Global IT Leasing and Financing Market By Type (Packaged Software (Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Others), Server Systems, PCs & Smart Handhelds, Networking & Telco (Routers, Switches, Others), Mainframes & Service, Others), By Application (Listed Companies/Large Companies, Small and Medium Companies, Others), By Financing Model (Operating Lease, Finance Lease, Others),By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171958

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Type Analysis

- Application Analysis

- Financing Model Analysis

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- By Application

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Development

- Report Scope

Report Overview

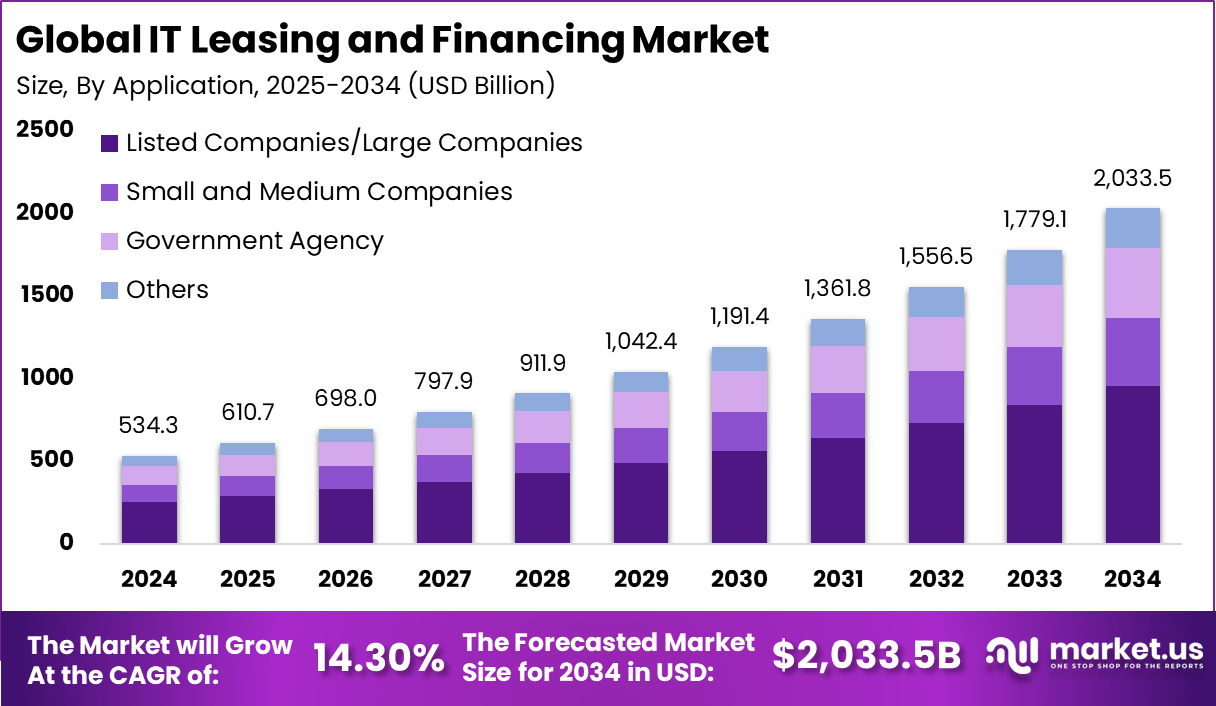

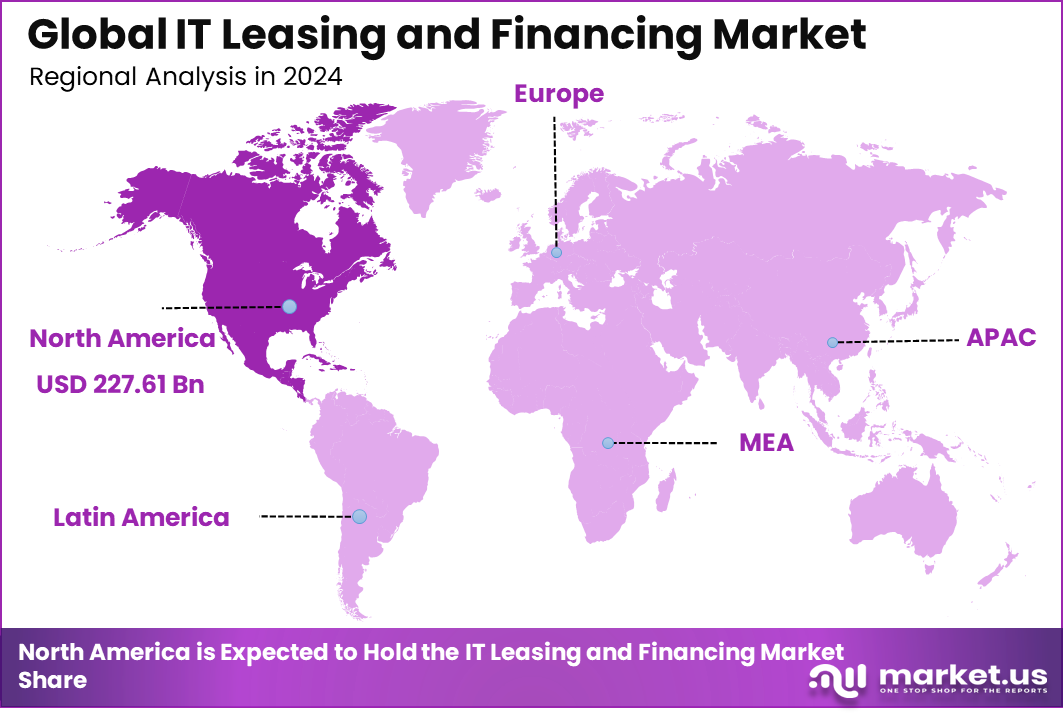

The Global IT Leasing and Financing Market generated USD 534.3 billion in 2024 and is predicted to register growth from USD 610.7 billion in 2025 to about USD 2,033.5 billion by 2034, recording a CAGR of 14.30% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 42.6% share, holding USD 227.61 Billion revenue.

The IT leasing and financing market refers to services that enable businesses to acquire information technology assets through lease arrangements or structured financing instead of outright purchase. These services support procurement of hardware such as servers, computers, networking equipment, and peripherals, as well as software and cloud licenses. Leasing and financing options help organizations manage capital more effectively, align payments with usage cycles, and refresh technology without large upfront expenditures.

Growth in this market is driven by rapid technological change and the need for frequent IT infrastructure upgrades. Organizations seek flexible funding solutions that allow them to adopt new technologies while preserving working capital. Financial institutions, independent leasing firms, and vendor finance arms offer tailored structures that support predictable payments, risk sharing, and asset lifecycle management.

The top driving factors for the IT leasing and financing market are linked to high demand for digital transformation and the rapid pace of technology change. Organisations increasingly need to adopt new hardware and software to support business growth, remote work, cybersecurity, and data analytics. Upfront purchase costs for advanced technology can be significant, creating budget pressure, especially for small and medium sized enterprises.

Leasing and financing provide an alternative that aligns payments with usage life and reduces capital expenditure burdens. Economic uncertainty and tight IT budgets further reinforce the appeal of spreading costs over predictable periodic payments. Demand analysis shows that interest in IT leasing and financing continues to grow as businesses prioritise flexibility and cost management.

Demand is also supported by the desire to improve cash flow, lower total cost of ownership, and mitigate risks associated with technology obsolescence. As digital dependency increases across industries, IT leasing and financing solutions are expected to remain an important enabler of technology adoption and operational resilience.

Top Market Takeaways

- By type, packaged software accounted for 30.8% of the IT leasing and financing market, as firms lease software bundles instead of buying licenses upfront.

- By application, listed and large companies held 47.2% share, using leasing to manage big IT refresh cycles while preserving cash flow.

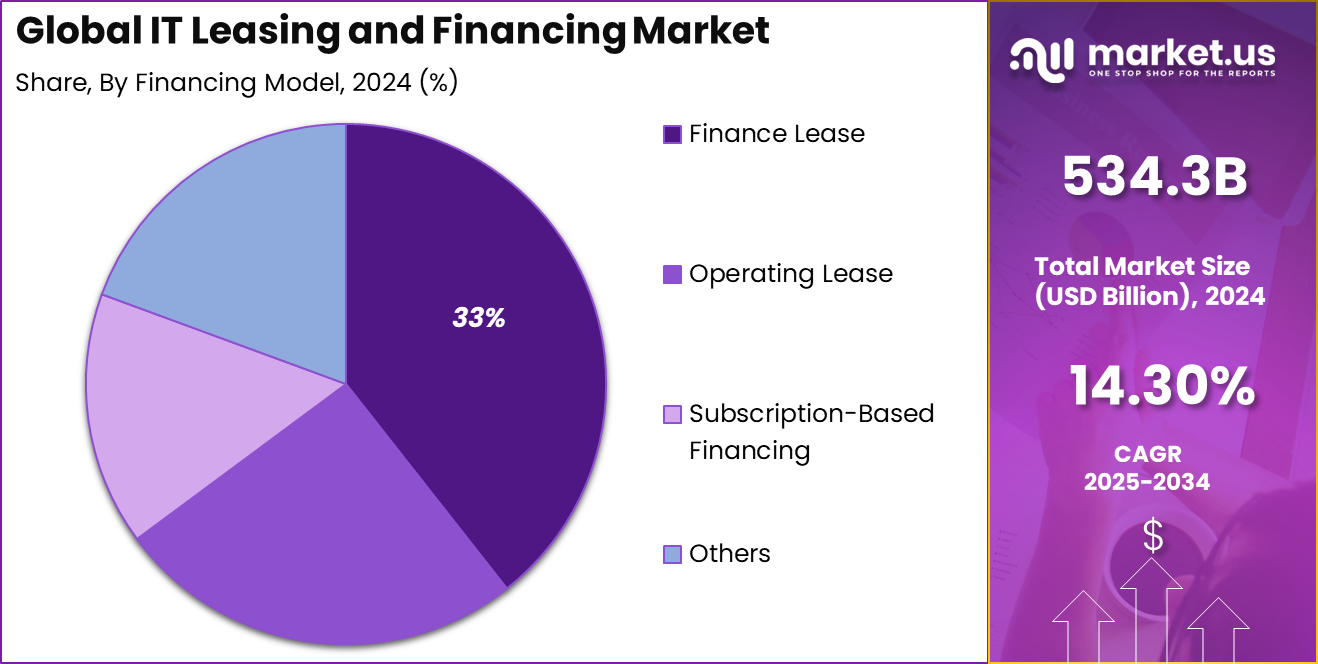

- By financing model, finance leases captured 32.5%, giving companies long-term use of IT assets with predictable payments and potential ownership at the end.

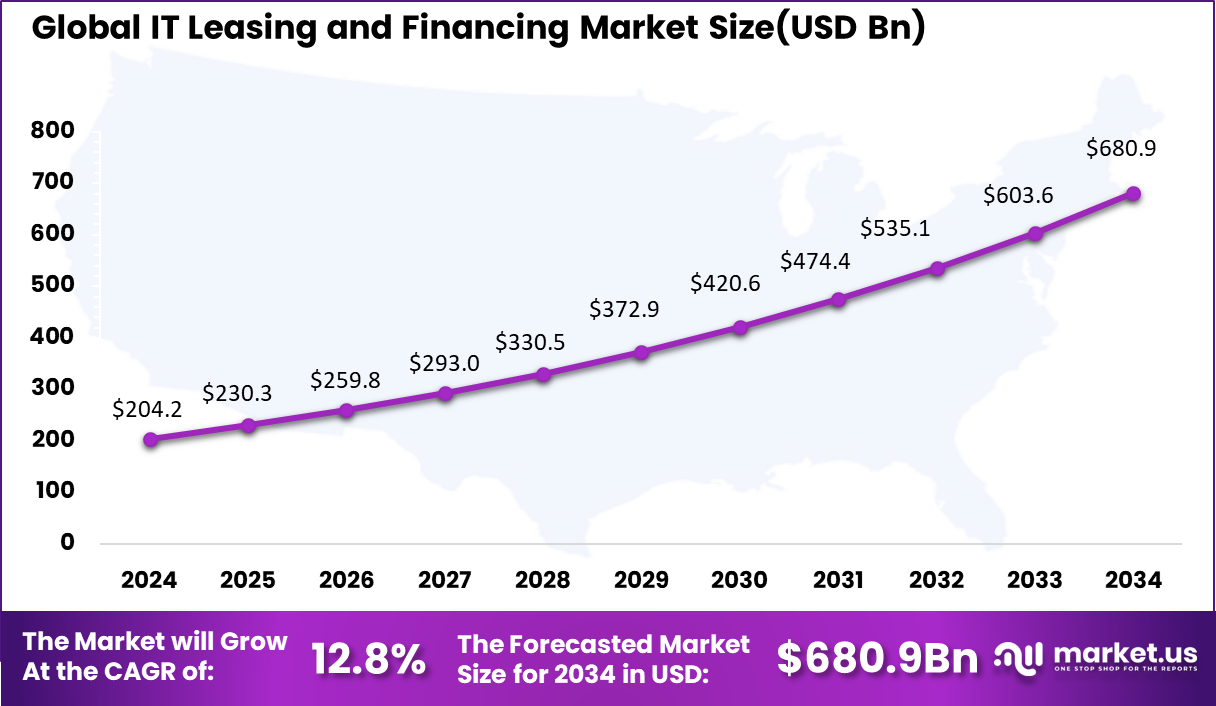

- North America made up 42.6% of the global market, with the U.S. reaching USD 204.17 billion in 2025 and growing at a CAGR of 12.8% on the back of strong enterprise tech spending and mature leasing ecosystems.

Type Analysis

Packaged software accounts for 30.8% of the IT Leasing and Financing market, reflecting steady demand from organizations seeking predictable and standardized software solutions. These software packages include enterprise applications, productivity tools, and industry-specific systems that are delivered as complete, ready-to-use products. Leasing packaged software allows companies to access essential digital tools without making large upfront capital investments.

From a financial perspective, packaged software leasing supports better cash flow management and budget planning. Organizations can spread costs over time while keeping their systems up to date. The strong share of this segment shows that many enterprises prefer structured software offerings that are easy to deploy, maintain, and finance under leasing arrangements.

Application Analysis

Listed and large companies represent 47.2% of application demand, making them the largest user group in the market. These organizations operate at scale and require continuous access to advanced IT systems to support operations, compliance, and growth. Leasing and financing models help them manage large IT portfolios efficiently while aligning technology spending with business cycles.

Large companies also face frequent technology refresh needs due to rapid digital change. Financing IT assets allows them to upgrade systems without disrupting capital budgets. The strong presence of this segment reflects the importance of flexible financing solutions for enterprises managing complex and evolving IT environments.

Financing Model Analysis

Finance lease holds 33% of the financing model segment, indicating strong preference for long-term leasing arrangements. Under this model, the lessee uses the IT asset for most of its economic life and often assumes ownership-related responsibilities. This approach is commonly used for critical IT infrastructure and software that remains relevant over extended periods.

Finance leases provide stability and predictable payment structures. They allow organizations to treat leased assets as part of long-term operational planning. The adoption of this model reflects demand for financing options that balance cost control with long-term technology usage.

Key Reasons for Adoption

- The adoption of IT leasing and financing is driven by the need to reduce high upfront capital spending on hardware and software.

- Flexible payment structures allow organizations to align technology costs with operational cash flows.

- Rapid technology upgrades encourage firms to avoid asset ownership and depreciation risks.

- Budget predictability improves as leasing converts capital expenses into manageable operating expenses.

- Small and mid-sized enterprises use leasing to access advanced IT systems without financial strain.

Benefits

- Improved cash flow management is achieved by spreading payments over fixed periods.

- Technology refresh cycles become easier, enabling regular upgrades to newer and more secure systems.

- Balance sheet efficiency improves as leased assets reduce capital intensity.

- Risk related to asset obsolescence is lowered, especially in fast-changing IT environments.

- Organizations gain financial flexibility to invest in core business activities.

Usage

- IT leasing is widely used for enterprise hardware such as servers, storage, and networking equipment.

- Financing solutions support large-scale software deployments and license renewals.

- Managed IT services often bundle leasing to offer end-to-end technology solutions.

- Cloud and hybrid IT infrastructure investments are supported through structured financing models.

- Short-term leasing is used for project-based IT requirements and seasonal capacity needs.

Emerging Trends

Key Trend Description AI Credit Checks AI speeds loan approval using real time risk scoring. Pay Per Use Models IT equipment is rented based on usage hours or data instead of full purchase. As a Service Bundles Hardware leasing includes cloud services and technical support. Green Refurb Leases Refurbished IT assets are financed to support sustainability goals and cost savings. Blockchain Contracts Smart contracts automate lease terms, payments, and renewals. Growth Factors

Key Factors Description Digital Change Boom Companies need fast IT upgrades without large upfront spending. Subscription Shift Preference for operating expense models over capital expense for technology. Hybrid Work Rise Device leasing grows as remote and hybrid work models expand. SME Tech Access Small businesses lease servers and IT tools to compete with large firms. Fintech Lease Speed Online financing reduces lease approval time from weeks to hours. Key Market Segments

By Type

- Packaged Software

- Enterprise Resource Planning (ERP)

- Customer Relationship Management (CRM)

- Others

- Server Systems

- PCs and Smart Handhelds

- Networking and Telco

- Routers

- Switches

- Others

- Mainframes and Service

- Others

By Application

- Listed Companies and Large Companies

- Small and Medium Companies

- Government Agency

- Others

By Financing Model

- Operating Lease

- Finance Lease

- Subscription-Based Financing

- Others

Regional Analysis

North America accounted for 42.6% share, supported by high enterprise spending on IT infrastructure and a strong preference for flexible asset management models. Organizations across sectors have increasingly adopted IT leasing and financing to manage rapid technology refresh cycles and control capital expenditure.

Demand has been driven by rising adoption of cloud, data centers, networking equipment, and end user devices, where ownership costs and obsolescence risks remain high. Leasing models have allowed enterprises to align IT costs with usage while maintaining access to up to date technology.

The U.S. market reached USD 204.17 Bn and is projected to grow at a 12.8% CAGR, reflecting strong demand from large enterprises, small and medium businesses, and public sector organizations. Adoption has been driven by the need to modernize IT environments without large upfront investments. Companies have used leasing and financing models to support hardware upgrades, software deployment, and digital transformation initiatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Support for Digital Transformation and Workforce Mobility

A major driver of this market is the acceleration of digital transformation efforts. Businesses invest in digital infrastructure to support automation, analytics, mobile workforces, and customer engagement systems. Leasing and financing solutions help fund these investments while aligning payments with expected returns on digital initiatives. This supports more sustainable growth strategies.

Another driver is the growth of remote and hybrid work models that increase demand for distributed IT assets. Employees require laptops, collaboration tools, and secure connectivity regardless of location. Leasing solutions let organizations scale device fleets quickly and update equipment as needs change. Structured financing accommodates spikes in demand without large cash outlays.

Restraint Analysis

Credit Risk Concerns and Economic Uncertainty

A significant restraint for the IT leasing and financing market is heightened credit risk, especially during periods of economic uncertainty. Lenders assess borrower creditworthiness to manage exposure, which may lead to stricter terms, higher interest rates, or reduced finance limits. Smaller businesses or those with volatile financial profiles may find it harder to access favorable financing, slowing market growth.

Another restraint is the complexity of valuing and repossessing technology assets. IT equipment and licenses may depreciate rapidly or lose value due to software updates and rapid innovation. Lessors must manage residual risk and depreciation assumptions carefully. Asset valuation challenges may limit the willingness of some financing providers to extend terms or tailor flexible structures.

Opportunity Analysis

Expansion of Value-Added Services and Bundled Financing Solutions

There is strong opportunity in offering value-added services alongside leasing and financing arrangements. Providers that bundle maintenance, technical support, insurance, and upgrade pathways with payment solutions can differentiate their offerings. These comprehensive packages provide clients with predictable total cost of ownership and reduce operational complexity.

Another opportunity lies in supporting small and medium-sized enterprises with tailored financing options. SMEs often face capital constraints that limit IT investment. Customized terms, flexible payment schedules, and shorter contract tenors can attract this segment. Providers that design solutions that match SME cash flows and technology needs can expand their customer base.

Challenge Analysis

Regulatory Compliance and Accounting Treatment

A key challenge in the IT leasing and financing market is navigating accounting and regulatory requirements. Changes in lease accounting standards can affect how contracts are recorded on balance sheets and impact financial ratios. Organizations and finance partners must align documentation and reporting practices with applicable standards to maintain compliance and avoid audit issues, increasing administrative effort.

Another challenge is ensuring transparent cost disclosure and risk sharing. Lessees need clear understanding of interest rates, residual values, penalty terms, and end-of-lease conditions. Misalignment between lessee expectations and contract terms may lead to disputes or dissatisfaction. Clear communication and structured contract design help mitigate these challenges but require careful negotiation and documentation.

Competitive Analysis

Dell Technologies, IBM Corporation, Hewlett Packard Enterprise, Lenovo, and Cisco Systems, Inc. lead the IT leasing and financing market by offering bundled hardware, software, and lifecycle services through flexible payment models. Their programs help enterprises preserve capital, refresh technology faster, and align IT spend with usage. These providers focus on scalability, global coverage, and integrated asset management. Rising demand for predictable IT costs continues to reinforce their leadership.

GRENKE AG, 3 Step IT Group, CSI Leasing, Inc., SHI International Corp., and Fujitsu Finance strengthen the market with vendor neutral leasing, device as a service, and end of life management. Their solutions support SMEs and large enterprises seeking flexibility and sustainability. These companies emphasize transparency, risk management, and circular IT practices. Growing focus on ESG and asset optimization supports wider adoption.

PCM Leasing, Edianzu, Hypertec Direct, and Verdant Finance, along with other players, expand the landscape with tailored financing for cloud, data center, and edge deployments. Their offerings address niche requirements and regional markets. These providers focus on speed, customization, and competitive terms. Increasing hybrid IT adoption continues to drive steady growth in IT leasing and financing.

Top Key Players in the Market

- Dell Technologies

- IBM Corporation

- GRENKE AG

- 3 Step IT Group

- Lenovo

- SHI International Corp.

- Cisco Systems, Inc.

- PCM Leasing

- CSI Leasing, Inc.

- Edianzu

- Hypertec Direct

- Fujitsu Finance

- Hewlett Packard Enterprise

- Verdant Finance

- Others

Future Outlook

The future outlook for the IT Leasing and Financing market is expected to remain positive as organizations focus on flexible technology investment and cost control. Leasing and financing models help businesses access updated hardware, software, and infrastructure without large upfront spending.

Growing adoption of cloud services, hybrid IT environments, and frequent technology refresh cycles is supporting steady demand. In the coming years, more companies are likely to prefer usage based and subscription style financing to align IT costs with actual business needs.

Recent Development

- February 2025 – IBM Corporation: Finalized $6.4 billion acquisition of HashiCorp to strengthen hybrid cloud and AI financing options. This move lets IBM offer seamless leasing for infrastructure automation tools, targeting enterprises upgrading to gen AI workloads.

- January 2025 – Lenovo: Completed $2 billion investment with Alat for data center and AI infrastructure financing. This partnership ramps up Lenovo’s leasing capacity in Saudi Arabia, focusing on hyperscale cloud builds.

Report Scope

Report Features Description Market Value (2024) USD 535.3 Bn Forecast Revenue (2034) USD 2,033.5 Bn CAGR(2025-2034) 14.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Packaged Software (Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), Others), Server Systems, PCs & Smart Handhelds, Networking & Telco (Routers, Switches, Others), Mainframes & Service, Others), By Application (Listed Companies/Large Companies, Small and Medium Companies, Others), By Financing Model (Operating Lease, Finance Lease, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dell Technologies, IBM Corporation, GRENKE AG, 3 Step IT Group, Lenovo, SHI International Corp., Cisco Systems, Inc., PCM Leasing, CSI Leasing, Inc., Edianzu, Hypertec Direct, Fujitsu Finance, Hewlett Packard Enterprise, Verdant Finance, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IT Leasing and Financing MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

IT Leasing and Financing MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dell Technologies

- IBM Corporation

- GRENKE AG

- 3 Step IT Group

- Lenovo

- SHI International Corp.

- Cisco Systems, Inc.

- PCM Leasing

- CSI Leasing, Inc.

- Edianzu

- Hypertec Direct

- Fujitsu Finance

- Hewlett Packard Enterprise

- Verdant Finance

- Others