Global Industrial Automation Market By Component (HMI, Industrial Robots, Sensors, and Other Components), By Control Systems (DCS, PLC, SCADA and Others), By End-User Industry (Oil and Gas, Automotive, Healthcare, Food and Beverages, Chemicals, Energy and Power, Manufacturing and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2024

- Report ID: 59468

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

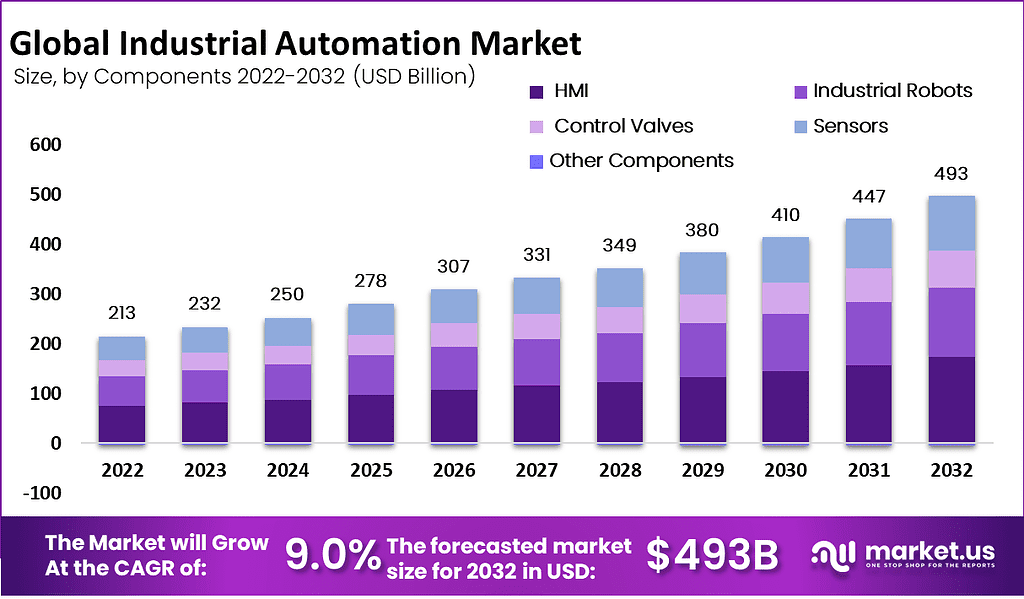

The Global Industrial Automation Systems Market size is expected to be worth around USD 493.0 Billion by 2032 from USD 232.0 Billion in 2023, growing at a CAGR of 9.0% during the forecast period from 2022 to 2032.

The Industrial Automation Systems market encompasses a broad range of technologies and solutions designed to control and monitor industrial processes with minimal human intervention. This market includes components like programmable logic controllers (PLCs), distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, human-machine interfaces (HMIs), and industrial robotics.

These systems streamline manufacturing operations, improve efficiency, reduce errors, and enhance operational flexibility across industries like automotive, food & beverage, oil & gas, pharmaceuticals, and electronics.

Several key factors are driving the growth of the Industrial Automation Systems market. The rapid adoption of Industry 4.0, which emphasizes smart factories and digital transformation, has been a significant catalyst. This transformation is further fueled by advancements in artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), which enhance the functionality of automation systems.

The demand for industrial automation systems is expected to continue growing as industries increasingly shift towards automation to maintain competitiveness. Manufacturing sectors are particularly driving this demand, as companies seek to reduce downtime, enhance precision, and meet the increasing quality standards of a globalized market.

The Industrial Automation Systems market, particularly in the realm of smart factories and the adoption of IIoT (Industrial Internet of Things). Emerging economies in Asia-Pacific, Latin America, and parts of Eastern Europe present substantial growth potential due to industrialization and modernization initiatives.

Governments around the world are increasingly investing in industrial automation to boost the competitiveness of their manufacturing sectors. Investments often target emerging technologies such as artificial intelligence (AI), robotics, and smart manufacturing systems (also known as Industry 4.0).

At the same time, regulations are being introduced to ensure that automation technologies are used responsibly, addressing issues like worker safety, cybersecurity, and data privacy. Additionally, governments provide incentives and grants to encourage small and medium-sized enterprises (SMEs) to adopt advanced manufacturing technologies.

This grant is designed to help manufacturers in Iowa invest in Industry 4.0 technologies, such as hardware or software that supports industrial automation. By offering up to $25,000, the program encourages companies to modernize their operations using the Internet of Things (IoT), which connects machines and devices to improve efficiency and productivity. This grant helps manufacturers stay competitive in the modern market by adopting the latest automation solutions.

As part of the Bipartisan Infrastructure Law, the U.S. government is investing $22 million in the State Manufacturing Leadership Program (SMLP). This funding aims to assist small and medium-sized manufacturers in acquiring smart manufacturing technologies. These include data-driven tools and advanced manufacturing systems, which are essential for improving productivity, sustainability, and competitiveness in a global market.

The National Institute of Standards and Technology (NIST) has launched a $70 million initiative over five years to promote the use of artificial intelligence (AI) in manufacturing. The goal of this competition is to make manufacturing more resilient by leveraging AI to improve processes, reduce downtime, and enhance decision-making. By integrating AI, manufacturers can better respond to disruptions and maintain high levels of productivity in the face of challenges like supply chain disruptions or labor shortages.

Industrial Automation systems refer to the automation of machinery and processes in different industrial sectors using autonomous technologies such as robotics or computer software. Automating 64.2% of manufacturing processes and tasks would allow the manufacturing industry to save 749 billion hours.

The market for Industrial Automation Systems is expected to grow exponentially over the forecast period due to the increasing adoption of process automation technology in various industrial sectors such as automotive, chemical, and energy utilities. An experienced researcher in the field of automation has examined the return on investment, both in tangible and intangible benefits depending on industry and region.

Key Takeaways

- The Industrial Automation Systems Market is expected to be worth around USD 493 Billion by 2032, with a projected compound annual growth rate (CAGR) of 9.0%. In 2023, the market was valued at USD 212.6 Billion.

- Analyst Viewpoint Summary: Industry 4.0 adoption, driven by AI, IoT, and smart manufacturing technologies, will significantly boost industrial automation demand across sectors, particularly in manufacturing and automotive industries.

- Industrial robots dominate the component segment, driven by their widespread use in manufacturing for optimized operations and efficiency.

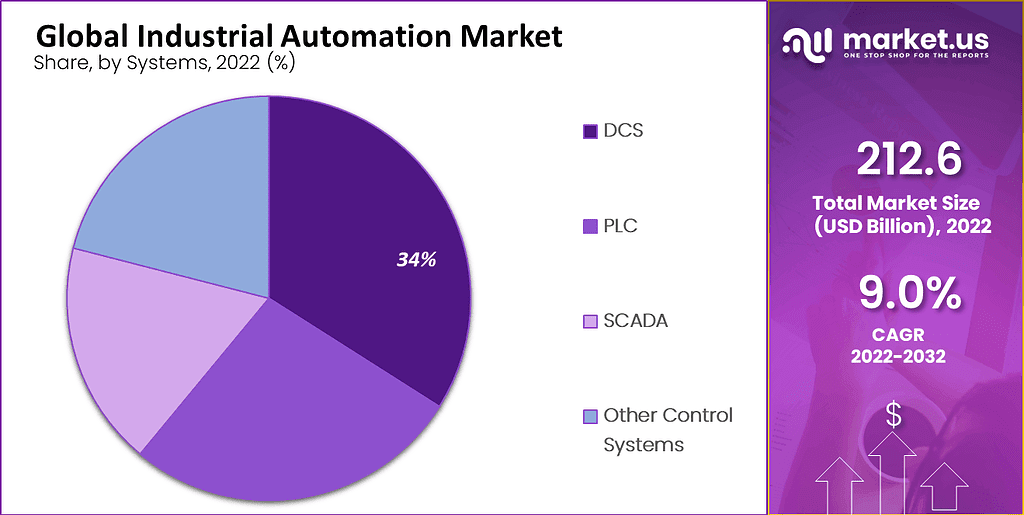

- The Distributed Control Systems (DCS) sub-segment led the control systems market with a 34% share in 2022 due to increasing IIoT adoption.

- The manufacturing sector holds the largest share in the end-user industry segment, driven by automation in factories for enhanced productivity and reduced errors.

- Regional Growth: Asia-Pacific’s 34.5% market share is fueled by automation adoption in manufacturing sectors like automotive and electronics.

- Growth Opportunity: Industry 4.0 adoption, projected to grow at over 16% CAGR through 2030, offers significant growth potential for the industrial automation systems market.

- Restraining Factor: High initial costs and skill gaps hinder widespread adoption of industrial automation, particularly among SMEs.

Component Analysis

Industrial Robots Hold the Major Market Share in the Industrial Automation Market.

The component segment is dominated by industrial robots. This is due to the extensive use by manufacturing companies of industrial robots and state-of-the-art machinery to optimize operations that require speed and strength. An industrial robot is a machine designed to perform production-related tasks in an industrial environment.

Because they can be programmed to perform many types of robotic tasks, industrial robots can be considered flexible automation. Robots are becoming the preferred choice of industrial automation for manufacturers because they are highly effective in increasing productivity and producing high-quality products. They also reduce costs.

These factors are anticipated to uplift the industrial segment in the upcoming years. Automation through robots can reduce the waste of raw materials, labor requirements, and energy consumption. It also allows for smooth, continuous manufacturing workflows, which will drive segment growth.

The sensors are helping the market growth by driving the increased use of sensor technology in new automation technologies and the increased demand from consumers for industrial sensors with enhanced developments. The sensors are used in manufacturing plants for machine processing. They also have better network connectivity, which allows them to improve the Internet of Things (IoT) wireless sensor capabilities. This involves saving data by analyzing the real-time data from the sensors.

HMI is used by control engineers and operators to set parameters or control algorithms in the controller. HMIs also display process status information, historical data, and other information for operators, administrators, managers, and business partners. HMIs are used by engineers and operators to monitor and set parameters, control algorithms, send commands, and adjust or establish parameters in the controller. HMIs also display historical and process information, which is why the HMI is anticipated to grow during the forecast period.

The market’s major components, the maintenance sensors, are equipped with new solutions that will help to increase its growth. Sensors with enhanced options include improved communication and facilitation. This is the key to industrial automation’s lucrative growth.

Control Systems Analysis

The Distributed Control Systems (DCS) segment commands the largest market share in the Industrial Automation Systems Market, accounting for 34% of the total revenue in 2022.

The distributed controls systems (DCS) segment dominated and was responsible for more than 34% of the total market revenue in 2022. DCS is composed of control elements that are distributed throughout a factory or plant. These control elements can include computers, sensors, or controllers.

Each element has a purpose. DCS allows each machine to have its controller, rather than a central control system that controls all machines. DCS includes several local controllers located throughout the factory. The local controllers are connected by a high-speed communications network. Each controller can work independently, but there is a central supervisory control that is run by an operator.

The rapid adoption of IIOT is driving the market growth for DCS. The advent of 5G technology and its adoption by the power sector will also boost the integration of IoT with DCS to improve output efficiency. Due to industry 4.0 adoption, the segment of Supervisory Control and Data Acquisition (SCADA), control system segments are expected to experience a high CAGR of more than 11% over the forecast period. SCADA systems connect local sensors, devices, and PLCs to a remote/virtual server.

You can also save data to a historical database for later analysis. SCADA allows users to interact remotely with it, as well as through operator workstations, HMIs, and directly on the SCADA Server. SCADA controls are used in many industries, including aerospace and defense, automotive, chemical, and energy, as well as healthcare. They can gather real-time data and instantly feed it to the controller systems.

This segment is expected to grow further due to the increased demand from manufacturers for digitalized and smart production processes that increase production efficiency.

PLC is also growing significantly in the control systems segment. PLC is an industrial computer that monitors inputs, and outputs and makes decisions based on the program stored in the PLC’s RAM. PLCs can help reduce human decision-making efforts and increase efficiency. PLCs include internal relays which can work as physical relays and reduce the footprint of relays, driving down costs which helps to drive the industrial automation market growth.

End-User Industry

Manufacturing Covers the Major Market Share in the End-User Segment of the Industrial Automation Market.

Due to the growing trend towards automated manufacturing processes in factories and other industries, the largest market share was held by manufacturing. This segment is expected to grow at a CAGR exceeding 10% during the forecast period of 2023-2032. Automation in manufacturing refers to the use of production software and robotic tools to manage a factory during the manufacture of a product.

These tools can be used to assist businesses in tasks like production planning, inspection, processing, assembly, and inventory management. With technological advances, the range of operations a tool can perform is increasing. Automated systems allow manufacturers to cut down on process time and reduce error rates in their factory processes. These automated systems can be software- or technology-operated and require little to no human intervention. This is expected to increase segment growth during the forecast period.

Healthcare is expected to dominate and account for around 11% of the total market revenue. Healthcare automation refers to a technology system that automates certain parts of healthcare organizations’ workflows. These include both clinical activities as well as non-clinical administrative tasks like scheduling appointments, billing, claims, and scheduling.

Healthcare automation solutions make it possible for healthcare professionals to focus on more important tasks. This is due to the services and consultations offered to patients to address their health concerns, such as curative, palliative, and rehabilitative. Automation and control reduce operational costs and eliminate supply chain errors. They also improve customer service, which allows for better patient care. Automation has allowed doctors to perform surgeries remotely with little human interference, which will drive segment growth.

The automotive industry has a long history of automation. Automakers used industrial robots and sensor technology to improve productivity and efficiency in their assembly plants before other industries looked at automation. Nearly every stage of vehicle manufacturing is automated in most automotive factories. Automation, machine vision, robots, and automation all work together to accomplish a variety of tasks, from welding and assembly to inspection, testing, and maintenance.

Automakers use different levels of automation. Others rely on partially automated processes that automate basic tasks but still allow humans to make final decisions regarding QA and compliance. Some use single automated machines for a specific task or combine them into an automated production line that passes the product from one machine to another.

Key Market Segments

Components

- HMI

- Industrial Robots

- Control Valves

- Sensors

- Other Components

Control Systems

- DCS

- PLC

- SCADA

- Other Control Systems

End-User Industry

- Oil and Gas

- Automotive

- Healthcare

- Food and Beverages

- Chemicals

- Energy and Power

- Manufacturing

- Other End-User Industries

Driver

Adoption of Industry 4.0 Technologies

The adoption of Industry 4.0 technologies is driving a significant transformation in the Industrial Automation Systems (IAS) market, providing the foundation for advanced digitalization and connectivity across manufacturing environments. Industry 4.0, characterized by the integration of cyber-physical systems, the Internet of Things (IoT), and cloud computing, has led to smarter, more efficient manufacturing processes that reduce costs, increase output, and enhance flexibility.

As businesses seek to improve operational efficiency, reduce human error, and meet the demand for customized products, automation solutions are becoming indispensable. One of the central drivers of this growth is the increased deployment of sensors, robotics, and AI-driven systems that facilitate real-time data collection and predictive analytics.

These capabilities empower manufacturers to optimize processes, minimize downtime through predictive maintenance, and increase overall productivity. For instance, IoT-enabled automation systems enable real-time monitoring and diagnostics of equipment, leading to fewer disruptions in production lines.

The global manufacturing sector is increasingly recognizing the need to adopt Industry 4.0 to stay competitive. According to recent industry studies, the global Industry 4.0 market was valued at around USD 140 billion in 2022 and is projected to grow at a CAGR of over 16% through 2030. This widespread adoption is pushing demand for industrial automation systems as companies look to modernize legacy systems and embrace smart manufacturing environments.

Moreover, Industry 4.0 technologies, such as AI and machine learning, are further accelerating automation by enabling systems to self-optimize and adapt to changing conditions without human intervention. This is particularly evident in sectors like automotive, electronics, and pharmaceuticals, where precision and scalability are critical.

The synergy between Industry 4.0 and other technological advancements like 5G and edge computing magnifies this growth. For example, 5G networks allow faster data transmission and enhanced communication between machines, enabling real-time decision-making and further enhancing the capabilities of automated systems.

In conclusion, the adoption of Industry 4.0 technologies not only serves as a direct catalyst for the industrial automation market’s growth but also amplifies the influence of other technological advancements. This results in a highly interconnected and data-driven industrial environment that promises sustained growth for automation systems in the coming years.

Restraining Factors

High Cost and Lack of Skills Affects the Market Negatively.

Although Industrial Automation Systems is cost-effective, the initial capital costs for technology implementation and training employees are high. Due to the fragmentation of the industry, it is difficult to predict the return on investment (ROI).

Small and medium-sized businesses (SMEs) are hesitant about adopting technology due to high upfront costs and unpredictability of the return on investment. Smart manufacturing and government policies such as the Government of India MSME loan scheme and the Make in India movement are likely to overcome these limitations and open up new markets for solutions.

Advanced technologies have been developed for industrial automation. The market growth for industrial automation may be impeded by the increased installation of automation equipment. There is less skill required to use new technologies in industrial automation.

Technology advancements in machines and equipment, as well as the increased use of software systems embedded, require deep knowledge and complete information to perform the task. The market growth in industrial automation may be affected by a lack of skilled workers. Market growth could be impeded by a lack of protocols to communicate with devices. This results in a lack of communication between other devices. These factors are restraining the growth of the industrial automation market.

Growth Opportunities

Rising Demand for Safety Compliance for Both Machines and Humans

One of the most significant growth drivers in the global industrial automation systems market in 2024 is the rising demand for safety compliance, which encompasses both machine safety and human protection. As industries increasingly adopt automation to enhance efficiency and reduce operational costs, ensuring that these systems adhere to stringent safety standards has become crucial. This is especially true for sectors like manufacturing, automotive, and pharmaceuticals, where human-machine interactions are frequent and complex.

In response to this growing need, many regulatory bodies worldwide are tightening safety standards, compelling industries to invest in automation systems that ensure compliance. For instance, ISO 13849 and IEC 62061 standards, which govern the safety of machinery and functional safety of electrical control systems, are being adopted at a rapid pace.

Additionally, the Occupational Safety and Health Administration (OSHA) in the U.S. and similar regulatory bodies in Europe and Asia have set clear guidelines to protect workers from industrial hazards. This compliance imperative creates a significant opportunity for automation solutions providers to offer integrated safety features like real-time monitoring, automated emergency shutdowns, and AI-driven predictive maintenance systems that prevent machine malfunctions.

Automation companies that can deliver enhanced safety capabilities incorporating both hardware and software innovations are well-positioned to capture market share. Safety centric solutions will not only meet compliance requirements but also foster long-term operational reliability, making them a critical area of growth in 2024

Latest Trends

Increased Adoption of Artificial Intelligence and Machine Learning

In 2024, the global industrial automation systems market will see a significant shift driven by the adoption of artificial intelligence (AI) and machine learning (ML). AI and ML technologies are transforming the automation landscape by enhancing the capabilities of industrial systems to perform complex tasks with higher precision, efficiency, and adaptability.

These technologies are expected to play a crucial role in predictive maintenance, where AI algorithms analyze machine data in real-time to predict failures before they occur, reducing downtime and maintenance costs.

Machine learning is also being leveraged to optimize production processes by identifying patterns in massive datasets that would otherwise be too complex for human analysis. By doing so, it enables automation systems to improve operational performance over time, adjusting parameters autonomously to enhance productivity.

Additionally, AI-powered automation systems are enabling advancements in areas such as quality control, where real-time inspection and anomaly detection reduce product defects and wastage.

The benefits of artificial intelligence (AI) and machine learning (ML) extend beyond just efficiency improvements. These technologies are also contributing to the development of more flexible manufacturing systems, allowing for greater customization and scalability in production processes.

As companies seek to remain competitive in a global market, the ability to integrate AI-driven decision-making and machine learning capabilities into their automation strategies will be key in driving innovation and achieving operational excellence. In 2024, AI and ML are poised to become indispensable tools in industrial automation, redefining the future of manufacturing and industrial operations.

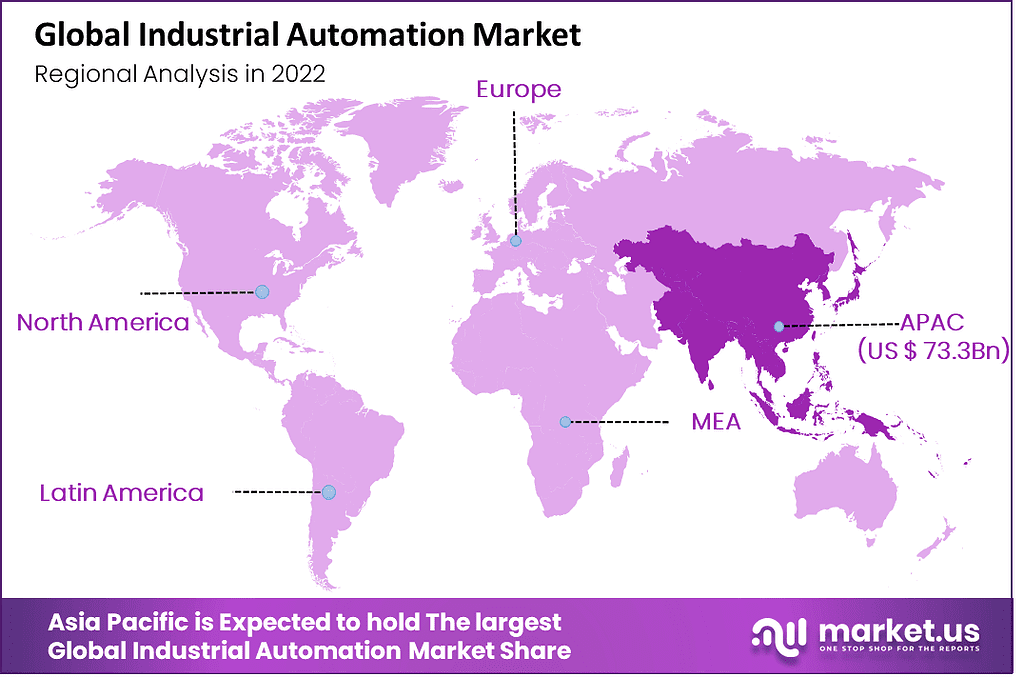

Regional Analysis

Industrial Automation Market Asia-Pacific Leads with 34.5% Market Share

Asia-Pacific holds the largest share of the industrial automation market, accounting for 34.5% of the global revenue. This dominance is driven by rapid industrialization, especially in countries like China, Japan, and South Korea, which are embracing automation to enhance manufacturing efficiencies.

The region’s push for smart factories, coupled with government initiatives like China’s Made in China 2025 and Japan’s focus on robotics, has led to a significant uptick in automation technology adoption. Asia-Pacific’s manufacturing sector, particularly automotive and electronics, has also been pivotal in driving the market, contributing to its leadership position.

North America remains a key player in the industrial automation landscape, with the U.S. and Canada being primary contributors. The region is characterized by strong demand for advanced automation technologies such as artificial intelligence (AI), machine learning (ML), and robotics, particularly in the automotive, aerospace, and defense industries.

The rise of Industry 4.0, coupled with a focus on increasing productivity and reducing labor costs, is propelling automation investments in this region. North America’s robust technological infrastructure supports the adoption of smart manufacturing solutions, further boosting market growth.

Europe continues to show steady growth in the industrial automation market, particularly in countries like Germany, France, and Italy, which have traditionally been strongholds in industrial technology. The European Union’s commitment to sustainability and energy-efficient manufacturing processes is driving demand for automation technologies that reduce operational costs while enhancing efficiency.

The industrial automation market in the Middle East & Africa is growing, albeit at a slower pace compared to more developed regions. However, Gulf countries like Saudi Arabia and the UAE are making significant investments in industrial automation as part of their economic diversification efforts, reducing reliance on oil exports. These nations are focusing on adopting automation in sectors such as oil & gas, construction, and utilities to improve operational efficiency and competitiveness on a global scale.

Latin America is emerging as a potential growth region for industrial automation, with Brazil and Mexico leading the charge. While the region’s adoption rate is still in its early stages compared to other markets, there is a growing emphasis on modernizing manufacturing processes, particularly in automotive and consumer goods. Investments in automation are rising as businesses seek to boost productivity and meet global competitive standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global industrial automation systems market in 2024 is poised for significant growth, driven by advancements in AI, robotics, IoT, and the increasing need for operational efficiency across industries. Among the key players, Siemens AG, ABB Ltd., and Rockwell Automation, Inc. remain dominant, leveraging their extensive product portfolios, innovation in digitalization, and comprehensive automation solutions. Siemens’ integration of AI with industrial processes, especially through its MindSphere platform, positions it as a leader in the digitalization of industrial operations.

ABB Ltd. continues to expand its robotics and automation offerings, with a strong emphasis on collaborative robots (cobots) and AI-enhanced solutions. ABB’s global footprint and partnerships will be critical to its sustained leadership. Rockwell Automation, with its focus on IoT and AI-driven industrial automation, strengthens its market share through advanced control systems and software, such as its FactoryTalk suite.

Mitsubishi Electric and Schneider Electric are pivotal players in energy-efficient automation solutions. Mitsubishi’s focus on factory automation, particularly in Asia, and Schneider’s emphasis on smart manufacturing through EcoStruxure enhance their competitive positions.

Honeywell International and Emerson Electric Co. leverage their strength in process automation for industries like oil and gas, chemicals, and pharmaceuticals, with advanced software solutions and a strong push toward sustainability and energy management.

Kawasaki Heavy Industries and OMRON Corporation stand out for their innovations in robotics, while Yokogawa Electric excels in process control systems. These players are likely to enhance their market positioning through strategic acquisitions and investments in next-gen technologies.

Top Key Players in the Market

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

- Fuji Electric Co., Ltd.

- Other Key Players

Recent Developments

- In April 2023, Emerson made a significant move by buying National Instruments (NI) for $8.2 billion. This purchase has helped Emerson grow its automation business, especially in fast-developing areas like semiconductors, electronics, and transportation. National Instruments is known for its advanced software and systems that perform automated tests and measurements, which complements Emerson’s existing products.

- In 2023, Rockwell introduced new products at the ARC Industry Forum. These include updates to its PlantPAx control system and the introduction of FactoryTalk Optix and FactoryTalk DataMosaix. These new tools are designed to help companies automate more processes and analyze data more effectively, supporting their digital transformation efforts across various industries.

- In 2024, ABB enhanced its AI-driven automation technologies by purchasing Meshmind, a company specializing in AI, machine learning, and vision systems. This acquisition is part of ABB’s strategy to improve its offerings in sectors like logistics and manufacturing. Additionally, at the end of 2023, ABB had acquired Sevensense, a company at the forefront of AI-powered 3D vision for autonomous robots, further strengthening its capabilities in AI-based automation.

Report Scope

Report Features Description Market Value (2023) US$ 232.0 Bn Forecast Revenue (2032) US$ 493.0 Bn CAGR (2023-2032) 9.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component – HMI, Industrial Robots, Control Valves, Sensors, and Other Components; By Control Systems – DCS, PLC, SCADA, Other Control Systems; By End-User Industry – Oil and Gas, Manufacturing, Automotive, Healthcare, Food and beverages, Chemicals, Energy and Power, and Other End-User Industries. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., Emerson Electric Co., Honeywell International, Inc., Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, OMRON Corporation, Rockwell Automation, Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation, Fuji Electric Co., Ltd., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

Industrial Automation Systems MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Automation Systems MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

- Fuji Electric Co., Ltd.

- Other Key Players