Global In-House Banking Platforms Market Size, Share, Industry Analysis Report By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By Application (Cash and Liquidity Management, Payments and Collections, Risk Management, Compliance and Reporting, Others), By End-User (BFSI, Manufacturing, Retail, Healthcare, IT & Telecom, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec.2025

- Report ID: 168912

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- U.S. Market Size

- Component Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- Application Analysis

- End-User Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

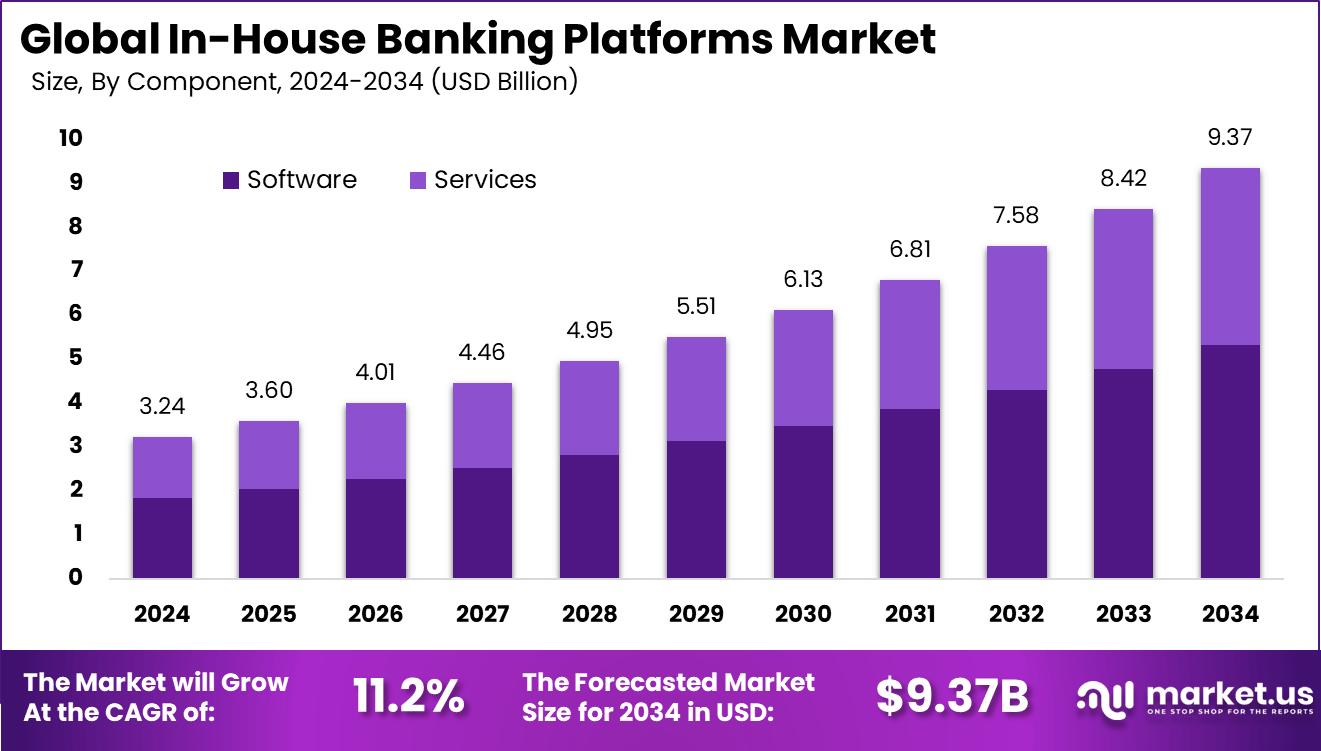

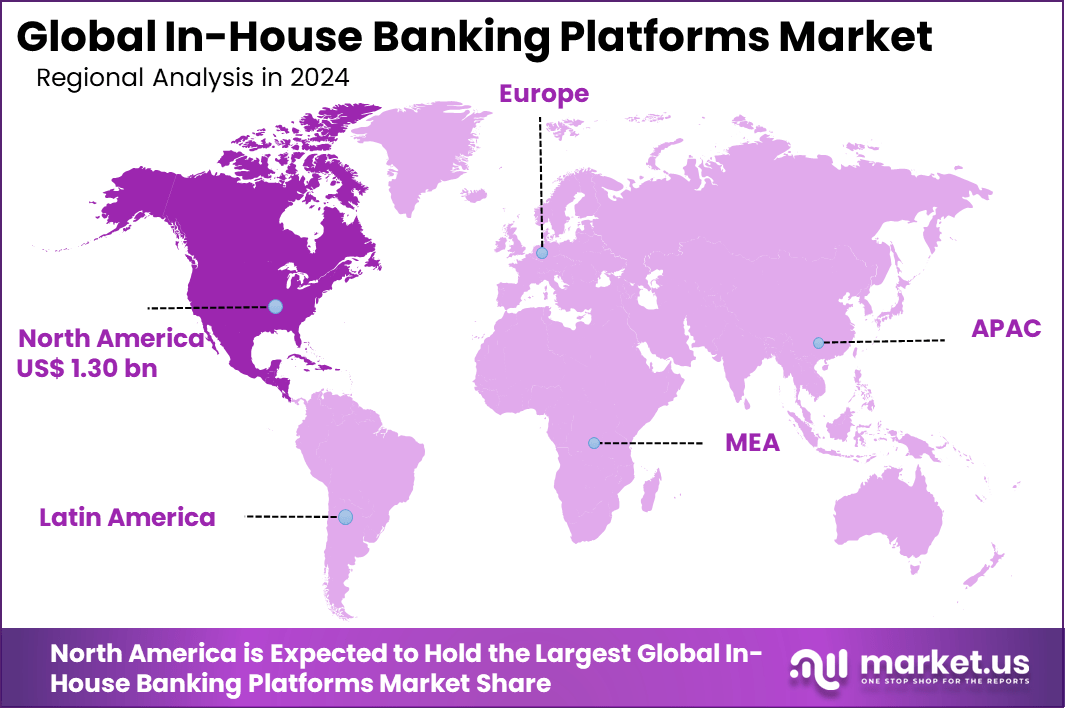

The Global In-House Banking Platforms Market size is expected to be worth around USD 9.37 billion by 2034, from USD 3.24 billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 40.3% share, holding USD 1.30 billion in revenue.

In-house banking platforms act as an internal bank for large companies. They centralize cash management, payments, and loans across subsidiaries in one spot. This setup cuts reliance on outside banks for routine tasks. Firms gain better control over funds with real-time views of flows. About 64% of global groups use this to pool cash and reduce account numbers. It speeds up internal transfers and simplifies tracking. Overall, it boosts financial oversight without extra external fees.

The market for In-House Banking Platforms is driven by the rising need for internal cash control. Banks and large firms build these systems to centralize cash flows across branches and units. This cuts reliance on external lenders, speeds up fund transfers, and gives real-time views on liquidity. Treasury teams handle peaks and shortfalls inside the group, lowering fees and boosting daily operations. Better matching of surplus funds with needs keeps money working harder without outside delays.

A recent study reported that 67% of companies with more than USD 10 Billion in annual sales have already adopted an in-house bank, showing that large enterprises rely on centralized treasury structures to manage financial complexity. The data also showed that adoption rises further among globally diversified firms, with 52% of businesses generating over half of their revenue outside their home country using in-house banking.

Demand rises from frustration with slow external bank services and high cross-border fees. Large firms value instant cash pooling to meet unit needs right away. 71% of multinational companies explore internal banks for liquidity checks, a clear jump lately. Subsidiaries push for quicker access without delays. Growing trade volumes increase the call for efficient internal flows. Mid-size players join in to cut dependency on outside lenders.Businesses seek tools to handle rising payment demands internally.

For instance, in October 2025, SAP joined the U.S. Treasury’s FM QSMO Marketplace with its S/4HANA Cloud, making advanced treasury tools more accessible to government agencies. This step boosts secure financial management for public sector clients while highlighting SAP’s strong position in North American in-house banking solutions. It shows how these platforms are becoming essential for handling complex fiscal operations with real-time accuracy.

Key Takeaway

- The software segment accounted for 56.8% in 2024, showing that most organizations preferred platform-driven systems to manage internal banking operations.

- Cloud-based deployment held 65.3%, reflecting a strong shift toward flexible and scalable infrastructure for treasury and cash functions.

- Large enterprises represented 70.5%, indicating that complex financial workflows continue to push bigger organizations toward in-house banking solutions.

- Cash and liquidity management captured 34.2%, confirming that real-time visibility of funds remains the core priority for adopters.

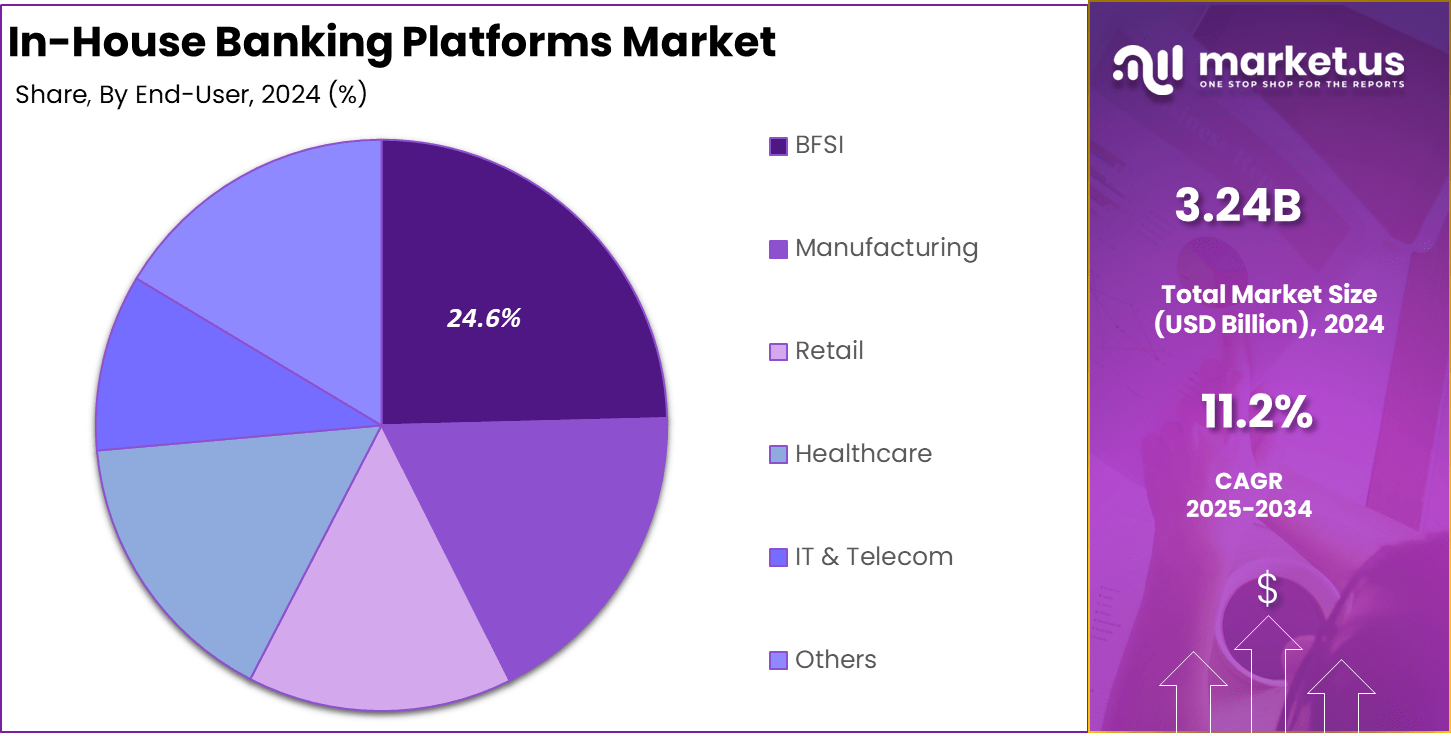

- The BFSI segment recorded 24.6%, supported by rising internal transaction volumes and tighter control requirements.

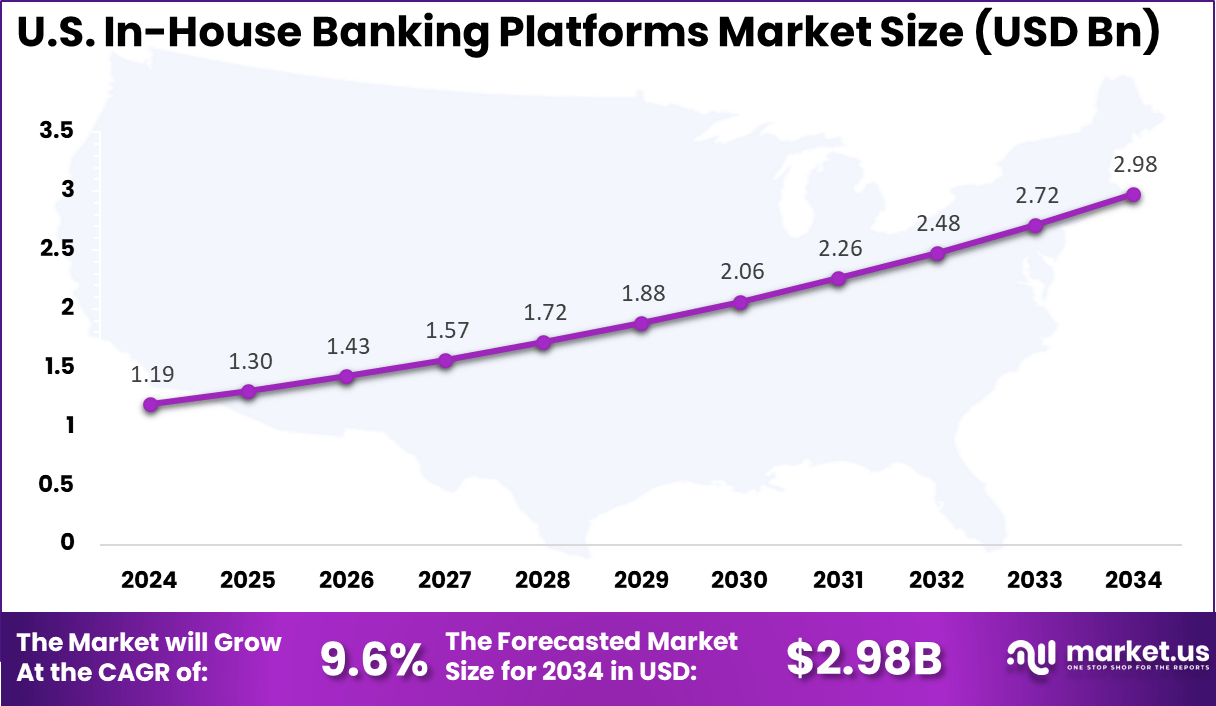

- The U.S. market reached USD 1.19 billion in 2024 with a 9.6% CAGR, showing steady investment in internal treasury modernization.

- North America held 40.3%, driven by strong digital infrastructure and mature adoption of advanced treasury systems.

Role of Generative AI

Generative AI helps in-house banking platforms handle tasks like summarizing reports and spotting risks faster. Banks see nearly 50% of them using or building these systems for internal work, which cuts down time on routine jobs. This lets staff focus on bigger decisions while keeping operations smooth.

Around 60% of bank leaders now run generative AI in daily processes, with gains in areas like risk checks and customer service. Early users report great improvements, such as 43% testing it across the whole organization for better accuracy. Tools like this also speed up compliance by handling complex rules with less effort.

U.S. Market Size

The market for In-House Banking Platforms within the U.S. is growing tremendously and is currently valued at USD 1.19 billion, the market has a projected CAGR of 9.6%. The market is growing due to banks shifting to cloud setups for quick scaling and lower costs. Real-time payments and AI tools speed up cash handling and cut fraud risks. Open banking APIs link systems better, while customers’ push for mobile access drives internal platform upgrades. Large firms lead adoption to manage complex flows nationwide.

For instance, in May 2025, Kyriba, headquartered in San Diego, California, introduced TAI, its agentic AI solution designed to transform finance operations with enhanced security, compliance, and trust. This innovation strengthens U.S. leadership in in-house banking platforms by enabling safer generative AI integration for treasury management, improving productivity amid economic challenges.

In 2024, North America held a dominant market position in the Global In-House Banking Platforms Market, capturing more than a 40.3% share, holding USD 1.30 billion in revenue. This dominance is due to early cloud adoption by major banks for scalable operations and lower costs. Tech-savvy users demand mobile-first services, pushing internal platforms to link APIs fast. Strict rules support secure data handling, while large firms handle cross-border flows with real-time tools. High digital penetration keeps the region ahead.

For instance, in September 2025, FIS, based in Jacksonville, Florida, launched Neural Treasury, an AI-powered solution that builds on its treasury management awards momentum. This platform automates liquidity aggregation, reconciliation, and risk management, empowering U.S. treasurers to focus on strategic growth. FIS reinforces North American dominance in in-house banking by delivering advanced AI tools previously accessible only to large corporations, now scaled for mid-market firms.

Component Analysis

In 2024, The Software segment held a dominant market position, capturing a 56.8% share of the Global In-House Banking Platforms Market. Banks rely on these tools to handle core tasks like transaction processing and account management right inside their operations. This setup lets them keep full control over data and cut down on outside help for daily financial work.

Strong software keeps everything running smoothly with real-time updates and easy links to other systems. Teams use it to track flows and spot issues fast, which helps in quick fixes. Overall, it builds a solid base for handling bank needs without extra layers.

For Instance, in October 2025, SAP rolled out updates to its S/4HANA Cloud for advanced payment tools. Banks now handle in-house software tasks like accounts payable with tighter links. This boosts real-time processing for daily banking flows. Software remains key for control in operations.

Deployment Mode Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 65.3% share of the Global In-House Banking Platforms Market. They offer quick setup and room to grow as banks add more users or tasks. Access from anywhere cuts travel time for staff and boosts work-from-home setups.

These systems scale up during busy times like end-of-month closes without big hardware buys. Banks save on upkeep since providers handle updates and backups. This keeps costs low and focuses on customer service high.

For instance, in August 2025, Infosys Finacle wrapped a cloud migration for an Australian fund in under five months. The SaaS setup on AWS runs core banking and digital channels smoothly. It scales for more users without hardware worries. Cloud leads as banks chase quick growth.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 70.5% share of the Global In-House Banking Platforms Market. These firms need strong systems for global cash moves and complex rules across borders. They use platforms to pool funds from units and lower outside loan needs.

In big setups, the tools link many sites for clear views on cash positions every day. This cuts risks from currency shifts and speeds up fund shifts between areas. Staff make better choices with full data at hand.

For Instance, in September 2025, Kyriba took top spot as the best treasury system for big firms worldwide. It links over 3400 clients to banks for large-scale cash views. Large enterprises gain from their global reach and real-time tools. This matches their need for wide operations.

Application Analysis

In 2024, The Cash and Liquidity Management segment held a dominant market position, capturing a 34.2% share of the Global In-House Banking Platforms Market. Banks use it to watch cash levels closely and free up stuck funds across accounts. This stops shortfalls and puts extra cash to work fast.

The focus stays on daily flows to meet payments on time and plan ahead. Teams forecast needs with real data to avoid extra borrowing costs. It ties all parts together for steady operations year-round.

For Instance, in October 2025, SAP’s Asia growth is tied to cloud tools for B2B payments and liquidity. Clients like airlines use it to optimize working capital in-house. Real-time views cut borrowing needs across apps. This lifts cash handling in banking apps.

End-User Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 24.6% share of the Global In-House Banking Platforms Market. This group pushes for digital tools to speed up loans and checks while meeting strict rules. They gain from linked systems that cut errors in customer dealings.

In BFSI, platforms aid secure data handling and fast reports for watchdogs. This builds trust with users through smooth services like quick transfers. Growth comes from better tools for high-volume tasks.

For Instance, in January 2025, Finastra tied up with a fintech for deposit account opens in BFSI. The link speeds retail and commercial setups in core systems. BFSI gains efficiency in high-volume client work. This supports their daily service push.

Emerging trends

In-house banking platforms shift to cloud-based for easy updates and tight links across tools. Adoption of generative AI rose to 78% in stages from only 8% last year, blending it into core jobs. Real-time scans now spot odd flows in payments, which raises safety levels.

Platforms build better ties between payments and data for even flows. AI aids 47% of marketing jobs and 39% in tech support, fitting services to needs with less work. Rule checks improve, too, with big drops in hand reviews over time.

Growth Factors

Demand rises as platforms offer faster customer service through smart automation. Generative AI lifts operations by up to 46% in some areas by reading customer needs and cutting costs. More users shift to digital channels, with 72% of transactions now online in public banks.

Personal touches from AI drive loyalty, as it spots patterns in data for quick fixes. Internal systems see 90% of banks set budgets for these tools, with 60% already in regular use for sales and finance tasks. This setup grows reach while keeping tight control on risks.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

By Application

- Cash and Liquidity Management

- Payments and Collections

- Risk Management

- Compliance and Reporting

- Others

By End-User

- BFSI

- Manufacturing

- Retail

- Healthcare

- IT & Telecom

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Need for Internal Cash Control

Banks building their own platforms gain a tight grip on cash flows across units. Real-time visibility into balances across multiple accounts lets teams spot issues fast and adjust moves between branches without delays. This central setup cuts external fees and speeds up fund transfers, helping handle daily peaks better.

Central control matches funds inside the company, skipping outside loans that add costs. Teams pool cash from global spots to meet short-term needs right away, keeping operations smooth. Over time, this boosts overall money handling with fewer risks from scattered data.

For instance, in September 2025, Serrala helped Intuitive Surgical roll out SAP Advanced Payment Management for in-house banking. This gave the firm real-time views on global cash and cut FX risks through better intercompany handling. The setup now runs phase one live, pooling funds across borders to meet daily needs without outside banks.

Restraint

High Setup and Upkeep Costs

Setting up in-house platforms demands big upfront spending on tech and staff training. Large banks invest millions to build custom systems, facing yearly upkeep that eats into budgets. Smaller lenders often pick outside vendors to skip these heavy hits.

Legacy systems from the past add to the pain, as linking them drags on for months with extra cash. Banks report delays from old tech clashes that slow the full shift. This setup locks in higher long-term costs for those stuck in the process.

For instance, in May 2025, Finastra sold its Treasury and Capital Markets unit to Apax Funds after big spending on cloud upgrades. The move frees cash for core banking software but shows the strain of maintaining full in-house tech stacks. Smaller teams often face years of high upkeep bills post-launch.

Opportunities

Growth in Embedded Finance Links

In-house platforms open doors to plug banking into apps for other firms. Banks offer payments or loans directly in partner apps, reaching new users from sectors like retail without full setups. API ties share services fast, turning platforms into extra profit spots.

This model pulls in clients from non-bank areas with quick embeds within weeks. Partners skip license needs, growing revenue from new deals tied to core banking. It shifts internal tools into shared services that draw steady use.

For instance, in September 2025, Oracle Fusion Cloud with J.P. Morgan helped Avis Budget Group automate payments worldwide. The tie lets non-banks embed treasury views and vendor payouts directly in ERP. Such links open revenue from supply chain finance without building from scratch.

Challenges

Tough Rules Across Borders

Global rules on data and cash moves block smooth in-house setups. Countries limit cross-border flows, forcing local accounts to incur extra costs with extra steps. Banks juggle dozens of rules, which slow rollouts across regions.

Privacy laws differ by area, needing checks that stretch launch times by months. Efforts often snag on these gaps, risking fines for small slips. Full control turns tricky amid shifting demands from place to place.

For instance, in April 2025, ION launched its Enterprise Payment Hub to handle global rules on data flows and sanctions. Yet cross-border setups still face delays from varying privacy checks in Europe and beyond. The tool centralizes, but compliance adds months and extra audits per region.

Key Players Analysis

SAP, Kyriba, FIS, and Finastra lead the in-house banking platforms market with comprehensive treasury and liquidity management systems that centralize cash positions, internal payments, and intercompany financing. Their platforms support large enterprises with real-time visibility, automated reconciliation, and robust risk controls. These companies focus on scalable architectures, strong integration capabilities, and advanced analytics.

ION Treasury, Oracle, Serrala, Bellin (Coupa Treasury), Reval, TIS, Broadridge, Openlink, Murex, and Infosys Finacle strengthen the competitive landscape with modular tools for cash pooling, FX management, and payment standardization. Their solutions help organizations streamline banking structures, reduce external transaction costs, and improve compliance with global regulations. These providers emphasize secure connectivity, automation, and seamless ERP integration.

Sopra Banking Software, Fiserv, and other participants expand the market with flexible, cloud-enabled systems designed for mid-sized and multinational corporations. Their offerings include multi-entity treasury support, real-time reporting, and controlled internal workflows for corporate banking operations. These companies prioritize ease of deployment, strong security frameworks, and customizable workflows.

Top Key Players in the Market

- SAP SE

- Kyriba

- FIS (Fidelity National Information Services)

- Finastra

- TreasuryXpress (a Bottomline Technologies company)

- ION Treasury

- Oracle Corporation

- Serrala

- Bellin (Coupa Treasury)

- Reval (ION Group)

- TIS (Treasury Intelligence Solutions)

- Broadridge Financial Solutions

- Openlink (ION Group)

- Murex

- FIS Global

- Infosys Finacle

- Sopra Banking Software

- FISERV

- Others

Recent Developments

- In October 2025, SAP SE strengthened its in-house banking leadership by advancing the rollout of SAP S/4HANA Cloud’s Advanced Payment Management, now handling integrated accounts payable, receivable, cash operations, and financial trading on a single platform. This upgrade helps big firms cut down on manual work and speed up internal settlements, which is key for treasury teams managing complex global cash flows.

- In April 2025, ION Treasury launched its Enterprise Payment Hub, pulling together payments, automation, and security for heavy-hitter clients like central banks. This centralizes everything from high-volume flows to risk checks, giving treasuries the visibility they need across borders.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Bn Forecast Revenue (2034) USD 9.3 Bn CAGR(2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Enterprise Size (Large Enterprises, Small and Medium Enterprises), By Application (Cash and Liquidity Management, Payments and Collections, Risk Management, Compliance and Reporting, Others), By End-User (BFSI, Manufacturing, Retail, Healthcare, IT & Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, Kyriba, FIS (Fidelity National Information Services), Finastra, TreasuryXpress (a Bottomline Technologies company), ION Treasury, Oracle Corporation, Serrala, Bellin (Coupa Treasury), Reval (ION Group), TIS (Treasury Intelligence Solutions), Broadridge Financial Solutions, Openlink (ION Group), Murex, FIS Global, Infosys Finacle, Sopra Banking Software, FISERV, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  In-House Banking Platforms MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample

In-House Banking Platforms MarketPublished date: Dec.2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- Kyriba

- FIS (Fidelity National Information Services)

- Finastra

- TreasuryXpress (a Bottomline Technologies company)

- ION Treasury

- Oracle Corporation

- Serrala

- Bellin (Coupa Treasury)

- Reval (ION Group)

- TIS (Treasury Intelligence Solutions)

- Broadridge Financial Solutions

- Openlink (ION Group)

- Murex

- FIS Global

- Infosys Finacle

- Sopra Banking Software

- FISERV

- Others