Global Lawful Interception (LI) Market Size, Share, Statistics Analysis Report By Component (Solution (Mediation devices, Interception access points, Interception management software), Services (Professional Services, Managed Services)), By Network (Fixed Networks (PSTN (Public Switched Telephone Network), Broadband networks), Mobile Networks (GSM (Global System for Mobile Communications), GPRS (General Packet Radio Service), 3G, 4G, LTE, and 5G), IP Networks (VoIP (Voice over Internet Protocol), Data traffic monitoring)), By Communication Content (Voice Communication, Video, Text Messaging, Faxcimile, Digital Pictures, File Transfer), By Type Of Interception (Active Interception, Passive Interception, Hybrid Interception), By End-User (Lawful Enforcement Agencies, Government), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148136

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Market Size

- Component Analysis

- Network Analysis

- Communication Content Analysis

- Type Of Interception Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

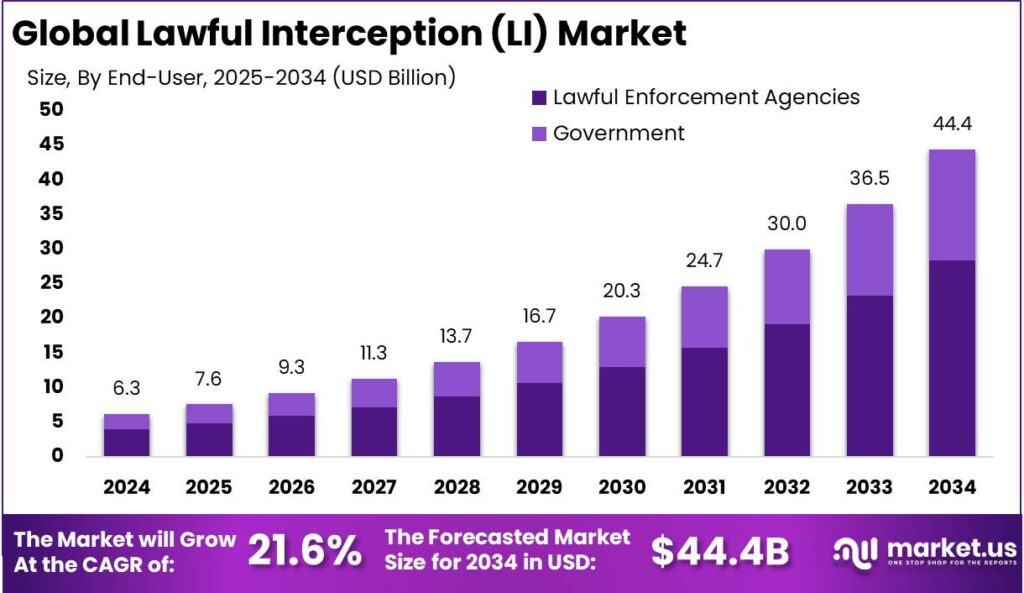

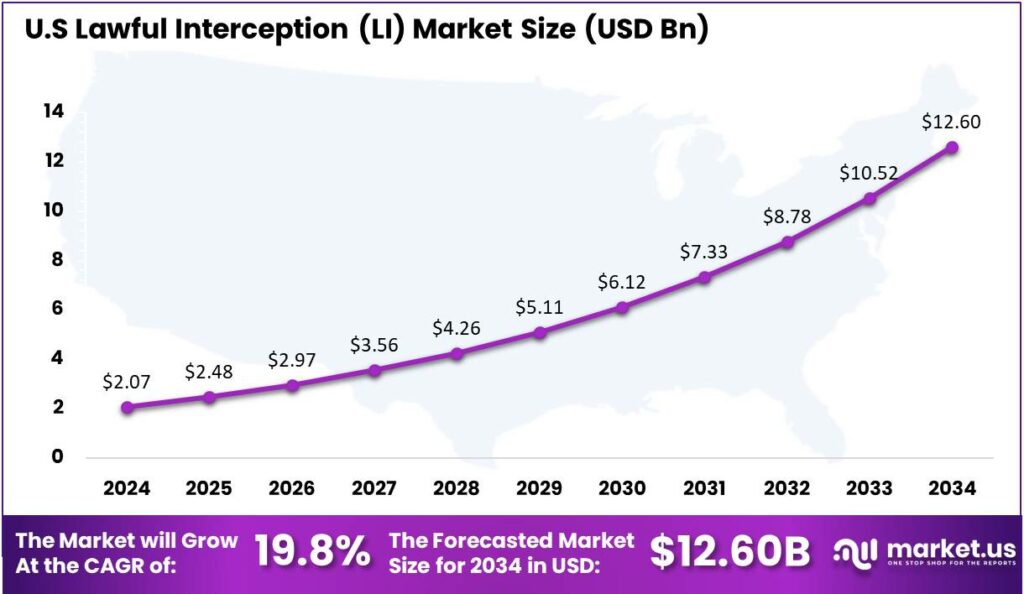

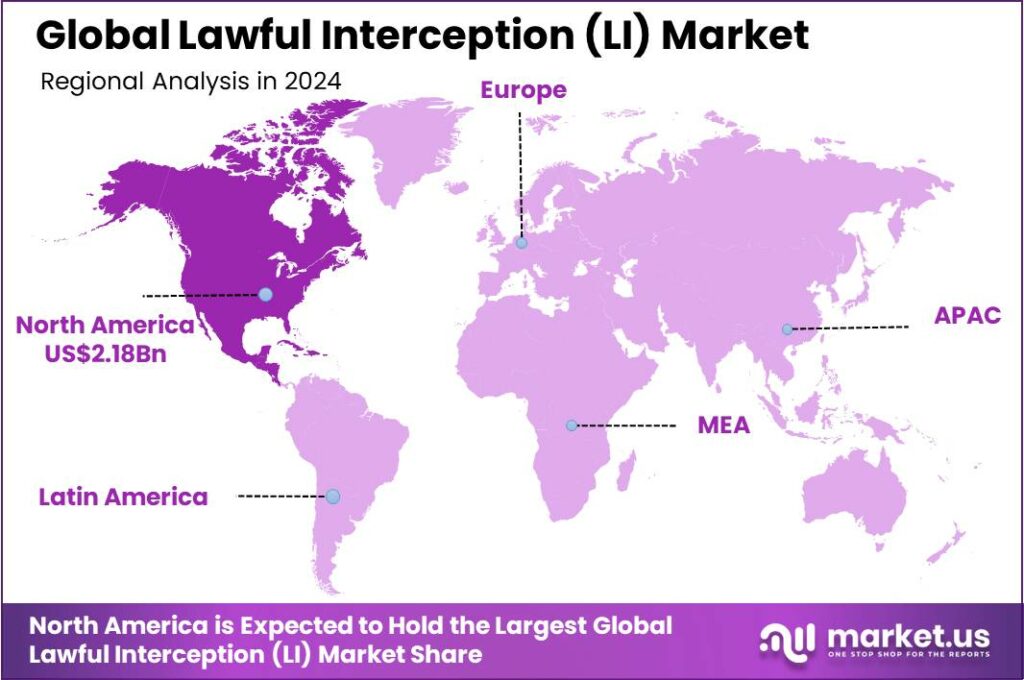

The Global Lawful Interception (LI) Market size is expected to be worth around USD 44.4 Billion By 2034, from USD 6.28 Billion in 2024, growing at a CAGR of 21.60% during the forecast period from 2025 to 2034. In 2024, North America led the global Lawful Interception (LI) market with over 34.8% share, generating approximately USD 2.18 billion. The U.S. market was valued at USD 2.07 billion and is projected to grow at a CAGR of 19.8%.

Lawful Interception (LI) refers to the legally sanctioned access by law enforcement and regulatory agencies to private communications such as phone calls, emails, internet traffic, and messaging services. Lawful Interception (LI) allows network operators and service providers to assist authorities in monitoring communications for security and crime prevention, under legal authorization.

The major factors driving the growth of the Lawful Interception market include the global rise in criminal cyber activity, digital fraud, and national security threats, which have prompted stricter regulatory surveillance measures. Governments are increasingly enforcing mandatory telecom and internet monitoring frameworks to prioritize public security and digital crime prevention.

The growth of 5G networks and IoT ecosystems has made communication infrastructures more complex, driving the need for advanced interception tools capable of operating across diverse networks. Geopolitical tensions and international intelligence cooperation are also pushing countries to modernize their interception capabilities, incorporating real-time data processing, multi-protocol tracking, and encrypted content decoding.

For technology providers and telecom vendors, the lawful interception market offers a steady revenue stream through compliance mandates. By innovating in areas like encryption bypass, data filtering, and real-time monitoring, businesses can differentiate themselves and build strategic ties with telecom regulators and security agencies. This fosters recurring service agreements, reputational credibility, and potential involvement in government-backed critical infrastructure initiatives.

The debate between digital privacy and national security presents opportunities for companies offering effective, transparent LI solutions. AI-powered analytics can enhance interception frameworks, providing valuable insights. Startups with ethical frameworks, strong encryption, and integration with 5G or cloud environments are well-positioned to attract institutional clients.

The market is expanding as more countries, particularly in Asia-Pacific and Latin America, introduce or update regulations requiring lawful access for telecom and internet infrastructure.The rise of 5G, IoT, and high-speed data services is driving upgrades to lawful interception systems, ensuring they can handle new protocols, higher traffic, and diverse devices in the digital age.

Key Takeaways

- The Global Lawful Interception (LI) Market size is projected to reach approximately USD 44.4 Billion by 2034, growing from USD 6.28 Billion in 2024, at a CAGR of 21.60% during the forecast period from 2025 to 2034.

- In 2024, the Solution segment held a dominant market position, capturing more than 61% share of the global Lawful Interception (LI) market.

- The Mobile Networks segment also held a dominant market position in 2024, with over 50% share of the global Lawful Interception (LI) market.

- The Voice Communication segment was a major player in 2024, capturing more than 32% share in the Lawful Interception (LI) market.

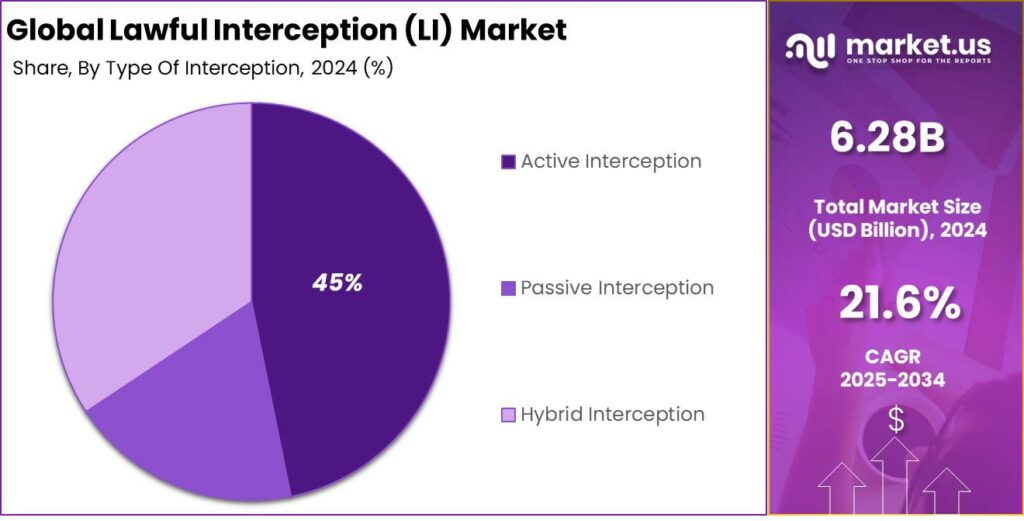

- The Active Interception segment dominated in 2024, with more than 45% market share, driven by the increasing demand for real-time monitoring capabilities in national security and counter-terrorism operations.

- In 2024, the Lawful Enforcement Agencies segment captured a dominant share of over 64% in the market.

- In 2024, North America led the market, accounting for more than 34.8% of the global Lawful Interception (LI) market, generating approximately USD 2.18 billion in revenue.

- The U.S. Lawful Interception (LI) market was valued at USD 2.07 billion in 2024 and is expected to grow at a CAGR of 19.8%.

U.S. Market Size

In 2024, the U.S. Lawful Interception (LI) market was valued at USD 2.07 billion, reflecting the growing importance of secure and regulated surveillance frameworks within the country’s digital ecosystem. Lawful Interception refers to the legally sanctioned process by which authorized agencies can access and monitor telecommunications and digital communications.

The market is anticipated to grow at a compound annual growth rate (CAGR) of 19.8%, signaling robust momentum over the forecast period. This high growth trajectory is driven by continuous technological innovations in surveillance and network analysis, as well as updated legal frameworks that mandate compliance from telecom operators and internet services.

The evolution of 5G and next-gen networks in the U.S. is driving the need for advanced lawful interception solutions. Vendors are creating scalable platforms to intercept communications across networks in real time, fueled by rising data volumes and encryption. U.S. government support boosts market growth in national security and digital governance.

In 2024, North America held a dominant market position, capturing more than 34.8% of the global Lawful Interception (LI) market, and generating approximately USD 2.18 billion in revenue. The region’s leadership can be attributed to a well-established telecommunications infrastructure, stringent regulatory enforcement, and substantial federal investment in security and surveillance technologies.

The U.S. market is fueled by concerns over cybercrime, data breaches, and terrorism, driving government reliance on lawful interception solutions to monitor digital communications. Strong collaboration between federal authorities and telecom providers further strengthens the ecosystem for compliance-driven monitoring technologies.

North America’s dominance in lawful interception (LI) is driven by key players like Cisco, SS8 Networks, and Verint Systems, which lead innovation in interception analytics and surveillance. These firms thrive in a mature regulatory environment, particularly the U.S. Communications Assistance for Law Enforcement Act (CALEA), which requires telecom and internet providers to design systems for interception.

The rapid rollout of 5G networks in the U.S. and Canada is driving demand for advanced interception systems capable of handling real-time, high-bandwidth, multi-device communications. As encrypted messaging, VoIP, and IoT networks grow, law enforcement prioritizes next-gen LI tools with AI-driven analytics and predictive threat detection, strengthening North America’s leadership in the global LI market.

Component Analysis

In 2024, the Solution segment held a dominant market position, capturing more than a 61% share in the global Lawful Interception (LI) market. This leadership is primarily attributed to the growing demand for advanced interception tools that can manage real-time data acquisition, filtering, and analysis across a wide range of networks.

Among the subcomponents, mediation devices and interception access points have witnessed a steep rise in adoption due to their ability to collect metadata and content from IP-based and traditional circuit-switched networks. These tools serve as the technical backbone for lawful interception frameworks, especially in jurisdictions where telecom service providers are legally bound to provide intercept capabilities.

The demand for interception management software has also surged, driven by the need for centralized monitoring, reporting, and analysis in real-time. These platforms allow security agencies to correlate communication events, manage case-based access, and comply with jurisdictional audit trails.

The Services segment, though important, remains supportive, with limited growth due to telecom operators and intelligence agencies becoming more self-sufficient in managing interception systems. In contrast, the Solutions segment leads, providing the core capabilities needed to address security, compliance, and intelligence demands in digital communication.

Network Analysis

In 2024, the Mobile Networks segment held a dominant market position, capturing more than a 50% share of the global Lawful Interception (LI) market. This leading status can be attributed to the widespread proliferation of mobile communication technologies such as 4G, LTE, and the rapid global rollout of 5G networks.

The evolution from GSM to 5G has increased the need for advanced lawful interception solutions. With 5G’s higher speed, lower latency, and expanded connectivity, telecom operators must upgrade their systems to comply with security regulations. As 5G becomes mainstream, demand for interoperable LI systems that handle high-throughput data and encryption monitoring is expected to rise.

Mobile Networks offer greater mobility and reach, particularly in emerging economies where mobile-first communication dominates. While fixed networks remain relevant in certain areas, their usage is declining due to the shift to wireless technologies. Additionally, fixed broadband networks are easier to secure, resulting in less frequent need for interception upgrades compared to mobile networks.

IP Networks, driven by the growth of internet-based communication, are seeing rising demand for interception, particularly for encrypted data. However, Mobile Networks continue to lead in lawful interception due to their large user base, dynamic data usage, and rapid technological advancements, maintaining their position at the forefront of deployment worldwide.

Communication Content Analysis

In 2024, Voice Communication segment held a dominant market position, capturing more than a 32% share in the lawful interception (LI) market. This dominance can be attributed to the widespread use of mobile and fixed-line voice calling services across both personal and enterprise communication.

Law enforcement and national security agencies continue to prioritize real-time voice monitoring due to its high value in intelligence gathering. Unlike other digital communication forms, voice calls provide direct, unfiltered insights into conversations, which enhances their importance in surveillance operations.

The widespread use of GSM, LTE, and VoIP has made voice communication highly traceable and interceptable. Lawful interception capabilities integrated into telecom infrastructure allow seamless voice data interception with minimal latency. In regions with strong telecom regulations, service providers are required to offer interception-ready systems, driving demand for LI solutions tailored to voice services.

Voice communication is favored for interception due to advanced technologies like voice pattern recognition, speech-to-text, and metadata analytics, making surveillance more efficient. As organized crime, terrorism, and financial fraud often rely on verbal coordination, intercepting voice traffic has become a key defense tool for security agencies worldwide.

Type Of Interception Analysis

In 2024, Active Interception segment held a dominant market position, capturing more than a 45% share, driven by the growing demand for real-time monitoring capabilities in national security and counter-terrorism operations. Active interception allows authorized agencies to directly tap into communication networks without the need for cooperation from network operators.

The widespread shift toward encrypted digital communication platforms has made traditional passive methods less effective. As a result, governments and intelligence bodies are increasingly allocating budgetary support for active interception systems that can penetrate advanced encryption protocols with legal authorization.

Moreover, technological advancements in deep packet inspection, AI-driven traffic analysis, and network behavior analytics have significantly enhanced the efficiency of active interception tools. These innovations allow for precise targeting of suspect communication while minimizing collateral data collection, thus addressing legal compliance and data privacy concerns.

In contrast, passive and hybrid interception methods, while still relevant in specific scenarios, are often limited by their dependency on pre-existing access points or partial network visibility. Active interception’s ability to function independently of telecom carrier cooperation, coupled with its scalability and precision, has firmly positioned it as the leading interception type.

End-User Analysis

In 2024, Lawful Enforcement Agencies segment held a dominant market position, capturing more than a 64% share, primarily due to the rising global need for real-time surveillance tools to combat criminal activities, cyber threats, and terrorism.

The growing investments by governments into national security infrastructure have significantly strengthened the technological capabilities of enforcement agencies. Lawful interception platforms integrated with real-time analytics, facial recognition, and voice pattern detection are being increasingly adopted to enhance investigative accuracy.

Additionally, cross-border intelligence sharing and international counter-terrorism efforts have encouraged the integration of lawful interception systems at the enforcement level. Agencies involved in organized crime prevention, anti-drug operations, and cyber policing prefer direct access to communication surveillance tools that provide end-to-end visibility.

Key Market Segments

By Component

- Solution

- Mediation devices

- Interception access points

- Interception management software

- Services

- Professional Services

- Managed Services

By Network

- Fixed Networks

- PSTN (Public Switched Telephone Network)

- Broadband networks

- Mobile Networks

- GSM (Global System for Mobile Communications)

- GPRS (General Packet Radio Service)

- 3G, 4G, LTE, and 5G

- IP Networks

- VoIP (Voice over Internet Protocol)

- Data traffic monitoring

By Communication Content

- Voice Communication

- Video

- Text Messaging

- Faxcimile

- Digital Pictures

- File Transfer

By Type Of Interception

- Active Interception

- Passive Interception

- Hybrid Interception

By End-User

- Lawful Enforcement Agencies

- Government

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Escalating Cybersecurity Threats and National Security Concerns

The increasing frequency and sophistication of cyber threats have necessitated enhanced surveillance measures globally. Lawful Interception (LI) has emerged as a critical tool for governments and law enforcement agencies to monitor and counteract malicious activities.

The global expansion of 5G networks and the rise of IoT devices have increased the attack surface for cybercriminals, introducing new vulnerabilities. LI systems help monitor these complex networks, ensuring security measures evolve with technological advancements.

The integration of AI and ML further enhances LI solutions by enabling faster anomaly detection and threat identification. As a result, demand for advanced LI systems is expected to grow, driven by the need to protect national security and critical infrastructure.

Restraint

Privacy Concerns and Regulatory Challenges

While LI is crucial for national security, it raises privacy concerns, as the interception of communications can violate individuals’ rights to privacy and freedom of expression. This conflict has led to strict regulations, such as the GDPR in North America and Europe, which enforce transparency, accountability, and personal data protection, complicating the implementation of LI systems.

The need for judicial oversight and warrants adds complexity to LI systems, as service providers must navigate varying legal requirements across jurisdictions. Non-compliance can lead to fines and reputational damage, discouraging investment in LI infrastructure. Ethical concerns also fuel public debate, with civil liberties groups calling for stronger safeguards. This societal pushback can influence policies, potentially limiting the scope of LI operations.

Opportunity

Technological Advancements and Integration of AI

The evolution of communication technologies presents significant opportunities for the LI market. The transition to 5G networks, characterized by high-speed data transmission and low latency, necessitates advanced interception capabilities.

The integration of AI and ML into LI solutions offers transformative potential. These technologies can automate the analysis of intercepted data, enabling real-time threat detection and response. AI-driven LI systems can identify patterns and anomalies that may indicate security breaches, enhancing the efficiency and accuracy of surveillance operations.

Moreover, the rise of cloud computing and virtualization allows for scalable and flexible LI deployments. Cloud-based LI solutions can be rapidly implemented and updated, ensuring that surveillance capabilities evolve alongside technological advancements. This adaptability is crucial in addressing the dynamic nature of cyber threats.

Challenge

Cross-Border Data Jurisdiction and Legal Complexities

The global nature of digital communications introduces significant challenges related to data jurisdiction and legal compliance. Communications often traverse multiple countries, each with its own legal framework governing surveillance and data protection.

Disparities in legal standards for lawful interception can create conflicts between countries, with some permitting activities others prohibit, leading to legal ambiguities. Data localization laws, requiring data storage within national borders, further complicate LI efforts, restricting access for investigations. Clear protocols and agreements are needed to balance lawful interception with national sovereignty and individual rights.

Emerging Trends

Lawful Interception (LI) is evolving rapidly to address the complexities of modern communication. With the rise of encrypted messaging, 5G, and IoT, traditional interception methods are less effective. AI and ML now play a key role, enabling real-time analysis of vast data to detect anomalies and threats more efficiently than manual approaches.

Natural Language Processing (NLP) is also playing a significant role by converting audio communications into searchable text, facilitating quicker investigations . AI-driven systems can now analyze images and videos to detect patterns linked to illicit activities an essential capability as multimedia content becomes more common in communication.

The rise of private mobile networks, especially in sectors like manufacturing and logistics, presents new opportunities and challenges for LI. These networks need custom interception tools that avoid disrupting operations. Meanwhile, regulations are evolving to balance privacy rights with national security.

Business Benefits

Implementing Lawful Interception provides key benefits for telecom and related businesses. It ensures compliance with legal requirements, helping avoid fines and reputational risks. In regions like North America and Europe, it’s a mandatory part of operations.

Beyond compliance, LI systems boost operational efficiency by monitoring network traffic to identify and address issues like fraud, unauthorized access, and service abuse. This proactive approach enhances security, customer trust, and satisfaction. For instance, detecting VoIP fraud helps prevent revenue loss and preserves service integrity.

The data gathered through LI offers valuable insights into user behavior and network performance, helping inform strategic decisions like optimizing infrastructure or creating targeted marketing campaigns. In private 5G networks, LI supports the management of machine-to-machine communications, ensuring automated processes run securely and effectively.

Key Player Analysis

The Lawful Interception (LI) market plays a critical role in supporting governments and law enforcement agencies by providing secure, regulated access to communications data.

Utimaco GmbH, based in Germany, is known for its reliable and secure lawful interception and data retention solutions. Utimaco stands out for its focus on compliance and security, working closely with telecom operators and governments to meet legal requirements and ensure data protection. Its flexible architecture enables easy integration with various network environments, making it a preferred choice for service providers globally.

SS8 Networks, a U.S.-based company, is a key player in intelligence and surveillance. SS8 specializes in LI systems that capture, analyze, and reconstruct communications for deeper insights. Known for its real-time analytics, SS8 transforms raw data into actionable intelligence, enabling law enforcement to act swiftly in critical situations, making it a leader in the LI market.

Verint Systems Inc., also headquartered in the U.S., brings a strong background in security intelligence and analytics. It offers tools for voice and data monitoring, threat analysis, and case management—all in one platform. This integrated approach gives agencies a clearer view of potential threats and makes Verint a powerful player in the global LI space.

Top Key Players in the Market

- Utimaco GmbH

- SS8 Networks, Inc.

- Verint Systems Inc.

- Vocal Technologies Ltd.

- Aqsacom Inc.

- Trovicor GmbH

- Bae Systems plc

- Gamma Group

- Elbit Systems Ltd.

- IPS S.p.A.

- Cisco Systems, Inc.

- Incognito Software Systems Inc.

- Net Optics (Ixia)

- NetScout Systems, Inc.

- Siemens Aktiengesellschaft

- ZTE Corporation

- Others

Top Opportunities Awaiting for Players

- Expansion of 5G and Encrypted Communications: The proliferation of 5G networks and encrypted communication platforms has heightened the demand for sophisticated interception solutions. LI providers are now focusing on developing tools that can effectively monitor and analyze data across these advanced networks, ensuring compliance with security protocols.

- Integration of Artificial Intelligence and Cloud Technologies: Artificial intelligence (AI) and cloud computing are becoming integral to LI operations. AI enhances the ability to detect and respond to threats in real-time, while cloud platforms offer scalable and flexible solutions for data storage and analysis. This integration facilitates more efficient and effective surveillance capabilities.

- Regulatory Developments in Satellite Communications: Recent regulatory initiatives, particularly in satellite telecommunications, have underscored the importance of lawful interception. For instance, following security concerns, authorities have introduced new rules focusing on interception and data privacy for satellite services.

- Emphasis on Managed Services: Organizations are increasingly adopting managed LI services to navigate complex compliance requirements and technological challenges. These services offer expertise and resources that may not be available in-house, ensuring that interception activities align with legal and ethical standards.

- Focus on Emerging Markets: Emerging markets are witnessing a surge in digital communication, leading to a corresponding need for lawful interception mechanisms. The expansion of digital infrastructures in these regions presents opportunities for LI providers to offer customized solutions that address local security concerns and regulatory frameworks.

Recent Developments

- In November 2024, a high-level advisory group called on the Commission to implement concrete lawful interception measures by 2025, while also recommending increased investments in digital forensics, especially in areas related to encryption.

- In August 2024, India’s Department of Telecommunications introduced the Telecommunications (Procedures and Safeguards for Lawful Interception of Messages) Rules, 2024, under the Telecommunications Act of 2023. These new regulations aim to establish a structured, transparent, and accountable framework for intercepting communications, reinforcing legal safeguards while balancing national security and individual privacy.

Report Scope

Report Features Description Market Value (2024) USD 6.28 Bn Forecast Revenue (2034) USD 44.4 Bn CAGR (2025-2034) 21.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution (Mediation devices, Interception access points, Interception management software), Services (Professional Services, Managed Services)), By Network (Fixed Networks (PSTN (Public Switched Telephone Network), Broadband networks), Mobile Networks (GSM (Global System for Mobile Communications), GPRS (General Packet Radio Service), 3G, 4G, LTE, and 5G), IP Networks (VoIP (Voice over Internet Protocol), Data traffic monitoring)), By Communication Content (Voice Communication, Video, Text Messaging, Faxcimile, Digital Pictures, File Transfer), By Type Of Interception (Active Interception, Passive Interception, Hybrid Interception), By End-User (Lawful Enforcement Agencies, Government) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Utimaco GmbH, SS8 Networks, Inc., Verint Systems Inc., Vocal Technologies Ltd., Aqsacom Inc., Trovicor GmbH, Bae Systems plc, Gamma Group, Elbit Systems Ltd., IPS S.p.A., Cisco Systems, Inc., Incognito Software Systems Inc., Net Optics (Ixia), NetScout Systems, Inc., Siemens Aktiengesellschaft, ZTE Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lawful Interception (LI) MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Lawful Interception (LI) MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Utimaco GmbH

- SS8 Networks, Inc.

- Verint Systems Inc.

- Vocal Technologies Ltd.

- Aqsacom Inc.

- Trovicor GmbH

- Bae Systems plc

- Gamma Group

- Elbit Systems Ltd.

- IPS S.p.A.

- Cisco Systems, Inc.

- Incognito Software Systems Inc.

- Net Optics (Ixia)

- NetScout Systems, Inc.

- Siemens Aktiengesellschaft

- ZTE Corporation

- Others