Imaging Markers Market By Product Type (MRI Markers, Ultrasound Markers, PET and SPECT Markers, Optical Imaging Markers, CT Markers, and Others), By Therapeutic Area (Oncology, Orthopedic, Neurology, Infectious Disease/Inflammation, Hepatic Imaging, and Cardiology), By Application (Diagnosis, Treatment Planning and Monitoring, Personalized Medicine, and Drug Development/Research), By End-user (Hospitals, Research Institutes, Pharmaceutical Companies, Diagnostic Imaging Centers, and Contract Research Organizations (CROs)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164025

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

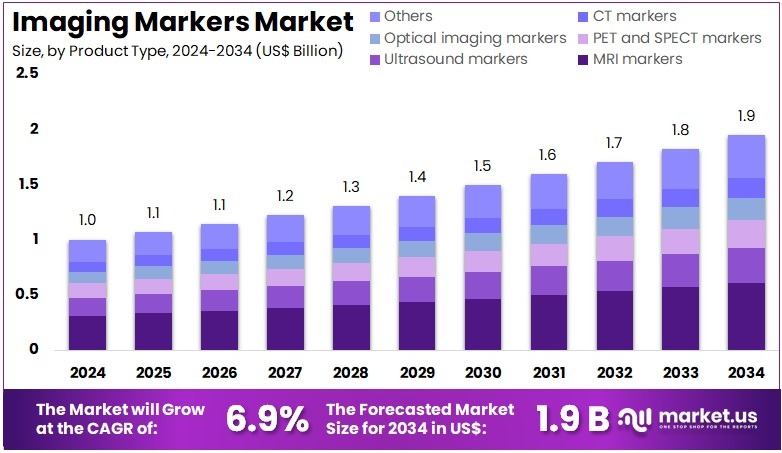

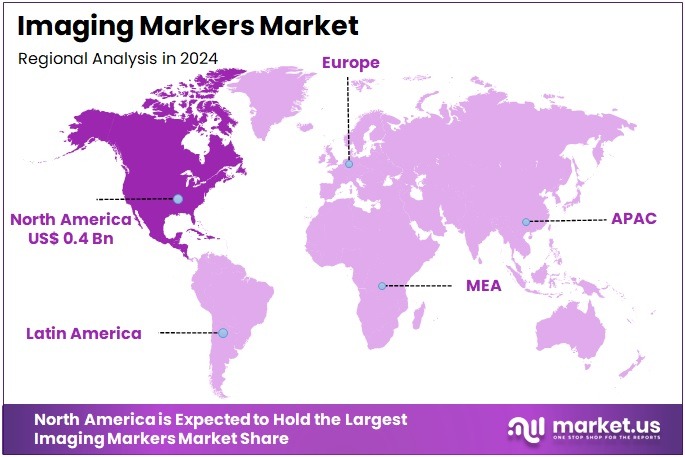

The Imaging Markers Market size is expected to be worth around US$ 1.9 billion by 2034 from US$ 1.0 billion in 2024, growing at a CAGR of 6.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.5% share and holds US$ 0.4 Billion market value for the year.

Increasing demand for precision diagnostics drives the Imaging Markers Market, as clinicians prioritize early detection of complex diseases. Radiologists utilize imaging markers like tumor-specific contrast agents to enhance MRI accuracy in oncology, guiding precise tumor staging. These markers support neurodegenerative disease research by highlighting amyloid plaques in brain PET scans, aiding Alzheimer’s diagnosis.

Pharmaceutical companies apply them in clinical trials to monitor drug response through biomarker visualization. In November 2024, GE HealthCare and RadNet integrated SmartMammo AI into the Senographe Pristina mammography system, enhancing detection of breast cancer imaging markers like density and lesion morphology. This innovation fuels market growth by improving diagnostic efficiency and outcomes in women’s health.

Growing adoption of advanced imaging technologies creates opportunities in the Imaging Markers Market, as healthcare systems seek enhanced visualization tools. Oncologists employ fluorodeoxyglucose markers in PET/CT scans to assess cancer metabolism, optimizing treatment planning. These markers aid cardiology by quantifying coronary artery calcification in CT imaging, supporting cardiovascular risk assessment.

Research institutions use them to track inflammatory biomarkers in autoimmune disease studies, advancing therapeutic development. In November 2024, Radon Medical Imaging’s acquisition of Alpha Imaging expanded service coverage for advanced imaging systems, improving access to biomarker quantification technologies. This expansion drives market growth by broadening deployment and maintenance support for diagnostic platforms.

Rising integration of artificial intelligence propels the Imaging Markers Market, as automated tools enhance biomarker detection accuracy. Radiologists leverage AI-enhanced markers to identify subtle lesions in lung cancer screening, improving early-stage detection rates. These markers support personalized medicine by quantifying tumor heterogeneity in molecular imaging, tailoring therapy selection.

Trends toward multimodal imaging combine MRI and PET markers, providing comprehensive disease insights in single scans. Automated analysis platforms streamline workflows, reducing diagnostic turnaround times in high-volume settings. These technological advancements position the market for sustained growth by fostering precision and efficiency in diverse clinical and research applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.0 billion, with a CAGR of 6.9%, and is expected to reach US$ 1.9 billion by the year 2034.

- The product type segment is divided into MRI markers, ultrasound markers, PET and SPECT markers, optical imaging markers, CT markers, and others, with MRI markers taking the lead in 2023 with a market share of 31.2%.

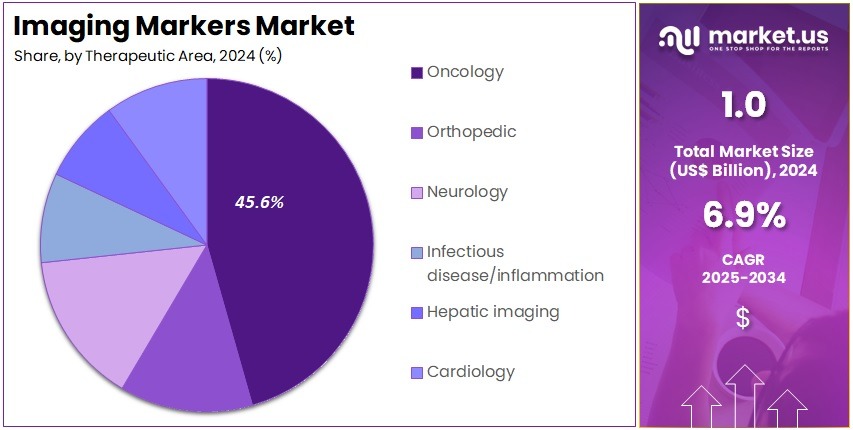

- Considering therapeutic area, the market is divided into oncology, orthopedic, neurology, infectious disease/inflammation, hepatic imaging, and cardiology. Among these, oncology held a significant share of 45.6%.

- Furthermore, concerning the application segment, the market is segregated into diagnosis, treatment planning and monitoring, personalized medicine, and drug development/research. The diagnosis sector stands out as the dominant player, holding the largest revenue share of 41.3% in the market.

- The end-user segment is segregated into hospitals, research institutes, pharmaceutical companies, diagnostic imaging centers, and CROs, with the hospitals segment leading the market, holding a revenue share of 47.8%.

- North America led the market by securing a market share of 39.5% in 2023.

Product Type Analysis

MRI markers hold a 31.2% share of the Imaging Markers market and are projected to maintain a strong growth trajectory driven by the increasing deployment of MRI systems globally and the need for enhanced marker tools. MRI markers improve spatial localization and image reproducibility, which are critical for accurate diagnosis and follow-up of disease conditions. As MRI adoption grows, particularly for soft tissue imaging in oncology and neurology, demand for MRI-specific markers is expected to rise.

Technological improvements such as higher-field MRI (3T and above), functional MRI (fMRI), and better coil compatibility further bolster marker usage. Manufacturers are developing markers designed to show clear reference points on MRI scans, enhancing clinician confidence in anatomical and functional alignment.

The push toward quantitative imaging and imaging biomarker standardization also supports marker uptake, since precise positioning leads to improved data consistency. Additionally, integration of MRI markers in hybrid imaging environments (e.g., PET/MRI) broadens their utility. As hospitals upgrade their MRI suites and radiology workflows become more demanding, MRI markers remain a foundational component of advanced imaging protocols.

Therapeutic Area Analysis

Oncology accounts for 45.6% of the therapeutic-area segment in the Imaging Markers market and is anticipated to continue as the fastest-growing application area. The rising global incidence of cancer, combined with advances in targeted therapies and imaging-guided interventions, drives the need for markers that support tumor visualization, treatment planning, and response monitoring. Imaging markers facilitate more accurate delineation of tumor boundaries, supporting radiation therapy, surgical planning, and post-therapy assessment.

Oncology imaging protocols increasingly include marker placement to enhance reproducibility across baseline and follow-up scans. The emergence of personalized oncology and precision medicine further amplifies demand for imaging markers that support longitudinal studies and biomarker-driven imaging endpoints.

Research in tracer-based imaging, radiomics, and AI-driven image analysis underscores the importance of consistent marker positioning. Hospitals and imaging centers specialising in cancer care are prioritising adoption of advanced markers to meet regulatory and clinical demands. As investment in oncology imaging infrastructure continues, the marker segment tied to oncology use is projected to expand significantly.

Application Analysis

The Diagnosis application holds 41.3% of the share and is expected to lead due to the critical requirement for precise imaging across multiple disease states. Imaging markers support diagnosis by ensuring accurate and reproducible image acquisition, facilitating consistent comparisons between scans. As early detection becomes an increasing priority-especially in oncology, neurology, and cardiology-markers that enhance image quality and localization provide significant clinical value.

The growth of screening programs and increased imaging utilisation in hospitals strengthens marker demand. Technological innovations such as hybrid imaging, AI-assisted diagnostics, and quantitative imaging increase the need for standardised markers to enable consistent image interpretation.

Radiology departments are also under pressure to reduce errors and improve throughput, making image markers a worthwhile investment. Additionally, regulatory requirements and guidelines promoting image standardisation support marker usage in diagnostic workflows. As healthcare systems shift toward image-driven decision-making, the marker segment tied to diagnosis is likely to maintain robust growth.

End-User Analysis

Hospitals represent 47.8% of the end-user segment and are projected to remain the dominant customers for imaging markers due to their large imaging volumes, diverse clinical needs, and integrated imaging infrastructure. Radiology departments in hospitals routinely perform MRI, CT, PET/SPECT, and ultrasound studies, which benefit from marker use to ensure consistent positioning and image quality. Hospitals are increasingly adopting markers as part of standard operating procedures to support multidisciplinary care (oncology, neurology, orthopaedics) and advanced imaging workflows.

The centralisation of imaging services in hospitals means marker procurement aligns with high throughput and standardisation targets. Additionally, hospitals are investing in digital imaging networks, hybrid modality suites (e.g., PET/MRI), and AI-driven diagnostics, all of which amplify the value of imaging markers that improve reproducibility and data integrity. Training programmes and accreditation of imaging departments also emphasise the use of markers for quality assurance. As hospitals upgrade equipment and imaging protocols become more stringent, the demand for markers in hospital settings is expected to surge.

Key Market Segments

By Product Type

- MRI Markers

- Ultrasound Markers

- PET and SPECT Markers

- Optical Imaging Markers

- CT Markers

- Others

By Therapeutic Area

- Oncology

- Orthopedic

- Neurology

- Infectious Disease / Inflammation

- Hepatic Imaging

- Cardiology

By Application

- Diagnosis

- Treatment Planning and Monitoring

- Personalized Medicine

- Drug Development / Research

By End-user

- Hospitals

- Research Institutes

- Pharmaceutical Companies

- Diagnostic Imaging Centers

- Contract Research Organizations (CROs)

Drivers

Rising Incidence of Cancer is Driving the Market

The escalating global burden of cancer has profoundly influenced the imaging markers market, as these quantitative tools derived from CT, MRI, and PET scans enable early detection and precise staging to guide therapeutic decisions. Imaging markers, such as tumor volume measurements and perfusion indices, provide objective assessments of disease progression, surpassing subjective interpretations in clinical evaluations. This driver is particularly salient in oncology, where radiographic biomarkers facilitate patient stratification for targeted therapies, reducing unnecessary interventions.

Healthcare systems are prioritizing their integration into screening protocols, especially for high-incidence malignancies like lung and breast cancer. The demand surges amid aging demographics, necessitating scalable imaging solutions for population-level surveillance. Public health agencies emphasize their role in reducing mortality through timely interventions, influencing infrastructure investments.

The American Cancer Society estimated 2,001,140 new cancer cases in the United States for 2024, reflecting the clinical imperative for advanced imaging markers to address this caseload. This projection underscores the diagnostic urgency, as markers like RECIST criteria enhance response monitoring. Innovations in automated segmentation algorithms improve reproducibility, accommodating heterogeneous tumor morphologies.

Economically, their deployment optimizes resource allocation, averting escalation to advanced therapies. International consortia standardize marker definitions, promoting interoperability across modalities. This oncogenic prevalence not only amplifies imaging utilization but also reinforces markers’ centrality in precision oncology frameworks. Overall, it catalyzes refinements toward multimodal integrations, aligning diagnostics with therapeutic evolutions.

Restraints

Regulatory Validation Challenges is Restraining the Market

The rigorous demands for regulatory validation of imaging markers continue to limit their clinical translation, as extensive clinical utility demonstrations prolong development timelines and inflate costs. These markers, requiring phase-based evidence from discovery to qualification, often falter in reproducibility across scanners and populations, undermining FDA acceptance. This restraint disproportionately impacts academic innovators, where funding constraints hinder multi-center trials essential for qualification.

Variability in imaging protocols exacerbates standardization gaps, complicating biomarker qualification under FDA-NIH frameworks. Developers must navigate iterative submissions, diverting resources from refinement to compliance audits. The resultant delays perpetuate reliance on established markers, stifling novel applications in emerging diseases.

The Food and Drug Administration received 18,800 medical device submissions in 2022, with imaging biomarkers facing heightened scrutiny for analytical and clinical performance, contributing to extended review periods. Such volumes highlight procedural backlogs, as qualification pathways demand robust evidentiary dossiers. Provider skepticism arises from unverified claims, favoring conventional metrics over unproven markers.

Efforts to streamline qualification via consortia advance methodically, impeded by inter-vendor variances. These validation hurdles not only attenuate adoption but also impede the market’s predictive potential. Consequently, they necessitate fortified collaborative models to equilibrate innovation with oversight imperatives.

Opportunities

Advancements in AI-Enhanced Image Analysis is Creating Growth Opportunities

The maturation of artificial intelligence algorithms for image analysis has engendered profound developmental vistas, permitting automated extraction of quantitative markers from raw scans to expedite diagnostic workflows. These convolutional neural networks discern subtle textural features in MRI and CT datasets, surpassing manual delineations in speed and objectivity.

Opportunities abound in consortia with software architects, underwriting corroborations for prognostic markers in oncology trials. This computational portability synchronizes with decentralized paradigms, refining asset apportionments in overburdened imaging centers. State acquisitions for vanguard analytics additionally stimulate magnification, ameliorating urban-rural schisms in marker access.

The Food and Drug Administration cleared 1016 AI/ML-enabled medical devices as of December 2024, with a peak of over 80 in 2023 reflecting rapid proliferation in imaging applications. This trajectory substantiates fiscal rationales, as AI markers forestall interpretive variances.

Algorithmic compaction, attuned to cloud architectures, amplifies pertinence to tele-radiology. As concordance norms evolve, datum confluences to archival systems unveil econometric revenues. These intelligent archetypes not only variegate endpoint demographics but also consolidate the market into durable interpretive conveyance archetypes.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the imaging markers market, leading them to delay tracer formulation upgrades while prioritizing essential contrast agent stockpiles amid constrained oncology funding. U.S.-China export restrictions and Indian Ocean shipping disruptions are restricting supplies of radiolabeled isotopes from regional suppliers, extending stability validation timelines and increasing certification costs for international clinical networks. To counter these hurdles, some developers are partnering with New Mexico-based isotope producers, adopting purity protocols that expedite FDA approvals and attract radiopharmaceutical grants.

Escalating cancer incidence rates are directing NCI allocations into PET/SPECT hybrid panels, enhancing adoptions in diagnostic imaging centers. U.S. tariffs of 10% on imported medical devices effective April 5, 2025, are elevating costs for Asian-sourced chelators and buffers, squeezing margins for research labs and occasionally stalling global marker standardization efforts. In response, developers are leveraging IRA innovation credits to establish Nevada synthesis facilities, introducing nanoparticle-enhanced tracers and building expertise in targeted delivery systems.

Latest Trends

FDA Approval of Flurpiridaz F-18 for Cardiac PET Imaging is a Recent Trend

The regulatory endorsement of novel radiotracers has epitomized a seminal advancement in the imaging markers domain throughout 2024, accentuating myocardial perfusion quantification for coronary artery disease stratification. Lantheus Medical Imaging’s Flurpiridaz F-18, a PET agent targeting mitochondrial complex I, yields high-contrast images within minutes, enabling absolute flow measurements independent of flow heterogeneity. This trajectory connotes a ripening toward absolute quantification, accommodating synchronous assessments of viability and ischemia to rationalize revascularization conduits.

Oversight ratifications corroborate negligible perturbations, expediting endorsements across cardiovascular solicitations. This amalgamation resonates with nuclear digitization, tethering emanations to intermediaries for algorithmic elucidations. The enlargement redresses interpretive exigencies, prioritizing tracer configurations resilient to patient motion.

The Food and Drug Administration approved Flurpiridaz F-18 on September 27, 2024, for positron emission tomography imaging to evaluate coronary artery disease in adult patients with known or suspected cardiac ischemia. Such performative indices hasten assimilation in referential epicenters, where extensibility dictates acquirement.

Contemplators prognosticate doctrinal endorsements, exalting its precedence in inaugural edicts. Diachronic gauges corroborate discordance diminutions, refining pharmacoeconomic appraisals. The azimuth envisions hybrid synergies, prognosticating remedial escalations. This tracer refinement not only magnifies quantitative virtuosity but also harmonizes with amalgamated cardiac diagnostic edicts.

Regional Analysis

North America is leading the Imaging Markers Market

In 2024, North America held a 39.5% share of the global imaging markers market, driven by the FDA’s approvals of innovative contrast agents that enhance diagnostic precision for oncology and cardiovascular applications, facilitating earlier intervention in high-burden diseases. Pharmaceutical and diagnostic firms accelerated development of gadolinium-based markers for MRI, with approvals like Iomervu in September 2024 enabling superior visualization of vascular abnormalities, reducing scan times by up to 20% in clinical workflows.

The National Institute of Biomedical Imaging and Bioengineering’s increased funding supported research into targeted radiotracers for PET imaging, bolstering collaborations between academia and industry to refine specificity for tumor staging in breast and prostate cancers. Regulatory pathways under the FDA’s Emerging Drug Safety Technology Program expedited clearances for AI-integrated markers, addressing disparities in rural access through portable ultrasound enhancements.

Demographic shifts toward an aging population amplified demand for amyloid PET ligands in Alzheimer’s evaluations, aligned with Medicare expansions for preventive screenings. These advancements reinforced the region’s leadership in biomarker-driven visualization technologies. The FDA approved three imaging markers in 2024, including Iomervu for contrast-enhanced MRI and flurpiridaz F 18 for cardiac perfusion assessment.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National authorities across Asia Pacific project the imaging markers sector to flourish during the forecast period, as infrastructure investments elevate diagnostic capabilities amid rising chronic disease incidences in urban centers. Officials in China and Japan allocate resources to gadolinium contrast procurement, equipping tertiary hospitals to improve lesion detection in hepatic carcinomas through enhanced CT resolution.

Diagnostic developers collaborate with regional labs to validate PET tracers for neurodegeneration, anticipating refined staging for dementia in aging cohorts. Oversight agencies in India and South Korea subsidize ultrasound microbubbles, positioning community facilities to assess vascular risks without advanced scanners.

Governments anticipate integrating marker data with digital health platforms, expediting oncology referrals for high-risk migrant groups. Regional radiologists pioneer nanoparticle-based agents, syncing with surveillance networks to profile inflammatory markers in metabolic syndromes. These efforts construct a resilient foundation for precision diagnostics. China’s State Council announced a CNY 1.70 trillion loan incentive in September 2022 for medical facility upgrades, including imaging markers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the imaging biomarkers sector drive expansion by engineering novel contrast agents that integrate with AI algorithms, enabling precise quantification of tumor perfusion and metabolic activity for oncology trials. They pursue targeted acquisitions of molecular imaging startups to incorporate radiolabeled tracers, enhancing portfolio depth and accelerating regulatory pathways. Organizations invest heavily in collaborative R&D consortia with academic centers, co-developing hybrid markers for multimodal applications in neurology and cardiology diagnostics.

Executives prioritize geographic diversification into Asia-Pacific and Latin America, customizing formulations to regional regulatory landscapes and tapping into rising chronic disease screenings. They forge alliances with pharmaceutical developers to align markers with companion diagnostics, streamlining therapy response evaluations. Additionally, they deploy outcome-based licensing models with healthcare networks, embedding predictive analytics to justify premiums and cultivate sustained revenue partnerships.

GE HealthCare, founded in 1892 and headquartered in Chicago, Illinois, engineers advanced diagnostic imaging technologies that support precision medicine across oncology, neurology, and cardiology worldwide. The company delivers its Clariscan gadolinium-based contrast agents and Optison ultrasound microbubbles, optimizing visualization for enhanced lesion detection and procedural guidance.

GE HealthCare allocates substantial resources to innovation, including AI-integrated platforms like Edison to refine marker interpretation and workflow efficiency. CEO Peter J. Arduini leads a global enterprise operating in over 160 countries, emphasizing sustainability and interoperability. The firm collaborates with clinical networks to validate new tracers, advancing evidence-based imaging protocols. GE HealthCare reinforces its market leadership by synergizing agent development with digital ecosystems to elevate diagnostic accuracy and patient outcomes.

Top Key Players in the Imaging Markers Market

- Solstice Corporation

- Siemens Healthineers AG

- PDC (Brady Corporation)

- Medline Industries

- Maven Imaging

- Marketlab

- Koninklijke Philips N.V.

- IZI Medical Products

- GE HealthCare

- AliMed

Recent Developments

- In March 2025: Bunkerhill Health partnered with Cleerly to advance noninvasive cardiovascular diagnostics using AI-powered coronary CT angiography. This partnership enhances the use of imaging biomarkers by improving plaque characterization and early detection of coronary artery disease, contributing to more precise risk stratification in cardiovascular care.

- In January 2025: Sutter Health entered a seven-year strategic imaging partnership with GE HealthCare, covering major modalities such as PET/CT, MRI, CT, and ultrasound. This collaboration expands access to multimodal imaging platforms that generate high-quality quantitative markers, supporting more accurate disease assessment and longitudinal biomarker tracking in clinical research and diagnostics.

Report Scope

Report Features Description Market Value (2024) US$ 1.0 billion Forecast Revenue (2034) US$ 1.9 billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (MRI Markers, Ultrasound Markers, PET and SPECT Markers, Optical Imaging Markers, CT Markers, and Others), By Therapeutic Area (Oncology, Orthopedic, Neurology, Infectious Disease/Inflammation, Hepatic Imaging, and Cardiology), By Application (Diagnosis, Treatment Planning and Monitoring, Personalized Medicine, and Drug Development/Research), By End-user (Hospitals, Research Institutes, Pharmaceutical Companies, Diagnostic Imaging Centers, and Contract Research Organizations (CROs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Solstice Corporation, Siemens Healthineers AG, PDC (Brady Corporation), Medline Industries, Maven Imaging, Marketlab, Koninklijke Philips N.V., IZI Medical Products, GE HealthCare, AliMed. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Solstice Corporation

- Siemens Healthineers AG

- PDC (Brady Corporation)

- Medline Industries

- Maven Imaging

- Marketlab

- Koninklijke Philips N.V.

- IZI Medical Products

- GE HealthCare

- AliMed