Global Industrial Solvent Separation Membranes Market By Material Type (Polyamide, Polytetrafluoroethylene, Mixed Cellulose Ester, Polyvinylidene Fluoride, Polyether Ether Ketone, Others), By Technology (Ultrafiltration, Microfiltration, Nanofiltration, Reverse Osmosis), By Application(Halogenated Solvents (Dichloromethane, Tetrachloroethylene, Others), Non-aqueous Solvents (Alcohols, Ketones, Others), C6 Hydrocarbons or Higher (Heptane, Hexane, Alkylbenzene, Others)), End-use (Chemicals, Pharmaceutical, Food And Beverage, Paints And Coatings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 123169

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

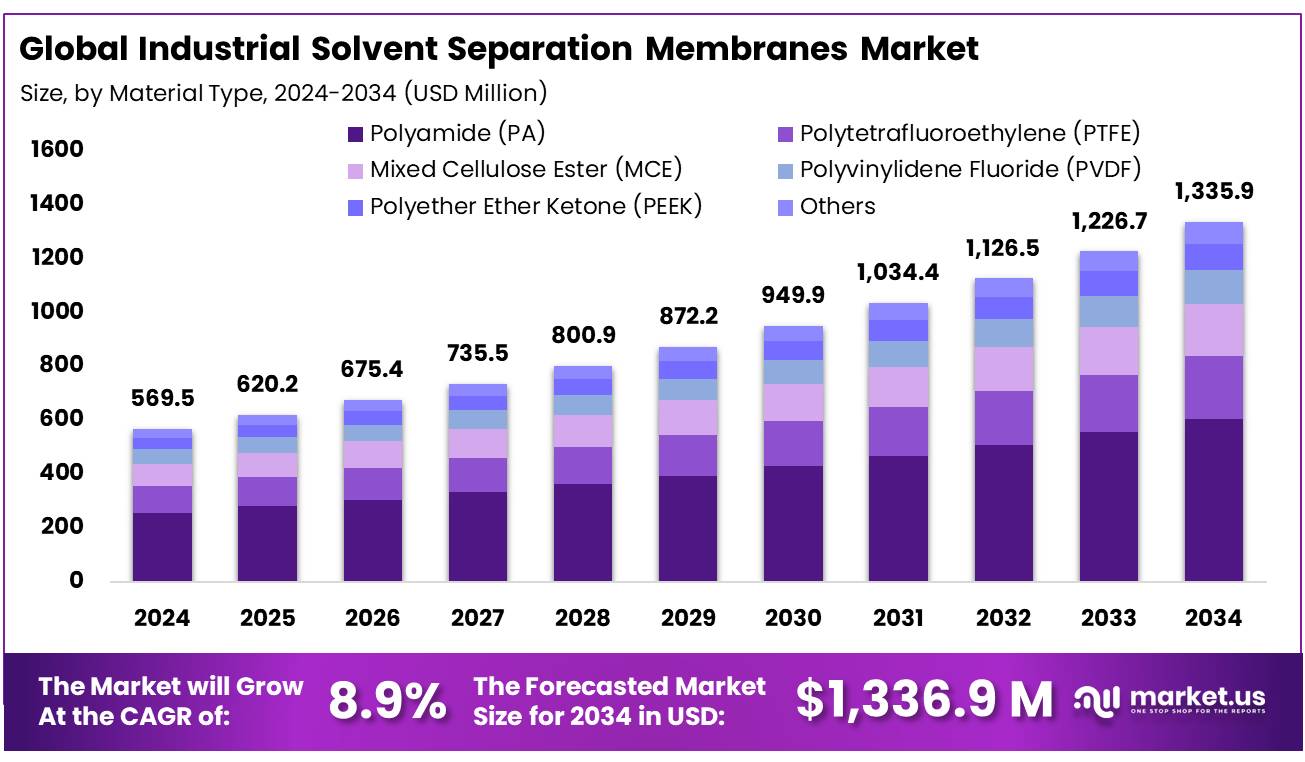

The Global Industrial Solvent Separation Membranes Market size is expected to be worth around USD 1,336.9 Million by 2034, from USD 569.5 Million in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034.

The industrial solvent separation is advanced membrane technologies designed for the adequate separation, purification, and recovery of solvents in various industrial processes. These membranes especially developed with chemically stable environments, particularly in the presence of organic solvents. Their numerous advantages including high separation efficiency, less time and energy consumption compared to traditional distillation methods making them popular for industrial separation process.

These technologies applicable across the various sectors such as in pharmaceuticals, these technologies utilized to purify active pharmaceutical ingredients (APIs) and reduce solvent consumption. In chemicals, useful in complex solvent separation and food and beverage, where they enhance product safety and quality by removing impurities. Additionally, they are widely used in wastewater treatment, particularly for removing hazardous organic compounds, thus supporting regulatory compliance and water reuse initiatives.

Globally, the industrial solvent separation membranes market is witnessing robust growth, driven by increasing environmental regulations, rising demand for solvent-efficient technologies, and innovations in membrane materials such as solvent-stable nanofibers and polymer composites. As industries prioritize eco-friendly and cost-effective separation solutions, membrane-based technologies are expected to capture a significant share of the global solvent recovery and purification landscape in the coming years.

Key Takeaways

- The global industrial solvent separation membranes market was valued at USD 569.5 million in 2024.

- The global industrial solvent separation membranes market is projected to grow at a CAGR of 8.9% and is estimated to reach USD 1,336.9 million by 2034.

- Among material type, polyamide accounted for the largest market share of 45.3%. Due to its excellent chemical resistance, and superior membrane-forming properties

- Among technology, reverse osmosis accounted for the majority of the market share at 54.1%. Due to its superior ability to remove a wide range of organic solvents and impurities.

- By Application, Halogenated Solvents accounted for the largest market share of 44.4%. Due to their widespread use in pharmaceutical, chemical, and electronics industries, where high-purity solvents are essential for precision applications

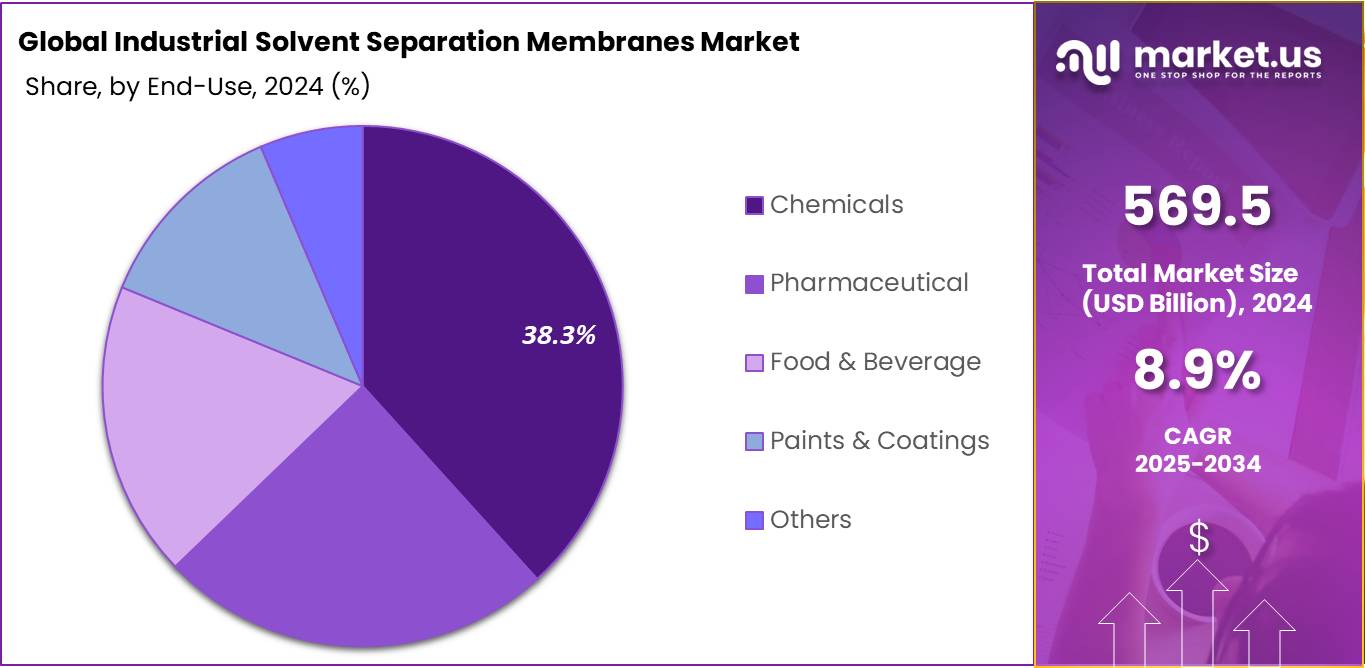

- By End-Use, Chemicals accounted for the majority of the market share at 58.5% Due to its high demand for solvent recovery, purification, and reuse in large-scale production processes.

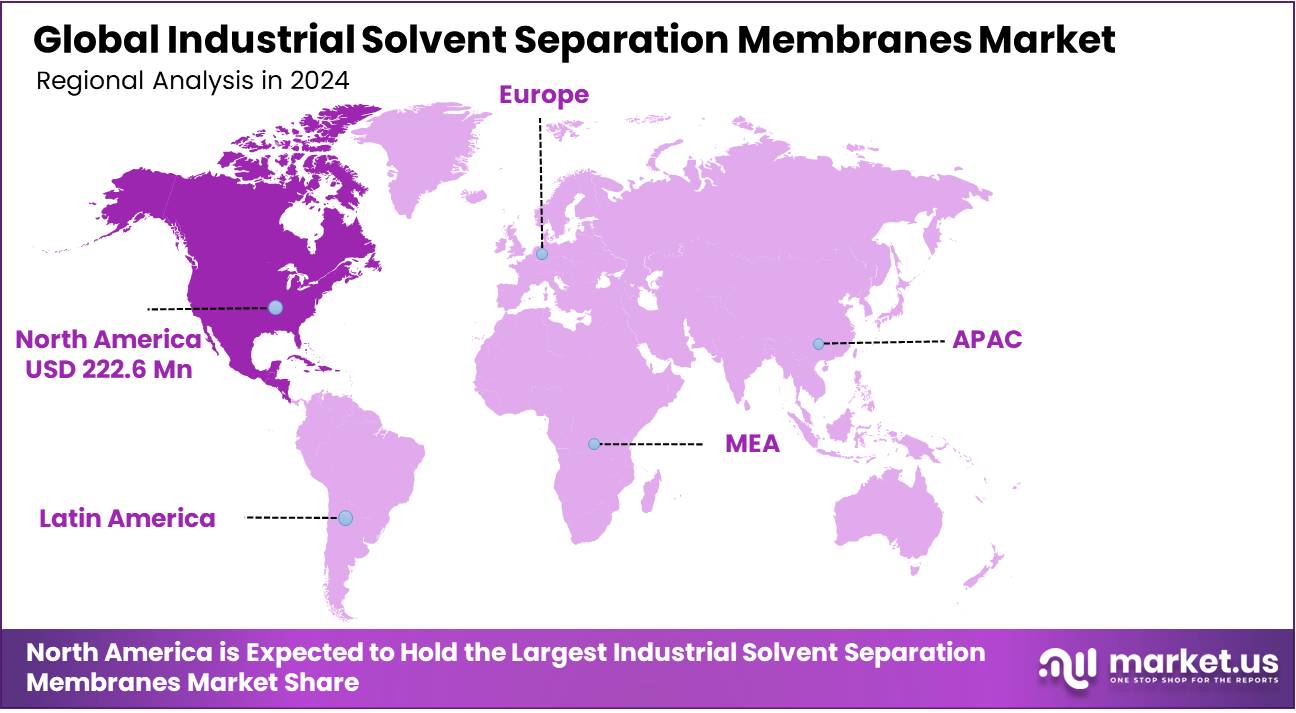

- North America is estimated as the largest market for Industrial Solvent Separation Membranes with a share of 39.1% of the market share.

Material Type Analysis

Polyamide Material Accounted For The Largest Market Share of 45.3%.

The industrial solvent separation membranes market is segmented based on material type into Polyamide, Polytetrafluoroethylene, Mixed Cellulose Ester, Polyvinylidene Fluoride, Polyether Ether Ketone and Others . In 2024, the Polyamide segment held a significant revenue share of 45.3%. Due to its excellent chemical resistance, high mechanical strength, and superior membrane-forming properties.

These characteristics make polyamide membranes highly effective in handling aggressive solvents and achieving precise molecular separations, particularly in pharmaceutical and chemical processing. Furthermore, polyamide membranes support high flux rates and are compatible with various separation technologies, such as nanofiltration and reverse osmosis, enhancing their adaptability across multiple industrial applications.

Technology Analysis

Reverse Osmosis Technology Hold the Majority Of The Market Share at 54.1%.

Based on technology, the market is further divided into ultrafiltration, microfiltration, Nano filtration, and reverse osmosis. The predominance of reverse osmosis, commanding a substantial 54.1% market share in 2024. Due to its superior separation efficiency, ability to remove a wide range of organic solvents and impurities, and its versatility across diverse industrial sectors.

RO technology is widely adopted in chemical processing, pharmaceuticals, and food & beverage industries for its high rejection rate of dissolved solids and contaminants. Additionally, advances in membrane durability and energy-efficient RO systems have further strengthened its market position as a cost-effective and environmentally sustainable solution for solvent recovery and purification.

Application Analysis

Halogenated Solvents Application Regarded For The Largest Market Share of 44.4%.

Among Applications, the market is classified into halogenated solvents, non-aqueous solvents, and c6 hydrocarbons or higher. In 2024, halogenated solvents held a dominant position with a 44.4% share. Due to their widespread use in pharmaceutical, chemical, and electronics industries, where high-purity solvents are essential for precision applications.

These solvents often require efficient and selective separation processes, making membrane technologies ideal for recovery and reuse. Additionally, the growing need to comply with stringent environmental and safety regulations surrounding halogenated solvent emissions has accelerated the adoption of advanced membrane systems for solvent recycling and waste minimization.

End-Use Analysis

By end-use, the market categorized into chemicals, pharmaceutical, food & beverage, paints & coatings, and others. With the chemicals segment emerging as the dominant user, holding 58.5% of the total market share in 2024. Due to its high demand for solvent recovery, purification, and reuse in large-scale production processes.

Chemical manufacturers extensively rely on membrane technologies to enhance operational efficiency, reduce solvent waste, and comply with tightening environmental regulations. The cost-effectiveness and scalability of membranes make them a preferred solution for solvent-intensive operations, particularly in the production of specialty and fine chemicals.

Key Market Segments

By Material type

- Polyamide (PA)

- Polytetrafluoroethylene (PTFE)

- Mixed Cellulose Ester (MCE)

- Polyvinylidene Fluoride (PVDF)

- Polyether Ether Ketone (PEEK)

- Others

By Technology

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Reverse Osmosis

By Application

- Halogenated Solvents

- Dichloromethane

- Tetrachloroethylene

- Others

- Non-aqueous Solvents

- Alcohols

- Ketones

- Others

- C6 Hydrocarbons or Higher

- Heptane

- Hexane

- Alkylbenzene

- Others

By End-Use

- Chemicals

- Pharmaceutical

- Food & Beverage

- Paints & Coatings

- Others

Drivers

Rapid Growth Industrial Sectors

The rapid growth of the global industrial sector is a major driver of the increasing demand for industrial solvent separation membranes. As industrial activity continues to expand particularly in regions such as Asia-Pacific, North America, and Europe there is a rising need for advanced separation technologies that can meet the performance requirements and environmental standards of modern industries. These membranes require significantly lower energy input compared to traditional separation methods like distillation, making them highly attractive for industries such as pharmaceuticals, food and beverage production, petrochemicals, and water treatment.

- Fractional distillation of crude oil consumes nearly 1% of global energy and accounts for 6% of the world’s carbon emissions.

- For instance, ExxonMobil’s W.R. Grace Field unit, used for dewaxing lubrication oils, demonstrated a 20% reduction in energy consumption, avoided 20,000 tons of greenhouse gas emissions annually, and saved millions of gallons of water per day. Such examples highlight the potential benefits of separation membrane processes.

Additionally, as industries aim to reduce their environmental impact and transition toward a more sustainable economy, there is increasing pressure to replace conventional, energy-intensive separation methods with more efficient alternatives. Membrane-based technologies such as Organic Solvent Nanofiltration (OSN), pervaporation (PV), and vapor permeation (VP) offer promising solutions, as they operate in the liquid phase and avoid the need for energy-heavy phase changes. These technologies not only lower energy consumption and solvent waste but also provide advantages such as high selectivity, ease of scale-up, and reduced environmental footprint.

- For instance, the U.S. Department of Energy’s Industrial Heat Earthshot aims to develop cost-competitive industrial heat decarbonization technologies with at least 85% lower greenhouse gas emissions by 2035, highlighting the critical role of industrial solvent separation membranes in achieving these ambitious climate goals.

Furthermore, Innovations in membrane materials including polymers, ceramics, metal-organic frameworks (MOFs), and mixed-matrix membranes (MMM) are further supporting this shift by offering improved performance, durability, and compatibility with a broad range of industrial solvents. As a result, membrane technology is increasingly being adopted in the chemical industry to enhance efficiency, sustainability, and product quality, positioning the industrial solvent separation membranes market for robust growth in the coming years.

Restraints

Limited Availability of Solvent Stable Membrane Material

The limited availability of solvent-stable membrane materials presents a significant restraint to the global growth of the industrial solvent separation membranes market. Most conventional polymer membranes exhibit poor chemical resistance in organic solvents, which hinders their performance and longevity in demanding separation applications, particularly in nanofiltration processes. This material limitation restricts broader industrial adoption, especially in solvent-intensive sectors such as pharmaceuticals, chemicals, and petrochemicals. As a result, the market’s expansion is contingent on the development of advanced membrane materials that can withstand aggressive solvents while maintaining efficiency and durability.

Opportunity

Expansion Into the Food and Beverage Sector

The expansion of membrane technology into the food and beverage sector is creating significant growth opportunities for the global industrial solvent separation membranes market. Membrane processes are increasingly adopted due to their ability to enhance product purity, quality, and processing efficiency while reducing energy consumption and environmental impact. Applications such as de-alcoholization of beer, wine clarity improvement, and vinegar clarification demonstrate the versatility and effectiveness of membranes in this industry.

Moreover, in the dairy sector, ultrafiltration and Nanofiltration technologies enable the production of high-quality cheese, whey protein concentrates, and lactose desalting, further driving demand for advanced membrane systems. The shift toward cleaner, more sustainable production methods in food processing highlights the critical role of solvent separation membranes in meeting regulatory standards and consumer expectations. Consequently, the integration of membrane technologies within food and beverage manufacturing is expected to propel market growth, reinforcing the membranes’ position as essential tools for achieving both operational excellence and environmental sustainability.

Trends

Developing Solvent-Stable Nano-Fiber Membrane

The development of solvent-stable nanofiber membranes represents a key trend in the global industrial solvent separation membranes market. These advanced membranes, capable of withstanding harsh organic solvents without compromising structural integrity or performance, are driving the expansion of Organic Solvent Nanofiltration (OSN) technology. OSN is gaining traction across industries such as petrochemicals, pharmaceuticals, dyes, and natural product extraction due to its efficiency in separating small molecules in organic solvents under pressure-driven processes.

Furthermore, Innovations in membrane fabrication methods including solvent evaporation, phase inversion techniques, thermal phase separation, coating, and interfacial polymerization are enhancing the solvent resistance and durability of nanofiber membranes. Additionally, surface modifications like polymer chain crosslinking further improve chemical stability, enabling membranes to operate reliably in aggressive solvent environments. This trend towards more robust, high-performance solvent-stable nanofiber membranes is expected to significantly boost market growth by meeting the increasing industrial demand for efficient, sustainable, and cost-effective separation solutions.

Geopolitical Impact Analysis

Geopolitical Uncertainties Have Accelerated Innovation and Resilience Strategies Within The Solvent Separation Membrane Industry.

Recent geopolitical developments have notably impacted the global Industrial Solvent Separation Membranes market, primarily through disruptions in trade relations and shifts in defense priorities. Heightened tensions between major economies, particularly the U.S. and China, have led to supply chain interruptions for critical raw materials such as Polyamide and Polytetrafluoroethylene (PTFE). These disruptions have increased production costs and caused delays in manufacturing, adversely affecting industries reliant on advanced membrane technologies, including chemicals, pharmaceuticals, food & beverage, and paints & coatings.

Moreover, stringent environmental regulations in key regions such as North America, Europe, and parts of Asia-Pacific have driven the adoption of membrane-based solvent separation solutions, promoting market growth and technological innovation. However, geopolitical uncertainties have intensified concerns over supply chain security. Trade restrictions, tariffs, and sanctions have prompted manufacturers to diversify suppliers and boost local production to reduce dependency on vulnerable international supply networks. This trend is particularly evident in Asia-Pacific, where rapid industrialization is accompanied by strategic government initiatives to strengthen domestic capabilities and safeguard access to essential membrane technologies, thereby ensuring market resilience amid global political complexities.

Regional Analysis

North America Held the Largest Share of the Global Industrial Solvent Separation Membranes Market

In 2024, North America dominated the global industrial solvent separation membranes market, accounting for 39.1% of the total market share. Driven by increasing demand from key industries such as pharmaceuticals, chemicals, and food and beverage, the North American industrial solvent separation membranes market is witnessing robust growth. The region’s strong focus on sustainability and stringent environmental regulations are encouraging companies to adopt membrane technologies that offer efficient solvent recovery and waste reduction.

Innovations in membrane materials, such as solvent-stable nanofiber membranes, further enhance separation performance and durability, promoting wider industrial applications across various sectors. Furthermore, regions government emphasis on reducing industrial emissions and minimizing solvent waste provide favourable conditions for adoption of efficient membrane separation technologies in North America. Industries are prioritizing eco-friendly processes, making membrane-based solvent recovery an attractive solution to lower energy consumption and mitigate environmental impact. Additionally, continuous research and development efforts by manufacturers and institutions to create cost-effective and high-performance membranes are fuelling market expansion and innovation.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the global industrial solvent separation membranes market maintain their dominance through a combination of continuous innovation, strategic collaborations, and robust R&D investments. Companies such as Evonik Industries AG, Novamem Ltd, and Asahi Kasei Corporation focus on developing high-performance, solvent-stable membranes tailored for complex industrial processes. Their ability to offer customized solutions, expand production capacity, and ensure global distribution supports their leadership. Moreover, strategic partnerships with pharmaceutical and chemical manufacturers allow these players to stay ahead of regulatory trends and evolving customer demands, further consolidating their market position.

The Major Players in The Industry

- Evonik Industries AG

- Novamem Ltd.

- Pall Corporation

- Sartorius AG

- SolSep BV

- Asahi Kasei Corporation

- Hawach Scientific Co., Ltd.

- Membrane Solutions, LLC.

- BORSIG GmbH

- SepPure Technologies

- Other Key Players

Recent Development

- In December 2023 – Asahi Kasei has developed an innovative forward osmosis membrane system that dehydrates organic solvents without heat or pressure, significantly reducing energy consumption and protecting heat-sensitive pharmaceutical intermediates. The company is collaborating with Ono Pharmaceutical for practical validation, targeting commercialization by 2027.

Report Scope

Report Features Description Market Value (2024) USD 569.5 Mn Forecast Revenue (2034) USD 1,336.9 Mn CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polyamide (PA), Polytetrafluoroethylene (PTFE), Mixed Cellulose Ester (MCE), Polyvinylidene Fluoride (PVDF), Polyether Ether Ketone (PEEK), Others), By Technology (Ultrafiltration, Microfiltration, Nanofiltration, Reverse Osmosis), By Application (Halogenated Solvents (Dichloromethane, Tetrachloroethylene, Others), Non-aqueous Solvents (Alcohols, Ketones, Others), C6 Hydrocarbons or Higher (Heptane, Hexane, Alkylbenzene, Others)), End-use (Chemicals, Pharmaceutical, Food & Beverage, Paints & Coatings, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Evonik Industries AG, Novamem Ltd., Pall Corporation, Sartorius AG, SolSep BV, Asahi Kasei Corporation, Hawach Scientific Co., Ltd., Membrane Solutions, LLC., BORSIG GmbH, SepPure Technologies, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Solvent Separation Membranes MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Solvent Separation Membranes MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Evonik Industries AG

- Novamem Ltd.

- Pall Corporation

- Sartorius AG

- SolSep BV

- Asahi Kasei Corporation

- Hawach Scientific Co., Ltd.

- Membrane Solutions, LLC.

- BORSIG GmbH

- SepPure Technologies

- Other Key Players