Global Leadership Development Program Market Size, Share, Growth Analysis By Program Type (High-Potential & Succession Planning Programs, New Manager/First-Time Leader Programs, Strategic Leadership & Executive Programs, Functional Leadership Programs, Customized Enterprise Programs, Open-Enrollment Programs), By Delivery Mode (In-Person/Instructor-Led Training (ILT), Online/Virtual Instructor-Led Training (vILT), Blended Learning, Self-Paced/Digital Learning Platforms), By Provider Type (Academic Institutions & Top-Tier Business Schools, Specialized Leadership Development Firms, Large Consulting & Professional Services Firms, Corporate Training & eLearning Companies, Boutique & Niche Coaching Firms), By Leadership Level (Frontline/First-Level Leaders, Mid-Level Leaders, Senior/Executive Leaders, C-Suite), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By End-User Industry (Technology & IT, BFSI (Banking, Financial Services, Insurance), Healthcare & Pharma, Manufacturing & Industrial, Energy & Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166850

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of Skills

- Industry Adoption

- Emerging Trends

- US Market Size

- By Program Type

- By Delivery Mode

- By Provider Type

- By Leadership Level

- By Organization Size

- By End-User Industry

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Trending Factors

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

The leadership development program market is expected to expand steadily as organizations prioritize structured talent-building frameworks to strengthen managerial capabilities and ensure long-term competitiveness.

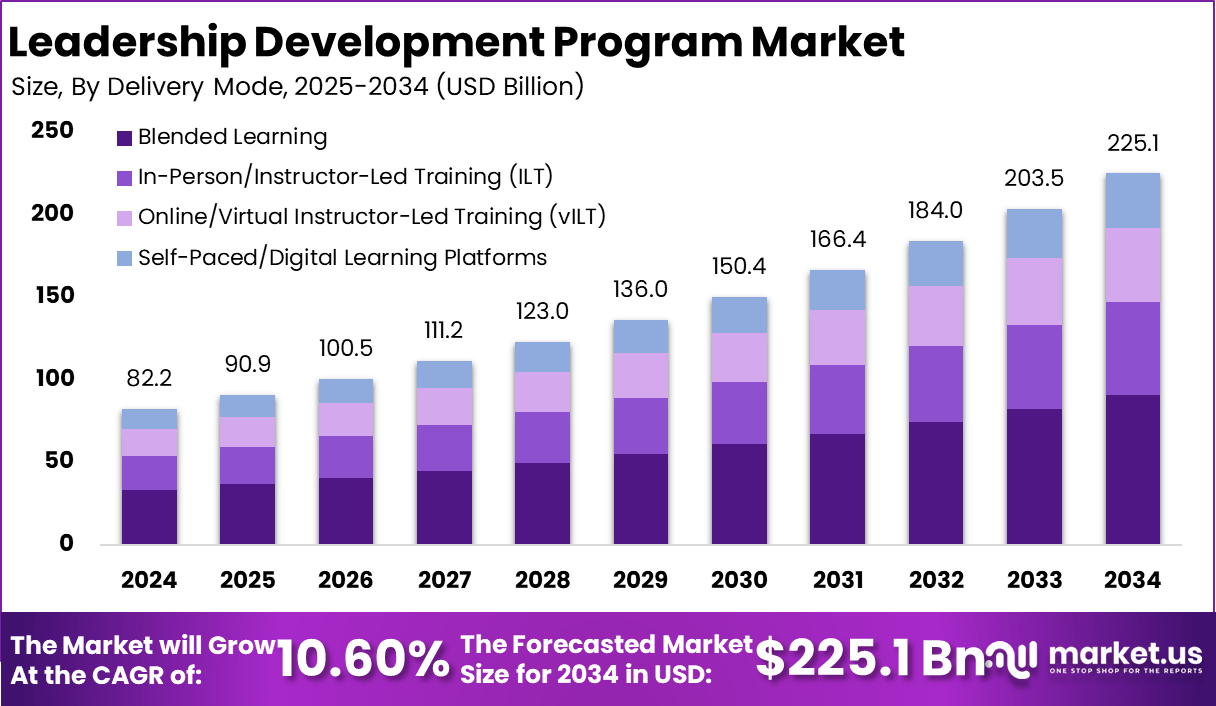

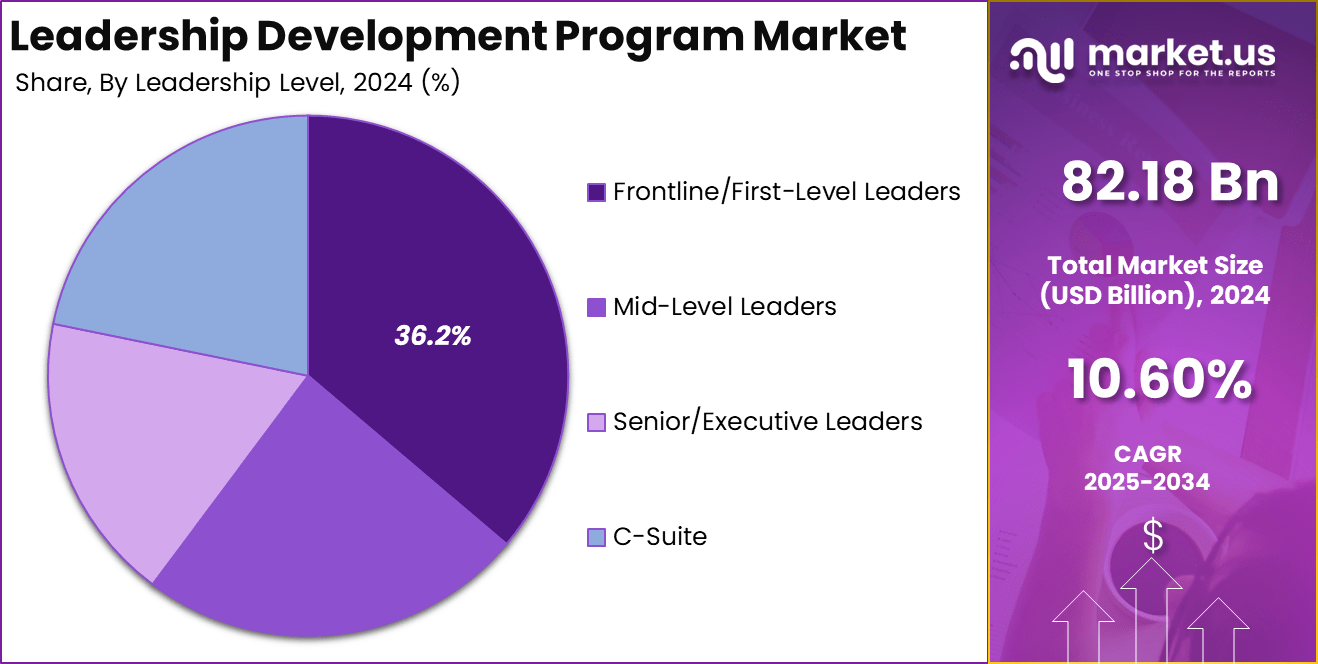

The market is valued at USD 82.18 billion in 2024 and is projected to reach USD 225.1 billion by 2034, growing at a 10.60% CAGR. This growth is driven by increasing corporate investment in employee upskilling, rising leadership gaps across industries, and the integration of digital learning ecosystems that support scalable training delivery.

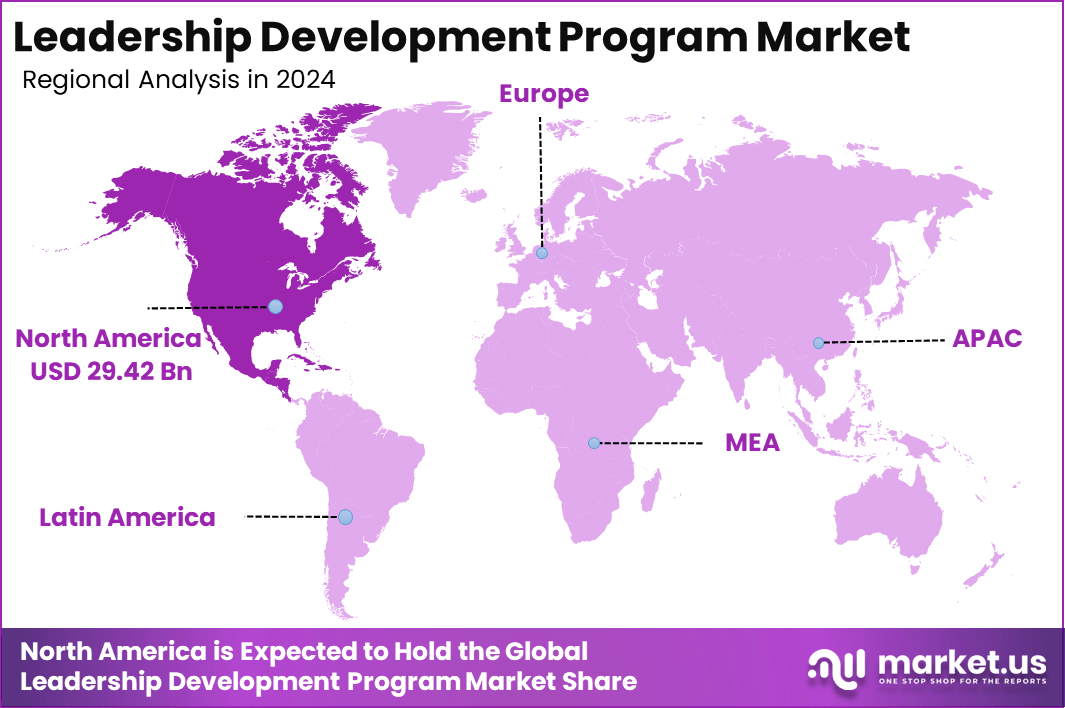

North America accounts for the largest regional share at 35.8%, representing a market size of USD 29.42 billion in 2024. The region benefits from strong enterprise adoption, early integration of AI-enabled learning tools, and continuous emphasis on executive coaching and strategic leadership programs.

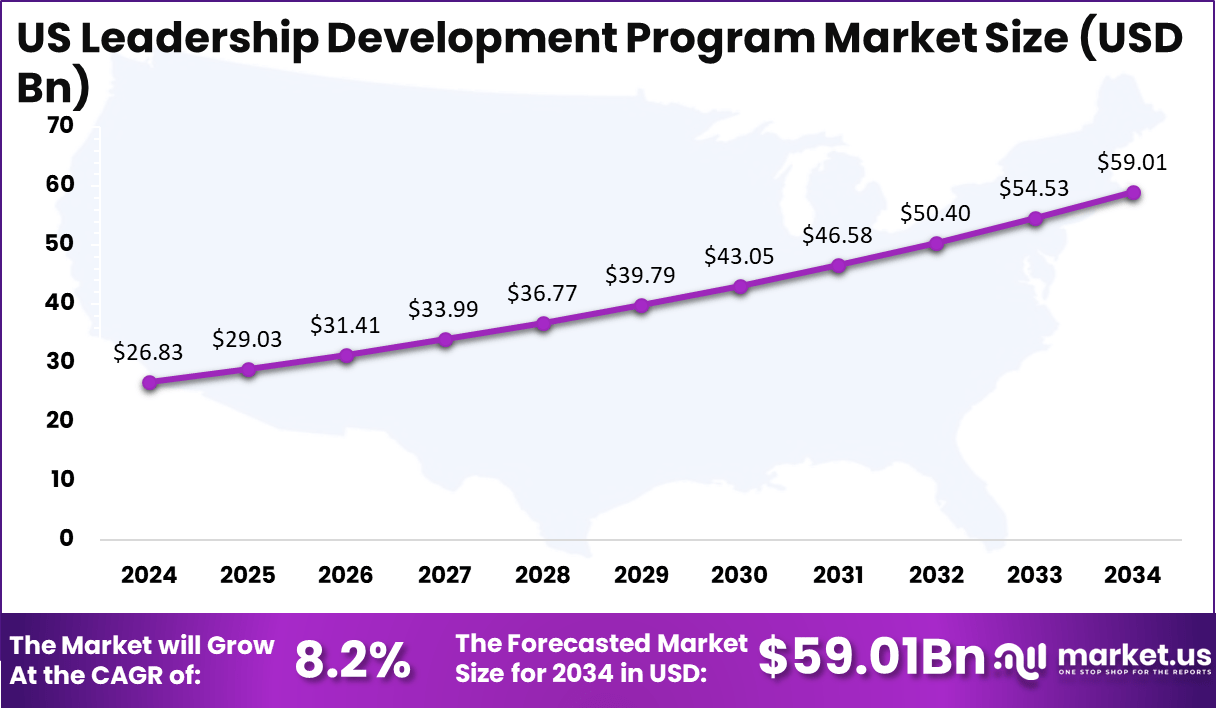

The US remains the dominant country-level market, valued at USD 26.83 billion in 2024 and projected to reach USD 59.01 billion by 2034 at an 8.2% CAGR. Expanding corporate succession planning initiatives, hybrid learning models, and increasing demand for leadership training in technology, finance, and healthcare industries continue to reinforce the region’s leading position.

Leadership development programs have become essential strategic tools for organizations aiming to build resilient, future-ready workforces. As global industries undergo rapid digital transformation, shifting workforce demographics, and increasing leadership gaps, companies are investing heavily in structured programs that cultivate managerial capability, emotional intelligence, strategic thinking, and adaptability.

Studies show that nearly 58% of organizations report leadership skill gaps as their top internal challenge, while over 70% of employees say they would stay longer with companies that invest in their growth. Modern leadership development initiatives now combine coaching, experiential learning, simulation-based training, and AI-driven analytics to personalize development pathways and accelerate outcomes.

The shift toward hybrid workplaces has further amplified the need for leaders who can manage distributed teams, drive collaboration, and sustain productivity across digital environments. Research indicates that teams with strong leadership demonstrate up to 25% higher employee engagement and 21% greater organizational profitability, underscoring the tangible return on leadership investments.

Additionally, organizations with formal leadership pipelines are 3.5 times more likely to outperform peers in long-term performance metrics. As companies worldwide navigate rising competitive pressure and workforce expectations, leadership development programs continue to evolve as critical enablers of organizational agility, cultural strength, and sustainable growth.

New trends include a surge in AI-driven virtual coaching, personalized learning paths, and microlearning modules, with year-over-year adoption of AI coaching platforms increasing by 38% and enterprise microlearning modules by 41%. Companies are integrating leadership development more closely with succession planning, especially emphasizing diversity, equity, and inclusion (DEI), which saw a 29% rise in investment.

Major players like Harvard Business School hold around 9% market share, while firms like the Center for Creative Leadership and Korn Ferry focus on scalable coaching solutions. Additionally, targeted leadership programs such as Samsung’s Young Leadership Development Program in 2025 emphasize self-leadership and innovation among emerging talent.

Funding initiatives like the UK’s Leadership Grant Fund provide up to £5,000 to innovative projects advancing leadership in the nonprofit sector. Overall, leadership development is becoming more tech-enabled, personalized, and closely aligned with organizational performance goals. These advances highlight a strong market trajectory with a focus on future-ready leadership capabilities across sectors.

Key Takeaways

- The Global Leadership Development Program Market reached USD 82.18 billion in 2024 and is projected to hit USD 225.1 billion by 2034 at a 10.60% CAGR.

- North America accounted for 35.8% of the global share in 2024, valued at USD 29.42 billion.

- The US market reached USD 26.83 billion in 2024 and is expected to grow to USD 59.01 billion by 2034 at an 8.2% CAGR.

- By Program Type, Customized Enterprise Programs: 24.7% dominated due to increasing demand for tailored leadership solutions.

- By Delivery Mode, Blended Learning: 40.4% emerged as the leading format driven by hybrid work models.

- By Provider Type, Large Consulting & Professional Services Firms: 31.5% captured the highest share, owing to broad global training capabilities.

- By Leadership Level, Frontline/First-Level Leaders: 36.2% represented the largest segment as companies strengthen early-stage leadership pipelines.

- By Organization Size, Large Enterprises: 80.4% dominated the market due to higher investments in structured development programs.

- By End-User Industry, Technology & IT: 21.1% remained the leading adopter because of continuous skill upgrades and fast-paced innovation cycles.

Role of Skills

Skills play a central role in shaping effective leadership development programs, forming the foundation upon which organizations build capable and future-ready leaders. As workplaces evolve, leaders require a blend of strategic, interpersonal, and digital skills to navigate increasing complexity.

Research indicates that over 60% of companies identify critical skill gaps in leadership pipelines, emphasizing the urgency for structured skill-building initiatives. Modern programs focus on developing competencies such as emotional intelligence, decision-making, conflict resolution, and cross-functional collaboration—skills shown to improve team productivity by up to 28%.

Technical and digital capabilities are also becoming essential. With the rise of automation and data-driven decision-making, leaders must possess digital literacy and analytical skills; studies show that organizations with digitally skilled leaders are 2.3 times more likely to outperform competitors in innovation. Additionally, communication and adaptability skills strengthen leaders’ ability to guide diverse and distributed teams, especially as hybrid work expands globally.

Companies that invest in leadership skill development report 37% higher employee engagement, highlighting the direct relationship between leadership capability and organizational performance. Ultimately, skill-focused leadership development programs equip individuals to meet dynamic business demands, strengthen cultural alignment, and contribute to long-term enterprise resilience.

Industry Adoption

Industry adoption of leadership development programs has accelerated as organizations across sectors recognize the strategic value of building strong leadership pipelines. Businesses facing rapid technological change, increasing competition, and evolving workforce expectations now view leadership capability as a core differentiator.

Surveys show that nearly 72% of global organizations have formal leadership development initiatives in place, while over 54% plan to increase investment in the next two years. This adoption is especially strong in technology, finance, healthcare, manufacturing, and professional services—industries where complex decision-making, innovation, and talent retention are critical.

Technology and IT companies lead adoption, driven by fast-paced innovation cycles and the need for leaders who can manage agile teams and large-scale digital transformation. In healthcare, rising patient demands and regulatory pressures push organizations to strengthen clinical and administrative leadership.

Meanwhile, financial institutions prioritize leadership programs to navigate regulatory shifts, risk management, and digital banking trends. Manufacturing and industrial sectors are adopting programs to build skills in automation oversight, operational excellence, and workforce transformation.

The expansion of hybrid and remote work models has further increased adoption across industries, with organizations reporting that leadership programs improve team alignment and productivity by 22–30%. As industries continue to evolve, leadership development is becoming a standardized, high-impact organizational investment essential for long-term growth.

Emerging Trends

Emerging trends in leadership development programs reflect the rapid transformation of workplaces, technology, and employee expectations. One of the most significant shifts is the integration of artificial intelligence and analytics into training frameworks. Organizations increasingly use AI-driven assessments to identify skill gaps, personalize learning paths, and track behavioral progress. Studies indicate that over 48% of companies now incorporate AI-based tools in leadership training, improving engagement and learning efficiency.

Another strong trend is the rise of experiential learning through simulations, role-playing, and scenario-based modules. These methods help leaders develop practical decision-making skills for high-pressure environments. Virtual reality and immersive learning are gaining adoption, especially in industries where real-world scenarios are costly or risky to replicate. Additionally, emotional intelligence and human-centric leadership are becoming core focus areas, with around 63% of organizations prioritizing empathy, resilience, and communication in their programs.

Hybrid and remote leadership development formats are also expanding, driven by distributed workforces. Blended learning—combining digital training with in-person workshops—has become the dominant model due to flexibility and cost-effectiveness. Finally, organizations are shifting toward continuous learning ecosystems rather than one-time workshops, emphasizing ongoing coaching, peer networks, and micro-learning. These trends highlight a broader movement toward adaptive, data-driven, and human-centered leadership development.

US Market Size

The US leadership development program market continues to expand as organizations prioritize structured talent development and long-term succession planning. Valued at USD 26.83 billion in 2024, the market reflects a strong corporate emphasis on enhancing managerial capabilities, especially in industries undergoing rapid digital and organizational transformation.

Companies increasingly invest in comprehensive programs that strengthen leadership pipelines, improve employee engagement, and support strategic growth initiatives. The shift toward hybrid work environments has further intensified demand for leaders skilled in digital communication, team management, and cross-functional collaboration.

Looking ahead, the US market is projected to reach USD 59.01 billion by 2034, advancing at a steady 8.2% CAGR. This growth is supported by the adoption of AI-enabled learning platforms, experiential training models, and data-driven performance analytics that personalize leadership development at scale. Sectors such as technology, finance, healthcare, and professional services are leading contributors, as these industries rely heavily on effective leadership to manage complexity and innovation.

Additionally, rising investments in diversity, equity, and inclusion (DEI) programs are encouraging organizations to expand leadership training for underrepresented groups. As skill gaps widen and competition for high-quality talent intensifies, the US market will remain one of the strongest global hubs for leadership development solutions.

By Program Type

Customized enterprise programs hold a dominant 24.7% share in the leadership development program market, driven by the growing need for organizations to design learning pathways that align directly with their culture, objectives, and strategic priorities. These programs are built around company-specific challenges, leadership competencies, and performance expectations, making them more effective than generic, one-size-fits-all training models.

Large enterprises, in particular, invest heavily in customized solutions to address diverse workforce structures, multi-level leadership requirements, and long-term succession planning needs. As organizations face rapid digital transformation and rising competitive pressures, the demand for highly tailored leadership programs continues to increase.

In contrast, high-potential and succession planning programs focus on developing future leaders capable of filling critical roles. New manager or first-time leader programs help emerging supervisors transition smoothly into leadership responsibilities, while strategic leadership and executive programs target senior decision-makers who guide organizational direction.

Functional leadership programs strengthen domain-specific capabilities across areas such as operations, finance, marketing, and HR. Open-enrollment programs, often offered by universities and training institutes, cater to individual professionals seeking career advancement. While all segments play an important role, the superior alignment and measurable impact of customized enterprise programs position them as the most preferred option across industries.

By Delivery Mode

Blended learning dominates the delivery mode landscape with a 40.4% share, driven by its balanced approach that integrates the strengths of both digital and in-person learning methods. Organizations increasingly prefer this model because it delivers flexibility, higher engagement, and stronger knowledge retention.

Blended learning allows leaders to participate in virtual discussions, complete digital modules at their own pace, and apply concepts through in-person workshops or real-time simulations. This mix enables companies to train large, distributed teams efficiently while still preserving the interactive and experiential qualities of instructor-led training. As hybrid workforces grow and digital tools advance, blended formats have become the most scalable and impactful leadership development solution.

In-person or instructor-led training remains valuable for experiential learning, group problem-solving, and executive workshops, especially for senior leadership teams. Online or virtual instructor-led training (vILT) has gained strong adoption as organizations shift toward remote collaboration, enabling real-time learning without geographic constraints.

Self-paced digital learning platforms also continue to rise, offering micro-learning modules, AI-based assessments, and personalized learning pathways that support continuous skill development. While each mode serves different organizational needs, blended learning leads the market by combining structure, flexibility, and rich learning experiences that align with modern workplace dynamics.

By Provider Type

Large consulting and professional services firms hold a leading 31.5% share in the provider landscape, driven by their global reach, multidisciplinary expertise, and ability to deliver highly customized leadership development solutions at scale. These firms combine strategic advisory capabilities with advanced learning technologies, enabling organizations to integrate leadership development with broader transformation initiatives.

Their programs often include competency mapping, executive coaching, behavioral assessments, and data-driven performance analytics, making them preferred partners for large enterprises seeking enterprise-wide leadership capability building. The ability of these firms to align leadership development with organizational strategy continues to reinforce their dominance.

Academic institutions and top-tier business schools remain influential, offering prestigious executive programs backed by research-driven content. Specialized leadership development firms focus on targeted behavioral skills, emotional intelligence, and industry-specific training needs. Corporate training and eLearning companies contribute by delivering scalable digital platforms, micro-learning modules, and interactive virtual training experiences suited for hybrid workforces.

outique and niche coaching firms cater to personalized leadership journeys, providing one-on-one coaching and specialized interventions for senior executives or high-potential talent. While each provider type serves distinct organizational needs, large consulting and professional services firms lead due to their comprehensive solutions, proven transformation frameworks, and strong alignment with enterprise growth priorities.

By Leadership Level

Frontline and first-level leaders represent the largest share at 36.2%, reflecting organizations’ growing focus on strengthening leadership capabilities at the earliest supervisory stages. As frontline leaders directly influence employee performance, team engagement, and day-to-day operational outcomes, companies recognize that skill gaps at this level can significantly affect productivity.

These programs focus on foundational competencies such as communication, conflict management, coaching, and decision-making. With studies indicating that over 70% of an employee’s experience is shaped by their immediate supervisor, organizations increasingly prioritize structured development for this group. The rise of hybrid work models has also elevated the need for frontline leaders who can manage distributed teams effectively.

Mid-level leader programs address more complex responsibilities, including cross-functional collaboration, strategic planning, and operational leadership. These leaders act as the bridge between frontline managers and senior executives, making their development crucial for organizational alignment. Senior and executive leadership programs focus on strategic growth, transformation management, and high-stakes decision-making.

C-suite development emphasizes enterprise-wide vision, culture building, governance, and long-term value creation. While all levels contribute to a cohesive leadership pipeline, frontline and first-level leaders dominate due to their high population size, direct operational impact, and the critical role they play in shaping workforce performance and organizational culture.

By Organization Size

Large enterprises account for a dominant 80.4% share of the leadership development program market, driven by their extensive workforce size, structured talent pipelines, and sustained investment capacity. These organizations operate in complex, competitive environments where leadership capability directly influences scalability, innovation, and operational efficiency.

As a result, large enterprises allocate substantial budgets toward customized leadership programs, executive coaching, blended learning platforms, and long-term succession planning. Many global companies report dedicating over USD 1,000 per employee annually to leadership learning initiatives, reflecting their commitment to building a strong internal leadership bench. Their multinational presence also requires leaders who can manage cross-cultural teams, digital transformation, and global strategic planning—further accelerating adoption.

Small and medium-sized enterprises (SMEs) contribute steadily but remain behind due to limited budgets and smaller leadership hierarchies. However, SMEs are increasingly adopting cost-effective virtual learning solutions, open-enrollment programs, and modular leadership courses.

With over 90% of SMEs acknowledging skill gaps in managerial capability, the segment is gradually shifting toward structured development programs. Nonetheless, large enterprises dominate the market because of their broader training infrastructure, higher demand for multi-tier leadership programs, and greater emphasis on developing future-ready leaders capable of driving long-term organizational resilience and competitive advantage.

By End-User Industry

Technology and IT hold the largest share at 21.1%, reflecting the sector’s constant need for agile, innovation-driven, and transformation-ready leadership. Fast-evolving digital ecosystems, shorter technology cycles, and rising competition push tech companies to invest heavily in leadership programs that strengthen strategic thinking, product ownership, cross-functional collaboration, and change management.

With studies indicating that over 65% of tech organizations face leadership skill shortages, companies prioritize programs that equip managers to lead global teams, drive AI adoption, manage cybersecurity risks, and accelerate digital initiatives. The sector also benefits from advanced learning platforms, making leadership development more scalable and personalized.

The BFSI sector relies on leadership development to navigate regulatory demands, fintech disruption, and risk management. Healthcare and pharma organizations focus on leadership to improve patient outcomes, optimize operations, and lead scientific innovation.

Manufacturing and industrial companies emphasize operational excellence, lean leadership, and managing automation-led workforce transitions. Energy and utilities prioritize leaders capable of overseeing sustainability projects, grid modernization, and large-scale infrastructure transformation. Other sectors adopt leadership programs based on organizational maturity and workforce needs.

While all industries value leadership capability, Technology and IT lead due to their rapid pace of innovation, complex workforce structures, and the critical need for leaders who can drive continuous transformation and competitive differentiation.

Key Market Segments

By Program Type

- High-Potential & Succession Planning Programs

- New Manager/First-Time Leader Programs

- Strategic Leadership & Executive Programs

- Functional Leadership Programs

- Customized Enterprise Programs

- Open-Enrollment Programs

By Delivery Mode

- In-Person/Instructor-Led Training (ILT)

- Online/Virtual Instructor-Led Training (vILT)

- Blended Learning

- Self-Paced/Digital Learning Platforms

By Provider Type

- Academic Institutions & Top-Tier Business Schools

- Specialized Leadership Development Firms

- Large Consulting & Professional Services Firms

- Corporate Training & eLearning Companies

- Boutique & Niche Coaching Firms

By Leadership Level

- Frontline/First-Level Leaders

- Mid-Level Leaders

- Senior/Executive Leaders

- C-Suite

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By End-User Industry

- Technology & IT

- BFSI (Banking, Financial Services, Insurance)

- Healthcare & Pharma

- Manufacturing & Industrial

- Energy & Utilities

- Others

Regional Analysis

North America accounts for a leading 35.8% share of the global leadership development program market, reflecting the region’s strong organizational focus on structured talent development and long-term workforce capability building. The market reached USD 29.42 billion in 2024, supported by high corporate investment levels, mature training ecosystems, and early adoption of digital learning technologies.

Companies across the US and Canada increasingly prioritize leadership development as a core strategic function, driven by rising skill gaps, rapid digital transformation, and the need for leaders who can manage hybrid and distributed teams. Large enterprises dominate adoption due to well-established HR infrastructures and substantial budgets dedicated to executive education, coaching, and blended-learning initiatives.

The region’s strong presence of global consulting firms, top-tier business schools, and specialized leadership training providers further strengthens market growth. Industries such as technology, finance, healthcare, and professional services lead regional adoption as they rely heavily on strategic decision-making, innovation management, and people leadership to maintain competitiveness.

The rise of AI-driven learning platforms and data-based performance assessments has also accelerated adoption across mid-size organizations. Additionally, increasing emphasis on diversity, equity, and inclusion (DEI) initiatives has encouraged companies to invest in leadership development for emerging and underrepresented talent groups. North America remains a highly advanced and influential hub for leadership capability-building initiatives.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Leadership development programs are increasingly driven by rising skill gaps, digital transformation, and evolving workforce expectations. Studies show that over 60% of organizations report shortages in critical leadership competencies, prompting higher investment in structured training. The shift toward hybrid and remote workplaces has accelerated demand for leaders skilled in virtual collaboration, change management, and digital communication.

Additionally, companies undergoing transformation initiatives—such as automation, AI integration, and global expansion—require leaders with advanced strategic and analytical capabilities.

Research indicates that organizations with strong leadership pipelines experience up to 29% higher productivity and 23% stronger profitability, reinforcing leadership development as a key performance driver. Increasing focus on employee engagement and retention also contributes, as 72% of employees state they value employers who invest in leadership development. Together, these factors significantly strengthen market growth.

Restraint Factors

Despite rapid adoption, several restraints limit the full-scale implementation of leadership development programs. High costs remain a major barrier, especially for smaller organizations, with advanced programs costing USD 3,000–10,000 per participant in many cases. Inconsistent ROI measurement also affects adoption, as nearly 40% of companies struggle to track tangible performance outcomes from leadership initiatives.

Time constraints further limit participation, with managers often unable to dedicate the recommended 20–30 hours of learning due to operational responsibilities. Additionally, resistance to behavioral change reduces program effectiveness, particularly in traditional or hierarchical organizational cultures.

Limited internal expertise and dependence on external providers can also create scalability challenges. The lack of long-term follow-up, coaching, and reinforcement leads many programs to lose impact after implementation. These factors collectively slow deeper penetration across industries and organization sizes.

Growth Opportunities

The leadership development market presents strong growth opportunities, particularly through AI-driven learning, experiential training models, and industry-specific leadership pathways. The integration of AI for personalization, behavioral analytics, and performance tracking is expected to expand rapidly, with analysts estimating that over 50% of leadership programs will use AI-enabled tools within the next five years.

Growing demand for leadership in digital transformation projects, cybersecurity readiness, and sustainability initiatives creates new program categories. Emerging markets in Asia-Pacific and Latin America offer significant potential as organizations scale their leadership capabilities to support regional growth.

Expanding DEI initiatives present another major opportunity, with over 67% of enterprises planning to invest in leadership programs for underrepresented groups. Small and medium-sized enterprises also represent an expanding segment as affordable digital platforms increase accessibility. These opportunities position the market for sustained long-term expansion.

Trending Factors

Several notable trends are reshaping leadership development programs globally. AI-powered adaptive learning and predictive analytics are becoming mainstream, with 48% of organizations integrating AI into leadership assessments and training pathways. Experiential learning methods—such as simulations, VR-based leadership scenarios, and real-time problem-solving labs—are gaining popularity due to higher engagement and retention levels.

Emotional intelligence, resilience, and human-centered leadership are increasingly prioritized, reflecting shifting workforce expectations, with 63% of organizations expanding training in these areas. Blended learning continues to rise as the most preferred delivery model, supported by hybrid work dynamics. Peer-learning networks and continuous micro-learning ecosystems are trending, replacing one-time workshops with ongoing capability-building structures.

There is also a growing focus on data-backed leadership decisions and cross-functional leadership skills to manage complex, fast-changing environments. Together, these trends represent a major shift toward more personalized, technology-enabled, and behavior-centric leadership development approaches.

Competitive Analysis

The competitive landscape of the leadership development program market is shaped by a mix of global consulting firms, specialized training providers, business schools, and digital learning platforms, each competing on program customization, technology integration, and measurable impact.

Large consulting and professional services firms hold a significant share of the market, supported by their ability to deliver end-to-end solutions that integrate leadership development with broader organizational transformation. These firms often serve multinational enterprises and maintain strong influence by providing data-driven assessments, executive coaching, and scalable learning ecosystems. Research shows that over 40% of Fortune 500 companies partner with major consulting firms for leadership capability building.

Top-tier business schools also remain highly competitive, leveraging academic credibility, research-based frameworks, and prestigious executive programs. Specialized leadership development firms differentiate through niche expertise in behavioral science, emotional intelligence, and leadership psychology, while digital learning providers compete by offering enhanced accessibility, AI-enabled personalization, and cost-effective delivery. With more than 55% of global organizations accelerating investments in digital learning, these providers continue gaining ground.

Boutique coaching firms hold a notable presence in senior leadership and C-suite development, offering personalized, high-touch programs. Overall, competition is intensifying as companies demand measurable ROI, advanced analytics, and leadership solutions aligned with fast-changing workplace dynamics.

Top Key Players in the Market

- Harvard Business School

- Dale Carnegie

- Center for Creative Leadership (CCL)

- Kellogg Executive Education

- IMD

- FranklinCovey

- Korn Ferry

- GP Strategies Corporation

- D2L Corporation

- Interaction Associates

- Skillsoft

- DDI

- BTS Group AB

- Wilson Learning

- Others

Recent Developments

- November 12, 2025: Hyundai Motor India partnered with IIM Tiruchirappalli and MDI Gurgaon to launch the “ARISE Core Talent” leadership development program, engaging around 100 employees in Phase 1 and preparing for an expanded Phase 2 rollout in fiscal 2026.

- October 28, 2025: IIM Trichy signed an MoU with Renault Nissan Automotive India Pvt. Ltd. and Hyundai to introduce customized strategic leadership certification programs focused on adaptive leadership, ethical decision-making, and organizational transformation.

- September 14, 2025: Australia’s Mawal Leadership Program was announced to advance Indigenous corporate leadership, offering 60 scholarships backed by major companies such as BHP Group and Ampol to support non-degree professionals with strong commercial aptitude.

Report Scope

Report Features Description Market Value (2024) USD 82.18 Billion Forecast Revenue (2034) USD 225.1 Billion CAGR(2025-2034) 10.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Program Type (High-Potential & Succession Planning Programs, New Manager/First-Time Leader Programs, Strategic Leadership & Executive Programs, Functional Leadership Programs, Customized Enterprise Programs, Open-Enrollment Programs), By Delivery Mode (In-Person/Instructor-Led Training (ILT), Online/Virtual Instructor-Led Training (vILT), Blended Learning, Self-Paced/Digital Learning Platforms), By Provider Type (Academic Institutions & Top-Tier Business Schools, Specialized Leadership Development Firms, Large Consulting & Professional Services Firms, Corporate Training & eLearning Companies, Boutique & Niche Coaching Firms), By Leadership Level (Frontline/First-Level Leaders, Mid-Level Leaders, Senior/Executive Leaders, C-Suite), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By End-User Industry (Technology & IT, BFSI (Banking, Financial Services, Insurance), Healthcare & Pharma, Manufacturing & Industrial, Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Harvard Business School, Dale Carnegie, Center for Creative Leadership (CCL), Kellogg Executive Education, IMD, FranklinCovey, Korn Ferry, GP Strategies Corporation, D2L Corporation, Interaction Associates, Skillsoft, DDI, BTS Group AB, Wilson Learning, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Leadership Development Program MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Leadership Development Program MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Harvard Business School

- Dale Carnegie

- Center for Creative Leadership (CCL)

- Kellogg Executive Education

- IMD

- FranklinCovey

- Korn Ferry

- GP Strategies Corporation

- D2L Corporation

- Interaction Associates

- Skillsoft

- DDI

- BTS Group AB

- Wilson Learning

- Others