Global Jam, Jelly And Preserve Market Size, Share, And Business Benefits By Product Type (Jams, Jelly, Marmalade and Preserves, Honey, Sweet Spreads, Others), By Ingredient Type (Pectin, Fruit and Fruit Juice, Sweeteners, Essence, Others), By Flavor Type (Mango, Blackberry, Grape, Strawberry, Others), By Distribution Channel (Hypermarket/Supermarket, E-Commerce, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152761

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

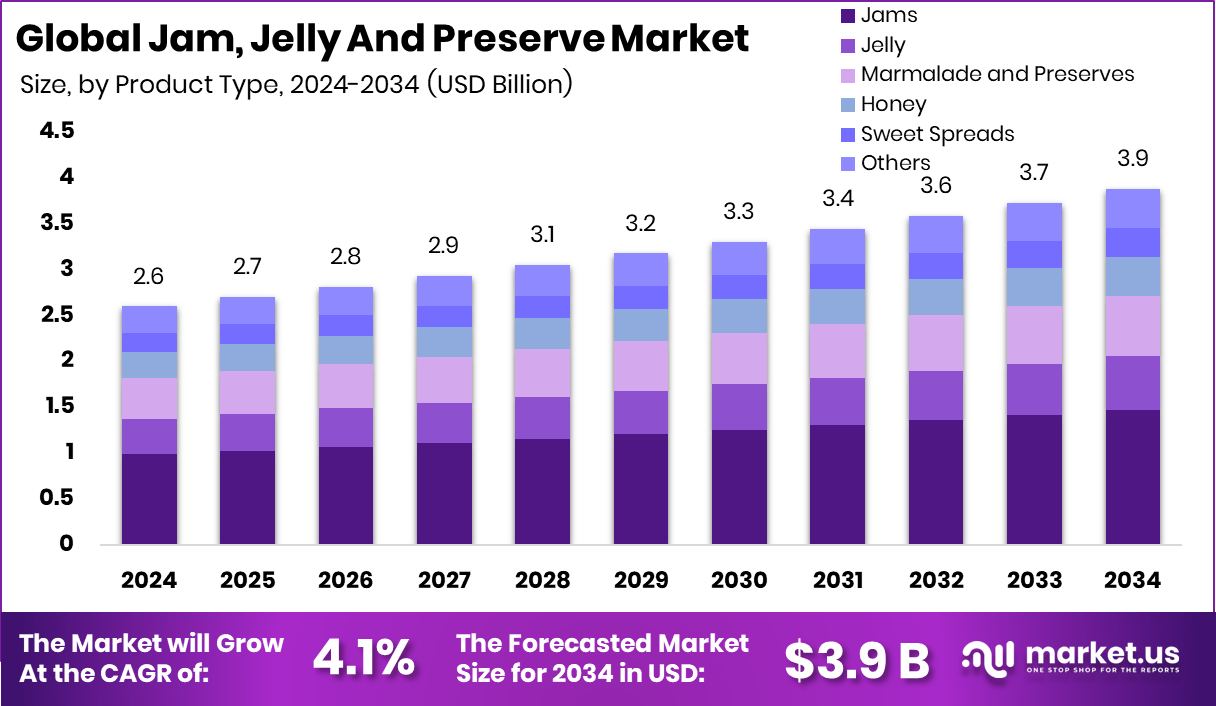

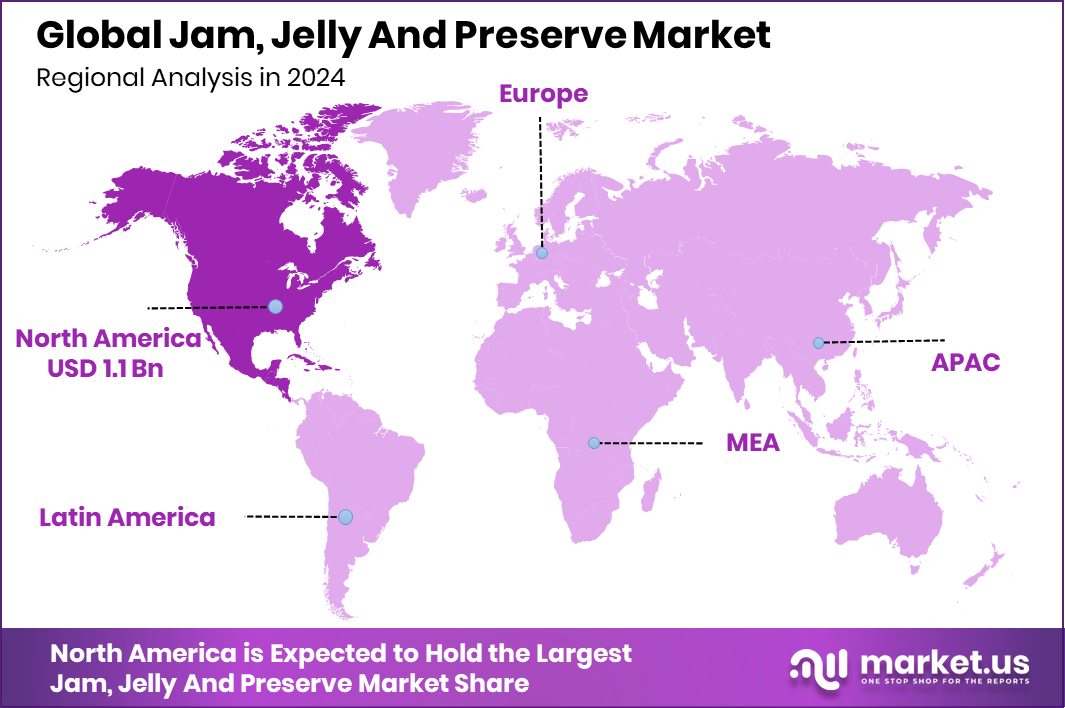

Global Jam, Jelly And Preserve Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034. Consumers in North America increasingly prefer fruit-based spreads, supporting the region’s strong USD 1.1 billion.

Jam, jelly, and preserves are fruit-based products made by combining fruit, sugar, and pectin, then cooking the mixture to create a thick spread. While all three are used as sweet spreads or condiments, they differ in texture and composition. Jam contains crushed or pureed fruit and has a thick, spoonable consistency. Jelly is made from fruit juice and is more translucent and firmer in texture.

The jam, jelly, and preserve market refers to the commercial industry involved in the production, distribution, and sale of fruit-based spreads. It covers both traditional recipes and modern variants using low sugar, organic, or exotic ingredients. The market includes a wide range of products catering to household consumption, foodservice applications, and industrial use in bakery and confectionery. According to an industry report, Alienkind, a next-generation juice company, has secured $1.2 million in seed funding.

The growth of this market is largely driven by rising health awareness and preference for natural fruit-based products. Consumers are increasingly seeking clean-label, non-GMO spreads with real fruit content and no artificial preservatives. Additionally, the inclusion of low-sugar and sugar-free variants has attracted health-conscious buyers, supporting consistent growth in both mature and emerging economies.

According to an industry report, Good Good raised $20 million in Series B funding led by SÍA and private investors, launched a no-added-sugar Peanut Butter, and expanded to 3,500 Walmart stores with its jam lineup.

Key Takeaways

- Global Jam, Jelly And Preserve Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.6 billion in 2024, and grow at a CAGR of 4.1% from 2025 to 2034.

- Jams lead the Jam, Jelly and Preserve Market by product type, holding a 37.9% share globally.

- Fruit and fruit juice dominate ingredient usage in the market, accounting for a significant 41.2% share.

- Strawberry flavor remains the most preferred choice among consumers, representing 33.1% of total flavor sales.

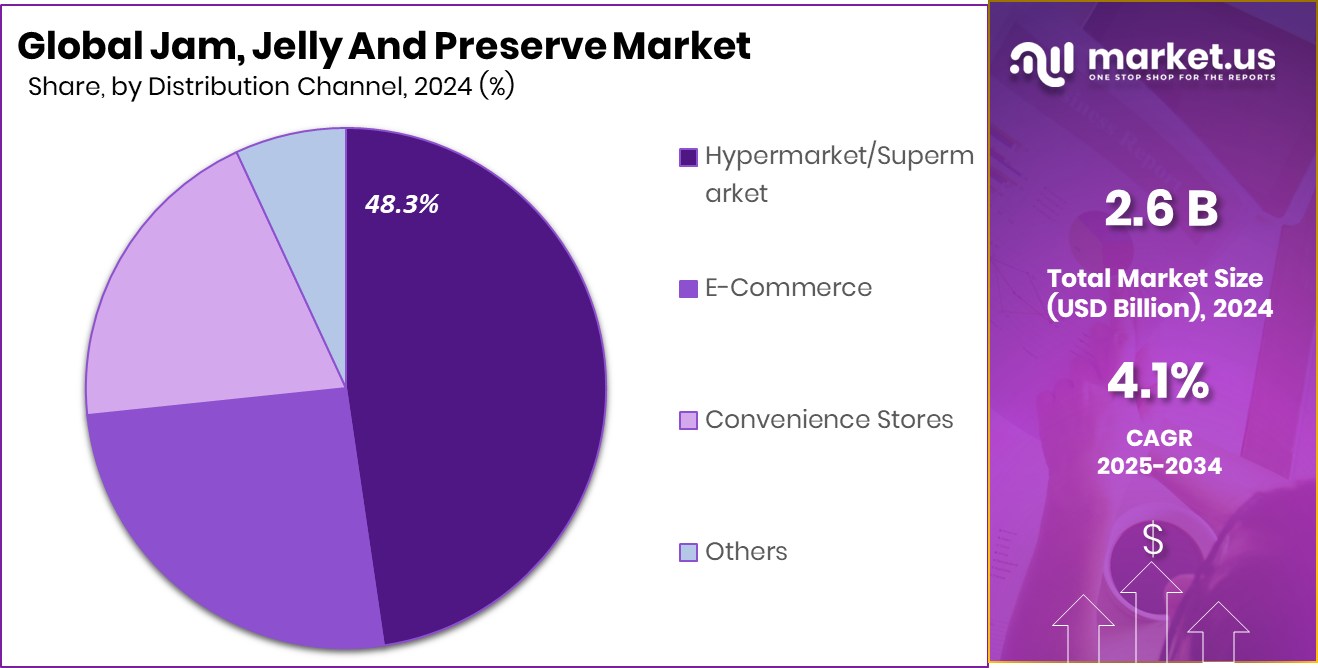

- Hypermarkets and supermarkets are the top distribution channels, contributing 48.3% to the overall market reach.

- North America dominated with a 44.80% share in the global market in 2024.

By Product Type Analysis

Jams dominate the Jam, Jelly, and Preserve Market with a 37.9% share.

In 2024, Jams held a dominant market position in the By Product Type segment of the Jam, Jelly, and Preserve Market, with a 37.9% share. This leadership can be attributed to the widespread consumer preference for fruit-based spreads with rich texture and natural taste. Jams, being made from crushed or pureed whole fruits, offer a dense and flavorful experience, making them a staple in both household consumption and foodservice applications.

Consumers increasingly favor jams due to their perceived health benefits when made with natural ingredients and fewer preservatives. The growing interest in fruit-rich, clean-label products further supports the expansion of this segment. In particular, demand has been rising in urban markets where convenient, ready-to-use food options are gaining ground.

The dominant share of jams also reflects their adaptability across price ranges, from mass-market offerings to premium, artisanal varieties. This broad appeal, combined with evolving packaging formats and flavor innovations, continues to reinforce the strong position of jams within the overall product type segment of the market.

By Ingredient Type Analysis

Fruit and fruit juice are key ingredients, accounting for 41.2% market share.

In 2024, Fruit and Fruit Juice held a dominant market position in the By Ingredient Type segment of the Jam, Jelly and Preserve Market, with a 41.2% share. This leadership reflects the strong consumer inclination towards products made from natural, recognizable ingredients.

Fruit and fruit juice are considered essential components for achieving authentic flavor, color, and aroma in jams, jellies, and preserves, which directly influences purchase decisions. Consumers increasingly associate fruit-based ingredients with freshness, nutritional value, and higher product quality, driving consistent demand across global markets.

The growing health consciousness among consumers has reinforced the preference for fruit and fruit juice as primary ingredients, especially as these elements are perceived to be more wholesome and less processed. Products highlighting real fruit content on their labels have witnessed higher shelf appeal, particularly in urban retail and specialty food stores.

Additionally, the ability to create varied taste profiles using different fruits allows producers to offer a wide range of flavor combinations while maintaining clean-label status.

The dominant share of this segment also benefits from increased innovation in fruit sourcing, including seasonal and exotic fruits. As consumer expectations continue to shift toward natural and transparent formulations, the Fruit and Fruit Juice segment remains central to the market’s ingredient landscape.

By Flavor Type Analysis

Strawberry remains the top flavor, contributing 33.1% to overall product sales.

In 2024, Strawberry held a dominant market position in the By Flavor Type segment of the Jam, Jelly and Preserve Market, with a 33.1% share. This strong market position reflects the widespread popularity of strawberry as a universally preferred flavor across age groups and regions. The sweet, mildly tangy profile of strawberries appeals to a broad consumer base, making it a consistent favorite in both household and foodservice applications. Its familiarity and nostalgic value further enhance consumer trust and brand loyalty within this category.

Strawberry-based jams, jellies, and preserves are often among the first choices for both new consumers and repeat buyers due to their vibrant taste, visual appeal, and compatibility with various foods such as bread, pastries, and desserts. The versatility of strawberry flavor contributes significantly to its sustained demand, particularly in urban markets where ready-to-use fruit spreads are integral to quick meals and snacks.

The dominant share also reflects the consistent availability of strawberries in processed form, allowing manufacturers to maintain quality and supply throughout the year. As consumers continue to seek flavors that balance tradition and enjoyment, the strawberry segment remains a key driver of growth and consumer preference in the flavor category of the jam, jelly, and preserve market.

By Distribution Channel Analysis

Hypermarkets and supermarkets lead distribution, holding 48.3% of the total market.

In 2024, Hypermarket/Supermarket held a dominant market position in the By Distribution Channel segment of the Jam, Jelly and Preserve Market, with a 48.3% share. This dominance is largely attributed to the strong retail presence and widespread accessibility of these large-format stores, which continue to serve as the primary shopping destinations for packaged food products. Hypermarkets and supermarkets offer a broad assortment of brands, flavors, and packaging formats, allowing consumers to make direct comparisons and informed choices in one place.

These retail formats also benefit from high footfall, particularly in urban and semi-urban areas, where consumers prefer one-stop solutions for grocery shopping. In-store promotions, product sampling, and shelf placements further influence buyer decisions, driving higher sales volumes of jams, jellies, and preserves. The convenience of physical examination and instant purchase also gives supermarkets an edge over other channels.

Furthermore, the ability of hypermarkets and supermarkets to stock both mass-market and premium offerings supports a diverse consumer base with varied preferences and spending capacities. Their established supply chains and promotional infrastructure help maintain product visibility and availability, reinforcing their role as the dominant distribution channel within the jam, jelly, and preserve market in 2024.

Key Market Segments

By Product Type

- Jams

- Jelly

- Marmalade and Preserves

- Honey

- Sweet Spreads

- Others

By Ingredient Type

- Pectin

- Fruit and Fruit Juice

- Sweeteners

- Essence

- Others

By Flavor Type

- Mango

- Blackberry

- Grape

- Strawberry

- Others

By Distribution Channel

- Hypermarket/Supermarket

- E-Commerce

- Convenience Stores

- Others

Driving Factors

Rising Demand for Natural and Fruit-Based Spreads

One of the top driving factors for the jam, jelly, and preserve market is the growing consumer shift toward natural, fruit-based spreads. People today are more health-conscious and want food products that are made from real fruits and have fewer artificial ingredients. Jams and preserves made with natural fruit and no chemical additives are seen as better choices for everyday consumption.

This demand is especially strong among families, urban buyers, and young consumers looking for healthier breakfast and snack options. Many consumers now carefully read product labels and choose items with high fruit content, fewer preservatives, and no artificial flavors.

Restraining Factors

High Sugar Content Limits Health-Conscious Consumer Interest

A key restraining factor in the jam, jelly, and preserve market is the high sugar content found in many traditional products. While these spreads are widely enjoyed for their sweet taste, health-conscious consumers are increasingly concerned about added sugars in their diets.

With rising awareness of diabetes, obesity, and lifestyle-related health issues, many people are reducing their sugar intake or avoiding sugary products altogether. This shift in eating habits can reduce demand for conventional jams and jellies, especially among older adults, parents buying for children, and wellness-focused consumers.

Although low-sugar and sugar-free options are emerging, their availability and taste acceptance still vary. This health-related concern poses a challenge to market growth unless addressed with more innovative, healthier formulations.

Growth Opportunity

Rising Popularity of Organic and Artisanal Spreads

A major growth opportunity in the jam, jelly, and preserve market lies in the increasing demand for organic and artisanal products. Many consumers are now choosing food items that are not only natural but also produced in small batches using traditional methods and organic fruits.

Artisanal jams often feature exotic fruit blends, less sugar, and no preservatives, making them attractive to modern consumers who value quality over quantity. As people become more aware of what goes into their food, there is strong potential for brands to expand in this space by offering clean-label, eco-friendly, and locally sourced jam and preserve options.

Latest Trends

Innovative Flavors and Exotic Fruit Blends Rising

One of the latest trends in the jam, jelly, and preserve market is the growing popularity of unique and exotic fruit combinations. Consumers, especially younger ones, are becoming more adventurous with their taste choices and are actively looking for new flavor experiences. Instead of the usual strawberry or grape, they are trying blends like mango-chili, blueberry-lavender, or fig and ginger.

These creative flavor profiles not only offer something new but also reflect changing food habits influenced by global cuisines. Many small and mid-sized producers are experimenting with limited-edition or seasonal flavors to keep the product lineup fresh and exciting.

Regional Analysis

In North America, the Jam, Jelly, and Preserve Market reached USD 1.1 billion.

In 2024, North America held a dominant position in the global Jam, Jelly, and Preserve Market, accounting for 44.80% of the total market share and reaching a value of USD 1.1 billion. This leadership is supported by high per capita consumption, widespread availability of premium and natural spreads, and growing consumer preference for convenience food items across the United States and Canada.

The region benefits from strong retail infrastructure, well-established distribution networks, and a steady demand for both traditional and innovative fruit-based products.

Europe remains a mature market with steady demand, driven by traditional breakfast habits and continued interest in fruit preserves made from locally sourced ingredients. In Asia Pacific, changing dietary habits, rising disposable incomes, and a growing urban population are gradually boosting demand for packaged spreads, although consumption remains lower compared to Western markets.

Meanwhile, the Middle East & Africa and Latin America represent emerging regions where the market is still developing, with increasing penetration of modern retail formats and shifting food consumption patterns supporting modest growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Andros Group has demonstrated a robust presence via its emphasis on high‑quality fruit spreads and preserves. Leveraging vertical integration from fruit sourcing to finished product, the organization ensures better control over ingredient quality and supply consistency. This strategic positioning has supported its capacity to deliver premium offerings and respond effectively to consumer demand for authentic and natural products.

B&G Foods Inc. maintains a broad market footprint by combining established brand recognition with widespread retail distribution channels. Its strength lies in consistent product availability across diverse retail formats and its appeal to mass‑market consumers seeking familiar, dependable spreads. B&G Foods Inc.’s efficient operations and supply chain management have enabled competitive pricing strategies that help maintain market share even amid increasing pressure from premium and artisanal alternatives.

Bonne Maman is widely regarded for its artisanal and heritage appeal, attracting consumers through traditional formulation and upscale packaging. The brand’s focus on clean‑label ingredients and recognizable fruit content has resonated with health‑ and taste‑driven buyers. Bonne Maman has effectively captured the premium segment by reinforcing the emotional value of authenticity and nostalgia, positioning itself as a preferred choice for consumers seeking a refined and natural experience.

McCormick Company, predominantly known for spices and flavorings, has augmented its presence in the spreads sector through targeted expansion efforts. McCormick’s deep expertise in flavor science and global sourcing has supported opportunities for introducing innovative blends and textures. While its share in the jam and preserve space remains smaller relative to specialist producers, McCormick’s strength in ingredient development positions it well for long‑term growth and entry into differentiated product segments.

Top Key Players in the Market

- Andros Group

- B&G Foods Inc.

- Bonne Maman

- McCormick Company

- F. Duerr & Sons Ltd

- Hormel Foods

- Kraft Heinz

- The J.M. Smucker Company

- Wilkin & Sons Ltd

Recent Developments

- In May 2025, Andros Group participated in the China International Import Expo (CIIE), presenting its high‑quality French fruit spread brands—Bonne Maman, Pierrot Gourmand, and Andros Sport—to a global audience. This marked the company’s continued push into the Asian market, highlighting premium French-made preserves and increasing its brand visibility in China’s rapidly growing retail sector.

- In November 2024, Bonne Maman introduced a new line of ready-to-bake pie fillings in glass jars—available in apple, blueberry, and cherry flavors. These fillings are made without high-fructose corn syrup or artificial preservatives and feature large pieces of fruit, offering convenience and premium quality for holiday baking occasions

Report Scope

Report Features Description Market Value (2024) USD 2.6 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Jams, Jelly, Marmalade and Preserves, Honey, Sweet Spreads, Others), By Ingredient Type (Pectin, Fruit and Fruit Juice, Sweeteners, Essence, Others), By Flavor Type (Mango, Blackberry, Grape, Strawberry, Others), By Distribution Channel (Hypermarket/Supermarket, E-Commerce, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Andros Group, B&G Foods Inc., Bonne Maman, McCormick Company, F. Duerr & Sons Ltd, Hormel Foods, Kraft Heinz, The J.M. Smucker Company, Wilkin & Sons Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Jam, Jelly And Preserve MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Jam, Jelly And Preserve MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Andros Group

- B&G Foods Inc.

- Bonne Maman

- McCormick Company

- F. Duerr & Sons Ltd

- Hormel Foods

- Kraft Heinz

- The J.M. Smucker Company

- Wilkin & Sons Ltd