Global Industrial Safety Market Size, Share, Growth Analysis By Type (Machine Safety, Worker Safety), By Component (Presence Sensing Safety Sensors, Safety Controllers/Modules/Relays, Programmable Safety Systems, Safety Interlock Switches, Emergency Stop Controls, Two-Hand Safety Controls, Others), By Industry (Oil & Gas, Energy & Power, Chemicals, Food & Beverages, Aerospace & Defense, Automotive, Semiconductor, Healthcare & Pharmaceuticals, Metals & Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174073

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

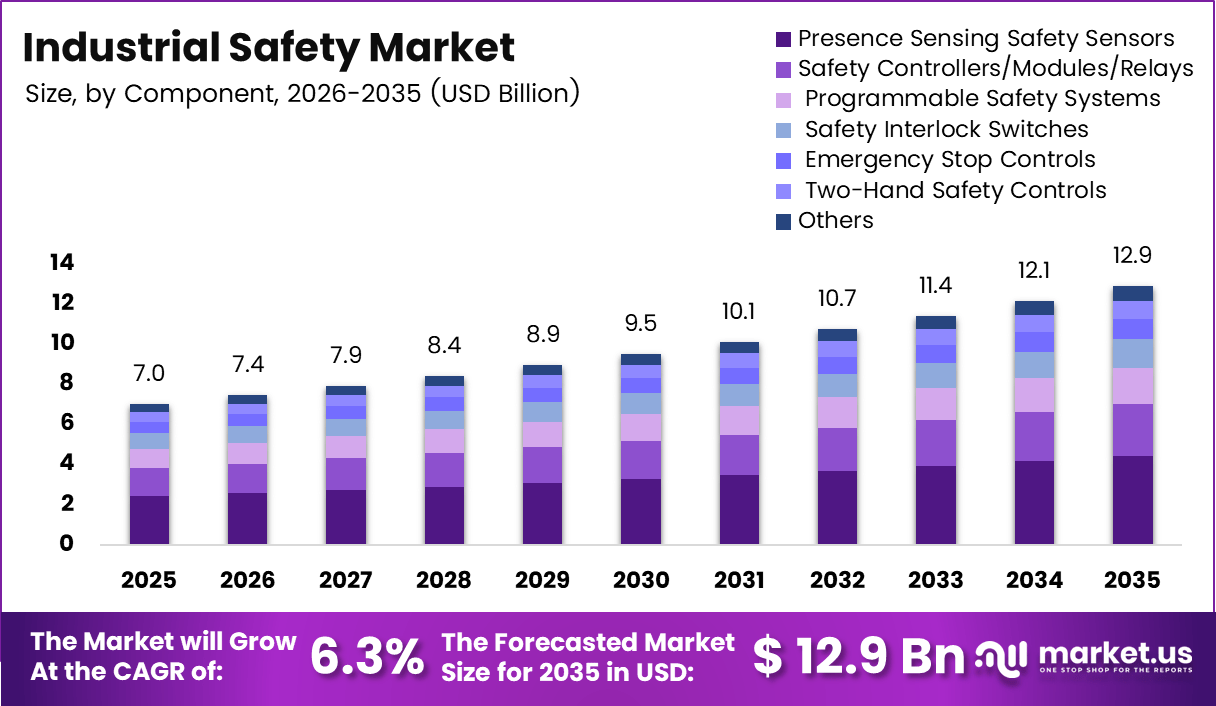

The Global Industrial Safety Market size is expected to be worth around USD 12.9 billion by 2035, from USD 7.0 billion in 2025, growing at a CAGR of 6.3% during the forecast period from 2026 to 2035.

The Industrial Safety Market represents a structured ecosystem of technologies, systems, and services focused on minimizing workplace risks. Industrial safety connects operational continuity with workforce protection. Consequently, organizations increasingly view safety spending as a strategic investment supporting compliance, productivity stability, and long-term industrial sustainability.

Industrial safety as a concept emphasizes protecting people, assets, and processes across industrial environments. It integrates machine safety, process control, and worker protection within standardized frameworks. As automation and digitalization expand, safety management progressively shifts from reactive incident response toward preventive and predictive risk control models.

From a growth perspective, the Industrial Safety Market expands alongside industrial automation, infrastructure development, and complex manufacturing operations. Governments enforce stricter workplace norms, while insurers link premiums to safety compliance levels. As a result, industries prioritize safety upgrades to reduce downtime, liability exposure, and workforce disruption.

Significant opportunities emerge through smart factories, renewable energy facilities, and advanced process industries. Digital safety platforms, connected sensors, and real-time analytics enable proactive hazard detection. Moreover, public infrastructure investments and evolving labor laws support consistent demand for compliant safety systems across construction, utilities, and heavy engineering sectors.

Government investment and regulation play a foundational role in shaping market adoption. Occupational safety authorities enforce compliance through audits, certifications, and penalties. Standards issued by ISO, OSHA, ASME, and national engineering bodies increasingly influence procurement decisions, making regulatory alignment a critical purchasing criterion for industrial operators.

According to industrial survey, industry-accepted safety factors vary by application and risk exposure. Buildings typically apply a factor near 2.0, automobiles around 3.0, and pressure vessels between 3.5 and 4.0. Aerospace applications range from 1.2 to 4.0, reflecting weight and reliability trade-offs.

Further, engineering design references and FAA-aligned guidelines indicate typical factors of safety range from 1.3 to 1.5 for highly reliable materials, 2.5 to 3 for brittle materials, and 3 to 4 under uncertain conditions. Equipment-level factors reach 6 to 8 for turbines, 8 to 9 for lifting components, and up to 20 for cast-iron wheels, reinforcing the critical role of industrial safety in risk-managed market growth.

Key Takeaways

- The Global Industrial Safety Market stood at USD 7.0 billion in 2025 and is projected to expand at a 6.3% CAGR during 2026–2035.

- Worker Safety emerged as the leading type segment, accounting for a dominant market share of 62.8% in 2025.

- Presence Sensing Safety Sensors led the component category with a market share of 34.3% in 2025.

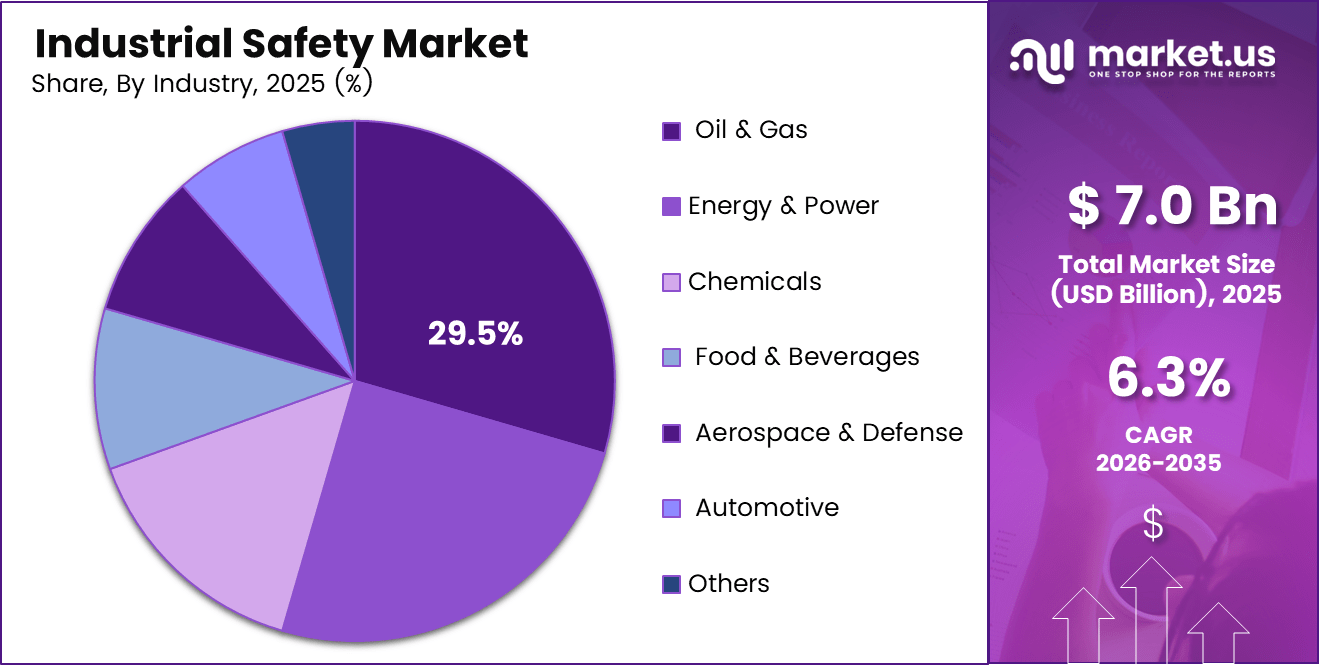

- Oil & Gas represented the largest industry segment, contributing 29.5% of the total market in 2025.

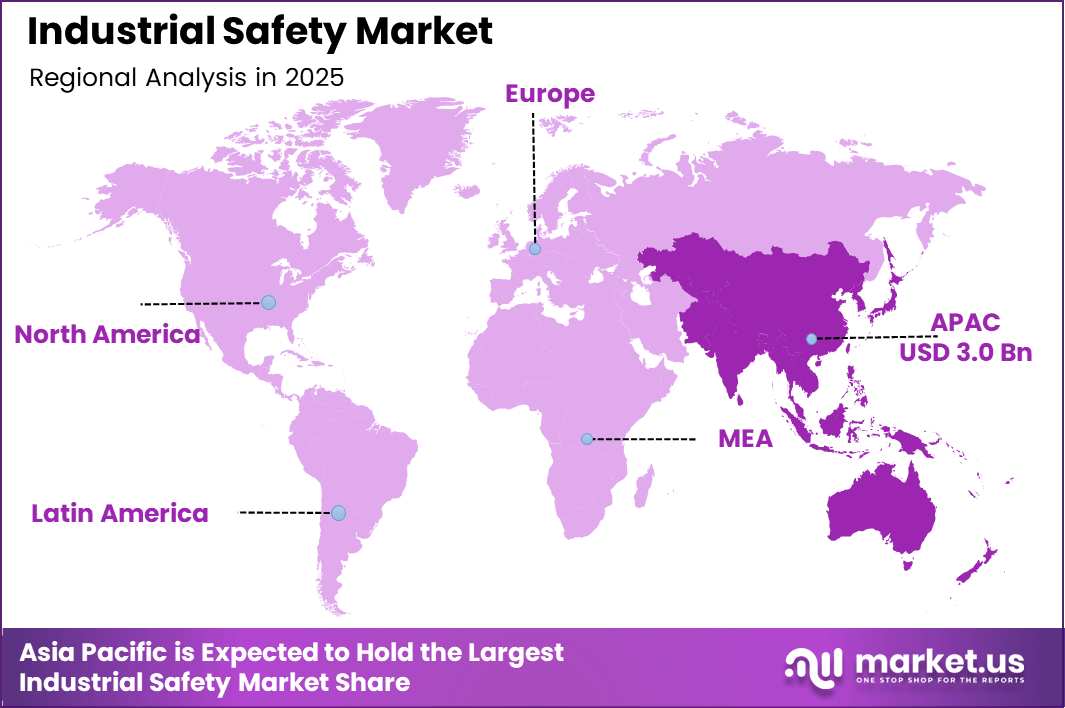

- Asia Pacific dominated the global market with a share of 43.9%, valued at approximately USD 3.0 billion in 2025.

- North America and Europe together accounted for a significant portion of global demand, supported by mature industrial bases and strict safety regulations.

- The market outlook through 2035 remains supported by industrial automation growth, regulatory enforcement, and expanding high-risk industrial operations.

By Type Analysis

Worker Safety dominates with 62.8% due to rising regulatory pressure, workforce protection mandates, and growing emphasis on occupational health compliance.

In 2025, Worker Safety held a dominant market position in the By Type Analysis segment of the Industrial Safety Market, with a 62.8% share. This dominance reflects increasing enforcement of workplace safety regulations and heightened awareness of employee wellbeing. Organizations increasingly prioritize personal protective systems, safety training, and monitoring solutions to reduce injury-related downtime.

Machine Safety represents the other critical sub-segment within this category. It focuses on safeguarding equipment, production lines, and automated machinery from operational hazards. As automation increases, machine safety solutions support accident prevention, equipment integrity, and uninterrupted production, making them essential for manufacturers seeking operational consistency and regulatory alignment.

By Component Analysis

Presence Sensing Safety Sensors dominate with 34.3% driven by their critical role in real-time hazard detection and automated shutdown mechanisms.

In 2025, Presence Sensing Safety Sensors held a dominant market position in the By Component Analysis segment of the Industrial Safety Market, with a 34.3% share. These sensors enable immediate detection of human presence near hazardous zones, supporting fast response and accident prevention across automated and semi-automated industrial environments.

Safety Controllers, Modules, and Relays play a central role by coordinating safety inputs and executing protective actions. They ensure compliance with safety logic requirements and provide reliability in complex industrial systems where multiple safety signals require accurate interpretation and response.

Programmable Safety Systems offer flexibility by allowing customized safety logic for diverse operational conditions. These systems support scalability, making them suitable for facilities undergoing modernization or frequent process changes while maintaining consistent safety performance.

Safety Interlock Switches restrict access to hazardous areas during operation, while Emergency Stop Controls and Two-Hand Safety Controls provide immediate manual intervention. The Others category includes auxiliary safety devices that enhance layered protection strategies across industrial facilities.

By Industry Analysis

Oil & Gas dominates with 29.5% due to high-risk operations, strict safety compliance requirements, and capital-intensive infrastructure.

In 2025, Oil & Gas held a dominant market position in the By Industry Analysis segment of the Industrial Safety Market, with a 29.5% share. This leadership reflects hazardous operating conditions, stringent regulatory oversight, and continuous investment in safety systems to prevent catastrophic incidents.

Energy & Power industries rely on industrial safety systems to manage high-voltage equipment and continuous operations. Safety solutions support grid stability, workforce protection, and compliance across generation, transmission, and distribution environments.

Chemicals, Food & Beverages, Aerospace & Defense, Automotive, Semiconductor, and Healthcare & Pharmaceuticals industries adopt safety systems to protect workers and ensure process reliability. Each sector applies tailored safety measures aligned with operational risks and regulatory expectations.

Metals & Mining and Others segments emphasize heavy equipment safety, environmental risk control, and workforce protection. These industries increasingly invest in safety solutions to reduce accident rates, improve compliance performance, and support long-term operational sustainability.

Key Market Segments

By Type

- Machine Safety

- Worker Safety

By Component

- Presence Sensing Safety Sensors

- Safety Controllers/Modules/Relays

- Programmable Safety Systems

- Safety Interlock Switches

- Emergency Stop Controls

- Two-Hand Safety Controls

- Others

By Industry

- Oil & Gas

- Energy & Power

- Chemicals

- Food & Beverages

- Aerospace & Defense

- Automotive

- Semiconductor

- Healthcare & Pharmaceuticals

- Metals & Mining

- Others

Drivers

Stringent Occupational Health and Safety Compliance Mandates Across High-Risk Industries Drive Market Growth

Industrial safety demand continues rising as governments enforce strict occupational health and safety rules across high-risk industries. Sectors such as oil and gas, chemicals, mining, and heavy manufacturing face constant inspections and compliance audits. As a result, companies invest in safety systems to meet legal standards and avoid operational shutdowns.

At the same time, the rising cost of workplace accidents strongly influences safety spending decisions. Injuries, fatalities, and equipment damage increase insurance premiums, legal expenses, and production losses. Therefore, organizations prioritize preventive safety investments to reduce long-term financial exposure and operational disruptions.

Moreover, the expansion of hazard-prone industrial operations strengthens market demand. Growth in oil and gas exploration, chemical processing, and large infrastructure projects increases exposure to safety risks. Consequently, industrial operators adopt structured safety solutions to control hazards and protect both personnel and assets.

Additionally, increasing employer accountability accelerates adoption. Legal frameworks now place direct responsibility on employers for worker safety outcomes. This shift drives management teams to integrate safety systems into core operational planning rather than treating safety as a secondary requirement.

Restraints

High Initial Capital Requirement for Integrated Industrial Safety Systems Limits Adoption

One major restraint in the Industrial Safety Market involves the high upfront cost of integrated safety systems. Advanced sensors, controllers, and monitoring platforms require significant capital investment. For many organizations, especially cost-sensitive operators, these expenses delay or reduce large-scale safety upgrades.

Smaller facilities and regional manufacturers often struggle to justify immediate returns on safety investments. While long-term benefits remain clear, short-term budget pressures limit purchasing decisions. As a result, safety adoption progresses unevenly across different industry sizes and geographies.

Another challenge arises from the complexity of retrofitting safety solutions into legacy infrastructure. Many industrial plants operate with aging equipment not designed for modern safety integration. This increases installation time, engineering effort, and operational downtime during upgrades.

Consequently, organizations may postpone safety modernization projects. These technical barriers restrain faster market penetration, particularly in traditional manufacturing hubs with long-established production systems.

Growth Factors

Rapid Industrialization in Emerging Economies Creates Strong Growth Opportunities

Emerging economies undergoing rapid industrialization present strong growth opportunities for the Industrial Safety Market. New manufacturing plants, energy facilities, and infrastructure projects increasingly incorporate safety systems from the design stage. This supports steady demand for modern safety technologies.

At the same time, smart manufacturing adoption expands safety solution requirements. Automated production lines require real-time hazard detection and machine protection. Therefore, safety systems become essential components within digitally connected factories.

Small and medium enterprises also contribute to growth. Expanding safety compliance requirements push SMEs to adopt basic safety solutions. Governments increasingly encourage standardized safety practices, creating new demand across previously underpenetrated segments.

Additionally, rising investments in industrial modernization and plant automation strengthen market potential. As companies upgrade operations, safety integration becomes a necessary part of productivity and efficiency improvements.

Emerging Trends

Integration of Industrial Safety Systems with Digital Manufacturing Platforms Shapes Market Trends

A key trend in the Industrial Safety Market involves integrating safety systems with digital manufacturing platforms. Safety data increasingly connects with production monitoring systems, improving visibility and decision-making across industrial operations.

Predictive safety analytics adoption continues rising as organizations seek early risk identification. Data-driven insights help prevent incidents before they occur, supporting proactive safety management rather than reactive responses.

Another trend involves centralized safety monitoring across multi-site facilities. Large enterprises manage safety performance from unified control centers, ensuring consistent standards and faster response times across geographically dispersed operations.

Additionally, wireless safety sensors gain popularity in harsh industrial environments. These solutions simplify installation, reduce wiring complexity, and improve safety coverage in challenging operational conditions.

Regional Analysis

Asia Pacific Dominates the Industrial Safety Market with a Market Share of 43.9%, Valued at USD 3.0 Billion

Asia Pacific leads the Industrial Safety Market, accounting for a dominant 43.9% share and a valuation of USD 3.0 billion. This dominance is driven by rapid industrialization, expanding manufacturing bases, and large-scale infrastructure development. Governments across the region continue strengthening occupational safety regulations to reduce workplace accidents. As a result, demand for industrial safety systems steadily increases across factories, energy projects, and process industries.

North America Industrial Safety Market Trends

North America represents a mature yet steadily evolving Industrial Safety Market. Strong regulatory enforcement and a high focus on worker protection drive consistent adoption of safety systems. Industries increasingly integrate digital safety solutions to enhance compliance and operational efficiency. Continuous modernization of industrial facilities further supports regional market stability.

Europe Industrial Safety Market Trends

Europe maintains a strong position due to strict labor safety laws and well-established industrial standards. Manufacturers prioritize safety compliance to meet regulatory expectations and sustainability goals. The region also shows growing adoption of advanced safety technologies aligned with automation and smart manufacturing initiatives.

United States Industrial Safety Market Trends

The U.S. market benefits from stringent occupational safety enforcement and a high concentration of advanced industrial operations. Companies invest in safety systems to reduce liability risks and ensure workforce protection. Increasing adoption of automated production lines further supports demand for machine and worker safety solutions.

Middle East and Africa Industrial Safety Market Trends

The Middle East and Africa region shows growing demand driven by oil and gas projects, mining activities, and infrastructure expansion. Governments increasingly emphasize workplace safety standards to reduce industrial incidents. This shift supports gradual adoption of safety systems across high-risk sectors.

Latin America Industrial Safety Market Trends

Latin America experiences steady growth as industrial activities expand across manufacturing, energy, and construction sectors. Regulatory improvements and rising awareness of worker safety encourage adoption of industrial safety solutions. Investments in industrial modernization further support long-term market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Industrial Safety Company Insights

In 2025, the Industrial Safety Market continues to be shaped by established leaders with strong technological foundations and comprehensive safety portfolios.

Schneider Electric maintains its competitive edge through integrated safety solutions that combine automation, energy management system, and digital monitoring. Its focus on predictive maintenance and IoT-enabled safety platforms enhances operational reliability for industrial customers, enabling reduced downtime and improved compliance across complex industrial environments.

Honeywell International remains a pivotal force in the industrial safety landscape with a diversified suite of products spanning personal protective equipment, gas detection systems, and process safety software. Its investments in advanced analytics and connected safety ecosystems help industrial operators proactively identify and mitigate risks. Honeywell’s deep domain expertise supports tailored solutions that address regulatory requirements and evolving industry challenges.

ABB strengthens its position through robust automation and electrification technologies that embed safety at the core of industrial processes. By integrating safety logic with control systems and robotics, ABB enables seamless protection mechanisms that improve both worker safety and productivity. Its commitment to digital transformation, including cloud-based safety analytics, empowers customers to optimize performance while managing risk more effectively.

Rockwell Automation Inc. drives innovation in industrial safety by aligning its safety offerings with smart manufacturing trends and Industry 4.0 initiatives. The company’s emphasis on scalable safety architectures and real-time data insights supports flexible manufacturing and adaptive risk management. Rockwell’s collaborative approach with clients fosters customized safety frameworks that elevate resilience and operational excellence across diverse industrial sectors.

Top Key Players in the Market

- Schneider Electric

- Honeywell International

- ABB

- Rockwell Automation Inc.

- Siemens

- HIMA

- Yokogawa Electric Corp.

- Emerson Electric Co.

- Baker Hughes

- Omron Corporation

Recent Developments

- June 19, 2024 – EHS Partnerships Ltd. (EHSP), a full-service environmental and occupational health and safety consulting firm, joined Bravo Target Safety, a national industrial safety services provider, strengthening Bravo Target’s capabilities in EHS consulting, regulatory compliance, and workforce safety management across industrial operations.

- October 2025 – Ideagen, a global software provider for regulated and high-compliance industries, acquired SafetyStratus, a Texas-based enterprise EHS software company, expanding Ideagen’s digital portfolio in environmental, health, safety, and risk management solutions for complex industrial environments.

Report Scope

Report Features Description Market Value (2025) USD 7.0 billion Forecast Revenue (2035) USD 12.9 billion CAGR (2026-2035) 6.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Machine Safety, Worker Safety), By Component (Presence Sensing Safety Sensors, Safety Controllers/Modules/Relays, Programmable Safety Systems, Safety Interlock Switches, Emergency Stop Controls, Two-Hand Safety Controls, Others), By Industry (Oil & Gas, Energy & Power, Chemicals, Food & Beverages, Aerospace & Defense, Automotive, Semiconductor, Healthcare & Pharmaceuticals, Metals & Mining, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Schneider Electric, Honeywell International, ABB, Rockwell Automation Inc., Siemens, HIMA, Yokogawa Electric Corp., Emerson Electric Co., Baker Hughes, Omron Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schneider Electric

- Honeywell International

- ABB

- Rockwell Automation Inc.

- Siemens

- HIMA

- Yokogawa Electric Corp.

- Emerson Electric Co.

- Baker Hughes

- Omron Corporation