Global Smart Transportation Market By Solution(Ticketing Management System, Parking Management and Guidance System, Integrated Supervision System, Traffic Management System), By Services(Business, Professional, Cloud Services), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 98811

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

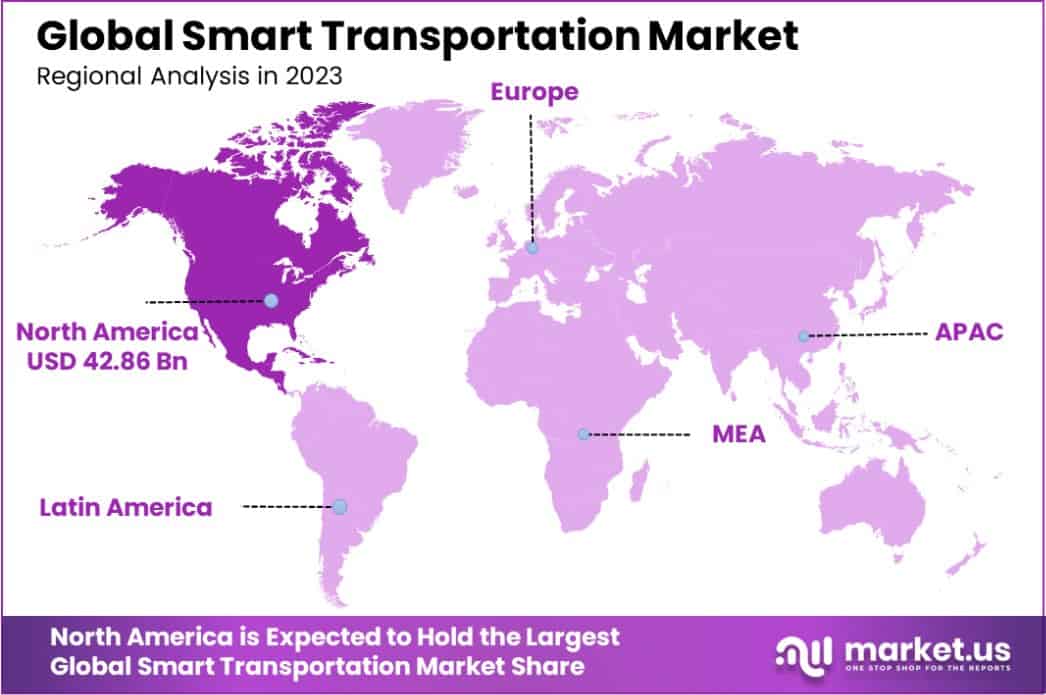

The Global Smart Transportation Market size is expected to be worth around USD 394.9 Billion By 2033, from USD 118.4 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033. North America dominated a 36.2% market share in 2023 and held USD 42.86 Billion in revenue from the Smart Transportation Market.

Smart transportation refers to the use of advanced technologies and management strategies in transportation systems to enhance mobility, improve traffic management, and increase the efficiency of transportation networks.

This approach integrates information and communication technology with transportation infrastructure, aiming to optimize the use of existing resources, reduce traffic congestion, and improve environmental sustainability.

In the smart transportation market, growth is driven by the increasing need for efficient traffic management solutions, the rising demand for eco-friendly infrastructure, and government initiatives promoting smart cities.

The integration of IoT and AI in traffic systems, the expansion of high-speed mobile networks, and the advent of autonomous vehicles are significant opportunities in this market. These technologies help in real-time traffic monitoring, smart traffic light systems, and integrated mobility solutions, paving the way for smarter urban transportation environments.

The Smart Transportation market is experiencing a transformative shift, driven by extensive government investments and technological innovations. A key component underpinning this evolution is the SMART Grants Program, initiated by the Bipartisan Infrastructure Law.

This program has strategically allocated $148 million across 93 projects spanning 39 states, including DC and Puerto Rico during its initial two rounds (FY22-FY23). This funding is part of a broader commitment to inject up to $500 million over five years, aiming to pilot advanced demonstration projects in smart transportation.

This substantial financial backing from the government is not only enhancing existing infrastructure but is also setting the stage for the integration of cutting-edge technologies like IoT, AI, and autonomous vehicles within urban mobility networks.

Such initiatives are pivotal in addressing critical challenges such as traffic congestion, urban planning, and environmental sustainability. Furthermore, they catalyze the adoption of innovative traffic management and smart city solutions across various municipalities, thereby boosting market growth.

As we assess the trajectory of the Smart Transportation market, it is evident that these government-funded projects will significantly influence market dynamics, encouraging further investment from both public and private sectors. The continued focus on sustainable and efficient transportation solutions will likely spur further innovations, ensuring that the market remains on a path of vigorous growth and dynamic change.

This forward-thinking approach not only aligns with global sustainability goals but also enhances the quality of urban living, positioning smart transportation as a critical component of future urban ecosystems.

Key Takeaways

- The Global Smart Transportation Market size is expected to be worth around USD 394.9 Billion By 2033, from USD 118.4 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033.

- In 2023, Traffic Management Systems held a dominant market position in the By Solution segment of Smart Transportation Market, capturing more than a 35.2% share.

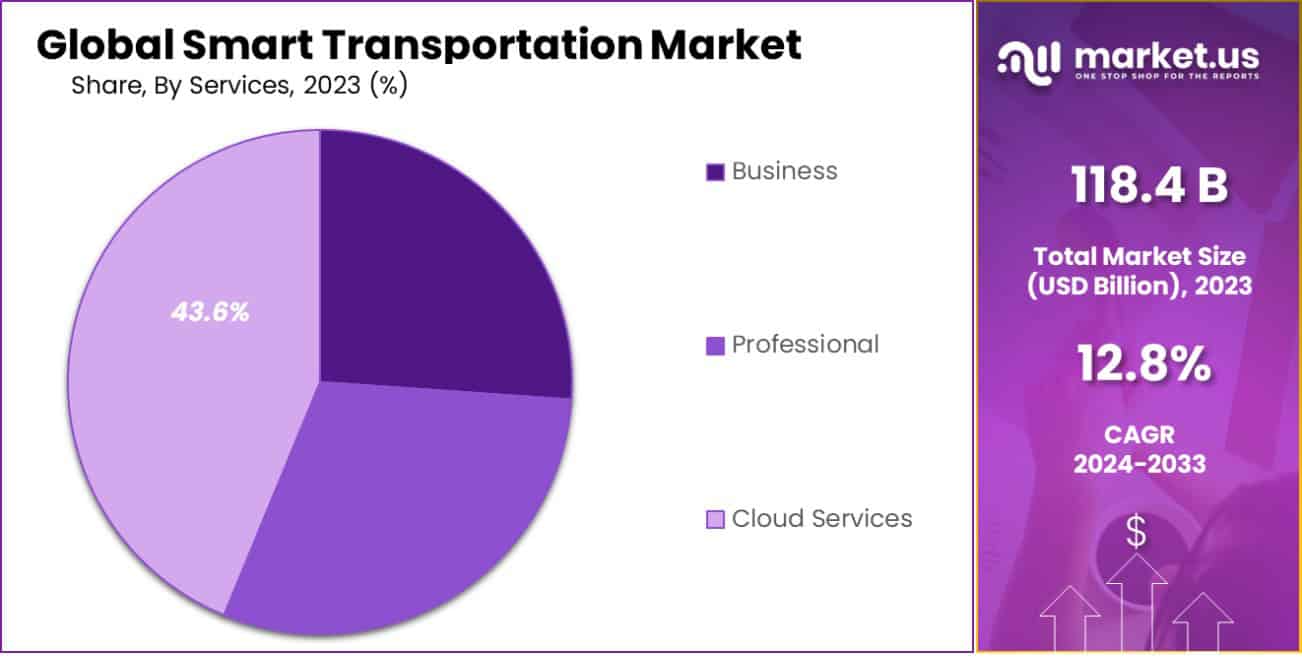

- In 2023, Cloud Services held a dominant market position in the By Services segment of Smart Transportation Market, capturing more than a 43.6% share.

- North America dominated a 36.2% market share in 2023 and held USD 42.86 Billion in revenue from the Smart Transportation Market.

By Solution Analysis

In 2023, the Traffic Management System held a dominant market position in the “By Solution” segment of the Smart Transportation Market, capturing more than a 35.2% share. This prominence is attributed to increasing demands for real-time traffic monitoring solutions, advanced traffic analytics, and the implementation of AI and IoT technologies aimed at reducing congestion and enhancing road safety.

Following closely, the Parking Management and Guidance System also emerged as a key player, streamlined by innovations that support smart parking solutions with real-time availability updates and automated payment systems. The Integrated Supervision System and the Ticketing Management System also contributed significantly to the market.

The former integrates various transportation modes to provide a unified view of the transit operations, improving response times during incidents. Meanwhile, the Ticketing Management System has been pivotal in revolutionizing the commuter experience by implementing contactless payments and multi-modal integration, making public transport more accessible and efficient.

Collectively, these segments underscore the diverse technological advancements propelling the Smart Transportation market forward. By addressing specific pain points within urban mobility, each solution plays a critical role in shaping smarter, more sustainable cities.

By Services Analysis

In 2023, Cloud Services held a dominant market position in the “By Services” segment of the Smart Transportation Market, capturing more than a 43.6% share. This segment’s leadership is largely driven by the scalable, flexible infrastructure it offers, enabling data-intensive applications such as real-time traffic management and analytics to perform optimally across transportation networks.

Close behind, Professional Services also played a crucial role, as they provide the expertise required for the deployment, maintenance, and optimization of smart transportation systems. These services ensure that technology implementations are aligned with the strategic goals of urban mobility plans, facilitating smoother transitions and more efficient system operations.

The Business Services segment, while smaller, remains vital by supporting the operational aspects of smart transportation initiatives. These services help organizations navigate the complexities of regulatory compliance, project financing, and change management, which are essential for sustaining long-term smart transportation projects.

Together, these service segments form a comprehensive ecosystem that supports the diverse needs of the Smart Transportation Market, each contributing to the seamless integration of technology and service delivery in the quest for enhanced urban mobility solutions.

Key Market Segments

By Solution

- Ticketing Management System

- Parking Management and Guidance System

- Integrated Supervision System

- Traffic Management System

By Services

- Business

- Professional

- Cloud Services

Drivers

Smart Transportation Market Drivers

The Smart Transportation market is primarily driven by the growing need for efficient traffic management solutions in urban areas. As cities around the world continue to expand, the challenge of managing ever-increasing traffic volumes becomes critical.

This has spurred the adoption of smart technologies that help reduce congestion, lower emissions, and improve overall travel efficiency. Key technologies fueling this growth include real-time traffic monitoring systems, AI-powered traffic prediction, and connected vehicles that communicate with traffic signals to smooth traffic flows.

Additionally, government initiatives and funding for smart city projects significantly contribute to the market’s expansion, encouraging the development and integration of innovative transportation solutions. This drive towards smarter transportation infrastructures is seen as essential for sustaining urban growth in a manageable, eco-friendly way.

Restraint

Challenges in Smart Transportation Adoption

A major restraint in the Smart Transportation market is the high initial cost of implementing advanced transportation technologies. Setting up comprehensive systems that integrate IoT, AI, and other smart technologies requires significant upfront investment, which can be a barrier for many cities, especially those with limited budgets.

There’s also the challenge of technological integration with existing infrastructure, which often involves complex upgrades and compatibility issues. Furthermore, concerns about data privacy and security related to user information collected through smart transportation systems add another layer of complexity, potentially slowing down the adoption rate.

These financial and technical hurdles, coupled with privacy concerns, represent significant obstacles to the widespread implementation of smart transportation solutions.

Opportunities

Expanding Horizons in Smart Transportation

The Smart Transportation market is ripe with opportunities, particularly from the rising demand for eco-friendly and efficient urban mobility solutions. As environmental concerns drive cities to reduce carbon emissions, smart transportation systems offer a viable solution by optimizing traffic flows and reducing idle times.

The advent of 5G technology further enhances these systems, enabling faster, more reliable communication between connected devices, which is crucial for real-time data transfer and processing. Additionally, the integration of artificial intelligence in transportation management can significantly improve decision-making processes, traffic predictions, and automated vehicle operations.

These technological advancements open up new possibilities for more dynamic and responsive urban transport networks, positioning smart transportation as a key player in the future of city planning and environmental sustainability.

Challenges

Navigating Challenges in Smart Transportation

The Smart Transportation market faces several challenges that could hinder its growth. One of the primary concerns is the interoperability between different transportation systems and technologies. As cities deploy various smart solutions from multiple providers, ensuring these systems work seamlessly together is crucial but often problematic.

There’s also the issue of regulatory and standardization hurdles, as governments must develop and enforce new guidelines that keep pace with rapid technological changes. Additionally, public acceptance and trust in automated and data-driven systems need to be fostered. People’s concerns about privacy and the reliability of autonomous vehicles, for example, could slow down adoption rates.

Overcoming these challenges requires collaborative efforts between technology providers, city planners, and regulatory bodies to create a cohesive, secure, and efficient smart transportation ecosystem.

Growth Factors

Key Growth Drivers for Smart Transportation

The Smart Transportation market is propelled by several key factors that encourage its expansion and adoption. Urbanization is a significant driver, as growing city populations increase the demand for efficient traffic management and smart mobility solutions.

Technological advancements play a crucial role too, with developments in AI, IoT, and big data analytics enhancing transportation systems’ efficiency and effectiveness. Government initiatives and funding for smart cities directly boost the market by facilitating the adoption of innovative transportation technologies.

Additionally, increasing environmental concerns push for greener, more sustainable transit options, aligning with smart transportation goals to reduce traffic congestion and pollution. Together, these factors create a conducive environment for the growth of smart transportation solutions, making cities more manageable and sustainable.

Emerging Trends

Emerging Trends in Smart Transportation

Emerging trends in the Smart Transportation market are shaping the future of urban mobility. A significant trend is the integration of autonomous vehicles into public and private transport fleets, enhancing efficiency and safety.

The use of electric vehicles (EVs) is also on the rise, supported by improved charging infrastructure and governmental incentives aimed at reducing carbon emissions. Another notable trend is the deployment of Mobility-as-a-Service (MaaS) platforms, which combine various forms of transport services into a single accessible on-demand service, streamlining user experiences and optimizing traffic flows.

Additionally, advancements in AI are enabling more predictive analytics in traffic management, foreseeing and mitigating congestion before it occurs. These trends not only enhance how we travel but also promise significant improvements in environmental sustainability and urban planning.

Regional Analysis

The Smart Transportation market exhibits robust growth across various regions, each contributing uniquely to the global landscape. North America dominates this sector, holding a 36.2% market share with a value of USD 42.86 billion. This leadership is driven by advanced technology adoption, significant investments in smart city projects, and stringent regulatory standards promoting sustainable transportation solutions.

In Europe, the market thrives due to strong governmental support, high environmental awareness, and the presence of leading automotive and tech companies investing heavily in smart transportation technologies. The European Union’s directives on reducing urban traffic emissions further propel the adoption of smart solutions.

Asia Pacific is witnessing rapid growth due to urbanization, rising disposable incomes, and increasing investments in infrastructure development. Countries like China, Japan, and South Korea are leading the charge, implementing extensive smart city and smart transportation projects to address their burgeoning urban populations.

Meanwhile, the Middle East & Africa, and Latin America are gradually catching up, with governments in these regions starting to recognize the potential of smart transportation solutions to solve their unique traffic and infrastructure challenges, though their market share is significantly smaller compared to the dominating regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Smart Transportation market, key players such as Accenture PLC, IBM Corporation, and Siemens AG have established themselves as pivotal contributors to the sector’s evolution in 2023.

Accenture PLC has strategically positioned itself by leveraging its vast consulting expertise to aid cities and transportation agencies in implementing smart solutions that optimize traffic management and enhance commuter services. Their approach often integrates cutting-edge technologies like AI and machine learning to predict traffic flows and improve decision-making processes within transportation networks.

IBM Corporation stands out through its deployment of advanced analytics and IoT solutions tailored for smart transportation. IBM’s offerings help cities harness real-time data for better infrastructure management and vehicle tracking, significantly reducing operational costs and improving transit times. Their expertise in cloud-based solutions further enables seamless integration of various transportation modalities, enhancing the efficacy of smart transit systems.

Siemens AG, with its deep roots in engineering and technology, excels in providing integrated hardware and software solutions that modernize and automate transportation systems. Their focus on sustainable and electrified transportation technologies is particularly notable, as they aim to reduce urban carbon footprints while improving the reliability and efficiency of public transit.

Each of these companies not only contributes to technological advancements within the Smart Transportation market but also helps shape regulatory frameworks and sustainability goals. Their combined efforts are crucial for driving the global shift towards more integrated, efficient, and sustainable transportation systems, positioning them as leaders in a rapidly evolving market landscape.

Top Key Players in the Market

- Accenture PLC

- IBM Corporation

- Siemens AG

- Cisco System, Inc.,

- Alstom, SA

- Cubic Corporation

- Indra Sistema S.A.

- Thales Group

- TomTom International

- General Electric Company (GE)

Recent Developments

- In May 2023, Cubic Corporation received a $50 million grant to develop a new real-time passenger information system for public transportation, enhancing commuter experience and operational transparency.

- In March 2023, Alstom, SA secured a major deal in March 2023 to supply digital signaling systems for urban rail networks in Europe, aiming to improve safety and efficiency.

- In January 2023, Cisco System, Inc. launched an innovative city traffic management solution to enhance vehicle flow and reduce congestion using advanced analytics and real-time data processing.

Report Scope

Report Features Description Market Value (2023) USD 118.4 Billion Forecast Revenue (2033) USD 394.9 Billion CAGR (2024-2033) 12.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Solution(Ticketing Management System, Parking Management and Guidance System, Integrated Supervision System, Traffic Management System), By Services(Business, Professional, Cloud Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture PLC, IBM Corporation, Siemens AG, Cisco System, Inc., Alstom, SA, Cubic Corporation, Indra Sistema S.A., Thales Group, TomTom International, General Electric Company (GE), Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Transportation MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Smart Transportation MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture PLC

- IBM Corporation

- Siemens AG

- Cisco System, Inc.,

- Alstom, SA

- Cubic Corporation

- Indra Sistema S.A.

- Thales Group

- TomTom International

- General Electric Company (GE)