Global Ice-Cream Packaging Market Size, Share, Growth Analysis By Material (Plastic, Glass, Paper, Metal), By Product Type (Cups, Jars, Stick packs, Cone, Others), By Distribution (Retail Stores, Supermarkets, Ice-Cream Parlours, E-commerce), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153011

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

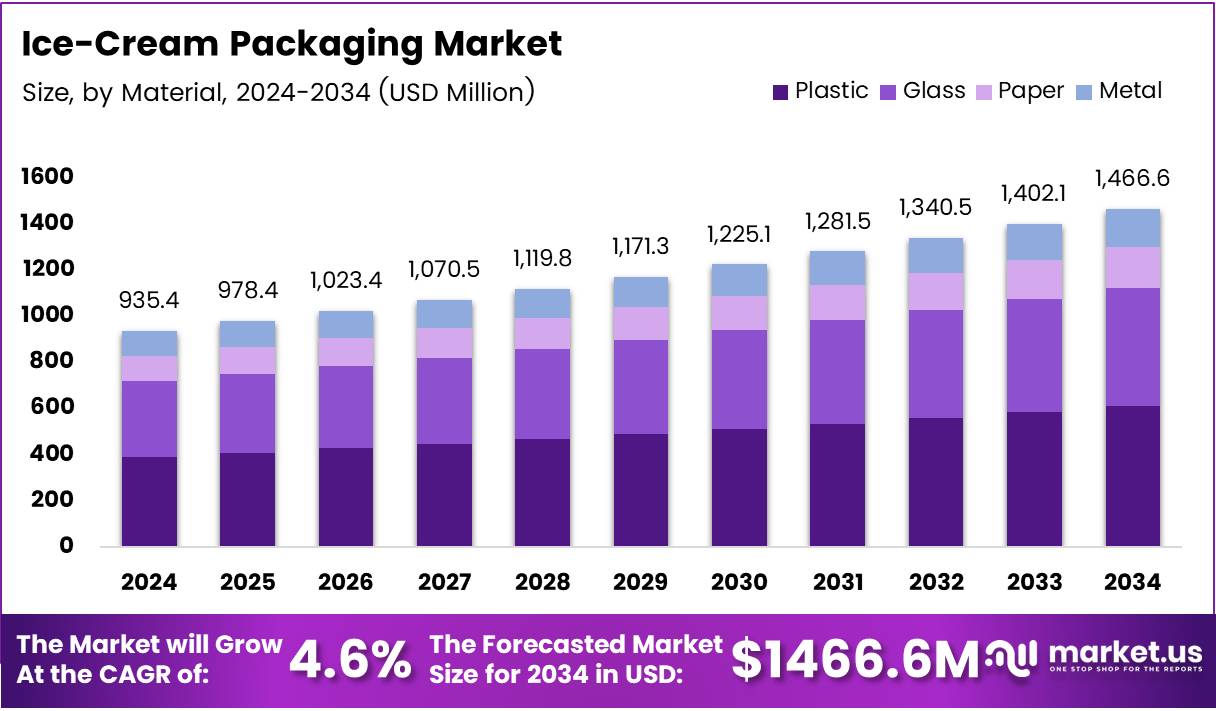

The Global Ice-Cream Packaging Market size is expected to be worth around USD 1466.6 Million by 2034, from USD 935.4 Million in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The ice cream packaging market has witnessed significant developments in recent years, driven by increased demand for convenient and visually appealing packaging solutions. As consumer preferences shift toward sustainability and eco-friendly packaging, manufacturers are focusing on innovative designs that combine functionality with aesthetic appeal. This market is expected to grow steadily as packaging plays a crucial role in attracting customers.

In terms of growth, the rising consumption of ice cream globally is propelling the demand for advanced packaging materials. Innovations in packaging, such as biodegradable and recyclable materials, are gaining momentum, as consumers are becoming more eco-conscious. Moreover, the introduction of single-serve packaging and portion-controlled packs is anticipated to further boost market growth, especially in the premium segment.

Government investments and regulations are also driving the market’s development. Various government initiatives support the adoption of sustainable practices within the packaging industry. These regulations, including bans on single-use plastics and incentives for using biodegradable materials, have encouraged companies to invest in greener packaging alternatives. Such policies are expected to fuel the shift towards more sustainable packaging solutions in the ice cream sector.

Additionally, market dynamics reveal a clear preference for ice cream purchased from grocery stores. According to the International Dairy Foods Association (IDFA), 84% of consumers prefer to purchase ice cream at grocery stores and consume it at home. This preference is pushing companies to develop packaging that ensures the product remains fresh during transportation and storage, enhancing the consumer experience.

The convenience factor plays a key role in shaping consumer behavior. IDFA reports that 73% of consumers eat ice cream at least once per week, with two out of three consuming it in the evening. This insight underscores the growing demand for easy-to-serve, well-packaged ice cream that fits into the modern, fast-paced lifestyle.

Key Takeaways

- The Global Ice-Cream Packaging Market is expected to reach USD 1466.6 Million by 2034, growing at a CAGR of 4.6% from 2025 to 2034.

- Plastic dominated the By Material Analysis segment in 2024, holding a 52.3% share due to its durability, light weight, and cost-effectiveness.

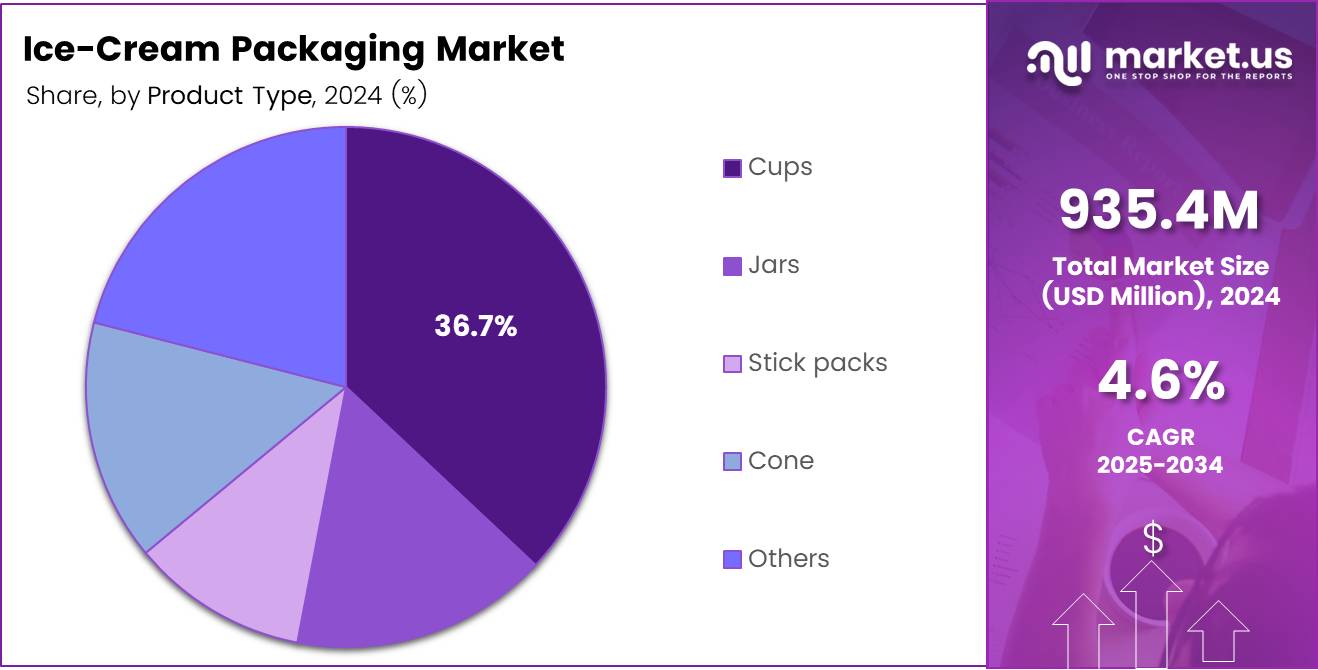

- Cups led the By Product Type Analysis segment in 2024, capturing 36.7% of the market due to consumer preference for convenient, single-serving packaging.

- Retail Stores maintained dominance in the By Distribution Analysis segment in 2024, holding a substantial share as the primary channel for ice cream sales.

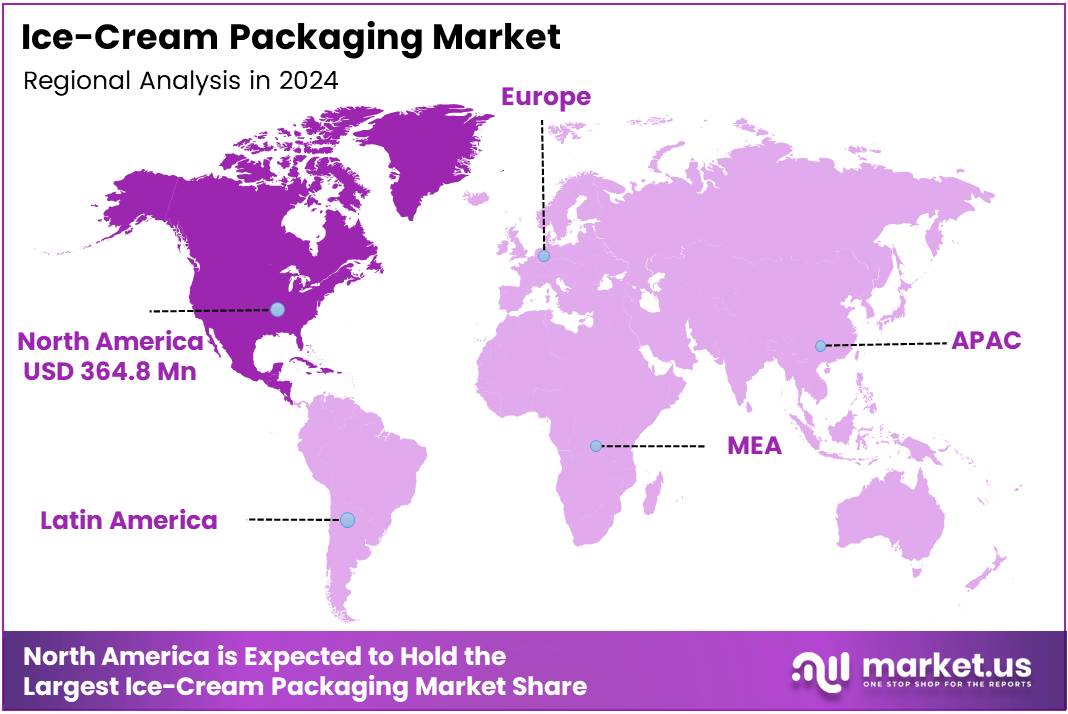

- North America led the Ice-Cream Packaging Market with 39.4% of the market share, valued at USD 364.8 Million, driven by demand for premium and sustainable packaging solutions.

Material Analysis

Plastic holds a dominant position with 52.3% due to its versatility, cost-effectiveness, and widespread use in ice-cream packaging.

In 2024, Plastic continued to dominate the Ice-Cream Packaging Market in the By Material Analysis segment, securing a significant share of 52.3%. This material remains the most favored choice due to its numerous advantages, including durability, light weight, and the ability to preserve the freshness of ice cream for extended periods. Additionally, its cost-effectiveness makes it an attractive option for manufacturers, who are continuously seeking efficient packaging solutions.

Glass, although often seen as a premium choice for packaging, held a smaller share in comparison. While glass provides an elegant and environmentally friendly option, its high production and transportation costs hinder its widespread use in the ice cream industry.

Paper and metal also represent important alternatives, though they continue to trail behind plastic in terms of market dominance. These materials are generally used for specific premium or niche packaging solutions.

Overall, plastic’s continued market leadership is a testament to its unmatched flexibility, performance, and affordability in the ice-cream packaging sector.

Product Type Analysis

Cups held the dominant market share with 36.7% due to their popularity and convenience for individual servings.

In 2024, Cups emerged as the leading product type in the Ice-Cream Packaging Market, capturing a dominant share of 36.7%. This segment’s dominance is driven by the widespread consumer preference for cup packaging, which is convenient and ideal for single servings of ice cream. Cups are commonly used across various retail and foodservice channels, making them the go-to packaging format for both large and small brands.

Jars and stick packs also continue to contribute to the market, albeit with smaller shares compared to cups. While jars are generally favored for premium or artisanal ice cream offerings, stick packs cater to on-the-go consumers seeking convenience and portability. The cone segment holds a smaller but steady position, primarily associated with the traditional ice cream experience.

Despite these alternatives, the cup remains the most favored option due to its affordability, ease of use, and strong consumer demand for individual-serving sizes.

Distribution Analysis

Retail Stores held the dominant market position with a significant share due to their widespread accessibility and customer preference for in-person shopping.

In 2024, Retail Stores held the dominant position in the By Distribution Analysis segment of the Ice-Cream Packaging Market, capturing a substantial share of the market. Retail stores, including convenience stores and specialty outlets, are the primary channels through which consumers purchase ice cream. The accessibility and convenience of retail stores make them the preferred choice for consumers seeking to buy ice cream in a variety of packaging types.

Supermarkets also play a major role, although their share slightly trails that of retail stores. They continue to be an essential part of the distribution network, offering a broader range of ice cream products and brands.

Ice-Cream Parlours, while significant in certain regions, have a more niche role in the market, focusing on serving freshly made or premium ice cream options. The e-commerce segment has shown growth but remains smaller in comparison to the physical retail options, driven by shifting consumer shopping habits and convenience preferences.

Overall, the market remains heavily reliant on physical retail outlets, which maintain their dominant position in ice cream distribution.

Key Market Segments

By Material

- Plastic

- Glass

- Paper

- Metal

By Product Type

- Cups

- Jars

- Stick packs

- Cone

- Others

By Distribution

- Retail Stores

- Supermarkets

- Ice-Cream Parlours

- E-commerce

Drivers

Rising Demand for Sustainable and Convenient Ice-Cream Packaging Drives Market Growth

The increasing demand for sustainable packaging solutions is one of the key drivers of the ice-cream packaging market. Consumers are becoming more environmentally conscious, prompting manufacturers to adopt eco-friendly materials. This shift has pushed brands to explore alternatives like plant-based and biodegradable packaging to meet growing demand.

There is also a rising focus on convenience and portability. As busy lifestyles become more common, packaging that is easy to carry and consume on-the-go is increasingly popular. Smaller, single-serve packaging options have seen a surge in demand, providing consumers with more accessible products.

Moreover, the growing preference for premium and customized packaging is driving the market. Consumers are looking for unique packaging that reflects the quality of the product inside. This trend has led to innovations such as personalized designs and unique shapes, making ice-cream more visually appealing.

Technological advancements in packaging materials are further enhancing the market. New materials are not only more sustainable but also offer better preservation and convenience features.

Restraints

Challenges in Ice-Cream Packaging Market Growth Due to Cost and Regulatory Issues

Despite the strong demand for sustainable packaging, the high production costs of eco-friendly materials pose a significant restraint in the ice-cream packaging market. These materials often cost more than traditional options, making it challenging for companies to balance cost and sustainability.

Regulatory challenges related to plastic use also add to the complexity of the market. As governments around the world impose stricter regulations on plastic packaging, ice-cream manufacturers are forced to find alternative solutions, which can be both time-consuming and costly.

Additionally, the complexities in logistics and transportation can be a barrier. Ice cream, being a perishable product, requires careful handling and packaging that can withstand temperature fluctuations, increasing logistics costs.

Fluctuating raw material prices further complicate production. Price volatility in materials like paper and plastic can make it difficult for manufacturers to maintain consistent pricing.

Growth Factors

Growth Opportunities in the Ice-Cream Packaging Market Driven by Innovation and Consumer Trends

The expansion of plant-based and biodegradable packaging presents a significant growth opportunity. With increasing awareness of environmental issues, more ice-cream brands are turning to these sustainable options, opening new avenues for growth in the market.

The integration of smart packaging technologies offers further growth potential. Innovations like QR codes and temperature-sensitive labels can enhance consumer experience and improve product tracking, making packaging more functional.

The growing popularity of online ice-cream sales is also fueling market expansion. As consumers shift to e-commerce platforms, packaging that supports shipping and ensures product safety during transit is in high demand.

Lastly, there is a surge in demand for portion-controlled packaging. With health-conscious consumers looking for smaller servings, single-serve packaging options are gaining traction, providing brands with the opportunity to cater to this growing trend.

Emerging Trends

Trending Factors Shaping the Ice-Cream Packaging Market

The shift toward recyclable and reusable packaging options is a key trend in the ice-cream packaging market. As environmental concerns grow, consumers are seeking products with packaging that can be reused or recycled, driving manufacturers to adopt more sustainable packaging practices.

The increased use of personalized packaging designs is another trend. Ice-cream brands are leveraging custom designs to make their products stand out on the shelf. This trend not only enhances product appeal but also offers a more personalized consumer experience.

The adoption of digital printing for packaging customization is also on the rise. This technology allows brands to easily modify packaging designs, ensuring a more flexible approach to consumer demands.

Finally, the growing trend of transparent and minimalistic packaging is reshaping the market. Consumers appreciate the simplicity and clarity of clear packaging, which allows them to see the product inside and connect with the brand in a more authentic way.

Regional Analysis

North America Dominates the Ice-Cream Packaging Market with a Market Share of 39.4%, Valued at USD 364.8 Million

North America holds a dominant position in the Ice-Cream Packaging Market, accounting for 39.4% of the market share, valued at USD 364.8 Million. This region is driven by strong consumer demand for premium, sustainable packaging solutions and a growing focus on convenience in food packaging. The region’s advanced infrastructure, along with continuous innovation in packaging technologies, supports its leadership in the market.

Europe Ice-Cream Packaging Market Trends

Europe is a significant player in the Ice-Cream Packaging Market, driven by increasing demand for sustainable packaging solutions. The region’s preference for eco-friendly and recyclable materials in packaging is expected to continue growing. With strict regulations on plastic usage and a shift towards biodegradable packaging, Europe is poised to witness steady growth in the coming years.

Asia Pacific Ice-Cream Packaging Market Insights

Asia Pacific is experiencing rapid growth in the Ice-Cream Packaging Market, driven by the rising disposable income and urbanization in emerging markets. The increasing consumption of packaged ice cream, especially in countries like China and India, is fueling demand for convenient and cost-effective packaging options. The region is expected to benefit from the rising popularity of e-commerce and retail growth.

Middle East and Africa Ice-Cream Packaging Market Trends

The Middle East and Africa are witnessing gradual growth in the Ice-Cream Packaging Market, influenced by the region’s increasing preference for premium ice cream brands. The demand for sustainable and aesthetically appealing packaging solutions is growing, especially in the urbanized areas. However, challenges such as high production costs and regulatory hurdles related to plastic packaging may limit growth to some extent.

Latin America Ice-Cream Packaging Market Overview

Latin America is seeing a rise in demand for innovative packaging solutions, driven by the growing middle class and the increasing consumption of packaged ice cream. While the market is still developing, it is expected to grow steadily, with an increasing focus on sustainability and cost-effective packaging solutions. The region’s market growth is projected to be supported by expanding retail sectors and changing consumer preferences.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Ice-Cream Packaging Company Insights

The global Ice-Cream Packaging Market is driven by several prominent players that continue to shape the industry with their innovative packaging solutions.

ITC Packaging has emerged as a leading player, offering high-quality, sustainable packaging solutions for the food industry, including ice cream, with a focus on environmentally friendly materials.

Uniflex has carved a niche in the market by delivering customized packaging designs, ensuring the protection and preservation of ice cream products while enhancing their visual appeal. Their products are particularly well-suited for bulk and retail packaging needs.

Huhtamaki Oyj, a key global packaging manufacturer, provides advanced packaging solutions for ice cream that emphasize sustainability, efficiency, and innovation. Their eco-friendly approach has helped them stay competitive in a market that increasingly values sustainability.

Amcor Plc remains a major player, with a strong presence in the ice cream packaging market. Known for its cutting-edge packaging technologies, Amcor focuses on producing flexible, recyclable materials that meet both consumer and environmental demands. Their commitment to sustainability positions them as a frontrunner in the market’s future growth.

These companies play a crucial role in driving innovation, sustainability, and customization within the global ice cream packaging market, responding to evolving consumer preferences and environmental concerns.

Top Key Players in the Market

- ITC Packaging

- Uniflex

- Huhtamaki Oyj

- Amcor Plc

- Tetra Laval

- Sonoco Products Company

- Berry Global Group

- Delkor Systems Inc.

- Insta Polypack

- Stora Enso Oyj

- Stanpac Inc.

- IIC Packaging

- International Paper Company

- Sirane Limited

- Safepack Solutions

Recent Developments

- In July 2025, Huhtamaki introduced new compostable ice cream cups designed to support sustainability in the packaging industry. The launch aims to meet increasing consumer demand for eco-friendly alternatives to traditional packaging.

- In March 2025, Vytal secured €14.2 million in funding to expand its smart reusable packaging solution into the US market. The investment will enable the company to scale its innovative packaging technology and reduce waste.

Report Scope

Report Features Description Market Value (2024) USD 935.4 Million Forecast Revenue (2034) USD 1466.6 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Glass, Paper, Metal), By Product Type (Cups, Jars, Stick packs, Cone, Others), By Distribution (Retail Stores, Supermarkets, Ice-Cream Parlours, E-commerce) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ITC Packaging, Uniflex, Huhtamaki Oyj, Amcor Plc, Tetra Laval, Sonoco Products Company, Berry Global Group, Delkor Systems Inc., Insta Polypack, Stora Enso Oyj, Stanpac Inc., IIC Packaging, International Paper Company, Sirane Limited, Safepack Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ITC Packaging

- Uniflex

- Huhtamaki Oyj

- Amcor Plc

- Tetra Laval

- Sonoco Products Company

- Berry Global Group

- Delkor Systems Inc.

- Insta Polypack

- Stora Enso Oyj

- Stanpac Inc.

- IIC Packaging

- International Paper Company

- Sirane Limited

- Safepack Solutions