Global Injection Pen Market By Device Type (Disposable Injection Pens and Reusable Injection Pens), By Application (Diabetes, Growth Hormonal Therapies, Autoimmune Diseases, Fertility Treatments, Osteoporosis, Anaphylaxis, Obesity and Others), By Age Group (Pediatric, Adult and Geriatric), By End-User (Hospitals, Home Use and Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172433

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

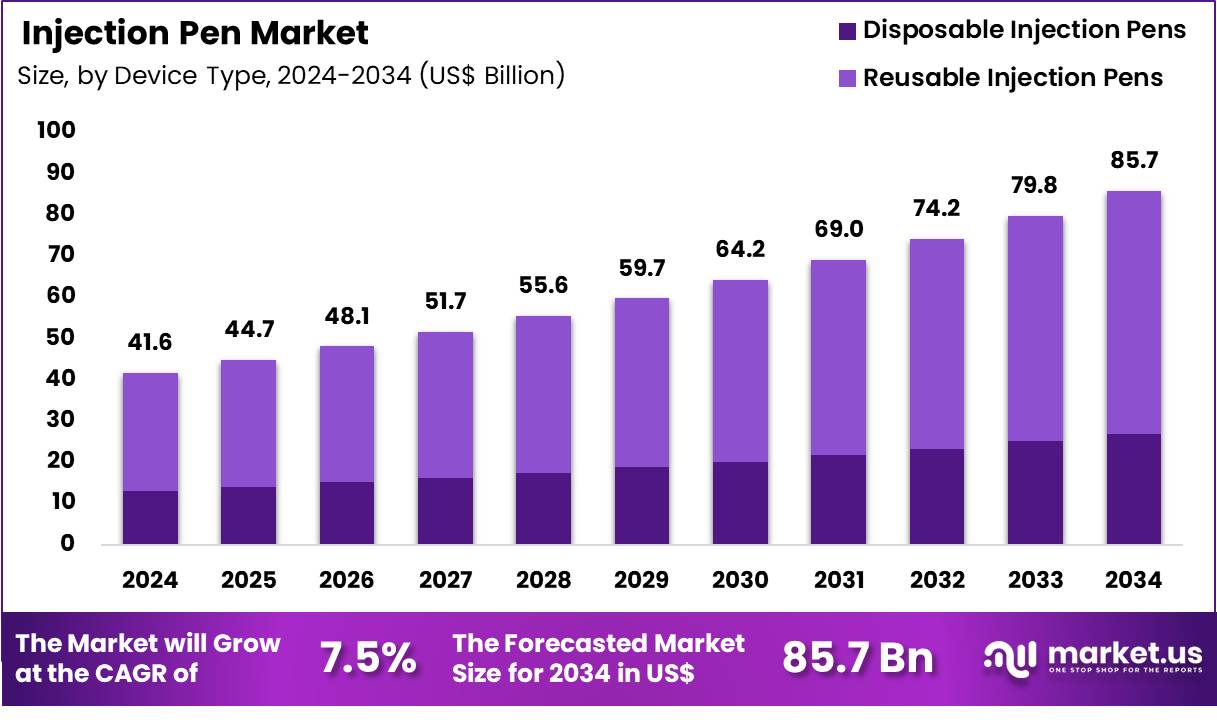

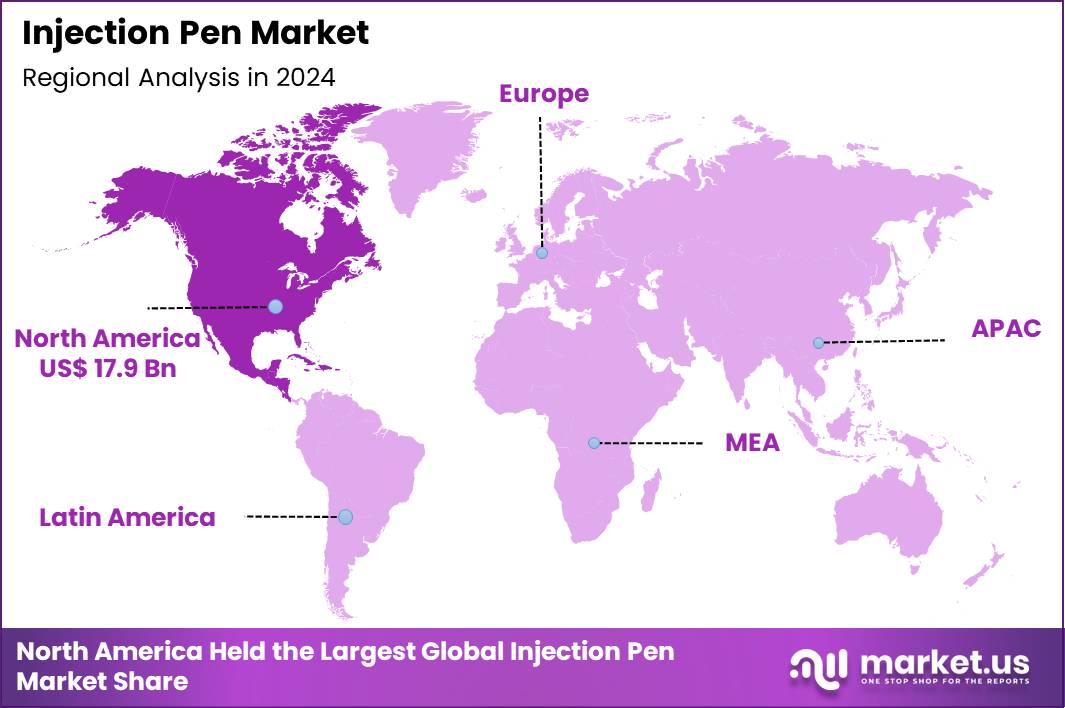

The Global Injection Pen Market size is expected to be worth around US$ 85.7 Billion by 2034 from US$ 41.6 Billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.1% share with a revenue of US$ 17.9 Billion.

Growing demand for patient-centric delivery systems accelerates the utilization of injection pens that offer precise dosing and ease of self-administration for chronic conditions. Healthcare providers increasingly prescribe these devices for insulin therapy in diabetes management, enabling accurate delivery of basal and bolus regimens to maintain glycemic control. These pens support GLP-1 receptor agonist administration, facilitating weight management and cardiovascular risk reduction in patients with type 2 diabetes.

Clinicians employ reusable injection pens for growth hormone replacement, ensuring consistent therapy in pediatric and adult deficiency cases. These tools enable follicle-stimulating hormone delivery in assisted reproductive technologies, supporting ovulation induction protocols.

In February 2023, Sanofi entered into a partnership with Glooko Inc. to strengthen digital support for people living with diabetes. By integrating Sanofi’s SoloSmart system with the Glooko digital platform, the collaboration aims to widen access to connected diabetes management tools for patients and healthcare professionals across markets where SoloSmart is available.

Pharmaceutical manufacturers explore opportunities to design smart injection pens with Bluetooth connectivity, enhancing dose tracking and integration with mobile health applications for multiple sclerosis therapies. Developers create prefilled disposable pens for anaphylaxis emergency treatments, providing rapid epinephrine delivery without needle exposure fears. These devices expand applications in osteoporosis management through parathyroid hormone analogs, promoting bone formation with weekly or monthly dosing convenience.

Opportunities emerge in rheumatoid arthritis biologics, where autoinjector-compatible pens improve adherence to tumor necrosis factor inhibitors. Companies advance pens for migraine prophylaxis using calcitonin gene-related peptide antagonists, offering monthly subcutaneous options for episodic and chronic cases. Firms pursue customizable dose settings in fertility treatments, accommodating individualized gonadotropin requirements during in vitro fertilization cycles.

Industry leaders incorporate dose memory functions into reusable pens, preventing missed or duplicate administrations in long-acting insulin regimens for diabetes care. Developers refine needle-hidden mechanisms to alleviate injection anxiety, broadening acceptance in growth hormone therapy for children with short stature.

Market participants launch eco-friendly disposable pens with reduced plastic components, aligning sustainability with high-volume GLP-1 usage in obesity management. Innovators embed haptic feedback for confirmation of complete dose delivery in multiple sclerosis interferon therapies.

Companies prioritize voice-guided interfaces to assist visually impaired patients during self-injection of anemia-stimulating erythropoietin analogs. Ongoing developments emphasize multi-drug compatibility, allowing sequential administration from single devices in complex hormone replacement protocols.

Key Takeaways

- In 2024, the market generated a revenue of US$ 41.6 Billion, with a CAGR of 7.5%, and is expected to reach US$ 85.7 Billion by the year 2034.

- The device type segment is divided into disposable injection pens and reusable injection pens, with reusable injection pens taking the lead in 2024 with a market share of 68.6%.

- Considering application, the market is divided into diabetes, growth hormonal therapies, autoimmune diseases, fertility treatments, osteoporosis, anaphylaxis, obesity and others. Among these, diabetes held a significant share of 46.9%.

- Furthermore, concerning the age group segment, the market is segregated into pediatric, adult and geriatric. The adult sector stands out as the dominant player, holding the largest revenue share of 55.3% in the market.

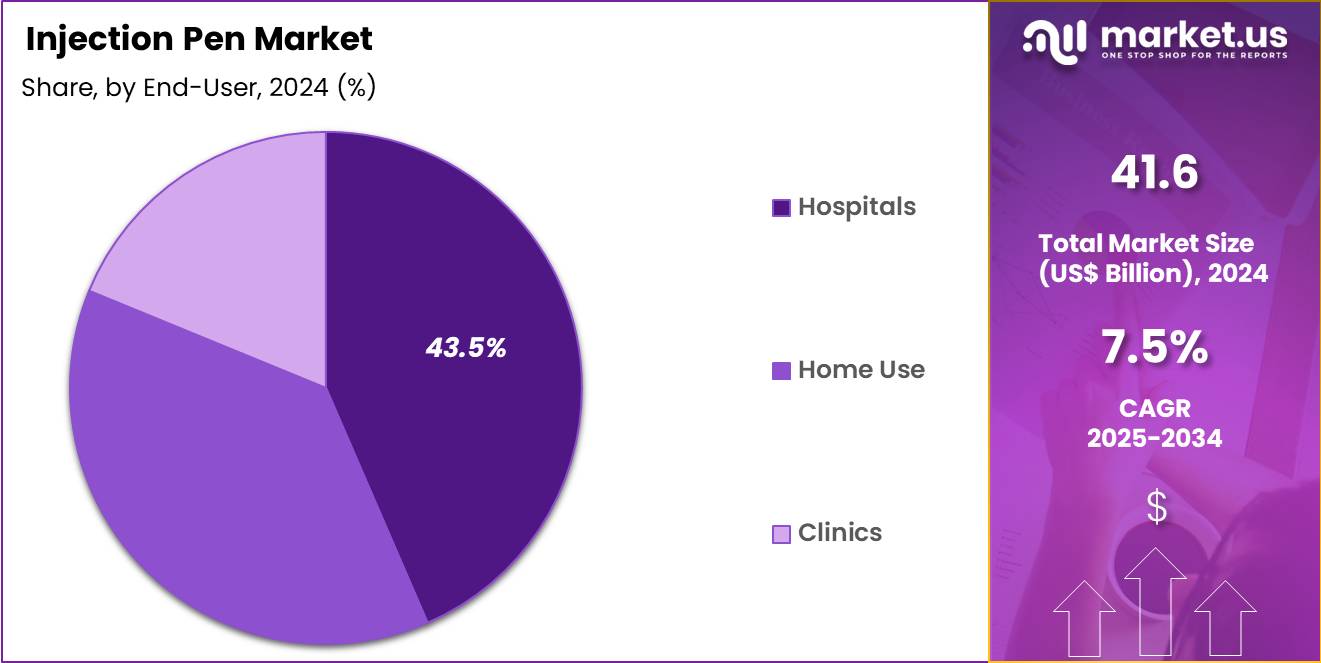

- The end-user segment is segregated into hospitals, home use and clinics, with the hospitals segment leading the market, holding a revenue share of 43.5%.

- North America led the market by securing a market share of 43.1% in 2024.

Device Type Analysis

Reusable injection pens, holding 68.6%, are expected to dominate due to their long term cost efficiency and growing preference for sustainable drug delivery solutions. Patients managing chronic conditions favor reusable designs because they reduce recurring device expenses and generate less medical waste. Manufacturers continue to improve ergonomics, dose accuracy, and digital tracking features, which strengthens patient adherence.

Healthcare providers increasingly recommend reusable pens for long duration therapies to lower overall treatment costs. Compatibility with multiple cartridges improves flexibility for patients and clinicians. Rising environmental awareness among healthcare systems further supports adoption. Technological enhancements that simplify cleaning and maintenance increase user confidence. These factors keep reusable injection pens anticipated to maintain a leading position in the market.

Application Analysis

Diabetes, accounting for 46.9%, is projected to remain the dominant application because of the continuously rising global prevalence of both type 1 and type 2 diabetes. Injection pens offer precise dosing and ease of use, which supports better glycemic control compared to traditional syringes. Increasing diagnosis rates and longer life expectancy expand the treated patient pool.

Physicians favor pen based insulin delivery to improve adherence and reduce dosing errors. Growing adoption of intensive insulin therapy strengthens demand. Patient education programs emphasize self administration convenience, further driving usage. Advances in insulin formulations designed for pen delivery accelerate uptake. These dynamics keep diabetes anticipated to lead application demand.

Age Group Analysis

Adults, representing 55.3%, are likely to dominate due to the high incidence of chronic diseases requiring injectable therapies within the working age population. Adults manage conditions such as diabetes, autoimmune disorders, and obesity that often require long term injection based treatment. Busy lifestyles increase preference for portable and discreet delivery systems.

Injection pens support self management without frequent clinical visits, aligning with adult patient needs. Rising obesity rates and metabolic disorders strengthen demand in this age group. Employer health programs and insurance coverage improve access to advanced delivery devices. Digital dose monitoring features appeal to tech aware adult users. These factors keep the adult segment expected to remain dominant.

End-User Analysis

Hospitals, holding 43.5%, are expected to lead end user adoption because they serve as primary diagnosis and treatment initiation centers for injectable therapies. Physicians commonly introduce injection pens during hospital based patient education sessions. Hospitals handle complex cases requiring supervised initiation of biologics and insulin therapy.

Standardized treatment protocols favor pen based delivery for safety and dosing accuracy. Inpatient and outpatient services within hospitals generate consistent device demand. Strong purchasing power enables bulk procurement and device standardization. Training support from manufacturers further encourages hospital adoption. These drivers keep hospitals anticipated to remain the leading end user segment.

Key Market Segments

By Device Type

- Disposable Injection Pens

- Reusable Injection Pens

By Application

- Diabetes

- Growth Hormonal Therapies

- Autoimmune Diseases

- Fertility Treatments

- Osteoporosis

- Anaphylaxis

- Obesity

- Others

By Age Group

- Pediatric

- Adult

- Geriatric

By End-User

- Hospitals

- Home Use

- Clinics

Drivers

Rising prevalence of diabetes is driving the market

The injection pen market is notably driven by the rising prevalence of diabetes, which heightens the need for convenient self-administration devices to deliver insulin and other glucose-regulating medications. Patients with diabetes often require regular injections, making user-friendly pens essential for improving compliance and daily management. These devices offer precise dosing, portability, and reduced pain compared to traditional syringes, aligning with patient preferences for home-based care.

Healthcare providers recommend injection pens to enhance therapeutic outcomes in chronic disease management. Advancements in pen design cater to varying insulin formulations, supporting diverse treatment regimens. Public health initiatives emphasize diabetes control, boosting adoption of reliable delivery systems. Global demographic shifts toward older populations exacerbate diabetes incidence, sustaining demand.

Pharmaceutical collaborations focus on pen-compatible therapies to address this growing burden. According to the Centers for Disease Control and Prevention, in 2022, 9.6% of adults aged 18 years and older had diagnosed diabetes in the United States. This statistic illustrates the expanding patient base propelling innovation and market expansion in injection pen technologies.

Restraints

Regulatory complexities and safety requirements are restraining the market

The injection pen market is constrained by regulatory complexities and stringent safety requirements that mandate extensive testing and validation for device-drug combinations. Manufacturers must navigate detailed submission processes for clearances, including human factors studies and biocompatibility assessments. Delays in regulatory review can extend product launch timelines, impacting competitiveness. Compliance with updated guidelines for labeling and usability adds operational burdens.

Potential for device malfunctions necessitates robust post-market surveillance systems. Smaller companies face challenges in meeting resource-intensive documentation standards. International variations in regulations complicate global distribution strategies. Risk mitigation measures, such as enhanced quality controls, elevate production costs.

In 2024, the U.S. Food and Drug Administration initiated a Communications Pilot to improve timeliness of communications for high-risk medical device recalls in categories including gastrorenal and urology. This development highlights ongoing safety emphases that influence development priorities and market entry barriers.

Opportunities

Increasing regulatory approvals for novel prefilled pens is creating growth opportunities

The injection pen market benefits from increasing regulatory approvals for novel prefilled devices, enabling expanded indications in areas like hemophilia and autoimmune disorders. These approvals validate integrated systems combining biologics with ergonomic pens for subcutaneous delivery. Developers capitalize on breakthrough designations to expedite pathways for innovative formats.

Expanded patient populations gain access to therapies requiring precise, self-administered doses. Partnerships between drug makers and device firms facilitate co-development of tailored pens. Post-approval expansions to pediatric or elderly uses broaden application scopes. Global regulatory convergence supports faster international introductions. Investments in sterile filling technologies enhance production scalability.

The U.S. Food and Drug Administration approved Hympavzi (marstacimab-hncq) prefilled autoinjector pen on October 11, 2024, for routine prophylaxis in hemophilia A or B. This milestone opens avenues for diversified therapeutic delivery and strengthened market positioning.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics strengthen the injection pen market as rising healthcare expenditures and escalating chronic conditions like diabetes worldwide encourage pharmaceutical companies to prioritize user-friendly, prefilled devices for reliable self-administration. Executives at major firms strategically enhance portfolios with smart connectivity features and needle-safety mechanisms, leveraging global trends in home-based care to expand penetration in developed and emerging healthcare systems.

Lingering inflation and economic fluctuations, however, raise costs for precision plastics and electronics, leading manufacturers to increase prices and prompting providers to slow inventory builds in cost-conscious environments. Geopolitical frictions, particularly U.S.-China trade disputes and regional supply constraints, routinely interrupt flows of critical components and packaging materials, creating manufacturing delays and sourcing challenges for internationally dependent producers.

Current U.S. tariffs substantially elevate landed costs on imported injection pens and components, especially from Asian suppliers, pressuring margins for American distributors and limiting affordability for patients reliant on imported brands. These measures also spark reciprocal barriers overseas that constrain U.S. exports of advanced pen technologies and slow multinational development partnerships.

Still, the tariff environment galvanizes meaningful investments in North American assembly operations and diversified supply networks, forging resilient foundations that promise enhanced innovation and sustained market leadership ahead.

Latest Trends

Adoption of smart connected injection pens is a recent trend

In 2024, the injection pen market has observed a key trend in the adoption of smart connected devices that incorporate Bluetooth and app integration for dose tracking and adherence monitoring. These pens provide real-time data on injection history, aiding patients in managing regimens effectively. Healthcare professionals utilize connected features for remote oversight and personalized adjustments. Manufacturers enhance pens with sensors to detect usage patterns and alert for missed doses.

Compatibility with continuous glucose monitors supports holistic diabetes care ecosystems. Regulatory clearances for updated smart functionalities promote widespread implementation. Clinical studies demonstrate improved glycemic control through data-driven insights. Collaborative platforms enable seamless integration with electronic health records.

In November 2024, Medtronic received U.S. Food and Drug Administration clearance for its InPen smart insulin pen paired with the Simplera continuous glucose monitor. This advancement underscores the shift toward digital-enabled tools transforming patient engagement and outcomes.

Regional Analysis

North America is leading the Injection Pen Market

In 2024, North America secured a 43.1% share of the global injection pen market, invigorated by escalating adoption of self-administered therapies for chronic conditions and advancements in user-centric device designs. Endocrinologists increasingly prescribe prefilled and reusable pens for insulin delivery, enhancing glycemic control in type 2 diabetes management while accommodating multifaceted treatment regimens. Pharmaceutical innovators introduce smart pens with dose-tracking connectivity, integrating seamlessly with mobile applications to monitor adherence in busy lifestyles.

Rheumatology specialists favor autoinjectors for biologic agents targeting rheumatoid arthritis flares, minimizing clinic visits through home-based administration. Pediatric endocrinologists deploy needle-free and adjustable-dose variants for growth hormone therapy, improving compliance among families navigating deficiency diagnoses. Fertility clinics expand utilization of gonadotropin pens, supporting precise ovulation induction protocols in assisted reproduction cycles.

Regulatory approvals expedite launches of dual-chamber systems for combination therapies, addressing comorbidities like obesity-linked insulin resistance. These innovations prioritize patient autonomy and accuracy, fueling sustained market momentum. The Centers for Disease Control and Prevention reports that the prevalence of obesity among U.S. adults reached 40.3% during August 2021–August 2023, amplifying demand for injectable weight management solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate robust expansion in injection pen utilization across Asia Pacific over the forecast period, as healthcare frameworks prioritize accessible chronic disease management amid demographic shifts. Ministries in India and China subsidize reusable insulin devices, equipping primary care networks to serve surging type 2 cohorts in peri-urban expansions.

Medtech firms localize production of disposable fertility hormone pens, tailoring dosages for polycystic ovary syndrome prevalent in reproductive-age women. Governments launch awareness drives for multiple sclerosis biologics, distributing autoinjectors through national insurance to mitigate disability progression. Enterprises engineer temperature-stable growth hormone variants, extending reach to remote pediatric clinics facing supply chain vulnerabilities.

Regional alliances harmonize approvals for connected glucagon-like peptide-1 pens, empowering obese patients with digital coaching for lifestyle integration. Public health campaigns train community pharmacists on anaphylaxis epinephrine delivery, bolstering emergency preparedness in allergy hotspots. These initiatives capitalize on economic growth and policy synergies, scaling equitable access to precise subcutaneous therapeutics. The International Diabetes Federation estimates substantial regional burdens, with diabetes prevalence driving parallel needs for advanced delivery systems in recent epidemiological assessments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the injection pen market accelerate growth by prioritizing user-centric design, dose accuracy, and ergonomic improvements that enhance adherence for chronic therapies such as diabetes and obesity management. Companies expand demand by integrating digital connectivity, smart dose tracking, and companion apps that support personalized care and real-time monitoring.

Commercial strategies emphasize partnerships with pharmaceutical brands and payers to align devices with branded drugs and reimbursement pathways. Manufacturing leaders invest in scalable, high-precision production and sustainable materials to ensure supply reliability while meeting environmental goals.

Market expansion targets emerging economies through localized assembly, clinician training, and affordability-focused portfolios. Novo Nordisk exemplifies leadership by combining a dominant portfolio of pen-based drug delivery devices with deep therapeutic expertise, global manufacturing scale, and continuous innovation that strengthens outcomes and long-term patient engagement.

Top Key Players

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Becton, Dickinson and Company

- Ypsomed Holding AG

- Merck KGaA

- AstraZeneca

- Owen Mumford Ltd.

- Pfizer Inc.

- Biocon Biologics Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lupin Ltd.

- Novartis AG

- Haselmeier GmbH

- Wockhardt Ltd.

Recent Developments

- In January 2025, Roche Diagnostics and Sanofi Sanofi-Aventis announced a joint initiative to develop a connected diabetes management solution that combines an insulin delivery pen with continuous glucose monitoring technology. The collaboration is designed to make daily diabetes care more intuitive by linking dosing and glucose data within a single, integrated system for patients.

- In February 2024, Eli Lilly expanded the European rollout of its obesity and diabetes therapy by launching Mounjaro in the UK. Regulatory approval from the MHRA covered the Mounjaro KwikPen, a four-dose formulation of tirzepatide, supporting its use in both glycemic control and weight management and marking another step in the drug’s broader European market expansion.

Report Scope

Report Features Description Market Value (2024) US$ 41.6 Billion Forecast Revenue (2034) US$ 85.7 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device Type (Disposable Injection Pens and Reusable Injection Pens), By Application (Diabetes, Growth Hormonal Therapies, Autoimmune Diseases, Fertility Treatments, Osteoporosis, Anaphylaxis, Obesity and Others), By Age Group (Pediatric, Adult and Geriatric), By End-User (Hospitals, Home Use and Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novo Nordisk A/S, Eli Lilly and Company, Sanofi S.A., Becton, Dickinson and Company, Ypsomed Holding AG, Merck KGaA, AstraZeneca, Owen Mumford Ltd., Pfizer Inc., Biocon Biologics Ltd., Sun Pharmaceutical Industries Ltd., Lupin Ltd., Novartis AG, Haselmeier GmbH, Wockhardt Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi S.A.

- Becton, Dickinson and Company

- Ypsomed Holding AG

- Merck KGaA

- AstraZeneca

- Owen Mumford Ltd.

- Pfizer Inc.

- Biocon Biologics Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lupin Ltd.

- Novartis AG

- Haselmeier GmbH

- Wockhardt Ltd.