Global Lactic Acid Market By Type (Glazed Ceramic Tile, Unglazed Ceramic Tile, and Porcelain Tile), By Application (Household Usage, and Commercial Usage), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 34505

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

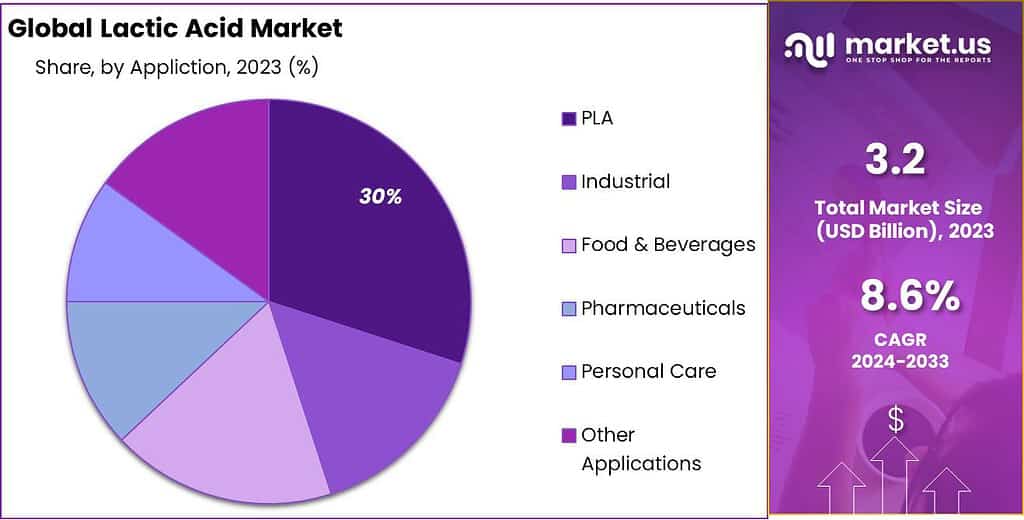

The global lactic acid market size is expected to be worth around USD 7.3 billion by 2033, from USD 3.2 billion in 2023, growing at a CAGR of 8.6% during the forecast period from 2023 to 2033.

This product will be used in many end-use industries including pharmaceuticals, food & beverages. The majority of these countries are emerging economies like India, China & Indonesia. PLA is a biodegradable plastic and a compostable thermoplastic. It is made from renewable resources such as lactic acids, which are produced by fermentation processes.

The majority of PLA is made using lactic acid. The chemical is Generally Recognized as Safe (GRAS) and is highly marketable in the food & beverage industry. It is being acknowledged as safe by the United States Food and Drug Administration.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The global lactic acid market is set to expand significantly, reaching an estimated value of USD 7.3 billion by 2033. This substantial growth from USD 3.2 billion in 2023 represents a CAGR of 8.6%.

- Diverse End-Use Industries: Lactic acid finds versatile applications across various industries, prominently in pharmaceuticals and food & beverages. Its use in these sectors is driven by its biodegradable nature and safety approvals, particularly in emerging economies like India, China, and Indonesia.

- Raw Material Dynamics: Corn emerges as a primary raw material for lactic acid production, experiencing a projected CAGR of 38.6%. Factors driving this choice include low cost, sustainability, and a shift towards environmentally friendly processing techniques.

- Applications and Market Dominance: Polylactic acid (PLA), a derivative of lactic acid, dominates the market with a significant revenue share of 30% in 2023. Its usage spans multiple sectors, including automotive (due to lightweight materials), food & beverages (for flavor enhancement and preservation), and pharmaceuticals (utilized in drug production and intravenous solutions).

- Environmental Drive and Regulatory Push: The market’s growth is bolstered by the rise in demand for eco-friendly resources. Regulations banning single-use plastics in various regions, combined with consumer awareness, propel the adoption of lactic acid and PLA in packaging, textiles, medical, and personal care industries.

- Challenges and Investment Barriers: High initial investment acts as a notable hurdle, especially for small and medium enterprises (SMEs). This financial barrier limits their entry into the market and stifles innovation, consolidating market dominance among larger corporations.

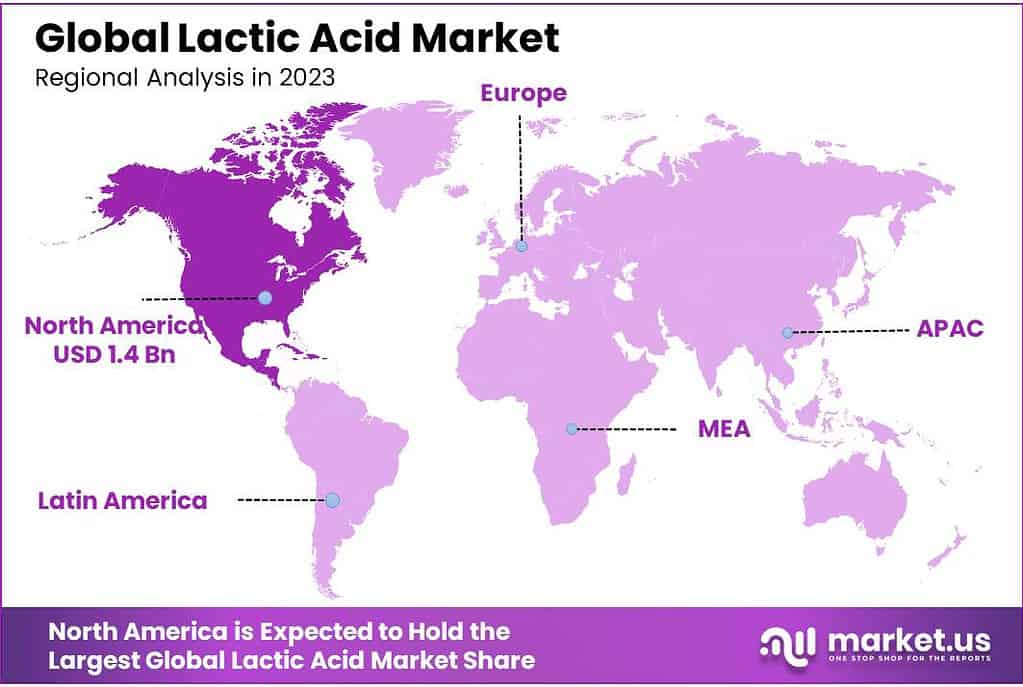

- Regional Influence: North America currently dominates the lactic acid market, accounting for 42% of the revenue share in 2021. Factors contributing to this dominance include an expanding pharmaceutical industry and the presence of major companies driving demand for personal care products.

- Key Market Players: Several major players shape the market landscape, including BASF SE, Galactic, Dow, NatureWorks LLC, and others. Mergers, acquisitions, and collaborations among these entities contribute to the market’s evolution and expansion.

Raw Material Analysis

Over the forecast period, the corn segment will see a 38.6.9% CAGR. Because of its low cost and sustainability, it has become a popular raw material. Over the forecast period, rising environmental concerns, sustainable processing techniques, and limited supplies of petroleum feedstock will increase the demand for corn-based lac acid products.

One of the most common ingredients used in the production of lactic acid is yeast extract. The high production costs associated with this process led to Corn Steep Liquor (CSL), which is a corn-based by-product of corn steeping.

In the next few years, the market for corn-based lactose will grow as it is used in the food & beverage industry as a pH regulator, microbial activator enhancer, and acidulant. Starchy and cellulosic raw materials are also used the produce lactic acid. These include potato, sweet sorghum as well as wheat, rye barley, and rice.

By Applications Analysis

The market for polylactic acid was dominated by the end-user segment and represented the largest revenue share at 30% in 2023. Its durability, mechanical strength, transparency, and cost-effectiveness are all reasons for this. This end-user segment is driven by the increasing demand for bio-degradable materials, the steady growth of the automotive sector, and the growing demand from end-use industries.

Many components used in vehicle interiors, such as trim and under-the-hood components, are made from lightweight materials. These lightweight components improve vehicle performance and reduce vehicle weight. PLA will see a significant increase in demand for bioplastic materials that can be recycled to improve fuel efficiency and durability.

Food and beverages were the second most popular application sector in 2021. The ability of lactic acid to control the growth of pathogenic microorganisms and enhance the flavor of foods and beverages can make them more shelf-worthy. This product’s unique properties will lead to a rise in demand. PLA is made from lactic acid, which is a key feedstock. It can also be used to make biodegradable plastic. These biodegradable plastics can be used in many industries such as chemical and packaging. Natural solvent lactic acid can be used in both mechanical and metal cleaning applications.

This market has seen significant growth in the pharmaceutical industry over the last few years due to the increased use of lactic acid in drug production and intravenous solutions that supplement the body’s required fluids. The growth of the pharmaceutical sector is expected to be boosted by lactic acid’s properties, such as pH regulator, metal sequestration, effectiveness as a natural body component, and chiral intermediate. This is due to the increasing use of skin care products in personal care applications.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Raw Material

- Corn

- Cassava

- Sugarcane

- Other Raw Materials

By Applications

- Industrial

- Pharmaceuticals

- Food And Beverages

- Personal Care

- Other Applications

Drivers

Rise in demand for alternative environment-friendly resources

The lactic acid and polylactic acid (PLA) market is experiencing significant growth, driven by the escalating demand for eco-friendly resources. As environmental concerns mount and sustainable practices gain traction, bio-based and biodegradable materials like lactic acid and PLA are becoming favored alternatives to traditional petrochemical-based products. Their renewable sourcing and biodegradability make them increasingly appealing across various industries, including packaging, textiles, medical, and personal care.

The surge in eco-consciousness among consumers and regulatory initiatives propelling eco-friendly packaging solutions are notably propelling market expansion. Lactic acid and PLA boast versatile properties like biocompatibility, thermal stability, and moldability, making them well-suited for diverse applications. Continuous advancements in production processes and technological innovations further amplify the market potential of these materials.

Several major cities in China have prohibited single-use plastic bags, cutlery, and straws since 2021, while Portugal took steps in 2020 to ban single-use plastics in catering services and implemented a restriction on free plastic bags in commercial establishments. These regulatory actions, coupled with growing environmental awareness and the surge in demand for eco-friendly packaging, are driving the lactic acid and PLA market’s upward trajectory.

Restraints

Concerns over the quality of lactic acid used in food & beverage products

Lactic acid and PLA possess exceptional qualities such as biodegradability, biocompatibility, and thermal stability, rendering them versatile for a multitude of applications. Within the packaging sector, they serve as eco-conscious substitutes for traditional plastics, offering both barrier properties and extending product shelf life.

Their utility extends into the medical realm, where they’re utilized in drug delivery systems, tissue engineering, and the creation of biodegradable implants. In the textile industry, these materials contribute to the production of environmentally friendly fabrics and fibers.

Moreover, lactic acid and PLA play crucial roles in the manufacturing of personal care items, cleaning solutions, and materials used in 3D printing. Their adaptability and wide array of functionalities make them appealing choices for industries seeking sustainable and inventive solutions.

Opportunity

Multi-functionalities of lactic and polylactic acids

Lactic acid and PLA boast exceptional biodegradability, biocompatibility, and thermal stability, making them versatile for a wide range of applications. Within the packaging sector, these materials act as sustainable substitutes for conventional plastics, delivering both barrier capabilities and prolonging the shelf life of products.

In the medical domain, lactic acid and PLA are pivotal in drug delivery systems, tissue engineering, and the creation of biodegradable implants. They also contribute significantly to eco-friendly fabrics and fibers in the textile industry. Additionally, they play integral roles in the formulation of personal care items, cleaning agents, and materials utilized in 3D printing.

Challenges

High investment costs involved for small and medium enterprises

The growth of the lactic acid and polylactic acid market faces a notable hurdle due to the substantial initial investment required, particularly for small and medium enterprises (SMEs).

Lactic acid holds immense promise and versatility across industries like food and beverages, pharmaceuticals, and bioplastics. However, entering the lactic acid production arena demands significant capital for infrastructure, equipment, and research and development efforts.

SMEs, often operating within constrained financial boundaries, find it challenging to allocate funds for these upfront expenses. Consequently, many SMEs encounter barriers to entering the lactic acid and polylactic acid market and struggle to compete with larger, more financially robust entities. This concentration of market dominance among a handful of major corporations stifles innovation, impedes market growth, and limits overall industry development.

Regional Analysis

North America was the dominant market for lactic acids and had the highest revenue share, of 42% in 2021. This can be attributed to the expanding personal care, pharmaceutical, food, and beverage industries. Market growth is expected to be positive due to the expansion of the U.S. pharmaceutical industry as a result of increased expenditures on medicine. The North American market for Lactic Acid is expected to grow due to the presence of several personal care and cosmetic companies such as Procter and Gamble and Colgate-Palmolive Company.

The strong manufacturing base of global cosmetic companies, including Johnson and Johnson Private Limited and Procter and Gamble in the U.S., is expected to increase the demand for personal care products. The U.S. government’s efforts to reduce carbon footprint and high demand for packaging applications will drive market growth for PLA over the forecast period.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Mergers and acquisitions are a common strategy for companies to increase their manufacturing capacity, diversify their product lines, and provide a more competitive product range. According to the November 2020 article, Sulzer Chemtech helped partnered with B&F PLA to develop China’s first fully integrated sugar-to-polylactic acid (Bengbu) plant. Sulzer’s technology for polymerization, distillation, and crystallization is used to produce 35,000 tons annually.

Market Key Players

- BASF SE

- Galactic

- Dow

- Jungbunzlauer Suisse AG

- NatureWorks LLC

- Musashino Chemical (China) Co., Ltd.

- Futerro

- Corbion

- Henan Jindan Lactic Acid Technology Co. Ltd.

- thyssenkrupp AG

- Cellulac

- Vaishnavi Bio Tech

- TEIJIN LIMITED

- Danimer Scientific

Recent Development

In November 2022, NatureWorks signed a collaboration agreement with CJ Biomaterials, a division of South Korea-based CJ CheilJedang and leading producer of polyhydroxyalkanoate (PHA). The aim of collaboration is the development of sustainable material solutions based on CJ Biomaterials’ PHACT Biodegradable Polymers an NatureWorks’ Ingeo biopolymers. Both companies will develop high-performanc biopolymer solutions alternative to fossil-fuel-based plastics in applications ranging fro compostable food packaging and food serviceware to personal care, films, and other end products.

Report Scope

Report Features Description Market Value (2022) USD 3.2 Bn Forecast Revenue (2032) USD 7.3 Bn CAGR (2023-2032) 8.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Type (Glazed Ceramic Tile, Unglazed Ceramic Tile, and Porcelain Tile), By Application (Household Usage, and Commercial Usage) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape BASF SE, Galactic, Dow, Jungbunzlauer Suisse AG, NatureWorks LLC, Musashino Chemical (China) Co., Ltd., Futerro, Corbion, Henan Jindan Lactic Acid Technology Co. Ltd., ThyssenKrupp AG, Cellular, Vaishnavi Bio-Tech, TEIJIN LIMITED, Danimer Scientific Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

What is Lactic Acid?Lactic acid is an organic compound that occurs naturally in many foods, particularly in fermented products like yogurt and pickled vegetables. It's also produced in the muscles during intense exercise.

How is Lactic Acid Used?Lactic acid finds applications across various industries. In the food and beverage industry, it's utilized as an acidity regulator, flavoring agent, and preservative. It's also used in pharmaceuticals, cosmetics, and as a raw material in the production of biodegradable plastics.

What Are the Benefits of Lactic Acid?Lactic acid boasts several benefits. It's biodegradable, making it environmentally friendly. Additionally, it's versatile and can serve multiple purposes in different industries. Its natural occurrence in the body also makes it safer for various applications.

-

-

-

- BASF SE

- Galactic

- Dow

- Jungbunzlauer Suisse AG

- NatureWorks LLC

- Musashino Chemical (China) Co., Ltd.

- Futerro

- Corbion

- Henan Jindan Lactic Acid Technology Co. Ltd.

- thyssenkrupp AG

- Cellulac

- Vaishnavi Bio Tech

- TEIJIN LIMITED

- Danimer Scientific

-