Global Kraft Paper Bag Market Size, Share, Growth Analysis By Paper (Brown Kraft Paper, White Kraft Paper), By Product (Sewn Open Mouth, Pinched Bottom Open Mouth, Pasted Valve, Pasted Open Mouth, Flat Bottom, Others), By Thickness (1 Ply, 2 Ply, 3 Ply), By End-use (Food Service, Retail, Pharmaceutical, E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158108

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

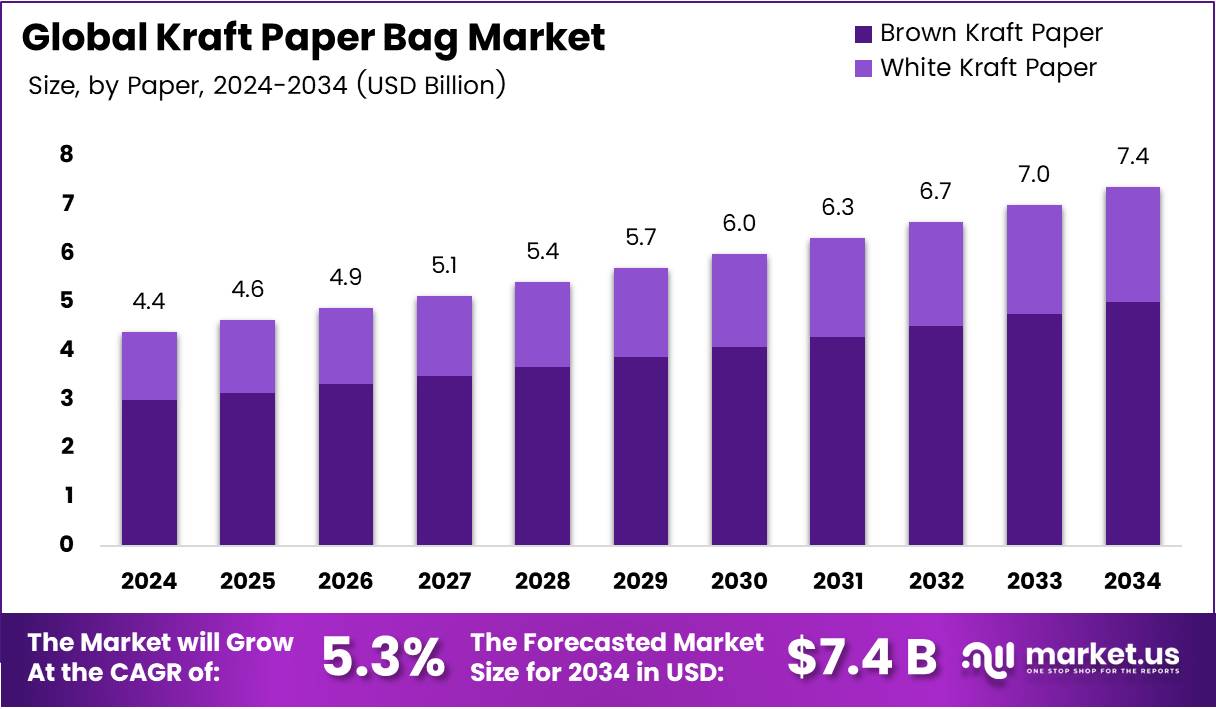

The Global Kraft Paper Bag Market size is expected to be worth around USD 7.4 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The Kraft Paper Bag Market represents a vital segment of sustainable packaging, driven by rising environmental awareness and regulatory pushes against single-use plastics. Businesses are transitioning toward eco-friendly packaging, making kraft paper bags an appealing alternative for retail, foodservice, and e-commerce. Their recyclability and biodegradability enhance long-term market attractiveness across diverse industries.

Retailers increasingly adopt kraft paper bags for branding and sustainability positioning. Additionally, government policies banning plastic bags in several countries are accelerating the switch, providing a significant opportunity for suppliers to strengthen market share and enhance product visibility in competitive markets.

Opportunities arise through innovation in product design and printing technologies, allowing companies to customize kraft paper bags for brand visibility. Rising e-commerce activity also boosts adoption, as online retailers prefer durable and eco-friendly packaging. Global trade expansion is further fueling production investments, creating a favorable landscape for sustained growth.

Government investments and regulations are crucial in shaping this industry. Plastic bans implemented in the European Union, India, and parts of the US encourage broader kraft paper bag usage. Incentives for paper recycling plants also reduce supply chain costs, improving profit margins and scalability for manufacturers targeting sustainable packaging solutions.

However, sustainability challenges exist. According to the US Environmental Protection Agency (EPA), paper bags consume twice as much energy to produce compared to plastic alternatives. Additionally, about 14 million trees are cut down annually to produce paper bags, highlighting a trade-off between renewable packaging benefits and environmental costs linked to deforestation.

The market outlook remains positive as companies align with circular economy goals and consumers prioritize green products. While energy-intensive production remains a concern, advancements in recycling technologies and tree-plantation programs are anticipated to balance environmental impacts. Hence, the kraft paper bag market is expected to maintain steady growth, supported by innovation and regulation.

Key Takeaways

- The Kraft Paper Bag market is projected to reach USD 7.4 Billion by 2034, growing from USD 4.4 Billion in 2024 at a CAGR of 5.3%.

- In 2024, Brown Kraft Paper led the paper segment with a 67.9% share, driven by durability and eco-friendly appeal.

- Sewn Open Mouth dominated the product segment with a 23.6% share, supported by versatile sealing and wide application use.

- 2 Ply emerged as the leading thickness category with a 52.7% share, balancing cost-efficiency and strength in packaging.

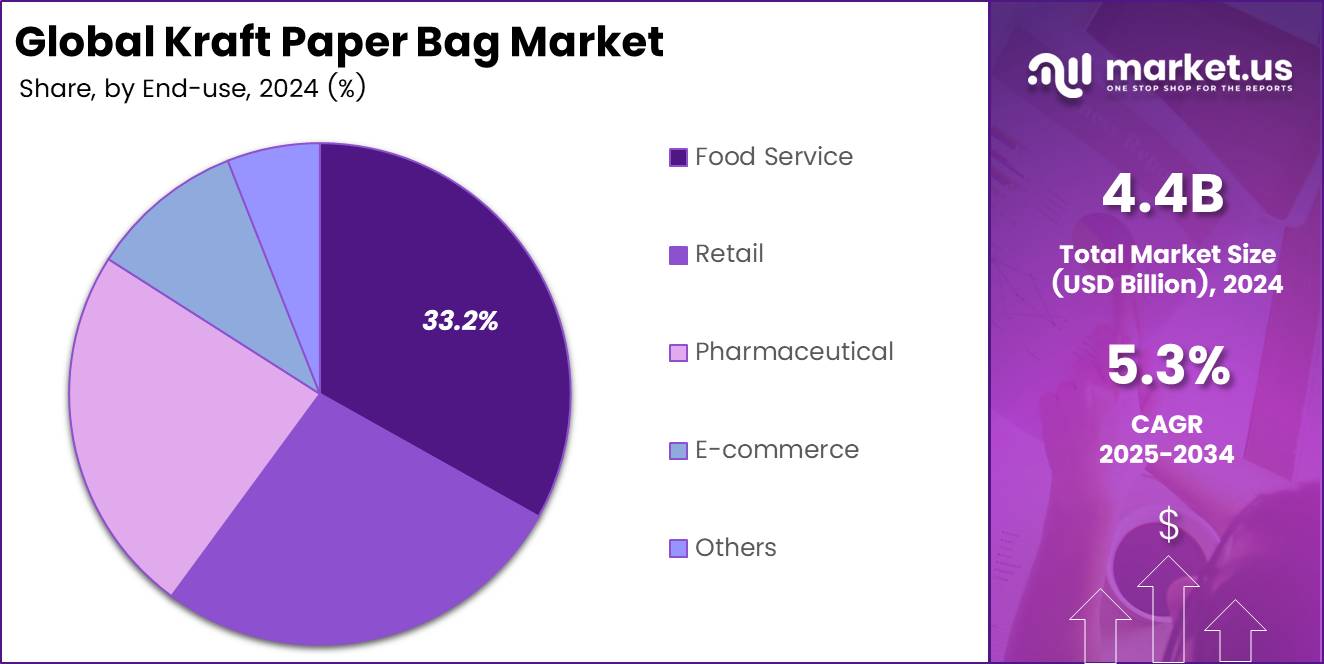

- Food Service held the top spot in end-use with a 33.2% share, fueled by demand in restaurants, cafes, and food delivery.

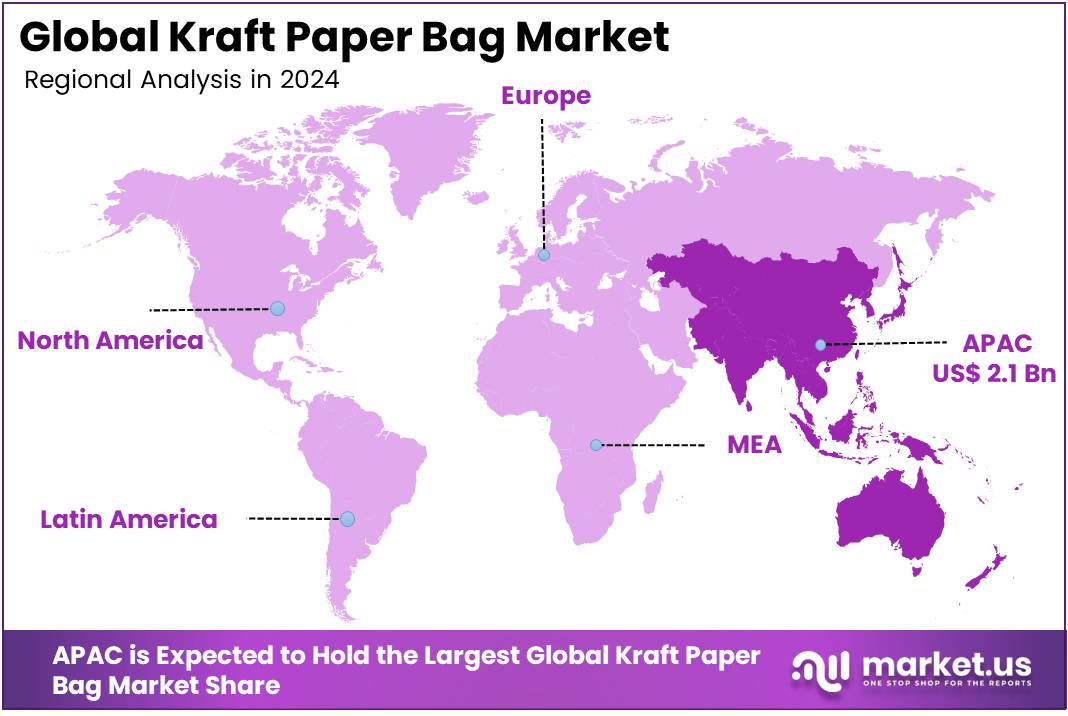

- Asia Pacific accounted for the largest market share at 48.2%, generating USD 2.1 Billion, supported by urbanization and retail expansion.

Paper Analysis

Brown Kraft Paper dominates with 67.9% due to its superior strength and natural appearance.

In 2024, Brown Kraft Paper held a dominant market position in By Paper Analysis segment of Kraft Paper Bag Market, with a 67.9% share. This commanding position stems from brown kraft paper’s exceptional durability and eco-friendly characteristics that resonate with environmentally conscious consumers and businesses.

Brown kraft paper’s natural brown color eliminates the need for bleaching processes, making it more cost-effective and sustainable compared to its white counterpart. The unbleached nature provides superior tensile strength, making it ideal for heavy-duty packaging applications across various industries.

White Kraft Paper represents the remaining market share, appealing primarily to premium packaging segments where aesthetic presentation takes precedence over cost considerations. The bleaching process required for white kraft paper results in a cleaner appearance but at higher production costs and reduced environmental benefits compared to brown variants.

Product Analysis

Sewn Open Mouth dominates with 23.6% due to its versatile applications and secure closure mechanism.

In 2024, Sewn Open Mouth held a dominant market position in By Product Analysis segment of Kraft Paper Bag Market, with a 23.6% share. This product type’s popularity stems from its reliable sealing capabilities and adaptability across multiple packaging requirements.

Sewn Open Mouth bags offer superior closure strength through their stitched design, making them preferred for industrial applications requiring secure containment. The sewing process creates a tamper-evident seal that enhances product security during transportation and storage.

Pinched Bottom Open Mouth and Pasted Valve segments follow as significant contributors, serving specialized packaging needs in agriculture and construction industries. Pasted Open Mouth variants provide cost-effective solutions for lighter applications, while Flat Bottom designs offer enhanced stability for retail displays.

The Others category encompasses niche products catering to specific industry requirements, collectively representing the remaining market share.

Thickness Analysis

2 Ply dominates with 52.7% due to its optimal balance of strength and cost-effectiveness.

In 2024, 2 Ply held a dominant market position in By Thickness Analysis segment of Kraft Paper Bag Market, with a 52.7% share. This thickness variant strikes the perfect balance between durability and economic viability, making it the preferred choice across diverse packaging applications.

2 Ply kraft bags provide adequate strength for medium-weight products while maintaining reasonable production costs. This configuration offers sufficient barrier protection and puncture resistance for most commercial packaging requirements, from food service to retail applications.

1 Ply bags serve lighter packaging needs where cost minimization is paramount, particularly in high-volume, low-weight applications. Meanwhile, 3 Ply variants cater to heavy-duty industrial packaging requiring maximum strength and durability.

The multi-layer construction in 3 Ply bags provides enhanced load-bearing capacity and superior protection for valuable or fragile contents, though at higher material costs.

End-use Analysis

Food Service dominates with 33.2% due to increasing demand for sustainable packaging solutions.

In 2024, Food Service held a dominant market position in By End-use Analysis segment of Kraft Paper Bag Market, with a 33.2% share. This sector’s leadership reflects the growing consumer preference for eco-friendly packaging in restaurants, cafes, and food delivery services.

The food service industry’s shift toward sustainable packaging has accelerated kraft paper bag adoption, driven by regulatory pressures and consumer environmental consciousness. These bags offer excellent grease resistance and food safety compliance while maintaining biodegradable properties.

Retail applications represent another significant segment, utilizing kraft bags for shopping and merchandise packaging. Pharmaceutical applications require specialized kraft bags meeting stringent hygiene standards, while E-commerce demands durable packaging for shipping protection.

The Others category encompasses industrial, agricultural, and specialty applications, collectively serving niche market requirements with specific performance criteria.

Key Market Segments

By Paper

- Brown Kraft Paper

- White Kraft Paper

By Product

- Sewn Open Mouth

- Pinched Bottom Open Mouth

- Pasted Valve

- Pasted Open Mouth

- Flat Bottom

- Others

By Thickness

- 1 Ply

- 2 Ply

- 3 Ply

By End-use

- Food Service

- Retail

- Pharmaceutical

- E-commerce

- Others

Drivers

Rising Government Bans on Single-Use Plastic Bags Drive Market Expansion

Government regulations worldwide are creating a strong push for kraft paper bags. Many countries and cities have banned single-use plastic bags, forcing retailers to find alternatives. This regulatory pressure is making kraft paper bags more popular as businesses need compliant packaging solutions.

The growth of online shopping is boosting demand for kraft paper bags. E-commerce companies need reliable packaging that protects products during shipping. Retail stores also want attractive bags that enhance customer experience. This dual demand from both online and offline retail sectors is expanding the market significantly.

Consumer awareness about environmental issues is driving preference for biodegradable options. People are actively choosing products that don’t harm the environment. Kraft paper bags decompose naturally, making them an attractive choice for eco-conscious consumers. This shift in buying behavior is pushing companies to adopt sustainable packaging.

Corporate responsibility initiatives are encouraging businesses to use eco-friendly packaging. Companies are setting sustainability goals and ESG commitments that include reducing plastic waste. Many organizations are switching to kraft paper bags to meet these environmental targets and improve their brand image among stakeholders.

Restraints

Higher Cost of Kraft Paper Compared to Plastic Alternatives Limits Market Growth

The main challenge facing kraft paper bags is their higher production cost compared to plastic alternatives. Manufacturing kraft paper requires more expensive raw materials and energy-intensive processes. This cost difference makes it difficult for price-sensitive businesses to switch from plastic bags, especially smaller retailers with tight profit margins.

Kraft paper bags have limitations when handling heavy or wet items. They can tear easily under excessive weight and lose strength when exposed to moisture. This durability issue restricts their use in certain applications like grocery stores selling heavy items or wet products, limiting overall market penetration.

Raw material prices for kraft paper fluctuate based on wood pulp availability and market conditions. These price variations make it challenging for manufacturers to maintain consistent pricing strategies. Supply chain disruptions can also affect production costs, creating uncertainty for both producers and buyers in the market.

Many emerging economies lack proper recycling infrastructure for paper products. Without adequate collection and processing systems, kraft paper bags may not be recycled effectively. This infrastructure gap reduces the environmental benefits and makes the sustainability argument less compelling in these markets, slowing adoption rates.

Growth Factors

Innovation in Coated and Laminated Kraft Paper Bags Creates New Growth Opportunities

Technological advances in coating and lamination are creating new possibilities for kraft paper bags. These innovations improve water resistance and durability while maintaining biodegradability. Enhanced kraft paper bags can now compete with plastic alternatives in more applications, opening up previously inaccessible market segments.

Luxury brands and fashion retailers are increasingly adopting kraft paper bags for their premium appeal. High-end stores want packaging that reflects their brand values and environmental consciousness. The natural, sophisticated look of kraft paper bags aligns with luxury brand positioning, creating a growing niche market with higher profit margins.

Custom printing and branding opportunities are driving demand for personalized kraft paper bags. Businesses want packaging that serves as a marketing tool and reinforces brand identity. Advanced printing technologies allow for high-quality graphics and logos on kraft paper, making these bags effective promotional materials that customers reuse.

Government support through subsidies and incentives is encouraging eco-friendly packaging adoption. Many authorities offer financial benefits to businesses that switch to sustainable alternatives. These policy measures reduce the cost disadvantage of kraft paper bags and accelerate market transition from plastic packaging solutions.

Emerging Trends

Shift Toward Minimalist and Natural Packaging Designs Shapes Market Trends

Consumer preferences are moving toward simple, natural-looking packaging designs. The minimalist trend favors kraft paper’s authentic, unprocessed appearance over flashy plastic alternatives. This aesthetic preference is driving demand among brands that want to project authenticity and environmental consciousness through their packaging choices.

Digital integration is becoming popular with QR codes and smart labels on kraft paper bags. These technologies provide additional functionality like product information, promotions, or sustainability credentials. The combination of traditional kraft paper with modern digital features creates value-added packaging solutions that appeal to tech-savvy consumers.

Manufacturers are increasingly using recycled fibers and post-consumer waste materials in kraft paper production. This circular approach reduces environmental impact and appeals to sustainability-focused customers. Using recycled content also helps address raw material availability concerns while supporting waste reduction initiatives across industries.

Water-resistant and compostable kraft bag innovations are gaining market traction. These advanced products maintain environmental benefits while improving functionality. Compostable options appeal to environmentally conscious consumers, while water-resistant features expand usage possibilities. These trending improvements are helping kraft paper bags compete more effectively against traditional packaging materials.

Regional Analysis

Asia Pacific Dominates the Kraft Paper Bag Market with a Market Share of 48.2%, Valued at USD 2.1 Billion

Asia Pacific accounted for the largest share of the Kraft Paper Bag Market with 48.2%, generating USD 2.1 Billion. This dominance is driven by rapid urbanization, expanding retail and e-commerce industries, and increasing consumer awareness toward sustainable packaging. Additionally, government restrictions on single-use plastics across countries further strengthen market growth in the region.

North America Kraft Paper Bag Market Trends

North America demonstrates strong growth due to rising demand for eco-friendly packaging and stricter environmental regulations. The region benefits from consumer preference for recyclable and biodegradable options in retail and foodservice. The U.S. leads within North America, supported by high consumption levels and ongoing sustainability initiatives.

Europe Kraft Paper Bag Market Trends

Europe shows consistent demand growth, underpinned by strict EU packaging waste directives and strong sustainability policies. The retail sector’s adoption of eco-friendly bags and increasing bans on plastic usage drive the regional market. Consumer inclination toward greener lifestyle choices further accelerates adoption of Kraft paper bags.

Middle East and Africa Kraft Paper Bag Market Trends

The Middle East and Africa are witnessing gradual growth, supported by regulatory moves to reduce plastic waste and rising urban retail infrastructure. Adoption is increasing in grocery retail and foodservice segments. However, challenges include higher production costs and limited awareness in certain sub-regions.

Latin America Kraft Paper Bag Market Trends

Latin America is experiencing steady growth as governments promote plastic alternatives through policies and initiatives. The retail sector, particularly supermarkets and quick-service restaurants, is driving the adoption of Kraft paper bags. Despite slower pace compared to other regions, rising consumer awareness is expected to support future growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kraft Paper Bag Company Insights

Mondi Group maintained a strong position in the global Kraft Paper Bag Market in 2024, leveraging its wide portfolio of sustainable packaging solutions. The company’s focus on lightweight and recyclable kraft paper has aligned with rising environmental regulations and consumer demand for eco-friendly shopping bags.

Smurfit Kappa Group played a pivotal role in driving innovation through its smart and recyclable paper-based bag solutions. In 2024, its focus on integrating circular economy principles with strong distribution networks reinforced its market presence, especially in Europe and North America.

WestRock Company strengthened its competitive edge by capitalizing on advanced paper manufacturing technologies and strong retail partnerships. Its commitment to delivering high-strength kraft paper bags catered to both industrial and consumer packaging needs, enhancing adoption across foodservice and retail sectors in 2024.

Georgia-Pacific LLC remained a key contributor with its diverse kraft paper products, focusing on bulk supply to retail chains and food industries. The company emphasized innovation in unbleached kraft solutions, meeting the increasing demand for sustainable, high-durability shopping bags across the United States and other international markets.

These players collectively influenced the market by emphasizing recyclability, durability, and compliance with sustainability policies. Their strategic investments in expanding production capacities, integrating eco-friendly technologies, and fostering partnerships with retailers shaped the competitive landscape in 2024. Overall, the leadership of these companies highlighted the growing transition toward sustainable packaging alternatives, driven by global regulatory frameworks and shifting consumer preferences.

Top Key Players in the Market

- Mondi Group

- Smurfit Kappa Group

- WestRock Company

- Georgia-Pacific LLC

- International Paper Company

- Seaman Paper Company

- Billerud

- SHAMROCK

- Nordic Paper

- PaperKraft Industries

Recent Developments

- In July 2025, THC acquired Polish paper bag manufacturer Promar, strengthening its European footprint and enhancing its sustainable packaging portfolio. This acquisition marks THC’s strategic expansion into Central Europe, aligning with rising demand for eco-friendly paper bag solutions.

- In April 2025, Reel Paper announced the acquisition of HoldOn Bags, expanding its portfolio of sustainable household brands. The deal positions Reel Paper to accelerate innovation in compostable packaging and scale environmentally responsible consumer products.

- In April 2024, Inteplast Group acquired Brown Paper Goods, reinforcing its presence in the North American foodservice packaging sector. The acquisition broadens Inteplast’s product offerings and supports its strategy of providing sustainable and functional paper-based solutions.

- In September 2024, Novolex acquired American Twisting, advancing its capabilities in specialty paper packaging. The deal supports Novolex’s strategy to diversify its product range and meet increasing customer demand for customized, sustainable packaging options.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Billion Forecast Revenue (2034) USD 7.4 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Paper (Brown Kraft Paper, White Kraft Paper), By Product (Sewn Open Mouth, Pinched Bottom Open Mouth, Pasted Valve, Pasted Open Mouth, Flat Bottom, Others), By Thickness (1 Ply, 2 Ply, 3 Ply), By End-use (Food Service, Retail, Pharmaceutical, E-commerce, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Mondi Group, Smurfit Kappa Group, WestRock Company, Georgia-Pacific LLC, International Paper Company, Seaman Paper Company, Billerud, SHAMROCK, Nordic Paper, PaperKraft Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mondi Group

- Smurfit Kappa Group

- WestRock Company

- Georgia-Pacific LLC

- International Paper Company

- Seaman Paper Company

- Billerud

- SHAMROCK

- Nordic Paper

- PaperKraft Industries