Intradermal Injection Market By Method (Normal Needles, Short Needle (Microneedle Arrays, Intradermal Microinjection, and Tattoo Devices), and Without Needle (Intradermal Liquid Jet Devices and Ballistic Intradermal Injectors)), By Application (Tuberculin Skin Test, Local Aesthetics, Allergy Test, and Others), By End-user (Hospitals, Academics and Research Institutes, Diagnostic Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133420

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

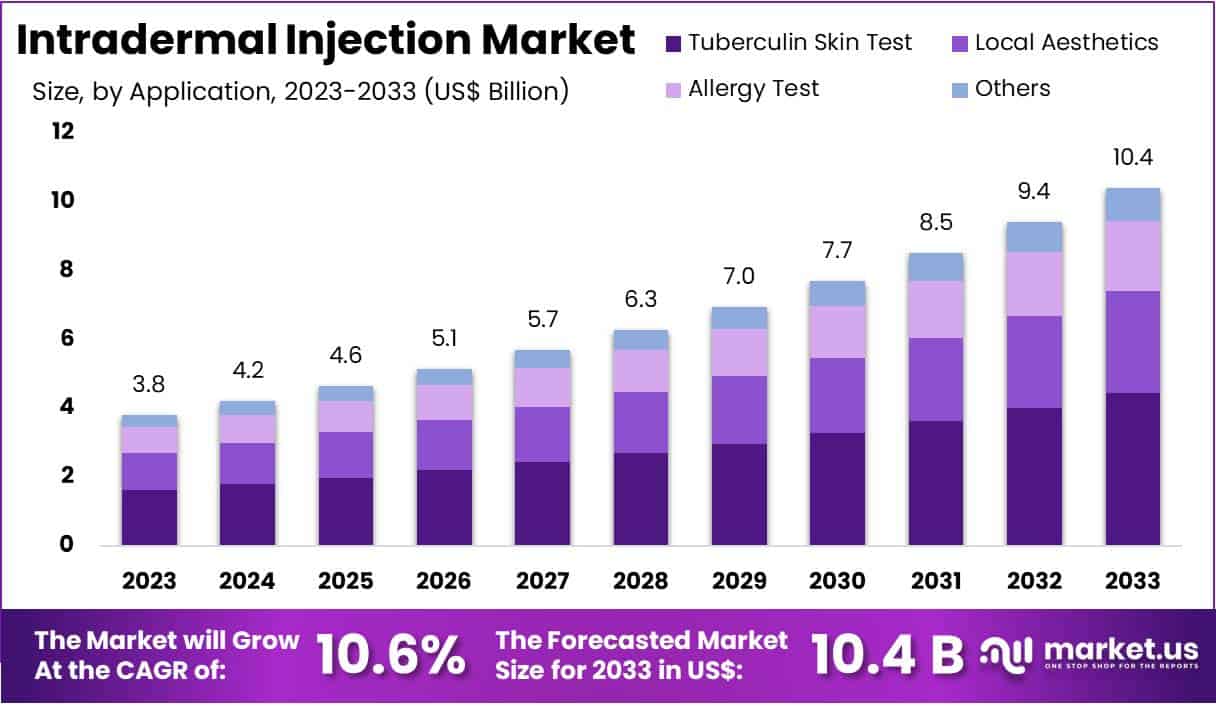

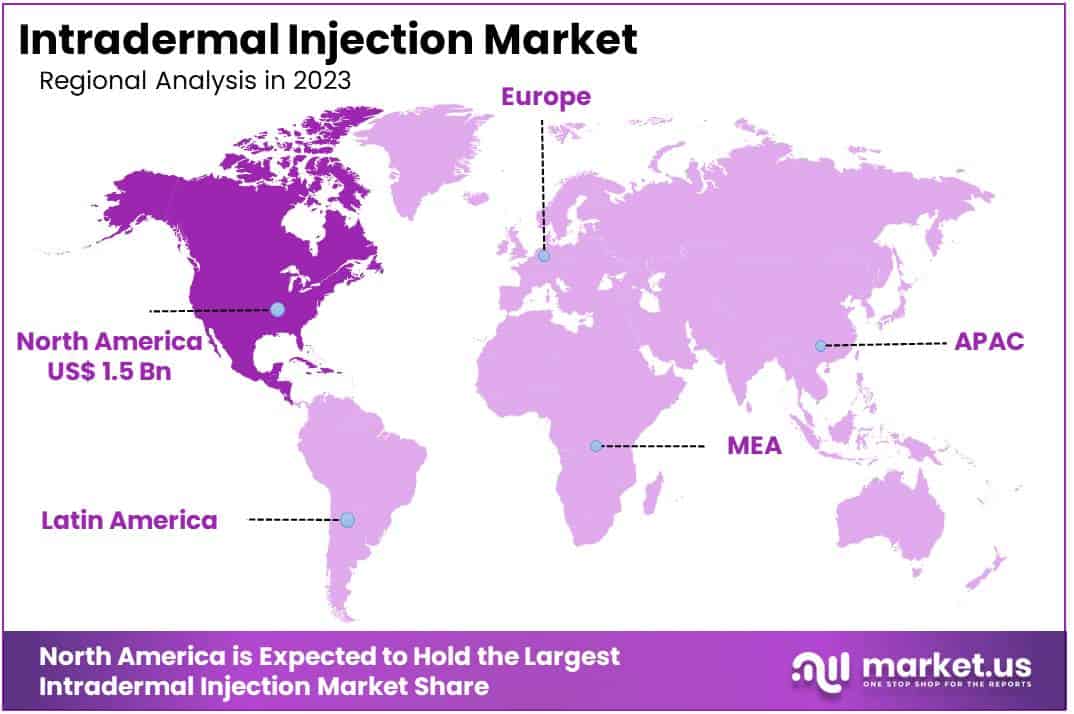

The Intradermal Injection Market size is expected to be worth around US$ 10.4 billion by 2033 from US$ 3.8 billion in 2023, growing at a CAGR of 10.6% during the forecast period 2024 to 2033. North America dominated the market, holding a 40.1% share.

Growing prevalence of chronic diseases and the demand for precise drug delivery drive the intradermal injection market. Intradermal injections, known for their applications in immunization, allergy testing, and localized treatments, offer advantages such as reduced dosage requirements and enhanced immune responses.

According to the International Diabetes Federation Diabetes Atlas 2021, the United Kingdom’s age-adjusted prevalence of diabetes was 6.3% in 2021, with projections rising to 7.0% by 2030 and 7.5% by 2045. This increasing burden of chronic diseases underscores the need for effective administration methods, including intradermal delivery for emerging treatments like vaccines and biologics.

Recent trends highlight the development of microneedle patches and jet injectors, improving patient compliance through minimally invasive techniques. Opportunities in the market also stem from advancements in personalized medicine, where intradermal injection plays a crucial role in delivering tailored therapies with precise dosing. Additionally, the growing focus on tuberculosis and other infectious disease prevention fuels demand for intradermal vaccines, supporting global immunization efforts.

Key Takeaways

- In 2023, the market for intradermal injection generated a revenue of US$ 3.8 billion, with a CAGR of 10.6%, and is expected to reach US$ 10.4 billion by the year 2033.

- The method segment is divided into normal needles, short needle, and without needle, with normal needles taking the lead in 2023 with a market share of 47.3%.

- Considering application, the market is divided into tuberculin skin test, local aesthetics, allergy test, and others. Among these, tuberculin skin test held a significant share of 42.7%.

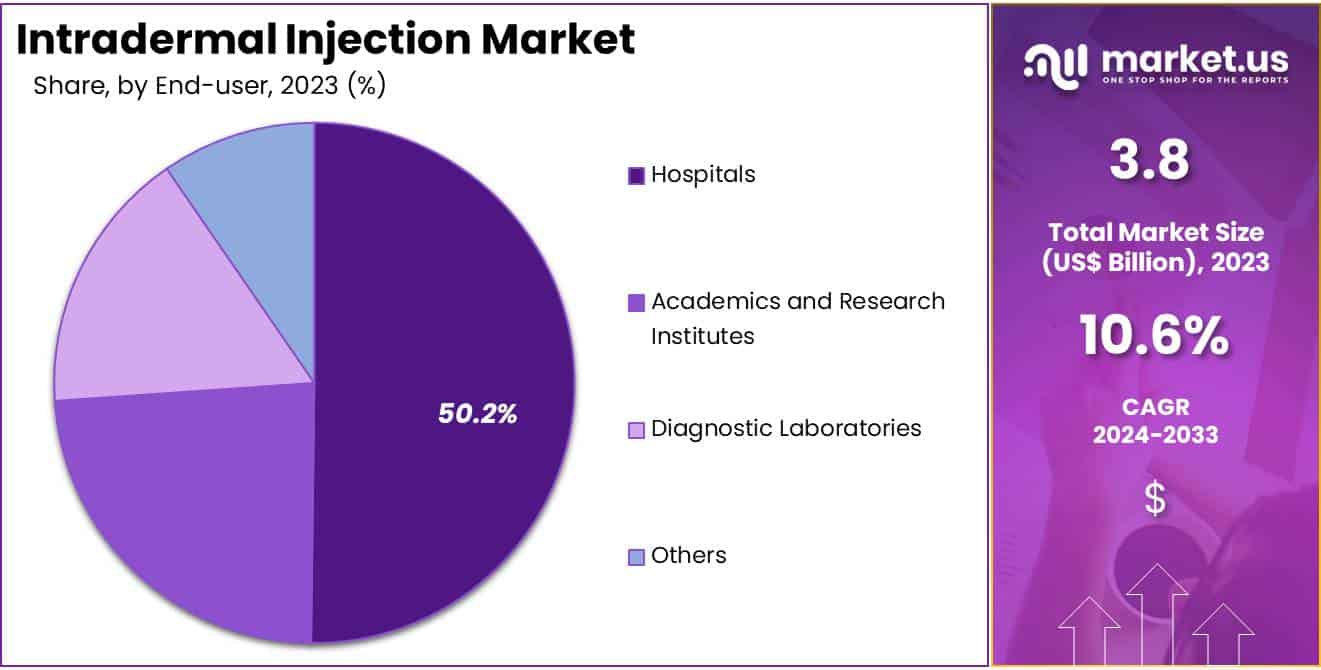

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, academics and research institutes, diagnostic laboratories, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 50.2% in the intradermal injection market.

- North America led the market by securing a market share of 40.1% in 2023.

Method Analysis

The normal needles segment led in 2023, claiming a market share of 47.3% owing to the widespread use of normal needles in both routine and specialized intradermal procedures, such as vaccinations and diagnostic tests. Healthcare providers favor normal needles due to their compatibility with a broad range of injection devices and their reliability in delivering precise doses into the dermis layer.

Additionally, normal needles are more cost-effective and widely available, making them the preferred choice in low-resource healthcare settings. The segment also benefits from ongoing improvements in needle design, which enhance patient comfort and minimize tissue damage. As the demand for intradermal injections increases, particularly for immunizations and allergy testing, the normal needles segment is projected to grow steadily.

Application Analysis

The tuberculin skin test held a significant share of 42.7% due to the rising global incidence of tuberculosis (TB), particularly in developing regions where early detection plays a crucial role in controlling the disease. Healthcare providers frequently rely on the tuberculin skin test as a cost-effective and reliable method for TB screening. Public health initiatives aimed at eradicating tuberculosis further boost demand for intradermal injections in this segment.

Additionally, advancements in diagnostic accuracy and increased awareness about the importance of early TB detection contribute to the segment’s growth. As governments and healthcare organizations intensify efforts to manage TB, the tuberculin skin test segment is anticipated to experience robust expansion.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 50.2% owing to the high volume of intradermal procedures performed in hospitals, including vaccinations, diagnostic tests, and therapeutic injections. Hospitals provide access to advanced medical equipment and trained healthcare professionals, ensuring accurate and efficient administration of intradermal injections.

The segment also benefits from the increasing number of hospital visits for preventive healthcare, such as TB screenings and allergy tests. Additionally, expanding healthcare infrastructure in emerging economies supports the growth of hospital-based intradermal procedures. As hospitals continue to play a pivotal role in primary and specialized care, the segment is anticipated to remain a key contributor to the intradermal injection market.

Key Market Segments

By Method

- Normal Needles

- Short Needle

- Microneedle Arrays

- Intradermal Microinjection

- Tattoo Devices

- Without Needle

- Intradermal Liquid Jet Devices

- Ballistic Intradermal Injectors

By Application

- Tuberculin Skin Test

- Local Aesthetics

- Allergy Test

- Others

By End-user

- Hospitals

- Academics and Research Institutes

- Diagnostic Laboratories

- Others

Drivers

Growing Prevalence of Cancer

The rising prevalence of cancer significantly drives the intradermal injection market as these injections play a crucial role in administering cancer vaccines and immunotherapies. According to the American Cancer Society’s 2022 report, over 1.9 million novel cancer cases were expected in the United States in that year. The report also highlighted that 80% of cancer patients are aged 55 or older, with 57% being 65 or older, indicating that the risk of cancer increases substantially with age.

As the aging population grows, the incidence of cancer is anticipated to rise, further driving demand for effective treatment and vaccination methods. Intradermal injections are increasingly used for delivering cancer immunotherapies, which stimulate the immune system to target and destroy cancer cells.

Their ability to improve the efficacy of therapeutic agents while minimizing systemic side effects makes them a preferred choice for healthcare providers. This trend aligns with the growing focus on personalized cancer treatments, supporting market growth.

Restraints

Rising Impact of Unfavorable Government Provisions

Unfavorable government provisions significantly impede the growth of the intradermal injection market, particularly in regions with stringent regulatory frameworks. Policies that impose high taxes on medical devices, complex approval processes, or restrictive import regulations hamper market expansion. These barriers increase the cost and delay the availability of intradermal injection devices, limiting their adoption in healthcare settings.

In some countries, limited reimbursement policies for advanced injection systems further discourage their use, impacting patient access to innovative therapies. Healthcare providers may opt for alternative delivery methods due to cost or regulatory constraints, affecting market penetration.

Additionally, inconsistent regulations across different regions create challenges for manufacturers, increasing compliance costs and operational complexities. This regulatory environment is anticipated to restrain market growth, particularly in low- and middle-income countries where policy barriers are more pronounced.

Opportunities

Rising Number of Diabetic Patients

The increasing number of diabetic patients presents a significant opportunity for the intradermal injection market as these injections offer a promising method for delivering insulin and other diabetes-related medications. According to the International Diabetes Federation’s December 2021 report, approximately 32.2 million people were living with diabetes in the United States in 2021, and this figure is projected to rise to 36.3 million by 2045.

Intradermal injections allow for precise and efficient delivery of insulin, enhancing glucose management while reducing discomfort compared to traditional subcutaneous methods. Additionally, ongoing research highlights the potential of intradermal injections in administering vaccines for diabetes-related complications, further expanding their application.

As the global diabetes burden grows, healthcare providers are likely to adopt advanced delivery systems that improve patient compliance and outcomes. This trend aligns with the increasing emphasis on personalized medicine and minimally invasive treatment options, driving demand for intradermal injections in diabetes management.

Impact of Macroeconomic / Geopolitical Factors

The intradermal injection market is significantly impacted by macroeconomic and geopolitical factors. In developed regions, economic growth boosts healthcare spending, which supports the adoption of advanced injection techniques. However, economic instability and inflation in emerging markets restrict healthcare budgets, limiting access to these specialized procedures.

Geopolitical tensions and trade restrictions disrupt global supply chains, leading to shortages and increased costs for medical devices needed for intradermal injections. Additionally, diverse regulatory environments across regions create compliance challenges, which can affect market entry and product availability.

Despite these challenges, the market has opportunities for growth. Increased awareness of minimally invasive procedures and supportive government initiatives are driving the adoption of intradermal injections. Moreover, expanding healthcare infrastructure and a growing focus on preventive care are fostering innovation and investment in this sector.

Trends

Impact of Rising Collaborations and Strategic Partnerships

Rising collaborations and strategic partnerships are anticipated to drive growth in the intradermal injection market. In May 2022, Stevanato Group S.p.A. entered an exclusive agreement with medical device developer Owen Mumford Ltd. for the Aidaptus auto-injector. Aidaptus is a two-step, single-use device accommodating both 1 mL and 2.25 mL prefilled glass syringes in the same base unit. Such partnerships combine expertise in device design and manufacturing, leading to innovative solutions that enhance patient comfort and compliance.

Collaborations between pharmaceutical companies and medical device manufacturers facilitate the development of advanced intradermal injection systems, addressing the growing demand for minimally invasive drug delivery methods. These alliances streamline product development and regulatory approval processes, accelerating market entry. As strategic partnerships continue to rise, the intradermal injection market is projected to experience sustained growth, offering improved therapeutic options for patients and healthcare providers.

Regional Analysis

North America is leading the Intradermal Injection Market

North America dominated the market with the highest revenue share of 40.1% owing to advancements in dermatological and therapeutic applications. A study published in the Journal of Plastic & Reconstructive Surgery in April 2024 examined mechanical factors such as syringe and needle size, length, and skin booster viscosity, highlighting their impact on the force required for intradermal injections.

The study concluded that using smaller syringe diameters under optimal conditions enhanced the efficacy of skin booster treatments, maximizing rejuvenating outcomes. These findings have spurred the development of novel intradermal therapies, particularly in aesthetics and dermatology, offering substantial market growth opportunities.

Additionally, the rising prevalence of chronic conditions, such as diabetes and autoimmune diseases, and increasing demand for minimally invasive procedures further supported the market’s expansion in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare awareness and the adoption of advanced drug delivery systems. In May 2020, Takeda Pharmaceutical Company received approval from the European Commission for the subcutaneous formulation of Entyvio (vedolizumab), designed for the maintenance treatment of moderate to severe ulcerative colitis and Crohn’s disease.

The availability of Entyvio SC in pre-filled syringes and pens has enhanced patient convenience and compliance, setting a precedent for similar innovations in the Asia Pacific market. The increasing prevalence of chronic diseases, growing investment in healthcare infrastructure, and government initiatives supporting vaccination programs are anticipated to drive demand for intradermal injection technologies in the region. Furthermore, expanding pharmaceutical research and the rise of biologics are likely to contribute to the sustained growth of this market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the intradermal injection market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the intradermal injection market focus on developing advanced delivery systems, such as microneedles and jet injectors, to improve accuracy and patient comfort.

Many invest in research and development to expand the use of intradermal delivery for vaccines, allergy tests, and cosmetic applications. Companies collaborate with healthcare institutions to conduct clinical trials and validate the efficacy of their innovations. They also target emerging markets where demand for minimally invasive procedures is rising. Comprehensive training programs for healthcare professionals help ensure proper usage and boost adoption rates.

Top Key Players in the Intradermal Injection Market

- West Pharmaceuticals Services

- Terumo Corporation

- Pharmajet

- Nanopass

- Idevax

- Enusung

- Crossject

- Cardinal Health

- Becton Dickinson

Recent Developments

- Terumo Corporation, a leader in hypodermic needle innovation, offers a comprehensive platform of precision-engineered needles and needle stick prevention technologies, designed for challenging applications and high-throughput environments. Its product portfolio includes the Nanopass 34G Needle for Pen Injectors, Neolus Needles, and SurGuard Safety Hypodermic Needles, which are instrumental in ensuring safer, less painful injections. This wide range of products supports the growth of the intradermal injection market by enhancing patient comfort and ensuring the efficacy of therapeutic drug delivery.

- In May 2021: Crossject strengthened its partnership with Cenexi to scale up industrial manufacturing of ZENEO, a needle-free auto-injection system. This collaboration highlights the increasing demand for innovative and sterile drug delivery solutions. The introduction of needle-free technologies like ZENEO supports the growth of the intradermal injection market by offering alternatives that improve patient compliance and expand application areas.

Report Scope

Report Features Description Market Value (2023) US$ 3.8 billion Forecast Revenue (2033) US$ 10.4 billion CAGR (2024-2033) 10.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Method (Normal Needles, Short Needle (Microneedle Arrays, Intradermal Microinjection, and Tattoo Devices), and Without Needle (Intradermal Liquid Jet Devices and Ballistic Intradermal Injectors)), By Application (Tuberculin Skin Test, Local Aesthetics, Allergy Test, and Others), By End-user (Hospitals, Academics and Research Institutes, Diagnostic Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape West Pharmaceuticals Services, Terumo Corporation, Pharmajet, Nanopass, Idevax, Enusung, Crossject, Cardinal Health, and Becton Dickinson. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intradermal Injection MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Intradermal Injection MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- West Pharmaceuticals Services

- Terumo Corporation

- Pharmajet

- Nanopass

- Idevax

- Enusung

- Crossject

- Cardinal Health

- Becton Dickinson