Global Insurtech Errors and Omissions (E&O) Market Size, Share and Analysis Report By Coverage Type (Technology Service Providers, Digital Brokers, Insurtech Startups, Others), By Application (Small and Medium Enterprises, Large Enterprises), By Distribution Channel (Direct Sales, Brokers/Agents, Online Platforms, Others), By End-User (Insurance Companies, Insurtech Firms, Third-party Administrators, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176523

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Adoption and Usage Rates

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Coverage Type

- By Application

- By Distribution Channel

- By End User

- Regional Perspective

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

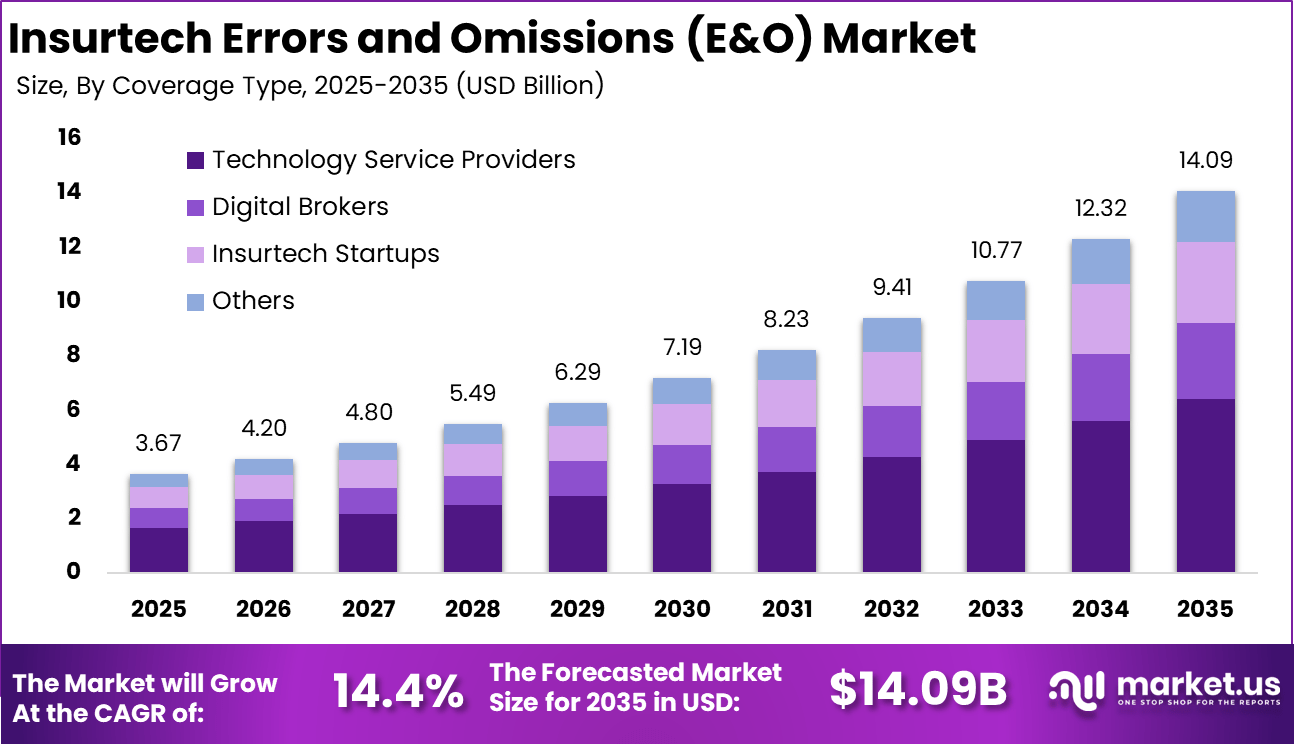

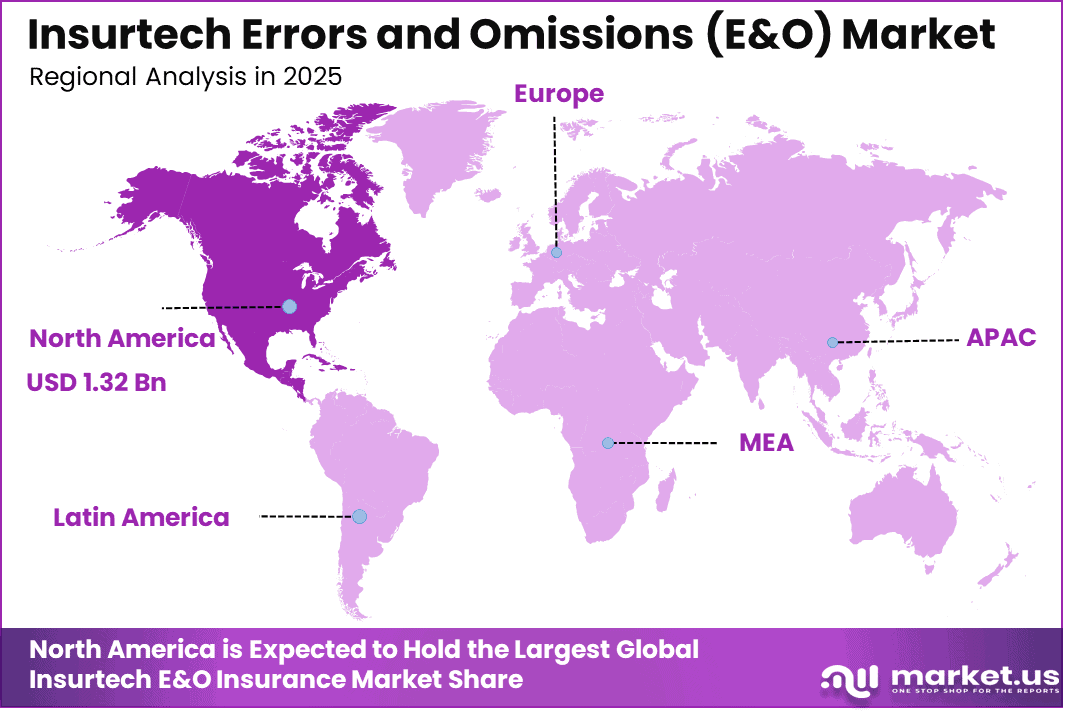

The Global Insurtech E&O Insurance Market size is expected to be worth around USD 14.09 billion by 2035, from USD 3.67 billion in 2025, growing at a CAGR of 14.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 36.1% share, holding USD 1.32 billion in revenue.

The insurtech errors and omissions insurance market focuses on professional liability coverage designed for technology driven insurance platforms and digital intermediaries. This market addresses financial losses arising from claims related to service failures, system errors, misrepresentation, data handling issues, or regulatory non compliance by insurtech firms. As insurance distribution, underwriting, and claims processing become more automated and software dependent, exposure to operational and technology related errors has increased.

Key driver factors shaping this market are the rapid digitization of insurance services, growing reliance on automated decision making, and heightened regulatory scrutiny of digital insurance operations. Insurtech firms handle sensitive customer data and complex transactions at scale, which raises the risk of service disruptions and compliance failures. These drivers make E&O insurance a critical risk management tool to protect balance sheets, maintain client trust, and support long term operational stability.

Growth in demand is being driven by rising dependence on digital insurance workflows, where a single outage, rating error, misconfigured rules engine, or incorrect data mapping can quickly impact many policyholders and partners. When insurance products are delivered through APIs and automated underwriting, the financial impact of mistakes can scale faster than in manual processes.

Another driver is the tightening focus on operational resilience and third party technology dependencies in financial services. In the European Union, EIOPA highlights governance expectations for cloud outsourcing in insurance, and the digital operational resilience framework has increased scrutiny of ICT risk management and third party oversight.

For instance, in October 2024, Tokio Marine HCC launched tech E&O insurance directly on its broker portal, simplifying access for digital-era professionals. This Texas-headquartered offering targets insurtech firms with fast quoting and broad coverage.

Key Takeaway

- In 2025, Technology Service Providers emerged as the leading customer group in the Global Insurtech E&O Insurance Market, accounting for 45.6% of total demand.

- In 2025, Large Enterprises represented the primary buyer segment, holding a dominant 74.7% share of the Global Insurtech E&O Insurance Market.

- In 2025, Direct Sales remained the most preferred distribution channel, capturing a 44.8% share of the Global Insurtech E&O Insurance Market.

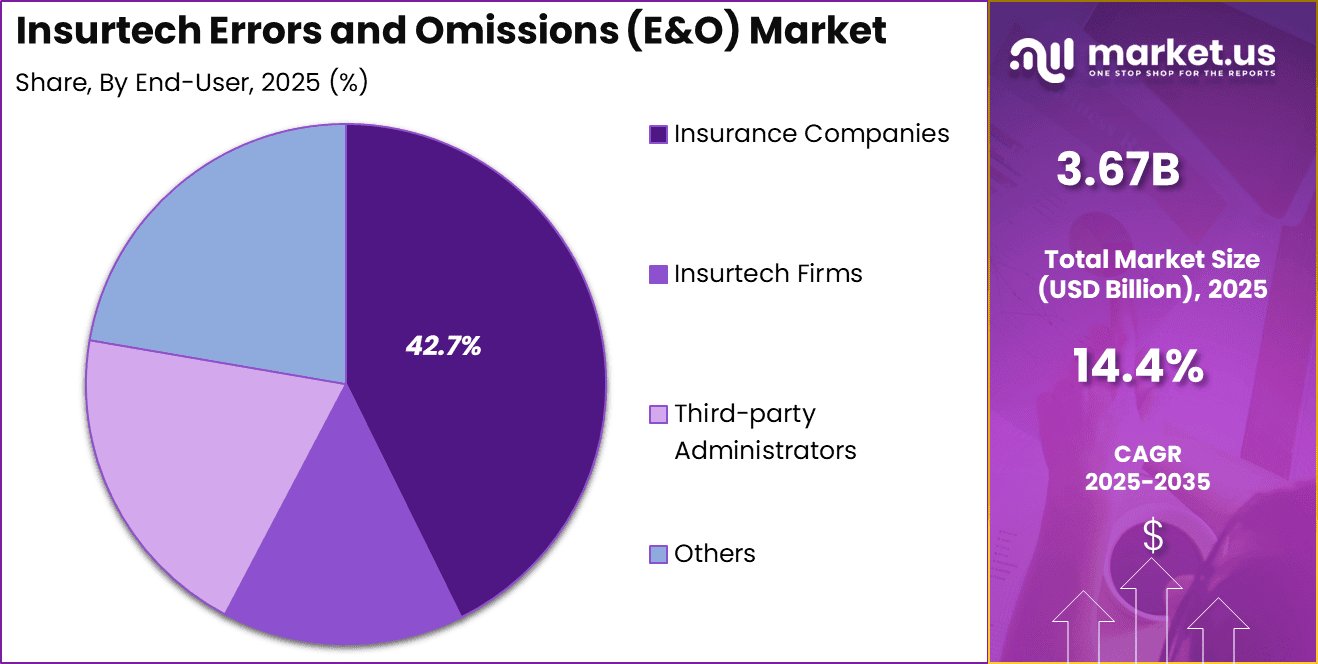

- In 2025, Insurance Companies were the largest end users, contributing 42.7% of total market activity in the Global Insurtech E&O Insurance Market.

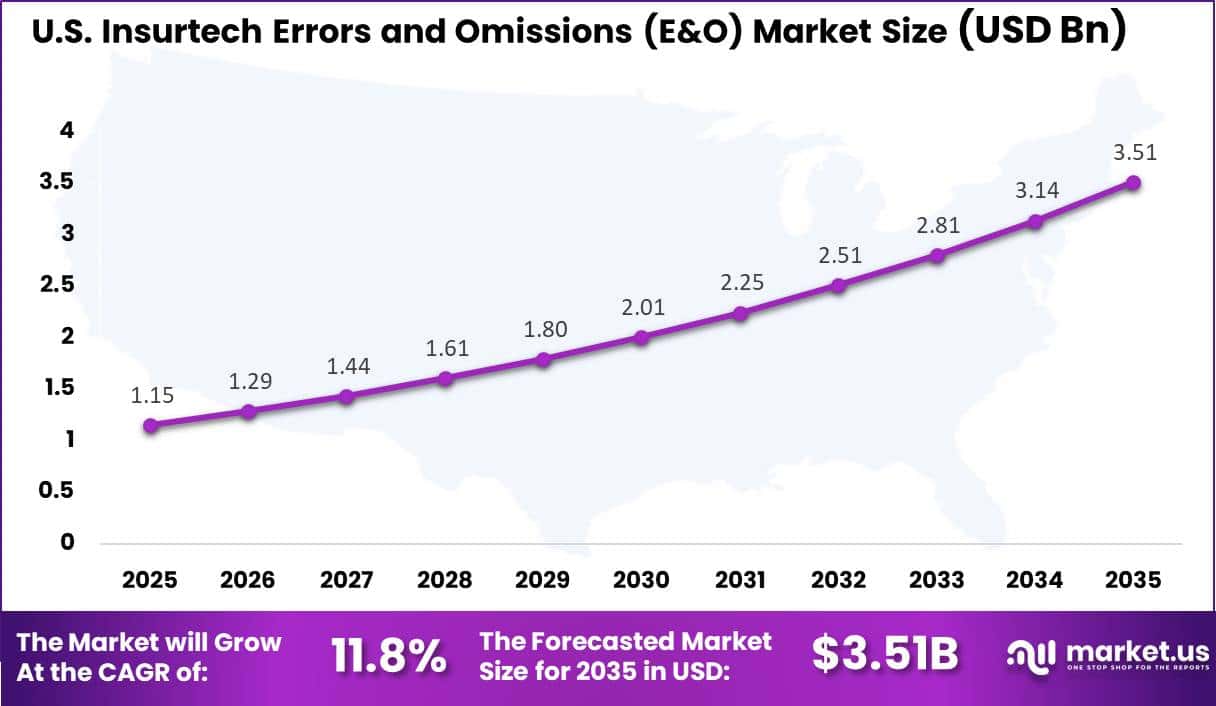

- In 2025, the US Insurtech E&O Insurance Market reached a value of USD 1.15 billion and recorded a strong growth rate of 29.6%.

- In 2025, North America led the global landscape, securing more than 36.1% of the total Insurtech E&O Insurance Market share.

Adoption and Usage Rates

- More than 82% of global insurance companies have adopted AI and machine learning for core functions such as claims processing and risk assessment, increasing demand for technology E&O coverage as traditional professional liability policies often do not fully address software or algorithm driven risks.

- Technology and telecommunications firms account for around 12% of all professional liability claims, highlighting the higher risk exposure faced by digital and insurtech focused businesses.

- Managed service offerings represent the largest service segment, contributing over 42% of sector revenue, as bundled models combining E&O and cyber protection gain wider adoption.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rapid growth of insurtech platforms and digital insurance models +4.1% North America, Europe Short to medium term Increasing technology and algorithm-related liability exposure +3.2% Global Short term Expansion of API-driven insurance distribution and automation +2.8% North America, Europe Medium term Rising regulatory scrutiny on digital insurance operations +2.4% Europe, North America Medium term Growth in B2B insurtech services and SaaS-based insurance tools +1.9% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High premium costs for early-stage and small insurtech firms -2.6% Global Short to medium term Limited historical claims data for emerging technologies -2.1% Global Medium term Complexity in underwriting AI- and algorithm-driven risks -1.8% North America, Europe Medium term Inconsistent regulatory frameworks across regions -1.5% Asia Pacific, Latin America Medium to long term Risk perception gaps among founders and startups -1.2% Emerging Markets Medium term By Coverage Type

Technology service providers account for 45.6% of coverage type adoption in the Insurtech E and O Insurance Market. This dominance reflects the growing exposure of software driven insurance platforms to professional liability risks. Errors related to system outages, data processing failures, or automated decision making increase the need for specialized E and O coverage.

The reliance on technology intensive services has increased accountability for service accuracy and performance. Clients expect uninterrupted digital insurance operations. As a result, technology service providers prioritize E and O insurance as a critical risk mitigation tool.

For Instance, in August 2025, Hiscox launched standalone E&O cover for technology companies. This move targets insurtech software and IT service providers with dedicated policies separate from cyber insurance. It protects against claims from code errors or service failures without eroding limits. The product supports fintech and insurtech growth by offering specialist underwriting and claims handling for tech risks like AI and SaaS.

By Application

Large enterprises represent 74.7% of total application based demand. These organizations operate complex digital insurance ecosystems with high transaction volumes and multiple integrations. Any service failure can result in significant financial and reputational impact.

Insurance adoption among large enterprises is driven by formal risk governance frameworks. E and O coverage supports contractual compliance and protects against claims arising from professional service errors. This sustains strong concentration of demand within this segment.

For instance, in December 2025, Chubb expanded tech E&O for large enterprises. Their solutions cover multinational software firms and cloud providers handling big contracts. Policies address risks from system downtime or bad advice in enterprise insurtech setups. Chubb’s risk engineers help scale safely amid growth.

By Distribution Channel

Direct sales account for 44.8% of policy distribution across the market. This channel is preferred due to the customized nature of E and O insurance for insurtech operations. Direct engagement allows insurers and clients to align coverage with specific technology risks.

The growth of direct sales is supported by long term insurer client relationships. Negotiated policy terms improve clarity around exclusions and liability limits. This strengthens the role of direct distribution within the market.

For Instance, in June 2025, Markel introduced a direct InsurtechRisk+ sales package. This online-friendly product lets large insurtechs buy E&O bundles fast without brokers. It cuts costs for direct channels via digital tools and quick quotes. Targets the growing self-service trend in tech insurance buys.

By End User

Insurance companies represent 42.7% of total end user demand in the Insurtech E and O Insurance Market. These organizations increasingly rely on digital platforms for underwriting, claims processing, and customer engagement. Errors within these systems can lead to regulatory scrutiny and customer disputes.

E and O insurance is viewed as essential protection for maintaining operational continuity. Insurance companies prioritize coverage to safeguard against professional negligence claims. This reinforces their strong presence within the end user segment.

For Instance, in January 2026, Beazley strengthened E&O for insurance companies. As a top specialty player, they offer financial institutions coverage for carriers adopting insurtech. Protects against errors in policy advice amid tech shifts. Partners with brokers for tailored end-user needs.

Regional Perspective

North America holds a leading position in the Insurtech E and O Insurance Market, accounting for 36.1% of total activity. The region benefits from advanced digital insurance adoption, strong regulatory oversight, and high concentration of insurtech firms.

Risk transfer through E and O insurance is widely embedded in operational strategies. The legal environment further encourages comprehensive liability coverage. Organizations actively manage professional risk exposure. These conditions support North America’s leading regional role.

For instance, in February 2025, Markel Corporation reorganized its U.S. professional liability products into four pillars, including errors & omissions (E&O), to improve consistency and ease of business. This strategic realignment leverages Bermuda underwriting expertise and economies of scale, solidifying North America’s leadership in specialized E&O coverage within the insurtech landscape.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 1.15 Bn and a growth rate of 11.8% CAGR. Expansion is supported by rapid digitization of insurance services and increased reliance on third party technology platforms. Professional liability exposure continues to rise with system complexity.

Insurance adoption in the U.S. is influenced by regulatory compliance and litigation risk. Insurtech firms and traditional insurers invest in E and O coverage to protect service integrity. These factors collectively support steady growth in the U.S. market segment.

For instance, in September 2025, AmTrust Financial Services expanded its Excess & Surplus division with new property, environmental, and builders risk lines, consolidating products into a brokerage casualty group. This strategic growth highlights AmTrust’s commitment to specialty E&O markets, enhancing U.S. leadership in tailored insurtech solutions.

Investment Opportunities

Investment opportunities are being created in underwriting and risk assessment capabilities tailored to insurtech operations, where exposures are driven by software delivery, cloud dependencies, and regulated customer outcomes. Tools that quantify change risk, incident frequency, and control maturity can improve underwriting accuracy and enable more stable pricing, which benefits insurers and insureds. This is especially relevant as operational resilience expectations become more explicit across financial services.

Opportunities also exist in packaged products that align professional liability with technology related allegations in a clearer, less fragmented way. Many buyers want coordinated coverage triggers, consistent incident reporting workflows, and fewer gaps between policy lines when a dispute mixes service error and security allegations. Clear product design supported by strong claims handling processes can become a differentiator, because it reduces uncertainty at the time of loss.

Business Benefits

For insurtech firms, the main business benefit is improved resilience against high severity disputes that could otherwise disrupt cash flow and operations. E&O can fund defense costs early, which matters because professional liability cases can take time to resolve and can require specialized legal support. This reduces the risk that a single client dispute forces product shutdowns, layoffs, or emergency financing.

Another business benefit is stronger governance discipline, because E&O purchase and renewal often require evidence of controls such as quality assurance, vendor oversight, incident response planning, and customer communication standards. Even when underwriting requirements vary, the process typically pushes firms to document processes and reduce avoidable errors. Over time, this can improve service reliability and reduce dispute frequency, which supports sustainable partnerships.

Regulatory Environment

The regulatory environment affecting this market is shaped by data security, operational resilience, and third party risk oversight rules that apply to insurance licensees and financial entities. In the United States, the National Association of Insurance Commissioners Insurance Data Security Model Law sets expectations for an information security program and includes investigation and notification concepts for cybersecurity events, influencing how insurtech firms structure controls and incident processes.

In the European Union, operational resilience rules and supervisory attention on critical ICT dependencies are reshaping governance expectations across the financial sector, including insurance. Digital Operational Resilience Act focuses on ICT risk management, incident reporting, resilience testing, and third party oversight, which increases the compliance stakes for technology enabled insurance operations.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Specialized technology E&O insurers High Medium North America, Europe Stable premium growth in niche lines Large commercial insurers Medium Low to Medium Global Portfolio diversification opportunity Digital insurance platforms High Medium North America Embedded E&O distribution upside Private equity firms Medium Medium North America, Europe Consolidation of specialty insurance books Venture capital investors Medium High North America Selective interest via insurtech enablement Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~) % Primary Function Geographic Relevance Adoption Timeline Automated underwriting for tech and professional liability +3.0% Faster policy issuance North America, Europe Short term Data analytics for risk profiling and pricing +2.6% Improved loss ratio control Global Medium term API-based policy management and compliance tools +2.2% Operational efficiency North America Medium term AI-assisted claims assessment and triage +1.9% Faster claims resolution Global Medium to long term Continuous risk monitoring and reporting platforms +1.5% Proactive risk mitigation Europe, North America Long term Emerging Trends Analysis

An emerging trend in the insurtech E&O insurance market is increased focus on coverage for AI and automated decision systems. As AI plays a larger role in underwriting and claims, errors linked to model bias, data quality, or system logic are gaining attention. E&O policies are gradually evolving to address these technology specific risks more explicitly.

Another trend is closer alignment between E&O coverage and cyber risk considerations. Many professional liability claims now overlap with data handling and system security issues. Integrated policy approaches that recognize this convergence are becoming more relevant. This trend reflects the interconnected nature of digital insurance operations.

Growth Factors Analysis

One of the key growth factors for the insurtech E&O insurance market is sustained investment in insurance technology innovation. As new platforms enter the market, the need for professional liability protection grows in parallel. Each new digital process introduces potential error exposure that must be insured. This structural link supports long term market growth.

Another growth factor is increasing client and partner expectations for risk protection. Enterprise clients, reinsurers, and investors often require insurtech firms to maintain E&O coverage as a condition of partnership or funding. This requirement embeds E&O insurance into standard operational frameworks. As a result, demand continues to rise alongside insurtech ecosystem expansion.

Opportunity Analysis

A major opportunity in the insurtech E&O insurance market lies in the development of tailored policies aligned with specific technology risks. Coverage designed around AI decision making, API failures, cloud outages, and data processing errors can better match real exposure profiles. Custom policy structures improve relevance and affordability for insurtech firms.

This specialization supports stronger uptake across different maturity levels. Another opportunity is the growth of insurtech activity in emerging markets. As digital insurance adoption expands in these regions, new firms face similar professional liability risks as those in mature markets. Rising regulatory frameworks and consumer protection rules further reinforce the need for E&O coverage.

For instance, in February 2025, Liberty Specialty Markets rolled out Technology & Media E&O insurance up to 10 million USD, fit for insurtech’s AI and digital risks. It targets custom needs like software errors and media services. This draws clients seeking exact-fit plans for tech work.

Challenge Analysis

A major challenge for the insurtech E&O insurance market is keeping coverage aligned with fast changing technology risk. New features, software updates, and integrations can alter risk exposure quickly. Policies must remain flexible enough to accommodate evolving operational models without frequent renegotiation. Failure to adapt coverage terms may leave protection gaps.

Another challenge is managing claims involving complex technical issues. Determining liability in cases involving algorithmic decisions or system interactions can be difficult. Claims assessment often requires technical expertise alongside legal analysis. Efficient handling of such claims is essential to maintain confidence in E&O insurance as a reliable risk transfer mechanism.

For instance, in January 2025, Munich Re highlighted emerging tech risks like AI flaws in its Tech Trend Radar for insurtech. It warns of gaps in E&O for software glitches and data issues. Insurers face pricing struggles with these new threats.

Key Market Segments

By Coverage Type

- Technology Service Providers

- Digital Brokers

- Insurtech Startups

- Others

By Application

- Small and Medium Enterprises

- Large Enterprises

By Distribution Channel

- Direct Sales

- Brokers/Agents

- Online Platforms

- Others

By End-User

- Insurance Companies

- Insurtech Firms

- Third-party Administrators

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Large commercial and specialty insurers such as AXA XL, Chubb, and AIG hold strong positions in the insurtech E&O market. Their policies address technology errors, platform outages, data handling failures, and professional negligence. These insurers apply advanced underwriting models aligned with digital insurance operations. Zurich Insurance Group and Allianz Global Corporate & Specialty add capacity for high-growth insurtech firms.

Specialty-focused providers such as Hiscox, Beazley, and Markel Corporation emphasize tailored E&O coverage for SaaS-based insurance platforms. Travelers and Liberty Mutual support mid-sized insurtechs with scalable policy structures. These players focus on cyber exposure, regulatory compliance, and third-party integration risk. Adoption is supported by increased reliance on APIs, automation, and cloud infrastructure.

Reinsurers and capacity providers such as Munich Re and Swiss Re play a key role in absorbing high-severity losses. Berkshire Hathaway Specialty Insurance, Tokio Marine HCC, and QBE Insurance Group expand underwriting depth. CNA Financial, Arch Insurance Group, AmTrust Financial Services, and The Hartford enhance regional access. Other insurers increase competition and customization across the insurtech E&O landscape.

Top Key Players in the Market

- AXA XL

- Chubb

- AIG (American International Group)

- Zurich Insurance Group

- Hiscox

- Beazley

- Liberty Mutual

- Travelers

- Markel Corporation

- Allianz Global Corporate & Specialty

- Sompo International

- Berkshire Hathaway Specialty Insurance

- CNA Financial

- Tokio Marine HCC

- Arch Insurance Group

- Munich Re

- QBE Insurance Group

- AmTrust Financial Services

- Swiss Re

- The Hartford

- Others

Recent Developments

- In September 2025, Liberty Mutual launched Liberty Cyber Resolution and Liberty Tech Resolution, global cyber suites with Tech E&O blended coverage. These offer top-tier features like quantum computing protection and executive personal losses, targeting North America and beyond. It’s a smart move as cyber risks explode, helping clients stay agile without the headaches.

- In November 2025, Chubb rolled out an AI-powered optimization engine in its Chubb Studio platform, making embedded insurance smarter and more personalized for digital partners. This move helps insurers match E&O coverage precisely with customer needs at the point of sale, boosting conversions and loyalty.

Report Scope

Report Features Description Market Value (2025) USD 3.6 Billion Forecast Revenue (2035) USD 14.0 Billion CAGR(2025-2035) 14.4% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Technology Service Providers, Digital Brokers, Insurtech Startups, Others), By Application (Small and Medium Enterprises, Large Enterprises), By Distribution Channel (Direct Sales, Brokers/Agents, Online Platforms, Others), By End-User (Insurance Companies, Insurtech Firms, Third-party Administrators, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA XL, Chubb, AIG (American International Group), Zurich Insurance Group, Hiscox, Beazley, Liberty Mutual, Travelers, Markel Corporation, Allianz Global Corporate & Specialty, Sompo International, Berkshire Hathaway Specialty Insurance, CNA Financial, Tokio Marine HCC, Arch Insurance Group, Munich Re, QBE Insurance Group, AmTrust Financial Services, Swiss Re, The Hartford, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Insurtech Errors and Omissions MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Insurtech Errors and Omissions MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-