Global IC Fabs Market Size, Share Analysis Report By Technology Node (3nm, 4-10nm, 14-28nm, and 28-130nm), By Industry Vertical (Consumer Electronics, Computing, IT & Telecom, Automotive, Industrial, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152993

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

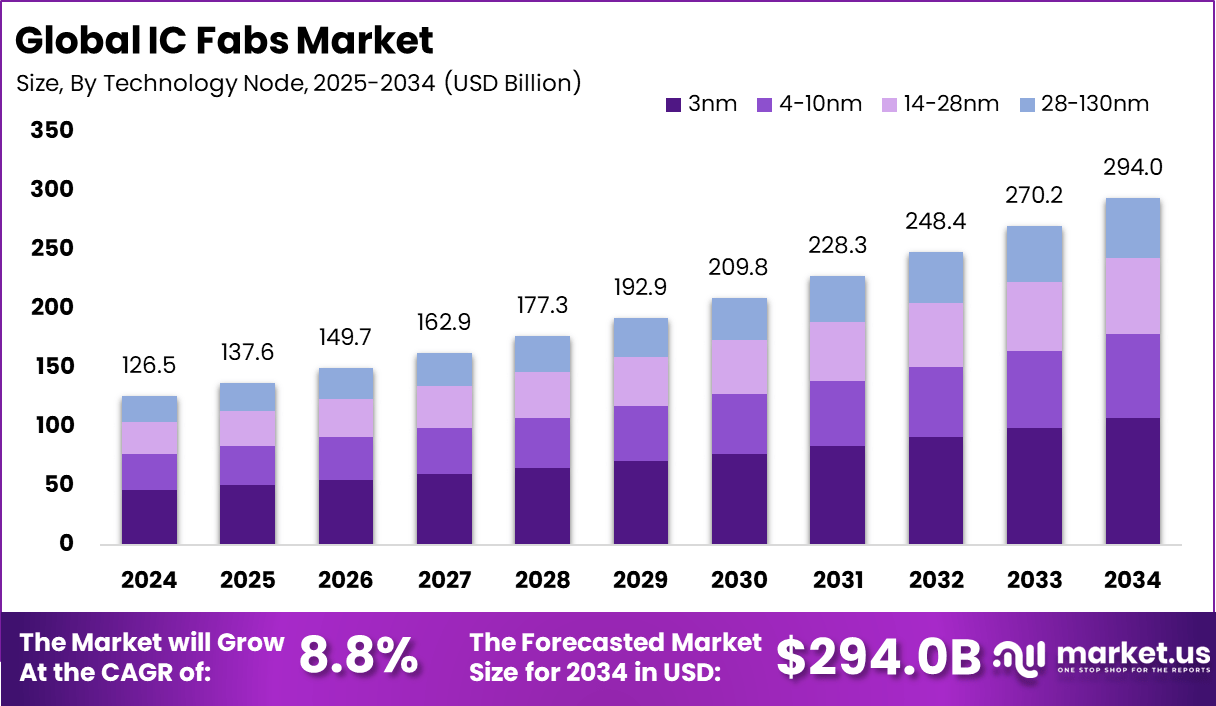

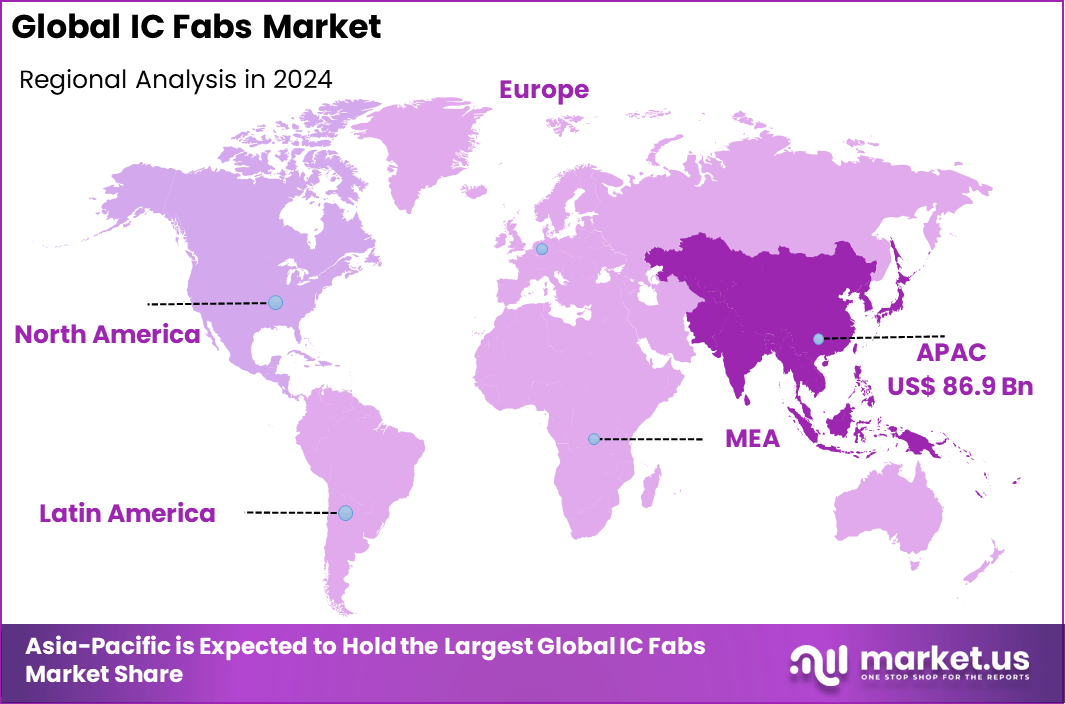

The Global IC Fabs Market size is expected to be worth around USD 294.0 billion by 2034, from USD 126.5 billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 68.7% share, holding USD 86.9 billion in revenue.

The integrated circuit (IC) fabrication market, encompassing the design and manufacturing of semiconductor chips, is a cornerstone of the global technology infrastructure. This sector supports a multitude of industries, including consumer electronics, automotive, telecommunications, and healthcare. The market’s evolution is closely tied to advancements in process technologies, materials science, and automation, reflecting the industry’s pivotal role in driving technological progress.

The expansion of the IC fabrication market is propelled by several key factors. The proliferation of data-intensive applications, such as artificial intelligence (AI), machine learning (ML), and 5G communications, necessitates the development of more powerful and efficient semiconductor devices. Additionally, the increasing demand for consumer electronics and the automotive industry’s shift towards electric vehicles and autonomous driving technologies further stimulate the need for advanced ICs.

Scope and Forecast

Report Features Description Market Value (2024) USD 126.5 Bn Forecast Revenue (2034) USD 294 Bn CAGR (2025-2034) 8.8% Largest market in 2024 APAC [68.7% market share] The demand for IC fabrication services is influenced by the technological requirements of end-user industries. In the consumer electronics sector, the trend towards miniaturization and enhanced performance drives the need for advanced semiconductor nodes. The automotive industry’s emphasis on safety features, infotainment systems, and electric drivetrains increases the demand for specialized ICs.

The adoption of cutting-edge technologies is transforming the IC fabrication landscape. The integration of AI and ML algorithms in the design and manufacturing processes enhances the efficiency and accuracy of chip production. Advanced packaging techniques, such as system-in-package (SiP) and chip-on-wafer technologies, enable the development of more compact and functional semiconductor devices.

Key Takeaways

- The Global IC Fabs market is projected to grow from USD 126.5 billion in 2024 to approximately USD 294.0 billion by 2034, registering a healthy 8.8% CAGR, driven by rising demand for advanced semiconductors across industries.

- In 2024, the Asia-Pacific region dominated the market with a substantial 68.7% share, generating about USD 86.9 billion, supported by strong manufacturing capacity and government initiatives.

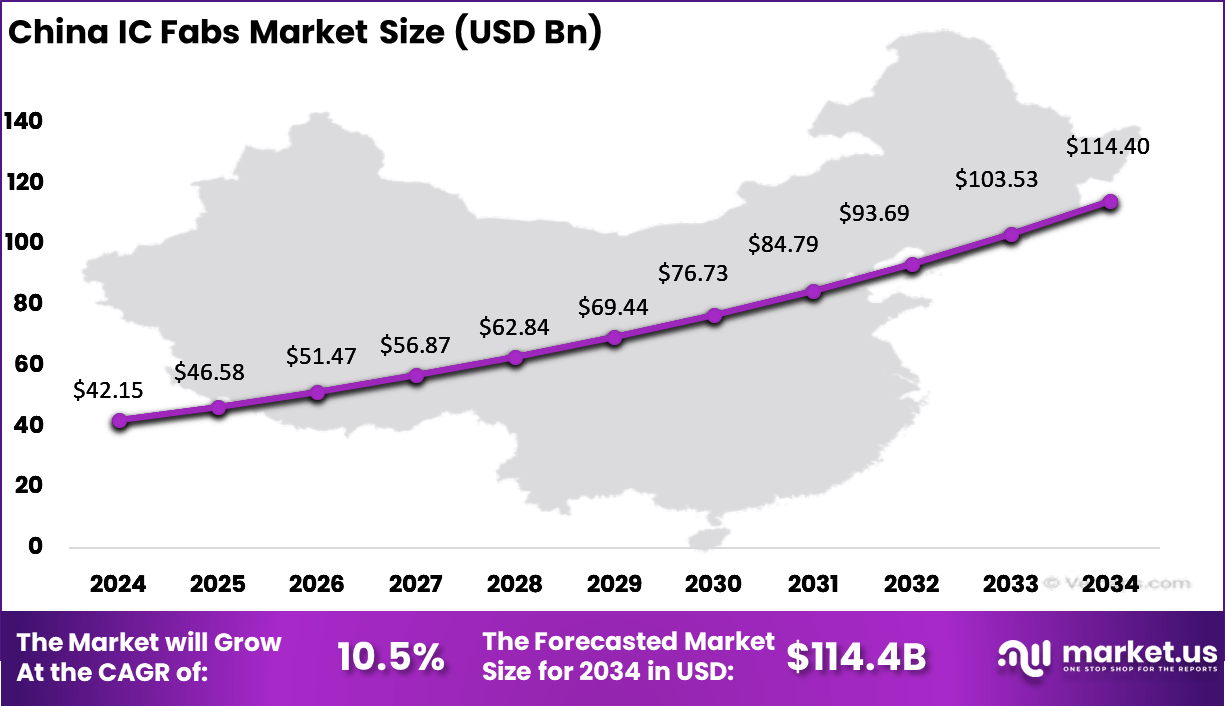

- Within Asia-Pacific, China contributed approximately USD 42.15 billion, and is expected to grow at a robust 10.5% CAGR, reflecting its strategic investments in semiconductor self-sufficiency.

- By technology node, the 3nm segment led the market with 36.7% share, driven by the shift toward smaller, more powerful, and energy-efficient chips.

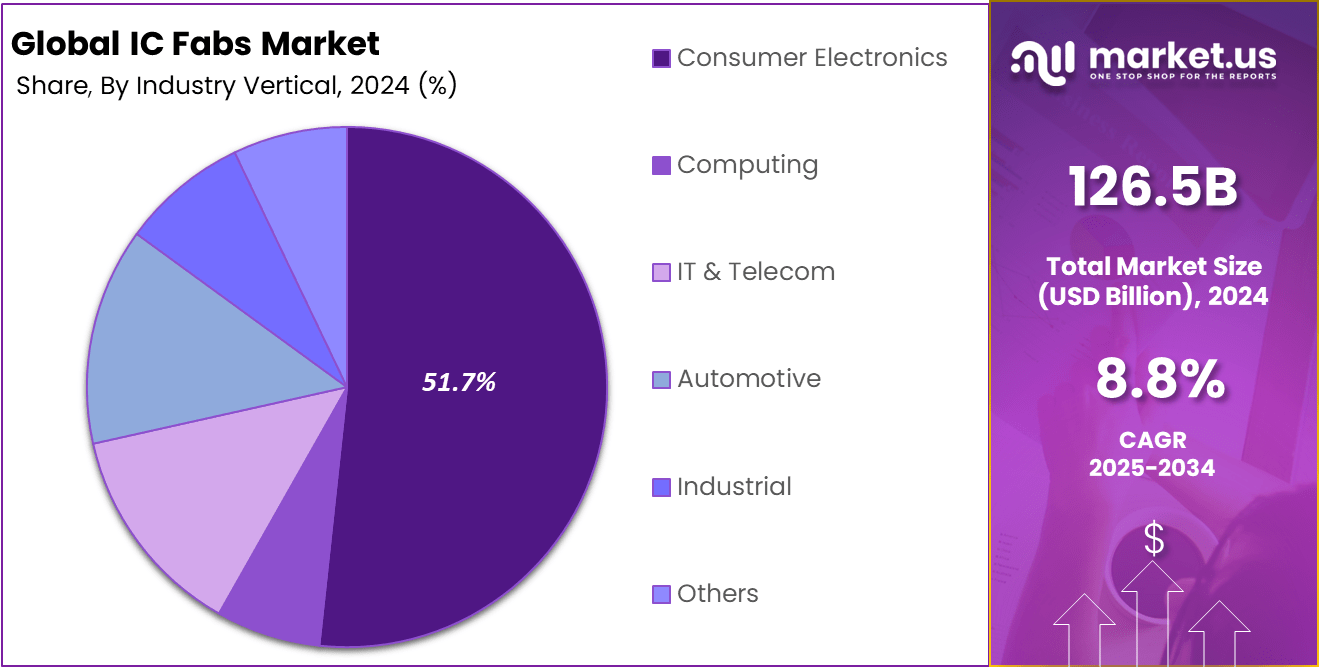

- By industry vertical, Consumer Electronics held the largest share at 51.7%, underscoring the continued demand for smartphones, tablets, and smart devices worldwide.

China IC Fabs Market

China’s IC fabs market is witnessing rapid expansion, driven by strong government support and a national push for semiconductor self-sufficiency. As of 2024, China hosts around 44 operational wafer fabs, including 25 advanced 300mm fabs, with another 32 under construction, highlighting aggressive infrastructure development.

Investment in semiconductor manufacturing equipment reached USD 41 billion in 2024, marking a 29% increase from the previous year. This growth trajectory is expected to expand China’s total chip production capacity by 40% within five years, and potentially double over the next decade. While most of China’s fabs focus on mature nodes (>28nm), there is a growing movement toward advanced nodes (≤16nm).

For instance, Nexchip is producing chips at 90–150nm nodes and scaling into automotive display applications. However, the market faces setbacks from failed or delayed projects -so-called “zombie fabs” – with losses estimated at USD 50-100 billion due to mismanagement or restrictions on access to advanced foreign equipment.

In 2024, APAC held a dominant market position, capturing more than a 40.8% share, holding USD 86.9 Billion revenue in the global IC fabs market. The region’s leadership is a direct result of its robust manufacturing ecosystem, large-scale investments, and strong government support for the semiconductor industry.

Countries like Taiwan, South Korea, and China are home to most of the world’s advanced chip foundries and continue to attract major capital for technological upgrades and expansion. The presence of a mature supply chain, advanced R&D centers, and a vast talent pool enables APAC to consistently deliver high-performance, energy-efficient chips used in everything from smartphones and computers to automotive and industrial products.

Analysts’ Viewpoint

The IC fabrication sector presents numerous investment opportunities, particularly in the development of advanced manufacturing facilities and the acquisition of state-of-the-art equipment. Investments in research and development are crucial for the innovation of new semiconductor materials and process technologies.

Moreover, the growing emphasis on environmental sustainability opens avenues for investments in green technologies and energy-efficient manufacturing solutions, aligning with global trends towards sustainability. Engaging in the IC fabrication market offers several business advantages. Companies can capitalize on the increasing demand for advanced semiconductor devices across various industries.

Establishing a presence in this sector allows businesses to leverage economies of scale, reduce production costs, and enhance their technological capabilities. Moreover, involvement in the IC fabrication market positions companies as key players in the global technology supply chain, fostering opportunities for strategic partnerships and collaborations.

The regulatory landscape for IC fabrication is shaped by national and international standards aimed at ensuring product quality, environmental sustainability, and fair competition. Compliance with these regulations is essential for maintaining operational legitimacy and market access. Governments worldwide are implementing policies to encourage domestic semiconductor production, including subsidies, tax incentives, and support for research and development initiatives.

By Technology Node Analysis

In 2024, 3nm segment held a dominant market position, capturing more than a 36.7% share of the integrated circuit fabrication market. The surge in preference for 3nm process technology comes as increasing global demand for next-generation smartphones, AI-enabled devices, and advanced data center solutions drives manufacturers towards smaller, more powerful, and energy-efficient chips.

The 3nm node stands out due to its exceptional transistor density and improved performance-per-watt, which directly benefit high-performance computing and mobile applications. Compared to previous technology nodes, 3nm allows for faster processing speeds and extended battery life, making it the preferred option for industries prioritizing cutting-edge performance and optimal power management.

Manufacturers are ramping up production and refining yields to support this rising demand, cementing the 3nm segment’s operational and technological advantages over legacy nodes. The leadership of the 3nm segment reflects a broader market shift toward more sophisticated chip architectures tailored for artificial intelligence, advanced graphics, and big data applications.

The adoption of 3nm is helped by a strong push from sectors eager to deliver technological breakthroughs quickly and efficiently. Its robust adoption is also facilitated by innovations in chip design and fabrication that lower power consumption while maximizing computing output. Although producing chips at this node remains capital-intensive, companies value the competitive advantages and long-term efficiency gains, motivating heavy investments in this segment.

By Industry Vertical Analysis

In 2024, Consumer Electronics segment held a dominant market position, capturing more than a 51.7% share of the integrated circuit fabrication market. This leadership is shaped by the ever-growing demand for smartphones, tablets, wearables, smart home devices, and entertainment systems. Everyday products have become smarter, slimmer, and more powerful, driving manufacturers to rely on highly advanced integrated circuits.

These chips not only enable new functionalities like voice assistance and health tracking but are also essential for improvements in battery life, processing, and display resolution. As consumer habits shift toward mobile-centric and connected environments, the industry responds by rapidly scaling up production and innovation for this segment.

The dominance of the Consumer Electronics segment is further fueled by global trends such as the rise of AI-powered features, integration of advanced sensors, and increasing adoption of high-speed connectivity. Integrated circuits provide the backbone for seamless multitasking, immersive gaming, and real-time communication across devices.

Moreover, advancements in chip design and fabrication process allow companies to pack more features in smaller form factors, making electronics lighter and more energy-efficient. The relentless introduction of new device categories and iterative upgrades ensures continuous demand for state-of-the-art ICs, securing Consumer Electronics as the market’s anchor vertical in 2024.

Key Market Segments

Technology Node

- 3nm

- 4-10nm

- 14-28nm

- 28-130nm

Industry Vertical

- Consumer Electronics

- Computing

- IT & Telecom

- Automotive

- Industrial

- Others

Emerging Trend

Accelerating Role of Artificial Intelligence and Advanced Computing in IC Fabs

One of the most compelling trends reshaping the landscape of IC fabs is the rapid adoption of artificial intelligence technologies and the pursuit of advanced computing capabilities. Today’s fabrication plants are not just manufacturing chips; they are increasingly embedding AI into core operations, from manufacturing process control to yield improvement and root cause analysis.

These smart fabs use data-driven methods such as predictive analytics and machine learning to quickly identify faults, optimize processes, and drive higher efficiencies at every stage. The growing reliance on advanced logic and memory, fueled by artificial intelligence and edge computing needs, is also prompting fabs to invest in leading-edge node technologies for various applications.

However, this trend is not just about cost savings or production volume. The use of AI and high-performance computing systems inside fabs marks a shift in how the industry thinks about growth, innovation, and global competitiveness. Workers find themselves adapting to new skillsets, while manufacturers are becoming more responsive to changing demands for AI-powered chips.

Key Driver

Global Digitalization and Rising Semiconductor Demand

The swift acceleration of global digitalization is a primary force powering growth in the IC fabs sector. As industries such as automotive, telecommunications, and electronics increasingly rely on integrated circuits to deliver smarter, faster, and more connected experiences, the demand for both new and legacy chips has soared.

National strategies to expand high-speed internet, the rollout of 5G and future 6G networks, and the evolution of cloud data centers have significantly contributed to this upswing. This driver is not solely technological – social and economic shifts, including remote work and digital inclusion, further multiply the need for robust semiconductor infrastructures.

This driver compels IC fabs to expand production capacity and diversify product offerings, opening doors for more advancements across the supply chain. As automation, digitization, and innovation continue to transform business and everyday life, IC fabs increasingly find themselves at the core of technological progress. Their pivotal role in the global ecosystem enables faster adoption of digital tools worldwide, turning these facilities into essential contributors to modern society.

Notable Restraint

High Capital Costs and Operational Complexity

IC fab construction is among the most expensive and complex manufacturing endeavors, presenting a significant restraint for industry entrants and even established players. The barrier to entry is not limited to massive initial investments for cleanroom environments, equipment, and materials; maintaining state-of-the-art operations requires ongoing spending on research, skilled workforce retention, utilities, and compliance with rigorous quality and environmental standards.

Many regions also face higher operational costs due to local infrastructure, energy, and labor expenses, putting pressure on overall profitability. Beyond costs, operational complexity can limit innovation and slow responses to market demand. IC fabs must operate almost continuously to be economically viable.

Delays in securing qualified staff, technology licenses, raw materials, or regulatory approvals can throttle expansion plans and sharply reduce return on investment. These financial and operational burdens mean that only the most well-capitalized and efficient players are able to thrive and scale, creating an environment where risk is high and entry is daunting for newcomers.

Opportunity Highlight

Localized Supply Chains for Strategic Resilience

A major opportunity for IC fabs arises from the ongoing move toward localizing semiconductor supply chains. With geopolitical uncertainties, trade disruptions, and a desire for national self-sufficiency sharpening focus on strategic industries, more countries are incentivizing the domestic production of integrated circuits.

Local fabs enable nations to secure critical components, foster high-tech job creation, and reduce their vulnerability to global supply shocks. This localization empowers manufacturers to better navigate regulatory requirements, tap into government incentives, and benefit from proximity to customers and research institutions.

For the broader ecosystem, this shift represents a chance to develop new supplier networks, establish robust partnerships, and cultivate homegrown expertise. Governments and businesses that take advantage of these localization strategies often stimulate innovation, accelerate product development, and build more adaptive, future-ready supply chains.

Persistent Challenge

Building a Skilled Workforce and Navigating Infrastructure Gaps

A recurring challenge for IC fabs is the struggle to develop a sufficiently skilled workforce and reliable supporting infrastructure. While there is a high demand for chip design engineers and specialists in process technology, most regions – especially emerging markets – face shortages in talent with hands-on fabrication experience.

Training a new generation of experts in areas such as device physics, materials science, and precision manufacturing takes years, creating bottlenecks for expansion and innovation in the sector. Infrastructure presents its own hurdles. IC fabs require steady power, clean water, advanced logistics, and swift customs operations to function efficiently.

Inadequate infrastructure, red tape, and delays in obtaining permits or supplies can stall projects and heap pressure on timelines and budgets. These combined constraints make it much harder for new regions to become competitive, highlighting a pressing need for coordinated efforts among government, academia, and industry to nurture talent and strengthen foundational infrastructure for sustainable growth.

Key Player Analysis

Samsung, TSMC, and GlobalFoundries are the leading players in the IC fabrication market, with Samsung focusing on advanced 5nm and 3nm technologies, TSMC dominating in high-performance semiconductor manufacturing, and GlobalFoundries specializing in mature nodes and specialty technologies.

United Microelectronics Corporation (UMC) and Vanguard International Semiconductor Corporation provide cost-effective solutions across various industries. PSMC Co., Ltd. and Semiconductor Manufacturing International Corporation (SMIC) are key players in Asia, expanding their production capacity.

Nexchip Semiconductor Corp. and Tower Semiconductor Ltd. offer expertise in specialty semiconductors for niche applications, while Hua Hong Semiconductor Limited is growing in the Chinese market. These players, along with others, are driving innovation and meeting the rising global demand for semiconductors.

Top Key Players

- Samsung

- GlobalFoundries Inc.

- Vanguard International Semiconductor Corporation

- United Microelectronics Corporation

- Taiwan Semiconductor Manufacturing Co., Ltd.

- PSMC Co., Ltd.

- Semiconductor Manufacturing International Corporation

- Nexchip Semiconductor Corp.

- Tower Semiconductor Ltd.

- Hua Hong Semiconductor Limited

- Other Key Players

Recent Development

- In June 2025, SkyWater completed the acquisition of a 200mm semiconductor fab in Austin, Texas, from Infineon, expanding its capacity by around 400,000 wafer starts annually. This move converts captive fab capacity into an open-access foundry, bolstering domestic manufacturing for industrial, automotive, and defense applications.

- In May 2025, India’s Union Cabinet approved a new semiconductor fab JV between HCL and Foxconn near Uttar Pradesh, with a design capacity of 20,000 wafers per month and an investment of about US$433.6 million. This fab will focus on display driver chips for multiple device segments.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology Node (3nm, 4-10nm, 14-28nm, and 28-130nm), By Industry Vertical (Consumer Electronics, Computing, IT & Telecom, Automotive, Industrial, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung, GlobalFoundries Inc., Vanguard International Semiconductor Corporation, United Microelectronics Corporation, Taiwan Semiconductor Manufacturing Co. Ltd., PSMC Co. Ltd., Semiconductor Manufacturing International Corporation, Nexchip Semiconductor Corp., Tower Semiconductor Ltd., Hua Hong Semiconductor Limited, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Samsung

- GlobalFoundries Inc.

- Vanguard International Semiconductor Corporation

- United Microelectronics Corporation

- Taiwan Semiconductor Manufacturing Co., Ltd.

- PSMC Co., Ltd.

- Semiconductor Manufacturing International Corporation

- Nexchip Semiconductor Corp.

- Tower Semiconductor Ltd.

- Hua Hong Semiconductor Limited

- Other Key Players