Global Industrial Labels Market Size, Share, Growth Analysis By Substrate Material (Paper Labels, Plastic Labels, and Metal Labels), By Printing Technology (Flexographic Printing, Offset Printing, Digital Printing, Gravure Printing, Screen Printing, Letterpress Printing, and Others), By Adhesion Type (Pressure-Sensitive, Glue-Applied, Shrink Sleeves, In-Mould, and Others), By Label Category (Linerless, and With Liner), By End-Use (Transportation & Logistics, Automotive, Food & Beverages, Personal Care & Cosmetics, Consumer Goods, Electronics & Electrical Equipment, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164853

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Substrate Material Analysis

- Printing Technology Analysis

- Adhesion Type Analysis

- Label Category Analysis

- End-Use Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Geopolitical Impact Analysis

- Regional Analysis

- Key Industrial Labels Company Insights

- Recent Developments

- Report Scope

Report Overview

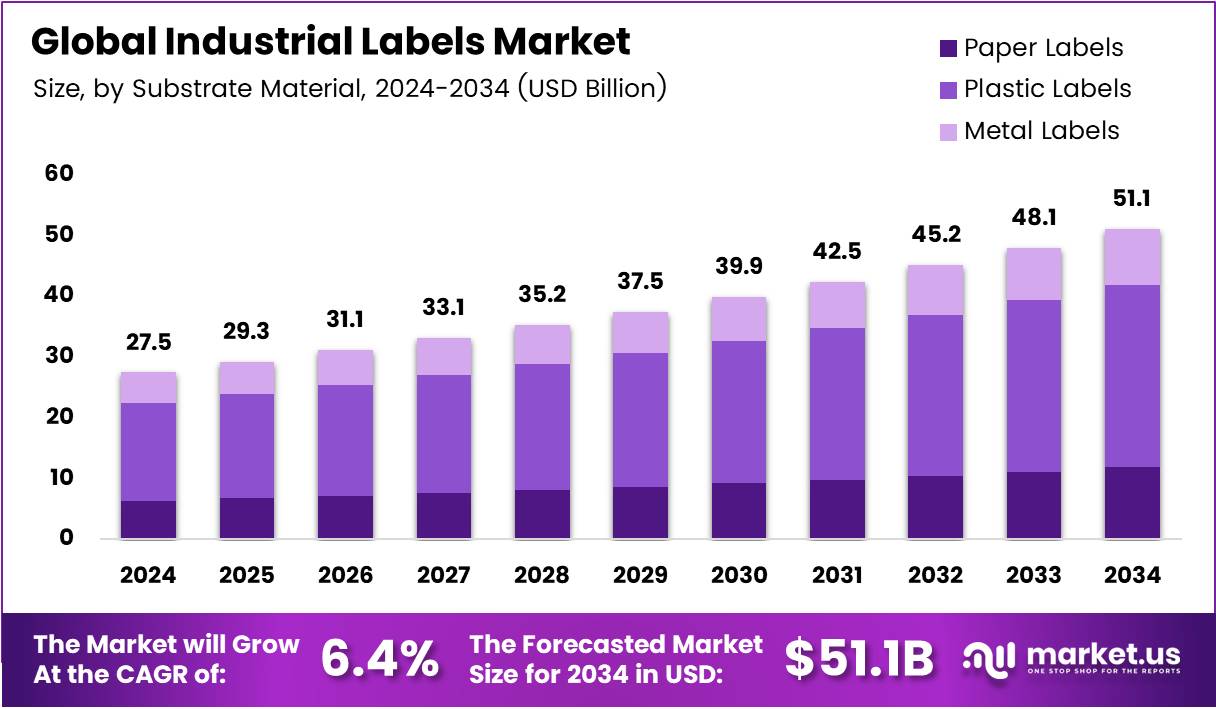

In 2024, the Global Industrial Labels Market was valued at US$27.5 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 6.4%, reaching about US$51.1 billion by 2034.

Industrial labels are durable, specialized labels designed for harsh environments to convey critical information such as product identification, safety warnings, and compliance details. The primary use of an industrial label is to identify equipment and provide visual or textual information regarding use or risks.

They are made from resilient materials with strong adhesives to withstand harsh conditions, ensuring long-term legibility. They are made to withstand a wide range of environmental factors, including exposure to chemicals, solvents, UV light, water, and extreme temperatures.

One of the crucial drivers of the industrial labels is that they allow the consumer to trace the product back to the manufacturer and help monitor the lifecycle of the product. As the relevance of e-commerce increases, traceability and product lifecycle management play a key role.

In recent years, technological advancements, such as the use of bar codes and RFID tags, have been the focus area of manufacturers in the industry. However, as there are no standard international laws regarding industrial labels, it becomes difficult for manufacturers to comply with the patchwork of different regional laws for a single product

Key Takeaways

- The global industrial labels market was valued at US$27.5 billion in 2024.

- The global industrial labels market is projected to grow at a CAGR of 6.4% and is estimated to reach US$51.1 billion by 2034.

- Based on the substrate material, the plastic labels dominated the market, with around 58.7% of the total global market.

- On the basis of printing technology, flexographic printing held a major share of the market, approximately 32.7%.

- In 2024, the adhesion type that was most used for industrial labels was pressure-sensitive, which comprised over 37.9% of total global consumption.

- Based on label category, labels with liner dominated the industrial label market, with a substantial market share of 69.8%.

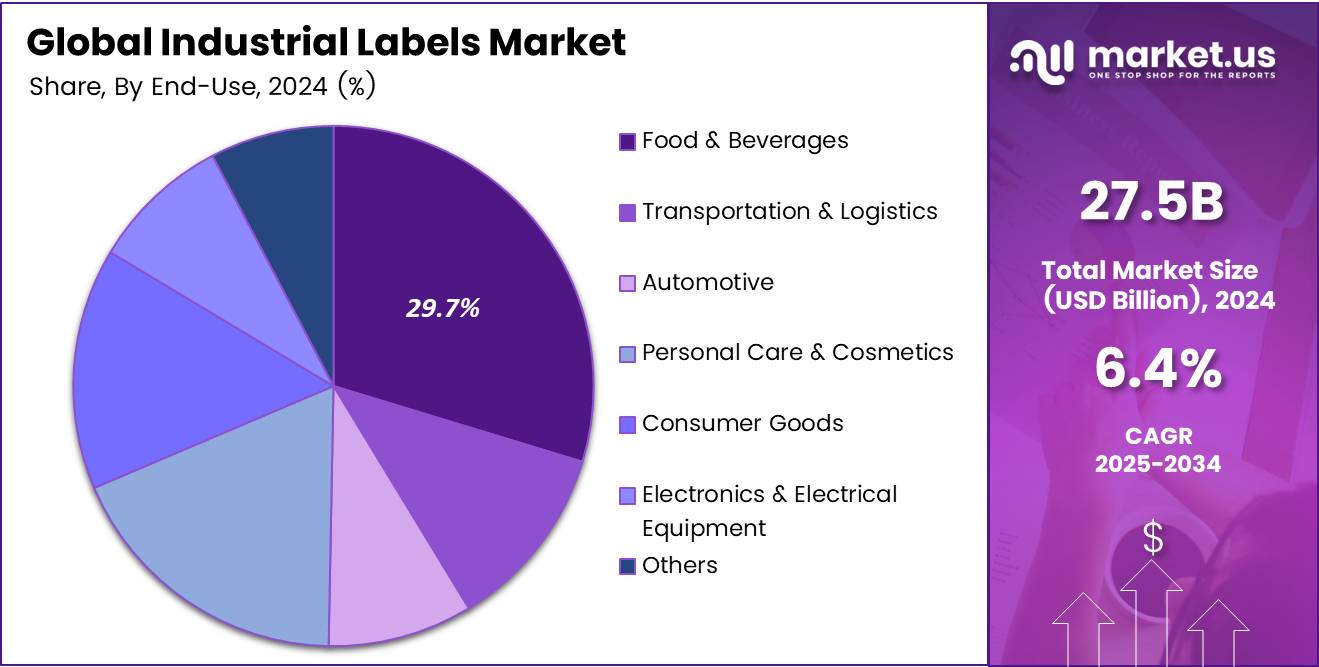

- Among the end uses of industrial labels, the food & beverages sector emerged as a major segment in the market, with 29.7% of the market share.

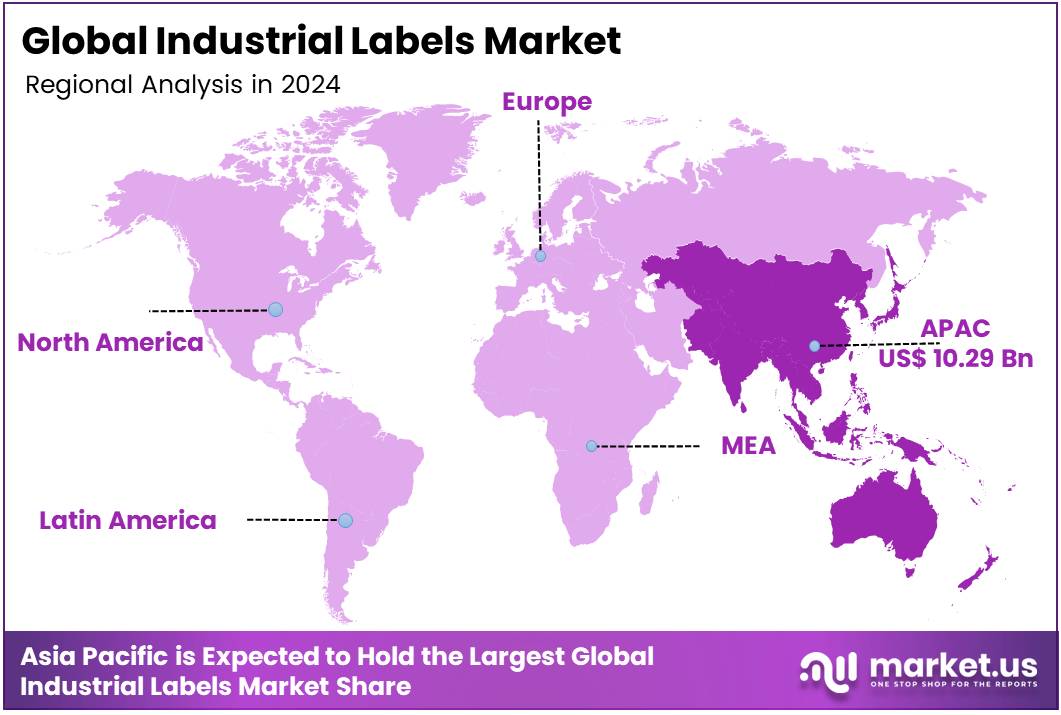

- In 2024, the Asia Pacific was the most dominant region in the industrial labels market, accounting for around 37.4% of the total global consumption.

Substrate Material Analysis

Plastic Labels Dominated the Industrial Labels Market in 2024.

The industrial labels market is segmented based on substrate material into paper labels, plastic labels, and metal labels. The plastic labels dominated the market, comprising around 58.7% of the market share. They are more widely used than paper or metal industrial labels as they offer superior durability, flexibility, and resistance to harsh environmental conditions. Unlike paper labels, which can tear or degrade when exposed to moisture, chemicals, or extreme temperatures, plastic labels remain intact and legible for extended periods.

In addition, they are lighter and more cost-effective than metal alternatives while providing excellent print quality for barcodes, QR codes, and safety information. Additionally, plastics such as polyester, polypropylene, and vinyl can be customized with strong adhesives and protective coatings, making them ideal for industrial applications that demand long-lasting identification on machinery, containers, and outdoor equipment.

Printing Technology Analysis

Flexographic Printing Held Major Share of the Market in 2024.

Based on the printing technology, the industrial labels market is segmented into flexographic printing, offset printing, digital printing, gravure printing, screen printing, letterpress printing, and others. The flexographic printing led the market, comprising around 32.7% of the market share. Most industrial labels are printed using flexographic printing as it offers exceptional speed, versatility, and cost efficiency for large-scale production.

Flexography uses flexible relief plates and quick-drying inks that adhere well to a wide range of materials, including plastic films, foils, and paper, making it ideal for industrial labeling. Unlike offset or gravure printing, flexography allows for continuous printing on rolls, reducing downtime and material waste.

Additionally, it supports water-based and UV-curable inks, enabling environmentally friendly production and resistance to harsh conditions. Moreover, modern flexographic presses provide high-quality, consistent output suitable for barcodes, safety symbols, and variable data, making the process highly adaptable for diverse industrial labeling needs.

Adhesion Type Analysis

Pressure-sensitive Adhesion is Utilized for Most Industrial Labels.

On the basis of adhesion type, the industrial labels market is divided into pressure-sensitive, glue-applied, shrink sleeves, in-mould, and others. The pressure-sensitive adhesion is utilized for most industrial labels, constituting around 37.9% of the market share. Most industrial labels use pressure-sensitive adhesion as it offers unmatched convenience, versatility, and strong bonding across various surfaces without requiring additional equipment or processes.

Unlike glue-applied labels, pressure-sensitive labels come ready to apply, allowing quick and easy application even on irregular or textured surfaces. They adhere firmly with just pressure, eliminating the need for drying or heating, which makes them ideal for high-speed production lines.

Compared to shrink sleeves or in-mold labels, pressure-sensitive labels are more cost-effective and flexible, as they can be removed or replaced if needed. Their ability to stick to metals, plastics, glass, and other materials under diverse environmental conditions makes them the preferred choice for many industrial labeling applications.

Label Category Analysis

Industrial Labels with Liner Accounted for the Majority of the Market.

The industrial labels market is segmented based on label category into linerless and with liner. The industrial labels with liner dominated the market, comprising around 69.8% of the market share. Industrial labels with liners are more commonly used than linerless labels as the liner provides a protective backing that makes handling, storage, and application easier and cleaner.

The liner prevents the adhesive from sticking prematurely to surfaces or other labels, ensuring that each label maintains its shape and adhesive quality until it is applied. This is especially important in high-speed automated labeling processes where precision and reliability are critical.

Additionally, liners allow for easier printing, cutting, and die-cutting during label production, supporting more complex shapes and designs. While linerless labels reduce waste, the benefits of protection, ease of use, and consistent application make liner-backed labels the preferred choice in many industrial environments.

End-Use Analysis

The Food and Beverage Industry Emerged as a Leading Segment in the Industrial Labels Market.

On the basis of end-use of industrial labels, the market is segmented into transportation & logistics, automotive, food & beverages, personal care & cosmetics, consumer goods, electronics & electrical equipment, and others. Among them, 29.7% of the revenue in the industrial labels market was generated by the food and beverage industry.

Most industrial labels are extensively used in the food and beverage industry as this sector demands strict regulatory compliance, traceability, and branding, which rely heavily on clear, durable labeling. Labels in this industry provide vital information such as ingredients, expiration dates, nutritional facts, and safety warnings that are crucial for consumer protection and quality control.

Additionally, food and beverage products often move through complex supply chains involving storage, transportation, and retail display, requiring labels that withstand moisture, temperature changes, and handling. Compared to industries like automotive or electronics, where labeling may focus more on durability or technical specifications, food and beverage labels must meet a wide range of functional, legal, and marketing needs, driving their higher utilization in this sector.

Key Market Segments

By Substrate Material

- Paper Labels

- Plastic Labels

- Polypropylene

- Polyethylene

- Polyvinyl Chloride

- Others

- Metal Labels

By Printing Technology

- Flexographic Printing

- Offset Printing

- Digital Printing

- Gravure Printing

- Screen Printing

- Letterpress Printing

- Others

By Adhesion Type

- Pressure-Sensitive

- Glue-Applied

- Shrink Sleeves

- In-Mould

- Others

By Label Category

- Linerless

- With Liner

By End-Use

- Transportation & Logistics

- Automotive

- Food & Beverages

- Personal Care & Cosmetics

- Consumer Goods

- Electronics & Electrical Equipment

- Others

Drivers

Traceability and Product Lifecycle Management Drive the Industrial Labels Market.

Traceability and product lifecycle management are key forces propelling the industrial labels market, as industries increasingly rely on accurate identification and monitoring throughout production and distribution.

Labels embedded with advanced technologies enable seamless tracking of components from manufacturing to end-of-life recycling, ensuring quality control and regulatory compliance. For instance, in the automotive industry, every part, from brake pads to engine components, carries a traceable label that links it to production data, improving recall efficiency and counterfeit prevention.

Similarly, in the food and pharmaceutical sectors, traceable labels help maintain safety standards by providing real-time visibility into supply chains, reducing contamination risks. Around 80% of manufacturers globally are now adopting digital labeling systems integrated with enterprise resource planning (ERP) and IoT platforms to enhance lifecycle management. This growing emphasis on traceability ensures accountability and supports sustainability and efficiency across industrial operations.

Restraints

Regulatory Landscape Poses a Challenge to the Industrial Labels Market.

The complex and evolving regulatory landscape presents a significant challenge to the industrial labels market, as manufacturers must comply with stringent labeling standards across different regions and industries. Governments and regulatory bodies enforce detailed requirements related to safety warnings, material composition, environmental impact, and product traceability.

For instance, in the chemical industry, the Globally Harmonized System (GHS) mandates precise hazard labeling to ensure worker safety and environmental protection. Similarly, the food and pharmaceutical sectors face strict labeling rules to prevent misinformation and ensure consumer safety, with penalties for non-compliance reaching millions annually.

Around 60% of labeling errors in manufacturing are linked to frequent regulatory updates or regional variations, highlighting the burden of constant adaptation. Moreover, sustainability regulations are pushing companies to transition from plastic to recyclable or biodegradable label materials, adding to production complexity.

For instance, the European Union’s Packaging & Packaging Waste Regulation proposal (PPWR) is the major directive that dictates the terms of packaging sustainability. Navigating these multifaceted compliance demands requires continuous innovation and flexibility from industrial label producers worldwide.

Growth Factors

Global Trade and E-Commerce Create Opportunities in the Industrial Labels Market.

The rapid expansion of global trade and e-commerce is generating new opportunities in the industrial labels market, as businesses require efficient labeling solutions to manage logistics, inventory, and compliance across borders. With over 22% of total retail sales occurring online worldwide, the demand for accurate product identification, tracking, and delivery information has surged.

- In 2023, there were approximately 2.64 billion digital buyers globally, which signifies that about 33.3% of the world’s population is shopping online.

Industrial labels, featuring barcodes, RFID tags, and QR codes, play a crucial role in streamlining cross-border shipments and preventing errors in order fulfillment. For instance, logistics companies such as DHL and FedEx rely heavily on durable and scannable labels to ensure timely delivery and real-time tracking of millions of parcels daily. Additionally, e-commerce platforms demand specialized labels that can withstand different environmental conditions during transport.

As international trade networks continue to expand and supply chains grow more complex, industrial labeling systems are becoming essential tools for ensuring efficiency, traceability, and customer satisfaction in a globalized marketplace.

Emerging Trends

Increased Demand for Smart Labels

The rising demand for smart labels has become a defining trend in the industrial labels market, driven by the need for enhanced connectivity, real-time tracking, and data-driven decision-making. Smart labels, which integrate technologies such as RFID, NFC, and QR codes, enable instant access to product information and improve supply chain visibility.

For instance, in the electronics industry, smart labels are used to monitor temperature and humidity conditions during shipment, ensuring sensitive components remain within safe parameters. In retail and logistics, over 70% of large-scale distributors now utilize RFID-based labeling systems to automate inventory management and reduce human error.

Additionally, smart labels support sustainability goals by providing digital product passports that inform consumers about sourcing and recyclability. As industries adopt Internet of Things (IoT) technologies, the integration of smart labeling solutions continues to enhance operational efficiency, transparency, and traceability across diverse industrial applications.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Industrial Labels market by Disrupting the Essential Supply Chains in the Market.

The geopolitical tensions are having a notable impact on the industrial labels market, influencing raw material supply, trade dynamics, and manufacturing operations worldwide. Conflicts and trade disputes between major economies, such as the U.S.- China trade friction and ongoing tensions in Eastern Europe and the Middle East, have disrupted supply chains and increased the cost of essential label materials such as adhesives, resins, and specialty papers. Around 40% of label raw materials are sourced through global trade routes that have faced significant slowdowns due to sanctions, shipping restrictions, and energy shortages.

For instance, the disruption of European energy supplies has affected production efficiency in printing and label manufacturing plants that rely on continuous operations. Additionally, shifting trade alliances due to trade wars have led companies to diversify sourcing and relocate production to more politically stable regions in Asia and Latin America.

These transitions have introduced logistical and regulatory challenges, including the need to comply with labeling standards and regional certification requirements. Moreover, heightened focus on national security and product traceability has accelerated the demand for secure and tamper-evident labeling solutions, especially in sectors like defense, pharmaceuticals, and critical electronics.

Regional Analysis

In 2024, the Asia Pacific dominated the global industrial labels market, holding about 37.4% of the total global consumption. The region holds the largest share of the global industrial labels market, driven by rapid industrialization, expanding manufacturing sectors, and strong export activity across the region.

Countries such as China, Japan, South Korea, and India have become major hubs for automotive, electronics, pharmaceuticals, and consumer goods production, all of which rely heavily on durable and efficient labeling solutions. For instance, China alone accounts for nearly 30% of global manufacturing output, creating immense demand for barcoded and RFID-enabled industrial labels to support logistics and traceability.

In India, government initiatives promoting Make in India and digital transformation have accelerated the adoption of smart labeling technologies in factories and warehouses. Additionally, Asia Pacific’s growing e-commerce and logistics networks, handling billions of parcels annually, further boost the need for reliable labeling systems to ensure accuracy and efficiency. This combination of industrial growth, technological advancement, and supply chain expansion solidifies the Asia Pacific’s leadership in the industrial labels market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Industrial Labels Company Insights

The major market players in the industrial labels market are Lintec Corp., Avery Dennison Corp., CCL Industries, Brady Corp., UPM Raflatac, DuPont de Nemours, Brook + Whittle, Multi-Color Corp., Fuji Seal International, Honeywell International, DIC Corp., Skanem Group, SATO Holdings Corporation, Zebra Technologies Corporation, and Weber Packaging Solutions. As the market of industrial labels is a vast market with its applications in various industries, from food to electronics, there are several small players as well operating in the market.

Most of these players invest in research and development to cater to the evolving demands for products such as precision and recyclability. In addition, as there is a consistent demand for industrial labels, various companies focus on the expansion of their manufacturing facilities. Similarly, due to the competitive nature of the market, participants in the market focus on strategic partnerships for distribution, and merger and acquisitions for expanding their portfolios and eliminating competition.

Top Key Players in the Market

- Lintec Corporation

- Avery Dennison Corporation

- CCL Industries Inc.

- Brady Corporation

- UPM Raflatac

- DuPont de Nemours Inc.

- Brook + Whittle Ltd

- Multi-Color Corporation

- Fuji Seal International

- Honeywell International Inc.

- DIC Corporation

- Skanem Group

- SATO Holdings Corporation

- Zebra Technologies Corporation

- Weber Packaging Solutions

- Other Key Players

Recent Developments

- In June 2025, Avery Dennison launched the first RFID label to receive APR Design for Recyclability (DfR) recognition from the Association of Plastic Recyclers (APR), which is a breakthrough in recyclable labeling.

- In January 2025, Brook + Whittle, a leader in sustainable packaging solutions, announced the acquisition of Stouse, LLC, a prominent manufacturer and supplier of high-quality decals, labels, and promotional printed items. The strategic acquisition brought Stouse into the Sprink Division of Brook + Whittle, which also includes Discount Labels, a leading label manufacturer.

Report Scope

Report Features Description Market Value (2024) USD 27.5 Billion Forecast Revenue (2034) USD 51.1 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Substrate Material (Paper Labels, Plastic Labels, and Metal Labels), By Printing Technology (Flexographic Printing, Offset Printing, Digital Printing, Gravure Printing, Screen Printing, Letterpress Printing, and Others), By Adhesion Type (Pressure-Sensitive, Glue-Applied, Shrink Sleeves, In-Mould, and Others), By Label Category (Linerless, and With Liner), By End-Use (Transportation & Logistics, Automotive, Food & Beverages, Personal Care & Cosmetics, Consumer Goods, Electronics & Electrical Equipment, and Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Lintec Corporation, Avery Dennison Corporation, CCL Industries Inc., Brady Corporation, UPM Raflatac, DuPont de Nemours Inc., Brook + Whittle Ltd, Multi-Color Corporation, Fuji Seal International, Honeywell International Inc., DIC Corporation, Skanem Group, SATO Holdings Corporation, Zebra Technologies Corporation, Weber Packaging Solutions, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lintec Corporation

- Avery Dennison Corporation

- CCL Industries Inc.

- Brady Corporation

- UPM Raflatac

- DuPont de Nemours Inc.

- Brook + Whittle Ltd

- Multi-Color Corporation

- Fuji Seal International

- Honeywell International Inc.

- DIC Corporation

- Skanem Group

- SATO Holdings Corporation

- Zebra Technologies Corporation

- Weber Packaging Solutions

- Other Key Players