Global Industrial Diagnostic Tools Market Size, Share, Growth Analysis By Tool Type (Vibration Analyzers, Thermal Imagers, Ultrasonic Testers, Portable Spectrum Analyzers, Others), By End-Use (Manufacturing, Oil & Gas, Power Generation, Automotive and Aerospace, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175977

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

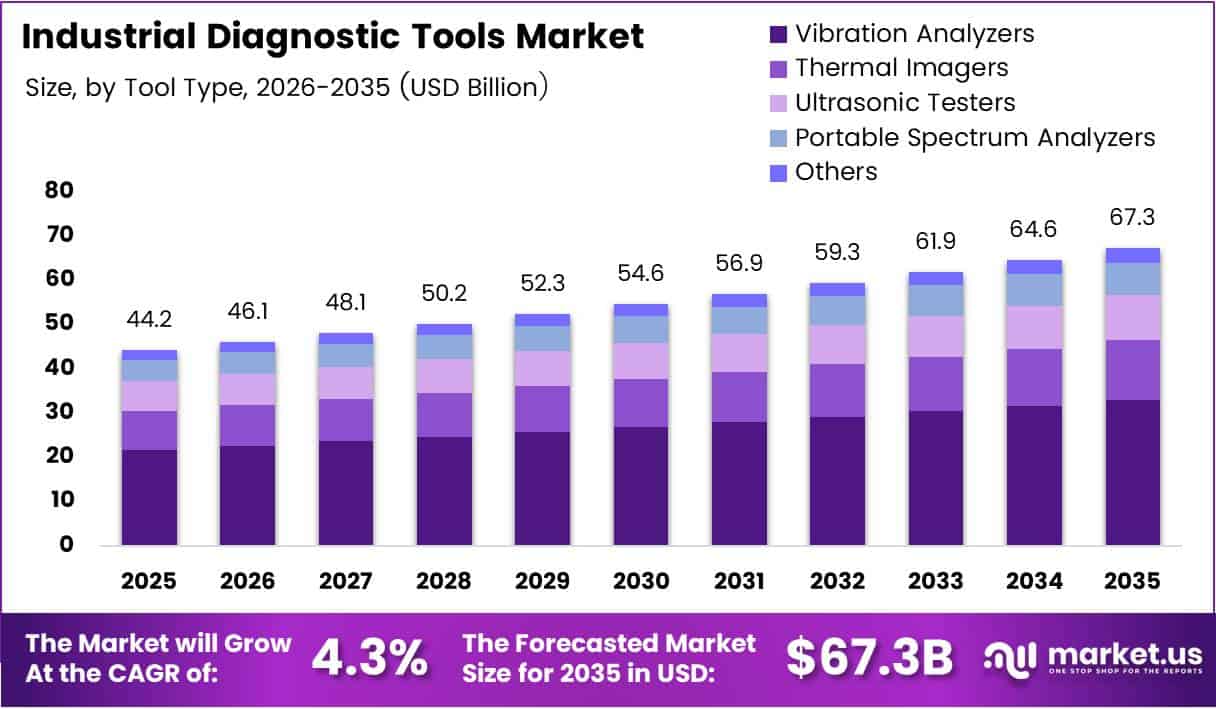

Global Industrial Diagnostic Tools Market size is expected to be worth around USD 67.3 Billion by 2035 from USD 44.2 Billion in 2025, growing at a CAGR of 4.3% during the forecast period 2026 to 2035.

Industrial diagnostic tools enable manufacturers to monitor equipment health and prevent costly failures in production environments. These specialized instruments include vibration analyzers, thermal imaging cameras, ultrasonic testers, and portable spectrum analyzers. Companies deploy these technologies to detect mechanical anomalies, electrical issues, and structural defects before catastrophic breakdowns occur in critical assets.

Predictive maintenance strategies drive market expansion as industries shift from reactive repair approaches to proactive condition monitoring programs. Manufacturing facilities adopt diagnostic solutions to minimize unplanned downtime and optimize maintenance scheduling efficiency. Moreover, these technologies help extend machinery lifespan by identifying wear patterns early, reducing capital expenditure on premature equipment replacements while improving overall asset reliability.

Industrial automation and digitalization initiatives accelerate demand for advanced monitoring platforms across global manufacturing sectors. Factories integrate IIoT sensors with diagnostic systems to enable continuous asset performance tracking and real-time health assessments. Therefore, cloud connectivity and data analytics capabilities become essential features that allow maintenance teams to make informed decisions based on actionable insights.

Government regulations increasingly mandate workplace safety standards and equipment compliance monitoring across industrial operations worldwide. Industries must conduct regular machinery condition assessments to meet occupational health requirements and avoid regulatory penalties. Additionally, environmental policies require organizations to monitor equipment emissions, energy consumption patterns, and potential leak sources through thermal imaging and ultrasonic testing technologies.

Remote monitoring solutions gain significant traction as enterprises seek to reduce on-site inspection costs and improve operational flexibility. Cloud-based diagnostic platforms allow technicians to evaluate equipment conditions from centralized control rooms or mobile devices anywhere. Furthermore, wireless sensor technologies eliminate costly cabling infrastructure while enabling real-time data transmission from hazardous or difficult-to-access industrial environments.

In March 2025, Siemens completed the acquisition of Altair Engineering for approximately $10 billion, significantly enhancing its industrial simulation, AI-powered analytics, and digital twin capabilities for predictive maintenance applications. This strategic consolidation reflects the growing convergence between physical diagnostic hardware and sophisticated enterprise software platforms that deliver comprehensive asset management solutions.

According to Deloitte’s 2025 smart manufacturing survey, industrial investments in connected technologies have delivered up to 20% improvements in production output and 20% gains in employee productivity across participating facilities. These measurable performance improvements demonstrate clear return on investment from condition monitoring implementations.

Moreover, according to KTVZ research, predictive maintenance programs can reduce overall maintenance costs by up to 25% and increase critical equipment uptime by 10-20%, validating the compelling business case for diagnostic tool adoption across manufacturing sectors.

Key Takeaways

- Global Industrial Diagnostic Tools Market projected to reach USD 67.3 Billion by 2035 from USD 44.2 Billion in 2025

- Market expected to grow at 4.3% CAGR during 2026-2035 forecast period

- Vibration Analyzers segment dominates By Tool Type with 34.8% market share in 2025

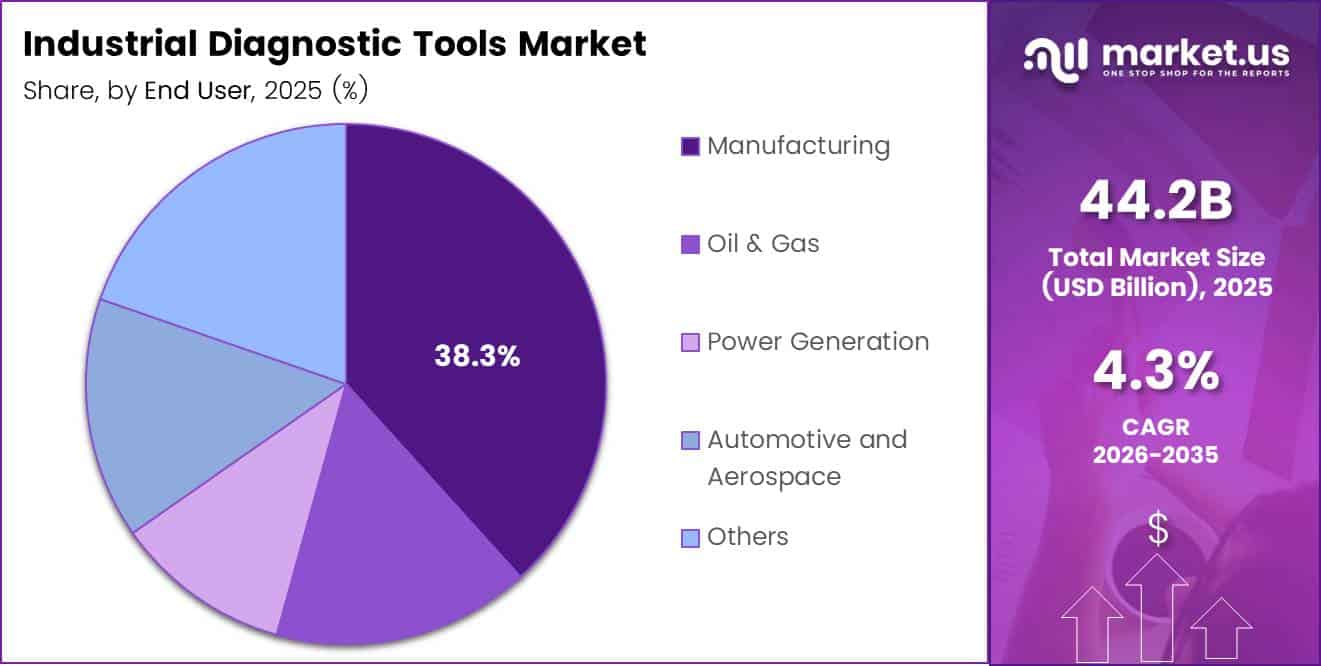

- Manufacturing sector leads By End-Use segment holding 38.3% share in 2025

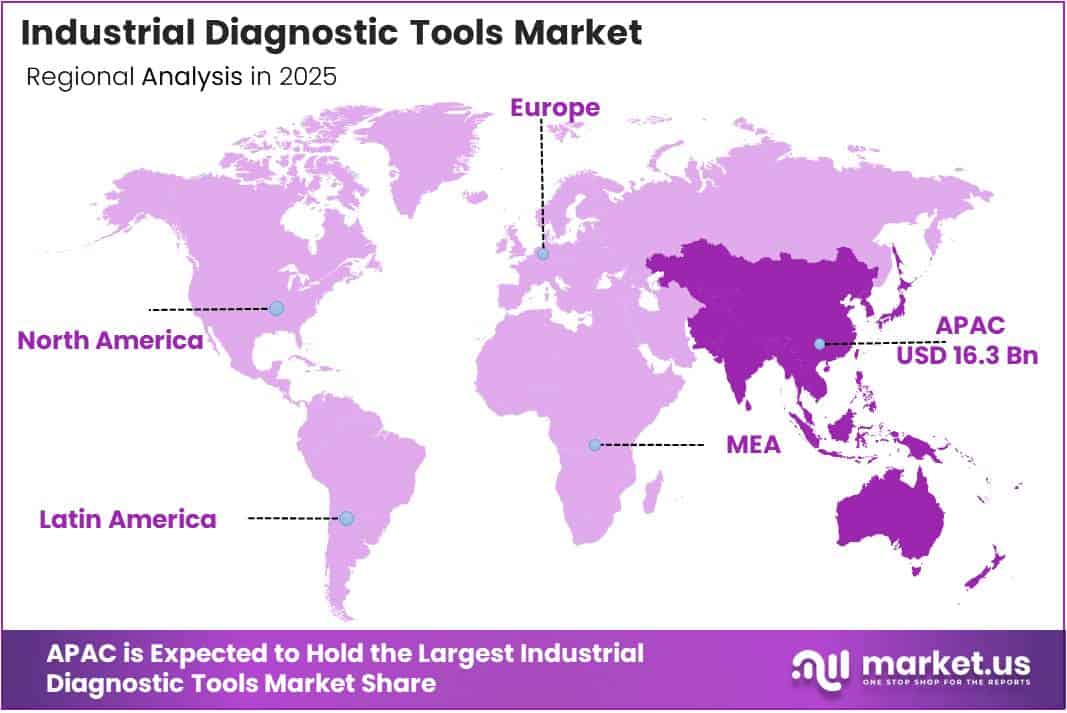

- Asia Pacific region commands largest market position with 36.9% share valued at USD 16.3 Billion

Tool Type Analysis

Vibration Analyzers dominates with 34.8% due to widespread adoption in rotating equipment monitoring.

In 2025, Vibration Analyzers held a dominant market position in the By Tool Type segment of Industrial Diagnostic Tools Market, with a 34.8% share. Manufacturing plants rely on these instruments to detect bearing failures and shaft misalignments early. Consequently, vibration monitoring prevents catastrophic breakdowns in motors, pumps, and compressors across production lines.

Thermal Imagers enable non-contact temperature measurement for electrical inspections and process monitoring. Maintenance teams use infrared cameras to identify hotspots in panels and overheating components. Moreover, these devices detect insulation defects and fluid leaks without shutting down operations.

Ultrasonic Testers identify compressed air leaks, electrical discharge, and mechanical friction issues effectively. Technicians apply ultrasonic technology for condition assessment of valves, steam traps, and bearing lubrication. Additionally, these tools support energy audits by quantifying compressed air losses throughout facilities.

Portable Spectrum Analyzers provide detailed frequency analysis for complex machinery diagnostics and troubleshooting. Engineers utilize spectrum analysis to isolate fault signatures in gearboxes and drive systems. Therefore, these devices complement basic vibration tools with advanced diagnostic capabilities.

End-Use Analysis

Manufacturing dominates with 38.3% due to extensive machinery assets requiring continuous condition monitoring.

In 2025, Manufacturing held a dominant market position in the By End-Use segment of Industrial Diagnostic Tools Market, with a 38.3% share. Production facilities deploy diagnostic instruments across assembly lines, CNC machines, and material handling systems. Consequently, manufacturers minimize unplanned downtime through proactive equipment health management strategies.

Oil & Gas operations demand robust diagnostic solutions for pipeline integrity and refinery equipment monitoring. Upstream and downstream facilities use thermal imaging and ultrasonic testing for leak detection. Moreover, harsh operating environments require ruggedized instruments with explosion-proof certifications.

Power Generation plants utilize diagnostic tools to maintain turbines, generators, and transformer reliability continuously. Utility operators monitor vibration signatures and thermal patterns to prevent outages and ensure grid stability. Additionally, renewable energy installations adopt these technologies for wind turbine and solar inverter maintenance.

Automotive and Aerospace manufacturers implement precision diagnostic equipment for quality control and assembly verification processes. These industries require high-accuracy instruments to meet stringent safety and performance standards. Therefore, diagnostic tools support both production operations and final product testing protocols.

Key Market Segments

By Tool Type

- Vibration Analyzers

- Thermal Imagers

- Ultrasonic Testers

- Portable Spectrum Analyzers

- Others

By End-Use

- Manufacturing

- Oil & Gas

- Power Generation

- Automotive and Aerospace

- Others

Drivers

Rising Adoption of Predictive Maintenance to Reduce Unplanned Industrial Downtime

Industries shift from reactive to predictive maintenance strategies to avoid costly production interruptions. Equipment failures cause significant revenue losses and safety hazards in continuous process operations. Therefore, companies invest in diagnostic tools that forecast component deterioration patterns.

According to KTVZ, 74% of maintenance leads reported less or the same amount of unschedulled downtime in 2025. This statistic demonstrates improved reliability outcomes from condition monitoring programs. Moreover, according to Moldstud, real-time monitoring systems can decrease maintenance costs by up to 30% and improve equipment uptime by approximately 20%, validating diagnostic tool effectiveness.

Manufacturing sectors prioritize asset availability to meet production targets and customer commitments. Diagnostic technologies enable maintenance teams to schedule repairs during planned shutdowns rather than emergency stops. Consequently, predictive approaches optimize spare parts inventory and labor resource allocation.

Restraints

High Initial Investment and Integration Costs for Advanced Diagnostic Systems

Capital expenditure requirements create barriers for small and medium-sized enterprises adopting diagnostic technologies. Comprehensive monitoring solutions demand significant upfront investments in hardware, software, and infrastructure modifications. Moreover, integration with existing control systems requires specialized engineering expertise.

According to Moldstud, implementing data analytics technologies in predictive maintenance can reduce equipment failure rates by up to 30% and increase operational efficiency by up to 20%. However, organizations must justify these benefits against initial deployment expenses and ongoing operational costs.

Budget constraints force companies to prioritize critical assets over plant-wide implementation strategies. Limited return visibility during early adoption phases discourages conservative industrial decision-makers. Additionally, competing capital allocation needs for production expansion often take precedence over maintenance technology upgrades.

Growth Factors

Rapid Deployment of Smart Factories Under Industry 4.0 Transformation Initiatives

Digital transformation programs accelerate diagnostic tool integration across connected manufacturing environments. Industry 4.0 frameworks emphasize data-driven operations and autonomous decision-making capabilities. Therefore, factories deploy sensors and analytics platforms to enable predictive intelligence.

In June 2025, Sensirion Connected Solutions acquired Kuva Systems to expand its methane emissions monitoring and industrial IoT sensing capabilities. This consolidation demonstrates market convergence between environmental compliance and equipment diagnostics. Moreover, according to ArXiv, IoT-enabled smart manufacturing systems can lead to an 18% reduction in energy consumption and a 22% decrease in machine downtime, validating smart factory investments.

Manufacturers pursue comprehensive digitalization strategies that unify diagnostic data with enterprise resource planning systems. Cloud platforms enable centralized monitoring across geographically distributed facilities and supply chain partners. Consequently, organizations achieve holistic visibility into asset performance and production efficiency metrics.

Emerging Trends

Integration of AI and Machine Learning for Automated Fault Detection and Root Cause Analysis

Artificial intelligence transforms diagnostic capabilities from reactive monitoring to autonomous anomaly identification systems. Machine learning algorithms analyze historical data patterns to establish equipment baseline behaviors and detect deviations. Therefore, AI-powered tools reduce dependence on expert technicians for interpretation tasks.

According to KTVZ, 35% of maintenance professionals say they use IIoT sensors extensively, with another 41% testing or considering them. Additionally, 32% of maintenance teams have fully or partially implemented AI solutions across maintenance processes, with 65% expecting to adopt AI in the next 12 months through 2026.

Neural networks enable predictive models that forecast remaining useful life for critical components accurately. Deep learning architectures process vibration signatures, thermal images, and acoustic data simultaneously for comprehensive assessments.

Moreover, according to ArXiv, advanced vibration and machine-learning diagnostic systems have achieved classification accuracy above 97% and mean errors below 1% for key metrics in predictive maintenance models.

Regional Analysis

Asia Pacific Dominates the Industrial Diagnostic Tools Market with a Market Share of 36.9%, Valued at USD 16.3 Billion

In 2025, Asia Pacific held a dominant position with 36.9% market share valued at USD 16.3 Billion. Rapid industrialization across China, India, and Southeast Asian nations drives diagnostic equipment adoption. Moreover, manufacturing expansion and infrastructure development create substantial demand for condition monitoring solutions throughout the region.

North America Industrial Diagnostic Tools Market Trends

North America maintains strong market presence through advanced manufacturing capabilities and early technology adoption rates. United States industrial facilities prioritize equipment reliability and workplace safety compliance requirements. Additionally, oil and gas operations across the region demand sophisticated diagnostic instruments for pipeline and refinery asset management.

Europe Industrial Diagnostic Tools Market Trends

Europe emphasizes sustainability and energy efficiency regulations that encourage predictive maintenance implementations. German automotive and aerospace sectors lead diagnostic technology integration for quality control applications. Furthermore, stringent environmental policies drive thermal imaging and leak detection tool deployments across industrial operations.

Latin America Industrial Diagnostic Tools Market Trends

Latin America experiences growing adoption in mining, petrochemical, and manufacturing industries seeking operational efficiency improvements. Brazil and Mexico represent primary markets with expanding industrial bases and foreign investment inflows. However, economic volatility occasionally constrains capital expenditure budgets for diagnostic system upgrades.

Middle East & Africa Industrial Diagnostic Tools Market Trends

Middle East and Africa regions focus on oil and gas sector applications with harsh environment requirements. Gulf Cooperation Council countries invest heavily in refinery and petrochemical facility monitoring capabilities. Additionally, South African mining operations adopt diagnostic tools to improve worker safety and equipment availability metrics.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Fluke Corporation leads industrial diagnostic equipment markets through comprehensive handheld testing instrument portfolios. The company provides vibration analyzers, thermal imagers, and multimeters trusted by maintenance professionals worldwide. Moreover, Fluke’s ruggedized designs withstand harsh industrial environments while delivering accurate measurements consistently.

SKF combines bearing manufacturing expertise with advanced condition monitoring solutions for rotating equipment applications. Their diagnostic platforms integrate vibration analysis, lubrication management, and alignment tools into unified maintenance ecosystems. Additionally, SKF offers training programs that develop customer technical competencies in predictive maintenance methodologies.

Honeywell International delivers integrated monitoring systems that connect diagnostic sensors with enterprise asset management software platforms. The company leverages industrial Internet of Things capabilities to enable remote equipment surveillance across facilities. Furthermore, Honeywell’s cybersecurity features protect diagnostic data from unauthorized access and manipulation threats.

Siemens provides comprehensive digital twin technologies that simulate equipment behavior alongside real-time diagnostic measurements. Their solutions combine sensor hardware with cloud analytics to predict failures and optimize maintenance schedules. Consequently, Siemens enables manufacturers to achieve higher asset utilization through data-driven decision-making frameworks.

Key players

- Fluke Corporation

- SKF

- Honeywell International

- Siemens

- Emerson

Recent Developments

- December 2024 – ANYbotics raised an additional $60 million to expand global industrial robot deployments and condition monitoring capabilities. This funding supports autonomous inspection robots that perform diagnostic tasks in hazardous environments without human intervention.

- September 2025 – Climate Investment joined as a strategic investor in ANYbotics, lifting total funding above $150 million and supporting autonomous inspection robots and future product rollout. The investment accelerates development of mobile diagnostic platforms for industrial facilities.

- September 2025 – Cadence Design Systems announced its planned acquisition of Hexagon AB’s Design & Engineering business including MSC Software for approximately €2.7 billion, expanding its engineering and simulation tech portfolio with deal expected to close Q1 2026. This transaction strengthens digital twin capabilities for industrial diagnostics.

Report Scope

Report Features Description Market Value (2025) USD 44.2 Billion Forecast Revenue (2035) USD 67.3 Billion CAGR (2026-2035) 4.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tool Type (Vibration Analyzers, Thermal Imagers, Ultrasonic Testers, Portable Spectrum Analyzers, Others), By End-Use (Manufacturing, Oil & Gas, Power Generation, Automotive and Aerospace, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fluke Corporation, SKF, Honeywell International, Siemens, Emerson Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Diagnostic Tools MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Industrial Diagnostic Tools MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Fluke Corporation

- SKF

- Honeywell International

- Siemens

- Emerson