Global Interplanetary Dust Sensor Market Size, Share Report Analysis By Product Type (Impact Ionization Sensors, Optical Sensors, Acoustic Sensors, Others), By Application (Space Missions, Satellite Protection, Research & Development, Others), By Platform (Satellites, Space Probes, Spacecraft, Others), By End-User (Space Agencies, Research Institutes, Commercial Space Companies, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169761

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

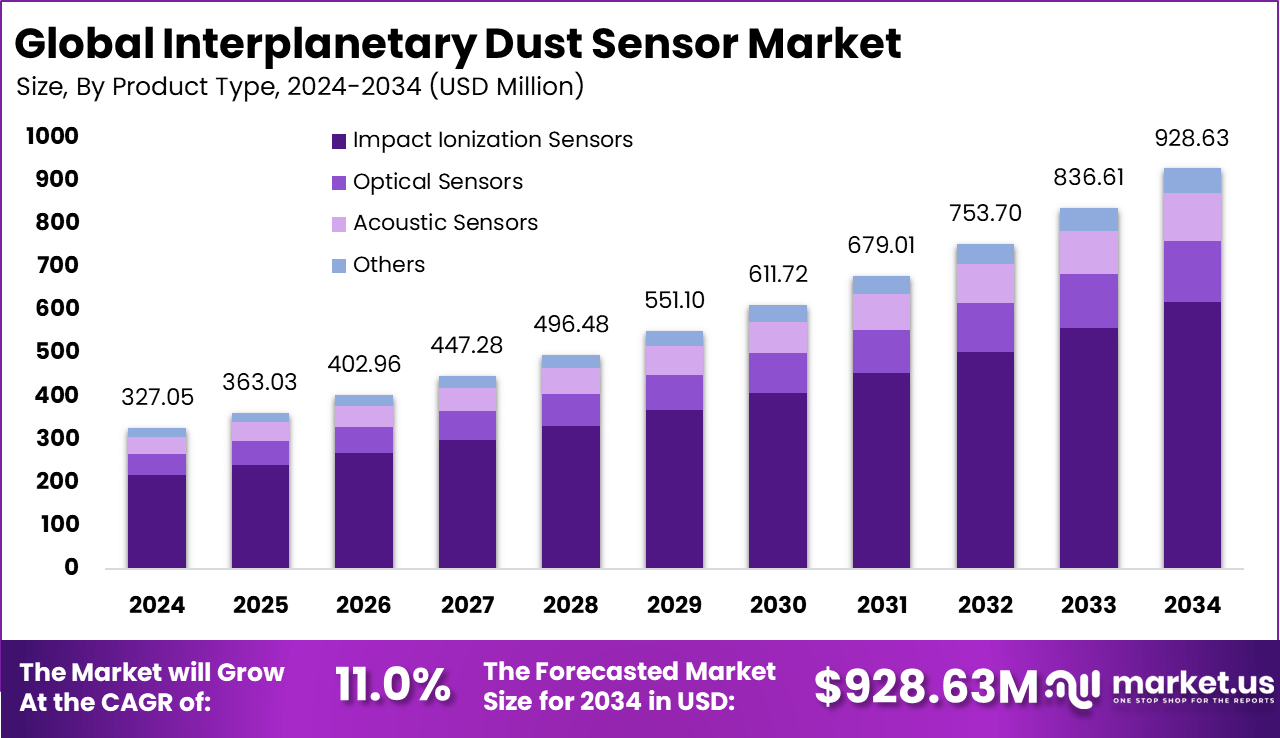

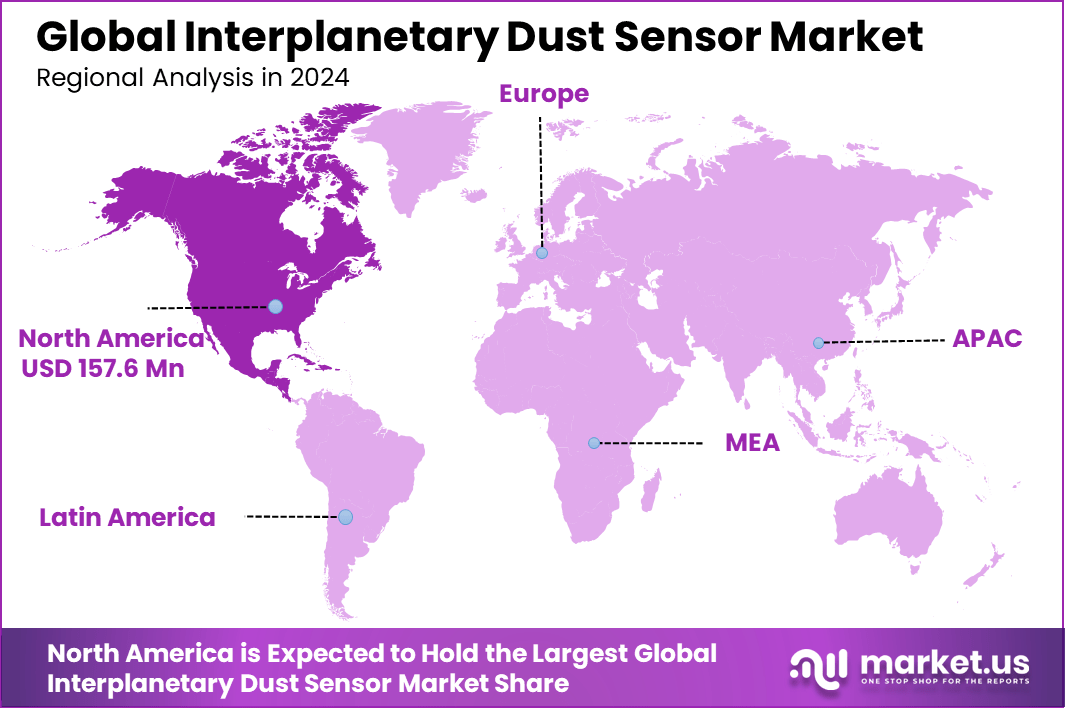

The Global Interplanetary Dust Sensor Market size is expected to be worth around USD 928.63 million by 2034, from USD 327.05 million in 2024, growing at a CAGR of 11.0% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 48.2% share, holding USD 157.6 million in revenue.

The interplanetary dust sensor market has grown as space agencies and research institutions increase deep space missions focused on planetary science and space environment studies. Growth is linked to the rising need to measure tiny dust particles that travel between planets and influence spacecraft safety, planetary formation studies and space weather research. These sensors are now an essential part of many scientific payloads sent beyond Earth orbit.

The growth of the market can be attributed to rising investment in space exploration, increasing number of planetary missions and growing interest in understanding the origin and movement of cosmic dust. Dust particles can damage spacecraft surfaces and instruments during long missions. Sensors help scientists study these risks while also providing valuable data on solar system evolution.

Demand is rising across national space programs, scientific research missions, planetary probes and interplanetary spacecraft developers. Dust sensors are required for missions to explore Mars, asteroids, comets and the outer solar system. Research focused on space debris behavior and micrometeoroid impact analysis also supports demand for these sensors.

The market for Interplanetary Dust Sensors is driven by the surge in deep space missions from agencies like NASA, ESA, and JAXA, plus private outfits such as SpaceX and Blue Origin. These trips to Mars, asteroids, and beyond need sensors to track dust belts and dodge particle hits that could wreck gear. Global spends hit billions yearly on probes like NASA’s IMAP and JAXA’s DESTINY+, pulling in demand for tough, real-time detectors.

For instance, in June 2025, JAXA advanced preparations for the DESTINY+ mission with its upgraded Dust Analyzer (DDA), a German-Japanese collaboration set for a 2026 launch to the Phaethon asteroid. The sensor will measure interplanetary and interstellar dust during cruise, improving on Cassini-era tech for real-time composition analysis.

Key Takeaway

- Impact ionization sensors led with a 66.8% share in 2024, confirming their high reliability for detecting high-speed dust particles in space environments.

- Space missions accounted for 72.4%, showing that most demand comes directly from exploration and scientific research programs.

- Space probes captured 60.6%, reflecting their primary role in deep-space dust measurement and interplanetary analysis.

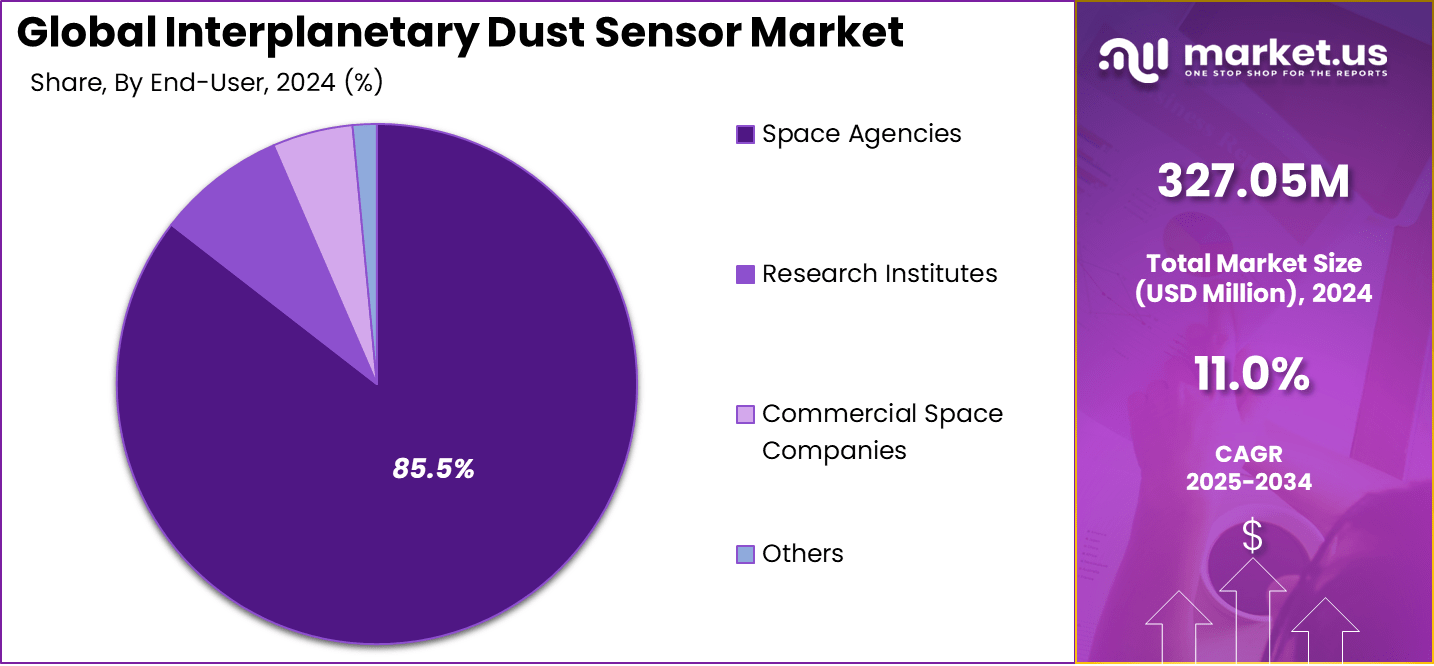

- Space agencies dominated with a strong 85.5% share, indicating that government-backed missions remain the main buyers of these advanced sensors.

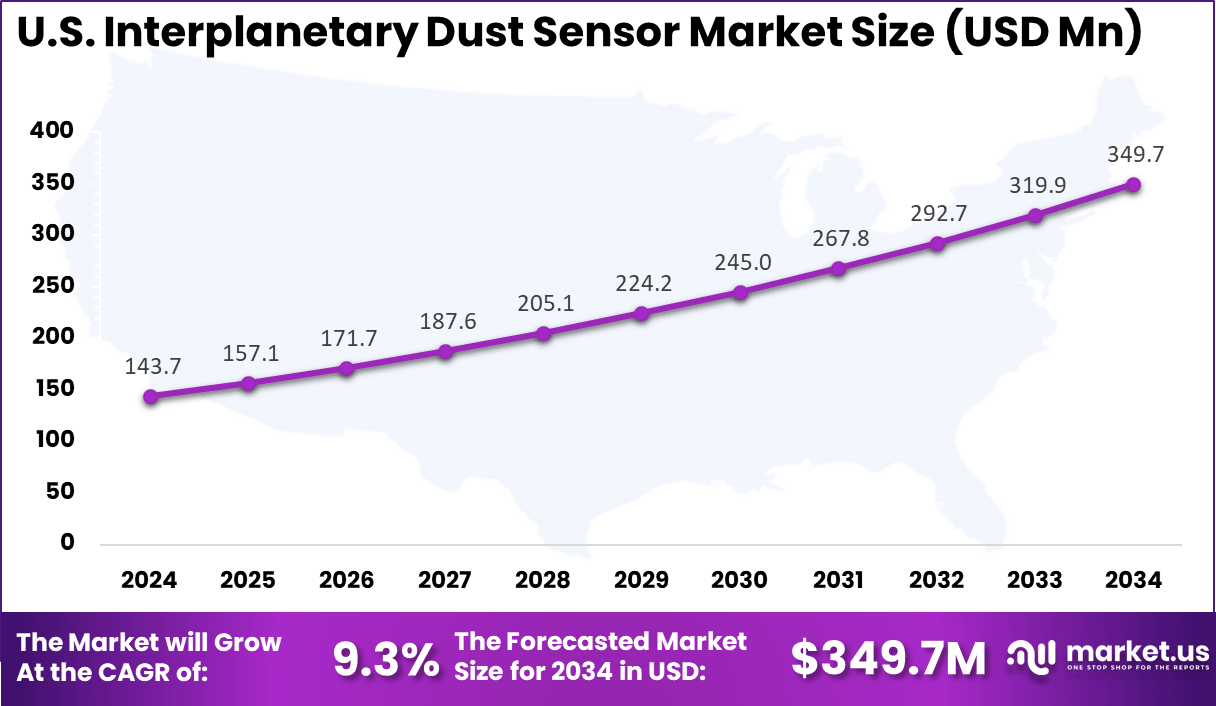

- The U.S. market reached USD 143.7 million in 2024 with a steady 9.3% CAGR, supported by continuous investment in planetary science and space exploration.

- North America held more than 48.2% share, driven by advanced space programs, high R&D spending, and strong institutional participation.

Role of Generative AI

Generative AI helps process the vast data from interplanetary dust sensors. It builds models to find hidden patterns in particle streams that people often overlook. Research shows these tools improve dust impact detection by 16-18% compared to traditional setups. This makes missions safer by spotting risks early. Teams train systems with created datasets for rare events like sudden dust bursts.

The tech cleans up noisy signals and sharpens predictions for better navigation. In real missions, it plans paths around dense dust areas. Ground crews rely on it to cut down false alerts during flights. Overall, generative AI turns raw sensor hits into clear action steps.

Investment and Business Benefits

Compact sensors suit lunar and Mars runs by private groups, slashing failure odds from dust. Lab team with space outfits to test prototypes for edge-of-system probes. AI ties lift detection on nanometer bits live, drawing funds for next-gen builds. Backers eye tools that handle stream peaks without fail. Growth comes from shared tech for sample grabs and relays. Ventures bank on durable designs that pay off in data hauls over time.

Early dust spots trim fix bills, letting missions run full 7-year spans unbroken. Impact logs turn to clues on solar history, aiding grant bids and papers. Auto flags tie hits to comet lanes in inner paths, streamlining ops. They save weight over extras like shields, freeing payload for science kits. Operators log cleaner flights with fewer surprises. Long-term, they build trust in repeat flights to dusty zones.

U.S. Market Size

The market for Interplanetary Dust Sensor within the U.S. is growing tremendously and is currently valued at USD 143.7 million, the market has a projected CAGR of 9.3%. The market is growing due to rising investments in deep space exploration by NASA and private firms.

Missions like Artemis and IMAP demand reliable dust detection to protect spacecraft from high-speed particles. Advances in impact ionization tech improve data on cosmic dust flows. Agencies prioritize these sensors for safety in asteroid belts and interstellar probes. Strong R&D funding fuels this steady rise.

For instance, in December 2025, NASA developed the Interstellar Dust Experiment (IDEX) for its IMAP mission, launching in Spring 2025 to capture interstellar dust particles traveling over 100,000 mph. This 47-pound instrument, built by the University of Colorado Boulder’s LASP, analyzes dust composition to reveal supernova origins and early solar system building blocks, reinforcing U.S. leadership in space dust detection technology.

In 2024, North America held a dominant market position in the Global Interplanetary Dust Sensor Market, capturing more than a 48.2% share, holding USD 157.6 million in revenue. This dominance is due to robust space programs led by NASA and key contractors.

Frequent missions like Artemis and IMAP require advanced dust sensors for spacecraft protection and data collection. Local innovation hubs drive tech upgrades in ionization detectors. Heavy R&D investments ensure reliable tools for deep space hazards. Private sector growth adds momentum to this strong lead.

For instance, in July 2025, Honeybee Robotics, in support of NASA’s Blue Ghost lunar lander mission, Honeybee Robotics successfully tested its PlanetVac pneumatic system 2025, collecting lunar regolith samples in just one second. This innovative dust collection technology demonstrates North American expertise in rapid, efficient planetary sample acquisition for future Artemis missions.

Product Type Analysis

In 2024, the Impact Ionization Sensors segment held a dominant market position, capturing a 66.8% share of the Global Interplanetary Dust Sensor Market. These devices detect fast-moving dust particles by creating an electric charge on impact. This method proves reliable in the harsh conditions of deep space. Missions count on them for accurate data about dust streams from comets and asteroids.

The strength of impact ionization sensors comes from their simplicity and durability. They need minimal power, which suits spacecraft with tight energy budgets. Data from past missions shows they capture particle size and speed effectively. This helps scientists map dust distribution across the solar system. As exploration expands, these sensors remain a go-to choice.

For Instance, in December 2024, NASA advances impact ionization tech with IMAP probe’s IDEX instrument. This drum-shaped collector captures interstellar dust by vaporizing particles into ions for analysis. It targets high-speed grains penetrating the heliosphere. Data will reveal cosmic origins during a two-year mission at Lagrange Point 1.

Application Analysis

In 2024, the Space Missions segment held a dominant market position, capturing a 72.4% share of the Global Interplanetary Dust Sensor Market. These tools protect spacecraft from unseen hazards during journeys to distant planets. They also collect vital samples of cosmic dust for study. Agencies use the data to understand solar system formation.

Demand rises with ambitious projects like sample returns from asteroids. Sensors must endure years in a vacuum and radiation. This segment grows as launch frequencies increase worldwide. In space missions, dust sensors provide real-time alerts and scientific insights. They track how dust affects spacecraft surfaces over time. Findings reveal patterns in interplanetary dust bands.

This information refines models for future trajectories. Teams integrate them early in mission design for the best results. Reliability in extreme environments sets them apart. Ongoing tests push boundaries for next-generation explorers heading to outer planets.

For instance, in July 2025, Honeybee Robotics will integrate dust tools into JAXA’s MMX mission. Their pneumatic sampler gathers Phobos material without surface seals. Nitrogen gas prevents contamination in harsh regolith. NASA contributes to this interplanetary dust handling effort.

Platform Analysis

In 2024, The Space Probes segment held a dominant market position, capturing a 60.6% share of the Global Interplanetary Dust Sensor Market. These uncrewed vehicles venture into asteroid belts and comet vicinities. Sensors on probes deliver precise measurements of dust flux and composition. They help unravel mysteries of planetary building blocks.

Probes face intense particle bombardment, so robust detection matters. This platform sees steady adoption in solar system surveys. Data feeds global research efforts. Probes benefit from compact, lightweight dust sensors tailored for autonomy. They operate without ground support for months or years.

The key advantage lies in the high-resolution timing of impacts. This captures rare events like meteor streams. Engineers prioritize redundancy to ensure data return. As probe missions multiply, sensor tech evolves for better range. They now detect finer details in dust trails from distant sources.

For Instance, in January 2025, the NASA Perseverance rover detects electric sparks in Mars dust devils. Images from Jezero Crater show particle activity in storms. This aids probe designs facing dynamic dust environments. Findings refine sensors for future rover paths.

End-User Analysis

In 2024, The Space Agencies segment held a dominant market position, capturing an 85.5% share of the Global Interplanetary Dust Sensor Market. These organizations fund large-scale missions requiring top-tier instrumentation. They demand proven performance from past flights like deep-space flybys. Sensors aid in hazard avoidance and payload protection.

Budgets prioritize tech with heritage in successful operations. This group shapes market direction through strict standards. Collaboration across agencies boosts innovation. Agencies integrate dust sensors into core mission systems for comprehensive monitoring. They analyze data to predict dust risks on upcoming paths. Long-term archives from these sensors build a dust environment database.

This informs safer designs for crewed ventures later. Procurement focuses on vendors with space-qualified parts. Training programs emphasize sensor data interpretation. Their lead ensures steady advancement in detection capabilities.

For Instance, in December 2025, NASA selected instruments for Artemis IV lunar surface work. Space agencies prioritize dust sensors for crewed missions. They deploy tools for hazard monitoring. This drives demand in agency budgets.

Emerging Trends

One emerging trend in the interplanetary dust sensor market is the increased use of compact sensors on small satellites and deep space probes. Improvements in miniaturization and low power electronics allow dust sensors to be installed on CubeSats and small missions that were previously limited by size and weight. This trend expands the number of missions capable of collecting dust data and supports broader scientific coverage across space environments.

Another trend is the adoption of multiple sensing methods within a single mission. Along with traditional impact based sensors, newer optical and electric field based detection techniques are being tested to measure particle size, speed, and direction more accurately. Using more than one method improves data reliability and helps scientists better understand dust behavior in different regions of space.

A further trend is the growing focus on spacecraft safety. Dust sensors are no longer used only for scientific observation. They are increasingly deployed to monitor collision risk and surface degradation on spacecraft. This shift reflects the need to protect long duration missions and sensitive instruments from damage caused by high speed dust particles.

Growth Factors

A major growth factor is the rising number of space missions beyond Earth orbit. Exploration programs targeting the Moon, Mars, asteroids, and deep space generate demand for environmental monitoring tools. Interplanetary dust sensors play an important role in understanding space conditions and protecting spacecraft during these missions. As mission frequency increases, sensor demand grows alongside it.

Another growth factor is increased awareness of micrometeoroid and dust related risks. High velocity dust impacts can affect solar panels, instruments, and spacecraft surfaces. Space agencies and private operators recognize the importance of early detection and continuous monitoring. This awareness encourages inclusion of dust sensors in mission payloads.

Technological progress also supports market growth. New sensor designs offer improved sensitivity, longer operational life, and lower power consumption. These improvements make it easier to integrate dust sensors into a wide range of spacecraft platforms. As deployment becomes simpler and more reliable, adoption continues to expand.

Key Market Segments

By Product Type

- Impact Ionization Sensors

- Optical Sensors

- Acoustic Sensors

- Others

By Application

- Space Missions

- Satellite Protection

- Research & Development

- Others

By Platform

- Satellites

- Space Probes

- Spacecraft

- Others

By End-User

- Space Agencies

- Research Institutes

- Commercial Space Companies

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rise in Space Missions

More space agencies and private companies are steadily increasing their number of deep-space missions, which directly raises the need for advanced dust sensors. These sensors are vital for tracking and studying cosmic particles, helping spacecraft withstand dust impacts and enabling better planetary research. Consistent government funding and expanding commercial participation continue to strengthen this market trend, ensuring long-term growth momentum.

Dust sensors play an essential role in gathering data that improves spacecraft design and mission planning. As more projects target Mars, the Moon, and deeper space, demand for durable and precise sensors keeps rising. Regions like the Asia Pacific, led by growing exploration activities, are seeing strong contributions to this development, keeping the global dust sensor market on a positive trajectory.

For instance, in January 2025, NASA prepped the Interstellar Dust Experiment for IMAP launch. This dust collector aims to snag interstellar particles at the L1 point. Ties right into more deep-space probes needing dust data for safe paths. Boosts mission planning as agencies chase outer reaches. Clear the driver from the rising exploration push.

Restraint

High Development Costs

Developing dust sensors for space use involves high costs due to the need for specialized materials and extensive testing. Components must endure harsh environments such as radiation and extreme temperatures, which drives up production expenses. Smaller manufacturers often find it difficult to sustain these costs, allowing larger firms with broader resources to dominate.

Budget limitations also restrict advanced sensor adoption in emerging space programs. Nations and organizations with limited funding focus on essential instruments over high-end sensing technologies. Supply chain challenges for critical materials further elevate development costs, slowing wider market participation and moderating growth potential.

For instance, in October 2024, ESA wrapped Hera launch amid tight budgets for dust tech quals. Planetary Dust Workshop in 2025 flags high test costs for void gear. Limits quick rollouts as funds stretch thin on long certs. Agencies weigh spending against mission needs. Holds back wider sensor builds.

Opportunities

Tech Advances in Sensors

Advancements in sensor technology are creating opportunities for more efficient and lightweight dust sensors. The integration of AI and miniaturized components allows improved detection, accuracy, and real-time data analysis during space missions. These innovations enable sensors to fit across various spacecraft types, reducing cost and power needs.

Collaborations between technology developers and space agencies are fostering faster innovation cycles. New designs now support multi-function capabilities that go beyond dust measurement, expanding application potential. The rise of commercial space ventures and growing technology hubs in emerging regions further strengthens the market’s outlook for long-term expansion.

For instance, in July 2025, Astroscale patented reusable debris removers with sensor smarts. Targets multi-ton junk via guided drops from 2026 ELSA-M. Opens low-cost slots for mini dust tech in orbit ops. Links to rising private cleanups. Tech leaps create fresh market spots.

Challenges

Tough Space Conditions

Space presents extreme conditions that test the reliability and endurance of dust sensors. They must operate efficiently in severe temperature fluctuations, radiation exposure, and vacuum environments without maintenance for years. Equipment failure results in mission losses, making durability a constant technical challenge for manufacturers.

Integration difficulties also emerge due to different mission designs and power configurations. Maintaining sensor calibration over long durations in space adds another layer of complexity. Despite continuous innovation, replicating the full range of space conditions on Earth remains difficult, keeping environmental challenges a persistent obstacle for widespread sensor use.

For instance, in July 2025, Lockheed tapped Raytheon for OPIR GEO payloads with dust risks. Cosmic rays demand years of rad-hard tests per NASA. Drift hits accuracy over time. Fresh standards lag each build. Harsh conditions slow deep-space fits.

Key Players Analysis

NASA, ESA, and JAXA lead the interplanetary dust sensor market through deep-space missions that require high-sensitivity particle detection and long-duration instrument stability. Their programs drive demand for ultra-reliable sensors used in planetary science, heliophysics, and cosmic dust analysis. These agencies focus on precision measurement, radiation tolerance, and long operational lifetimes. Rising investment in lunar and deep-space exploration continues to reinforce their leadership.

Honeybee Robotics, Astroscale, Teledyne Technologies, Thales, and QinetiQ strengthen the market with flight-proven sensors, space-grade electronics, and precision detection systems. Their technologies support impact ionization sensors, dust trajectory analysis, and real-time data capture. These companies emphasize miniaturization, low power consumption, and mission-critical reliability. Growing spacecraft deployment beyond Earth orbit supports broader adoption.

MDA, SpaceX, Lockheed Martin, Northrop Grumman, Raytheon Technologies, Blue Origin, and Airbus Defence and Space expand the market through spacecraft manufacturing, launch systems, and science payload integration. Their involvement improves mission scalability and commercial access to space science instrumentation. These players focus on ruggedization, payload integration, and data transmission reliability.

Top Key Players in the Market

- NASA

- ESA (European Space Agency)

- JAXA (Japan Aerospace Exploration Agency)

- Honeybee Robotics

- Astroscale Holdings Inc.

- Teledyne Technologies Incorporated

- Thales Group

- QinetiQ Group plc

- MDA Ltd.

- SpaceX

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Blue Origin

- Airbus Defence and Space

- Others

Recent Developments

- In July 2025, Honeybee Robotics wrapped up tests on its pneumatic dust sampler for JAXA’s MMX mission to Phobos. The tool blasts nitrogen to suck up loose regolith even without a tight seal on uneven ground. Teams watched lunar lander footage showing dusty success in seconds flat. This keeps the spacecraft clean while grabbing samples for Earth return.

- In September 2025, NASA shipped the Interstellar Dust Experiment to IMAP spacecraft builders ahead of a 2025 launch. Built at the University of Colorado, this drum catches high-speed grains from outside our solar system by turning hits into ion clouds for study. It aims to snag a few hundred particles over two years at the L1 point. Findings could rewrite solar system origin stories.

Report Scope

Report Features Description Market Value (2024) USD 327.05 Mn Forecast Revenue (2034) USD 928.6 Mn CAGR(2025-2034) 11.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Impact Ionization Sensors, Optical Sensors, Acoustic Sensors, Others), By Application (Space Missions, Satellite Protection, Research & Development, Others), By Platform (Satellites, Space Probes, Spacecraft, Others), By End-User (Space Agencies, Research Institutes, Commercial Space Companies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NASA, ESA (European Space Agency), JAXA (Japan Aerospace Exploration Agency), Honeybee Robotics, Astroscale Holdings Inc., Teledyne Technologies Incorporated, Thales Group, QinetiQ Group plc, MDA Ltd., SpaceX, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Blue Origin, Airbus Defence and Space, Others” Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Interplanetary Dust Sensor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Interplanetary Dust Sensor MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- NASA

- ESA (European Space Agency)

- JAXA (Japan Aerospace Exploration Agency)

- Honeybee Robotics

- Astroscale Holdings Inc.

- Teledyne Technologies Incorporated

- Thales Group

- QinetiQ Group plc

- MDA Ltd.

- SpaceX

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Blue Origin

- Airbus Defence and Space

- Others