Global KNX Sensors Market Size, Share and Analysis Report By Type (Temperature Sensors, Motion/Occupancy Sensors, Light Sensors, Air Quality Sensors, Others), By Application (Residential, Commercial, Industrial, Others), By End-User (Building Automation, HVAC Systems, Lighting Control, Security and Access Control, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173226

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Demand Analysis

- Top Market Takeaways

- Energy Efficiency Statistics – KNX Sensors

- KNX Ecosystem and Manufacturers – Key Facts

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Type

- By Application

- By End User

- By Region

- Increasing Adoption Technologies

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

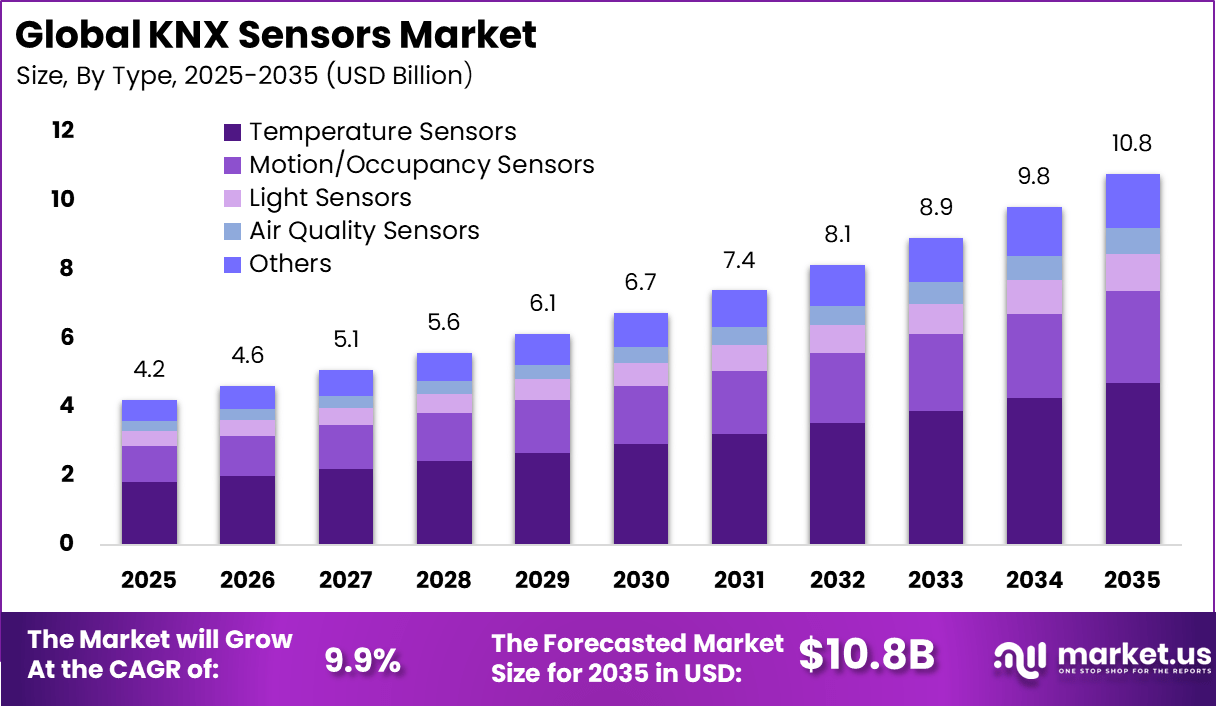

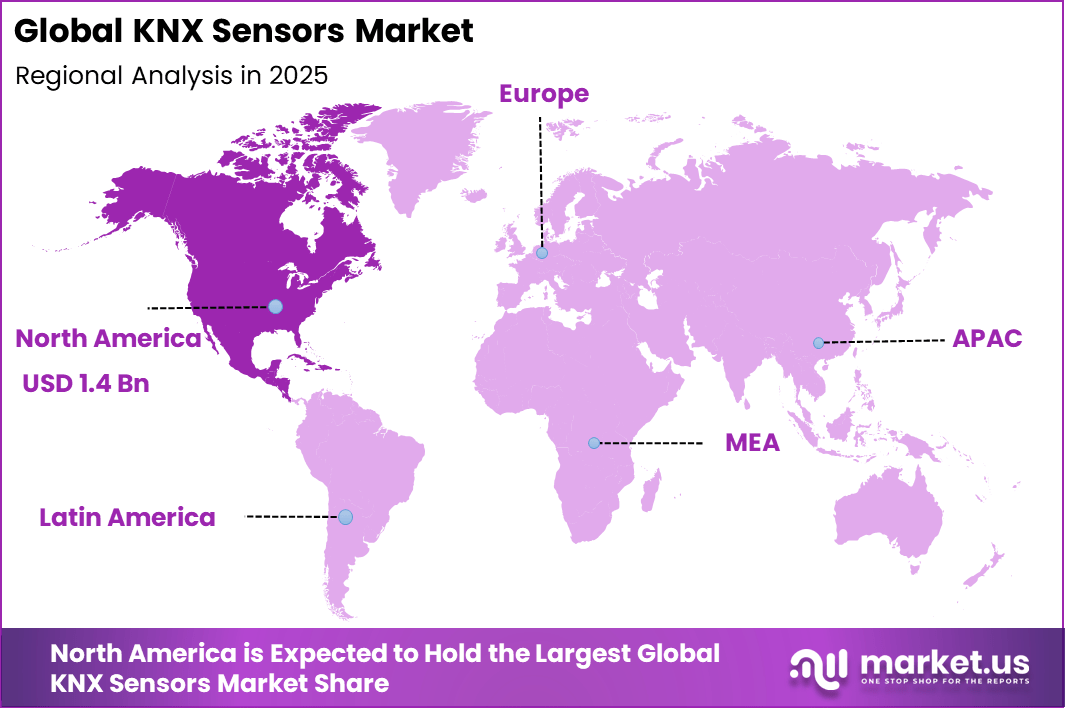

The Global KNX Sensors Market size is expected to be worth around USD 10.8 Billion By 2035, from USD 4.2 billion in 2025, growing at a CAGR of 9.9% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 33.6% share, holding USD 1.4 Billion revenue.

The KNX sensors market refers to the ecosystem of sensor devices designed to operate within the KNX protocol, a standardized communication framework for smart building automation. These sensors detect and transmit environmental data such as temperature, humidity, motion, light intensity, and air quality to intelligent control systems. KNX sensors support multiple building applications including lighting control, HVAC management, security systems and energy optimization functions.

Adoption has been observed in commercial, residential and industrial facilities seeking integrated, interoperable automation solutions. Growth in this market is driven by the expanding focus on smart infrastructure, energy efficiency and occupant comfort. Organizations and building owners increasingly prioritize automation that enhances operational outcomes while reducing energy costs.

Demand Analysis

Demand for KNX sensors is influenced by the expansion of commercial real estate and renovation initiatives in urban centers. New construction and retrofit projects are leveraging automation to improve facility management and operational efficiency. Building owners and operators prioritize solutions that can integrate with existing infrastructure and scale over time. This trend has increased adoption of standardized sensor protocols like KNX.

Demand is also shaped by regulatory frameworks that mandate energy performance and building efficiency standards. Governments in multiple regions require compliance with codes that promote efficient use of resources and reduction of operational costs. KNX sensors provide critical data that supports compliance reporting and automated control strategies. As regulatory requirements tighten, demand for sensor-based automation grows.

Top Market Takeaways

- Temperature sensors lead by type with a 43.5% share, as precise indoor climate monitoring remains a core requirement in smart buildings and energy management systems.

- Commercial applications account for 38.2%, driven by widespread use of KNX sensors in offices, retail spaces, hotels, and large commercial facilities.

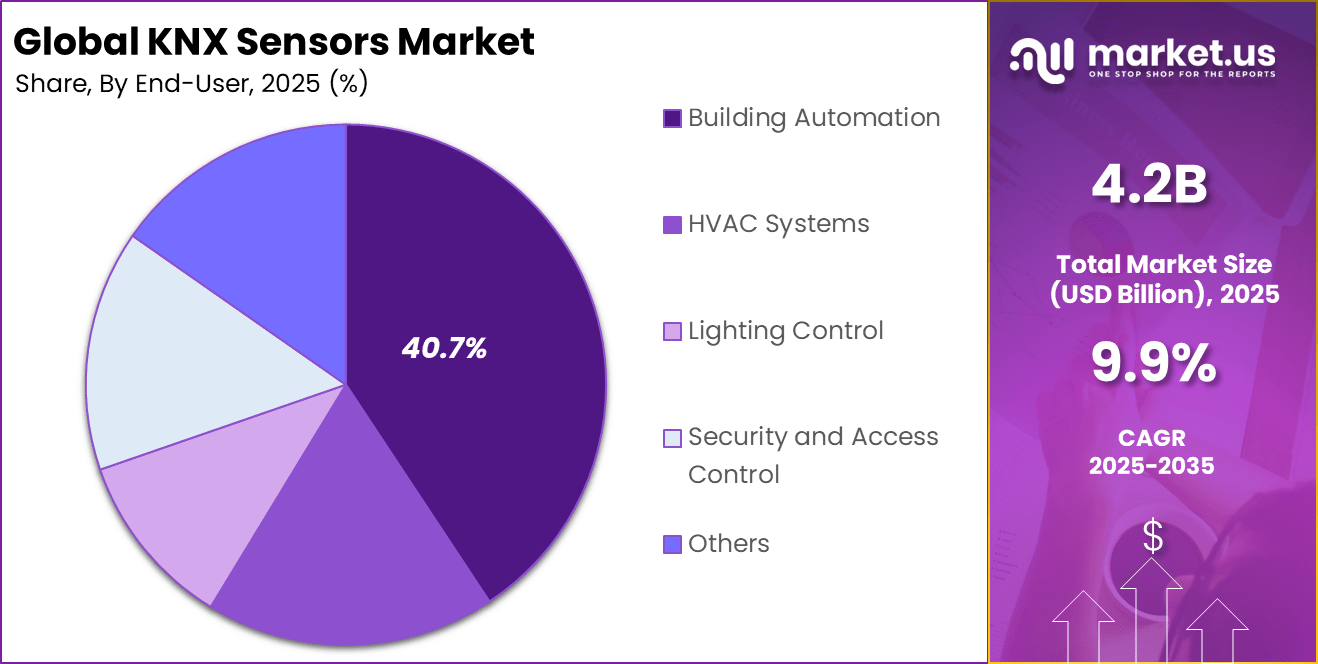

- Building automation represents the largest end-user segment at 40.7%, reflecting strong integration of KNX sensors with HVAC, lighting, and energy control systems.

- Asia Pacific holds a 33.6% regional share, supported by rapid urbanization, smart city projects, and growing adoption of intelligent building standards.

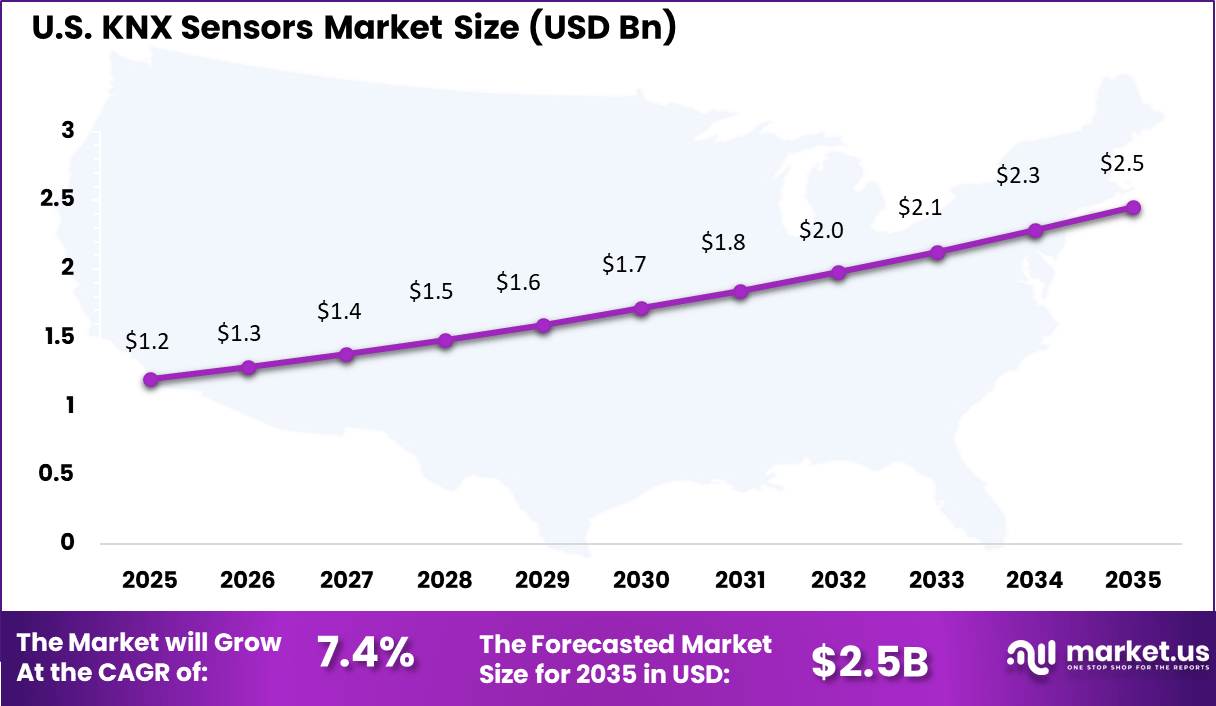

- The U.S. market reached USD 1.25 billion, expanding at a 7.4% CAGR, driven by modernization of commercial buildings and rising focus on energy efficiency and automation.

Energy Efficiency Statistics – KNX Sensors

- Lighting control savings reach up to 60%, achieved through occupancy detection and constant light regulation in automated spaces.

- Ventilation systems deliver energy reductions of up to 60%, as KNX sensors adjust airflow based on real-time occupancy and air quality.

- HVAC and room-level temperature control achieve savings of up to 50%, supported by precise, sensor-driven heating and cooling management.

- Overall building energy consumption is reduced by an average of 34% across smart building projects using KNX-based automation.

- Payback periods have shortened significantly, with KNX system investments now recovering costs in around 2 years by 2025-2026, compared with 5-10 years in earlier adoption phases.

KNX Ecosystem and Manufacturers – Key Facts

- More than 8,000 KNX-certified devices are available globally, ensuring broad interoperability across building automation systems.

- Over 500 manufacturers across 45 countries actively develop and supply KNX-certified sensors and solutions.

- The KNX community includes nearly 120,000 certified partners operating in 190 countries, supporting installation, integration, and maintenance.

- The ecosystem is led by established players such as Schneider Electric, ABB, Siemens, Hager (Berker), JUNG, GIRA, and Theben AG, reflecting strong global standardization and long-term industry commitment.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Smart building adoption Increased deployment of intelligent building systems ~2.6% Asia Pacific, Europe Short to Mid Term Energy efficiency mandates Regulations promoting optimized energy consumption ~2.1% Europe, Asia Pacific Mid Term Urban infrastructure growth Expansion of commercial and residential construction ~1.9% Asia Pacific Mid Term Demand for automation comfort Rising preference for automated lighting and climate control ~1.7% Global Short Term Integration with IoT platforms Interoperability with broader building systems ~1.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High installation cost Initial deployment cost limits adoption ~2.3% Emerging Markets Short Term Skilled workforce shortage Limited trained KNX professionals ~1.8% Global Mid Term Interoperability challenges Integration complexity with legacy systems ~1.5% Global Mid Term Cybersecurity concerns Risk associated with connected building systems ~1.2% Global Long Term Economic slowdown Construction delays impact sensor deployment ~0.9% Global Short Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High upfront investment Cost sensitive buyers delay projects ~2.7% Asia Pacific, Latin America Short to Mid Term Limited retrofit adoption Difficulty upgrading existing buildings ~2.0% Europe Mid Term Standard awareness gap Low familiarity with KNX standards ~1.6% Emerging Markets Short Term Longer payback periods ROI realization takes time ~1.2% Global Mid Term Supply chain constraints Sensor component availability issues ~0.8% Global Short Term By Type

Temperature sensors account for 43.5%, reflecting their critical role in KNX-based building systems. These sensors monitor indoor conditions to maintain comfort and energy efficiency. Accurate temperature data supports automated heating and cooling control. Consistent sensing improves system responsiveness. Reliability makes temperature sensors widely adopted.

The dominance of temperature sensors is driven by demand for climate control automation. Buildings rely on precise measurements to optimize energy use. Integration with KNX controllers supports centralized management. Sensors operate continuously with low maintenance needs. This sustains strong adoption across installations.

By Application

Commercial applications represent 38.2%, making them the leading application area. Offices, retail spaces, and public buildings use KNX sensors to manage indoor environments. Automated control helps reduce energy consumption. Commercial facilities prioritize occupant comfort and operational efficiency. Sensors support consistent performance.

Growth in commercial applications is driven by building modernization efforts. Facility managers seek centralized monitoring and control. KNX sensors integrate with broader building systems. Data-driven control improves maintenance planning. This supports steady adoption in commercial settings.

By End User

Building automation accounts for 40.7%, highlighting its central role as an end user. KNX sensors feed data into automated systems for lighting, HVAC, and safety. Automation improves operational consistency across buildings. Sensors enable real-time adjustments based on conditions. This enhances efficiency and comfort.

Adoption in building automation is driven by smart building initiatives. Owners invest in systems that reduce manual intervention. KNX compatibility supports interoperability across devices. Automation systems benefit from accurate sensor inputs. This sustains strong demand.

By Region

North America accounts for 33.6%, supported by expanding construction activity and smart building adoption. Urban development increases demand for automated building systems. Energy efficiency regulations support sensor deployment. Infrastructure investment remains strong. The region contributes steadily to market growth.

The United States reached USD 1.25 Billion with a CAGR of 7.4%, indicating stable expansion. Growth is supported by upgrades in building automation systems. Demand for KNX-compatible sensors continues to rise. Energy management remains a priority. Market momentum stays consistent.

Increasing Adoption Technologies

Integration of wireless communication technologies has accelerated adoption of KNX sensors. Wireless variants reduce installation complexity and cost, especially in retrofit environments where cabling is impractical. These technologies maintain compatibility with the KNX standard while increasing flexibility in device deployment. Wireless adoption broadens application possibilities and meets evolving installation needs.

The incorporation of edge computing capabilities within sensor devices is another technology influencing market growth. Edge processing allows preliminary data analysis locally before transmission, reducing response times and network burdens. This supports real time control and enhances system resilience. As sensor intelligence increases, overall building automation performance improves.

One underlying reason organizations adopt KNX sensor solutions is the quest for energy optimization and cost savings. Real time environmental monitoring enables adaptive control of lighting, HVAC and other energy consuming systems. This leads to measurable reductions in utility costs and improved operational efficiency. Financial benefits drive adoption among cost conscious facility managers.

Another reason for adoption is the desire to enhance occupant comfort and safety. KNX sensors provide data that supports intelligent adjustments to indoor conditions, improving wellbeing and productivity. Motion and environmental sensors also contribute to security monitoring and hazard detection. These integrated capabilities support holistic building management objectives.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Small and medium enterprises Very High ~39% Protection from litigation risk Selective policy purchase Large enterprises High ~27% Balance sheet protection Portfolio based coverage Insurers High ~18% Specialty insurance expansion Product innovation Reinsurers Moderate ~11% Risk diversification Capacity allocation Legal and IP advisory firms Low to Moderate ~5% Risk mitigation support Partnership driven Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status IP analytics platforms Patent strength and risk assessment ~2.0% Growing Legal cost modeling tools Litigation expense forecasting ~1.6% Growing Digital underwriting systems Faster policy issuance ~1.3% Developing AI driven prior art analysis Improved infringement risk detection ~0.9% Developing Blockchain documentation Secure IP ownership records ~0.5% Early Emerging Trends

The KNX sensors market is experiencing increased adoption of smart building solutions that enable real-time monitoring and control of environmental conditions. KNX sensors are being deployed to measure parameters such as temperature, humidity, occupancy, and light levels, which support automated responses across heating, ventilation, and lighting systems. This movement toward integrated environment sensing supports improved comfort and energy efficiency within commercial and residential buildings.

Another emerging trend is the integration of KNX sensors with Internet of Things (IoT) networks that connect devices across facilities. Interoperability between sensors and centralized controllers allows building managers to access data through unified dashboards and mobile applications. These connected systems facilitate predictive maintenance, trend analysis, and fault detection across multiple locations.

Opportunity Analysis

There is strong opportunity in expanding KNX sensor applications beyond temperature and occupancy to include advanced environmental metrics such as air quality, vibration, and sound levels. These enhanced sensing capabilities can support specialized environments such as laboratories, healthcare facilities, and educational institutions where precise monitoring is critical.

Providing a broader range of sensor types under unified KNX protocols can attract new market segments. Another opportunity lies in combining KNX sensor data with analytics and automation platforms that support predictive insights and adaptive control.

By analyzing historical sensor data, building managers can identify patterns, forecast maintenance needs, and optimize system performance. Analytics-enhanced solutions can reduce operating costs and improve system uptime. Supporting data-driven building management can differentiate KNX offerings and increase adoption.

Challenge Analysis

A key challenge for the market is ensuring interoperability and standardization across diverse device manufacturers and system configurations. While KNX is an open standard, variations in implementation and communication protocols can create interoperability issues. Ensuring seamless integration across devices and platforms requires rigorous testing and certification.

Without strong compatibility, sensor networks may underperform or require bespoke coordination. Another challenge is addressing cybersecurity risks associated with connected sensor networks. KNX devices that communicate over IP networks can be vulnerable to unauthorized access if security measures are not properly implemented.

Protecting sensor data and control signals from intrusion is essential to maintain system integrity and user trust. As connectivity increases, robust security frameworks must be in place to safeguard building automation environments.

Key Market Segments

By Type

- Temperature Sensors

- Motion/Occupancy Sensors

- Light Sensors

- Air Quality Sensors

- Others

By Application

- Residential

- Commercial

- Industrial

- Others

By End-User

- Building Automation

- HVAC Systems

- Lighting Control

- Security and Access Control

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Siemens AG, ABB Ltd., and Schneider Electric SE lead the KNX sensors market by offering reliable and scalable sensors for lighting, HVAC, occupancy, and energy management. Their KNX compliant devices are widely deployed in smart residential and commercial buildings. These companies focus on interoperability, long product lifecycles, and strong system integration. Growing adoption of standardized building automation continues to support their leadership.

Hager Group, Gira Giersiepen GmbH & Co. KG, Theben AG, Jung GmbH & Co. KG, and Busch-Jaeger Elektro GmbH strengthen the market with high precision motion, presence, and environmental sensors. Their solutions emphasize design quality, user comfort, and energy efficiency. These providers focus on seamless integration within KNX ecosystems. Rising demand for intelligent and energy saving buildings supports wider adoption.

Ekinex S.p.A., Zennio Avance y Tecnología S.L., HDL Automation Co., Ltd., MDT technologies GmbH, and Basalte expand the landscape with cost effective, design focused, and application specific KNX sensors. Their offerings target both mass market and premium projects. These companies focus on flexibility and ease of configuration. Increasing global KNX adoption continues to drive steady growth in the KNX sensors market.

Top Key Players in the Market

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Hager Group

- Gira Giersiepen GmbH & Co. KG

- Theben AG

- Jung GmbH & Co. KG

- Busch-Jaeger Elektro GmbH

- Ekinex S.p.A.

- Zennio Avance y Tecnología S.L.

- HDL Automation Co., Ltd.

- Ivory Egg (UK) Limited

- Elsner Elektronik GmbH

- MDT technologies GmbH

- Weinzierl Engineering GmbH

- Interra KNX Solutions

- Lingg & Janke OHG

- Tense Top Design Switches

- Basalte

- B.E.G. Brück Electronic GmbH

- Others

Recent Developments

- October, 2025 – MDT Technologies grabbed majority stakes in Tapko Technologies and Apricum, strengthening its KNX sensor tech and long-term partnerships.

- March, 2025 – Siemens AG showcased advanced KNX all-in-one solutions and hybrid heating controls at ISH 2025, focusing on energy savings that appeal to KNX sensor integrators.

- January, 2025 – ABB Ltd. announced the acquisition of Sensorfact BV, a Dutch firm specializing in AI-driven energy sensors, to bolster its digital management tools that integrate well with KNX systems for industrial setups.

Report Scope

Report Features Description Market Value (2025) USD 4.2 Bn Forecast Revenue (2035) USD 10.8 Bn CAGR(2026-2035) 9.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Temperature Sensors, Motion/Occupancy Sensors, Light Sensors, Air Quality Sensors, Others), By Application (Residential, Commercial, Industrial, Others), By End-User (Building Automation, HVAC Systems, Lighting Control, Security and Access Control, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, ABB Ltd., Schneider Electric SE, Hager Group, Gira Giersiepen GmbH & Co. KG, Theben AG, Jung GmbH & Co. KG, Busch-Jaeger Elektro GmbH, Ekinex S.p.A., Zennio Avance y Tecnología S.L., HDL Automation Co., Ltd., Ivory Egg (UK) Limited, Elsner Elektronik GmbH, MDT technologies GmbH, Weinzierl Engineering GmbH, Interra KNX Solutions, Lingg & Janke OHG, Tense Top Design Switches, Basalte, B.E.G. Brück Electronic GmbH, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Hager Group

- Gira Giersiepen GmbH & Co. KG

- Theben AG

- Jung GmbH & Co. KG

- Busch-Jaeger Elektro GmbH

- Ekinex S.p.A.

- Zennio Avance y Tecnología S.L.

- HDL Automation Co., Ltd.

- Ivory Egg (UK) Limited

- Elsner Elektronik GmbH

- MDT technologies GmbH

- Weinzierl Engineering GmbH

- Interra KNX Solutions

- Lingg & Janke OHG

- Tense Top Design Switches

- Basalte

- B.E.G. Brück Electronic GmbH

- Others