Global Injectable Liquid Filling Machines Market Size, Share, Growth Analysis By Machine Type (Servo Pump, Overflow Liquid, Peristaltic, Time Gravity, Piston Liquid, Net Weigh, Others), By Type (4 Heads, 6 Heads, Others), By Size (Medium, Small, High), By Application (Pharmaceutical, Cosmetics, Food Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160961

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

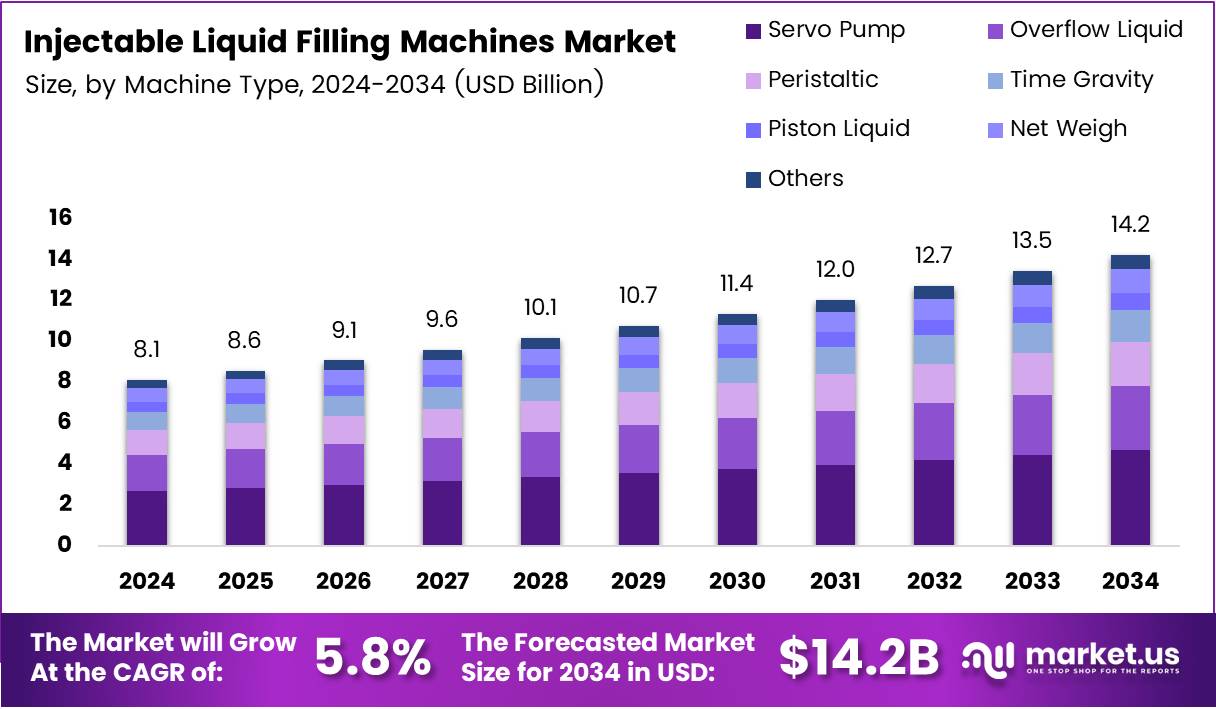

The Global Injectable Liquid Filling Machines Market size is expected to be worth around USD 14.2 Billion by 2034, from USD 8.1 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Injectable Liquid Filling Machines Market refers to specialized equipment used for accurately filling vials, ampoules, and syringes with liquid drugs. These machines ensure precision, sterility, and efficiency in pharmaceutical manufacturing. As injectable drugs gain demand globally, automation in liquid filling supports higher output, safety compliance, and consistent product quality.

The market shows steady expansion driven by growing biologics and vaccine production. Pharmaceutical firms are adopting automated filling systems to minimize contamination and human error. Moreover, with the rise in chronic diseases, the global injectable drug segment is projected to witness strong demand, directly fueling equipment adoption across regions.

Furthermore, technological innovation is transforming the market. Modern servo-driven filling machines offer enhanced accuracy and speed, reducing operational costs. Manufacturers are also integrating digital monitoring and cleanroom-compatible designs. Consequently, firms focusing on customized, high-speed filling solutions are likely to capture emerging opportunities in aseptic filling systems.

Additionally, increasing government investment in pharmaceutical infrastructure strengthens market potential. Many countries are establishing GMP-certified production facilities under national healthcare programs. Such initiatives support local drug manufacturing and boost demand for advanced filling machinery, especially in India, China, and the United States, where injectable production is expanding rapidly.

Regulatory compliance also plays a crucial role in shaping the competitive landscape. Global agencies like the FDA and EMA emphasize sterile manufacturing standards. Therefore, companies are investing in validation-ready and 21 CFR Part 11 compliant systems. This trend encourages adoption of automated inspection and filling equipment to meet stringent safety norms.

Looking ahead, market growth is expected to accelerate with rising biologic and biosimilar production. Firms embracing sustainable, energy-efficient designs will gain a competitive edge. In addition, opportunities will emerge in contract manufacturing organizations (CMOs) seeking reliable, scalable, and compliant liquid filling technologies for global pharmaceutical supply chains.

Key Takeaways

- The Global Injectable Liquid Filling Machines Market is projected to reach USD 14.2 Billion by 2034, up from USD 8.1 Billion in 2024, growing at a CAGR of 5.8% (2025–2034).

- In 2024, the Servo Pump segment led the By Machine Type category with a 23.2% share, driven by high accuracy and automation compatibility.

- The 4 Heads configuration dominated the By Type segment with a 46.8% share in 2024, offering optimal balance between speed, cost, and precision.

- Medium size machines held the largest share in the By Size segment at 48.5% in 2024, due to their versatility and cost-effectiveness.

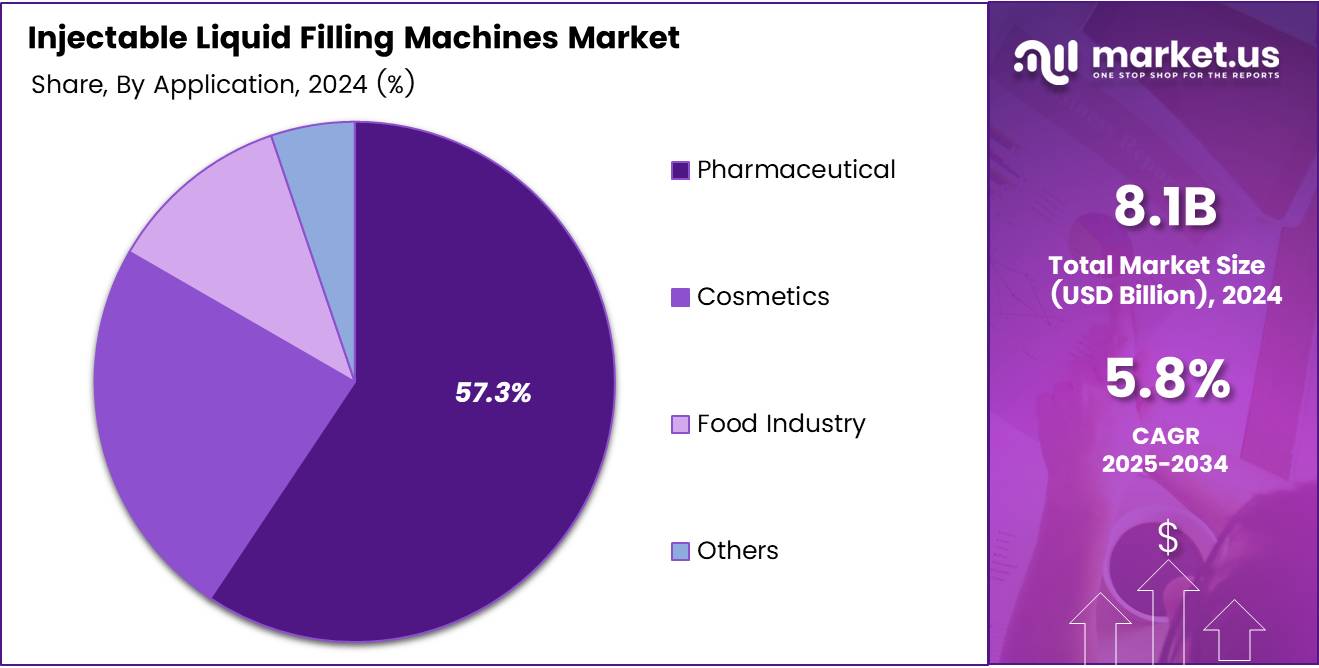

- The Pharmaceutical application segment captured a 57.3% market share in 2024, fueled by rising demand for vaccines and sterile formulations.

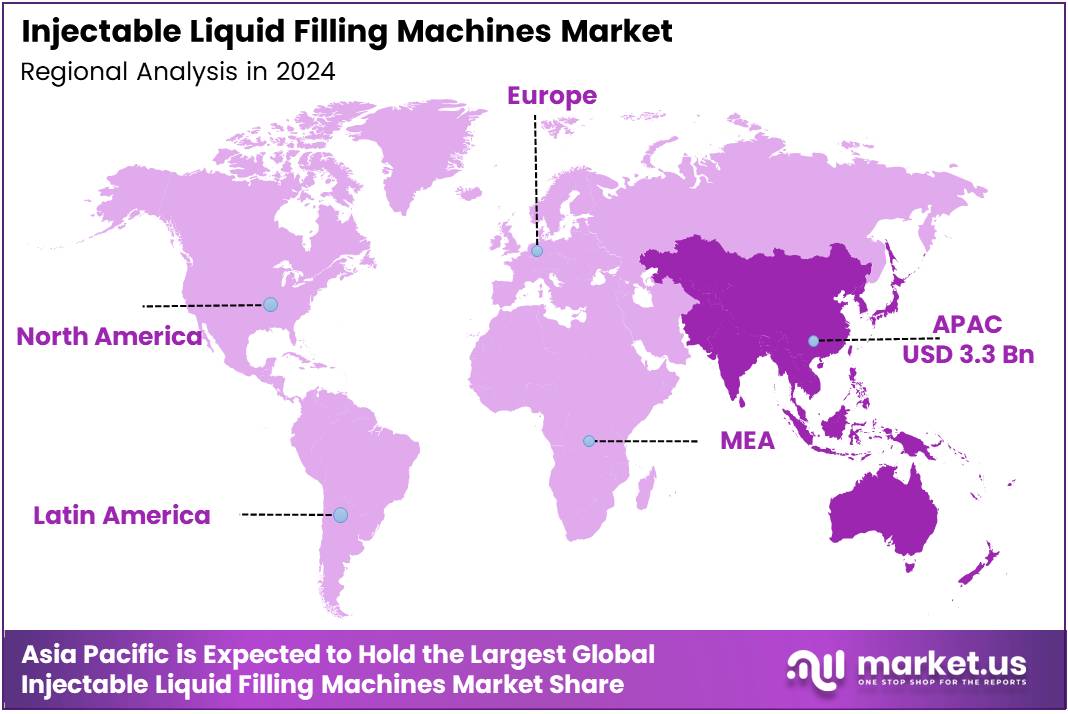

- The Asia Pacific region led globally with a 41.2% share, valued at USD 3.3 Billion, driven by strong pharmaceutical manufacturing growth in China, India, and Japan.

By Machine Type Analysis

Servo Pump dominates with 23.2% due to its precision and reliability in handling injectable liquid formulations.

In 2024, Servo Pump held a dominant market position in the By Machine Type segment of the Injectable Liquid Filling Machines Market, with a 23.2% share. This segment’s leadership stems from its ability to deliver high accuracy, consistency, and control during the filling process. Servo pumps are favored for pharmaceutical and biotech applications, offering minimal wastage and improved automation compatibility.

The Overflow Liquid filling machines also exhibit strong growth, primarily due to their suitability for transparent containers where consistent fill levels are visually important. These machines are cost-effective and ensure clean filling operations, making them an ideal choice for mid-scale operations in the pharmaceutical and food industries.

The Peristaltic segment gains traction as it prevents product contamination by eliminating contact between the pump and the liquid. This makes it a popular choice for sensitive and sterile applications. Its flexibility in handling various viscosities further boosts its adoption.

The Time Gravity machines are valued for their simplicity and affordability, particularly in low-viscosity liquid applications. They are preferred in settings requiring straightforward operations and low maintenance, ensuring ease of use for small production lines.

The Piston Liquid segment continues to grow due to its adaptability for viscous liquids and high-volume operations. These machines provide excellent accuracy and are commonly employed in industrial and cosmetic applications. Their mechanical design ensures robust performance and durability.

The Net Weigh filling machines find their niche among manufacturers who prioritize product weight consistency over volume accuracy. Their advanced weighing systems make them ideal for high-value formulations where precision is critical.

The Others category includes customized and hybrid liquid filling machines designed to meet unique industry requirements. These machines cater to niche applications, offering advanced automation, integration, and enhanced process flexibility.

By Type Analysis

4 Heads dominates with 46.8% due to its operational efficiency and widespread industrial preference.

In 2024, 4 Heads held a dominant market position in the By Type segment of the Injectable Liquid Filling Machines Market, with a 46.8% share. This dominance arises from its balance between speed, cost-effectiveness, and precision. The four-head configuration allows efficient multi-bottle filling while maintaining compact equipment design, making it ideal for pharmaceutical operations.

The 6 Heads segment is gaining attention due to its increased throughput capacity, enabling manufacturers to handle larger production volumes. These machines are particularly favored in high-demand environments where efficiency and output speed are crucial, such as contract manufacturing and large-scale drug production facilities.

The Others category comprises multi-head and custom machines tailored to specific manufacturing needs. These configurations are designed for specialty products requiring variable volumes or complex packaging formats. They offer flexibility and scalability, aligning with advanced automation trends.

By Size Analysis

Medium dominates with 48.5% due to its balanced capacity and adaptability across industries.

In 2024, Medium size machines held a dominant market position in the By Size segment of the Injectable Liquid Filling Machines Market, with a 48.5% share. Their versatility, moderate cost, and ability to cater to both small and large batches make them a preferred choice for pharmaceutical and cosmetic manufacturers.

The Small size machines are favored by startups and small-scale producers due to their affordability and compact footprint. They are best suited for laboratories and pilot-scale production, offering flexibility in operations with lower maintenance requirements.

The High size machines serve large manufacturing units focusing on mass production. These systems are integrated with automation and monitoring technologies, ensuring high throughput and precision. Their capability to meet strict regulatory standards makes them essential for global pharmaceutical production facilities.

By Application Analysis

Pharmaceutical dominates with 57.3% due to its critical role in sterile injectable production.

In 2024, the Pharmaceutical segment held a dominant market position in the By Application segment of the Injectable Liquid Filling Machines Market, with a 57.3% share. Rising demand for vaccines, biologics, and sterile formulations drives this growth. Manufacturers prioritize precision and contamination-free operations, boosting machine adoption.

The Cosmetics segment is expanding as brands increasingly rely on automation for filling serums, lotions, and other liquid products. Injectable liquid filling machines ensure uniformity, quality, and high-speed packaging—supporting the growing trend toward personalized and hygienic cosmetic products.

The Food Industry segment leverages these machines for accurate dosing of liquid supplements and health drinks. The precision in filling ensures consistent product quality and reduces waste, appealing to nutraceutical producers seeking reliable automation.

The Others category includes biotechnology, veterinary, and research applications where sterile and precise filling processes are essential. These machines offer adaptability to small-batch and custom formulations, supporting innovation in emerging scientific and healthcare sectors.

Key Market Segments

By Machine Type

- Servo Pump

- Overflow Liquid

- Peristaltic

- Time Gravity

- Piston Liquid

- Net Weigh

- Others

By Type

- 4 Heads

- 6 Heads

- Others

By Size

- Medium

- Small

- High

By Application

- Pharmaceutical

- Cosmetics

- Food Industry

- Others

Drivers

Rising Demand for Pre-Filled Syringes and Injectable Drug Delivery Systems Drives Market Growth

The growing demand for pre-filled syringes and advanced injectable drug delivery systems is one of the main drivers of the injectable liquid filling machines market. Pharmaceutical companies are increasingly shifting toward ready-to-use injectable formats to improve patient convenience and reduce contamination risks. This trend is creating a strong need for high-precision liquid filling machines that can handle sterile and accurate dosing.

Global expansion of biopharmaceutical manufacturing capabilities is also fueling market growth. With more biologics and vaccines being produced, manufacturers require efficient and flexible filling systems to meet global supply needs. This is especially evident in emerging economies that are enhancing their production infrastructure to support local and export demand.

Automation and precision technologies are becoming key elements in injectable filling operations. Automated filling systems improve accuracy, minimize human error, and increase production throughput—benefits that are highly valued in modern pharmaceutical manufacturing.

Additionally, rising investments in Contract Manufacturing Organizations (CMOs) are boosting the adoption of injectable filling machines. Many pharmaceutical companies are outsourcing their production to CMOs, who are rapidly upgrading their facilities with advanced filling equipment to meet strict client and regulatory requirements.

Restraints

Stringent Regulatory Compliance and Validation Requirements Challenge Market Expansion

One of the major restraints in the injectable liquid filling machines market is the strict regulatory compliance and validation requirements. Every machine used in pharmaceutical manufacturing must adhere to rigorous standards for sterility, accuracy, and safety. The process of obtaining approval from authorities like the FDA or EMA can be time-consuming and costly, often delaying equipment installation and production timelines.

In addition, frequent updates in regulatory guidelines demand constant validation and documentation, increasing operational complexity for manufacturers. Companies must invest heavily in testing, certification, and staff training to maintain compliance.

Another significant challenge is the limited availability of skilled technicians. Injectable liquid filling machines require expertise in aseptic operations, automation, and maintenance. However, there is a shortage of professionals trained in these advanced systems, particularly in developing regions.

This shortage can lead to longer downtimes, lower productivity, and higher maintenance costs. The lack of skilled labor also discourages some companies from adopting new technologies, slowing overall market growth despite strong demand.

Growth Factors

Emerging Markets’ Focus on Local Pharmaceutical Production Facilities Creates Growth Opportunities

The growing focus of emerging markets on establishing local pharmaceutical production facilities presents major growth opportunities for the injectable liquid filling machines market. Governments in Asia, Africa, and Latin America are encouraging domestic drug manufacturing to reduce import dependency and ensure faster access to essential medicines. This trend is expected to increase the demand for modern filling machines capable of sterile and high-speed production.

Another opportunity lies in the development of multi-dose and dual-chamber filling technologies. These innovations allow for more complex drug formulations, improving patient convenience and dosage accuracy. Manufacturers offering such advanced solutions are likely to gain a competitive advantage in the market.

Additionally, the rising preference for customizable and modular filling systems is shaping new business prospects. Pharmaceutical companies seek flexible machines that can be adapted for different vial sizes and product types without major reconfiguration.

Technological progress in aseptic and sterile filling processes is also opening doors for innovation. With improved contamination control and automation, companies can achieve higher production efficiency and meet international quality standards more easily.

Emerging Trends

Adoption of Industry 4.0 and IoT-Enabled Smart Filling Systems Sets Market Trends

The injectable liquid filling machines market is experiencing strong trends driven by the adoption of Industry 4.0 and IoT-enabled smart systems. These technologies enable real-time monitoring, predictive maintenance, and data-driven performance optimization, allowing manufacturers to enhance efficiency and reduce downtime.

Another major trend is the shift toward single-use components in filling operations. These disposable systems minimize contamination risks and reduce cleaning time, making them ideal for aseptic production environments. They also offer greater flexibility for handling different drug batches, which is crucial in small-scale or clinical production.

Integration of vision inspection systems and real-time quality monitoring is becoming standard in advanced filling lines. These technologies detect errors such as underfilling, leaks, or particle contamination instantly, ensuring product safety and regulatory compliance.

Finally, the growing use of robotics and artificial intelligence (AI) is transforming injectable filling operations. Robots handle delicate containers with precision, while AI algorithms optimize filling accuracy and process control. Together, these innovations are setting new benchmarks for productivity and reliability in pharmaceutical manufacturing.

Regional Analysis

Asia Pacific Dominates the Injectable Liquid Filling Machines Market with a Market Share of 41.2%, Valued at USD 3.3 Billion

The Asia Pacific region leads the global injectable liquid filling machines market, accounting for a significant 41.2% share and valued at USD 3.3 Billion. The market growth is primarily driven by the rapid expansion of pharmaceutical manufacturing hubs in countries such as China, India, and Japan.

Increasing investments in automation, coupled with rising demand for sterile and precise liquid filling in injectable formulations, are further propelling regional growth. The presence of a robust generic drug industry and government support for pharmaceutical infrastructure also contribute to the market’s dominance.

North America Injectable Liquid Filling Machines Market Trends

North America holds a substantial share in the global market, supported by the strong presence of advanced pharmaceutical manufacturing facilities and regulatory emphasis on high-quality drug packaging. The demand for technologically sophisticated and compliant liquid filling solutions continues to rise in the U.S. and Canada, driven by innovation in injectable drug delivery systems and biologics.

Europe Injectable Liquid Filling Machines Market Trends

Europe represents a mature and highly regulated market for injectable liquid filling machines, with a strong focus on precision engineering and compliance with stringent pharmaceutical standards. The region benefits from the presence of established pharmaceutical and biotechnology sectors across Germany, France, and the U.K. Increasing adoption of advanced automation systems and aseptic filling technologies is enhancing production efficiency and safety, fueling market expansion across the continent.

Middle East and Africa Injectable Liquid Filling Machines Market Trends

The Middle East and Africa region is witnessing gradual growth in the injectable liquid filling machines market, driven by expanding healthcare infrastructure and the growing pharmaceutical manufacturing base. Investments in modernization of drug production facilities, particularly in the GCC countries and South Africa, are supporting demand for automated filling equipment. Furthermore, government initiatives aimed at improving local pharmaceutical production capacity are expected to create new growth opportunities in the coming years.

Latin America Injectable Liquid Filling Machines Market Trends

Latin America’s injectable liquid filling machines market is experiencing moderate growth, primarily fueled by the increasing production of generics and biosimilars in countries such as Brazil and Mexico. The region’s evolving regulatory landscape and rising investments in pharmaceutical manufacturing are encouraging the adoption of efficient and sterile filling systems. While infrastructure challenges persist, gradual modernization and international partnerships are likely to strengthen market presence over the forecast period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Injectable Liquid Filling Machines Company Insights

The global Injectable Liquid Filling Machines Market in 2024 has witnessed steady growth driven by increasing demand for precision, sterility, and automation in pharmaceutical manufacturing.

Among the prominent players, Cozzoli Machine Company continues to strengthen its market position through technological innovation and customizable solutions. Its robust product portfolio caters to both small-scale laboratories and large pharmaceutical production lines, emphasizing reliability and advanced filling accuracy that enhance operational efficiency.

Harsiddh Engineering remains a competitive player with a strong focus on aseptic filling systems and modular machinery design. The company’s adaptability in providing cost-effective and compliant solutions has positioned it well among emerging pharmaceutical manufacturers, particularly in regions emphasizing automation and cleanroom compatibility.

IMA Group, a globally recognized leader, leverages its vast technological expertise to deliver highly automated and integrated injectable filling lines. Its continuous investment in R&D and digital manufacturing technologies reinforces its dominance, offering pharmaceutical firms flexible solutions for handling various vial and syringe formats while ensuring stringent regulatory compliance.

Syntegon continues to demonstrate leadership through innovation in sustainable and smart filling technologies. The company’s emphasis on advanced robotics and digitization enhances precision and reduces human intervention, thereby minimizing contamination risks. Syntegon’s customer-centric approach and focus on efficiency and scalability make it a preferred partner for global pharmaceutical firms aiming for high throughput and reliability.

Collectively, these companies are shaping the competitive landscape by advancing automation, enhancing aseptic performance, and aligning with the evolving global pharmaceutical manufacturing standards.

Top Key Players in the Market

- Cozzoli Machine Company

- Harsiddh Engineering

- IMA Group

- Syntegon

- Lodha International LLP

- Ambica Pharma Machines

- Parth Engineers & Consultant Manufacture

- Shree Bhagwati

- Adinath International

- NKP Pharma Pvt

- Laxmi Pharma Equipment

Recent Developments

- In October 2025, Groninger Group, a leading filling and finishing machine manufacturer, acquired RTU (Reinraumtechnik Ulm GmbH). This acquisition strengthens Groninger’s position in aseptic processing by integrating RTU’s cleanroom and isolator technologies into its portfolio.

- In May 2025, Syntegon introduced its innovative filling line concept called SynTiso, aimed at enhancing flexibility and sterility in pharmaceutical production. The SynTiso platform enables seamless integration of isolator and filling technologies for efficient small-batch manufacturing.

- In July 2025, TurboFil, a specialist in liquid-filling and assembly machines, became Ravona’s exclusive U.S. distributor. This partnership combines Ravona’s aseptic containment and isolation systems with TurboFil’s filling line expertise to offer complete sterile processing solutions.

Report Scope

Report Features Description Market Value (2024) USD 8.1 Billion Forecast Revenue (2034) USD 14.2 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine Type (Servo Pump, Overflow Liquid, Peristaltic, Time Gravity, Piston Liquid, Net Weigh, Others), By Type (4 Heads, 6 Heads, Others), By Size (Medium, Small, High), By Application (Pharmaceutical, Cosmetics, Food Industry, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cozzoli Machine Company, Harsiddh Engineering, IMA Group, Syntegon, Lodha International LLP, Ambica Pharma Machines, Parth Engineers & Consultant Manufacture, Shree Bhagwati, Adinath International, NKP Pharma Pvt, Laxmi Pharma Equipment Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Injectable Liquid Filling Machines MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Injectable Liquid Filling Machines MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cozzoli Machine Company

- Harsiddh Engineering

- IMA Group

- Syntegon

- Lodha International LLP

- Ambica Pharma Machines

- Parth Engineers & Consultant Manufacture

- Shree Bhagwati

- Adinath International

- NKP Pharma Pvt

- Laxmi Pharma Equipment