Global Investment Banking and Asset Management Market Size, Share Analysis Report by Service Type (Assets Managed Service (Equities (stocks), Fixed Income (bonds), Real Estate, Commodities, Alternative Investments, and Others), and Equities (stocks), Fixed Income (bonds), Real Estate, Commodities, Alternative Investments, and Others)), by Enterprise Size (Large Enterprises, and Small & Medium Enterprises (SMEs)), and by End Use (Corporations, Governments, High-net-worth individuals, Retail investors, and Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152316

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

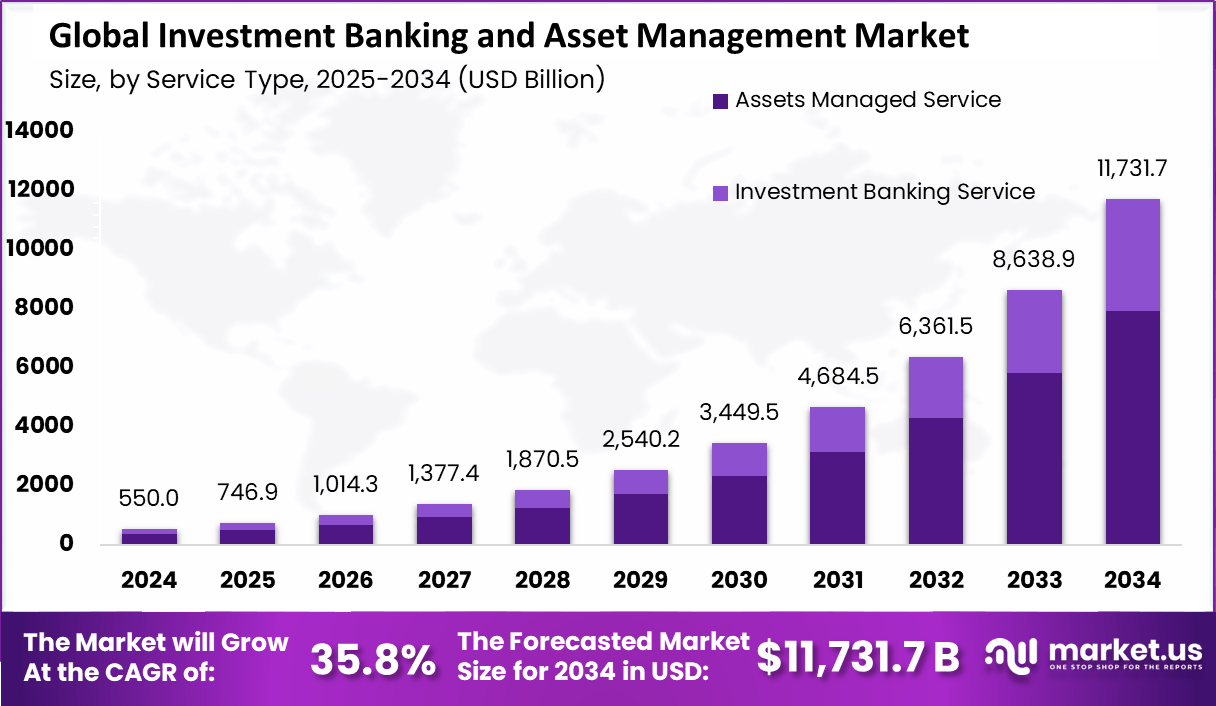

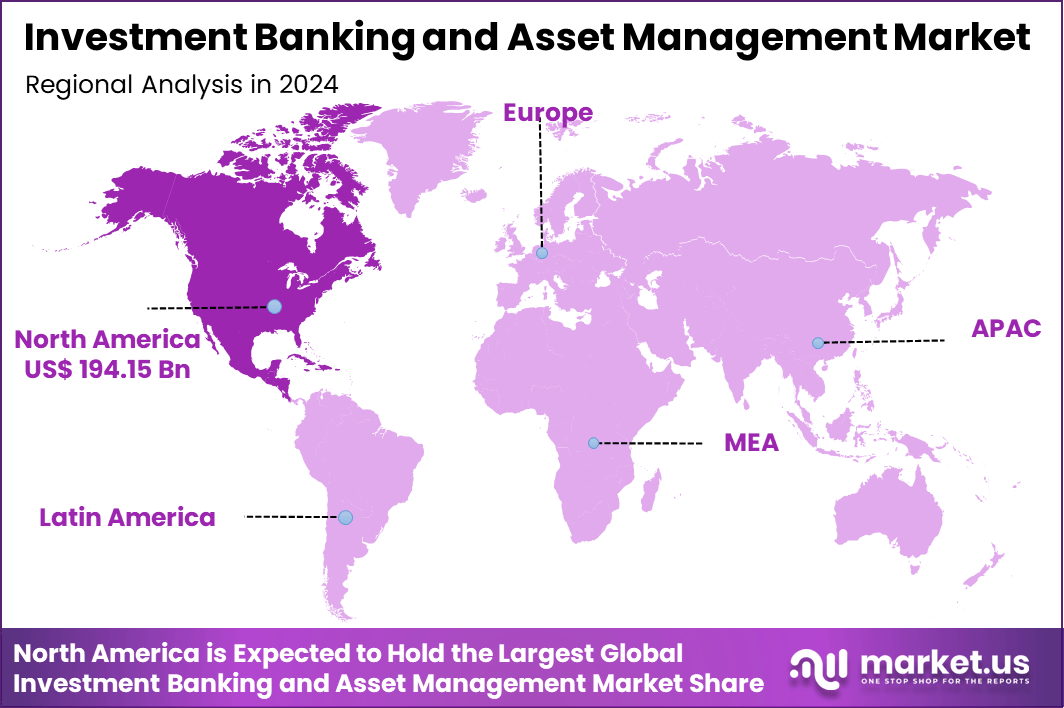

The Global Investment Banking and Asset Management Market size is expected to be worth around USD 11,731.7 billion by 2034, from USD 550.0 billion in 2024, growing at a CAGR of 35.8% during the forecast period from 2024 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.3% share, holding USD 194.15 Billion revenue.

Global investment banking and asset management industry is a major segment of the financial services sector, which provides special investment and advisory services to both institutions and individuals. Investment banks mainly focus on services such as merger and acquisition (M&A) consultation, securities underwriting and capital raising for companies. They assist customers with complex financial transactions such as public offerings and private placements.

In contrast, asset management firms are responsible for the overseeing of the investment portfolio of customers, with various financial assets such as equity, bonds and real estate’s aiming to increase funds through real estate. These firms serve institutional customers such as pension funds, insurance firms and high-net-priests.

For instance, June 2025, JioBlackRock Asset Management, the 50:50 joint venture between Jio Financial Services and BlackRock, has launched its official website and introduced an early access initiative for users. Alongside, it has also unveiled its executive leadership team as it gears up for the rollout of its investment products.

The growth of this market can be attributed to the increasing globalization of capital markets and heightened corporate activities. Rising corporate restructuring, demand for advisory on cross-border mergers, and higher issuance of equity and debt instruments continue to drive the investment banking segment.

As per the latest insights from Market.us, The global digital asset management market is projected to grow from about USD 4.9 billion in 2023 to nearly USD 20 billion by 2033, at a CAGR of approximately 15.1%. This growth is being driven by the rising demand for efficient digital content organization, improved workflow automation, and the need for consistent brand management across industries.

The global generative AI in asset management market is expected to expand significantly, increasing from around USD 289.4 million in 2023 to roughly USD 3,109.5 million by 2033, registering a CAGR of nearly 26.8%. North America dominated the market in 2023, holding over 47.6% share, supported by advanced AI adoption, innovation-friendly regulations, and strong technological infrastructure.

Key Takeaways

- In 2024, the global investment banking and asset management market was valued at USD 550.0 billion and is projected to reach about USD 11,731.7 billion by 2034, growing at a CAGR of 35.8%. The market is expanding at an accelerated pace.

- North America dominated with a share exceeding 35.3%, generating nearly USD 194.15 billion in revenue.

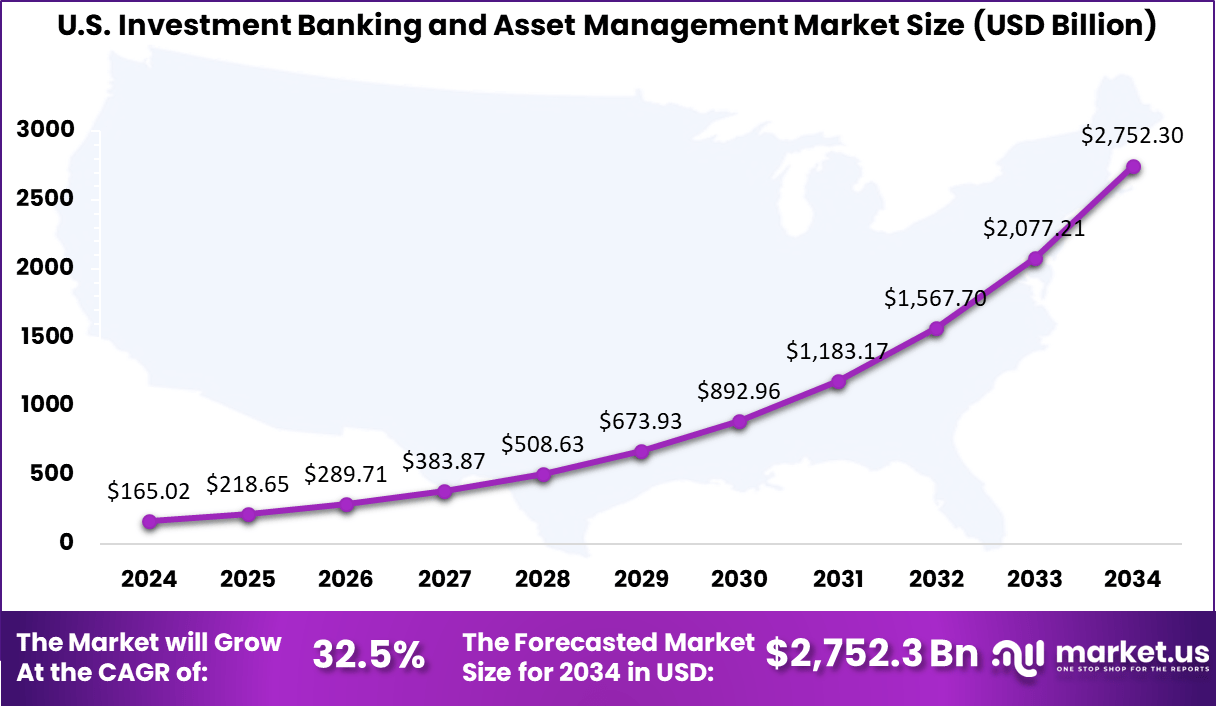

- The United States alone contributed approximately USD 165.02 billion, recording a CAGR of 32.5%.

- By service type, assets managed service held a leading share of 67.5%. Demand is rising for professionally managed investment solutions.

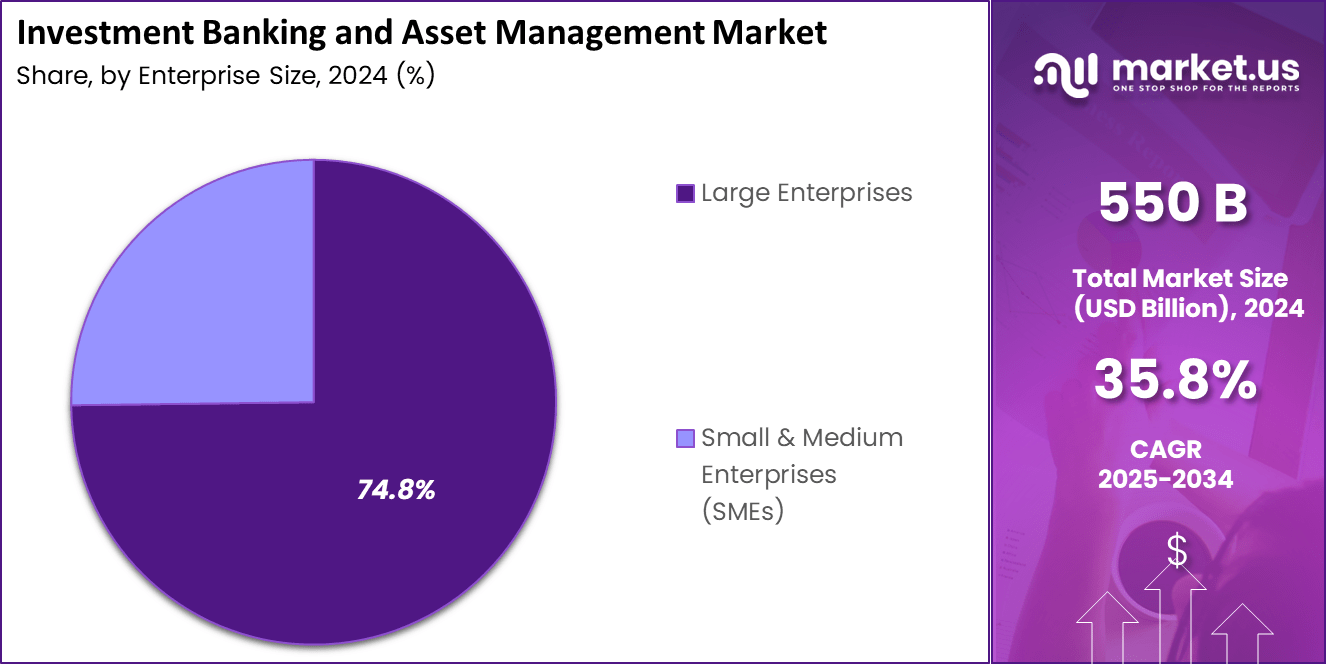

- By enterprise size, large enterprises accounted for the largest segment at 74.8%. These firms are driving significant market activity.

- By end use, corporations represented 35.6% of the market. Businesses remain key adopters of investment banking and asset management services.

- The market growth is fueled by increasing corporate investments, rising institutional demand, and strong focus on financial portfolio optimization.

U.S. Market Size

The U.S. Investment Banking and Asset Management Market was valued at USD 165.02 Billion in 2024 and is anticipated to reach approximately USD 2,752.3 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 32.5% during the forecast period from 2025 to 2034.

The U.S. Investment Banking and Asset Management market plays a pivotal role in the global financial landscape. Investment banks mainly facilitate capital raising, merger and acquisition, while asset management firm invests and grows on behalf of institutions and individuals. The major strength of the market is its well-established financial infrastructure, large institutional presence and its integration with global financial markets.

The US market dominates firms such as Goldman Sachs, JP Morgan and Bank of America, which offer a wide range of services ranging from persistence and advisor to money management. Investment banks continue to develop by incorporating new technologies like AI and blockchain to increase trade and investment strategies.

In 2024, North America held a dominant market position in the global Investment Banking and Asset Management Market, capturing more than a 35.3% share. North American investment banking and asset management market is experiencing strong growth, which is inspired by the demand for financial market complications and demand for sophisticated services.

This growth is fuel by merger, acquisition and increased capital market activity. With the transfer of investors to alternative investment and sustainable finance solutions, the asset continues to grow with the industry. Major players in the market are taking advantage of technology, including artificial intelligence and blockchain, to increase efficiency and develop demands. This growth indicates a promising future for the area.

Service Type Analysis

In 2024, the Assets Managed Service segment held a dominant market position, capturing more than a 67.5% share of the Global Investment Banking and Asset Management Market. This dominance can be attributed to many major drivers such as asset management and increasing demand for efficiency and cost reduction within investment banking firms, which have contributed to rapid adoption and development of services managed in the region.

Outsourcing asset management services for third-party providers allows businesses to focus on main operations, taking advantage of the expertise and scalability of managed service providers. This approach reduces internal resource burden and reduces the need for in-house infrastructure.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing more than a 74.8% share of the Global Investment Banking and Asset Management Market. Several key factors have contributed to this strong market dominance like technological advancements and automation, rising demand for passive investment strategies, expanding wealth management services, and increased focus on ESG criteria.

Large enterprises often have longstanding relationships with institutional investors, including pension funds, insurance companies, and sovereign wealth funds. These partnerships provide a steady stream of capital and contribute to their dominance in the asset management space.

End Use Industry Analysis

In 2024, the corporations segment held a dominant market position, capturing more than a 35.6% share of the Global Investment Banking and Asset Management Market. Market growth is attributed to the increasing demand for financial services and analog investment strategies that meet large corporations seeking capital for expansion and development.

Additionally, changes towards digital changes and adopting advanced technologies such as AI and Big Data Analytics have increased efficiency in managing corporate assets. In addition, the growing requirement of merger and acquisitions run by corporate strategies to remain competitive in the global economy is promoting the demand for investment banking services.

Key Market Segments

By Service Type

- Assets Managed Service

- Equities (stocks)

- Fixed Income (bonds)

- Real Estate

- Commodities

- Alternative Investments

- Others

- Investment Banking Service

- Mergers and Acquisitions (M&A) Advisory

- Capital Raising Advisory

- Restructuring

- Risk Management

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End Use

- Corporations

- Governments

- High-net-worth individuals

- Retail investors

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rise in ESG-linked Underwriting

The rise in ESG-linked underwriting in investment banking is driven by the increasing demand for socially responsible investments. Investors are becoming more conscious of environmental, social, and governance (ESG) factors and are seeking investment opportunities that align with their values. This shift has led investment banks to develop specialized ESG products, such as green bonds and sustainability-linked loans, to cater to this growing demand.

ESG-linked underwriting not only helps banks tap into new market segments but also reduces the risk of investing in companies with poor ESG practices, which could face regulatory penalties or reputational damage. This trend is further supported by growing regulatory pressure on businesses to disclose ESG performance, driving companies to adopt sustainable practices to attract investors.

As institutional investors, asset managers, and corporate clients prioritize ESG factors in their portfolios, investment banks are increasingly integrating these considerations into their underwriting processes, offering a more holistic and ethical approach to capital markets. This ensures long-term value creation for both clients and the environment.

Restraint

Technological Risks

Increasing integration of advanced technologies such as Artificial Intelligence (AI), blockchain and investment banking and asset management has given rise to significant innovations but has also presented sufficient risks. While these technologies increase operational efficiency and decision making, they also highlight firms to technical weaknesses.

Cyber security hazards, such as hacking and data violations, are among the most pressure concerns. Financial institutions handle vast amounts of sensitive customer data, making them the major goals for cyber criminals. A violation can severely damage the reputation of a firm, causing the client trust and potentially damaged the expensive legal consequences.

In addition, the complexity and rapid development of AI and blockchain technologies makes them susceptible to unexpected technical flaws and weaknesses. As financial institutions rapidly rely on these techniques, increasing the risk of system failures or misuse, which can directly affect financial stability.

Opportunities

Growing demand for personalization

Increasing regulation and compliance requirements in financial markets offer an important opportunity for investment banks and asset managers. As financial markets develop, stringent rules such as the Dod-Frank Act, Mifid II, and Basel III are continuously shaping the method of operating financial institutions.

This complexity can be benefited by firms that offer special compliance advisors and regulatory reporting services. Investment banks and asset managers can help customers to navigate the complex web of rules, providing value -added services that are in line with the rules that develop customers.

Firm may offer expertise in risk management, regulatory reporting, and transactions supervision, allowing customers to focus on their main occupation by reducing the risk of non-transportation. In addition, such as the regulatory landscape becomes more complex, the demand for these advisory services is increasing.

Challenges

Rapid changes in regulations

Global investment banking and asset management industries are struggling with the challenge of maintaining efficient talent between developing the dynamics of the market. Since financial services are rapidly data-operated, firms especially have pressure to recruit and maintain professionals with expertise in specialized fields such as data science, artificial intelligence (AI) and regulatory compliance.

The demand for these highly skilled professionals is increasing, but the supply of qualified talent is limited. This creates an important skill difference, as traditional financial services must be compatible with new techniques and functioning, which require a separate set of competencies. To overcome this challenge, firms must invest in strong training and development programs aimed at raising their workforce.

This includes promoting data analysis, machine learning, and complex regulatory structure to promote continuous learning culture and resource for employees to enhance their technical skills. Additionally, organizations should focus on creating an attractive task environment to maintain top talents, including career development opportunities, competitive compensation and a positive company culture.

Growth Factors

One of the primary development factors is the increasing demand for permanent investment, especially inspired by increasing attention to the environment, social and governance (ESG) norms. Investors are now more inclined to choose assets that align with their values, and as a result, financial institutions are offering more ESG-linked products such as green bonds and stability-centered funds.

Another important factor is technological progress in financial services, especially AI, blockchain and Big data analytics. These technologies are increasing operational efficiency, improving risk management, and enabling more individual investment strategies. Asset management firm and investment banks that take advantage of these innovations will be well deployed to capture market share.

Latest Trends

The global investment banking and asset management market is evolving rapidly, driven by by many major trends. One of the most prominent is the integration of advanced technology, such as Artificial Intelligence (AI), Blockchain and Big Data.

These technologies are revolutionizing financial services, improving capacity, enabling more personal investment strategies. Investment banks and asset managers are rapidly benefiting from these devices to increase risk management, optimize portfolio and to streamline operations.

Another trend is the rise of ESG (environment, social and governance) investment, which continues to gain momentum. Both investors and institutes are focusing on permanent investment opportunities, along with ESG-linked bonds, funds and other financial products. This trend is carrying forward banks and asset managers to align their offerings with the increasing demand of customers for socially responsible.

Key Players Analysis

One of the prominent players in the global investment banking and asset management market, J.P. Morgan Chase offers a comprehensive suite of services, including investment banking, asset management, and treasury services. J.P. Morgan is known for its strong presence in mergers and acquisitions (M&A), capital markets, and wealth management services.

The firm leverages cutting-edge technology and a deep understanding of global financial markets to deliver personalized solutions to institutional and retail clients. Their investment strategies and innovative financial products cater to a wide range of asset classes, offering high returns with minimal risks.

Another key player, Goldman Sachs, is a leading global investment banking, securities, and investment management firm. Goldman Sachs provides advisory services, capital raising, and asset management solutions to clients worldwide.

The firm is recognized for its deep expertise in M&A transactions, market insights, and risk management. Goldman Sachs integrates advanced data analytics and AI-driven models to optimize financial strategies, further enhancing its competitive edge in the market.

Top Key Players in the Market

- ABB Inc.

- Adobe Systems Inc.

- Brookfield Asset Management Inc.

- Honeywell International Inc.

- IBM Corp.

- Oracle Corp.

- Rockwell Automation, Inc.

- Siemens AG

- WSP Global Inc.

- Zebra Technologies Corp.

- Hitachi, Ltd.

- General Electric Company

- Bentley Systems, Incorporated

- Hexagon AB

- AssetWorks, Inc.

- SAP SE

- Others

Recent Developments

- In April 2025, Barclays and Brookfield Asset Management Ltd. through its Financial Infrastructure strategy, announced a long-term strategic partnership to grow and transform Barclays’ payment acceptance business. Barclays and Brookfield work to create a standalone entity over time.

- In April 2025, UBS announced to entered into an exclusive strategic collaboration with 360 ONE WAM Ltd, one of India’s largest independent wealth and asset management firms. This strategic collaboration combined UBS’s global and regional expertise with 360 ONE’s local knowledge and reach to deliver enhanced benefits to clients, representing a significant advancement in UBS’s global Indian wealth management business.

- In April 2025, Nomura and Macquarie announced that they have entered into an agreement for Nomura to acquire Macquarie’s U.S. and European public asset management business, with approximately US$180 billion in retail and institutional client assets across equities, fixed income and multi-asset strategies.

Report Scope

Report Features Description Market Value (2024) USD 550 Bn Forecast Revenue (2034) USD 11,731.7 Bn CAGR (2025-2034) 35.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Assets Managed Service (Equities (stocks), Fixed Income (bonds), Real Estate, Commodities, Alternative Investments, and Others), and Equities (stocks), Fixed Income (bonds), Real Estate, Commodities, Alternative Investments, and Others)), by Enterprise Size (Large Enterprises, and Small & Medium Enterprises (SMEs)), and by End Use (Corporations, Governments, High-net-worth individuals, Retail investors, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Inc., Adobe Systems Inc., Brookfield Asset Management Inc., Honeywell International Inc., IBM Corp., Oracle Corp., Rockwell Automation, Inc., Siemens AG, WSP Global Inc., Zebra Technologies Corp., Hitachi, Ltd., General Electric Company, Bentley Systems, Incorporated, Hexagon AB, AssetWorks, Inc., SAP SE, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Investment Banking and Asset Management MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Investment Banking and Asset Management MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Inc.

- Adobe Systems Inc.

- Brookfield Asset Management Inc.

- Honeywell International Inc.

- IBM Corp.

- Oracle Corp.

- Rockwell Automation, Inc.

- Siemens AG

- WSP Global Inc.

- Zebra Technologies Corp.

- Hitachi, Ltd.

- General Electric Company

- Bentley Systems, Incorporated

- Hexagon AB

- AssetWorks, Inc.

- SAP SE

- Others