Global Krill Oil Market By Type (Liquids, and Tablets), By Application (Functional Food & Beverages, Dietary Supplements, Pharmaceuticals, and Animal Food & Pet Food), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 55439

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

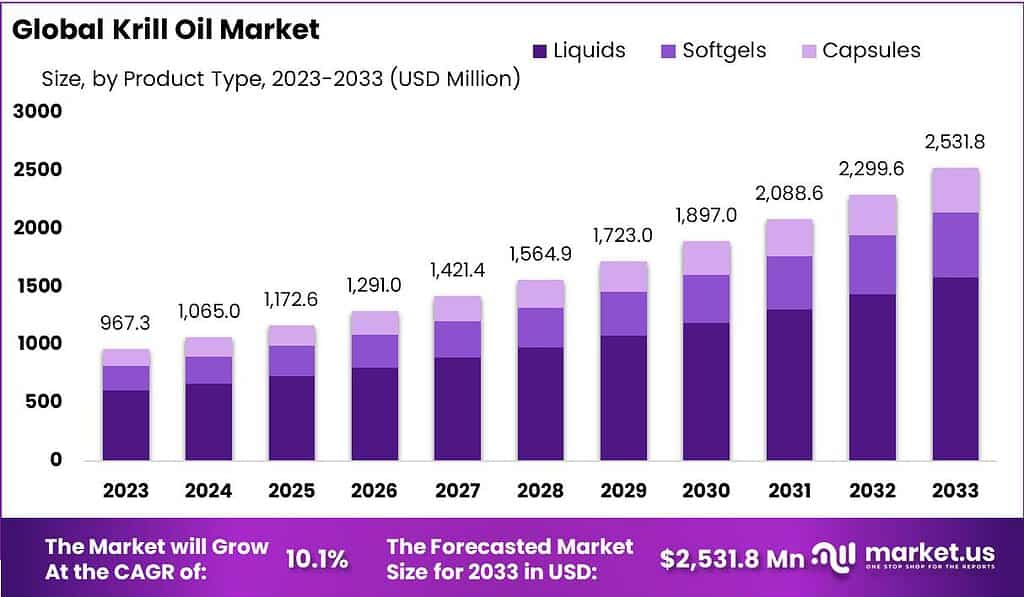

The global krill oil market size is expected to be worth around USD 2531.8 Million by 2033, from USD 967.3 Million in 2023, growing at a CAGR of 10.1% during the forecast period from 2023 to 2033.

The krill oil market refers to the industry involved in the production, distribution, and sale of oil extracted from krill, which are tiny shrimp-like crustaceans found in the cold waters of the ocean.

Krill oil is rich in omega-3 fatty acids, primarily eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA), which are beneficial for human health.

This is due to the growing geriatric population in developed countries like Germany, France, and Japan. Consumption of nutrient-rich foods and beverages will increase as consumers become more aware of their health in countries like India, China, and the U.S.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Growing Market Size: Projected Worth The Krill Oil market is anticipated to reach a substantial value of around USD 2531.8 Million by 2033 from its 2023 value of USD 967.3 Million. CAGR: It is expected to grow steadily at a Compound Annual Growth Rate (CAGR) of 10.1% during the forecast period from 2023 to 2033.

- Krill Oil and its Source: Rich Omega-3 Content: Krill oil is derived from tiny crustaceans, abundant in essential Omega-3 fatty acids like EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid) along with antioxidants. Health Benefits: These fatty acids offer various health benefits, including support for cardiovascular health, inflammation reduction, and more.

- Market Analysis by Type: Preferred Form: Liquids are the dominant form, constituting over 62.6% of the market share in 2023. Growth Segments: Soft gels and capsules are also gaining momentum due to their ease of consumption and protective features.

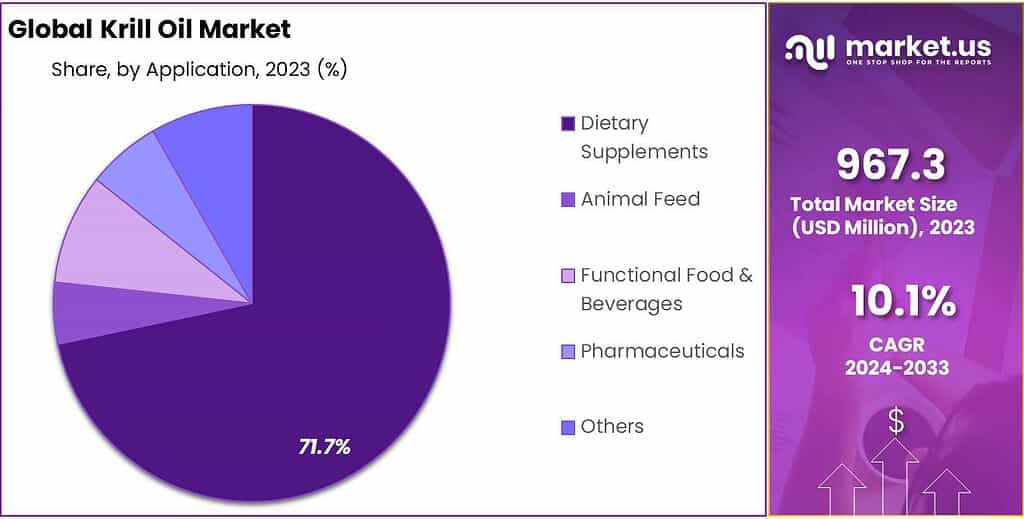

- Application Analysis: Dietary Supplements: Dominates the market with over 71.7% share in 2023, driven by increasing consumption for health benefits. Pharmaceutical Potential: Growing usage in pharmaceuticals for conditions like cholesterol reduction, blood pressure control, and heart health.

- Distribution Channels: Supermarkets/Hypermarkets Lead: Captured 38.3% of the market share in 2023, ensuring accessibility and ease of purchase. Online Retailers: Rising popularity due to convenience and a wide product range, providing another avenue for consumers.

- Drivers: Increased health awareness, demand for supplements, incorporation in functional foods, and accessible distribution channels are propelling market growth.

- Restraints: Environmental concerns regarding overfishing, sustainability issues, and the relatively higher cost compared to alternatives pose challenges.

- Challenges: Players face obstacles in adhering to fishing regulations and ensuring sustainable practices.

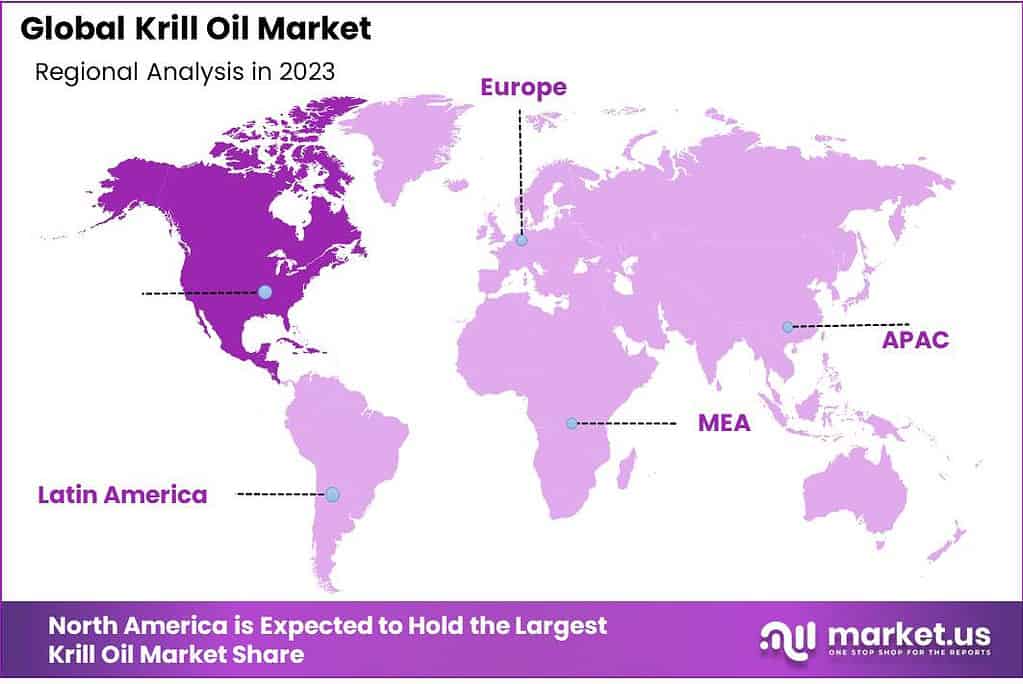

- Regional Analysis: North America Leading: Accounted for over 35.6% of revenue in 2023, driven by various applications including functional foods, pharmaceuticals, and more. Asia Pacific Surge: Increasing demand in countries like China, Japan, and South Korea due to rising health awareness and expanding use of pharmaceuticals.

- Key Players: Aker BioMarine, Rimfrost AS, Enzymotec Ltd, among others, are making significant contributions to the industry.

Product Type Analysis

As of 2023, Liquids emerged as the most popular form, capturing over 62.6% of the market. These are typically in a liquid state, allowing for easy consumption. Users might add a few drops to their beverages or take them directly for quick absorption.

Liquid Krill Oil is a liposomal supplement that is especially good for infants. It is expected to be in high demand during the forecast period. The krill oil market is divided into soft gels and capsules based on product type. The segment is expected to grow due to rising demand for liquid Krill Oil in infant formulas and pet food.

Soft gels are popular because of their smooth texture and ability to map flavors. Soft gels are also easier to swallow due to their flexible shape. In the coming years, soft gel applications are expected to skyrocket.

Capsules are popular because they protect sensitive ingredients, allow for unique ingredient combinations, deliver oil-soluble and fat-soluble nutrients, and reduce GI irritation. Furthermore, hard Sealed gelatin capsules provide proper oxygen barriers. These factors will raise the demand for the krill oil capsules market.

Application Analysis

In 2023, Dietary Supplements dominated the Krill Oil market, holding over a 71.7% share. Dietary supplements are the most popular application, as many people consume krill oil supplements for their health benefits.

The rising consumption of omega-3 polyunsaturated fatty acids in functional foods and pharmaceuticals will drive demand over the forecast period.

In developed countries such as the United States and France, demand for krill oil is expected to rise. This is due to a rise in public awareness of healthcare and chronic diseases. The use of omega 3 in infant formulas is encouraged by some regulations.

Docosahexaenoic and eicosapentaenoic acids (DHA) will drive the market shortly. Lowering bad cholesterol and blood pressure, as well as preventing heart attacks and strokes, are among them.

Industry penetration will be further accelerated by high investments from foreign players such as the Swiss company and GlaxoSmithKline (GSK) in the UK.

In addition, increased spending in the pharmaceutical sector in China and other countries such as India, Singapore, Thailand, Indonesia, Malaysia, Vietnam, and Malaysia will encourage the industry to expand.

*Actual Numbers Might Vary In The Final Report

By Distribution Channel

In 2023, Supermarkets/Hypermarkets took the lead in the Krill Oil market, securing over a 38.3% share. These large retail outlets were the primary source for customers to purchase krill oil due to their extensive product range and convenience.

Drug Stores & Pharmacies is Offering krill oil supplements and products known for health benefits, attracting health-conscious customers.

Online Retailer is an Online platform serving as a popular avenue for purchasing krill oil, providing convenience and a wide selection to consumers.

The dominance of Supermarkets/Hypermarkets reflects the ease and accessibility for consumers to find krill oil products while shopping for their daily needs.

Key Market Segments

By Product Type

- Liquids

- Soft gels

- Capsules

By Application

- Dietary Supplements

- Animal Feed

- Pharmaceuticals

- Functional Food & Beverages

- Other Applications

By Distribution Channel

- Supermarkets/Hypermarkets

- Drug Stores & Pharmacies

- Online Retailers

- Others

Drivers

Health Awareness: Expanding public knowledge regarding the numerous health advantages offered by krill oil, such as its omega-3 fatty acids that support cardiovascular health and its capacity to reduce inflammation is a significant driver.

Demand for Dietary Supplements: An increase in consumer appetite for omega-3-rich supplements has propelled the market expansion of krill oil.

Functional Foods & Beverages: Krill oil’s incorporation into functional foods and beverages due to its nutritional advantages contributes to its market expansion.

Pharmaceutical Applications: Increased utilization of krill oil in pharmaceuticals, owing to its potential therapeutic properties, fuels market growth.

Convenient Distribution Channels: Accessibility through various distribution channels like supermarkets, pharmacies, and online retailers is enhancing consumer reach and market growth.

Restraints

The krill oil market encounters several challenges that influence its growth trajectory. One significant concern revolves around the sustainability and environmental impact of krill harvesting. As demand increases, there’s a growing apprehension about overfishing in the Antarctic region, which is the primary source of krill.

The delicate balance of the Antarctic ecosystem raises concerns about the potential repercussions of excessive krill extraction on marine life and the broader environment. This apprehension has led to calls for more responsible and sustainable harvesting practices to ensure the preservation of krill populations and their habitat.

Another challenge faced by the krill oil market is its relatively higher cost compared to alternative omega-3 supplements. The pricing of krill oil, often higher than other sources of omega-3 fatty acids like fish oil, may act as a deterrent for some potential consumers. The cost factor can limit the market’s expansion, particularly in regions or among demographics that prioritize affordability over specific health benefits.

Overall, these challenges, encompassing environmental concerns and cost considerations, underscore the need for the industry to address sustainability issues while finding ways to make krill oil more accessible and affordable without compromising its quality or benefits. Efforts toward sustainable harvesting practices and price competitiveness may be vital to navigate these challenges and sustain growth in the krill oil market.

Opportunities

The krill oil market holds several opportunities for growth and expansion. One significant prospect lies in the increasing awareness and demand for natural and sustainable supplements. As consumers become more health-conscious and environmentally aware, there’s a rising preference for supplements sourced from sustainable marine resources like krill oil.

This shift towards eco-friendly and ethical consumption habits presents an opportunity for krill oil to gain traction among health-conscious consumers looking for sustainable alternatives.

Research and development within the nutraceutical industry offers endless possibilities for innovation when it comes to krill oil formulation.

Given its potential health benefits – particularly its high omega-3 content and antioxidant content – diversification is possible; for instance, novel supplements tailored specifically towards individual health needs or enhanced delivery systems could open up new market segments while meeting consumers’ preferences more efficiently.

Additionally, the expanding market scope in regions with a rising health and wellness culture provides an avenue for the krill oil market’s growth. As more populations adopt healthier lifestyles and dietary habits, there’s a parallel surge in the demand for dietary supplements, including omega-3-rich krill oil, presenting a considerable market opportunity for industry players to capitalize on this growing trend.

Challenges

The krill oil market faces its share of challenges that can hinder its growth. One significant challenge is the high dependency on krill as a primary source for oil extraction. Overfishing or changes in environmental conditions affecting krill populations can directly impact the availability and sustainability of krill oil.

This dependency on a single source might pose supply chain disruptions or affect product availability, influencing market stability.

Regulatory complexity and quality standards within the nutraceutical industry may present challenges for krill oil manufacturers. Compliance with various regulations while upholding quality, safety, and purity standards may prove demanding and expensive; stricter regulations or differing standards across regions might present unique obstacles when trying to ensure consistent quality while complying with various regulatory frameworks.

Consumer perception and acceptance of krill oil as an omega-3 supplement may also present challenges. Although krill oil offers unique advantages over other omega-3 sources, such as increased bioavailability of omega-3s and antioxidants, there may still be misconceptions among consumers as to its efficacy or sustainability compared with other fish-derived omega-3 sources.

Additionally, price fluctuations due to raw material supply issues combined with economic uncertainties or fluctuations may influence consumer purchasing decisions and demand for krill oil products in the market. Industry players must take great care in managing this challenge effectively to remain relevant and achieve growth.

Regional Analysis

North America accounted for the highest revenue share, at over 35.6% in 2023. The region’s major applications include functional and supplement foods, infant formulas, pharmaceuticals, and pharmaceuticals.

Functional food and beverage applications will see a rise in demand due to the rising consumer interest in fitness in the U.S., Canada, and Mexico. In North America, krill oil will be in high demand due to growing health benefits and new forms of dietary supplementation.

The Asia Pacific market will be driven by the increasing cultivation of krill fish, especially in the South China Sea or the Indian Ocean.

Rising demand in countries like Australia, Japan, South Korea, and China for omega three is driving the Asia Pacific region’s growth.

This region is seeing a rise in demand for omega-three due to increased consumption of krill oil and increasing awareness about health.

The market will be driven by the increasing use of krill oil within the pharmaceutical industry and growing research and development activities.

The region’s growing demand for krill oil-based products is expected to be driven by the increasing use of better medication and the increased life expectancy of the older population.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

A prominent presence is seen in the industry of nutrition supplements by the major players. They work to introduce new product forms to appeal to a wide audience. The product was previously only available as a tablet, but manufacturers now offer liquid and powder versions.

Manufacturers face a major obstacle in the fishing of Krill. CCAMLR has strict regulations regarding krill fishing. This limits the number of krill fish that fishermen can catch each year.

Aker Bio Marine and Rimfrost AS are key players. Aker Bio marine’s 2017 acquisitions of Neptune Wellness Solutions Ltd. and Enzymotec Ltd. have pushed the market toward consolidation.

Маrkеt Кеу Рlауеrѕ

- Aker BioMarine

- Coastside Bio Resources

- Enzymotec Ltd

- RIMFROST AS

- NutriGold Inc

- Olympic Seafood AS

- Qingdao Kangjing Marine Biotechnology Co., Ltd

- Nutracode LLC

- Luhua Biomarine

- Neptune Wellness Solutions

- Enzymotec

- Omega Protein Corporation

- Reckitt Benckiser Group plc

Recent Development

In September 2023, Aker BioMarine and Swisse collaborated to launch a ground-breaking product under Australia’s Listed Assessed Medicine category. The Superba™ Boost Krill oil, used by the Swiss brand in Australia, is included in the Australian Register of Therapeutic Goods (ARTG) as an ‘assessed listed’ medicine.

In September 2022, Aker BioMarine unveiled a ground-breaking technological platform that made use of the phospholipids in krill oil as a novel delivery system to innovate the nutraceuticals market.

Report Scope

Report Features Description Market Value (2023) USD 967.3 Million Forecast Revenue (2033) USD 39.6 Billion CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Apple, Banana, Strawberry, Mango, Guava, Berries, Others), By Nature(Organic, Conventional), By End-Use(Beverages, Bakery, Baby Food, Dairy & Desserts, Dressings & Sauces, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Dohler, AGRANA Beteiligungs-AG, Freshcut, S.L., Tree Top, Grünewald GmbH, CHINA KUNYU INDUSTRIAL CO, Nestle, Kraft Heinz, Abbott Laboratories, DANONE, Hain Celestial, Plum Organics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is krill oil?Krill oil is an oil extracted from tiny crustaceans called krill, rich in omega-3 fatty acids EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid), along with astaxanthin, an antioxidant.

What are the health benefits of krill oil?Krill oil is known for supporting heart health, brain function, joint health, and overall well-being due to its omega-3 content. Astaxanthin present in krill oil also provides antioxidant properties.

How is krill oil extracted?Krill oil is obtained through extraction methods that involve solvents or cold-press techniques. The extracted oil undergoes refining processes to ensure purity and quality.

-

-

- Qіngdао Каngјіng Маrіnе Тесhnоlоgу

- Еnzуmоtес Ltd.

- RВ LLС

- NWС Nаturаlѕ LLС

- Nutrіgоld Іnс.

- Dаеduсk FRD Іnс.

- Nерtunе Тесhnоlоgіеѕ & Віоrеѕоurсеѕ

- Оlуmріс Ѕеаfооd АЅ

- Аzаntіѕ Іnс

- Nоrwеіgаn Fіѕh Оіl

- Other Key Players