Global Insecticides Market Size, Share Analysis Report By Product (Organochlorine, Organophosphate, Organosulfur, Carbamates, Formamidines, Dinitrophenols, Others), By Type (Systemic Insecticide, Ingested Insecticide, Contact Insecticide), By Origin (Organic, Synthetic), By Formulation (Solid, Liquid, Gaseous), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155176

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

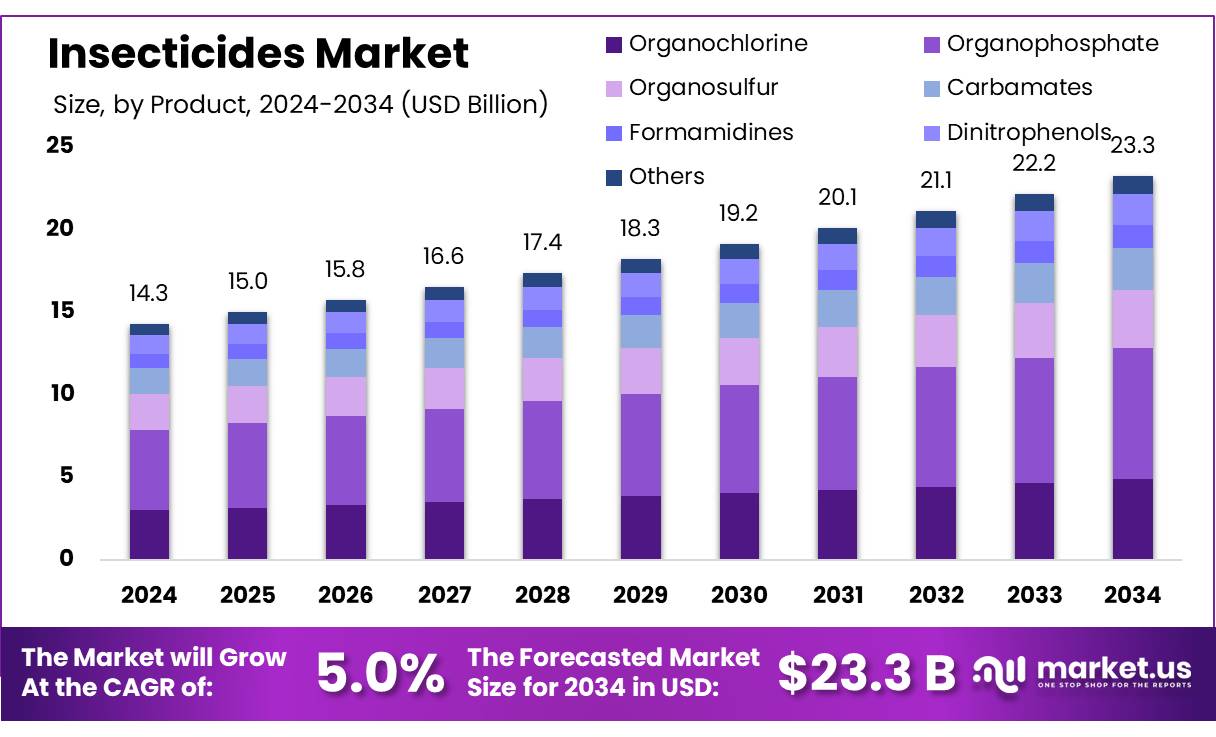

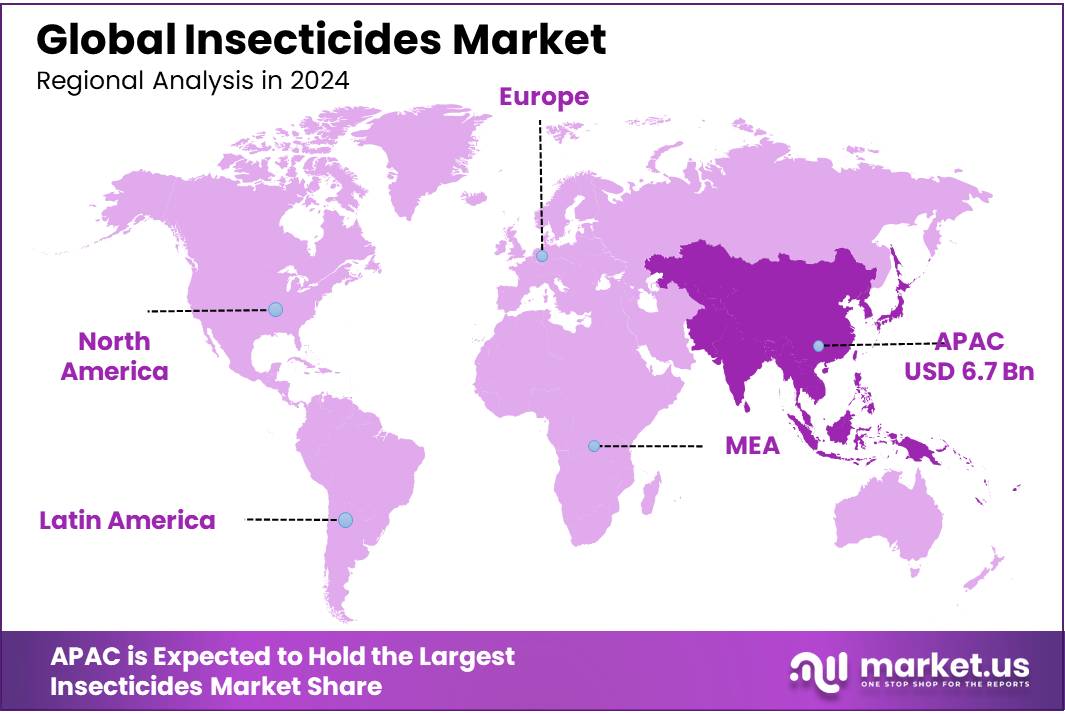

The Global Insecticides Market size is expected to be worth around USD 23.3 Billion by 2034, from USD 14.3 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 46.9% share, holding USD 6.7 Billion revenue.

Insecticide concentrates—such as emulsifiable concentrates (EC), suspension concentrates (SC), capsule suspensions (CS) and oil-dispersion (OD) formats—are the workhorses of crop and vector protection because they deliver high active-ingredient loadings with stable shelf life and efficient field dilution.

They are used across cash crops and staples, in stored-grain protection, and in public-health programs for adulticide and larvicide control. Industrially, they sit within the broader pesticide value chain of actives synthesis, formulation, tolling, and distribution, with stringent stewardship requirements and growing scrutiny on solvent content and operator exposure.

Demand drivers remain structural. Between 20% and 40% of global crop yields are lost to pests and diseases each year, a food-security gap that keeps insecticide concentrates integral to integrated pest management (IPM). Public-health programs add steady offtake: WHO estimates 263 million malaria cases and 597,000 deaths in 2023, and National Malaria Programmes distributed more than 190 million insecticide-treated nets (ITNs) in 2022, largely in sub-Saharan Africa.

Policy remains a powerful shaper of product mix. The EU’s Farm-to-Fork pathway maintains a headline target to cut the use and risk of chemical pesticides by 50% by 2030 (non-binding), even as the proposed Sustainable Use Regulation (SUR) was withdrawn on 27 March 2024; the earlier Sustainable Use Directive framework continues to apply.

Key Takeaways

- Insecticides Market size is expected to be worth around USD 23.3 Billion by 2034, from USD 14.3 Billion in 2024, growing at a CAGR of 5.0%.

- Organophosphate held a dominant market position, capturing more than a 34.2% share.

- Systemic Insecticide held a dominant market position, capturing more than a 39.4% share.

- Synthetic held a dominant market position, capturing more than a 81.8% share.

- Liquid held a dominant market position, capturing more than a 71.10% share.

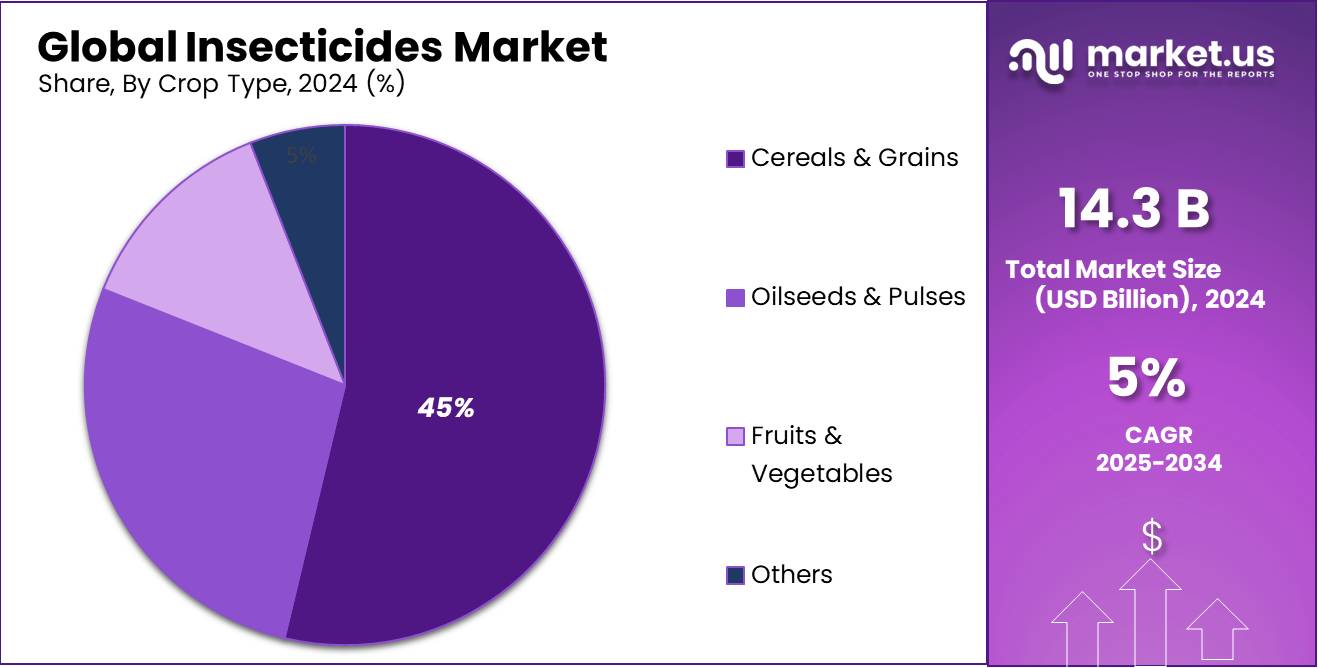

- Cereals & Grains held a dominant market position, capturing more than a 45.30% share.

- Asia Pacific was the dominating region in insecticides, holding a 46.9% share worth USD 6.7 Bn.

By Product Analysis

Organophosphate leads with 34.2% on breadth, speed, and versatility.

In 2024, Organophosphate held a dominant market position, capturing more than a 34.2% share. This edge comes from its broad-spectrum knockdown against chewing and sucking pests, fast field performance, and fit with common concentrate formats (EC/SC/CS) that distributors and spray services already stock. Producers value its flexible tank-mixing, reliable residual control under tropical pressure, and competitive post-patent pricing—factors that keep it in core cotton, cereals, horticulture, and plantation crop programs despite tighter stewardship rules.

Procurement teams also lean on organophosphates as rotation partners to slow resistance build-up in pyrethroid or newer MOA blocks, while agronomists push label-driven best practices (buffer zones, PHI, PPE) to meet residue and drift limits. In 2025, demand is set to remain resilient in cost-sensitive acres and public-health vector-control bids, with growth skewing toward safer, lower-solvent concentrates, microencapsulation for operator safety, and precision application (calibrated nozzles, drone spraying). Net-net: organophosphate stays the workhorse where efficacy, speed, and affordability matter most.

By Type Analysis

Systemic insecticides lead with 39.4% for inside-out crop protection.

In 2024, Systemic Insecticide held a dominant market position, capturing more than a 39.4% share. Farmers favor systemics because the active moves through the plant, guarding new growth and hidden feeding sites where contact sprays struggle. Their fit spans seed treatments, soil drenches, and drip applications, giving longer protection windows, fewer re-sprays, and steadier yields in pressure-prone seasons.

Distributors like the predictable performance in cereals, cotton, oilseeds, and high-value fruits and vegetables, while advisors use systemics to rotate modes of action and slow resistance. In 2025, demand is expected to hold firm as acreage shifts to precision delivery (seed coatings, chemigation) and stewardship tightens around drift and operator exposure. The near-term focus is cleaner formulations, better compatibility in tank mixes, and label-driven resistance management—keeping systemics the dependable backbone of integrated pest programs.

By Origin Analysis

Synthetic dominates with 81.8% thanks to reliable, broad-spectrum control.

In 2024, Synthetic held a dominant market position, capturing more than a 81.8% share. Farmers and spray contractors lean on synthetic actives for fast knockdown, predictable field performance, and wide crop and pest labels that simplify procurement. Formulators favor synthetics because they work well in EC, SC, and CS concentrates, travel efficiently through existing distribution, and stay stable across storage conditions.

On the ground, agronomists use synthetics as rotation anchors to manage resistance and to backstop biologicals when pest pressure spikes. Stewardship has tightened, but better nozzles, buffer practices, and operator training are keeping synthetics central to integrated programs. In 2025, demand is set to hold in cost-sensitive acres and public-health bids, with momentum toward cleaner solvents, microencapsulation for operator safety, and precision delivery (seed coatings, chemigation, drones) that gets more from each application without changing the proven chemistry mix.

By Formulation Analysis

Liquid formulations lead with 71.10% for simple, reliable spraying.

In 2024, Liquid held a dominant market position, capturing more than a 71.10% share. Growers prefer liquids because they mix fast, flow cleanly through booms and nozzles, and deliver uniform leaf and canopy coverage with standard sprayers and emerging drone rigs. Retailers like liquids for easier stocking and safer handling in concentrates that translate well into EC, SC, and CS formats, reducing downtime at the tank and in the field.

Liquids also travel smoothly across climates and storage conditions, keeping performance consistent from warehouse to farm. Agronomists use liquid insecticides as the backbone of integrated programs, rotating modes of action and pairing with adjuvants to improve sticking, spreading, and rainfastness without changing equipment. In 2025, demand is set to remain strong as applicators push for cleaner labels, better operator safety, and precision delivery that minimizes waste while preserving efficacy—keeping liquids as the default choice when speed, coverage, and convenience matter most.

By Crop Type Analysis

Cereals & Grains lead with 45.30% thanks to scale and season-long pest pressure.

In 2024, Cereals & Grains held a dominant market position, capturing more than a 45.30% share. This edge reflects the vast planted area of wheat, rice, and corn, where aphids, borers, armyworms, and sucking pests demand dependable control across multiple growth stages. Growers favor insecticides that fit seed treatments for early protection and liquid foliar sprays for in-season rescue, allowing flexible tank mixes and fast turnaround during tight weather windows.

Distributors lean on broad labels and proven formulations that move easily through existing spray rigs and drones, keeping coverage uniform and downtime low. Agronomists position these products as anchors in integrated programs—rotating modes of action, tightening spray intervals only when pressure spikes, and using adjuvants to improve canopy reach. In 2025, demand is expected to remain firm as producers push for precision application, cleaner formulations, and stronger resistance-management practices to protect yield stability in staple cereals and grains.

Key Market Segments

By Product

- Organochlorine

- Organophosphate

- Organosulfur

- Carbamates

- Formamidines

- Dinitrophenols

- Others

By Type

- Systemic Insecticide

- Ingested Insecticide

- Contact Insecticide

By Origin

- Organic

- Synthetic

By Formulation

- Solid

- Liquid

- Gaseous

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Emerging Trends

The Rise of Food Sprays in Sustainable Pest Control

In recent years, the agricultural industry has witnessed a significant shift towards sustainable pest management practices. One notable innovation is the use of food sprays to attract natural predators, reducing the reliance on chemical insecticides. This approach not only enhances biodiversity but also offers a cost-effective and environmentally friendly alternative to traditional pest control methods.

The concept of using food sprays to entice beneficial insects was pioneered in the 1990s by Australian entomologist Dr. Robert Mensah. He developed a yeast- and sugar-based solution that, when sprayed on crops, emitted an odor attracting natural predators like ladybirds and lacewings.

These predators then helped control pest populations, particularly bollworms in cotton fields, without the need for chemical pesticides. This method is a key component of Integrated Pest Management (IPM), a strategy that combines biological, cultural, and mechanical control methods to manage pest populations in an environmentally sustainable way.

The adoption of food sprays has gained momentum globally, with successful implementations in countries like Benin, Ethiopia, Vietnam, and India. In India, the Better Cotton Initiative has trained over 214,000 farmers across states like Maharashtra, Gujarat, and Telangana to use food sprays as part of their pest management practices. While the technique is labor-intensive, it has proven effective in reducing pesticide use and promoting ecological balance in farming systems.

Beyond individual initiatives, governments are recognizing the importance of sustainable pest management. In India, the Ministry of Agriculture and Farmers Welfare has been actively involved in promoting eco-friendly pest control methods.

For instance, the Institute of Pesticide Formulation Technology (IPFT) in Gurugram focuses on developing user- and environment-friendly pesticide formulation technologies and promoting efficient application methods. Additionally, the government’s push for compliance with labeling requirements ensures that farmers have access to accurate information on pesticide use, supporting informed decision-making.

Drivers

Increasing Pest Resistance Driving Demand for Insecticides

As India’s agricultural landscape faces escalating challenges from pest resistance, the demand for effective insecticides has surged. This phenomenon, where pests evolve to withstand conventional treatments, has led to significant crop losses, compelling farmers to seek more potent solutions. The Indian government has recognized this issue and is actively promoting the development and use of advanced agrochemicals to combat resistant pest populations.

In response to these challenges, the Indian government has implemented several initiatives to support the agricultural sector. Programs such as the Soil Health Card Scheme aim to provide farmers with detailed information on soil health, enabling them to apply the right amount of fertilizers and pesticides, thereby reducing overuse and promoting sustainable farming practices.

Additionally, the National Mission on Agricultural Extension and Technology focuses on enhancing the reach of agricultural technologies, including the use of modern insecticides, to improve productivity and pest management.

These government efforts are complemented by the private sector’s advancements in insecticide formulations. Companies are investing in research and development to create more effective and environmentally friendly insecticides. This collaborative approach between the government and the private sector is crucial in addressing the growing concern of pest resistance and ensuring the sustainability of India’s agricultural productivity.

Restraints

Regulatory Challenges and Export Implications

One of the significant challenges facing India’s insecticide industry is the stringent regulatory environment concerning pesticide residues in food products. While these regulations are essential for ensuring food safety, they can also act as a barrier to the export of Indian agricultural products. For instance, the Food Safety and Standards Authority of India (FSSAI) has set maximum residue limits (MRLs) for pesticides in various food items, including vegetables and fruits. These MRLs are often more stringent than those in other countries, which can lead to trade restrictions.

In 2024, the FSSAI increased the MRL for unregistered pesticides in spices and herbs to 0.1 mg/kg from 0.01 mg/kg. While this adjustment was made to align with international standards, it raised concerns among exporters about the potential for increased pesticide residues in exported products. Such concerns can lead to a loss of market access, particularly in regions with strict import regulations.

The Directorate of Plant Protection, Quarantine & Storage (DPPQS) has also been active in monitoring pesticide residues in food products. In its October-December 2023 newsletter, the DPPQS reported conducting extensive pesticide residue analysis during this period. These efforts are part of India’s commitment to ensuring the safety of its food exports. However, the rigorous testing and compliance requirements can be burdensome for producers, especially small-scale farmers who may lack the resources to meet these standards.

To address these challenges, the Indian government has implemented several initiatives. The Integrated Pest Management (IPM) program, for example, aims to reduce the reliance on chemical pesticides by promoting the use of biological and cultural practices. The DPPQS reported that chemical pesticide sprays were reduced by up to 100% in rice and by nearly 51% in cotton through the adoption of IPM practices. This not only helps in reducing pesticide residues but also aligns with global trends towards sustainable agriculture.

Furthermore, the government has been working on the Pesticide Management Bill, 2020, which seeks to regulate the manufacture, sale, and use of pesticides in the country. The bill aims to ensure the availability of safe and effective pesticides, promote sustainable agricultural practices, and enhance the competitiveness of Indian agricultural exports.

Opportunity

Expansion of Biopesticides in Indian Agriculture

India’s agricultural sector is undergoing a significant transformation, with a growing emphasis on sustainable farming practices. One of the most promising developments in this regard is the increasing adoption of biopesticides. These naturally derived pest control agents are gaining popularity due to their environmental benefits and alignment with organic farming principles.

The Indian government has been proactive in promoting the use of biopesticides through various initiatives. For instance, the Central Insecticide Board & Registration Committee (CIB&RC) has simplified the registration process for biopesticides, allowing provisional commercialization under The Insecticides Act, 1968. Additionally, schemes like the Paramparagat Krishi Vikas Yojana (PKVY) provide financial assistance to farmers for adopting organic farming practices, including the use of biopesticides.

In line with these efforts, the Indian Council of Agricultural Research (ICAR) and the National Institute of Biotic Stress Management (NIBSM) have been actively involved in training farmers on sustainable farming techniques. In June 2025, over 4,100 farmers across 49 villages in Chhattisgarh were trained on practices such as Direct Seeded Rice (DSR), IPM, and the use of biopesticides.

The adoption of biopesticides not only benefits the environment but also enhances the safety and quality of agricultural produce, making it more competitive in both domestic and international markets. As awareness grows and government support continues, the biopesticides sector in India is poised for substantial growth, offering significant opportunities for stakeholders across the agricultural value chain.

Regional Insights

Asia Pacific leads with 46.9% and a value of $6.7 Bn.

In 2024, Asia Pacific was the dominating region in insecticides, holding a 46.9% share worth $6.7 Bn. The region’s scale in cereals and grains—especially rice, wheat, and corn—sustains multi-stage pest pressure from stem borers, planthoppers, aphids, and fall armyworm, keeping demand for fast-acting liquid concentrates and longer-lasting systemic options high. A dense network of contract formulators and toll blenders in China, India, and Southeast Asia supports reliable supply of EC, SC, and CS products, while established distributor channels ensure quick in-season availability.

Tropical and monsoon climates drive frequent curative sprays, so growers value formulations that mix easily, travel well in varied storage conditions, and deliver uniform canopy coverage through boom sprayers and increasingly through drones. Public-health programs for vector control add a steady institutional layer of demand across populous markets. Stewardship standards are tightening, but agronomists are managing risk with better nozzle calibration, buffer practices, and rotation of modes of action.

In 2025, Asia Pacific is set to retain leadership as acreage consolidates around high-value horticulture and staple cereals, and as precision delivery expands—seed treatments, drip/chemigation, and drone applications that stretch efficacy without changing proven chemistry choices. Procurement remains cost-focused, favoring dependable synthetics alongside selective adoption of cleaner solvents and microencapsulation for operator safety. Net result: the region’s combination of crop scale, pest intensity, and agile formulation capacity keeps Asia Pacific firmly at the front of the global insecticides market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Adama Agricultural Solutions Ltd. focuses on off-patent insecticides with differentiated formulations and mixes that solve practical field problems. Backed by Syngenta Group manufacturing scale, it leverages Chinese intermediates, tolling, and key brands across Brazil, India, and Europe. Competitive edges include EC/SC/CS know-how, microencapsulation for operator safety, and robust post-patent lifecycle management. Risks are tightening EU rules and FX swings in Latin America. 2025 priorities: drone-ready liquids, resistance-management programs, and selective biological add-ons that protect share in cereals, cotton, and horticulture.

BASF SE’s Agricultural Solutions business brings scale, chemistry depth, and a portfolio across insecticides, herbicides, seeds, and digital tools. In insecticides, strengths include novel modes like Inscalis-based offerings for sucking pests, pyrethroid and diamide franchises, and robust formulation science for EC, SC, and SE formats. Global R&D, regulatory expertise, and xarvio digital agronomy support label stewardship and resistance management. 2025 priorities: broaden biological companions, expand precision-application integrations, and defend share in fruits, vegetables, and row crops amid evolving EU requirements.

Bayer CropScience AG pairs chemistry with seeds and traits, giving insecticides a systems role alongside genetics and agronomy via Climate FieldView. Portfolio spans established neonics and pyrethroids plus newer, targeted solutions and biologicals for residue-sensitive crops. Global manufacturing and stewardship programs support reliable supply and resistance rotation. Regulatory scrutiny remains a headwind in Europe, but scale and data help defend key positions. 2025 emphasis: precision delivery, formulations, and integrated offers that better protect yield in cereals, cotton, fruits, and vegetables.

Top Key Players Outlook

- Adama Agricultural Solutions Ltd

- American Vanguard Corporation

- BASF SE

- Bayer CropScience AG

- Corteva Agriscience

- FMC Corporation

- Isagro SPA

- Nufarm Ltd

- Syngenta AG

- Sumitomo Chemical Co. Ltd

- UPL Limited

Recent Industry Developments

In 2024, Adama reported sales of $4,141 million, adjusted gross profit of $1,061 million, and adjusted EBITDA of $469 million, reflecting better mix and lower input costs.

In 2024, Crop Science sales were €12.888 bn, with insecticides up in EMEA on higher volumes/prices even as Latin America saw price declines. Operationally, Bayer emphasized stewardship and precision delivery while advancing its branded insecticide franchises.

Report Scope

Report Features Description Market Value (2024) USD 14.3 Bn Forecast Revenue (2034) USD 23.3 Bn CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Organochlorine, Organophosphate, Organosulfur, Carbamates, Formamidines, Dinitrophenols, Others), By Type (Systemic Insecticide, Ingested Insecticide, Contact Insecticide), By Origin (Organic, Synthetic), By Formulation (Solid, Liquid, Gaseous), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adama Agricultural Solutions Ltd, American Vanguard Corporation, BASF SE, Bayer CropScience AG, Corteva Agriscience, FMC Corporation, Isagro SPA, Nufarm Ltd, Syngenta AG, Sumitomo Chemical Co. Ltd, UPL Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adama Agricultural Solutions Ltd

- American Vanguard Corporation

- BASF SE

- Bayer CropScience AG

- Corteva Agriscience

- FMC Corporation

- Isagro SPA

- Nufarm Ltd

- Syngenta AG

- Sumitomo Chemical Co. Ltd

- UPL Limited