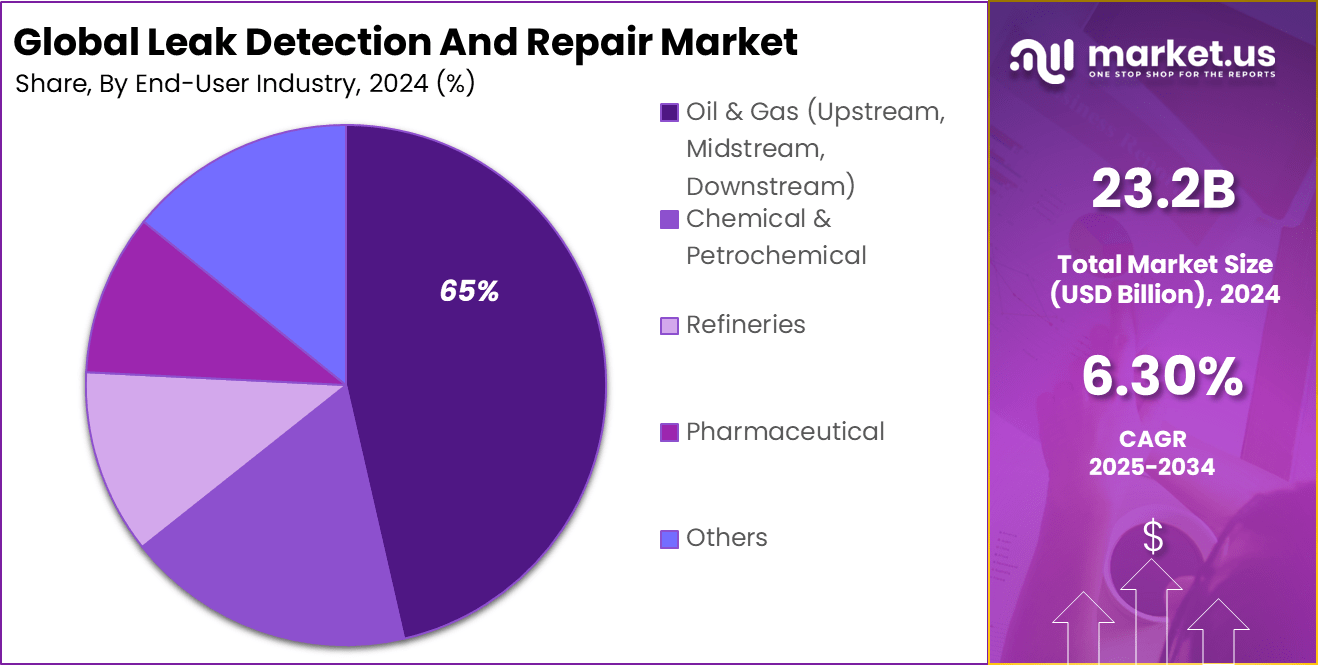

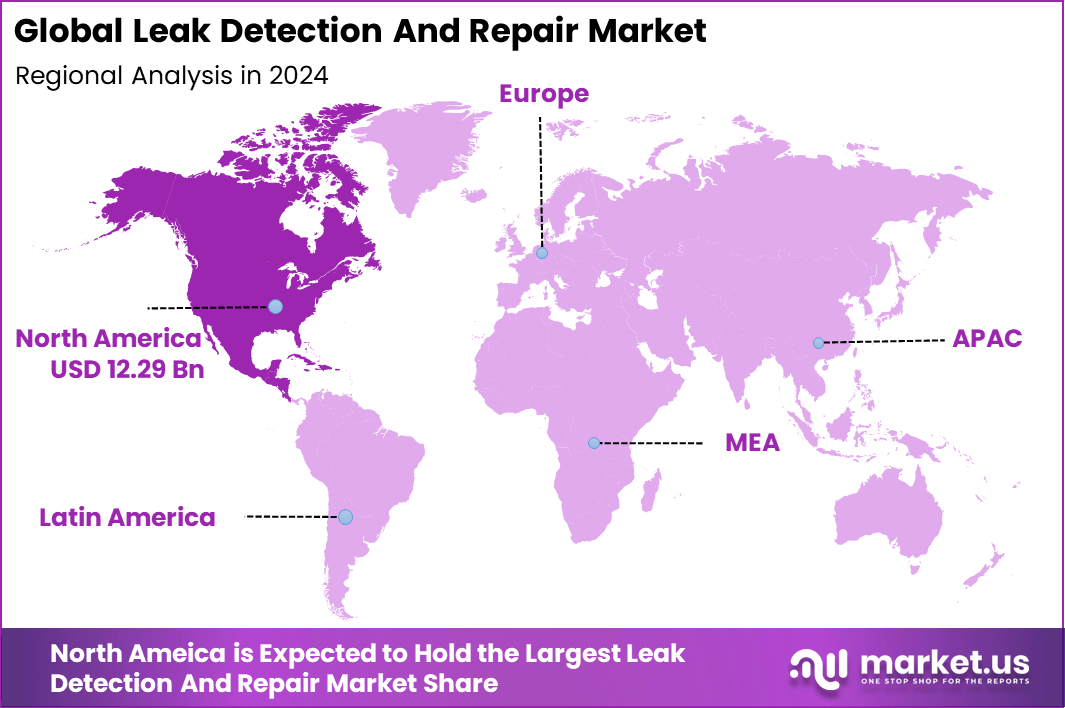

The Global Leak Detection And Repair Market generated USD 23.2 billion in 2024 and is predicted to register growth from USD 24.6 billion in 2025 to about USD 42.6 billion by 2034, recording a CAGR of 6.30% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 53.11% share, holding USD 12.29 Billion revenue.

The leak detection and repair market refers to systems, services, and technologies used to find and address unintended emissions and leaks of gases or liquids in industrial environments. These solutions are widely used in sectors such as oil and gas, petrochemicals, chemical processing, manufacturing, and utilities. Leak detection tools help organizations identify the presence of leaks in pipelines, valves, storage tanks, and process equipment, while repair services ensure that identified issues are corrected promptly to prevent further loss or risk.

Leak detection and repair programs are increasingly adopted as part of operational risk management and environmental protection efforts. They help prevent product waste, reduce safety hazards, and support compliance with environmental standards. Leak detection solutions include handheld analyzers, fixed sensors, infrared imaging cameras, ultrasonic detectors, and software platforms that help monitor, record, and manage leak data for analysis and reporting.

The main factors driving growth in this market are regulatory requirements, environmental management, and cost control. Governments and industry standards impose strict mandates on emissions, water loss, and industrial pollution, making leak detection essential for compliance. Companies are also under pressure to reduce waste and avoid penalties associated with uncontrolled releases.

Advances in sensor technology and data analytics enable more accurate and continuous monitoring, making detection systems more effective and accessible. Rising awareness of safety risks and community expectations for responsible operations further reinforce investment in leak detection and repair solutions. Demand for leak detection and repair is strengthening as infrastructure ages and industrial operations expand.

Utilities and energy companies face growing challenges to maintain extensive networks of pipelines and distribution systems, where undetected leaks can escalate into major failures. In the water sector, reducing non-revenue water through early leak detection improves service efficiency and conserves scarce resources.

Industrial firms are adopting proactive leak monitoring to protect assets, maintain production uptime, and support sustainability initiatives. As organisations prioritise risk management and operational resilience, leak detection and repair tools are increasingly regarded as critical components of infrastructure maintenance and environmental risk control.

Top Market Takeaways

- By technology, optical gas imaging took 42.3% of the leak detection and repair market, as it spots gas leaks from far away without contact.

- By component, services held 58.7% share, covering setup, training, and ongoing checks for leak systems.

- By end-user industry, oil and gas led with 64.8%, needing tools to find methane leaks and meet safety rules.

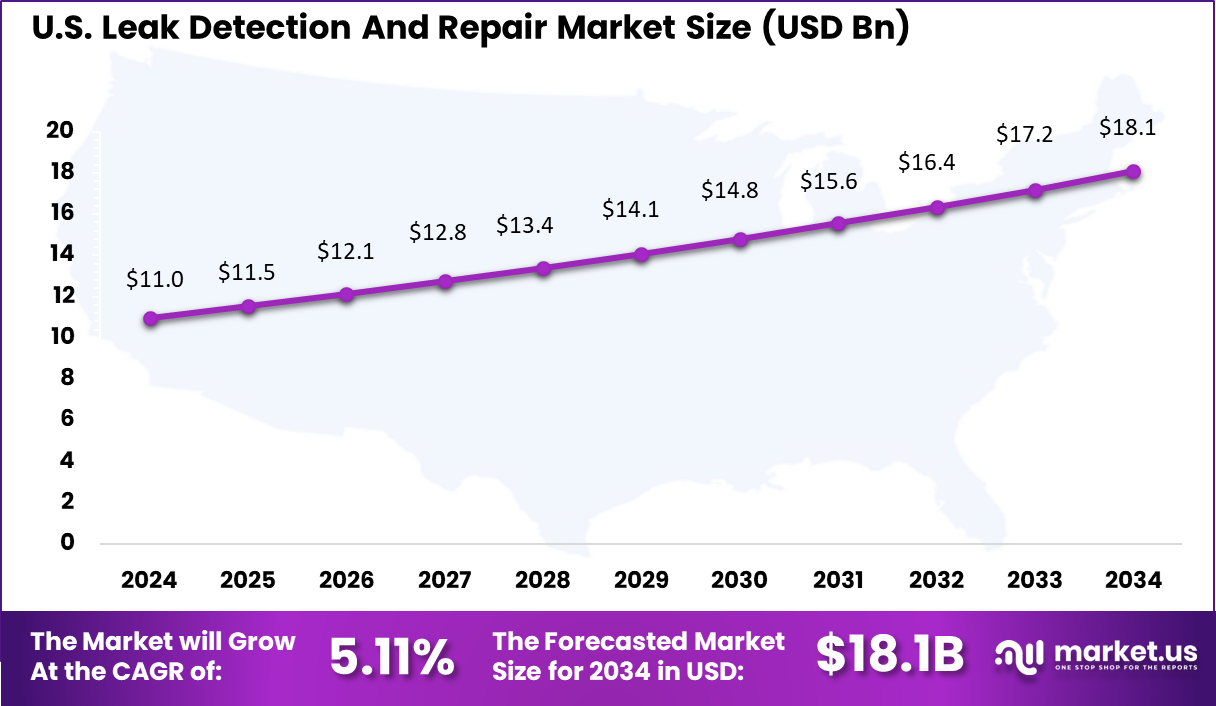

- North America had 53.11% of the global market, with the U.S. at USD 10.98 billion in 2025 and growing at a CAGR of 5.11%.

Technology Analysis

Optical Gas Imaging holds 42.3% of the Leak Detection and Repair market, making it the most widely used technology segment. OGI systems allow operators to visually detect gas leaks using infrared cameras without direct contact with equipment. This technology is highly effective in identifying leaks in hard-to-reach or hazardous areas, such as pipelines, valves, and processing units. Its ability to provide real-time visual confirmation improves inspection accuracy and reduces inspection time.

From an operational perspective, OGI technology supports faster leak identification and prioritization of repair actions. It enables field teams to scan large areas quickly and focus on high-risk leak sources. The strong adoption of OGI is driven by its reliability, regulatory acceptance, and ability to support compliance with emission monitoring requirements. As environmental monitoring standards continue to tighten, OGI remains a preferred solution for effective leak detection.

Component Analysis

Services account for 58.7% of the market, highlighting the importance of inspection, monitoring, and maintenance activities in LDAR programs. Many organizations rely on specialized service providers for leak surveys, compliance reporting, and repair execution. These services ensure consistent monitoring and help companies meet regulatory obligations without building large in-house teams.

Service-based models also offer flexibility and access to experienced technicians and advanced equipment. Regular inspection services help detect leaks early, reduce emission losses, and prevent costly equipment failures. The dominance of the services segment reflects the ongoing need for expert-led monitoring and maintenance to support long-term operational efficiency and environmental compliance.

End-User Industry Analysis

The oil and gas industry represents 65% of end-user demand, making it the largest contributor to the LDAR market. This sector operates extensive networks of pipelines, storage facilities, and processing plants where gas leaks can result in safety risks and environmental impact. Leak detection and repair systems are critical for maintaining operational integrity and minimizing product losses.

Oil and gas operators also face strict regulatory oversight related to emissions and safety standards. LDAR programs help these companies monitor assets, reduce greenhouse gas emissions, and improve transparency in reporting. The strong share of this end-user segment reflects the industry’s continued focus on safety, compliance, and sustainable operations across upstream, midstream, and downstream activities.

Key reasons for adoption

- Environmental compliance requirements are becoming stricter across oil, gas, and industrial facilities. Leak detection programs are adopted to meet emission limits and reporting rules.

- Loss of valuable gases and liquids directly affects operating margins. Early leak identification helps reduce product losses and improves asset efficiency.

- Safety risks linked to gas leaks remain a major concern in hazardous environments. Leak detection systems help prevent fires, explosions, and worker exposure.

- Aging pipelines and processing infrastructure increase the probability of unnoticed leaks. Advanced detection tools support proactive maintenance practices.

- Corporate sustainability goals are gaining importance across industries. Leak detection is adopted to support emission reduction targets and public accountability.

Benefits

- Improved environmental performance is achieved through timely identification and repair of fugitive emissions. This supports long term sustainability commitments.

- Operational reliability improves as unplanned shutdowns and emergency repairs are reduced. Equipment performance becomes more predictable.

- Cost control improves by lowering wasted product and avoiding regulatory penalties. Maintenance spending becomes more targeted and efficient.

- Workplace safety is enhanced by reducing exposure to hazardous gases and volatile compounds. This contributes to lower incident rates.

- Data visibility increases through continuous monitoring and inspection records. This supports informed decision making and audit readiness.

Usage

- Oil and gas upstream operations use leak detection to monitor wellheads, valves, and gathering lines. This helps manage emissions in remote locations.

- Midstream pipeline operators apply detection systems to monitor long distance transport networks. Early alerts support rapid response to leaks.

- Refining and petrochemical plants use leak detection for equipment inspection programs. Compressors, flanges, and storage units are common focus areas.

- Chemical manufacturing facilities apply these solutions to control hazardous substance releases. Compliance and worker safety remain key drivers.

- Utilities and industrial gas suppliers use leak detection to protect distribution networks. Continuous monitoring supports service reliability and public safety.

Emerging Trends

Key Trend Description AI Predictive Detection AI analyzes operational data to detect potential leaks before failures occur. Drone Optical Imaging Drones equipped with cameras inspect pipelines and storage tanks quickly. IoT Real Time Sensors Wireless sensors send instant alerts when leak conditions are detected. Cloud Monitoring Platforms Centralized dashboards allow operators to monitor multiple sites from one screen. LiDAR as a Service Detection tools are offered on a rental basis instead of large upfront purchases. Growth Factors

Key Factors Description Strict Emission Rules Regulations require oil and gas companies to reduce methane leakage. Oil Gas Boom Rising production increases the number of pipelines and facilities needing inspection. ESG Goals Push Companies invest in leak detection to improve environmental performance scores. Cost Save Repairs Early detection of small leaks prevents expensive repairs later. Asia Factory Growth Rapid industrial expansion in China and India increases demand for safety tools. Key Market Segments

By Technology

- Optical Gas Imaging (OGI)

- Laser Absorption Spectroscopy

- Acoustic Leak Detection

- Vapor Recovery Monitoring

- Others

By Component

- Hardware

- Software

- Services

By End-User Industry

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical & Petrochemical

- Refineries

- Pharmaceutical

- Others

Regional Analysis

North America accounted for 53.11% share, supported by strict environmental regulations and strong enforcement of emission control standards across oil and gas, chemicals, and utilities. Leak detection and repair solutions have been widely adopted to monitor methane, volatile organic compounds, and hazardous gas leaks, particularly in upstream and midstream operations.

Demand has been driven by regulatory compliance requirements, aging pipeline infrastructure, and growing pressure to reduce environmental impact. Operators in the region increasingly rely on advanced detection technologies to improve safety, reduce product loss, and maintain operational integrity.

The U.S. market reached USD 10.98 Bn and is projected to grow at a 5.11% CAGR, reflecting steady demand across energy, manufacturing, and municipal infrastructure sectors. Adoption has been particularly strong in oil and gas operations, where federal and state regulations require regular inspection and documentation of leaks. LDAR solutions help operators meet compliance obligations while improving operational efficiency and reducing unplanned shutdowns.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Opportunities & Threats

The Leak Detection and Repair market shows strong opportunities as industries focus more on safety, environmental protection, and asset efficiency. Stricter rules around emissions and resource loss are encouraging companies to adopt structured leak monitoring and repair programs.

Oil and gas, chemicals, water utilities, and manufacturing facilities are investing in early leak detection to reduce losses and avoid regulatory penalties. Modern detection technologies also help operators identify issues before they lead to major failures or shutdowns.

The market faces threats related to cost sensitivity and operational complexity. Implementing a full leak detection and repair program requires investment in equipment, training, and ongoing monitoring, which can be a barrier for smaller operators.

In some regions, enforcement of environmental rules is inconsistent, reducing urgency for adoption. Limited technical expertise can also affect the effective use of advanced detection tools. Another threat comes from challenging operating environments. Harsh weather, remote locations, and complex facility layouts can reduce detection accuracy and increase maintenance costs.

Competitive Analysis

FLIR Systems, ABB, Picarro, Thermo Fisher Scientific, and Aeris Technologies lead the leak detection and repair market with advanced sensing technologies used to identify gas leaks across oil and gas, utilities, and industrial facilities. Their solutions include optical gas imaging, laser based detection, and continuous monitoring systems. These companies focus on high detection accuracy, rapid response, and compliance with environmental regulations.

Heath Consultants, ERG, Bacharach, Honeywell, Siemens, and Emerson Electric strengthen the market with portable detectors, fixed monitoring systems, and integrated LDAR programs. Their offerings help operators locate, quantify, and repair leaks efficiently while improving worker safety. These providers emphasize reliability, ease of deployment, and integration with asset management systems.

Spec Sensors, Crowcon Detection Instruments, ATEX Explosion Proof Equipment, Agilent Technologies, and other players expand the landscape with specialized gas sensors and safety focused detection equipment. Their solutions address niche applications in confined spaces, hazardous environments, and industrial safety. These companies focus on cost efficiency, durability, and regulatory compliance.

Top Key Players in the Market

- FLIR Systems, Inc. (Teledyne Technologies)

- ABB, Ltd.

- Picarro, Inc.

- Thermo Fisher Scientific, Inc.

- Aeris Technologies, Inc.

- Heath Consultants, Inc.

- ERG (Environmental Research Group)

- Bacharach, Inc.

- Honeywell International, Inc.

- Siemens AG

- Emerson Electric Co.

- Spec Sensors, LLC

- Crowcon Detection Instruments, Ltd.

- ATEX Explosion Proof Equipment

- Agilent Technologies, Inc.

- Others

Future Outlook

The future outlook for the Leak Detection and Repair market is expected to remain steady as industries focus on safety, compliance, and operational efficiency. Oil and gas, chemicals, utilities, and manufacturing sectors are increasing monitoring activities to reduce emissions, product losses, and unplanned shutdowns.

Stronger environmental regulations and public pressure to limit harmful releases are supporting long term demand. Over time, wider use of advanced sensors, remote monitoring, and digital reporting systems is likely to improve detection accuracy and shorten repair cycles.

Recent Developments

- In September 2025, SLB announced that its Methane LiDAR Camera received U.S. EPA approval as an Alternative Test Method for methane detection under OOOO regulations. The autonomous system delivers high resolution, component level measurements that distinguish leaks from permitted emissions, enabling operators to replace manual OGI surveys with reliable, standalone monitoring across varied weather conditions.

- In December 2023, CO2Meter launched the CM-900 series industrial fixed gas detectors to monitor elevated carbon dioxide levels up to 5% (50,000 ppm) or low oxygen, safeguarding workers from hazardous leaks in industrial environments with alarms, relays, and rugged IP64 design.

Report Scope

Report Features Description Market Value (2024) USD 23.2 Bn Forecast Revenue (2034) USD 42.6 Bn CAGR(2025-2034) 6.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Optical Gas Imaging (OGI), Laser Absorption Spectroscopy, Acoustic Leak Detection, Vapor Recovery Monitoring, Others), By Component (Hardware, Software, Services), By End-User Industry (Oil & Gas (Upstream, Midstream, Downstream), Chemical & Petrochemical, Refineries, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape FLIR Systems, Inc. (Teledyne Technologies), ABB, Ltd., Picarro, Inc., Thermo Fisher Scientific, Inc., Aeris Technologies, Inc., Heath Consultants, Inc., ERG (Environmental Research Group), Bacharach, Inc., Honeywell International, Inc., Siemens AG, Emerson Electric Co., Spec Sensors, LLC, Crowcon Detection Instruments, Ltd., ATEX Explosion Proof Equipment, Agilent Technologies, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Leak Detection and Repair MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Leak Detection and Repair MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FLIR Systems, Inc. (Teledyne Technologies)

- ABB, Ltd.

- Picarro, Inc.

- Thermo Fisher Scientific, Inc.

- Aeris Technologies, Inc.

- Heath Consultants, Inc.

- ERG (Environmental Research Group)

- Bacharach, Inc.

- Honeywell International, Inc.

- Siemens AG

- Emerson Electric Co.

- Spec Sensors, LLC

- Crowcon Detection Instruments, Ltd.

- ATEX Explosion Proof Equipment

- Agilent Technologies, Inc.

- Others