Global Industrial Batteries Market By Type (Lead-Acid Batteries, Lithium-Ion Batteries, Nickel-Cadmium (Ni-Cd) Batteries, Nickel-Metal Hydride (Ni-MH) Batteries, Others), By End-Use (Motive Power, Telecom And Data Communication, Uninterruptible Power Supply (UPS)/Backup, Grid-Level Energy Storage, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122899

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

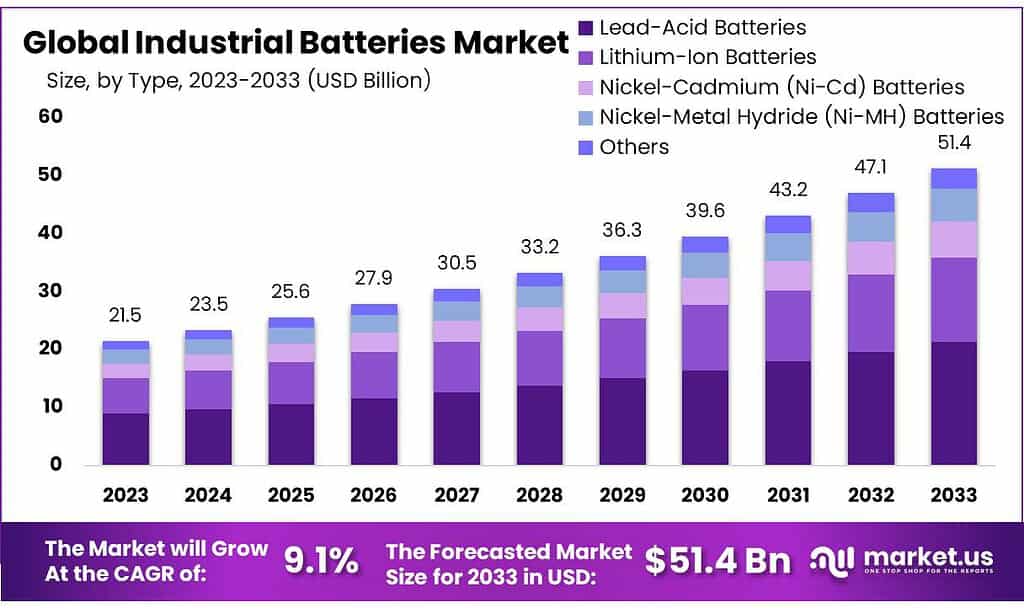

The global Industrial Batteries Market size is expected to be worth around USD 51.4 billion by 2033, from USD 21.5 billion in 2023, growing at a CAGR of 9.1% during the forecast period from 2023 to 2033.

The Industrial Batteries Market encompasses a broad range of battery technologies designed specifically for heavy-duty or high-demand applications across various sectors. As of 2023, this market has become crucial for the operation and efficiency of industries such as telecommunications, energy storage, transportation, and utilities, among others. Industrial batteries differ from consumer batteries in their size, capacity, durability, and costs, as they are engineered to handle larger scales and more rigorous demands.

Lead-acid batteries, known for their reliability and cost-effectiveness, have traditionally dominated the market, particularly in applications requiring large-scale, uninterruptible power supplies and backup power solutions. Lithium-ion batteries are also significantly, valued for their higher energy density and efficiency, which make them suitable for newer industrial applications that require more power and longevity, such as in renewable energy systems and electric vehicles.

Furthermore, the market for industrial batteries is also expanding due to the growing shift towards sustainable and renewable energy sources. Batteries play a vital role in the energy transition by enabling the efficient storage and distribution of renewable energy, thus facilitating a more resilient and flexible energy grid. This transition is supported by continuous advancements in battery technology, which improve the performance, efficiency, and lifecycle of batteries, making them more suitable for a broader range of industrial applications.

Key Takeaways

The global industrial batteries market is expected to grow from USD 21.5 billion in 2023 to USD 51.4 billion by 2033, at a CAGR of 9.1%.

Motive Power held a 32.5% share in 2023, essential for electric vehicles and industrial equipment.

Lead-Acid Batteries held a dominant market position, capturing more than a 41.6% share.

Asia Pacific leads with a 35.6% share, driven by rapid industrialization and urbanization, especially in China and India.

By Type

In 2023, Lead-Acid Batteries held a dominant market position, capturing more than a 41.6% share. This type of battery is favored for its cost-effectiveness and reliability, making it widely used in areas like automotive, UPS systems, and telecommunications for backup power solutions.

Lithium-Ion Batteries are also highly significant in the industrial batteries market, known for their high energy density and longer lifecycle, which make them ideal for more demanding applications such as electric vehicles and renewable energy storage systems.

Nickel-Cadmium (Ni-Cd) Batteries have established a niche in the market due to their ability to perform well under harsh conditions and maintain excellent cycle life. These batteries are commonly utilized in railway rolling stock, aviation, and emergency backup systems where durability is crucial.

Nickel-Metal Hydride (Ni-MH) Batteries are appreciated for their lesser environmental impact compared to Ni-Cd batteries and have found their place in applications that require a balance between weight, energy density, and power capacity, such as hybrid cars and medical instruments.

By End-Use

In 2023, Motive Power held a dominant market position in the Industrial Batteries Market, capturing more than a 32.5% share. This segment primarily encompasses batteries used in electric vehicles and industrial equipment, where high-density and long-lasting energy solutions are crucial for operational efficiency.

Telecom & Data Communication is another significant segment, relying heavily on industrial batteries for the consistent and reliable operation of communications infrastructure. These batteries ensure uptime and energy resilience for data centers and telecom facilities, especially in areas prone to power fluctuations.

The Uninterruptible Power Supply (UPS)/Backup segment uses industrial batteries to provide emergency power during unexpected power disruptions, critical for maintaining operations in hospitals, data centers, and financial institutions without interruption.

Grid-Level Energy Storage has seen rapid growth, driven by the increasing integration of renewable energy sources into the grid. Industrial batteries in this segment help stabilize the energy supply and manage load differences by storing excess energy and releasing it as needed.

Key Market Segments

By Type

- Lead-Acid Batteries

- Lithium-Ion Batteries

- Nickel-Cadmium (Ni-Cd) Batteries

- Nickel-Metal Hydride (Ni-MH) Batteries

- Others

By End-Use

- Motive Power

- Telecom & Data Communication

- Uninterruptible Power Supply (UPS)/Backup

- Grid-Level Energy Storage

- Others

Drivers

Transition to Renewable Energy and Electrification

One of the primary drivers of the global industrial batteries market is the accelerating transition towards renewable energy sources and the increasing electrification of transport and industrial activities. This shift is being heavily supported by governmental policies and investments aimed at reducing carbon emissions and promoting energy security.

Governments around the world are actively promoting the adoption of renewable energy technologies, which typically require efficient, large-scale energy storage solutions that industrial batteries can provide. For example, the deployment of lithium-ion batteries in stationary energy storage systems is anticipated to grow significantly, from 1.5 GW in 2020 to an estimated 8.5 GW by 2030. This increase is a direct response to the need for stabilizing the electrical grid as intermittent renewable energy sources like solar and wind become more prevalent.

Additionally, the industrial sector is transforming with the electrification of vehicles and equipment, which relies heavily on advanced battery technology. This includes not only electric vehicles (EVs) but also non-automotive applications like material handling equipment, emergency power systems, and heavy machinery. The growing demand for these batteries is further bolstered by technological advancements and cost reductions, making industrial batteries more competitive and attractive for a broader range of applications.

Moreover, industrial batteries are increasingly being utilized in critical infrastructure to enhance energy efficiency and ensure reliability in power supply, particularly in data centers, telecommunications, and transportation networks. These applications benefit significantly from the advancements in battery technology, including improved energy density and lower costs, which are essential for supporting the ongoing expansion of these sectors.

Government initiatives, such as grants and incentives for clean energy technologies, are also instrumental in driving the market. These policies help offset the initial high costs associated with deploying advanced battery systems and encourage businesses and consumers to invest in new energy technologies.

The combined impact of these factors is creating a robust demand for industrial batteries, positioning them as a crucial component in the global transition towards more sustainable and resilient energy and industrial systems.

Restraints

Supply Chain and Raw Material Challenges

One significant restraint facing the industrial batteries market is the complexity and vulnerability of the supply chain, compounded by the volatility in the availability and price of critical raw materials. Industrial batteries, particularly those using lithium-ion technology, require specific minerals like lithium, cobalt, and nickel, which are subject to price fluctuations and geopolitical tensions.

The global supply chain for these materials is intricate, involving several stages from mining to final battery production. Any disruption at any point, such as geopolitical instability in resource-rich countries or trade restrictions, can lead to significant delays and increased costs.

For example, during the COVID-19 pandemic, the industrial batteries market experienced disruptions in the supply chain, affecting the availability of raw materials and the operation of battery production facilities. This highlighted the market’s vulnerability to external shocks and underscored the need for robust and resilient supply chain strategies.

Furthermore, the extraction and processing of these raw materials raise environmental and ethical concerns, which can lead to regulatory challenges. Governments and regulatory bodies are increasingly scrutinizing mining practices for battery materials, demanding more sustainable and socially responsible sourcing. This scrutiny can lead to tighter regulations that may restrict supply or increase production costs, thereby posing a restraint on market growth.

Additionally, the industrial batteries sector is also facing challenges related to the end-of-life disposal of batteries, which involves handling hazardous materials and ensuring proper recycling processes. The need for efficient recycling technologies and processes to manage battery waste without harming the environment is becoming a critical issue as the volume of spent batteries grows with the expansion of the market.

To overcome these challenges, companies in the industrial batteries market are investing in research and development to find alternative materials and improve recycling technologies. They are also looking to diversify their supply sources and develop more sustainable battery solutions to mitigate these restraints and ensure steady market growth. However, the complexity of these issues means they will remain a significant restraint for the foreseeable future.

Opportunity

Expansion in Electric Vehicle and Energy Storage Sectors

A significant opportunity in the industrial batteries market lies in the burgeoning electric vehicle (EV) sector and the growing need for energy storage solutions, particularly driven by the increasing adoption of renewable energy sources. Governments worldwide are introducing various incentives and regulations to promote the use of electric vehicles and renewable energy, which in turn is fueling the demand for advanced battery technologies.

The rapid expansion of the EV market, supported by government initiatives such as tax credits and grants, is a major driver for the demand for lithium-ion and other high-performance batteries. In the United States, for instance, the administration’s push to increase EV uptake includes substantial investments in EV infrastructure, such as a $7.5 billion allocation to build a national network of EV chargers. This initiative is expected to significantly enhance the demand for batteries, not only for vehicles but also for supporting infrastructure.

Moreover, the integration of renewable energy sources like wind and solar into the national grids necessitates reliable energy storage solutions to manage supply variability and ensure consistent power delivery. Industrial batteries play a crucial role in energy storage systems, helping to stabilize the grid and store excess energy produced during peak production times. The U.S. government’s strategy includes enhancing grid storage capabilities, further supported by the Infrastructure Investment and Jobs Act, which promotes the adoption of energy storage systems.

In addition to these national strategies, global market dynamics indicate a shift towards larger-scale battery storage systems due to the increasing demands of the power sector and industrial applications. This trend is expected to continue growing, with the industrial battery market size anticipated to expand significantly in the coming years.

This growth is facilitated by technological advancements that improve the efficiency, capacity, and cost-effectiveness of batteries. The ongoing research and development in battery technology, partly funded by public investments, are likely to yield innovations that could open up new applications and markets for industrial batteries.

Trends

Increasing Adoption of Lithium-Ion Batteries for Diverse Applications

A significant trend shaping the industrial batteries market is the increasing adoption of lithium-ion batteries across various sectors. This trend is driven by the batteries’ high energy density, efficiency, and longer lifecycles, making them ideal for applications ranging from portable consumer electronics to large-scale energy storage systems.

The rising demand for electric vehicles (EVs) and the expansion of renewable energy installations are key factors fueling this trend. Lithium-ion batteries are crucial in EVs due to their ability to store large amounts of energy, thereby extending the driving range of these vehicles. Governments worldwide are pushing for cleaner transportation solutions, which has led to increased investment in EV infrastructure, further boosting the demand for these batteries.

In the renewable energy sector, lithium-ion batteries are integral to energy storage systems that help stabilize the grid and manage the intermittent nature of renewable sources like solar and wind. These batteries store excess energy generated during peak production times and release it when there is higher demand or lower production, enhancing the reliability and efficiency of renewable energy systems.

Additionally, the development of advanced lithium-ion batteries with improved performance metrics such as enhanced safety, lower costs, and greater energy efficiency continues to expand their applications in industrial settings. These advancements are making lithium-ion batteries a pivotal component in transitioning towards more sustainable and efficient energy and transportation ecosystems.

Regional Analysis

The industrial batteries market demonstrates significant regional variation, with the Asia Pacific (APAC) region leading the global market. APAC accounts for 35.6% of the market share, valued at USD 7.6 billion. This dominance is driven by rapid industrialization and urbanization in countries such as China and India.

In these countries, substantial investments in infrastructure development and the booming manufacturing and automotive sectors have propelled market growth. China’s focus on sustainable energy solutions and India’s extensive infrastructure projects contribute to the region’s leading position.

North America holds a substantial share of the industrial batteries market, driven by the robust manufacturing and automotive industries in the United States and Canada. The region’s market growth is further supported by the increasing adoption of advanced energy storage solutions aimed at improving sustainability and performance. The U.S. leads in promoting renewable energy practices and sustainable solutions.

Europe is another significant market, underpinned by stringent environmental regulations and a strong focus on sustainable energy practices. Key contributors include Germany, France, and the United Kingdom. The region also benefits from the automotive sector’s push towards electric vehicles and renewable energy storage solutions.

The Middle East & Africa region is experiencing moderate growth, supported by increased infrastructure development and energy projects. Large-scale projects, such as the development of smart cities and various initiatives in the UAE, drive demand for industrial batteries. Urbanization and infrastructure development projects in these countries are key drivers of market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The industrial batteries market features several prominent players that contribute significantly to its growth and innovation. Leading companies such as Toshiba International Corporation, East Penn Manufacturing Company, Robert Bosch GmbH, and C&D Technologies, Inc. are recognized for their advanced battery solutions and extensive market reach.

These companies focus on continuous research and development to enhance battery performance, energy efficiency, and lifespan, catering to diverse industrial applications including backup power, telecommunications, and material handling equipment.

Market Key Players

- Toshiba International Corporation

- East Penn Manufacturing Company

- Robert Bosch GmbH

- C&D Technologies, Inc.

- Northstar Battery Company LLC

- GS Yuasa Corporation

- Saft Groupe S.A.

- Enersys Inc.

- Exide Technologies Inc.

- Johnson Controls Inc.

- Exide Industries Ltd.

- Crown Batteries

- East Penn Manufacturing Company

- Leoch International Technology Limited Inc.

- Samsung SDI Co., Ltd.

- LG Chem

- Narada Power

- Vision Group

- Saft Group

- Hoppecke

- Sunlight

- Rolls Battery

Recent Development

In 2023 Samsung SDI Co., Ltd, achieved significant milestones, with annual revenue of KRW 22.7 trillion, driven by a 40% year-on-year growth in its EV battery business.

Crown Batteries In 2023 Monthly revenues reflected a steady increase, starting at $5.2 million in January and reaching $8.4 million by December.

Report Scope

Report Features Description Market Value (2023) US$ 21.5 Bn Forecast Revenue (2033) US$ 51.4 Bn CAGR (2024-2033) 9.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Lead-Acid Batteries, Lithium-Ion Batteries, Nickel-Cadmium (Ni-Cd) Batteries, Nickel-Metal Hydride (Ni-MH) Batteries, Others), By End-Use (Motive Power, Telecom And Data Communication, Uninterruptible Power Supply (UPS)/Backup, Grid-Level Energy Storage, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Toshiba International Corporation, East Penn Manufacturing Company, Robert Bosch GmbH, C&D Technologies, Inc., Northstar Battery Company LLC, GS Yuasa Corporation, Saft Groupe S.A., Enersys Inc., Exide Technologies Inc., Johnson Controls Inc., Exide Industries Ltd., Crown Batteries, East Penn Manufacturing Company, Leoch International Technology Limited Inc., Samsung SDI Co., Ltd., LG Chem, Narada Power, Vision Group, Saft Group, Hoppecke, Sunlight, Rolls Battery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Batteries MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Batteries MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Toshiba International Corporation

- East Penn Manufacturing Company

- Robert Bosch GmbH

- C&D Technologies, Inc.

- Northstar Battery Company LLC

- GS Yuasa Corporation

- Saft Groupe S.A.

- Enersys Inc.

- Exide Technologies Inc.

- Johnson Controls Inc.

- Exide Industries Ltd.

- Crown Batteries

- East Penn Manufacturing Company

- Leoch International Technology Limited Inc.

- Samsung SDI Co., Ltd.

- LG Chem

- Narada Power

- Vision Group

- Saft Group

- Hoppecke

- Sunlight

- Rolls Battery