Global Investment Banking and Trading Services Market Size, Share, Statistics Analysis Report By Service Type (Trading and Related Services, Equity Underwriting and Debt Underwriting Services, Financial Advisory, Other Service Types), By Industry Vertical (IT and Telecommunications, BFSI, Manufacturing, Retail, Healthcare, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132999

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

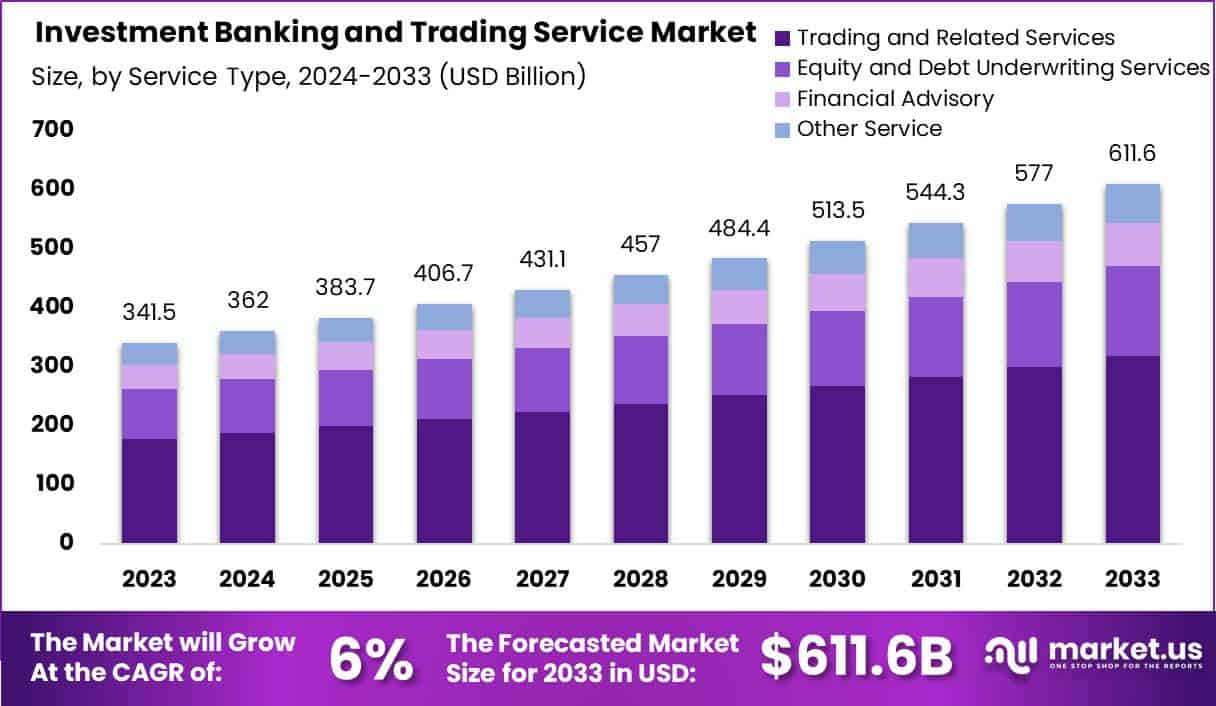

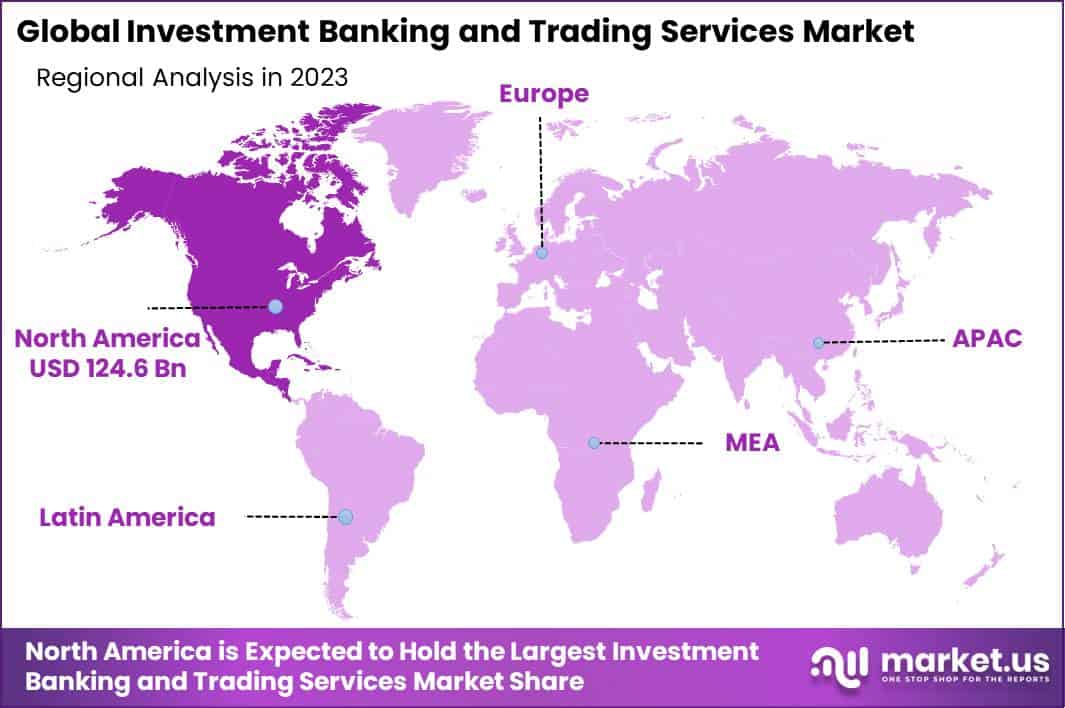

The Global Investment Banking and Trading Services Market size is expected to be worth around USD 611.6 Billion By 2033, from USD 341.5 Billion in 2023, growing at a CAGR of 6.00% during the forecast period from 2024 to 2033. In 2023, North America led the investment banking and trading services market, accounting for over 36.5% of the market share, with revenues reaching USD 124.6 billion.

Investment banking is a specialized sector within the financial services industry that focuses on helping companies, governments, and institutions manage large, complex financial transactions. Investment banks facilitate processes such as issuing new securities, managing initial public offerings (IPOs), and advising on mergers and acquisitions. They play a crucial role in connecting investors with opportunities, helping to allocate capital effectively across the economy.

The market for investment banking and trading services encompasses a variety of financial activities, including equity trading (dealing with stocks and their derivatives) and fixed income trading, which involves bonds and other debt instruments. This market is integral to the functioning of global financial systems, supporting everything from corporate expansions to governmental financing.

Investment banks operate in distinct segments, with large global institutions generally offering a full range of services, including sales and trading, and smaller boutique firms often specializing in specific areas like M&A or restructuring. The primary drivers of the investment banking and trading services market include economic growth, corporate profit, and the need for capital.

Additionally, global economic stability and the health of major economies significantly influence market activity, as they impact investor confidence and the availability of capital. Market demand in investment banking is largely driven by corporate transactions, public offerings, and strategic advisory services. As industries evolve and companies seek to grow or restructure, the demand for sophisticated financial advice and the ability to raise capital efficiently remains high.

Technological advancements are profoundly reshaping the investment banking and trading services market. The integration of artificial intelligence and machine learning into financial analysis and decision-making processes is enhancing the efficiency and accuracy of services provided. Moreover, advancements in data analytics are enabling deeper insights into market trends, risk management, and customer needs, facilitating more informed decision-making and strategic planning for investment banks.

The investment banking market is ripe with opportunities, particularly in emerging markets and in sectors undergoing significant transformation. As digital transformation accelerates, there is a growing need for investment banks that can navigate the complexities of tech mergers, cybersecurity investments, and the fintech boom. Additionally, sustainability and green finance represent growing niches, as companies increasingly need to align their operations with global sustainability goals.Key Takeaways

- The Global Investment Banking and Trading Services Market is projected to reach USD 611.6 billion by 2033, up from USD 341.5 billion in 2023, growing at a compound annual growth rate (CAGR) of 6.00% from 2024 to 2033.

- In 2023, the Trading and Related Services segment held the largest market share in the Investment Banking and Trading Services sector, capturing over 52.1% of the total market.

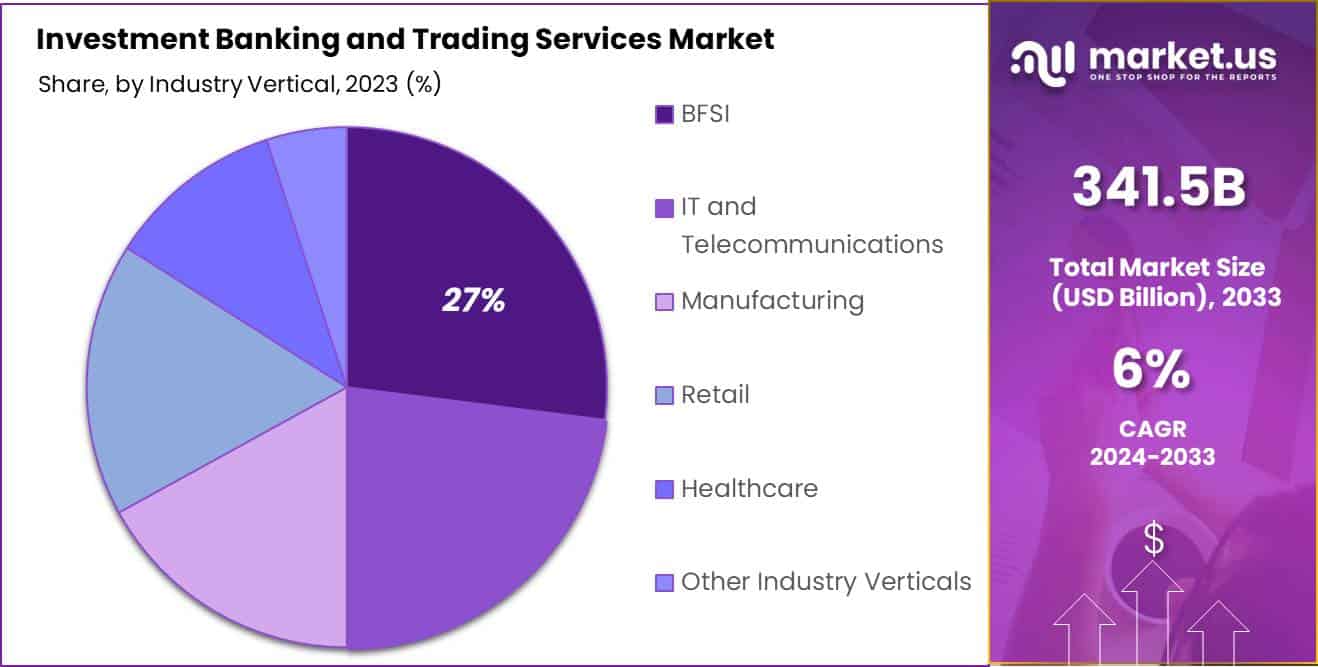

- The BFSI (Banking, Financial Services, and Insurance) segment also dominated the market in 2023, accounting for more than 27.0% of the market share.

- North America led the global Investment Banking and Trading Services market in 2023, holding more than 36.5% of the market share, with revenues totaling USD 124.6 billion.

Service Type Analysis

In 2023, the Trading and Related Services segment held a dominant market position within the Investment Banking and Trading Services market, capturing more than a 52.1% share. This leading stance can be attributed to several core factors that emphasize its central role in investment banking.

The volatility and liquidity in the financial markets have significantly increased the demand for trading services. As markets become more interconnected and complex, investors and institutions seek reliable partners that can provide sophisticated trading solutions and risk management strategies.

Technological advancements have transformed trading operations, making them more efficient and scalable. The integration of algorithmic trading systems, high-frequency trading, and artificial intelligence has not only increased transaction speeds but also improved the precision of trades, thus attracting a broader client base to this segment.

Additionally, the global nature of today’s economy demands robust trading frameworks that can operate across different time zones. Investment banks have scaled their trading operations globally, providing round-the-clock services. This global reach allows them to capitalize on opportunities in emerging markets, driving further growth in this segment.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant position in the investment banking and trading services market, capturing more than a 27.0% share. This segment’s leadership is primarily due to the intrinsic nature of the BFSI sector, which heavily relies on these services for fund management, securing capital, risk management, and regulatory compliance.

The prominence of the BFSI segment is also bolstered by the increasing number of global financial crises, which have compelled banks and financial institutions to seek sophisticated advisory services to mitigate risks and enhance profitability.

The digital transformation within the BFSI sector fuels demand for investment banking services, as companies look to innovate and stay competitive. Investment banks assist these institutions in acquiring fintech startups, securing investments in new technology, and navigating the complex digital landscape.

Also, the expansion of the BFSI sector into emerging markets presents significant opportunities for investment banking and trading services. As these institutions look to expand their global footprint, they require expert guidance on cross-border transactions, regulatory hurdles, and market entry strategies.

Key Market Segments

By Service Type

- Trading and Related Services

- Equity Underwriting and Debt Underwriting Services

- Financial Advisory

- Other Service Types

By Industry Vertical

- IT and Telecommunications

- BFSI

- Manufacturing

- Retail

- Healthcare

- Other Industry Verticals

Driver

Digital Transformation and Automation

The rapid adoption of digital transformation and automation is one of the strongest drivers for the growth of investment banking and trading services. In recent years, financial institutions have increasingly relied on advanced technology to streamline processes, enhance efficiency, and improve decision-making capabilities.

Automation tools, including artificial intelligence (AI) and machine learning (ML), have enabled investment banks to analyze vast amounts of data in real-time, allowing for better risk management, more accurate market predictions, and faster trade executions.

A key benefit of automation in trading services is the reduction of manual processes that traditionally slowed down operations. Tasks such as compliance checks, data entry, and portfolio management have become faster and more reliable through automated solutions.

Restraint

High Regulatory Burden and Compliance Costs

One of the significant restraints affecting the investment banking and trading services industry is the high regulatory burden and associated compliance costs. Regulatory frameworks worldwide are becoming increasingly complex and stringent, with financial institutions facing continuous scrutiny from government bodies and regulatory agencies.

Complying with regulations requires substantial investments in legal and compliance departments, technology systems, and data management tools to ensure full adherence. This results in increased operational costs, diverting resources that could be better allocated to business growth or innovation.

Opportunity

Rise of Sustainable and ESG Investments in Banking and Trading

With an increasing number of investors and institutions prioritizing sustainability, there is a strong demand for financial products and services that align with ESG principles.This trend offers investment banks the chance to develop innovative products, such as green bonds, socially responsible exchange-traded funds (ETFs), and impact investing solutions.

Companies are increasingly integrating ESG criteria into their business strategies, creating a need for advisory services that guide clients on incorporating sustainability into their operations. Investment banks can act as strategic partners, providing guidance on ESG-related mergers and acquisitions, carbon footprint reduction initiatives, and socially responsible governance practices.

Challenge

Cybersecurity Threats and Data Breaches in Investment Banking

Cybersecurity threats and data breaches represent a formidable challenge for investment banking and trading services. As the sector becomes increasingly digitized, it also becomes more vulnerable to cyberattacks that can compromise sensitive data and disrupt trading operations. High-profile breaches can result in significant financial losses, reputational damage, regulatory penalties, and loss of client trust.

The financial services sector remains a prime target for cybercriminals due to the large volume of sensitive client data and high-value transactions it handles. Hackers frequently employ advanced tactics, such as ransomware attacks, phishing scams, and distributed denial-of-service (DDoS) attacks, to infiltrate systems and steal confidential data. The complexity of modern cyberattacks means that even institutions with robust cybersecurity measures are not immune to breaches.

Emerging Trends

Investment banking and trading services are undergoing significant transformations, driven by technological advancements, evolving market dynamics, and regulatory changes.

A notable trend is the shift towards electronic and algorithmic trading, which has enhanced efficiency and reduced transaction costs. Firms like Citadel Securities and Jane Street have capitalized on this by employing sophisticated algorithms to execute high-frequency trades, thereby gaining substantial market share.

Another emerging trend is the increasing focus on sustainable finance. Investment banks are developing products that align with environmental, social, and governance (ESG) criteria, catering to the growing demand for responsible investing.

The rise of fintech and digital platforms is also reshaping the landscape. Traditional banks are integrating digital solutions to enhance client experiences and streamline operations. For instance, UBS has expanded its digital offerings to provide more efficient services to its clients.

Business Benefits

- Capital Raising: Investment banks assist companies in securing funds through equity or debt offerings, enabling expansion and operational improvements.

- Expert Advisory: They provide strategic advice on mergers, acquisitions, and restructuring, helping businesses make informed decisions.

- Market Access: Through trading services, businesses gain access to various financial markets, facilitating efficient buying and selling of securities.

- Risk Management: Investment banks offer tools and strategies to manage financial risks, safeguarding businesses against market volatility.

- Liquidity Provision: They ensure liquidity by acting as intermediaries in transactions, making it easier for businesses to convert assets into cash.

Regional Analysis

In 2023, North America held a dominant market position in the investment banking and trading services market, capturing more than a 36.5% share with revenues amounting to USD 124.6 billion. This leading stance can be attributed primarily to the mature financial markets of the United States and Canada, which are home to some of the world’s largest investment banks and financial institutions.

The region’s dominance is bolstered by its advanced technological infrastructure, which supports sophisticated trading platforms and investment banking activities. Innovations in fintech, along with a robust regulatory framework that ensures transparency and security in financial transactions, have made North America an attractive hub for both investors and companies seeking investment banking services.

North America benefits from a strong entrepreneurial ecosystem that continuously drives demand for capital raising activities through IPOs, venture capital, and private equity. The presence of major stock exchanges such as the New York Stock Exchange and NASDAQ facilitates high trading volumes and a dynamic market environment, attracting both domestic and international companies.

Additionally, the aggressive pursuit of cross-border mergers and acquisitions by North American corporations has propelled the need for expert financial advisory and consulting services, a role predominantly filled by investment banks. This trend is expected to persist as North American companies seek to expand their global footprint and enter new markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The investment banking and trading services sector is dominated by a mix of established global financial institutions, boutique investment banks, and emerging fintech players.

Citigroup, Inc. stands as one of the prominent figures in the investment banking and trading services sector. Known for its global presence, Citigroup offers a comprehensive suite of services including corporate and investment banking, securities brokerage, transaction services, and wealth management.

JPMorgan Chase & Co. is another titan in the field, renowned for its robust asset management and investment banking services. As the largest bank in the United States by assets, JPMorgan has a significant impact on the market with its deep market insights and financial acumen. The company excels in mergers and acquisitions, debt and equity underwriting, and risk management.

Morgan Stanley rounds out this trio of leaders with its strong emphasis on investment banking and wealth management. Known for its strategic advisory services, Morgan Stanley assists clients in major industries with mergers, acquisitions, public offerings, and other critical financial activities.

Top Key Players in the Market

- Citigroup, Inc.

- JPMorgan Chase & Co.

- Morgan Stanley

- Bank of America Corporation

- Deutsche Bank AG

- Barclays PLC

- HSBC Holdings plc

- Wells Fargo

- Nomura Holdings, Inc.

- The Goldman Sachs Group, Inc.

- Other Key Players

Recent Developments

- In April 2024, Deutsche Bank reported a 54% increase in its dealmaking unit, driven by a boom in debt underwriting. The bank also saw a 12% rise in compensation costs for its investment bank, investing more in front-office staff.

- In November 2024, Bank of America reports increased investment banking fees, driven by a rise in deals and corporate debt issuance. The bank anticipates that Federal Reserve rate cuts will make borrowing cheaper, boosting dealmaking activities.

- In November 2024, Wells Fargo reports increased investment banking fees, driven by a rise in deals and corporate debt issuance. The bank anticipates that Federal Reserve rate cuts will make borrowing cheaper, boosting dealmaking activities.

- In November 2024, Goldman Sachs reported a 20% year-on-year increase in investment banking fees, reaching $1.87 billion. This growth was driven by strong performance in leveraged finance, investment-grade activity, and equity underwriting.

Report Scope

Report Features Description Market Value (2023) USD 341.5 Bn Forecast Revenue (2033) USD 611.6 Bn CAGR (2024-2033) 6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Trading and Related Services, Equity Underwriting and Debt Underwriting Services, Financial Advisory, Other Service Types), By Industry Vertical (IT and Telecommunications, BFSI, Manufacturing, Retail, Healthcare, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Citigroup, Inc., JPMorgan Chase & Co., Morgan Stanley, Bank of America Corporation, Deutsche Bank AG, Barclays PLC, HSBC Holdings plc, Wells Fargo, Nomura Holdings, Inc., The Goldman Sachs Group, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Investment Banking and Trading Services MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Investment Banking and Trading Services MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Citigroup, Inc.

- JPMorgan Chase & Co.

- Morgan Stanley

- Bank of America Corporation

- Deutsche Bank AG

- Barclays PLC

- HSBC Holdings plc

- Wells Fargo

- Nomura Holdings, Inc.

- The Goldman Sachs Group, Inc.

- Other Key Players