Laboratory Proficiency Testing Market By Type (Clinical Diagnostics (Oncology, Molecular Diagnostics, Immunochemistry, Hematology, Coagulation, Clinical Chemistry, and Others), Pharmaceuticals (Biological Products, Blood, Vaccines, Tissues, and Others), Microbiology (Sterility Testing, Pathogen Testing, Growth Promotion Testing, Endotoxin & Pyrogen Testing, and Others), Cannabis (Medical and Non-Medical)), By Application (Cell Culture, Spectrometry, Polymerase Chain Reaction, Chromatography, and Others), By End-User (Hospitals, Pharmaceutical & Biotechnology Companies, Independent & Specialty Laboratories, Contract Research Organizations, and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156375

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

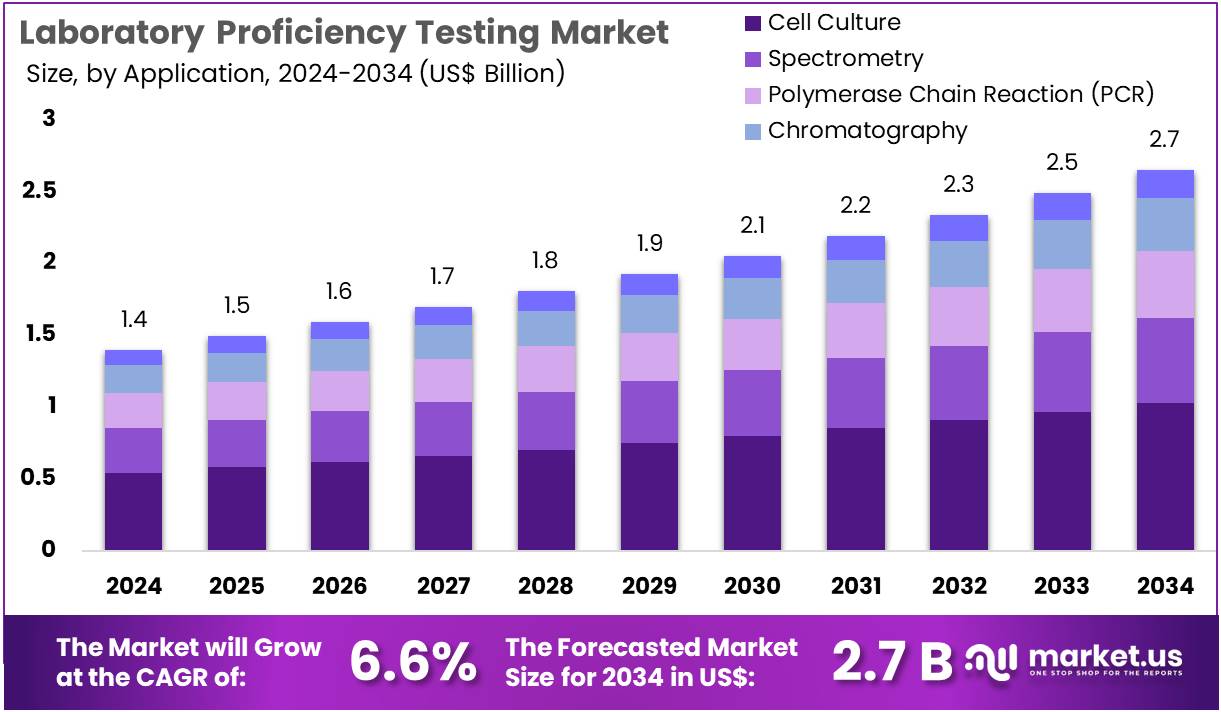

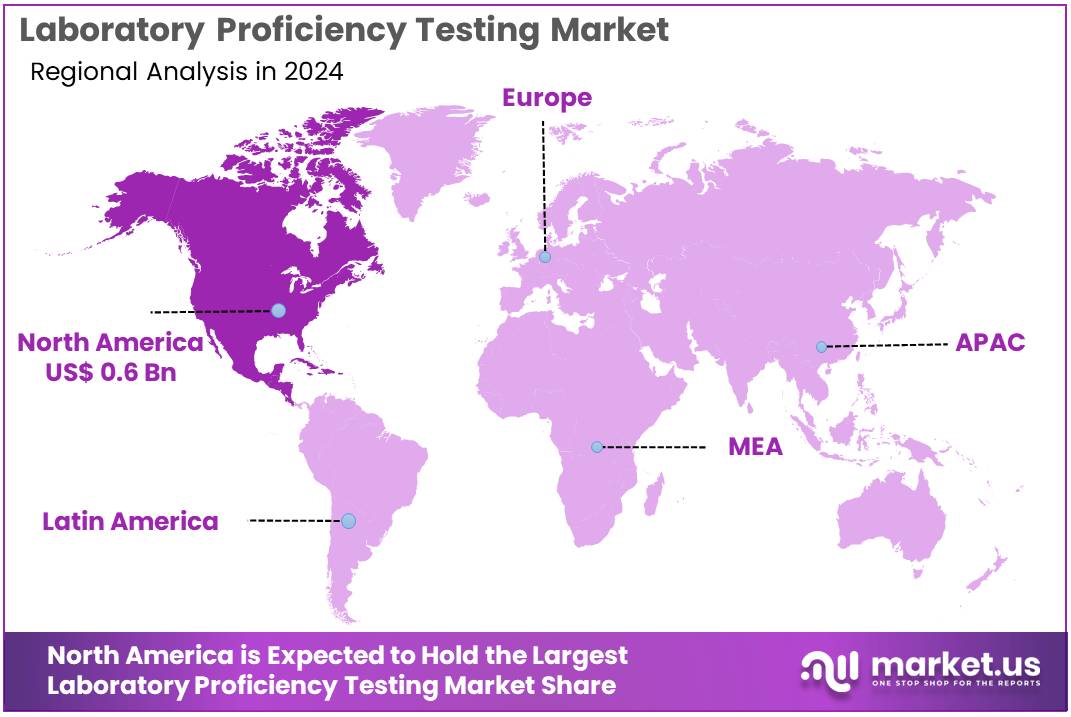

The Laboratory Proficiency Testing Market Size is expected to be worth around US$ 2.7 billion by 2034 from US$ 1.4 billion in 2024, growing at a CAGR of 6.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.9% share and holds US$ 0.6 Billion market value for the year.

The laboratory proficiency testing market is expanding due to the increasing demand for strict quality assurance across multiple industries. Water testing remains a major growth driver, as laboratories must accurately detect microbial contaminants and micropollutants in drinking water and wastewater.

Proficiency testing ensures laboratories can reliably identify pathogens such as Legionella, E. coli, enterococci, and Staphylococcus species. By distributing blind samples, these programs provide an objective measure of laboratory performance, which is essential for public health. According to the World Health Organization, around 2 billion people globally rely on drinking water that is contaminated with fecal matter, emphasizing the critical need for precise water quality testing.

Beyond environmental applications, proficiency testing plays a vital role in the pharmaceutical and medical device sectors. Laboratories are required to accurately measure endotoxins and pyrogens in water and products, as these can pose severe health risks if uncontrolled.

High-precision methods such as the Limulus Amebocyte Lysate (LAL) assay are used to validate results, ensuring compliance with strict regulatory standards. Agencies like the US FDA provide detailed guidance for pyrogen and endotoxin testing in sterile products, while organizations such as the National Institute of Standards and Technology (NIST) support laboratories with uniform measurement standards and technical assistance, reinforcing the importance of these programs.

The market is also witnessing growth in emerging sectors, including medical cannabis testing. As legalization expands globally, laboratories are increasingly required to demonstrate competence in pesticide analysis, heavy metal detection, and cannabinoid potency testing. This ensures both regulatory compliance and consumer safety. Rising incidences of foodborne and waterborne illnesses, including Legionella outbreaks tracked by the CDC, further highlight the public health necessity for proficiency testing, which helps laboratories maintain accuracy and respond effectively to potential threats.

Key Takeaways

- In 2024, the market for laboratory proficiency testing generated a revenue of US$ 1.4 billion, with a CAGR of 6.6%, and is expected to reach US$ 2.7 billion by the year 2034.

- The type segment is divided into clinical diagnostics, pharmaceuticals, microbiology, and cannabis, with clinical diagnostics taking the lead in 2023 with a market share of 47.6%.

- Considering application, the market is divided into cell culture, spectrometry, polymerase chain reaction, chromatography, and others. Among these, cell culture held a significant share of 38.9%.

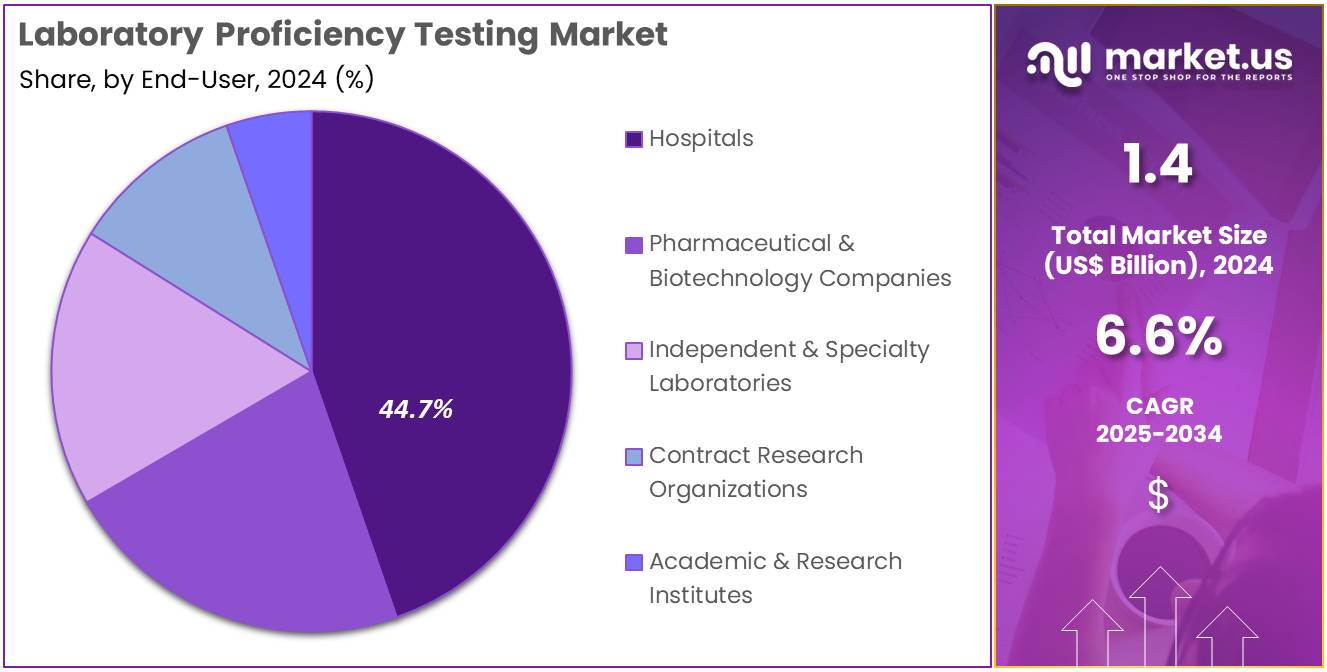

- Concerning the end-user segment, the hospitals sector stands out as the dominant player, holding the largest revenue share of 44.7% in the laboratory proficiency testing market.

- North America led the market by securing a market share of 43.9% in 2023.

Type Analysis

Clinical diagnostics represents 47.6% of the type segment in the laboratory proficiency testing market. This growth is projected to continue due to the increasing demand for accurate laboratory testing and quality assurance in patient care. As hospitals and diagnostic centers expand their testing capabilities, clinical diagnostics proficiency testing is expected to be adopted widely to ensure standardized results and minimize errors. Regulatory bodies and accreditation agencies, such as the College of American Pathologists (CAP) and Clinical Laboratory Improvement Amendments (CLIA), emphasize the importance of regular proficiency testing, which is likely to drive market growth.

Additionally, advancements in diagnostic technologies, including high-throughput screening and molecular diagnostics, are expected to increase the reliance on proficiency testing to validate accuracy. Rising awareness among healthcare providers about patient safety and reliable laboratory outcomes further supports growth. With the global prevalence of chronic and infectious diseases, clinical diagnostics is projected to remain a central segment in the market, with continuous investment in quality assurance and testing protocols.

Application Analysis

Cell culture accounts for 38.9% of the application segment in the laboratory proficiency testing market. Its growth is expected to remain strong due to the increasing adoption of cell-based research in drug discovery, vaccine development, and personalized medicine. Proficiency testing in cell culture is essential to maintain reproducibility and reliability of experiments across laboratories. The rise in biologics production and stem cell research is projected to drive demand for standardized cell culture protocols and testing methods.

Laboratories are anticipated to invest in proficiency testing programs to validate the performance of cell culture reagents, media, and techniques. Regulatory authorities are increasingly encouraging standardized procedures for cell-based experiments, which is likely to boost adoption. Additionally, collaborations between research institutions and pharmaceutical companies are expected to expand the scope of proficiency testing in cell culture applications. Growing awareness about contamination risks and experimental variability reinforces the need for rigorous proficiency testing programs, further supporting segment growth.

End-User Analysis

Hospitals represent 44.7% of the end-user segment in the laboratory proficiency testing market. This segment is projected to grow rapidly as hospitals increasingly integrate advanced laboratory services into their patient care frameworks. Proficiency testing ensures that diagnostic results are accurate, reliable, and comparable across multiple hospital laboratories, supporting effective clinical decision-making. Rising patient volumes and the complexity of modern diagnostics, including molecular and genomic testing, are likely to drive the adoption of proficiency testing programs.

Hospitals are expected to invest in training staff and implementing standardized protocols to comply with regulatory requirements and accreditation standards. The increasing focus on patient safety, quality management, and laboratory efficiency further enhances the growth prospects for hospitals in this market. Additionally, the expansion of hospital networks and multi-center laboratories globally is projected to contribute significantly to the adoption of proficiency testing solutions.

Key Market Segments

By Type

- Clinical Diagnostics

- Oncology

- Molecular Diagnostics

- Immunochemistry

- Hematology

- Coagulation

- Clinical chemistry

- Others

- Pharmaceuticals

- Biological Products

- Blood

- Vaccines

- Tissues

- Others

- Biological Products

- Microbiology

- Sterility testing

- Pathogen testing

- Growth promotion testing

- Endotoxin & pyrogen testing

- Others

- Cannabis

- Medical

- Non-Medical

By Application

- Cell Culture

- Spectrometry

- Polymerase Chain Reaction

- Chromatography

- Others

By End-user

- Hospitals

- Pharmaceutical & Biotechnology Companies

- Independent & Specialty Laboratories

- Contract Research Organizations

- Academic & Research Institutes

Drivers

The increasing global incidence of foodborne illnesses is driving the market

The rising global prevalence of foodborne illnesses is the key driver of the laboratory proficiency testing market, creating a substantial need for enhanced laboratory testing and validation. The serious nature of these outbreaks has led to increased regulatory scrutiny and highlighted the need for improved food testing and rapid recall capabilities.

According to the World Health Organization (WHO), foodborne illnesses affect around 600 million people annually, causing approximately 420,000 deaths. Children under five are a particularly vulnerable group, accounting for 40% of this burden and around 125,000 deaths each year. These diseases are caused by various contaminants, including bacteria such as Vibrio cholerae, E. coli, Listeria, and Salmonella.

In 2024, the US experienced a notable increase in outbreaks, including a Salmonella outbreak from eggs that infected 93 people across 12 states and a Listeria outbreak from frozen shakes that led to at least 12 deaths across 21 states. These critical incidents directly underscore the need for laboratories to validate their testing methods and ensure accuracy, thereby fueling the demand for proficiency testing programs.

Restraints

The high cost of participation and compliance is restraining the market

A significant restraint on the market is the high cost of participation in proficiency testing programs, coupled with the complexity and financial burden of maintaining compliance with strict regulatory standards. Laboratories, particularly smaller and independent facilities, face substantial annual fees for enrollment in multiple testing panels to meet accreditation requirements from various bodies. These costs include not only the subscription fees but also the expense of handling and processing the test samples and reporting the results.

A 2023 review of challenges in clinical laboratory management highlighted that proficiency testing fees, while essential for quality assurance, can represent a significant portion of a laboratory’s annual operational budget, with the price of advanced test panels being a particularly acute concern. Furthermore, a failure to meet performance metrics can result in costly re-testing and, in some cases, the loss of accreditation, which can severely impact a laboratory’s ability to operate and generate revenue.

The administrative burden of managing multiple testing schedules and ensuring all personnel are up-to-date on training adds another layer of complexity. These financial and procedural hurdles create a significant barrier for smaller labs, thereby limiting market penetration in certain segments.

Opportunities

Remote and digital platforms for proficiency testing are creating growth opportunities

The current market presents compelling opportunities, propelled by the increasing global adoption of remote and digital proficiency testing platforms. This technological shift is a strategic imperative, enabling geographically dispersed laboratories to participate in international quality assurance programs without the logistical burdens of physical sample shipments.

Market intelligence indicates a significant acceleration in this trend, with a 45% increase in digital proficiency testing participation reported by the College of American Pathologists (CAP) from 2021 to 2023. This momentum is further underscored by the World Health Organization’s (WHO) data, which confirms that over 2,500 laboratories across 120 countries were utilizing these digital solutions in 2023, representing a 60% expansion since 2021. This trajectory demonstrates the scalability and widespread acceptance of these digital ecosystems, which not only enhance efficiency and reduce operational costs but also foster a more collaborative and agile global quality management framework.

Impact of Macroeconomic / Geopolitical Factors

The life sciences sector is facing significant challenges due to a mix of macroeconomic and geopolitical factors. Rising interest rates, a critical monetary policy tool used to address inflation, have placed pressure on capital expenditures and deal-making activities. A mid-2025 analysis of the US pharmaceutical and life sciences market indicated that elevated interest rates and increased market volatility have particularly affected early-stage companies, making initial public offerings (IPOs) more challenging.

In addition to financial pressures, geopolitical events have introduced further risks, particularly in supply chains. Disruptions to major global shipping routes, such as those in the Red Sea, led to a 350% surge in shipping costs from Asia to Europe in early 2024. This increase in logistics costs has had a direct impact on the prices and delivery times of critical raw materials like plastics and specialized chemicals.

Despite these hurdles, the sector’s long-term outlook remains positive, driven by continued scientific advancements and a strong pipeline of new drug approvals, which continue to attract investment. This resilience is bolstered by companies that are strategically adapting, diversifying their supply chains, and managing complex cross-border issues.

US tariff policies are reshaping global supply chains within the life sciences sector, bringing both challenges and opportunities. Trade duties on imported goods, including laboratory equipment and diagnostic kits, have increased costs for end-users such as research institutions and healthcare providers. Data from the US Census Bureau in 2024 revealed a significant rise in the US trade deficit for capital goods, which includes laboratory instruments, highlighting the complexities of importing these essential products.

A 2024 bio-pharma supply chain report noted that these tariffs have prompted companies to reassess their sourcing strategies. However, these tariffs are also accelerating a shift towards domestic manufacturing. A June 2025 report on biomanufacturing investment revealed that major pharmaceutical companies have committed to over US$270 billion in US-based manufacturing and research projects in the next five years. This substantial investment is driving a resurgence of domestic production and enhancing the security and localization of the supply chain for critical life sciences products, including reagents and specialized laboratory equipment.

Latest Trends

The increasing demand for molecular and genetic proficiency testing is a recent trend

A significant trend observed in 2024 is the increasing demand for proficiency testing programs specifically for molecular and genetic assays, which are at the forefront of personalized medicine and infectious disease diagnostics. The rapid adoption of technologies like next-generation sequencing (NGS) and real-time polymerase chain reaction (PCR) in clinical and research settings has created a new level of complexity and a corresponding need for specialized quality control.

The global molecular diagnostics market was valued at US$25.75 billion in 2024, a clear indicator of the scale of this shift. Traditional proficiency testing panels are often insufficient for these intricate assays, which require validation of everything from DNA extraction to data analysis. This trend is being driven by regulatory bodies that now require external validation for these high-complexity tests.

For instance, new guidelines by the Korean Society for Laboratory Medicine in 2024 have been updated to reflect the need for proficiency testing for pharmacogenetic testing, including NGS methods. This focus on molecular and genetic proficiency testing ensures the accuracy of advanced diagnostics and supports the market’s continued expansion.

Regional Analysis

North America is leading the Laboratory Proficiency Testing Market

The North American laboratory proficiency testing market holds a dominant position, commanding a 43.9% share of the global market in 2024. The region’s dominance stems from a well-established pharmaceutical and diagnostics industry, a stringent regulatory framework, and a high rate of adoption of laboratory competence evaluation.

The presence of leading market players and a sophisticated healthcare infrastructure are key drivers. The US market, in particular, is driven by a vast network of accredited laboratories that must comply with strict proficiency testing requirements to maintain their certifications. The Centers for Medicare & Medicaid Services (CMS) reported that as of September 2023, there were over 320,000 CLIA-certified laboratories in the US, a number that underscores the massive scale of the market.

The Clinical Laboratory Improvement Amendments (CLIA) guidelines are a key regulatory force in the US market, mandating certification for laboratories based on the complexity of their testing. The CDC’s Division of Laboratory Systems plays a vital role in ensuring compliance and improving the quality of laboratory testing.

According to their 2023 annual report, the DLS works with over 33,000 clinical laboratories that are subject to participation in proficiency testing, a critical component of their quality management systems. This intense focus on quality assurance, combined with a high volume of testing—with hospital-based laboratories, which constitute only 5% of the total, accounting for approximately 55% of all tests performed—creates a significant and consistent demand for proficiency testing services.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific laboratory proficiency testing market is experiencing significant growth, driven by the expansion of the pharmaceutical and biopharmaceutical industries, increased funding, and improved laboratory infrastructure. The region is attracting major investments from global pharmaceutical companies, which, in turn, fuels the demand for standardized testing to ensure regulatory compliance and quality control.

For instance, in 2024, China’s total expenditure on healthcare reached 2,547.00 RMB per capita, reflecting a strong commitment to enhancing its medical and diagnostic infrastructure. This investment supports the establishment of new laboratories and the modernization of existing ones, all of which require proficiency testing.

The market’s expansion is also a result of the rising prevalence of chronic diseases and the rapid growth of the biopharmaceutical sector. China is experiencing a surge in the prevalence of chronic diseases such as Alzheimer’s and cancer, which increases the demand for advanced, high-precision diagnostic laboratories. The need for accredited and reliable laboratories is growing as healthcare providers strive for accurate disease management and early detection.

Japan is also a key region, driven by a rapidly aging population and a corresponding increase in healthcare demands. This demographic shift heightens the need for accurate and high-quality diagnostic services, boosting the demand for proficiency testing and accreditation programs across a range of sectors, including clinical diagnostics, pharmaceuticals, and food safety.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the laboratory proficiency testing market are driving expansion through a combined strategy of technological innovation and industry consolidation. These companies are actively developing highly automated assessment platforms that leverage artificial intelligence and machine learning, which enhances data analysis and streamlines evaluation processes for laboratories. They are also aggressively pursuing acquisitions of smaller providers to integrate niche testing capabilities and expand their client base. Furthermore, manufacturers are capitalizing on the global demand for quality assurance by offering programs that help laboratories in emerging markets secure and maintain key accreditations such as ISO/IEC 17025 and CLIA. This multi-faceted approach solidifies their market leadership.

LGC, a global leader in life sciences tools, is a company based in the UK with a substantial international footprint. It serves the UK government with advisory and analytical services, and its operations extend across more than 14 countries. LGC’s diverse portfolio of products and services is vital to industries dedicated to protecting food, water, medicine, and the environment. The company has strategically grown its proficiency testing division through targeted acquisitions and its AXIO portfolio, which now provides independent performance evaluation for laboratories in various sectors worldwide.

Top Key Players in the Laboratory Proficiency Testing Market

- Weqas

- Randox Laboratories Ltd

- QACS – The Challenge Test Laboratory

- NSI Lab Solutions

- Merck KGaA

- LGC Limited

- INSTAND

- BIPEA

- Bio-Rad Laboratories, Inc

- Absolute Standards, Inc

Recent Developments

- In February 2025: Cormay Diagnostics joined forces with the Randox International Quality Assessment Scheme (RIQAS) to deliver top-tier External Quality Assessment (EQA) services. This collaboration allows Cormay’s in vitro diagnostic (IVD) solutions to be assessed within one of the largest EQA frameworks globally, connecting over 70,000 laboratories and ensuring consistent accuracy and reliability across international testing networks.

- In November 2024: The College of American Pathologists (CAP) introduced a new Proficiency Testing (PT) report tailored for IVD manufacturers. The report aims to provide deeper insights into laboratory performance, helping companies refine their diagnostic products and enhance overall testing precision, thereby strengthening the quality of clinical diagnostics.

- In June 2024: BIPEA rolled out its experimental PT 56A program, which focuses on microbiological testing of flour samples with controlled contamination. The program is designed to advance laboratory capabilities in detecting microbial contaminants, ultimately supporting improved food safety protocols and quality control practices within the food production industry.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 billion Forecast Revenue (2034) US$ 2.7 billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Clinical Diagnostics (Oncology, Molecular Diagnostics, Immunochemistry, Hematology, Coagulation, Clinical Chemistry, and Others), Pharmaceuticals (Biological Products, Blood, Vaccines, Tissues, and Others), Microbiology (Sterility Testing, Pathogen Testing, Growth Promotion Testing, Endotoxin & Pyrogen Testing, and Others), Cannabis (Medical and Non-Medical)) By Application (Cell Culture, Spectrometry, Polymerase Chain Reaction, Chromatography, and Others) By End-User (Hospitals, Pharmaceutical & Biotechnology Companies, Independent & Specialty Laboratories, Contract Research Organizations, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Weqas, Randox Laboratories Ltd, QACS – The Challenge Test Laboratory, NSI Lab Solutions, Merck KGaA, LGC Limited, INSTAND, BIPEA, Bio-Rad Laboratories, Inc, Absolute Standards, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Laboratory Proficiency Testing MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Laboratory Proficiency Testing MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Weqas

- Randox Laboratories Ltd

- QACS - The Challenge Test Laboratory

- NSI Lab Solutions

- Merck KGaA

- LGC Limited

- INSTAND

- BIPEA

- Bio-Rad Laboratories, Inc

- Absolute Standards, Inc