Global Intellectual Property Insurance Market Size, Share, Industry Analysis Report By Type (Infringement Defense, Abatement Enforcement), By Industry Vertical (Media and Entertainment, Technology and Software, Pharmaceuticals and Life Sciences, Consumer Electronics, Manufacturing, Retail and Consumer Goods, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162987

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

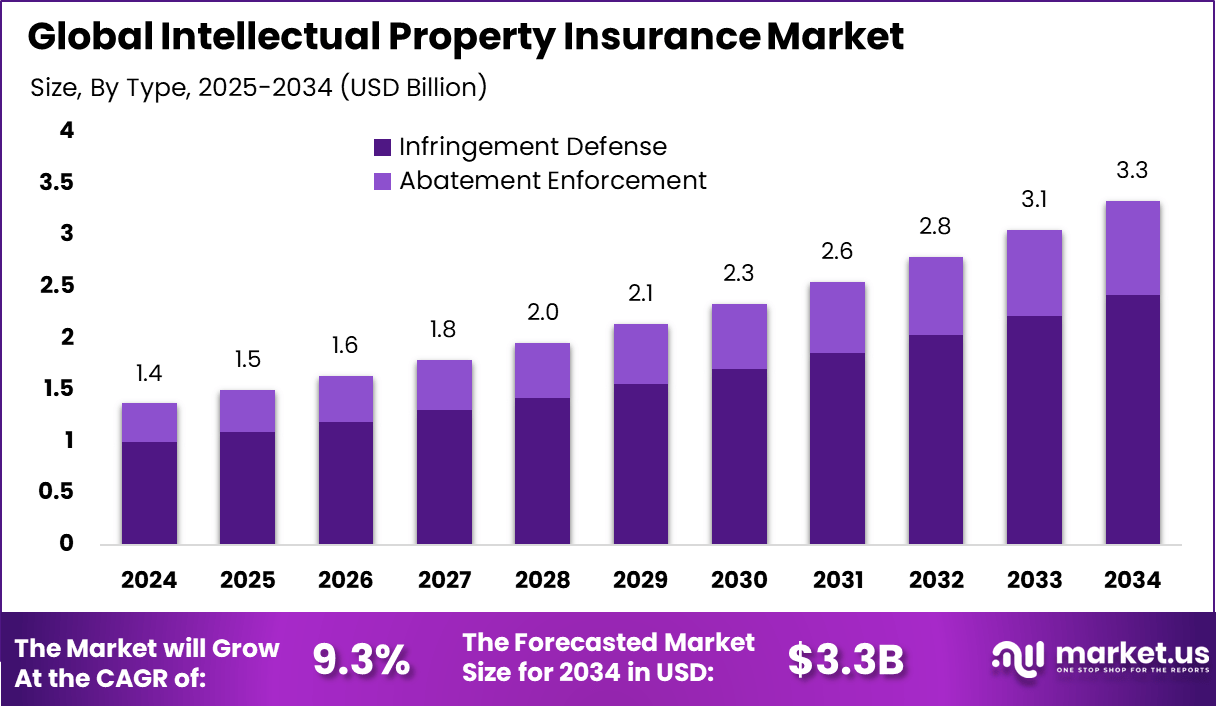

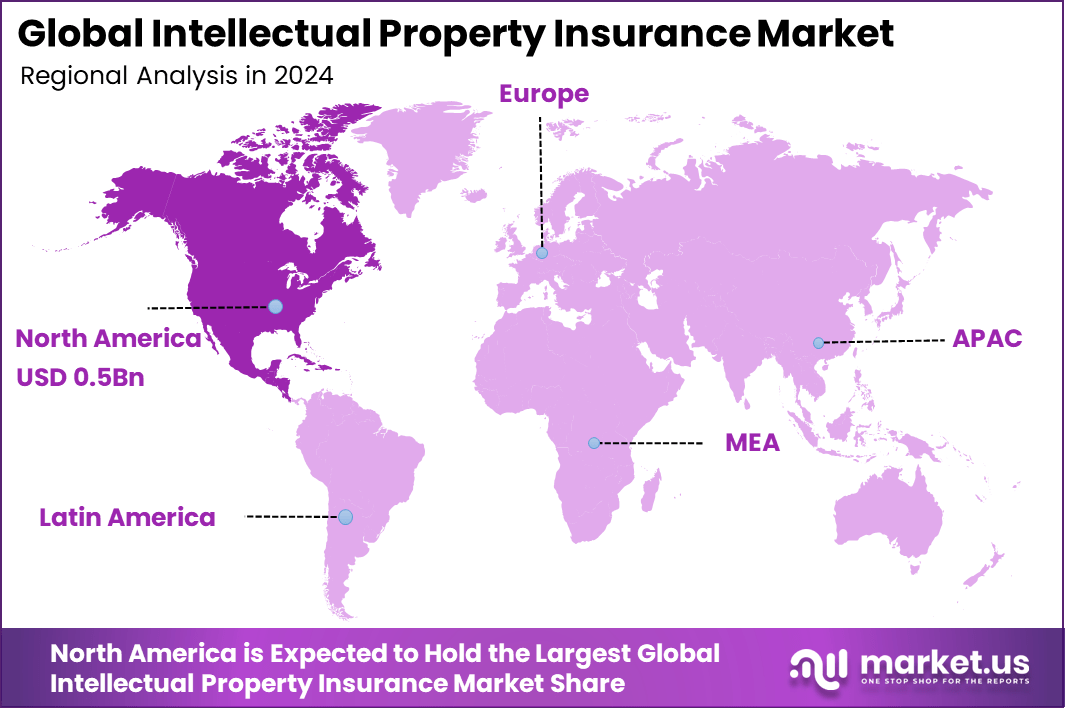

The Global Intellectual Property Insurance Market generated USD 1.4 billion in 2024 and is predicted to register growth from USD 1.5 billion in 2025 to about USD 3.3 billion by 2034, recording a CAGR of 9.3% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.9% share, holding USD 0.5 Billion revenue.

The intellectual property (IP) insurance market consists of insurance products designed to protect holders of patents, trademarks, copyrights, trade secrets and other intangible assets against legal costs, infringement claims and enforcement challenges. The market is gaining prominence as intangible assets become more central to business value.

Top driving factors for the IP insurance market include the skyrocketing costs of IP lawsuits, which often reach millions of dollars per case. This financial risk forces many businesses to seek protection to avoid crippling expenses. The technology sector’s reliance on patents and trade secrets makes these companies particularly vigilant. About 40% of technology firms now consider IP insurance essential to defend their market positions.

Another driver is the surge in patent troll lawsuits, where entities buy patents to sue firms aggressively. Smaller companies, especially startups with limited legal budgets, form a significant share of new adopters since 35% report vulnerability to costly IP disputes without protection. Businesses understand intangible assets are often worth more than physical ones, with IP constituting up to 84% of corporate value in large firms.

According to Market.us, The Global AI in Insurance Market is projected to rise from USD 5 billion in 2023 to approximately USD 91 billion by 2033, recording a robust CAGR of 32.7% during the forecast period from 2024 to 2033. The growth is driven by the rapid adoption of AI technologies in underwriting, claims management, risk assessment, and fraud detection, enabling insurers to improve accuracy and operational efficiency.

Meanwhile, the Global Online Insurance Market is expected to expand from USD 95.6 billion in 2024 to around USD 681.2 billion by 2034, growing at a steady CAGR of 21.7%. In 2024, North America held a leading position with over 34% market share, generating USD 32.5 billion in revenue. The regional growth can be attributed to advanced digital infrastructure, higher internet penetration, and a strong consumer shift toward online policy purchases and automated claim services.

Top Market Takeaways

- The Infringement Defense segment dominated with 72.8%, driven by the growing need for legal protection against patent and trademark disputes.

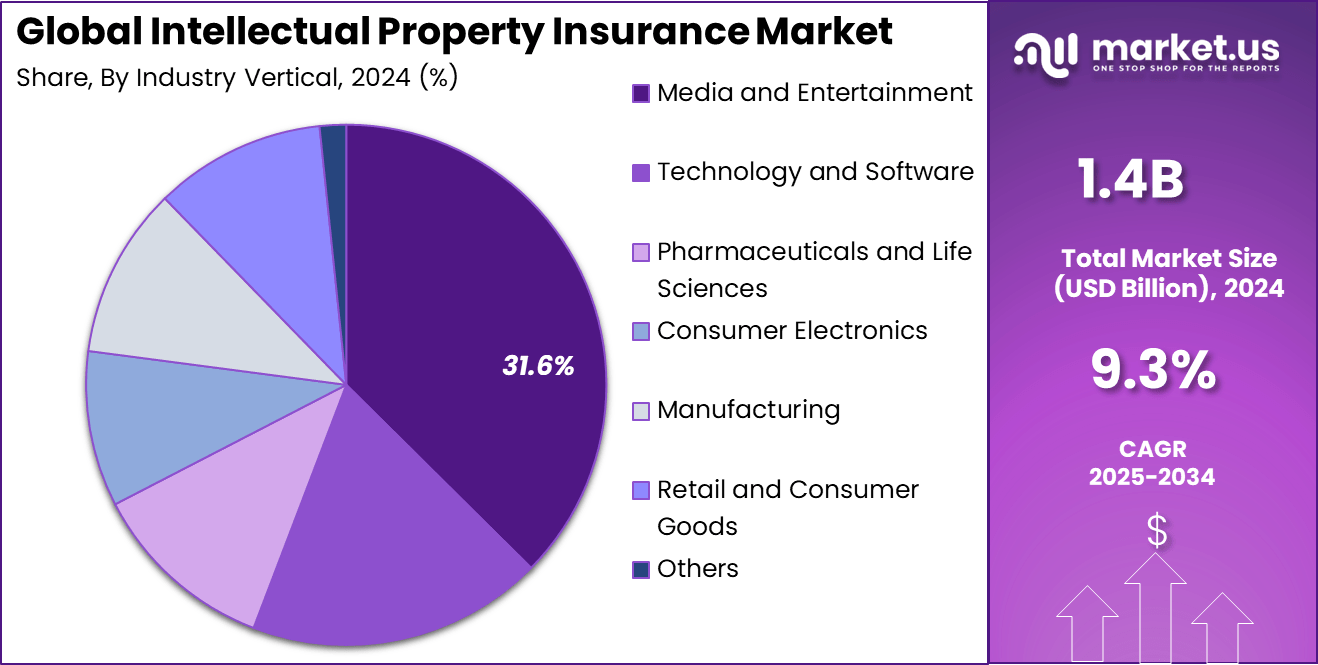

- The Media and Entertainment sector accounted for 31.6%, reflecting high exposure to copyright issues, brand licensing conflicts, and content ownership claims.

- North America led with 38.9% of the global market, supported by strong IP enforcement frameworks and high awareness of intellectual property rights.

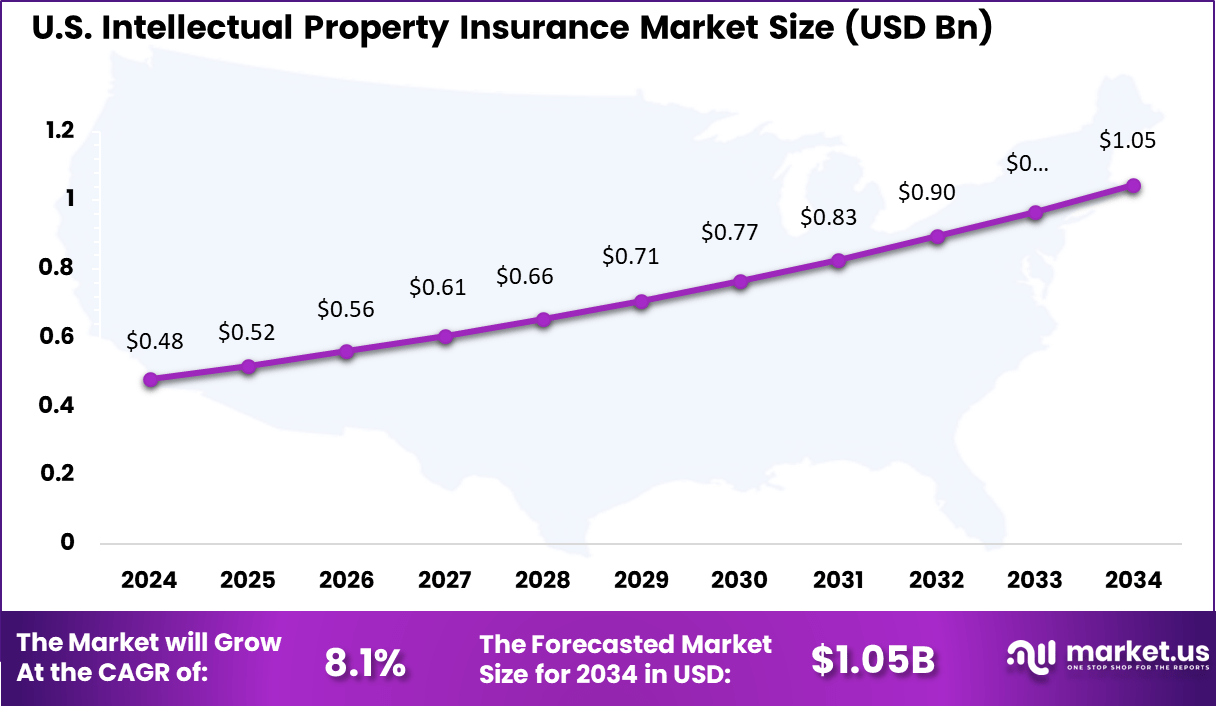

- The US market was valued at USD 0.48 Billion in 2024, expanding at a steady 8.1% CAGR, fueled by increasing litigation risks and the rising value of creative and technological assets.

Litigation and Claims Statistics

- Claims frequency: Intellectual property (IP) disputes are a significant risk area. Data from insurer CFC shows that IP-related disputes are the third most frequent type of claim for digital healthcare companies, ranking only behind medical negligence and cyber claims.

- Trade secret misappropriation: Employee departures remain a major vulnerability. Statistics indicate that up to 60% of companies experience trade secret misappropriation linked to departing staff. Between 2016 and 2022, about 36% of federal trade secret cases involved former employees, highlighting the scale of insider-driven risks.

- Rising legal costs: IP litigation continues to be costly and time-intensive. A 2023 WIPO survey found that average court litigation in a home jurisdiction takes around 3 years and costs about $475,000. For cross-border disputes, costs can exceed $850,000, placing heavy financial burdens on businesses.

- Non-practicing entities (NPEs): Patent litigation is increasingly driven by NPEs. Data from Lex Machina and FactSet shows that over 50% of patent cases in H1 2023 were filed by NPEs. The technology sector remains the most common target, reflecting its reliance on patent portfolios.

Demand for IP Insurance

- Higher submissions: Insurers, including Tokio Marine Kiln and Arch Insurance, report strong growth in demand, with year-over-year increases in submissions for IP liability insurance.

- Broader client base: Demand is no longer limited to technology and pharmaceutical companies. Industries such as manufacturing, financial services, and consumer goods are increasingly seeking IP coverage.

- Strategic importance: IP insurance is evolving beyond niche risk management. It is now recognized as a critical strategic tool for defending innovation, supporting competitive positioning, and attracting investment. Businesses view IP coverage as essential in navigating today’s litigation-heavy environment.

Investment and Benefits

Investment opportunities in the IP insurance market lie in the increasing number of companies relying on intangible assets and the ongoing rise in IP litigation cases. Insurers offering tailored policies for emerging sectors like biotechnology, software, and AI stand to gain. There is growing potential in the SME segment where awareness and adoption remain below potential.

Financial institutions also see value in IP insurance as it reduces lending risks when using IP as collateral, thereby expanding credit opportunities. The trend toward integrating AI for risk assessment and claims management opens paths for innovative insurance products and business models. Business benefits of IP insurance include enhanced protection of critical intangible assets and reduced financial exposure from protracted legal battles.

Insured companies report improved investor confidence and better bargaining positions during mergers and acquisitions because insurers assume some IP-related risks. It also fosters long-term stability, allowing businesses to focus on innovation rather than legal fears. About 40% of insured firms cite increased peace of mind and operational security as top benefits, enabling them to pursue growth more aggressively.

US Market Size

The United States alone contributes around USD 0.48 billion, expanding at a steady 8.1% CAGR. The market’s growth is supported by strong intellectual property enforcement frameworks and an active insurance industry capable of delivering specialized legal coverage.

Legal reforms and heightened enforcement actions against infringement have further encouraged corporate clients to adopt tailored insurance products. Ongoing collaboration between legal and insurance providers is expected to refine risk evaluation models for future coverage options.

In 2024, North America accounts for 38.9% of the global market, reflecting an advanced understanding of intellectual property rights and a high volume of innovation-driven businesses. Growing litigation activity in the United States continues to influence regional adoption, as companies prioritize legal protection within competitive markets. The prevalence of technology, entertainment, and life sciences firms strengthens the market’s foundation across the region.

By Type

In 2024, Infringement defense insurance holds the largest share of the intellectual property insurance market at 72.8%. Companies invest in this coverage to protect themselves from costly legal disputes related to patent, trademark, or copyright claims.

As innovation becomes central to business growth, even small and midsize enterprises are recognizing the need for protection against unexpected lawsuits. The growing complexity of the global innovation ecosystem also fuels this demand.

With the rise of digital content, software, and AI-generated works, infringement risks have expanded across borders. Insurers now offer tailored policies that combine coverage for legal defense, settlement costs, and counterclaims. This wider scope strengthens the position of infringement defense as the most essential form of intellectual property protection for technology-driven sectors.

By Industry Vertical

In 2024, The media and entertainment sector dominates with 31.6% of the market, reflecting its heavy dependence on creative content and licensing revenue. This industry faces frequent copyright and trademark disputes linked to film production, digital streaming, and advertising.

As the volume of online content surges, producers and distributors increasingly rely on insurance to manage legal uncertainties. Insurers have responded by designing specialized coverage suited to digital rights and creative ownership risks. Streaming platforms, gaming studios, and digital advertising firms are especially prone to intellectual property challenges due to global content sharing and overlapping licensing agreements.

The adoption of intellectual property insurance in this sector safeguards revenue continuity and reputation. This trend also signals a shift toward more proactive risk management strategies, where legal preparedness is treated as a necessary operational requirement rather than an optional safeguard.

Emerging Trends

One key trend shaping the market is the integration of digital tools and blockchain technology to enhance IP management and insurance processes. About 38% of businesses now incorporate digital platforms to register and verify IP assets, a shift that simplifies claims and reduces fraud risks.

Additionally, there is a noticeable move toward specialized policies catering to emerging sectors such as biotech, AI, and blockchain, which demand unique coverage due to their complex legal and technical challenges. Another significant trend involves increased investments in cyber risk coverage linked to IP assets.

The digitalization of IP and the rising frequency of cyberattacks mean that nearly 35% of insurers are expanding their policies to include cyber liability tailored to IP theft and trade secret breaches. Growing awareness among companies, especially in regions like North America and Asia-Pacific, is fueling demand for these next-generation insurance solutions, fostering more widespread adoption.

Growth Factors

The industry is driven forward by a surge in global IP disputes, which has seen the market size reach around USD 754 million in 2025. As companies expand globally and develop innovative products, the risk of infringement claims intensifies, prompting about 45% of firms to seek dedicated IP coverage for protection against costly legal battles. Increasing R&D investments also contribute by creating valuable intangible assets that require protection, especially in high-tech and creative industries.

Further boosting growth are advancements in legal frameworks and international IP laws, which are encouraging companies to safeguard their inventions more diligently. Technological improvements in underwriting, such as AI-powered risk assessment, are making IP insurance more accessible and affordable. These factors collectively create a favorable environment for sustained industry growth and deepen the commitment of businesses to safeguard their IP portfolios.

Key Market Segments

By Type

- Infringement Defense

- Abatement Enforcement

By Industry Vertical

- Media and Entertainment

- Technology and Software

- Pharmaceuticals and Life Sciences

- Consumer Electronics

- Manufacturing

- Retail and Consumer Goods

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Intellectual Property Litigation

The growing number of intellectual property disputes worldwide is a key factor driving demand for IP insurance. Companies face increasing risks of costly patent, trademark, and copyright litigation as their innovations attract challenges from competitors or patent assertion entities. This rise in IP legal battles makes insurance essential, helping businesses cover expensive legal fees and settlements that could otherwise severely impact their finances.

Industries reliant on technology, biotech, and creative content are particularly vulnerable, pushing a large share of companies to seek IP insurance as a risk management tool. With global patent applications steadily increasing, businesses see IP insurance as a necessary shield that supports their innovation-driven growth while protecting against unpredictable legal exposure.

Restraint

Complex Valuation and Policy Standardization

A significant barrier for the Intellectual Property Insurance market is the complexity involved in valuing intangible assets accurately. IP assets vary widely across sectors and geographies, making it challenging to set premiums or define coverage that reflects true risk and potential loss. This difficulty complicates underwriting and leads to inconsistencies across insurers in coverage terms and pricing.

Moreover, the lack of standardized policies across regions adds to the challenge, as companies and insurers must navigate differing IP laws and legal systems. For smaller businesses and emerging markets, these complexities can discourage adoption of IP insurance despite its benefits, slowing overall market growth.

Opportunity

Expansion Through Emerging Technologies

The growth of new technology sectors such as artificial intelligence, blockchain, and green innovation creates substantial opportunities for IP insurance providers. These emerging fields generate novel intellectual property that requires specialized coverage tailored to unique risks. Developing targeted insurance products for such innovations can unlock new market segments and diversify insurer portfolios.

Additionally, leveraging advanced analytics, machine learning, and legal technology platforms can improve risk assessment and claims handling, enhancing customer experience. Growing awareness of IP risks among startups and SMEs also offers insurers a chance to reach underserved clients with flexible, affordable coverage solutions, expanding overall IP insurance adoption.

Challenge

Slow Adoption and Talent Shortage

Despite the growth potential, the market faces challenges including slow uptake among some business sectors due to limited awareness or perceived complexity of IP insurance. Many smaller companies still view IP insurance as non-essential or too costly, limiting penetration outside large enterprises with dedicated legal budgets.

Additionally, a shortage of specialized talent in IP law and insurance underwriting hampers the ability of insurers to develop and manage effective products. Combined with rapid changes in IP legislation and increasing litigation complexities, insurers must invest in expertise and innovation to keep pace, making it harder to scale IP insurance offerings efficiently.

Competitive Analysis

The Intellectual Property (IP) Insurance Market is led by major global insurers and reinsurers such as AXA XL, Chubb Limited, Allianz Global Corporate & Specialty, and Munich Re. These companies offer specialized IP coverage solutions that protect businesses against patent infringement, trade secret theft, and copyright litigation. Their underwriting expertise, global presence, and focus on innovation-driven industries make them key enablers of risk mitigation in the growing knowledge economy.

Prominent insurance and brokerage firms including Tokio Marine HCC, Tokio Marine Kiln, Lloyd’s of London, CFC Underwriting, and The Hanover Insurance Group provide tailored intellectual property insurance for technology firms, startups, and R&D-intensive sectors. Their policies cover legal expenses, defense costs, and loss of income due to IP disputes. The integration of AI-based risk assessment and IP valuation tools enhances their ability to price complex innovation-related risks.

Additional contributors such as Swiss Re, Sompo Holdings, Ping An Insurance, Mitsui Sumitomo Insurance, Aon plc, and Lockton Companies, along with other market participants, play a crucial role in reinsurance, risk advisory, and brokerage services. Their focus on cross-border IP protection, portfolio valuation, and regulatory compliance is helping enterprises safeguard intangible assets.

Top Key Players in the Market

- AXA XL

- Tokio Marine HCC

- Lloyd’s of London

- CFC Underwriting

- The Hanover Insurance Group

- Chubb Limited

- Munich Re

- Swiss Re

- Allianz Global Corporate & Specialty

- Tokio Marine Kiln

- Aon plc

- Lockton Companies

- Sompo Holdings

- Ping An Insurance

- Mitsui Sumitomo Insurance

- Others

Recent Developments

- August 2025, The Hanover Insurance Group expanded its Business Owner’s Advantage product to better serve the life sciences sector. This includes enhanced property and liability coverage tailored to the unique risks of life sciences organizations along with a streamlined online quoting process, helping clients protect their IP-driven innovations with specialized underwriting guidance.

- May 2025, CFC Underwriting launched a new simplified intellectual property insurance product tailored for companies from startups to those with revenues up to $500 million. Coverage includes defense and enforcement against IP infringement, loss of future profits, and reputational brand protection.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 3.3 Bn CAGR(2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Infringement Defense, Abatement Enforcement), By Industry Vertical (Media and Entertainment, Technology and Software, Pharmaceuticals and Life Sciences, Consumer Electronics, Manufacturing, Retail and Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA XL, Tokio Marine HCC, Lloyd’s of London, CFC Underwriting, The Hanover Insurance Group, Chubb Limited, Munich Re, Swiss Re, Allianz Global Corporate & Specialty, Tokio Marine Kiln, Aon plc, Lockton Companies, Sompo Holdings, Ping An Insurance, Mitsui Sumitomo Insurance, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intellectual Property Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Intellectual Property Insurance MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AXA XL

- Tokio Marine HCC

- Lloyd’s of London

- CFC Underwriting

- The Hanover Insurance Group

- Chubb Limited

- Munich Re

- Swiss Re

- Allianz Global Corporate & Specialty

- Tokio Marine Kiln

- Aon plc

- Lockton Companies

- Sompo Holdings

- Ping An Insurance

- Mitsui Sumitomo Insurance

- Others