Global Laboratory Information Management System Market By Component (Software, Services), By Product (On-Premise, Cloud-Based, Web-Hosted), End-Use Industry (Life Sciences, Food & Beverage, Chemical, Oil & Gas, Environmental Testing, Agriculture, Other End-Use Industries), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 32885

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

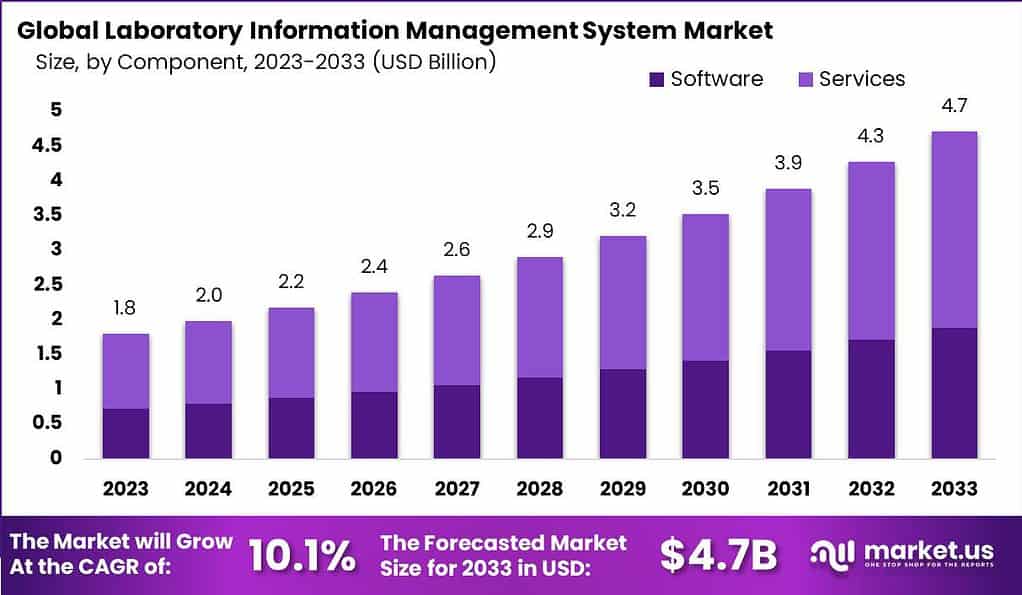

The Global Laboratory Information Management System Market is anticipated to be USD 4.7 billion by 2033. It is estimated to record a steady CAGR of 10.1% in the Forecast period 2024 to 2033. It is likely to total USD 2.0 billion in 2023.

A Laboratory Information Management System (LIMS) is a software solution designed to streamline and manage laboratory workflows, data, and processes. LIMS enables laboratories to efficiently track and manage samples, automate workflows, record test results, and generate reports.

It serves as a central database to store, organize, and retrieve laboratory data, including sample information, test methods, quality control measures, and analytical results. LIMS enhances laboratory efficiency, data integrity, regulatory compliance, and collaboration among laboratory personnel. It finds applications in various industries, including healthcare, pharmaceuticals, environmental sciences, food and beverage, and research.

Note: Actual Numbers Might Vary In The Final Report

The Laboratory Information Management System Market comprises the industry that provides LIMS software solutions and services to laboratories across different sectors. The market has witnessed significant growth due to the increasing demand for efficient data management, automation, and compliance with regulatory standards in laboratories. The market offers a wide range of LIMS solutions, including on-premises, cloud-based, and hybrid deployments, catering to the diverse needs of laboratories of all sizes.

Key Takeaways

- Market Size and Growth: The Laboratory Information Management System (LIMS) Market is expected to reach USD 4.7 billion by 2033, growing at a steady CAGR of 10.1%. This significant growth is driven by the increasing demand for efficient data management and compliance with regulatory standards in laboratories.

- Definition of LIMS: LIMS is a software solution designed to streamline and manage laboratory workflows, data, and processes. It serves as a central database to store, organize, and retrieve laboratory data, enhancing efficiency, data integrity, and collaboration among laboratory personnel.

- Component Analysis: In 2023, the Services segment held the majority share (59.8%) of the LIMS market. Services such as training, implementation, and consulting are crucial for effective LIMS deployment. The Software component, although smaller in share, is also significant and expected to see steady growth.

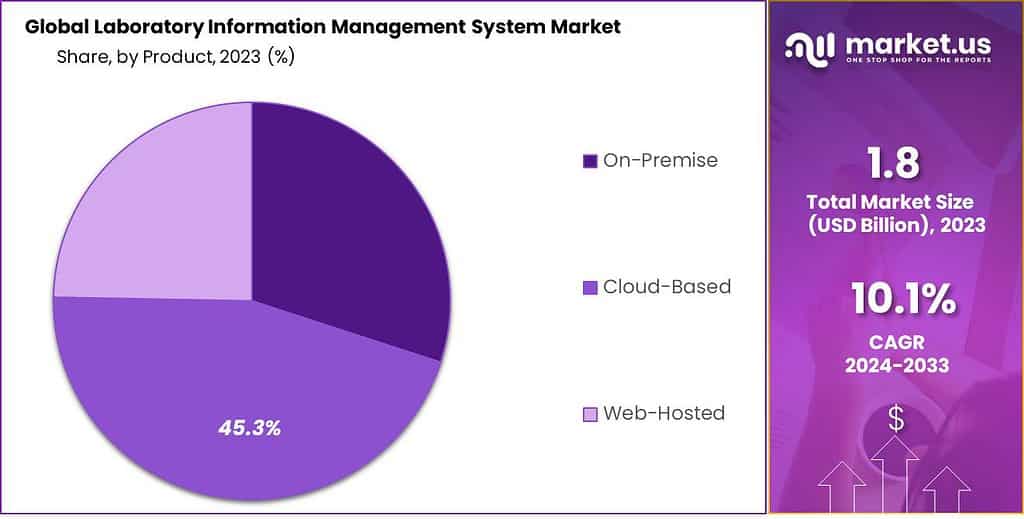

- Product Analysis: Cloud-Based LIMS solutions dominated the market in 2023, capturing 45.3% of the share due to their flexibility and cost-effectiveness. On-Premise solutions remain vital for data control and security, while Web-Hosted solutions offer a middle ground between the two.

- End-Use Industries: Life Sciences held the dominant market position (43.1%) in 2023, driven by the need for efficient data management and compliance in pharmaceuticals, biotechnology, and clinical research. Other sectors like Food & Beverage, Chemical, Oil & Gas, Environmental Testing, Agriculture, and Others are also adopting LIMS for various purposes.

- Driving Factors: LIMS enhances laboratory efficiency, patient care, research and development, regulatory compliance, and minimizes inaccuracies. It optimizes productivity and guarantees data reliability.

- Restraining Factors: Challenges include a shortage of skilled professionals, high costs associated with advanced technologies, and potential barriers due to complex integrated systems.

- Growth Opportunities: Opportunities lie in emerging markets, increased demand for lab automation in research and development, the outsourcing industry in emerging economies, and the rising demand for laboratory data for research purposes.

- Market Trends: Trends include using LIMS to meet regulatory requirements, growing demand for laboratory data for research, and the geographic expansion of market players.

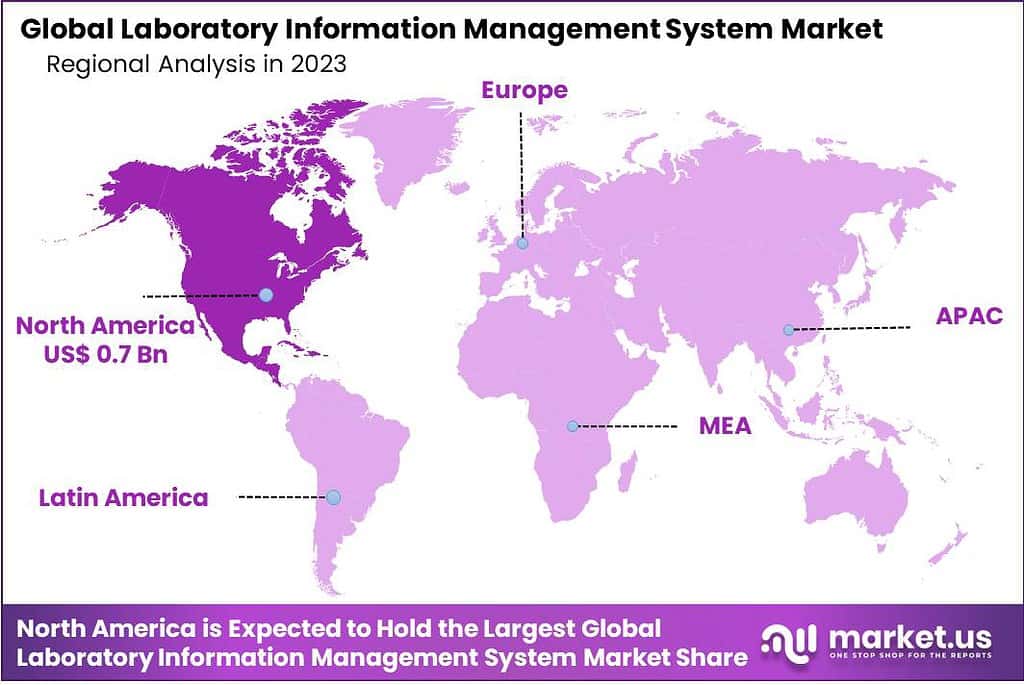

- Regional Analysis: In 2023, North America held the dominant market position (41.5%), followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each with its unique growth drivers.

- Key Players: Major players in the LIMS market include Thermo Fisher Scientific Inc., Siemens AG, Abbott Laboratories, LabWare, Inc., PerkinElmer, Inc., and others. These companies are continuously innovating and expanding their market presence.

Component Analysis

In 2023, the Services segment held a dominant market position, capturing more than a 59.8% share of the Laboratory Information Management System (LIMS) market. This substantial market share is attributed to the increasing demand for ongoing support, maintenance, and optimization of LIMS software. Services such as training, implementation, and consulting are crucial for the effective deployment and utilization of LIMS across various industries, including pharmaceuticals, biotechnology, and clinical research.

On the other hand, the Software component, while not holding the majority share, is also a significant segment of the LIMS market. This segment benefits from the continual advancements in technology and the growing need for data management and automation in laboratories. The integration of LIMS software is pivotal for enhancing efficiency, compliance, and data integrity in research and testing environments. It’s expected that as more laboratories recognize the value of digital solutions for managing complex data, the adoption of LIMS software will see a steady increase.

Product Analysis

In 2023, the Cloud-Based segment held a dominant market position in the Laboratory Information Management System (LIMS) market, capturing more than a 45.3% share. This dominance is primarily due to the flexibility, scalability, and cost-effectiveness that cloud-based solutions offer. Laboratories across various sectors are increasingly adopting cloud-based LIMS to enhance data accessibility and collaboration while reducing the need for extensive on-site IT infrastructure.

Meanwhile, the On-Premise segment continues to be vital, particularly for organizations prioritizing data control and security. This traditional deployment method is preferred in settings where strict regulatory compliance and data confidentiality are paramount. Although it requires significant upfront investment and ongoing maintenance, its appeal persists in certain sectors.

The Web-Hosted solution, while smaller in market share, offers a middle ground with its ease of access and reduced operational costs. It’s an appealing option for small to medium-sized laboratories seeking to leverage the advantages of both on-premise and cloud-based systems.

Note: Actual Numbers Might Vary In The Final Report

End-Use Industry

In 2023, the Life Sciences segment held a dominant market position in the Laboratory Information Management System (LIMS) market, capturing more than a 43.1% share. This segment’s substantial share is primarily attributed to the growing demand for efficient data management and regulatory compliance in pharmaceuticals, biotechnology, and clinical research organizations. The incorporation of LIMS in Life Sciences helps streamline laboratory processes, enhance data quality, and facilitate compliance with stringent regulatory standards.

Meanwhile, the Food & Beverage sector is also integrating LIMS to ensure product safety and quality, manage complex testing requirements, and comply with food safety regulations. This adoption is driven by the need for traceability and the efficient handling of a vast amount of data generated during food processing and testing.

In the Chemical industry, LIMS plays a crucial role in managing data, maintaining quality control, and supporting R&D activities. The system’s ability to handle complex workflows and maintain stringent quality standards fuels its adoption in this sector.

Similarly, the Oil & Gas industry relies on LIMS for sample management, data analysis, and regulatory compliance, aiding in efficient resource management and decision-making processes. The Environmental Testing segment utilizes LIMS to manage large datasets, ensuring accurate and timely reporting for compliance with environmental regulations.

The Agriculture sector is turning to LIMS to improve the quality of agricultural products, manage genetic information, and streamline testing procedures. Other End-Use Industries are also recognizing the benefits of LIMS, such as increased operational efficiency, reduced errors, and improved data integrity.

Driving Factors

- Enhancing Laboratory Efficiency: LIMS significantly boosts lab efficiency by automating routine tasks, reducing manual errors, and speeding up data retrieval processes. This enhancement is crucial in today’s fast-paced laboratory environments, where time and accuracy are of the essence.

- Improving Patient Care and Outcomes: In healthcare and clinical settings, LIMS plays a pivotal role in managing patient data, ensuring faster and more accurate diagnostics, which directly contributes to better patient care and outcomes.

- Facilitating Research and Development: LIMS supports R&D activities by efficiently managing experimental data, aiding in data analysis, and maintaining records for future reference, thereby accelerating the pace of innovation and discovery.

- Meeting Regulatory Requirements: With industries facing stricter regulations, LIMS helps laboratories comply with legal standards by maintaining proper records, ensuring quality control, and providing audit trails.

- Streamlining Laboratory Processes and Minimizing Inaccuracies: By automating workflows and standardizing procedures, LIMS reduces the chances of human error and enhances the overall quality of laboratory outputs.

- Optimizing Productivity and Guaranteeing Data Reliability: LIMS increases lab productivity by allowing more work to be done in less time while ensuring the reliability and integrity of laboratory data.

Restraining Factors

- Insufficiently Skilled Professionals: The lack of professionals who are proficient in LIMS can hinder its implementation and effective use, limiting the system’s potential benefits.

- High Cost Associated with Advanced Technologies: The initial setup and maintenance costs of advanced LIMS can be prohibitive for some laboratories, especially smaller ones or those in developing regions.

- Potential Barriers and Obstructions Due to Complex Integrated Systems: Integrating LIMS with other existing systems can be complex and challenging, leading to potential barriers and disruptions in laboratory operations.

Growth Opportunities

- Emerging Revenue Pockets: As laboratories around the world continue to modernize, new markets are opening up, especially in developing regions, offering substantial opportunities for revenue growth.

- Increasing Demand for Lab Automation Research and Development: There is a growing demand for automation in research and development activities, which LIMS is well-positioned to support, representing a significant growth opportunity.

- Growing Outsourcing Industry in Emerging Economies: The rise of the outsourcing industry in emerging economies presents a lucrative opportunity for LIMS providers to expand their market presence.

- Increasing Use of LIMS to Meet Regulatory Requirements: As regulations become stricter, the need for systems like LIMS grows, creating more demand and opportunities for market players.

- Rising Demand for Laboratory Data for Research Purposes: The increasing need for accurate and reliable laboratory data for research and development purposes is driving the demand for sophisticated LIMS.

Market Challenges

- Shortfall of Laboratory Professionals: The shortage of trained laboratory professionals can impede the effective implementation and utilization of LIMS, affecting overall market growth.

- Potential Devastating Impact of Complexities if Not Handled Well in Time: If the complexities associated with LIMS, such as integration and data management, are not managed effectively, they can lead to significant operational disruptions.

Key Market Trends

- Increasing Use of LIMS to Meet Regulatory Requirements: There’s a growing trend of utilizing LIMS to ensure compliance with increasingly stringent regulatory requirements, shaping the market’s evolution.

- Growing Demand for Laboratory Data for Research Purposes: The need for detailed and accurate laboratory data for advanced research is on the rise, driving the adoption of LIMS.

- Geographic Expansion of Market Players: LIMS providers are expanding their geographic presence to tap into new markets, especially in regions with growing healthcare and research sectors.

Key Market Segments

Component

- Software

- Services

Product

- On-Premise

- Cloud-Based

- Web-Hosted

End-Use Industry

- Life Sciences

- Food & Beverage

- Chemical

- Oil & Gas

- Environmental Testing

- Agriculture

- Other End-Use Industries

Regional Analysis

In 2023, North America held a dominant market position in the Laboratory Information Management System (LIMS) sector, capturing more than a 41.5% share. This can be attributed to the region’s advanced healthcare infrastructure, strong emphasis on research and development, and stringent regulatory standards requiring sophisticated data management solutions. The presence of major pharmaceuticals and research institutions in the U.S. and Canada further fuels the demand for LIMS to streamline operations and ensure compliance.

Europe follows closely, leveraging its robust research environment, well-established pharmaceutical industry, and strong governmental support for healthcare and technological advancements. Countries like Germany, the UK, and France are leading adopters, integrating LIMS to enhance laboratory efficiency and data integrity, thereby ensuring high-quality outcomes in research and patient care.

The Asia-Pacific (APAC) region is witnessing rapid growth, driven by its expanding healthcare sector, increasing investment in R&D, and the rising adoption of technology in countries like China, India, and Japan. The region’s focus on improving healthcare services and the growing need for efficient data management systems in laboratories present significant opportunities for the LIMS market.

Latin America is gradually embracing LIMS, with countries like Brazil and Mexico at the forefront. The region’s growing healthcare infrastructure, coupled with increasing awareness about the benefits of laboratory automation, is fostering the adoption of LIMS.

The Middle East and Africa (MEA) are emerging markets for LIMS, with an increasing focus on healthcare reforms, investment in research facilities, and the adoption of modern technologies in laboratories. The demand in this region is primarily driven by the need to improve healthcare services and establish international standards in laboratory practices.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Laboratory Information Management System (LIMS) industry continues to be fiercely competitive. Key players engage in acquisitions, strategic collaborations, and the introduction of new products to fortify their position in the market. These companies emphasize the implementation of various strategies, including the launch of new products, expansion into different regions, forging partnerships, and entering distribution agreements, all aimed at augmenting their share of revenue.

Top Key Players

- Thermo Fisher Scientific Inc.

- Siemens AG

- Abbott Laboratories

- LabWare, Inc.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- LabVantage Solutions, Inc.

- Autoscribe Informatics

- Illumina, Inc.

- Waters Corporation

- RURO, Inc.

- Blaze Systems Corporation

- Other Key Players

Recent Developments

- In August 2023, Thermo Fisher Scientific, Inc. introduced the EXENT solution, a comprehensive and automated mass spectrometry platform designed to address unmet clinical needs in the management of monoclonal gammopathy.

- Similarly, in December 2022, LabVantage Solutions, Inc. unveiled Version 8.8 of its leading Laboratory Information Management System (LIMS) platform, incorporating numerous enhancements across all components. These developments are anticipated to significantly contribute to the market’s growth throughout the forecast period.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Bn Forecast Revenue (2033) USD 4.7 Bn CAGR (2023-2032) 10.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Product (On-Premise, Cloud-Based, Web-Hosted), End-Use Industry (Life Sciences, Food & Beverage, Chemical, Oil & Gas, Environmental Testing, Agriculture, Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Siemens AG, Abbott Laboratories, LabWare, Inc., PerkinElmer, Inc., Agilent Technologies, Inc., LabVantage Solutions, Inc., Autoscribe Informatics, Illumina, Inc., Waters Corporation, RURO, Inc., Blaze Systems Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Laboratory Information Management System (LIMS)?A Laboratory Information Management System (LIMS) is a software solution designed to manage and streamline laboratory operations, including sample tracking, data management, and reporting.

How big is Laboratory Information Management System Market?The Global Laboratory Information Management System Market is anticipated to be USD 4.7 billion by 2033. It is estimated to record a steady CAGR of 10.1% in the Forecast period 2024 to 2033. It is likely to total USD 2.0 billion in 2023.

What factors are driving the growth of the LIMS market globally?Factors driving the growth of the LIMS market include increasing demand for efficient laboratory operations, technological advancements, and the need for compliance with industry regulations.

Which are the major companies in the Laboratory Information Management Systems (LIMS) market?Major companies in the Laboratory Information Management Systems (LIMS) market include industry leaders such as Thermo Fisher Scientific Inc., Siemens AG, Abbott Laboratories, LabWare, Inc., PerkinElmer, Inc., Agilent Technologies, Inc., LabVantage Solutions, Inc., Autoscribe Informatics, Illumina, Inc., Waters Corporation, RURO, Inc., Blaze Systems Corporation, Other Key Players

Laboratory Information Management System MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Laboratory Information Management System MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Siemens AG

- Abbott Laboratories

- LabWare, Inc.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- LabVantage Solutions, Inc.

- Autoscribe Informatics

- Illumina, Inc.

- Waters Corporation

- RURO, Inc.

- Blaze Systems Corporation

- Other Key Players