Global Intercity Bus Travel Market Size, Share, Growth Analysis By Service Type (Economy / Standard, Premium / Luxury), By Booking Channel (Offline Counter / Agency, Operator-Owned Websites & Apps, Online Aggregators / OTAs), By Propulsion Type (Diesel, CNG / LNG, Battery-Electric, Hybrid & Hydrogen Fuel-Cell), By Bus Type (Single-Deck Buses, Double-Deck Buses, Coach Buses, Luxury Buses), By Distance Band (Short-haul (less than 200 km), Medium-haul (200-400 km), Long-haul (above 400 km)), By End-user (Students & Young Professionals, Leisure & VFR, Business Travelers, Migrant & Seasonal Workers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167657

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Service Type Analysis

- By Booking Channel Analysis

- By Propulsion Type Analysis

- By Bus Type Analysis

- By Distance Band Analysis

- By End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Intercity Bus Travel Company Insights

- Recent Developments

- Report Scope

Report Overview

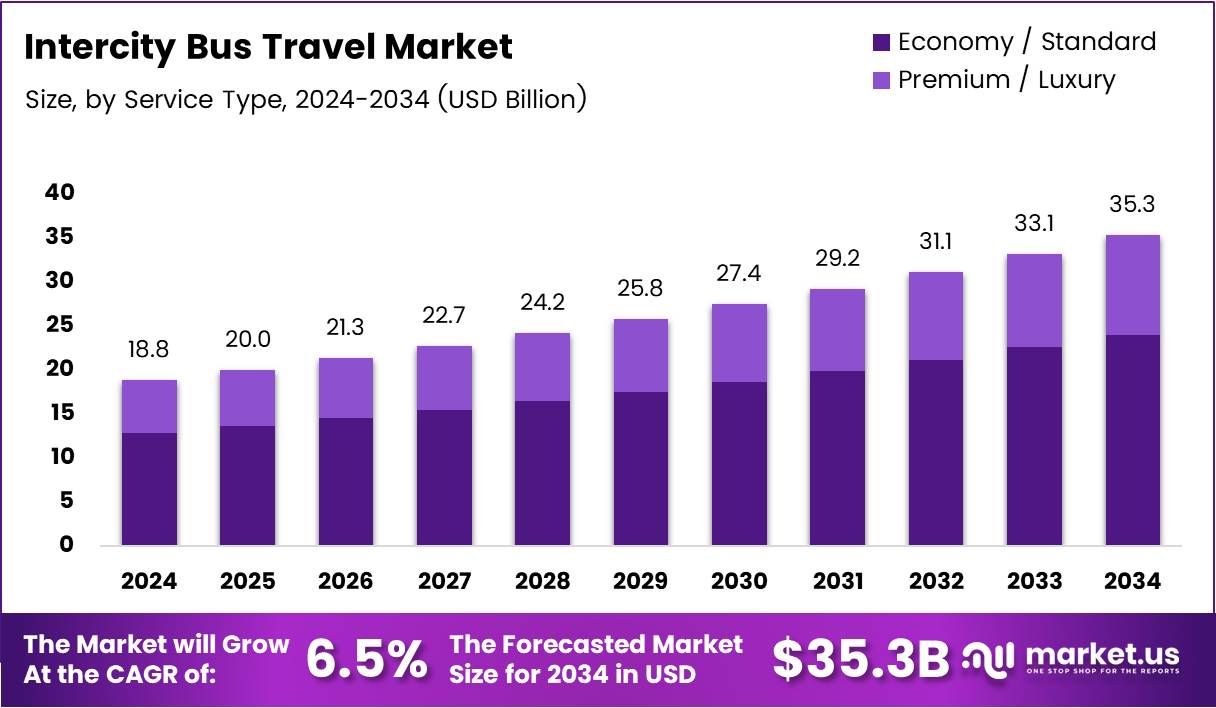

The Global Intercity Bus Travel Market size is expected to be worth around USD 35.3 Billion by 2034, from USD 18.8 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The Intercity Bus Travel Market represents scheduled long-distance ground transportation connecting cities with affordable mobility options. It delivers cost-efficient routes, digital ticketing, flexible schedules, and increased accessibility, appealing to budget travelers, commuters, students, and tourists. As travel demand rises, intercity buses support sustainable transportation models and integrated public transit networks.

Intercity Bus Travel continues to gain relevance by improving seat comfort, Wi-Fi access, and app-based bookings, enhancing user experience. Moreover, operators optimize routes and leverage dynamic pricing to increase occupancy and improve profitability. Consequently, the service improves long-distance connectivity and increases consumer shift from personal vehicles.

The industry shows strong growth potential supported by urbanization, tourism expansion, and rising environmental awareness. Additionally, governments implement policies that encourage modal shift to buses due to lower emissions and road congestion management, creating favorable opportunities for service expansion.

Furthermore, the market experiences increasing investment in fleet modernization, low-emission buses, and smart mobility infrastructure. Governments support these improvements through subsidies and intercity route permits, generating business prospects for operators. As a result, digital adoption and sustainable fleet upgrades strengthen revenue models and shape long-term market attractiveness.

Moreover, strategic opportunities emerge in underserved routes, regional connectivity platforms, and multimodal mobility services that integrate buses with rail and air transport. Operators focusing on dynamic scheduling, loyalty programs, and enhanced comfort features witness greater traveler retention, increasing repeat usage in highly competitive mobility ecosystems.

Notably, ridership trends reinforce the continued relevance of bus travel in public transportation demand. According to a survey, Spain recorded 3,393.8 million public-transport trips in 2023, with 1,579 million by bus and 1,813 million by rail, demonstrating that buses remain almost as significant as rail in overall public-transport use.

Similarly, future projections highlight positive growth momentum for the Intercity Bus Travel Market. According to a survey, intercity bus ridership in the U.S. could grow 4% in 2025, driven by low fares, digital booking platforms, and sustainable transportation initiatives. Therefore, rising demand supports continuous expansion of long-distance bus services across regions.

Key Takeaways

- The Global Intercity Bus Travel Market is projected to reach USD 35.3 Billion by 2034 from USD 18.8 Billion in 2024, growing at a CAGR of 6.5% (2025–2034).

- Economy / Standard service type leads the market with a 78.3% share due to affordability and broad accessibility.

- Offline Counter / Agency remains the top booking channel with a 41.9% share, driven by traditional buying habits and rural accessibility.

- Diesel propulsion dominates with a 69.7% market share as the main fuel choice for long-distance routes.

- Single-Deck Buses account for the largest bus type share at 56.5%, supported by versatility across route profiles.

- Short-haul routes (<200 km) hold the highest distance band share at 49.6%, driven by frequent daily commuter travel.

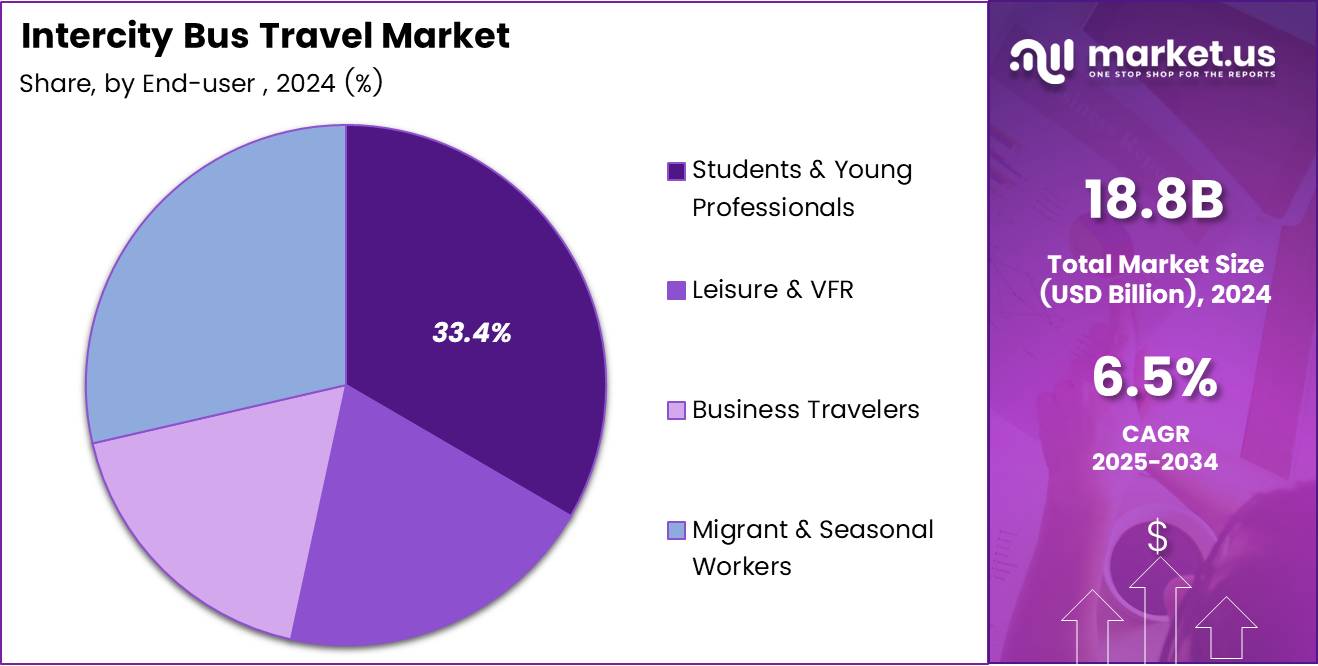

- Students & Young Professionals represent the biggest end-user segment at 33.4%, reflecting strong demand for low-cost mobility.

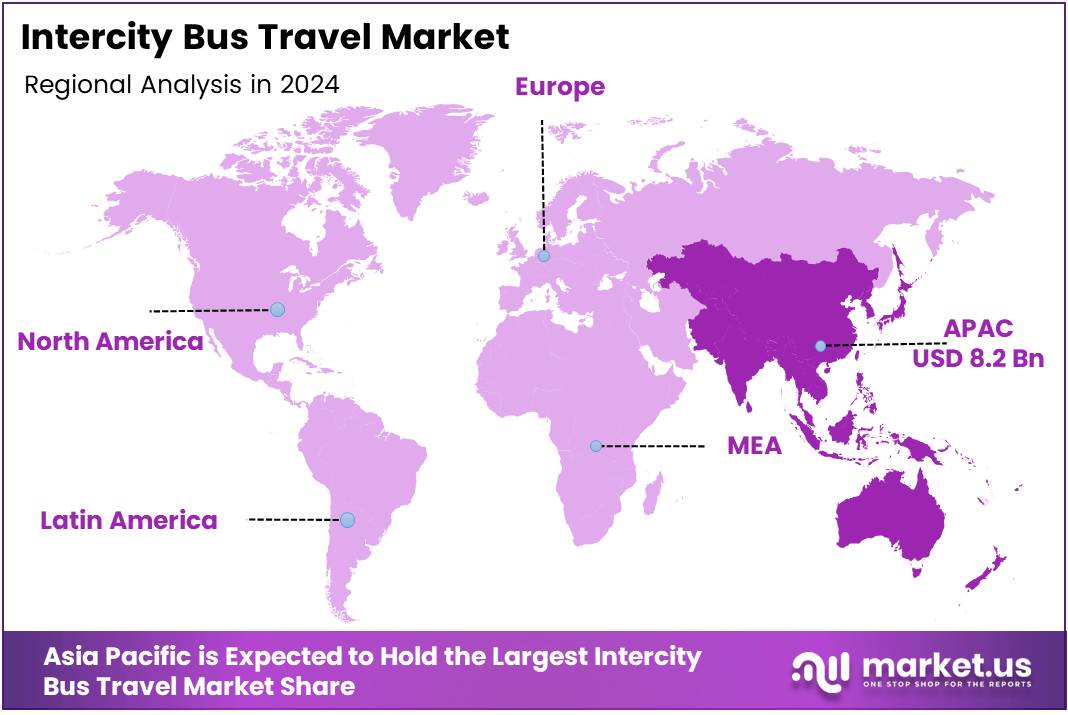

- Asia Pacific leads regionally with a 43.9% market share valued at USD 8.2 Billion, supported by rapid urbanization and large population mobility.

By Service Type Analysis

Economy / Standard dominates with 78.3% due to its widespread accessibility and affordability across regions.

In 2024, Economy / Standard held a dominant market position in the By Service Type segment of the Intercity Bus Travel Market, with a 78.3% share. This dominance reflects its affordability, extensive coverage, and appeal to the mass traveling population. Operators emphasize reliability, frequency, and cost-effective connections that make it the preferred option for commuters and budget travelers alike.

The Premium / Luxury segment is gradually expanding as rising disposable incomes and comfort-seeking consumers drive demand. Passengers increasingly choose buses with reclining seats, entertainment systems, and enhanced safety. While it captures a smaller share, its growth trajectory remains strong, supported by luxury service providers targeting urban corridors and business travelers who value convenience.

By Booking Channel Analysis

Offline Counter / Agency dominates with 41.9% owing to traditional preferences and limited digital access in rural routes.

In 2024, Offline Counter / Agency held a dominant market position in the By Booking Channel segment of the Intercity Bus Travel Market, with a 41.9% share. Many travelers still prefer physical ticket counters or agencies due to trust, personal interaction, and ease of cash payments, especially in non-urban regions.

Operator-Owned Websites & Apps continue to gain popularity as major bus companies invest in digital interfaces offering route tracking and flexible rescheduling. Convenience, transparency, and promotional discounts encourage adoption, particularly among younger users who favor direct communication with operators and avoid third-party fees.

Online Aggregators / OTAs are transforming booking behavior through price comparisons and real-time seat availability. Their share grows steadily, boosted by smartphone penetration and multi-operator visibility. Although they face strong offline loyalty, continuous tech improvements and cashless transactions are accelerating their future expansion across metropolitan and tier-two markets.

By Propulsion Type Analysis

Diesel dominates with 69.7% as conventional fleets continue to serve the majority of long-distance routes efficiently.

In 2024, Diesel held a dominant market position in the By Propulsion Type segment of the Intercity Bus Travel Market, with a 69.7% share. Diesel buses remain the backbone of intercity operations, offering proven reliability, range, and established refueling infrastructure. Fleet operators favor them for lower upfront costs and ease of maintenance over emerging alternatives.

CNG / LNG buses are gaining traction in environmentally conscious regions. These vehicles reduce carbon emissions and operating costs, appealing to operators under green policy mandates. Despite infrastructure limitations, government subsidies and fuel price advantages enhance their adoption prospects over the forecast period.

Battery-Electric buses show strong potential as technological advancements extend driving range and charging speed. Though still at a nascent stage, their deployment in short and medium routes demonstrates a shift toward sustainability driven by global emission reduction goals and urban clean-mobility initiatives.

Hybrid & Hydrogen Fuel-Cell solutions remain in early commercial testing phases. They combine energy efficiency with eco-friendliness and could reshape long-haul segments once infrastructure matures. Investments in pilot programs suggest future scalability beyond traditional diesel dominance.

By Bus Type Analysis

Single-Deck Buses dominate with 56.5% owing to versatility and widespread deployment on intercity corridors.

In 2024, Single-Deck Buses held a dominant market position in the By Bus Type segment of the Intercity Bus Travel Market, with a 56.5% share. They remain the standard choice for medium and long-distance services because of their fuel efficiency and ease of operation. Operators value their flexibility for mixed passenger and luggage capacity on diverse routes.

Double-Deck Buses are growing in popularity on high-density corridors. Offering higher seating capacity without increasing fleet size, they appeal to operators serving popular urban and tourist routes. Their comfort and space efficiency are promoting gradual adoption in crowded markets across Europe and Asia.

Coach Buses are positioned for longer routes, providing enhanced seating and onboard facilities. They cater to tourism and inter-state journeys where travel time and comfort balance are crucial. Operators leverage coaches to differentiate premium services within competitive corridors.

Luxury Buses represent the upper segment targeting affluent travelers seeking exclusive amenities like Wi-Fi, recliners, and refreshments. Although their volume is limited, the category is expected to grow as tourism revives and corporate mobility demands increase globally.

By Distance Band Analysis

Short-haul (less than 200 km) dominates with 49.6% reflecting frequent commuter and regional connections.

In 2024, Short-haul (less than 200 km) held a dominant market position in the By Distance Band segment of the Intercity Bus Travel Market, with a 49.6% share. These routes are favored for daily commuting, regional trade, and intra-state travel due to frequency, lower fares, and quick turnaround times.

Medium-haul (200–400 km) routes serve intermediate city connections where comfort and efficiency are balanced. These routes support economic corridors between industrial and commercial hubs, offering an ideal option for passengers who seek affordable alternatives to rail or air travel without compromising time efficiency.

Long-haul (above 400 km) services address overnight and cross-border journeys. They usually offer reclining seats, rest stops, and premium amenities. While demand is lower in volume, their higher ticket value and tourism-based routes create stable revenue streams for operators expanding into luxury segments.

By End-User Analysis

Students & Young Professionals dominate with 33.4% due to budget-friendly mobility preferences and regular travel patterns.

In 2024, Students & Young Professionals held a dominant market position in the By End-User segment of the Intercity Bus Travel Market, with a 33.4% share. Their cost-sensitivity and frequent intercity movements for education and work make economical bus options highly attractive, driving steady occupancy rates across key routes.

Leisure & VFR (Visiting Friends and Relatives) travelers constitute a large portion of seasonal and holiday traffic. They prefer comfortable and convenient services with flexible schedules. Operators offer discounts and family packages to appeal to this segment during festive and vacation periods.

Business Travelers favor premium and punctual services that ensure timely arrival and productivity on the go. With Wi-Fi, charging ports, and ergonomic seating, operators cater to professionals seeking reliable alternatives to trains and short-haul flights within competitive price ranges.

Migrant & Seasonal Workers form a vital but price-sensitive group driving steady ridership on longer routes. They depend on intercity buses for periodic relocation between work sites and hometowns. Operators focus on affordable fares and frequent departures to meet this essential demand.

Key Market Segments

By Service Type

- Economy / Standard

- Premium / Luxury

By Booking Channel

- Offline Counter / Agency

- Operator-Owned Websites & Apps

- Online Aggregators / OTAs

By Propulsion Type

- Diesel

- CNG / LNG

- Battery-Electric

- Hybrid & Hydrogen Fuel-Cell

By Bus Type

- Single-Deck Buses

- Double-Deck Buses

- Coach Buses

- Luxury Buses

By Distance Band

- Short-haul (less than 200 km)

- Medium-haul (200-400 km)

- Long-haul (above 400 km)

By End-user

- Students & Young Professionals

- Leisure & VFR

- Business Travelers

- Migrant & Seasonal Workers

Drivers

Rising Demand for Cost-Effective Long-Distance Mobility Alternatives Drives Market Growth

The intercity bus travel market is expanding because more passengers are looking for affordable ways to move between distant cities. Compared to flights or private cars, buses provide budget-friendly transportation, encouraging frequent travel for work, education, and leisure. This shift in consumer preference is becoming a key driver of industry growth.

Digital ticketing and real-time tracking platforms are also widening the market. These online tools make planning and managing trips easier, giving passengers more confidence and transparency during their journey. Improved convenience is attracting both younger and tech-savvy travelers.

Government investment in regional transportation networks is another strong driver. New highways and bus terminals are improving connectivity between small towns and cities, creating more routes and increasing travel volume.

The introduction of premium sleeper buses, luxury coaches, and Wi-Fi-enabled fleets is lifting customer expectations. Passengers now enjoy greater comfort and productivity during long routes, leading to repeat travel and higher ridership across major operators.

Restraints

Competition from Low-Cost Airlines and Expanding Railway Networks Limits Market Growth

The intercity bus travel market faces pressure from low-cost airlines that shorten long-distance travel times at competitive prices. Travelers who value speed often switch from buses to flights when ticket discounts are available, especially during holiday seasons.

Expanding railway networks also present a strong challenge. High-speed and modern rail services provide comfort and reliability in many regions, reducing the demand for long-haul bus travel. Governments often prioritize trains for mass transit, widening the performance gap.

Fluctuating fuel prices further weigh on bus operators. When fuel costs rise, ticket prices increase, making buses less appealing for price-sensitive passengers. Operators struggle to maintain profitability during these periods.

Fleet maintenance is another cost challenge. Buses require frequent repairs, upgrades, and safety checks to operate long distances. High maintenance expenses reduce earnings and make it harder for smaller companies to compete with larger service providers.

Growth Factors

Integration of Intercity Bus Networks with Smart City Mobility Hubs Creates Growth Potential

Smart city mobility hubs are opening new opportunities for intercity bus operators. Linking buses with metro, bike-sharing, and ride-hailing services can offer seamless end-to-end transport, making intercity buses more attractive for daily and business travelers.

The adoption of electric and hybrid buses is another promising opportunity. These vehicles reduce fuel dependency and operating costs while appealing to environmentally conscious passengers. Governments worldwide are offering incentives that encourage operators to shift to clean-energy fleets.

Strategic cross-border partnerships also support growth by expanding route reach. Operators can connect new countries and regions, improving travel options for tourism and trade. Shared services reduce operational risks while maximizing route coverage.

Onboard entertainment and retail services are becoming profitable add-ons. By selling digital content, snacks, or branded products, bus companies can create additional revenue streams. This approach enhances customer experience and supports higher earnings per passenger.

Emerging Trends

Contactless Payments and AI-Based Passenger Demand Forecasting Shape Market Trends

The shift to contactless payments is transforming the intercity bus travel experience. Passengers prefer fast, simple, and hygienic ticket purchases, motivating operators to adopt digital payment technology across terminals and mobile apps.

AI-based forecasting tools are now helping companies predict customer demand. These insights enable better fleet planning, improved seat availability, and reduced operational waste during low-traffic periods.

Subscription-based commuter passes are becoming a trend among frequent travelers. Monthly or yearly plans lower overall travel costs and encourage repeat bookings, strengthening customer loyalty for major operators.

Gamified loyalty programs are also gaining popularity. By rewarding travelers with points, badges, or discounts, companies make the booking experience engaging and interactive, especially for younger passengers.

AI-powered dynamic pricing across peak and off-peak hours is another rising trend. By adjusting ticket prices according to demand, operators can maximize revenue while still offering affordable travel options during less busy periods.

Regional Analysis

Asia Pacific Dominates the Intercity Bus Travel Market with a Market Share of 43.9%, Valued at USD 8.2 Billion

The Asia Pacific region leads the global intercity bus travel market, driven by rapid urbanization, a high population base, and expanding intercity connectivity. Increasing economic activity and rising preference for cost-effective public transportation contribute to the region’s strong performance. With a market share of 43.9% and valuation of USD 8.2 Billion, the region continues to invest in smart mobility networks and environmentally sustainable fleet upgrades, reinforcing its dominant position.

North America Intercity Bus Travel Market Trends

North America experiences strong market adoption supported by the demand for long-distance affordable travel, especially across the U.S. and Canada. Improved bus infrastructure, digital booking systems, and enhanced passenger comfort are fueling market expansion. Growing domestic tourism and government emphasis on reducing carbon emissions are further contributing to market resilience.

Europe Intercity Bus Travel Market Trends

Europe’s intercity bus market is propelled by an extensive regional travel culture, integration of cross-border routes, and strong regulatory support for sustainable mobility. Increased intermodal connectivity with rail and air transport enhances passenger convenience. Continuous investments in fuel-efficient fleets and digital ticketing platforms are helping the region register steady growth.

Middle East and Africa Intercity Bus Travel Market Trends

The Middle East and Africa are witnessing gradual adoption owing to expanding road networks and increasing economic diversification efforts. Tourism-centric nations are enhancing intercity bus routes to improve accessibility and reduce traffic congestion. Growing investments in transport infrastructure and rising urban migration are expected to support long-term market potential.

Latin America Intercity Bus Travel Market Trends

Latin America’s market growth is influenced by a large intercity-dependent population and relatively lower car ownership rates. Countries in the region are modernizing bus fleets and improving ticketing systems to enhance passenger experience. Rising tourism activity and government focus on strengthening public transport infrastructure are contributing to continued market progress.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Intercity Bus Travel Company Insights

The global Intercity Bus Travel Market in 2024 continues to evolve as consumer mobility patterns shift toward cost-effective, sustainable, and technology-enabled transportation. Digital ticketing, onboard amenities, and flexible routing are becoming core differentiation drivers as competition intensifies across regions. The market is also benefiting from rising cross-border travel, increasing fuel prices pushing passengers toward shared transport, and strategic partnerships with tourism and mobility-as-a-service platforms.

FlixBus remains a dominant growth engine in the sector, leveraging an asset-light operating model supported by an extensive digital booking ecosystem and dynamic routing. Its rapid expansion into North America and strategic acquisitions continue to enhance network scale while maintaining competitive pricing for long-distance travelers.

Greyhound Lines sustains a strong position in the United States, backed by brand legacy and an extensive intercity network. Despite rising competition, Greyhound is prioritizing modernization through digital booking upgrades and selective route optimization to strengthen profitability while retaining its core customer base.

Megabus maintains a competitive foothold by focusing on value-driven fares, express routes, and strategic university and city-center hubs. Its marketing emphasis on affordability and convenience continues to resonate, especially with the student and budget-conscious segments across North America and Europe.

National Express remains a key contender through its comprehensive service coverage in the UK and expanding international footprint. The company’s investments in fleet sustainability and customer service—supported by strategic contracts and long-distance corridor expansions—position it to benefit from rising demand for reliable and eco-efficient intercity travel.

Overall, the competitive landscape in 2024 is characterized by digital acceleration, operational optimization, and environmentally focused fleet transformation, shaping a more connected and passenger-centric travel ecosystem.

Top Key Players in the Market

- FlixBus

- Greyhound Lines

- Megabus

- National Express

- ALSA

- RegioJet

- Itabus

- Lux Express

- RedCoach

- RedBus

- Busbud

Recent Developments

- In July 2024, Keolis signed an agreement to acquire the Transit and Motorcoach business divisions of Pacific Western Transportation Ltd. (PWT) in Canada, a move that significantly strengthens its position in the intercity coach sector and broadens its operational footprint across Western Canada.

- In January 2025, GOGO Charters launched its first luxury intercity bus route between Dallas and San Antonio — with stops in San Marcos, Austin, Temple, and Waco — introducing a premium and more comfortable alternative to air travel for long-distance passengers across Texas.

- In March 2025, Volvo Buses introduced the new electric intercity bus model, the Volvo 7800 Electric, in Mexico, marking a strategic product launch targeting long-distance and intercity travel markets with zero-emission, next-generation vehicle technology.

Report Scope

Report Features Description Market Value (2024) USD 18.8 Billion Forecast Revenue (2034) USD 35.3 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Economy / Standard, Premium / Luxury), By Booking Channel (Offline Counter / Agency, Operator-Owned Websites & Apps, Online Aggregators / OTAs), By Propulsion Type (Diesel, CNG / LNG, Battery-Electric, Hybrid & Hydrogen Fuel-Cell), By Bus Type (Single-Deck Buses, Double-Deck Buses, Coach Buses, Luxury Buses), By Distance Band (Short-haul (less than 200 km), Medium-haul (200-400 km), Long-haul (above 400 km)), By End-user (Students & Young Professionals, Leisure & VFR, Business Travelers, Migrant & Seasonal Workers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape FlixBus, Greyhound Lines, Megabus, National Express, ALSA, RegioJet, Itabus, Lux Express, RedCoach, RedBus, Busbud Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intercity Bus Travel MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Intercity Bus Travel MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FlixBus

- Greyhound Lines

- Megabus

- National Express

- ALSA

- RegioJet

- Itabus

- Lux Express

- RedCoach

- RedBus

- Busbud