Global Kitting And Assembly Packaging Services Market Size, Share, Growth Analysis By Service (Kitting, Light Assembly, Re-Packaging, Labelling, Others), By Material (Corrugated Paper, Plastics, Metals, Composites, Others), By Packaging Format (Boxes, Blister and Clamshells, Bags and Pouches, Returnable Crates, Others), By End-user (Consumer Goods, Healthcare and Pharma, Industrial and Aerospace, Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168653

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

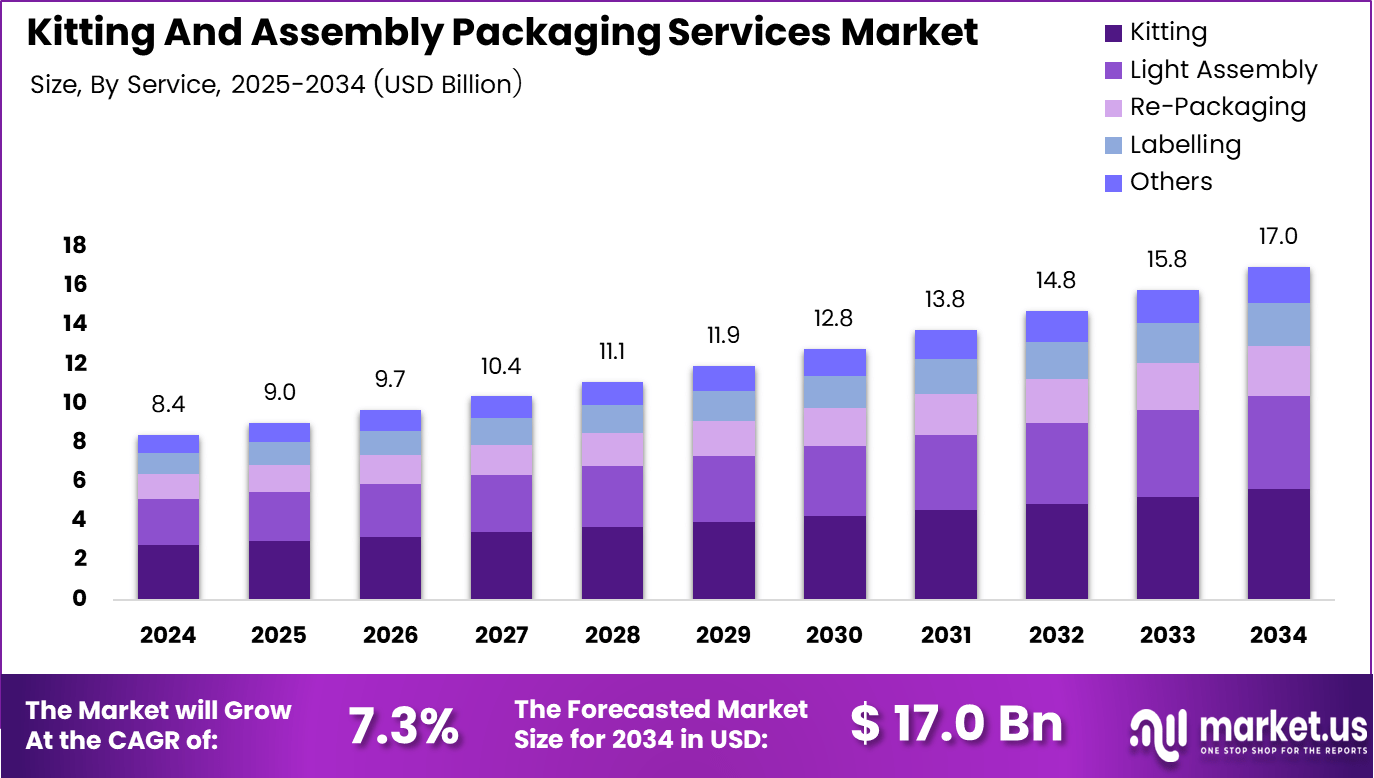

The Global Kitting And Assembly Packaging Services Market size is expected to be worth around USD 17.0 billion by 2034, from USD 8.4 billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The Kitting and Assembly Packaging Services Market represents a value-added segment of contract packaging where components are organized, assembled, and packaged into ready-to-ship units. This market improves fulfillment speed, reduces warehouse complexity, and enhances product presentation across industries seeking scalable and customized packaging solutions.

Growing e-commerce volumes continue to accelerate demand as brands streamline order fulfillment through consolidated kits that reduce handling and shipping time. Companies increasingly rely on outsourced kitting partners to optimize inventory accuracy and support multi-SKU packaging needs. This shift strengthens market adoption among consumer goods, healthcare, industrial, and electronics supply chains.

Meanwhile, the expansion of omnichannel retailing creates additional pressure for fast and error-free assembly packaging. Businesses actively pursue lean packaging workflows that reduce operational waste and enhance productivity. As a result, automation, ergonomic workspace redesign, and standardized assembly protocols are becoming foundational investments for organizations modernizing their fulfillment ecosystems.

Moreover, government initiatives supporting logistics infrastructure upgrading indirectly stimulate kitting service adoption. Regulatory emphasis on traceability, labeling compliance, and sustainability also motivates companies to integrate structured kitting models. These trends provide long-term opportunities for providers offering eco-friendly materials, serialized components, and compliant assembly workflows.

In addition,Survey highlights operational benefits that strengthen market relevance. According to a study published in the Journal of Survey, structured kitting layouts achieved 36% to 49% reduction in kitting times for high-demand parts and improved space utilization by 30% to 36%. The study examined a 7,350-sqft kitting area containing four aisles totaling 4,150 sqft and eight rack rows covering 3,200 sqft dedicated to seasonal field-cultivator parts.

Further extending operational insights, consumer fulfillment behavior also shapes packaging requirements. According to arXiv logistics behavior analysis, the median value for shortening delivery-time slots (VOTS) is only 5.0 JPY/hour, indicating low monetary sensitivity toward narrower delivery windows and reinforcing the need for fast assembly packaging that minimizes delays without raising cost structures.

Key Takeaways

- The Global Kitting and Assembly Packaging Services Market reached USD 8.4 billion in 2024 and is projected to hit USD 17.0 billion by 2034.

- The market is expected to grow steadily at a CAGR of 7.3% between 2025 and 2034.

- Plastics dominated the material segment with a strong share of 47.2% in 2024.

- Primary packaging led the packaging type segment with a commanding 59.4% share.

- Food & Beverage emerged as the leading end-use segment, accounting for 41.6% of total market demand.

- North America remained the largest regional market, securing a market share of 43.9% valued at USD 3.6 billion.

By Service Analysis

Kitting dominates with 33.2% due to its structured workflow benefits, accuracy improvements, and widespread adoption across multi-SKU fulfillment operations.

In 2024, Kitting held a dominant market position in the By Service Analysis segment of the Kitting And Assembly Packaging Services Market, with a 33.2% share. This service supports organized component consolidation, faster picking, and reduced handling errors, making it essential for e-commerce, subscription box, and multi-product packaging workflows.

Light Assembly played a significant role by enabling businesses to combine pre-manufactured components into finished or semi-finished sets. This service accelerated final product readiness, reduced labor-intensive in-house tasks, and enhanced scalability for brands needing accurate assembly of hardware, cosmetic kits, health packs, and promotional bundles.

Re-Packaging contributed to value recovery and improved product presentation. This included reconfiguring packaged items, replacing damaged outer packs, and preparing goods for new markets or campaigns. Its importance grew as companies optimized inventory management, reduced waste, and enhanced customer experience with cleaner, more organized packaging.

Labelling supported traceability, compliance, and brand communication. Correct labeling ensured accurate identification of kitted units, batch tracking, and region-specific regulatory alignment—particularly in healthcare, food, and electronics segments—which depend heavily on precise and error-free labeling activities.

Others included shrink-wrapping, bundling, inspection, and quality checks that strengthened overall packaging efficiency. These supplementary services helped organizations enhance operational flexibility and tailor packaging workflows for specialized applications requiring high accuracy and customization.

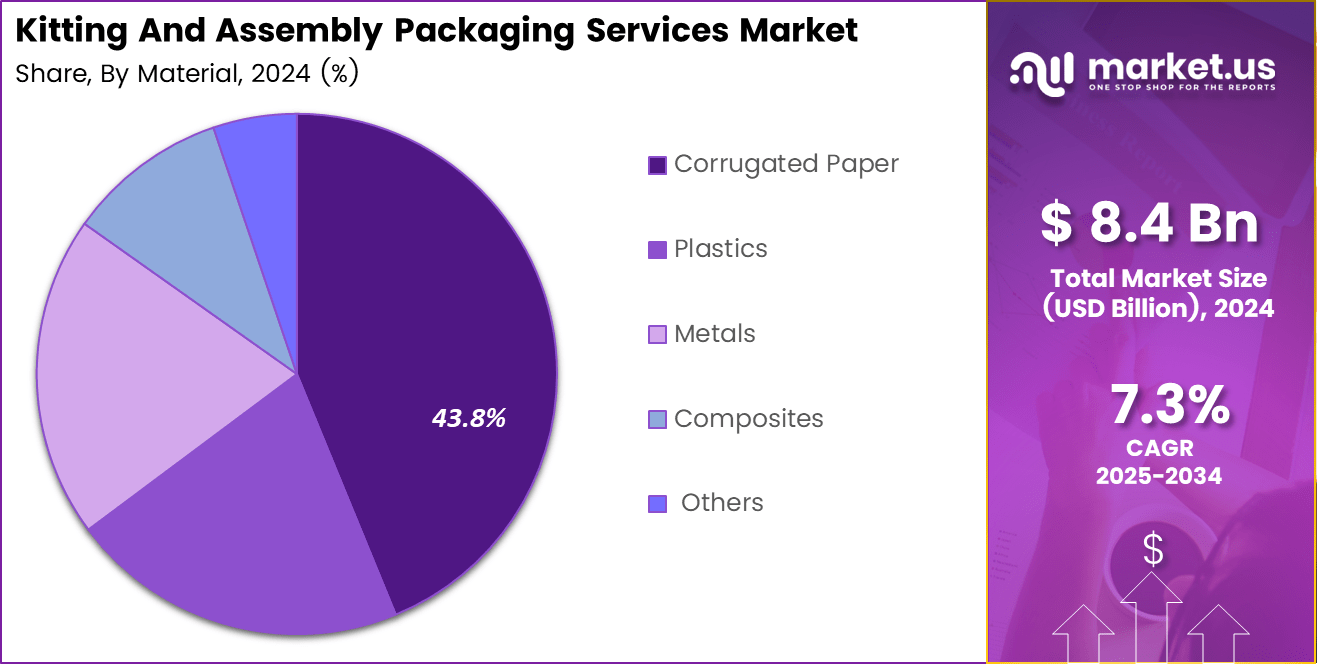

By Material Analysis

Corrugated Paper dominates with 43.8% due to its strength, recyclability, and suitability for protective kitting and assembly packaging.

In 2024, Corrugated Paper held a dominant market position in the By Material Analysis segment of the Kitting And Assembly Packaging Services Market, with a 43.8% share. Its lightweight, sturdy construction supported safe transport of multi-item kits while aligning with sustainability goals, making it a preferred packaging base.

Plastics remained widely used for protective inserts, flexible pouches, and transparent kit components. Their durability and moisture resistance supported secure handling of medical devices, electronics, and cosmetic products, enabling companies to achieve reliable performance in environments requiring strong barrier properties.

Metals played a niche but critical role in heavy-duty and industrial kitting. Metal trays and structured components were essential for aerospace, automotive, and high-precision manufacturing applications where durability, rigidity, and long-term reusability were key selection factors.

Composites supported specialized applications requiring high strength-to-weight ratios. These materials ensured structural stability for sensitive or irregular-shaped products, enabling secure storage and transportation of kits in demanding environments across healthcare and engineering sectors.

Others included biodegradable substrates, molded fiber, and hybrid engineered materials that addressed evolving sustainability needs. These alternatives allowed companies to integrate eco-friendly features without compromising the strength or protection required in complex kitting workflows.

By Packaging Format Analysis

Boxes dominate with 39.1% due to their versatility, protection level, and suitability for standardized and custom kitting layouts.

In 2024, Boxes held a dominant market position in the By Packaging Format Analysis segment of the Kitting And Assembly Packaging Services Market, with a 39.1% share. They accommodated multiple product configurations, enhanced stacking strength, and supported reliable shipping performance across retail and industrial applications.

Blister and Clamshells served sectors requiring visibility, hygiene, and tamper resistance. These formats were essential for pharmaceuticals, electronics accessories, and consumer goods, helping companies maintain product integrity while improving shelf impact and user convenience in pre-assembled kits.

Bags and Pouches offered lightweight and flexible options suitable for small components, refill kits, and grouped accessories. Their compact design reduced storage footprints and supported moisture-sensitive or single-use assembly packaging tasks, particularly in food, personal care, and healthcare segments.

Returnable Crates were widely used in industrial, automotive, and manufacturing supply chains. Their reusability, robust structure, and compatibility with repetitive kitting cycles reduced long-term costs and improved sustainability metrics for businesses managing large-volume assembly parts.

Others included tubes, sleeves, and hybrid protective structures tailored for niche kitting requirements. These formats supported delicate, oversized, and irregular products where customized packaging geometries enhanced operational efficiency and product safety.

By End-user Analysis

Consumer Goods dominate with 38.7% owing to rising demand for bundled packs, gift sets, subscription kits, and promotional assemblies.

In 2024, Consumer Goods held a dominant market position in the By End-user Analysis segment of the Kitting And Assembly Packaging Services Market, with a 38.7% share. This segment relied on efficient kitting to manage diverse SKUs, seasonal variations, and high-volume packaging cycles across retail categories.

Healthcare and Pharma used kitting to streamline sample kits, diagnostic packs, device assemblies, and compliance-driven packaging. Precision, sterility, and traceability remained critical, making structured assembly systems essential for supporting clinical, hospital, and laboratory distribution workflows.

Industrial and Aerospace required robust, highly organized kitting systems for complex parts, maintenance kits, and engineering assemblies. These applications benefited from reduced downtime, accurate component staging, and reliable logistics performance within mission-critical environments.

Electronics relied on kitting for cables, modules, device accessories, and component sets. Anti-static handling, secure compartmentalization, and accuracy-driven assembly ensured reliable shipment of delicate and high-value electronic items across global supply chains.

Others included education, automotive accessories, home improvement products, and small tools. These sectors adopted kitting services to improve product presentation, reduce manual sorting, and enhance delivery accuracy across diverse packaging requirements.

Key Market Segments

By Service

- Kitting

- Light Assembly

- Re-Packaging

- Labelling

- Others

By Material

- Corrugated Paper

- Plastics

- Metals

- Composites

- Others

By Packaging Format

- Boxes

- Blister and Clamshells

- Bags and Pouches

- Returnable Crates

- Others

By End-user

- Consumer Goods

- Healthcare and Pharma

- Industrial and Aerospace

- Electronics

- Others

Drivers

Rising Outsourcing of Contract Packaging Reduces Operational Burdens

The rising outsourcing of contract packaging is expected to drive strong market momentum as companies try to cut operational workloads and reduce in-house labor dependencies. Many businesses now rely on external kitting specialists who manage tasks faster and more efficiently, helping manufacturers focus on core production. This shift increases demand for organized, high-volume kitting solutions. The expansion of multi-SKU product portfolios across industries is projected to support market growth as brands introduce more product variations, accessories, and bundled offers.

Managing these combinations internally becomes complex, increasing the need for specialized kitting partners who can coordinate inventory, labeling, and assembly with accuracy. Growing demand for customized promotional and subscription-box kitting also accelerates adoption. Brands in consumer goods, electronics, and beauty increasingly seek personalized packaging to enhance unboxing experiences. This trend boosts the requirement for flexible kitting workflows.

The increased use of automation further strengthens the market. Automated conveyors, pick-and-place systems, and advanced sorting tools help reduce errors and scale high-volume assembly. This modernization improves speed, efficiency, and cost control for clients relying on kitting services.

Restraints

Labor Shortages in Skilled Packaging Operations Restrict Market Expansion

Labor shortages in skilled packaging and assembly roles remain a significant restraint for this market. Many facilities struggle to find trained workers capable of handling detailed kitting tasks such as component identification, precise arrangement, and compliance-based packaging. This shortage slows throughput and increases dependency on temporary labor.

The high setup cost of advanced kitting automation also limits adoption, especially for small and mid-sized companies. Robotics, vision systems, and automated sorting require large upfront investment and ongoing maintenance, making it difficult for new entrants to scale technologically. These capital constraints discourage rapid modernization and delay workflow optimization.

Companies may postpone upgrades, leading to slower fulfillment cycles. As a result, limited access to skilled labor and expensive automation systems can create operational bottlenecks that affect overall efficiency in contract kitting and assembly environments

Growth Factors

Rapid Growth of E-Commerce Increases Demand for Fulfillment Kitting

The rapid rise of e-commerce creates strong growth opportunities for value-added fulfillment kitting, especially as brands look for faster order consolidation and personalized packaging. Subscription boxes, combo kits, and promotional bundles expand as online retail volume increases. Integrating IoT and RFID technologies into assembly packaging opens new opportunities for smart tracking.

These tools improve inventory visibility, reduce errors, and allow real-time monitoring of components throughout the kitting cycle. There is a rising demand for climate-controlled and sterile kitting in healthcare, pharmaceuticals, and medical-device packaging. As regulatory expectations rise, hospitals and manufacturers need contamination-free assembly environments.

Together, these opportunities support long-term expansion as companies seek smarter, safer, and more automated kitting solutions linked with digital tracking and specialized packaging conditions.

Emerging Trends

Shift Toward Sustainable, Minimal-Waste Kitting Materials Gains Momentum

A strong shift toward sustainable, minimal-waste packaging materials is shaping market trends. Companies increasingly replace plastics with recycled cardboard, molded fiber, and biodegradable fillers to meet environmental regulations and consumer expectations. The growing use of 3D modeling for pre-assembly validation reduces errors and redesign costs. This trend helps clients visualize kit layouts, optimize space, and improve packaging accuracy before production begins.

Robotics adoption is rising in micro-assembly and precision packaging, especially for electronics, medical devices, and high-value parts. Robots improve speed and accuracy while reducing human error in delicate tasks. On-demand and just-in-time kitting solutions are also trending as companies aim to reduce inventory costs and align assembly volumes with real-time demand. This flexible model supports lean operations and faster delivery cycles across industries.

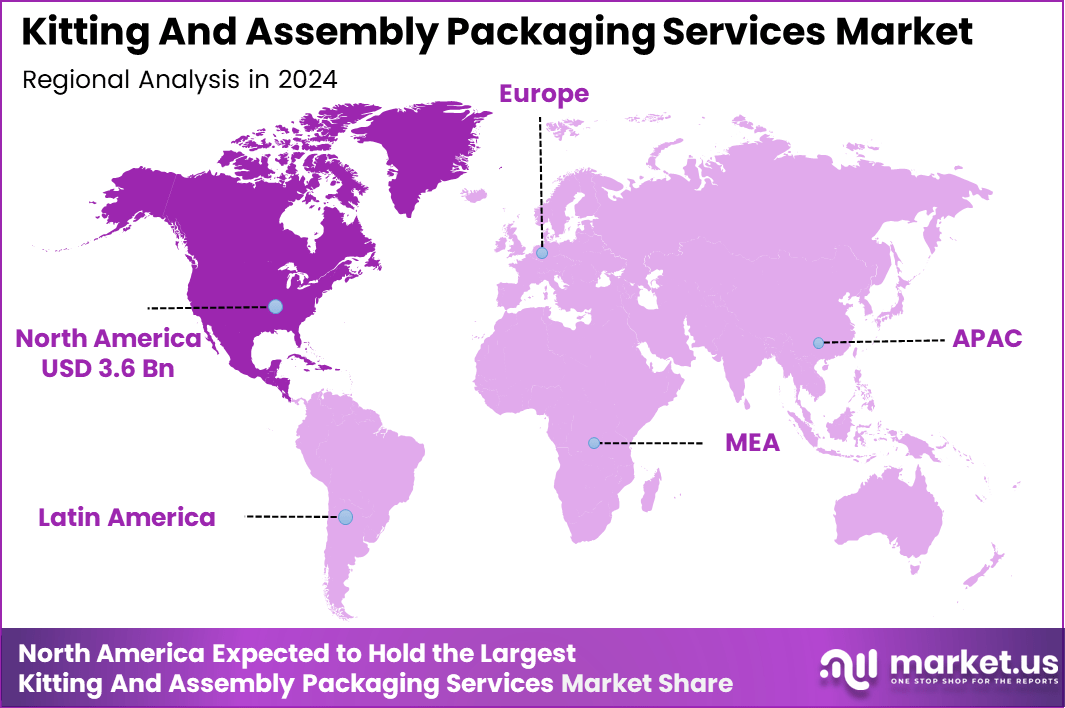

Regional Analysis

North America Dominates the Kitting and Assembly Packaging Services Market with a Market Share of 43.9%, Valued at USD 3.6 Billion

North America emerged as the dominant regional market, capturing a substantial 43.9% share and reaching a valuation of USD 3.6 billion in 2024. The region expanded as industries accelerated automation, standardized fulfillment workflows, and strengthened contract packaging partnerships. Furthermore, strong demand from retail, healthcare, and electronics sectors continued to support the rise of advanced kitting and assembly services.

Europe Kitting And Assembly Packaging Services Market Trends

Europe experienced steady expansion due to increasing emphasis on sustainable materials, eco-friendly workflows, and efficient packaging consolidation. The region progressed as manufacturers modernized fulfillment centers and adopted precision-based kitting to streamline complex supply chains. Additionally, rising e-commerce penetration encouraged broader outsourcing of assembly-intensive packaging services across major EU economies.

Asia Pacific Kitting And Assembly Packaging Services Market Trends

Asia Pacific advanced rapidly, supported by large-scale manufacturing activities, cost-effective labor structures, and growing outsourcing trends. The region benefited from strong industrialization in China, India, and Southeast Asia, improving demand for organized kitting solutions. Expanding electronics, automotive, and consumer goods production further accelerated regional adoption across diverse sectors.

Middle East and Africa Kitting And Assembly Packaging Services Market Trends

The Middle East and Africa region grew gradually as industries strengthened logistics infrastructure and adopted structured packaging operations. Expanding FMCG, pharmaceutical, and industrial sectors contributed to rising kitting and assembly requirements. Additionally, government-led diversification programs supported market development, enabling wider adoption of value-added packaging services.

Latin America Kitting And Assembly Packaging Services Market Trends

Latin America observed moderate growth fueled by increasing contract packaging activity and rising regional supply chain optimization efforts. Expanding retail and food processing industries supported broader integration of kitting solutions. Moreover, improving industrial capabilities in Brazil, Mexico, and neighboring economies encouraged steady market development across multiple applications.

U.S. Kitting And Assembly Packaging Services Market Trends

The U.S. market expanded consistently, driven by strong adoption of automation-driven kitting, SKU bundling, and lean packaging operations. High fulfillment volumes across e-commerce, healthcare, and consumer goods industries accelerated reliance on specialized assembly services. Continuous upgrades in warehousing technology and supply chain digitalization further strengthened the country’s market position.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kitting And Assembly Packaging Services Market Company Insights

The global Kitting and Assembly Packaging Services Market in 2024 reflected steady operational refinement, with leading companies strengthening capabilities through advanced workflows, automation enhancements, and greater service customization. WestRock Company advanced its position by expanding integrated packaging solutions that improved efficiency across fulfillment environments. The company leveraged strong material expertise and scalable assembly operations to support rising demand for streamlined kitting programs across multiple industries.

Sepha continued enhancing its role by focusing on precision-driven packaging systems that supported consistent accuracy in component handling and assembly activities. Its solutions aligned well with industries requiring high-integrity packaging, enabling the company to serve specialized kitting requirements with improved reliability and speed.

Peoria Production Solutions strengthened service capabilities through flexible labor systems, customized assembly workflows, and high-volume kitting support. The company’s process-oriented approach enabled faster turnaround times, delivering dependable packaging outcomes for consumer goods, industrial components, and retail-ready kits.

ActionPak expanded its relevance by offering tailored kitting, co-packing, and assembly services designed for brands seeking rapid market deployment. The company’s multi-facility infrastructure and adaptable production lines helped businesses manage promotional kits, subscription boxes, and seasonal assortments with improved operational consistency.

Across the broader market, increasing outsourcing trends supported growth for additional players such as Co-Pak, Packservice Group, MDI, Hollingsworth, Jonco Industries, and ProStar. These companies benefited from rising demand for value-added assembly solutions, SKU bundling, and fulfillment-ready packaging formats, collectively contributing to a more agile and responsive global kitting and assembly ecosystem.

Top Key Players in the Market

- Ryder System, Inc.

- FedEx Corporation

- XPO, Inc.

- Geodis S.A.

- ShipBob, Inc.

- Kühne + Nagel International AG

- Schenker AG

- CEVA Logistics S.A.

- NFI Industries, Inc.

- Saddle Creek Logistics Services, Inc.

Recent Developments

- In Dec 2025, Value Added Distributors (VAD) acquired L.T.L. Supply, a manufacturer of custom wire harnesses, expanding its manufacturing depth.

The acquisition integrates new production capabilities with VAD’s existing kitting, assembly, and vendor managed inventory services. - In Dec 2025, Sonepar acquired Grup Carol, a specialist in B2B distribution of industrial products in Spain.

The deal strengthens Sonepar’s industrial kitting and assembly service footprint across key European markets. - In Jul 2024, Smurfit Kappa and WestRock completed their mega merger to form Smurfit Westrock, creating a global leader in sustainable paper and packaging.

The combined entity delivers expanded kitting and secondary assembly capabilities with a significantly enhanced global operational scale.

Report Scope

Report Features Description Market Value (2024) USD 8.4 billion Forecast Revenue (2034) USD 17.0 billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Kitting, Light Assembly, Re-Packaging, Labelling, Others), By Material (Corrugated Paper, Plastics, Metals, Composites, Others), By Packaging Format (Boxes, Blister and Clamshells, Bags and Pouches, Returnable Crates, Others), By End-user (Consumer Goods, Healthcare and Pharma, Industrial and Aerospace, Electronics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ryder System, Inc., FedEx Corporation, XPO, Inc., Geodis S.A., ShipBob, Inc., Kühne + Nagel International AG, Schenker AG, CEVA Logistics S.A., NFI Industries, Inc., Saddle Creek Logistics Services, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Kitting and Assembly Packaging Services MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Kitting and Assembly Packaging Services MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ryder System, Inc.

- FedEx Corporation

- XPO, Inc.

- Geodis S.A.

- ShipBob, Inc.

- Kühne + Nagel International AG

- Schenker AG

- CEVA Logistics S.A.

- NFI Industries, Inc.

- Saddle Creek Logistics Services, Inc.