Global Know Your Customer Software Market Size, Share Report Analysis By Component (Software, Services (Managed Services, Professional Services)), By Deployment (On-premise, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End-use (BFSI (Banks, Insurance Companies, Financial Service Provider), Telecom, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 170511

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

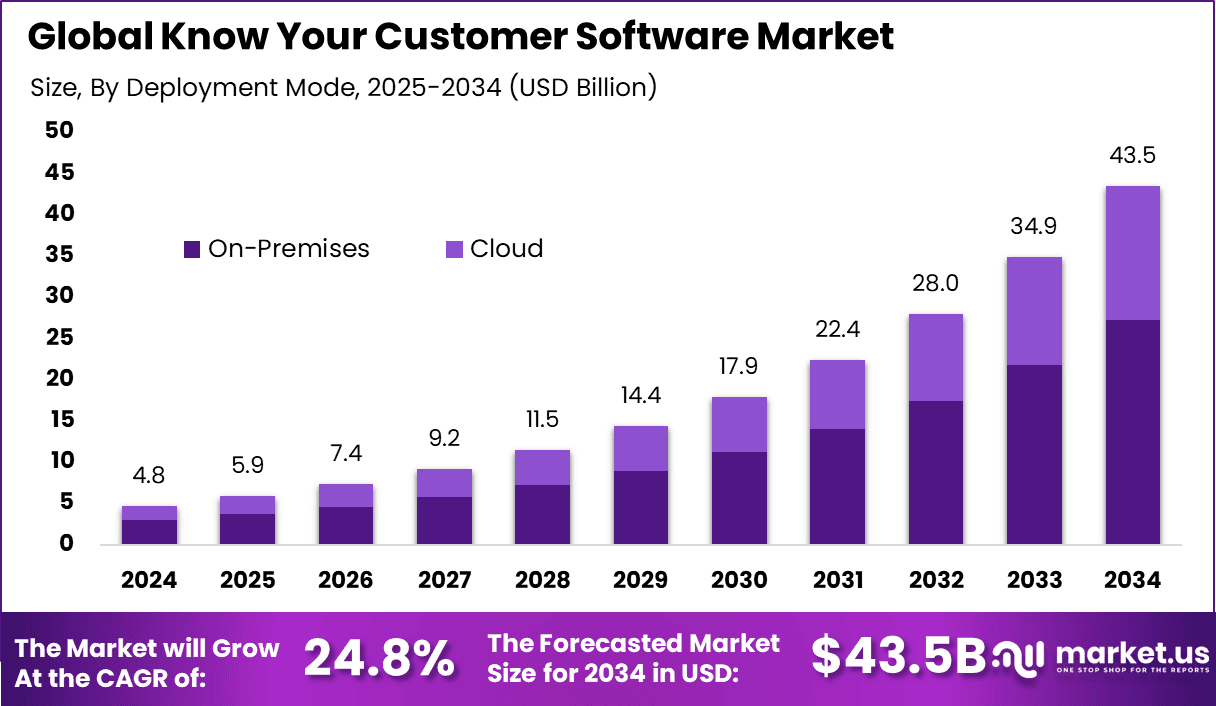

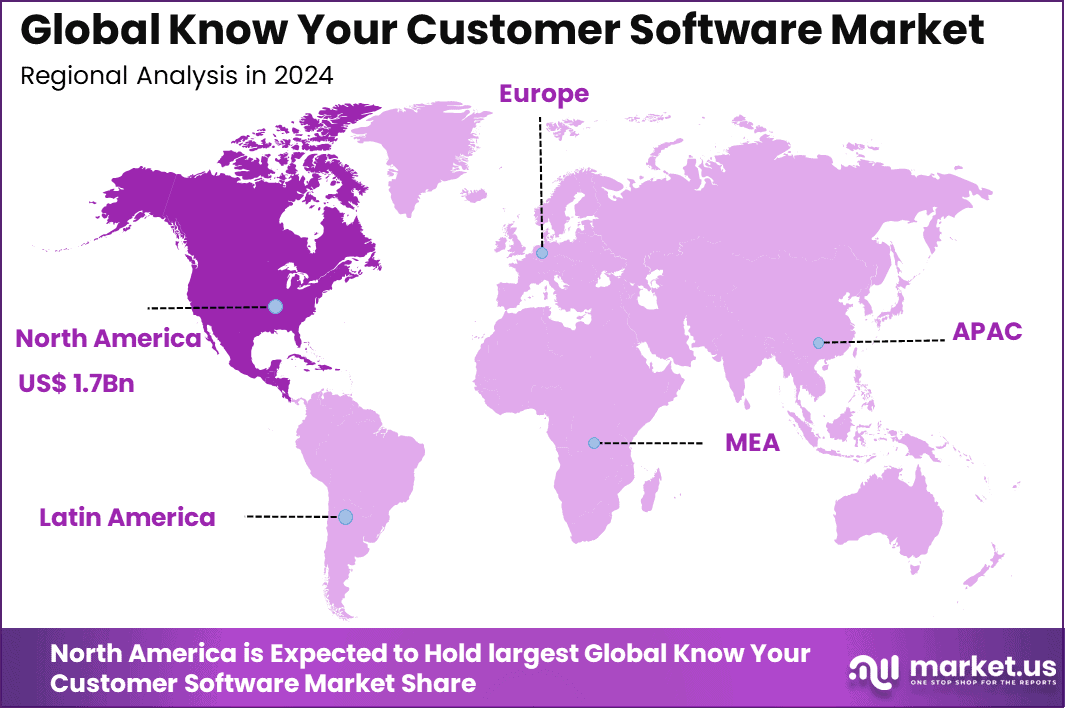

The Global Know Your Customer Software Market generated USD 4.8 billion in 2024 and is predicted to register growth from USD 5.9 billion in 2025 to about USD 43.5 billion by 2034, recording a CAGR of 24.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 35.8% share, holding USD 1.7 Billion revenue.

The Know Your Customer software market (KYC) focuses on digital solutions that help organizations verify customer identity, assess risk, and comply with regulatory requirements. These platforms support identity verification, document validation, biometric checks, sanctions screening, and ongoing customer monitoring. Adoption has increased across banking, financial services, fintech, insurance, telecom, and digital platforms where remote onboarding is common.

The market is supported by the need for secure customer onboarding while maintaining a smooth user experience. Growth of this market is driven by stricter regulatory requirements related to anti money laundering and counter terrorist financing. Organizations are required to verify identities accurately and maintain audit ready records. Rapid growth in digital banking, online payments, and remote account opening has increased the need for automated verification tools.

Rising fraud incidents and identity theft risks have further encouraged investment in advanced verification technologies. Improvements in biometrics, artificial intelligence, and document recognition have also strengthened solution effectiveness and adoption. Demand for KYC software is increasing steadily across both large enterprises and emerging digital businesses.

Financial institutions are adopting these platforms to reduce manual checks, lower compliance costs, and improve onboarding speed. Fintech firms and online platforms are using KYC software to scale operations while meeting regulatory standards. Demand is also rising in regions with expanding digital financial inclusion initiatives. As regulations continue to evolve and digital transactions increase, demand for reliable KYC solutions is expected to remain strong.

Top Market Takeaways

- Software solutions dominate with 67.3%, driven by growing demand for automated identity verification and compliance tools.

- On-premise deployment holds 62.5%, reflecting preference for stronger control over sensitive customer data.

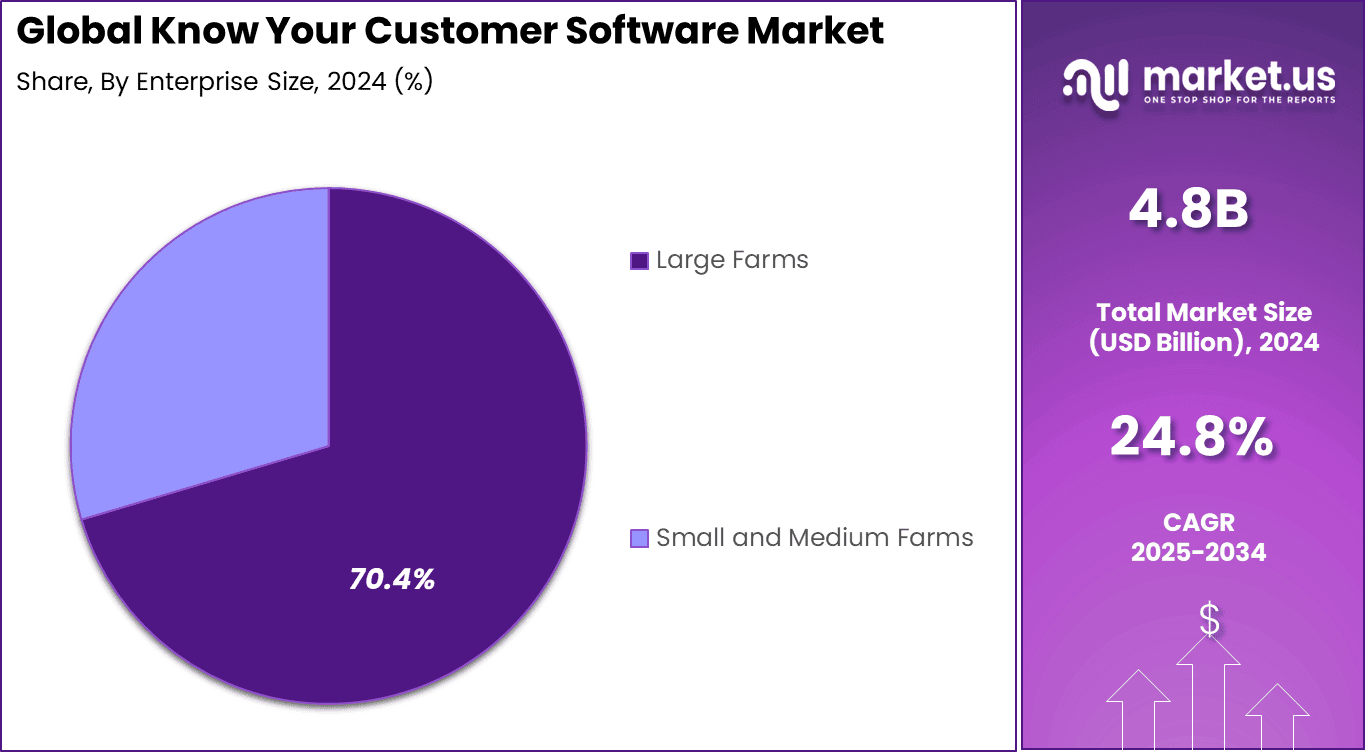

- Large enterprises account for 70.4%, as complex regulatory requirements push adoption of robust KYC platforms.

- The BFSI sector leads with 40.7%, relying heavily on KYC software to meet AML and regulatory obligations.

- North America captures 35.8% of global demand, supported by strict compliance standards and advanced digital banking.

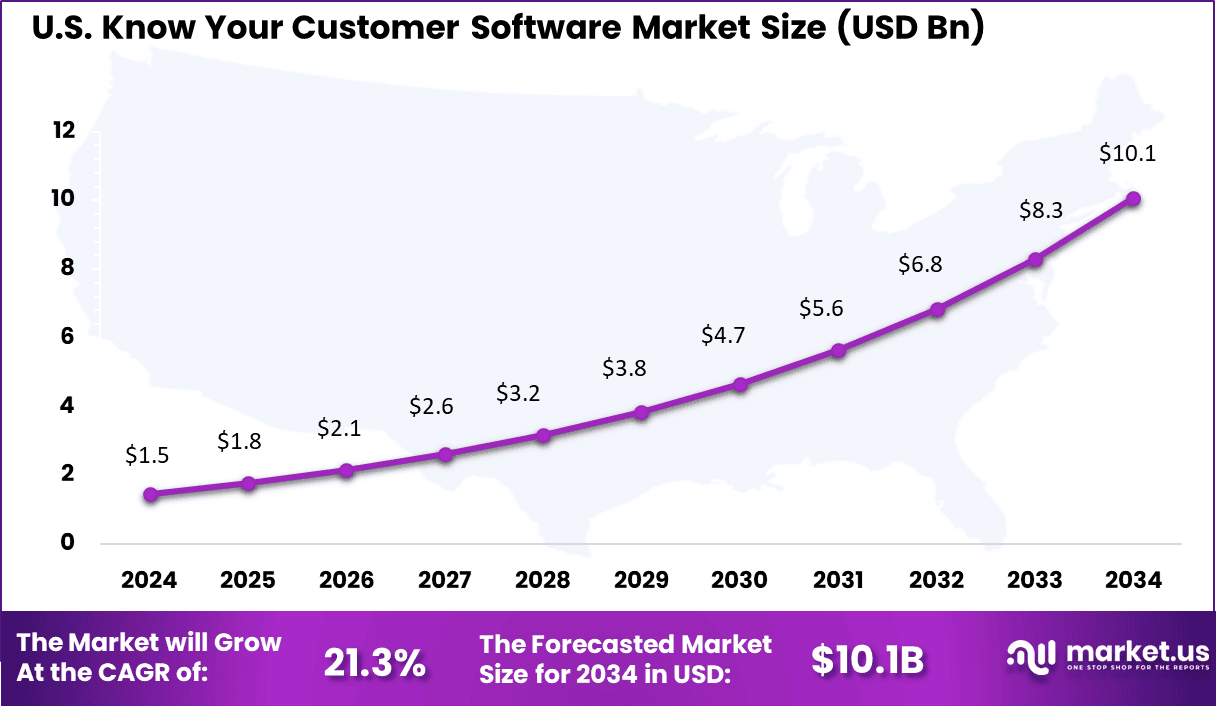

- The U.S. market reached USD 1.46 billion, expanding at a strong 21.3% CAGR due to rising digital onboarding and fraud prevention needs.

Key Adoption

- Over 70% of banks in developed markets are replacing legacy KYC systems with automated and digital platforms.

- More than 70% of KYC onboarding is expected to be automated in 2025, using digital identity checks and biometrics.

- Biometric authentication accounts for 45.4%, driven by strong adoption of facial recognition and fingerprint verification.

- Automated KYC reduces onboarding time from days to minutes, improving customer experience.

- Operational costs fall by 40-70% after automation, while fraud losses drop by up to 50%.

- Biometric eKYC cuts identity fraud by around 85% compared to document-only verification methods.

By Component

The software segment leads with 67.3%, showing that KYC adoption is largely driven by digital platforms rather than manual or service-led models. Software solutions enable identity verification, document validation, and customer risk assessment through automated workflows, which improves speed and accuracy.

Demand for KYC software continues to grow as organizations handle rising customer volumes and stricter regulatory requirements. Automated software reduces human error, supports real-time verification, and allows seamless integration with banking and compliance systems.

By Deployment

On-premise deployment accounts for 62.5%, reflecting the strong preference for internal control over sensitive customer data. Many regulated institutions rely on on-site infrastructure to manage identity information securely and meet internal data governance standards.

This deployment mode is especially important for organizations operating under strict compliance frameworks. On-premise systems allow better customization, tighter security oversight, and easier integration with legacy IT environments.

By Enterprise Size

Large enterprises represent 70.4%, highlighting their dominant role in KYC software adoption. These organizations manage high customer onboarding volumes and complex compliance obligations across multiple regions.

Adoption among large enterprises is driven by the need for scalable and standardized verification processes. KYC software helps these organizations reduce onboarding delays, improve audit readiness, and maintain consistent compliance practices.

By End Use

The BFSI sector holds 40.7%, making it the largest end-use segment for KYC software. Banks and financial institutions face continuous regulatory scrutiny related to customer identity, transaction monitoring, and fraud prevention.

KYC software supports BFSI organizations by enabling accurate identity checks and ongoing customer due diligence. These systems also help reduce financial crime risks while maintaining smooth digital customer experiences.

By Region

North America holds 35.8%, supported by strong regulatory enforcement and widespread adoption of digital banking services. Organizations across the region invest heavily in compliance technology to manage identity verification and risk controls.

The United States reached USD 1.46 Bn with a strong CAGR of 21.3%, reflecting rapid adoption of digital KYC solutions. Growth is driven by expansion of online financial services, rising fraud concerns, and increasing focus on customer data protection.

Key Market Segments

By Component

- Software

- Services

- Managed Services

- Professional Services

By Deployment

- On-premise

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-use

- BFSI

- Banks

- Insurance Companies

- Financial Service Provider

- Telecom

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growth in the Know Your Customer software market is supported by rising enforcement of identity verification and financial compliance rules. Banks, fintech firms, insurers, and digital-first service providers must verify customer identity with high accuracy to reduce fraud and meet regulatory expectations. Manual checks are slow and prone to errors, so many organizations are adopting software that automates document verification, risk scoring, and monitoring of customer profiles.

Another driver is the expansion of digital onboarding across sectors. As more customers open accounts or access services online, organizations need reliable tools that can confirm identities without physical interactions. KYC software supports this growth by providing real time checks of documents, biometric information, and customer history.

Restraint Analysis

A major restraint is the cost of implementing advanced verification systems. High quality KYC tools require secure servers, updated data sources, and continuous system maintenance. Smaller firms or startups may find these costs difficult to manage, leading to slower adoption in markets where financial resources are limited. This creates a gap between large institutions with strong budgets and smaller firms that depend on basic verification methods.

Another restraint comes from data integration challenges. KYC software must connect with internal databases, third party sources, and government identity systems. Many organizations operate on legacy systems that are not prepared for these integrations. As a result, deploying KYC tools often requires additional development work and staff training. This complexity can hold back organizations that lack technical capacity or stable data infrastructure.

Opportunity Analysis

A strong opportunity exists in the increasing use of digital payments, online banking, and cross border financial services. These activities require accurate identification of customers to prevent financial crime. KYC software that supports automated screening and continuous monitoring can serve this growing need. Providers that offer flexible tools for different types of institutions can expand into new regions and sectors.

There is also opportunity in integrating KYC software with emerging authentication methods. Biometrics, liveness checks, and document capture tools supported by mobile devices allow faster identity verification with higher accuracy. Software that can combine these methods in a single workflow is likely to attract interest from organizations seeking to reduce friction during onboarding while keeping risk controls strong.

Challenge Analysis

A key challenge is maintaining data security and customer trust. KYC systems store sensitive identity information, and any breach can cause significant harm to both customers and institutions. Protecting this information requires continuous updates, encryption, and strict access controls. Institutions that lack mature security practices may hesitate to deploy advanced KYC platforms due to the risk of mishandling personal data.

Another challenge involves meeting varied regulatory expectations across different countries. Identity verification rules, document requirements, and reporting standards differ widely from one region to another. KYC software must adapt to these differences to remain useful across global markets. Updating the software to match local regulations requires continuous effort, and delays can limit its use in fast changing compliance environments.

Emerging Trends

One clear trend in the Know Your Customer software market is the shift toward identity verification that uses multiple data sources at once. Traditional document checks are increasingly supported by biometric scans, liveness detection, device analysis, and behavioral signals. This combined approach helps institutions reduce false approvals and detect suspicious activity earlier in the onboarding process.

Another trend is the wider use of continuous customer monitoring. Instead of verifying identity only at the time of onboarding, institutions are deploying systems that track changes in customer behavior, updated sanctions lists, and risk indicators over time. This model supports ongoing compliance and improves fraud detection because it flags unusual activity as soon as it appears.

Growth Factors

Strong growth in this market is supported by the expansion of digital onboarding across banking, payments, investment platforms, insurance, and e-commerce. As more users prefer opening accounts online, institutions need reliable tools to verify identities without in-person checks. KYC software helps reduce manual work and supports large volumes of applicants with consistent accuracy.

Another growth factor is the rise in global financial regulations focused on anti-money laundering and customer due diligence. Governments continue to strengthen rules around identity verification, reporting, and screening. Organizations that operate across regions must comply with these rules to avoid penalties. KYC software offers structured workflows, automated checks, and clear audit trails, making it easier to meet regulatory expectations.

Competitive Analysis

Trulioo, Jumio, Onfido, AU10TIX, and Mitek Systems lead the know your customer software market with digital identity verification platforms that support document checks, biometric authentication, and global data coverage. Their solutions are widely used by banks, fintech firms, and online platforms to meet onboarding and regulatory requirements. These companies focus on accuracy, speed, and fraud prevention.

IDEMIA, LexisNexis Risk Solutions, Refinitiv, ComplyAdvantage, GB Group, Shufti Pro, and SumSub strengthen the market with risk intelligence, sanctions screening, and continuous customer monitoring. Their platforms help organizations detect financial crime, manage AML risks, and maintain audit-ready compliance. These providers emphasize real-time data updates, global regulatory alignment, and scalable deployment.

Regula Forensics, Acuant, IDnow, Experian, Thomson Reuters, KYC Global Technologies, PassFort, FIS, and other players broaden the landscape with modular KYC tools and workflow-driven compliance platforms. Their offerings support customer lifecycle management and regulatory reporting. These companies focus on flexibility, API integration, and cost efficiency. Growing adoption of digital finance and regulatory technology continues to drive steady growth in the KYC software market.

Top Key Players in the Market

- Trulioo Information Services Inc.

- Jumio Corporation

- Onfido Ltd.

- AU10TIX Limited

- Mitek Systems Inc.

- IDEMIA Group S.A.S.

- LexisNexis Risk Solutions Inc.

- Refinitiv Limited

- ComplyAdvantage Ltd.

- GB Group plc

- Shufti Pro Limited

- SumSub Ltd.

- Regula Forensics Inc.

- Acuant Inc.

- IDnow GmbH

- Experian plc

- Thomson Reuters Corporation

- KYC Global Technologies Ltd.

- PassFort Limited

- Fidelity National Information Services Inc.

- Others

Recent Developments

- In October 2025, Trulioo unveiled next‑generation identity capabilities on its platform, adding advanced document verification (including tamper checks on utility bills and bank statements), deepfake and “known faces” detection, and real‑time KYB risk intelligence so customers can monitor business counterparties continuously instead of treating KYB as a one‑off check.

- In May 2025, its Online Identity Study highlighted how generative‑AI‑driven scams are eroding trust and argued that traditional document‑only KYC is no longer sufficient, pushing enterprises toward continuous, AI‑driven monitoring.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Bn Forecast Revenue (2034) USD 43.5 Bn CAGR(2025-2034) 24.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services (Managed Services, Professional Services)), By Deployment (On-premise, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End-use (BFSI (Banks, Insurance Companies, Financial Service Provider), Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trulioo Information Services Inc., Jumio Corporation, Onfido Ltd., AU10TIX Limited, Mitek Systems Inc., IDEMIA Group S.A.S., LexisNexis Risk Solutions Inc., Refinitiv Limited, ComplyAdvantage Ltd., GB Group plc, Shufti Pro Limited, SumSub Ltd., Regula Forensics Inc., Acuant Inc., IDnow GmbH, Experian plc, Thomson Reuters Corporation, KYC Global Technologies Ltd., PassFort Limited, Fidelity National Information Services Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Know Your Customer Software MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

Know Your Customer Software MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Trulioo Information Services Inc.

- Jumio Corporation

- Onfido Ltd.

- AU10TIX Limited

- Mitek Systems Inc.

- IDEMIA Group S.A.S.

- LexisNexis Risk Solutions Inc.

- Refinitiv Limited

- ComplyAdvantage Ltd.

- GB Group plc

- Shufti Pro Limited

- SumSub Ltd.

- Regula Forensics Inc.

- Acuant Inc.

- IDnow GmbH

- Experian plc

- Thomson Reuters Corporation

- KYC Global Technologies Ltd.

- PassFort Limited

- Fidelity National Information Services Inc.

- Others