Global Internal Gear Skiving Machine Market Size, Share, Growth Analysis By Machine Type (Standalone, Multi-functional), By Automation Level (Semi-automatic, Fully Automatic), By Gear Size (Small Gears (upto 200 mm), Medium Gears (200-500 mm), Large Gears (above 500 mm)), By Technology (Conventional, CNC), By End-use (Automotive, Aerospace, Industrial Machinery, Robotics, Wind Energy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167742

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Machine Type Analysis

- By Automation Level Analysis

- By Gear Size Analysis

- By Technology Analysis

- By End-use Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Internal Gear Skiving Machine Market Company Insights

- Recent Developments

- Report Scope

Report Overview

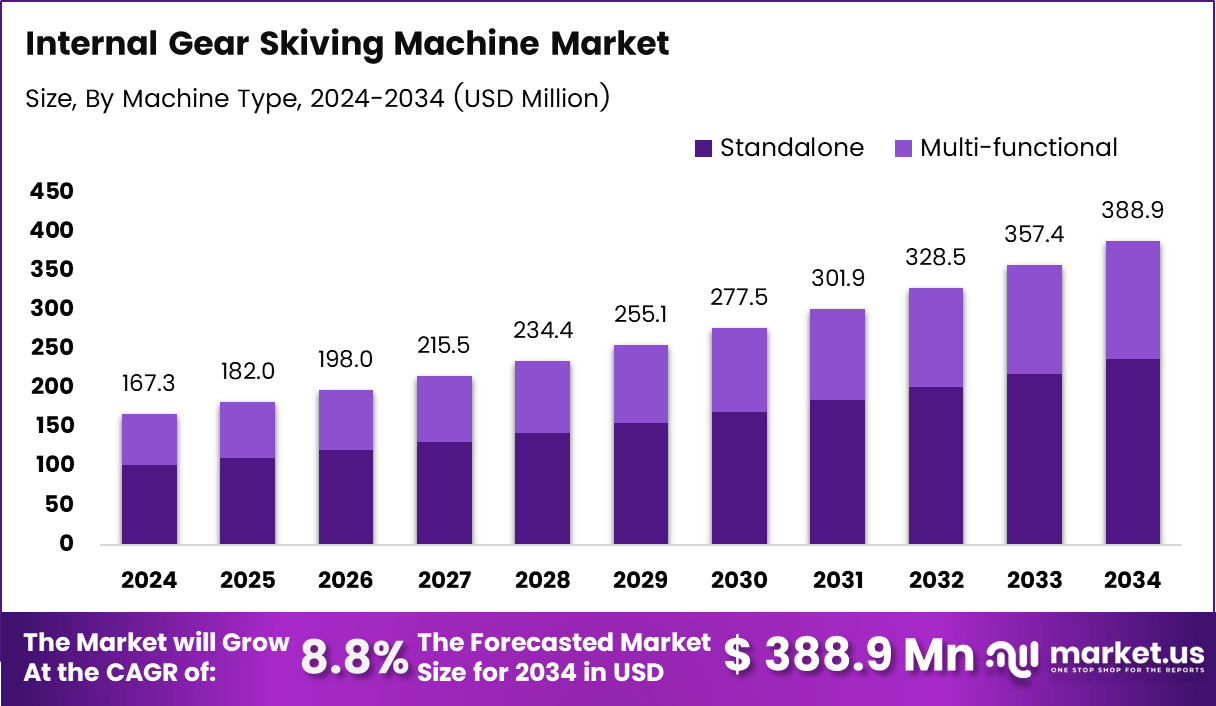

The Global Internal Gear Skiving Machine Market size is expected to be worth around USD 388.9 Million by 2034, from USD 167.3 million in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034.

Internal gear skiving machines represent an advanced machining technology used for producing high-precision internal gears across automotive, industrial, and aerospace systems. The market is evolving as industries transition toward faster, flexible, and automated gear-manufacturing solutions. This creates consistent demand for high-accuracy, high-speed processes that outperform traditional shaping or broaching.

Moreover, the market experiences stable growth as manufacturers shift to CNC gear skiving to reduce cycle time and improve productivity. Industries increasingly adopt these machines because they support complex geometries and tighter tolerances, especially in EV drivetrains and lightweight machinery. This shift encourages companies to explore faster production strategies supporting large-scale modernization plans.

Additionally, governments in the US, Japan, and Europe continue investing in advanced manufacturing technologies, including precision machining and high-accuracy gear systems. These investments strengthen automation adoption and help industries upgrade to digitally controlled machining environments. As regulations emphasize quality, energy efficiency, and performance improvements, demand for precision gear tooling steadily accelerates.

Furthermore, opportunities expand as manufacturers integrate digital controls, process monitoring, and tool-life analytics into skiving machines. These innovations reduce operational downtime, support predictive maintenance, and enhance throughput. Industries also evaluate skiving technology for flexible batch production, enabling faster transitions between prototypes, small lots, and mass-production environments.

In the technical domain, academic and industrial studies validate the precision advantages of skiving. According to research, experimental testing achieved a gear-tooth profile error within ±0.004 mm, demonstrating extremely tight accuracy in cylindrical skiving tool design. This performance strengthens confidence in skiving for high-precision internal gear applications where microscopic deviations affect functional quality.

Similarly, according to survey, the peak cutting force during internal circular-arc gear skiving reached 600 N in both experimental and finite-element simulation environments under identical conditions. This alignment confirms stable repeatability and strengthens adoption for advanced gear machining. These findings indicate the market’s strong technical foundation, supporting wider industry-level deployment.

Key Takeaways

- The Global Internal Gear Skiving Machine Market is projected to reach USD 388.9 Million by 2034 from USD 167.3 Million in 2024.

- The market is expanding steadily at a CAGR of 8.8% from 2025 to 2034.

- Standalone machines dominate the machine type segment with a strong share of 61.2% in 2024.

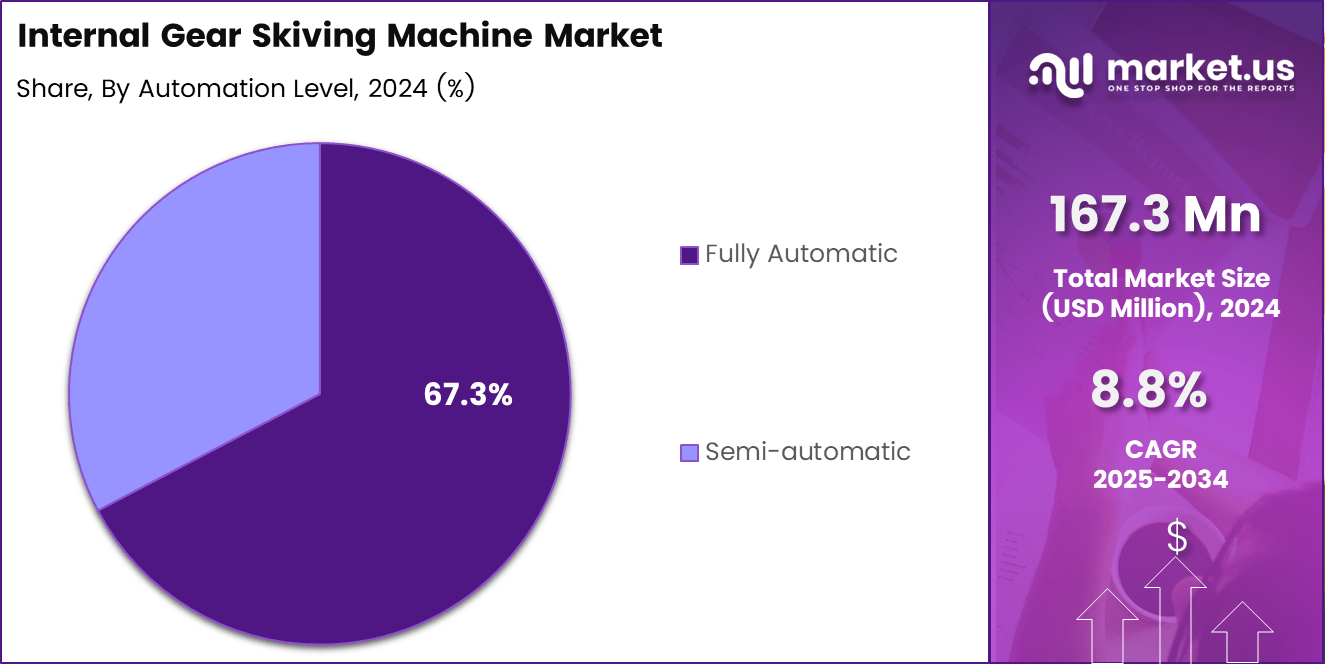

- Fully Automatic systems lead the automation level segment with a significant 67.3% share.

- Small Gears (up to 200 mm) account for the largest gear-size share at 49.8% in 2024.

- CNC Machines represent the largest technology segment with a commanding 69.3% share.

- Automotive remains the dominant end-use segment, contributing 44.5% to the total market in 2024.

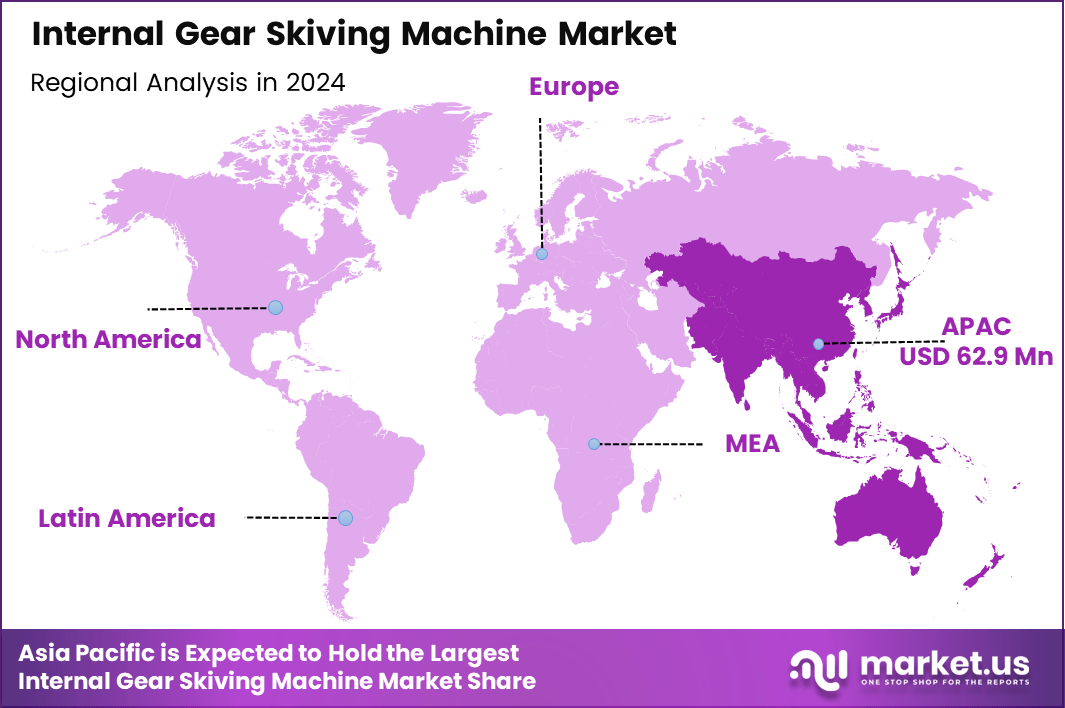

- Asia Pacific holds the highest regional share with 37.6%, valued at USD 62.9 Million in 2024.

By Machine Type Analysis

Standalone dominates with 61.2% due to its precision-driven configuration and stable operations.

In 2024, Standalone held a dominant market position in the By Machine Type Analysis segment of the Internal Gear Skiving Machine Market, with a 61.2% share. Standalone skiving machines gained traction as manufacturers pursued higher output consistency and reduced setup complexity across automotive and machinery applications. Their ability to deliver continuous skiving cycles without multi-process interruptions encouraged higher adoption across mid-sized workshops transitioning from hobbing or shaping.

Additionally, users preferred standalone models for tighter tolerances in internal gear finishing, enabling smoother driveline performance. As industries upgraded legacy systems, standalone platforms became strategic investments for minimizing vibrations, thermal deviations, and alignment errors during rotational gear cutting.

Multi-functional skiving machines expanded gradually as companies sought flexibility in machining workflows, supporting both prototyping and hybrid gear-finishing operations. These machines appealed to users targeting space optimization and consolidated process flows that merge skiving, drilling, or measurement functions. Their integration-ready design supported hybrid gear geometries and enabled faster tool-change routines.

Although adoption remained below standalone systems, multi-functional skiving machines benefited from rising interest in modular production cells, where multi-tasking boosts return on investment. Their relevance strengthened in precision-component sectors demanding machine adaptability to handle shifting volume cycles and variable internal gear profiles while reducing ancillary machine procurement.

By Automation Level Analysis

Fully Automatic dominates with 67.3% owing to advanced control and hands-free processing benefits.

In 2024, Fully Automatic held a dominant market position in the By Automation Level Analysis segment of the Internal Gear Skiving Machine Market, with a 67.3% share. Demand accelerated as manufacturers adopted automation to counter process bottlenecks and skill shortages. Fully automatic skiving machines delivered consistent cutting conditions, efficient tool-feed control, and real-time adjustment capabilities.

Their integration with digital calibration utilities improved gear-accuracy levels during high-speed internal machining. Industries valued automation’s ability to maintain uniformity in gear-tooth dimensions, thereby reducing rejection rates. Automated systems also supported inline measurement features, strengthening compliance with international quality standards in large-batch production cycles.

Semi-automatic skiving machines maintained relevance among cost-sensitive users managing medium-volume workloads. These systems offered structured operator assistance while retaining manual oversight for setup adjustments and tool alignment. Adoption remained higher in developing manufacturing clusters where skilled labor is available and operational costs must remain controlled.

Semi-automatic options proved beneficial for workshops handling varied internal gear diameters or short-run batches that demand human decision-making. Their lower capital investment encouraged use in maintenance-related machining and low-volume gear finishing. Despite slower scaling, semi-automated systems continued attracting small enterprises, balancing precision output with manageable equipment expenditure.

By Gear Size Analysis

Small Gears (up to 200 mm) dominate with 49.8% driven by automotive and compact machinery demand.

In 2024, Small Gears (up to 200 mm) held a dominant market position in the By Gear Size Analysis segment of the Internal Gear Skiving Machine Market, with a 49.8% share. Expansion stemmed from strong internal gear requirements in automotive transmissions, robotics joints, and consumer equipment.

Small gears required tighter tolerances and surface-finish precision, making skiving favorable for achieving high-quality internal tooth forms. Manufacturers also preferred the process for higher cutting speeds and improved thermal stability during dense production cycles. Demand strengthened as EV drivetrains increasingly incorporated small, lightweight gears for compact torque-transfer assemblies and multi-stage reduction systems.

Medium Gears (200–500 mm) gained attention as industrial machinery manufacturers upgraded to digitally controlled skiving systems capable of handling more complex tooth geometries. These gears were widely used in machine tools, textile equipment, compressors, and material-handling systems demanding reliable torque distribution. Medium gear skiving benefited from rising preferences for CNC-enabled toolpaths that ensured consistent internal profile finishing.

As industries enhanced operational uptime, medium gear processing transitioned toward tighter accuracy bands, supporting better meshing efficiency. Growth in automation-driven industrial expansions contributed to the steady rise in medium gear skiving, especially in emerging manufacturing economies.

Large Gears (above 500 mm) formed a niche but vital segment supported by heavy engineering, wind energy, and high-capacity mechanical systems. These gears required rigid machine frames and optimized tool synchronization to manage high radial forces during deep internal skiving operations. Adoption increased in wind turbine drive systems where internal gears facilitated efficient load transfer.

Large equipment manufacturers appreciated the material-removal stability and reduced post-processing requirements achievable through skiving. Despite slower volume growth, demand persisted due to modernization across energy and construction machinery sectors requiring durable, large-diameter precision internal gears.

By Technology Analysis

CNC dominates with 69.3% due to superior precision, programmability, and stable machining outcomes.

In 2024, CNC held a dominant market position in the By Technology Analysis segment of the Internal Gear Skiving Machine Market, with a 69.3% share. CNC-controlled skiving solutions supported high-speed synchronization between tool and workpiece, ensuring extremely accurate internal tooth formation. Their programmable interface allowed rapid gear-variant switching, making them essential for diverse production setups.

CNC systems enhanced productivity by minimizing setup errors and supporting advanced compensation algorithms that improved skiving tolerances. Industries valued CNC platforms for improved lifecycle consistency and the ability to deliver repeatable precision in automotive, machinery, and robotics segments requiring refined internal gear finishing.

Conventional technology remained in use among small-scale manufacturers handling simpler internal gear profiles with lower accuracy requirements. These systems were cost-effective for basic machining needs and low-volume gear finishing, especially in non-automotive sectors. Conventional machines were preferred where maintenance simplicity and operator control mattered more than automation or digital accuracy.

They served as dependable solutions for repair operations, custom gear manufacturing, or limited production runs. Although slower in productivity compared to CNC platforms, conventional skiving equipment maintained relevance due to its affordability and practical utility in entry-level industrial environments needing foundational gear machining capability.

By End-use Analysis

Automotive dominates with 44.5% because of the heavy demand for precision internal transmission gears.

In 2024, Automotive held a dominant market position in the By End-use Analysis segment of the Internal Gear Skiving Machine Market, with a 44.5% share. Automakers increasingly relied on precision internal gears for transmissions, e-axles, hybrid systems, and steering modules. Skiving machines supported quieter tooth profiles and improved torque transfer performance, essential for EV drivetrains.

As OEMs increased production of compact gearsets, skiving facilitated reduced cycle times and lower finishing costs. Automotive suppliers valued the process for achieving consistently tight tolerances, supporting better vehicle efficiency. Strong global vehicle output and component localization policies further strengthened automotive skiving adoption.

Aerospace applications expanded steadily as internal gears became integral for actuators, landing systems, engine accessories, and flight-control assemblies. These components required accuracy under stress and varying loads, pushing manufacturers toward advanced machining techniques.

Skiving helped reduce profile deviations and tool wear during complex internal gear production. Aerospace programs modernizing fleets and introducing next-generation propulsion systems continued driving multi-year demand. Increasing investments in commercial aircraft refurbishment also boosted internal gear manufacturing.

Industrial Machinery represented a strong user base, particularly for conveyors, compressors, pumps, and heavy-duty operating systems. Internal gears in these machines demanded reliability under continuous mechanical loads. Skiving machines allowed for controlled heat dissipation and uniform tooth finishing, supporting longer machinery life. Modern industrial automation upgraded equipment fleets, reinforcing demand.

Robotics applications grew as precision internal gears supported motion control, joint articulation, and high-torque compact gearboxes. Skiving improved positional accuracy and reduced backlash in robotic movements. Rising industrial robot deployment accelerated gear miniaturization, strengthening the need for high-precision skiving processes.

Wind Energy applications benefited from large internal gears used in yaw and pitch systems. Skiving enabled stable internal tooth formation for gears facing fluctuating loads. The push for renewable energy expansion supported continued adoption.

Other end-use sectors, such as medical machinery, textile automation, and specialty equipment, utilize internal gears for rotational accuracy and compact designs. Skiving offered surface-quality advantages that reduced noise and enhanced mechanical stability.

Key Market Segments

By Machine Type

- Standalone

- Multi-functional

By Automation Level

- Semi-automatic

- Fully Automatic

By Gear Size

- Small Gears (up to 200 mm)

- Medium Gears (200-500 mm)

- Large Gears (above 500 mm)

By Technology

- Conventional

- CNC

By End-use

- Automotive

- Aerospace

- Industrial Machinery

- Robotics

- Wind Energy

- Others

Drivers

Rising Preference for High-Precision Internal Gear Production in EV Drivetrains Drives Market Growth

Growing adoption of electric vehicles is increasing the need for high-precision internal gears that support quieter drivetrains and improved torque transfer. Manufacturers are now prioritizing skiving machines because they enable faster and more accurate gear finishing. This shift is strengthening demand for advanced skiving solutions across global EV production hubs.

Modern factories are also expanding automated gear manufacturing lines to improve consistency and reduce manual errors. Skiving machines integrate smoothly with robotic handling, CNC controllers, and digital monitoring systems. This helps companies achieve higher productivity while lowering operational delays. As automation grows, the preference for flexible and high-speed skiving systems continues to rise.

Many industries are gradually replacing broaching with internal gear skiving because it offers a faster, more efficient, and cost-effective machining method. Skiving minimizes cycle time, reduces tooling expense, and supports complex tooth geometries with greater accuracy. These advantages are pushing manufacturers to upgrade from traditional gear-cutting methods.

Demand from aerospace companies is also boosting market expansion. This sector depends heavily on lightweight and high-accuracy gear components for actuation and propulsion systems. Skiving machines enable precision machining of advanced materials and internal profiles, making them essential for next-generation aerospace gear assemblies.

Restraints

High Skill Requirements for CNC Programming and Skiving Tool Alignment Limit Market Growth

Internal gear skiving requires advanced CNC programming skills to maintain proper synchronization between the tool and workpiece. Many factories still struggle to recruit or train operators capable of handling these technical requirements. This skill gap often slows machine adoption, particularly in developing manufacturing regions.

Another challenge comes from the need for highly skilled alignment of skiving tools. Even minor inaccuracies in tool setup can affect tooth profile quality and accelerate tool wear. As a result, companies face additional training and setup time, which increases operational complexity.

The market also faces limitations due to the restricted availability of specialized skiving tools designed for complex internal gear geometries. Advanced cutters are required for high-module or non-standard gear designs, but only a few tool manufacturers supply such products. This lack of availability increases procurement lead times. In many cases, it also raises production costs, delaying adoption among small and mid-scale manufacturers aiming to modernize their gear-cutting processes.

Growth Factors

Growing Role of AI-Driven Predictive Vehicle Diagnostics Creates New Opportunities

The growing use of artificial intelligence (AI) in vehicles presents major opportunities for automotive operating systems. AI-driven predictive diagnostics help detect issues before they occur, improving safety and reducing maintenance costs. OS platforms that support AI will gain strong adoption.

Another opportunity lies in the expansion of cloud-native automotive OS platforms. As automakers move more software functions to the cloud, operating systems that enable smooth cloud connectivity will become essential. This shift allows faster updates and improved performance.

The rise of autonomous Mobility-as-a-Service (MaaS) solutions—such as self-driving taxis and shared autonomous shuttles—also creates new demand for reliable operating systems. These vehicles require extremely stable, secure, and high-processing OS platforms to function safely.

Finally, the increased use of open-source automotive software frameworks opens new doors for developers and manufacturers. Open-source systems reduce development costs and speed up innovation, helping automakers build flexible and scalable vehicle software environments.

Emerging Trends

Increasing Shift Toward Fully Automated Closed-Loop Gear Inspection Systems Shapes Market Trends

A major trend in the market is the transition toward fully automated closed-loop inspection systems that measure tooth geometry in real time. These solutions automatically adjust machine parameters to maintain accuracy throughout production. This trend is helping manufacturers reduce rejection rates and ensure consistent output quality.

High-speed synchronization software is also becoming a critical trend. Skiving requires perfect synchronization between the cutter and the gear blank, and new software solutions allow faster processing while minimizing errors. These digital improvements support higher productivity and smoother machining.

Manufacturers are also adopting advanced machine controllers that enhance speed matching at micro-level tolerances. This trend is improving finish quality in internal gears used in automotive, robotics, and precision engineering applications. As industries push for higher accuracy, software-driven synchronization tools continue growing in demand.

Regional Analysis

Asia Pacific Dominates the Internal Gear Skiving Machine Market with a Market Share of 37.6%, Valued at USD 62.9 Million

Asia Pacific emerged as the dominant regional market with a 37.6% share and a valuation of USD 62.9 Million, driven by strong manufacturing clusters across China, Japan, South Korea, and India. The region benefited from the rapid adoption of advanced gear machining technologies supporting automotive, robotics, and industrial machinery. Growing investments in EV drivetrains and precision engineering enhanced regional demand for internal gear skiving solutions, ensuring continued market expansion.

North America Internal Gear Skiving Machine Market Trends

North America reflected steady adoption of high-precision skiving machines due to the region’s strong automotive retooling activity, aerospace machining needs, and rising automation intensity. Users preferred CNC-enabled skiving platforms to address accuracy requirements in transmissions, actuators, and industrial gear components. Ongoing reshoring initiatives further supported demand across specialized machining workshops and OEM component manufacturers.

Europe Internal Gear Skiving Machine Market Trends

Europe maintained a significant position supported by advanced engineering capabilities and a mature industrial base. The region’s strong footprint in automotive components, industrial machinery, and high-performance gear systems encouraged the use of precision skiving equipment. Emphasis on energy-efficient production and Industry 4.0 upgrades increased the preference for CNC-based skiving machines.

Asia Pacific Internal Gear Skiving Machine Market Trends

Asia Pacific continued experiencing rapid adoption due to large-scale automotive production, robotics deployment, and machinery exports. Regional manufacturers favored faster cycle times and improved gear finishing offered by modern skiving technologies. Government-backed manufacturing expansion policies further strengthened long-term equipment demand.

Middle East and Africa Internal Gear Skiving Machine Market Trends

The Middle East and Africa saw gradual traction as industrial diversification initiatives expanded machinery and equipment manufacturing. Demand grew from oilfield equipment, construction machinery, and emerging automotive assembly activities. Investments in localized precision-machining capabilities contributed to the region’s moderate but rising adoption.

Latin America Internal Gear Skiving Machine Market Trends

Latin America demonstrated stable demand driven by automotive component production, agricultural machinery, and industrial equipment upgrades. Countries such as Brazil and Mexico supported incremental adoption of precision skiving machines to improve gear quality and reduce reliance on imports. Gradual modernization of manufacturing facilities sustained growth prospects.

U.S. Internal Gear Skiving Machine Market Trends

The U.S. market advanced steadily with strong uptake in aerospace, electric mobility, and high-precision machinery applications. Manufacturers invested in CNC skiving solutions to enhance productivity and meet tight tolerance specifications across drivetrain and mechanical system components. Technology upgrades and process automation remained key demand drivers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Internal Gear Skiving Machine Market Company Insights

The global Internal Gear Skiving Machine Market in 2024 reflected strong consolidation among technology-driven machine tool manufacturers, with innovation centered around precision tooling, automation enhancement, and multi-axis synchronization capabilities.

Liebherr strengthened its position through advanced skiving platforms engineered for high rigidity and thermal stability. Its focus on gear quality optimization and integrated measurement systems enabled manufacturers to meet tighter tolerance demands in automotive and industrial machinery segments.

Gleason Corporation maintained a notable influence by offering digitally enabled skiving solutions with enhanced cutting geometry, process diagnostics, and software-controlled accuracy. Its ability to support high-speed internal gear finishing allowed users to shift from traditional shaping or broaching toward more flexible and productive skiving workflows across medium- and large-volume applications.

Mitsubishi Heavy Industries expanded its relevance through robust CNC skiving machines, offering stable synchronization control and improved material-removal consistency. Its platforms supported complex internal gear geometries widely used in EV transmissions, robotics actuators, and precision engineering equipment. The company’s emphasis on machining efficiency and tool-life stability strengthened customer adoption.

EMAG GmbH & Co. KG further contributed to market growth through modular skiving solutions designed for process automation and compact production setups. Its vertical machining architectures provided improved chip evacuation and reduced cycle times, appealing to users requiring faster throughput with lower operational footprint.

Klingelnberg AG, NACHI-FUJIKOSHI Corporation, JTEKT Corporation, NIDE C Machine Tool Corporation, FFG Werke, and DMG Mori continued reinforcing the competitive landscape through hybrid machining innovations, stronger CNC ecosystems, and investments in skiving-compatible tooling technologies. Collectively, these companies supported the expanding shift toward high-precision internal gear finishing across global manufacturing hubs.

Top Key Players in the Market

- Liebherr

- Gleason Corporation

- Mitsubishi Heavy Industries

- EMAG GmbH & Co. KG

- Klingelnberg AG

- NIDE C Machine Tool Corporation

- NACHI-FUJIKOSHI Corporation

- JTEKT Corporation

- FFG Werke

- DMG Mori

Recent Developments

- In Jan 2024, KOYO Machinery USA merged with JTEKT Machinery Americas, unifying operations under a single organizational structure.This merger strengthens manufacturing, sales, and service capabilities while enhancing operational efficiency and customer support across the Americas.

Report Scope

Report Features Description Market Value (2024) USD 167.3 Million Forecast Revenue (2034) USD 388.9 Million CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine Type (Standalone, Multi-functional), By Automation Level (Semi-automatic, Fully Automatic), By Gear Size (Small Gears (upto 200 mm), Medium Gears (200-500 mm), Large Gears (above 500 mm)), By Technology (Conventional, CNC), By End-use (Automotive, Aerospace, Industrial Machinery, Robotics, Wind Energy, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Liebherr, Gleason Corporation, Mitsubishi Heavy Industries, EMAG GmbH & Co. KG, Klingelnberg AG, NIDE C Machine Tool Corporation, NACHI-FUJIKOSHI Corporation, JTEKT Corporation, FFG Werke, DMG Mori Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Internal Gear Skiving Machine MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Internal Gear Skiving Machine MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Liebherr

- Gleason Corporation

- Mitsubishi Heavy Industries

- EMAG GmbH & Co. KG

- Klingelnberg AG

- NIDE C Machine Tool Corporation

- NACHI-FUJIKOSHI Corporation

- JTEKT Corporation

- FFG Werke

- DMG Mori