Global Lawn Care Market Size, Share, And Business Benefits By Source (Gasoline, Electric, Battery), By Service (Mowing, Trimming and Edging, Fertilization and Weed Control, Aeration and Overseeding, Pest Control, Others), By Property Type (Residential, Commercial, Municipal), By Equipment Type (Walk-Behind Mowers, Riding Mowers, Zero-Turn Mowers, Tractors, Trimmers, Edgers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158224

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

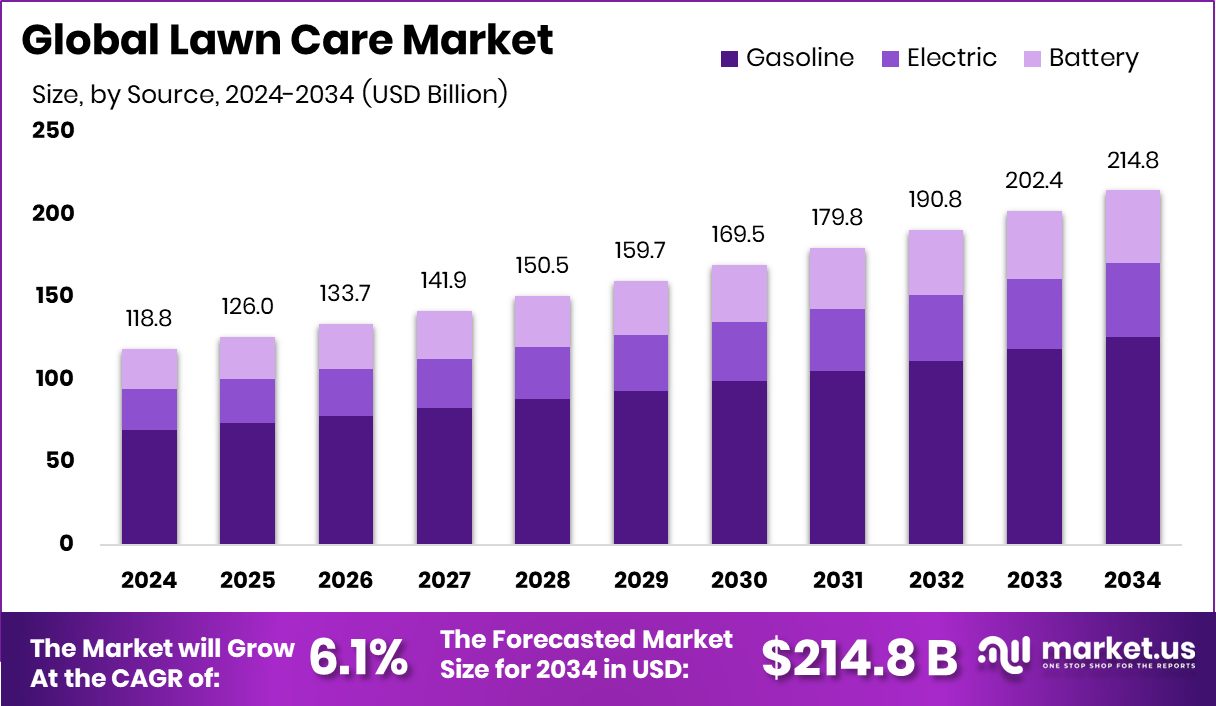

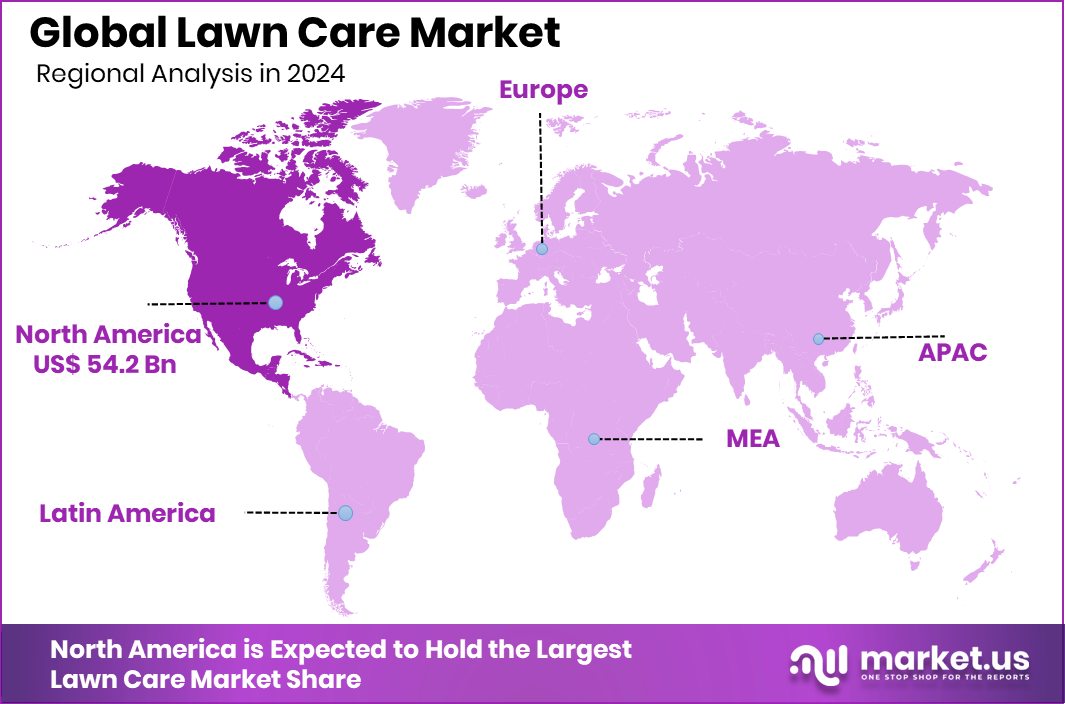

The Global Lawn Care Market is expected to be worth around USD 214.8 billion by 2034, up from USD 118.8 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Expanding eco-friendly practices boosted North America’s Lawn Care Market to 45.70% share, USD 54.2 Bn.

Lawn care is the routine upkeep of turf and surrounding green areas—mowing, edging, fertilizing, watering, aeration, weed and pest control, and seasonal clean-ups—to keep yards, parks, and campuses healthy, safe, and attractive.

The lawn care market covers paid services and products that deliver those tasks: service crews, equipment (mowers, trimmers, blowers), inputs (seed, fertilizer, soil amendments), irrigation, and eco-solutions like battery tools and smart watering. Buyers range from homeowners to municipalities, schools, and property managers.

Demand is lifted by urban densification, year-round property standards, and the shift to quieter, cleaner equipment. Public incentives are speeding the change:California’s Clean Off-Road Equipment Voucher Incentive Project (CORE) offers point-of-sale discounts for zero-emission off-road gear, including lawn and landscape equipment, lowering upgrade costs for small businesses and public agencies. South Coast AQMD adds up to an 85% discount with caps as high as $15,000 for commercial ride-on mowers, directly stimulating purchases and contract activity.

Government greening funds create multi-year maintenance work. The USDA Forest Service’s Urban & Community Forestry program, backed by Inflation Reduction Act dollars, shows large obligated totals for community tree canopy and urban green projects—work that requires mowing, mulching, irrigation, and long-term care. EPA’s Urban Waters and green-infrastructure grants expand rain gardens, bioswales, and open spaces—each adding recurring lawn and landscape maintenance needs in neighborhoods.

Key Takeaways

- The Global Lawn Care Market is expected to be worth around USD 214.8 billion by 2034, up from USD 118.8 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- Gasoline-powered equipment dominates the Lawn Care Market, holding a strong 58.5% share in 2024.

- Mowing services account for only 32.8%, yet remain an essential activity driving recurring Lawn Care Market demand.

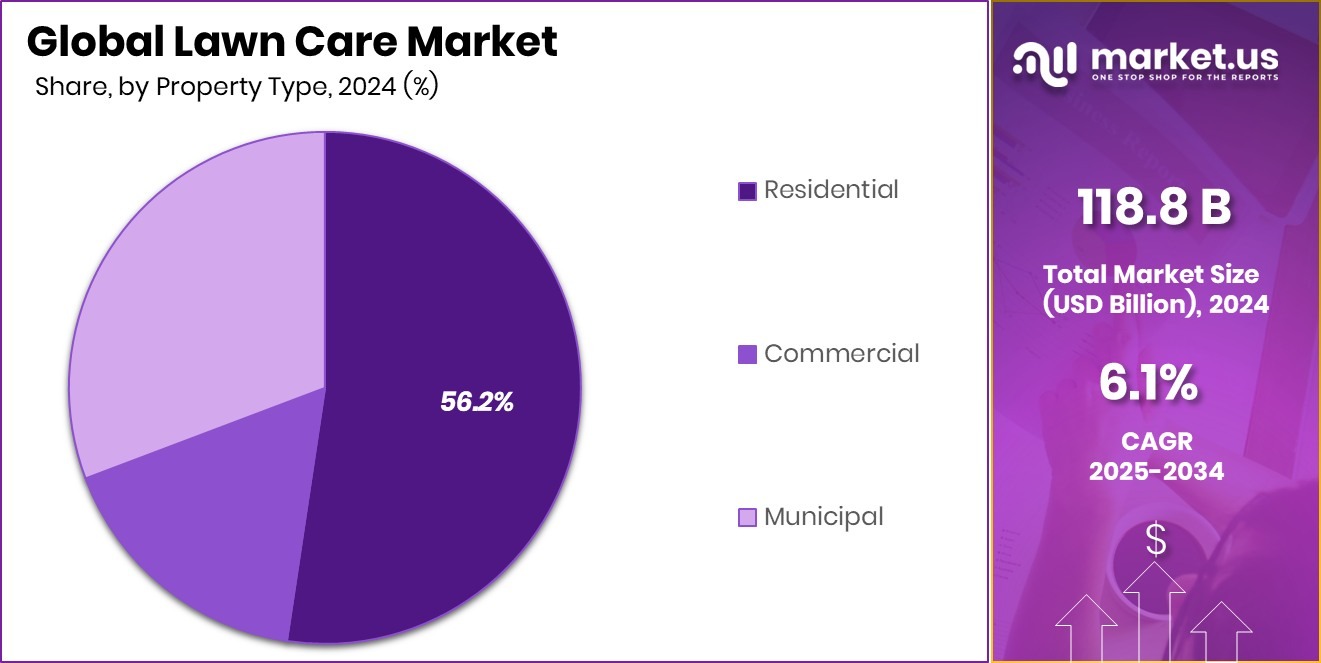

- Residential properties lead the Lawn Care Market, representing 56.2% of the sector’s overall service demand.

- Riding mowers capture 31.4% in the Lawn Care Market, highlighting their efficiency and growing homeowner preference.

- Strong consumer demand in North America (45.70%, USD 54.2 Bn) highlights its lawn maintenance dominance.

By Source Analysis

Gasoline-powered equipment dominates the Lawn Care Market with 58.5%.

In 2024, Gasoline held a dominant market position in the By Source segment of the Lawn Care Market, with a 58.5% share. This leadership reflects the long-standing reliance on gasoline-powered equipment such as mowers, trimmers, and blowers, which continue to deliver consistent performance and affordability for large-scale lawn maintenance.Despite rising awareness around emissions and noise, gasoline systems remain preferred due to their durability and widespread availability, especially in regions where electric infrastructure or charging access is limited. The dominance of this segment highlights its role as the backbone of commercial and residential lawn care operations, ensuring steady demand while slowly transitioning alongside government-driven incentives that encourage greener alternatives.

By Service Analysis

Mowing services account for 32.8% of the Lawn Care Market.

In 2024, Mowing held a dominant market position in the By Service segment of the Lawn Care Market, with a 32.8% share. This strong share is driven by the essential role mowing plays in maintaining healthy, aesthetically pleasing lawns across residential, commercial, and public properties. Regular mowing not only enhances visual appeal but also supports weed control and balanced turf growth, making it the most frequently requested service.The steady rise of urban green spaces, community parks, and institutional landscapes further fuels demand for mowing as a core service. Its recurring nature ensures consistent revenue streams, solidifying its status as the backbone of lawn care services and a priority for property owners aiming to maintain curb appeal.

By Property Type Analysis

Residential properties drive lawn care market demand, holding 56.2% share.

In 2024, Residential held a dominant market position in the By Property Type segment of the Lawn Care Market, with a 49.2% share. The segment’s strength is supported by the growing emphasis on maintaining attractive home landscapes, which directly enhances property value and neighborhood appeal. Homeowners continue to invest in regular lawn care services such as mowing, fertilization, and seasonal upkeep, reflecting lifestyle preferences for well-kept outdoor spaces.

Rising suburban housing developments and community-driven beautification efforts also contribute to this strong demand. Additionally, government-supported urban greening programs indirectly encourage residential lawn maintenance by promoting healthier, greener neighborhoods. This consistent reliance on lawn care makes residential properties the primary driver of market growth and service expansion.

By Equipment Type Analysis

Riding mowers lead equipment sales, capturing 31.4% market share.

In 2024, Riding Mowers held a dominant market position in the By Equipment Type segment of the lawn care market, with a 31.4% share. This dominance is attributed to their efficiency and suitability for maintaining large lawns, estates, parks, and institutional grounds where push mowers are less practical. Riding mowers save time, reduce physical strain, and deliver consistent results, making them the preferred choice for both residential users with expansive properties and professional service providers.

Their ability to cover wide areas quickly ensures higher productivity, which directly supports their strong market presence. Continuous improvements in comfort, precision, and fuel or battery efficiency further strengthen the adoption of riding mowers as a core lawn care equipment choice.

Key Market Segments

By Source

- Gasoline

- Electric

- Battery

By Service

- Mowing

- Trimming and Edging

- Fertilization and Weed Control

- Aeration and Overseeding

- Pest Control

- Others

By Property Type

- Residential

- Commercial

- Municipal

By Equipment Type

- Walk-Behind Mowers

- Riding Mowers

- Zero-Turn Mowers

- Tractors

- Trimmers

- Edgers

Driving Factors

Government Grants Catalyse Eco-Friendly Equipment Adoption

A major driving force in the lawn care market is the increasing government funding for greener, cleaner lawn care tools and practices. Governments are offering grants and subsidies to encourage businesses and individuals to replace old, gas-powered mowers, leaf blowers, and other landscaping equipment with electric or battery-powered alternatives. This reduces air pollution and emissions, is quieter, and lowers operating costs over time. For example, Minnesota is using US$1 million from its legislative environmental fund to help eligible applicants purchase electric landscaping and snow-removal equipment.

This kind of government support makes sustainable equipment more affordable and accelerates adoption. It also boosts demand for electric lawn care tools in the market, pushing manufacturers to innovate and supply more of these greener machines.

Restraining Factors

Insufficient Subsidies Burden Small Landscapers and Startups

A top restraining factor in the lawn care market is that government funding or subsidies are often too small or structured in ways that leave out many small landscapers and new businesses. Though governments offer rebates and grants to promote clean, electric tools instead of gas-powered ones, the funding may only cover a fraction of the true cost. For example, California set aside US$30 million for its incentive program to help operators switch to electric tools, but many small operators say this isn’t enough, since it gives only a 50% coupon for one tool while many need several tools.

Because of this, smaller businesses struggle to afford the up-front cost of multiple electric machines or batteries. Also, difficulties in eligibility (who qualifies for grants) and application processes further weigh on them. This slows adoption and restricts the growth of electric lawn care among those who need help the most.

Growth Opportunity

Organic Practices Grants Open New Lawn Care Growth Ways

One big growth opportunity in the lawn care market is the rising availability of government grants that support organic and sustainable turf and landscaping practices. More people want lawns that are safe for kids, bees, and the environment — less chemical fertilizer, more natural methods. Governments are starting to fund organic agriculture research, education, and transition programs, which can extend into lawn care businesses that adopt organic mowing, composting, native plant landscaping, or soil-friendly methods.

For example, in the U.S., the USDA’s Organic Agriculture Research & Extension Initiative (OREI) gives about US$50 million per year to help farmers, growers, and producers adopt and improve organic methods. Also, the Organic Market Development Grant (OMDG) program has approximately US$85 million available for building supply chains, processing, and marketing of organic agricultural goods.

These funds create chances for lawn care businesses to offer eco-friendly services, get certified organic, educate clients about healthier lawns, and differentiate themselves in the market. If such programs expand to include more landscaping / lawn-care specific support, businesses that move early may gain a big advantage.

Latest Trends

Rebates & Robotics Driving Smart Lawn-Care Tech Uptake

A fresh trend in the lawn-care market is the growing use of financial incentives plus robot and electric tools, supported by government policies. Governments and air-quality agencies are giving rebates, vouchers, and grants to homeowners and businesses to encourage switching from gas-powered lawn equipment to battery-electric or robotic alternatives. On top of that, public bodies are themselves buying automated mowers to maintain public spaces more cheaply and sustainably.

- In California, the South Coast AQMD offers rebates of up to US$250 per piece of residential electric lawn or garden equipment (lawn mowers, trimmers, leaf blowers, chainsaws) when old gasoline-powered tools are surrendered.

- In Colorado, the “Mow Down Pollution” program offers grants of up to US$150 for households and up to US$3,000 for commercial operators when they buy electric models.

This trend is accelerating because people want quieter, cleaner lawns and lower running costs. Manufacturers of robotic and electric gear are innovating faster. Over time, the combination of public funding + tech advances is making smart tools (robots, batteries, automation) more affordable and widespread.

Regional Analysis

In 2024, North America captured a 45.70% share of the Lawn Care Market, worth USD 54.2 Bn.

In 2024, North America emerged as the leading region in the global Lawn Care Market, securing a dominant 45.70% share valued at USD 54.2 billion. The region’s strong position is supported by high household adoption of professional lawn maintenance, coupled with the widespread presence of landscaping service providers and equipment manufacturers.

Rising consumer preference for aesthetically pleasing outdoor spaces, especially in the U.S. and Canada, is fueling consistent growth. Additionally, increasing government initiatives to promote environmentally friendly equipment, such as rebates on electric mowers and leaf blowers, are creating new opportunities for service providers and equipment suppliers.

In comparison, Europe, Asia Pacific, Latin America, and the Middle East & Africa are experiencing steady adoption, driven by growing urbanization, rising disposable incomes, and cultural emphasis on outdoor aesthetics.

However, North America continues to dominate due to its higher service penetration, advanced technological adoption, and favorable funding programs supporting greener equipment transitions. This strong dominance not only highlights North America’s market maturity but also sets the benchmark for sustainable practices that other regions are beginning to follow.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Greenworks Tools continues to strengthen its position as a leader in battery-powered lawn equipment. The company’s wide range of cordless mowers, trimmers, and blowers appeals to eco-conscious consumers seeking quiet and emission-free solutions. By investing heavily in lithium-ion technology and smart connectivity, Greenworks is aligning with the growing demand for sustainable and user-friendly lawn care tools. Its focus on affordability and residential markets positions it strongly among households shifting away from gas-powered equipment.

Deere & Company, a global giant in machinery, retains its dominance in the premium lawn care equipment category. With its John Deere brand recognized for durability and innovation, the company leverages strong dealer networks and after-sales services to maintain customer loyalty. Deere’s adoption of precision technologies, such as GPS-enabled mowing systems, reflects its strategy to serve both residential and commercial markets. Its emphasis on high-performance riding mowers and landscaping machinery ensures steady growth in developed markets, especially North America.

Echo Incorporated remains a strong competitor with its specialization in professional-grade handheld tools. Known for robust products such as trimmers, chainsaws, and blowers, Echo appeals to commercial landscapers and contractors who prioritize reliability and performance. The company’s push toward hybrid and low-emission models demonstrates its responsiveness to regulatory shifts and consumer preference for greener alternatives. By blending professional trust with emerging eco-friendly lines, Echo secures a balanced market presence.

Top Key Players in the Market

- Greenworks Tools

- Deere Company

- Echo Incorporated

- Ryobi Power Tools

- Makita Corporation

- The Toro Company

- MTD Products

- Ariens Company

- Scotts MiracleGro

- Honda Motor Company

Recent Developments

- In January 2025, Deere revealed a fully electric, autonomous commercial mower at CES 2025. This mower is part of its broader autonomy push that includes retrofitting and integrating autonomous technology into lawn, turf, and landscape equipment.

- In January 2024, at CES Las Vegas, Greenworks introduced many new battery-powered and charging innovations. This included an Electric Vehicle Charger, four new Zero-Turn Mowers, the AiConic Robotic Mower, the ChargeLink™ battery charging system, and several Power Stations across its 24V, 40V, 60V, and 80V platforms.

Report Scope

Report Features Description Market Value (2024) USD 118.8 Billion Forecast Revenue (2034) USD 214.8 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Gasoline, Electric, Battery), By Service (Mowing, Trimming and Edging, Fertilization and Weed Control, Aeration and Overseeding, Pest Control, Others), By Property Type (Residential, Commercial, Municipal), By Equipment Type (Walk-Behind Mowers, Riding Mowers, Zero-Turn Mowers, Tractors, Trimmers, Edgers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Greenworks Tools, Deere Company, Echo Incorporated, Ryobi Power Tools, Makita Corporation, The Toro Company, MTD Products, Ariens Company, Scotts MiracleGro, Honda Motor Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Greenworks Tools

- Deere Company

- Echo Incorporated

- Ryobi Power Tools

- Makita Corporation

- The Toro Company

- MTD Products

- Ariens Company

- Scotts MiracleGro

- Honda Motor Company