Global Hydroponics Market Size, Share, And Business Benefits By Type (Aggregate Systems, EBB and Flow Systems, Drip Systems, Wick Systems, Liquid Systems, Deep Water Culture, Nutrient Film Technique (NFT), Aeroponics), By Crop Type (Tomatoes, Lettuce, Peppers, Cucumbers, Herbs, Others), By Crop Area (Upto 1000 sq.ft., 1000-50000 sq.ft., Above 50000 sq.ft),By Equipment (HVAC, Led Grow Lights, Control Systems, Irrigation Systems, Material Handling Equipment, Others), By Farming Method (Indoor, Outdoor), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158836

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

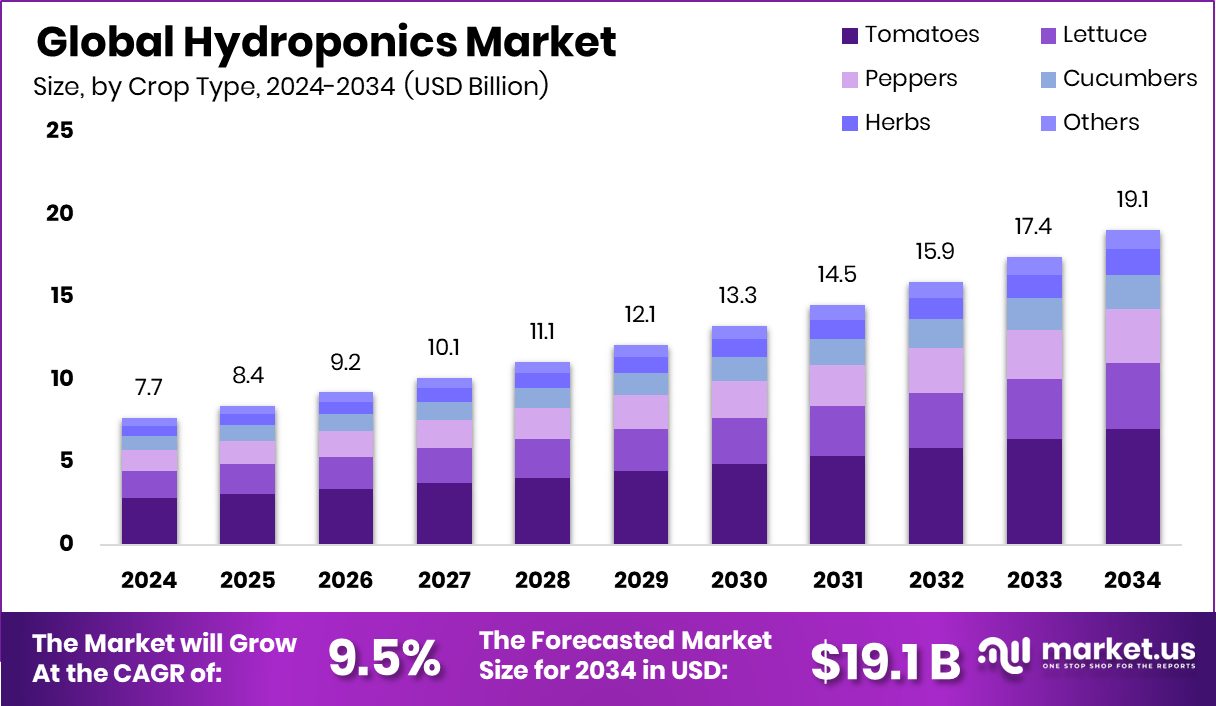

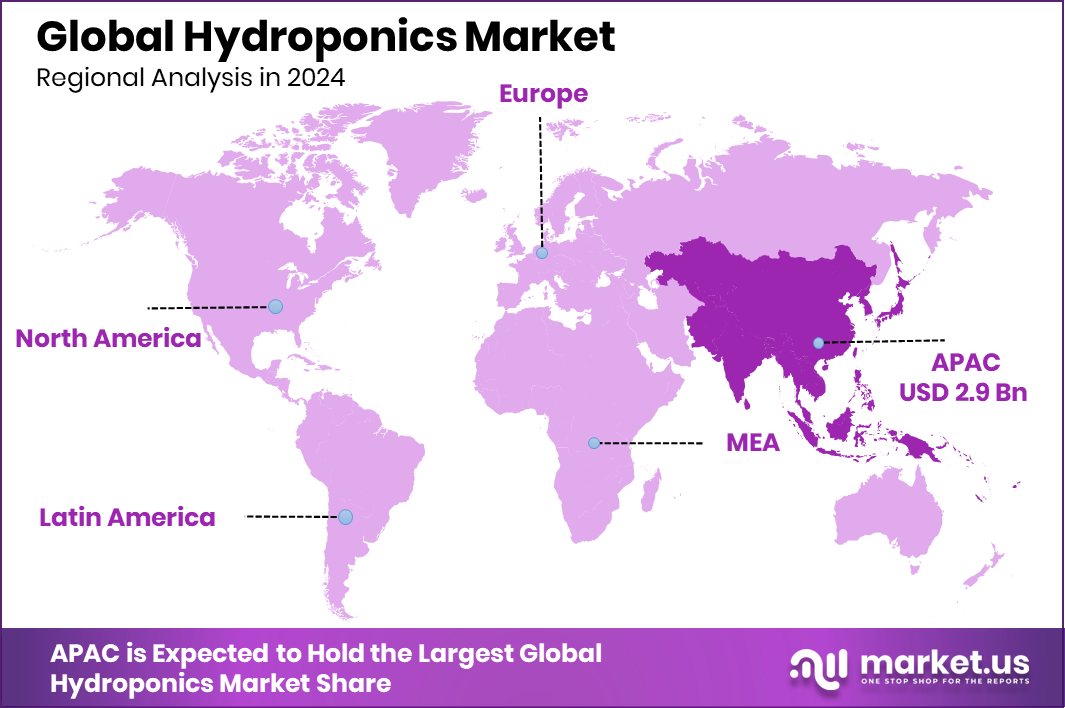

The Global Hydroponics Market is expected to be worth around USD 19.1 billion by 2034, up from USD 7.7 billion in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034. With a USD 2.9 Bn value, Asia Pacific secured a 38.30% share in the Hydroponics Market 2024.

Hydroponics is a modern method of growing plants without soil, where crops are cultivated in nutrient-rich water solutions. Instead of relying on natural soil, plants receive essential minerals directly through water, which enhances growth efficiency and allows farming in regions with poor soil conditions. This system is widely adopted in urban agriculture, greenhouses, and controlled environments, as it helps save water, ensures faster plant growth, and reduces the need for pesticides.

The hydroponics market represents the global trade, adoption, and expansion of this farming method. It is gaining popularity due to increasing food demand, shrinking arable land, and the need for sustainable farming practices. Countries with desert climates and urban centers with limited farmland are rapidly investing in hydroponics to secure food supply. Innovations and funding are accelerating market growth, with initiatives such as Arable, a Saudi AgriTech startup, securing USD 2.55 million in funding, and similar global efforts highlighting its growing commercial appeal.

One of the key growth factors is rising awareness about food security and sustainable farming. Governments and startups are supporting projects like the $240,000 grant to revolutionize agriculture in California’s Imperial Valley, which reflects a growing commitment to new farming technologies. This is expected to drive adoption across both developed and emerging economies.

Demand is fueled by urbanization, changing diets, and the preference for fresh, chemical-free produce. Hydroponics enables year-round crop production in urban setups, ensuring fresh vegetables and fruits are available close to consumers. As consumers continue to prioritize quality food with fewer resources, demand for hydroponically grown crops will see a steady rise.

Opportunities lie in technological innovation and funding support. For instance, the £500k seed funding secured by Phytoponics in Wales demonstrates investor confidence in new hydroponic systems. With advancements in automation, IoT monitoring, and vertical farming, the sector offers significant scope for scaling up food production sustainably, making hydroponics a key contributor to future agriculture.

Key Takeaways

- The Global Hydroponics Market is expected to be worth around USD 19.1 billion by 2034, up from USD 7.7 billion in 2024, and is projected to grow at a CAGR of 9.5% from 2025 to 2034.

- The Hydroponics Market by type shows Aggregate Systems holding 31.2%, reflecting growing adoption across growers.

- Within crop type, the Hydroponics Market highlights tomatoes at 36.8%, driven by steady consumer demand globally.

- By crop area, the Hydroponics Market shows dominance of 1000–50000 sq.ft. farms, capturing 56.3%.

- Equipment analysis in the Hydroponics Market indicates LED grow lights leading with a 31.2% share adoption.

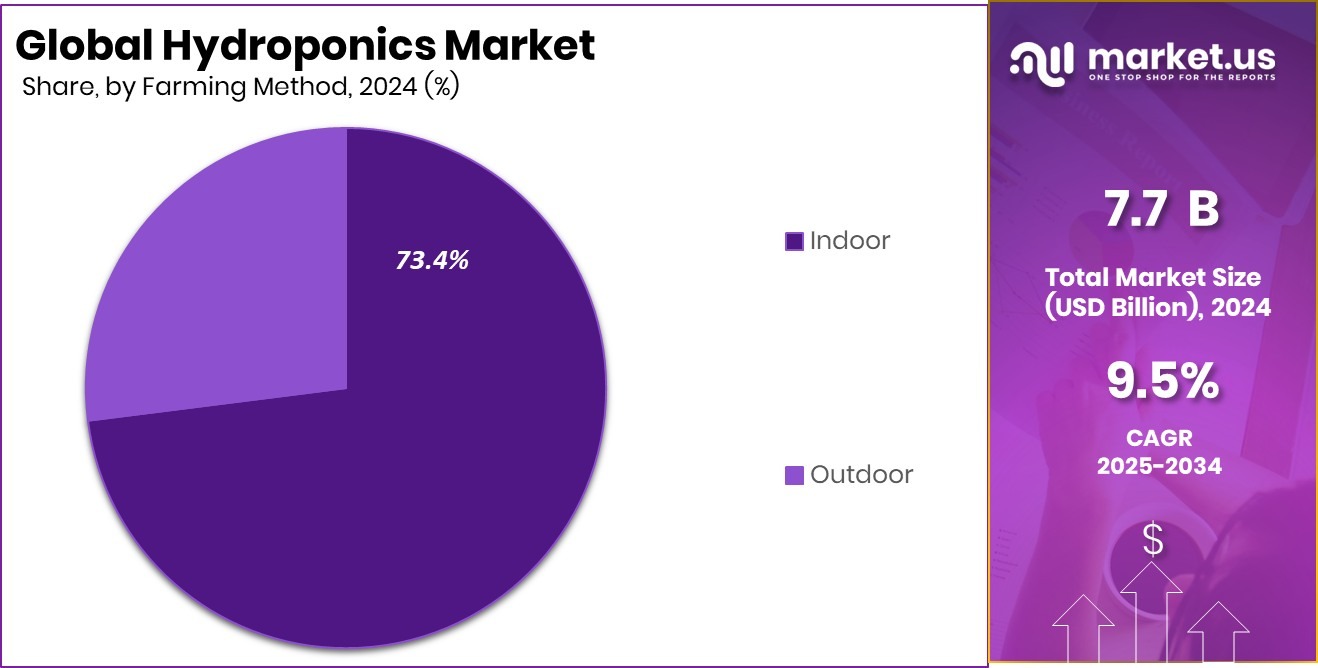

- By farming method, the Hydroponics Market strongly favors indoor farming, holding 73.4% of the share.

- Asia Pacific, holding a 38.30% share, generated USD 2.9 Bn revenue in the Hydroponics Market 2024.

By Type Analysis

The Hydroponics Market by type shows Aggregate Systems leading with 31.2%.

In 2024, Aggregate Systems held a dominant market position in the By Type segment of the Hydroponics Market, with a 31.2% share. This system relies on inert growing media such as perlite, rock wool, clay pellets, and vermiculite, which provide stable root support while ensuring proper aeration and nutrient absorption. The popularity of aggregate systems stems from their cost-effectiveness, ease of use, and suitability for large-scale farming as well as small greenhouse setups.

Farmers prefer this method for its flexibility in supporting a variety of crops and its relatively low maintenance compared to other hydroponic techniques. With rising demand for efficient farming solutions, aggregate systems continue to be a preferred choice, reinforcing their leadership within the market.

By Crop Type Analysis

Tomatoes dominate the Hydroponics Market by crop type, holding 36.8% share.

In 2024, Tomatoes held a dominant market position in the By Crop Type segment of the Hydroponics Market, with a 36.8% share. Tomatoes are among the most widely cultivated hydroponic crops due to their high demand, consistent consumption worldwide, and suitability for controlled environment farming. Hydroponic systems allow growers to achieve higher yields, better quality, and year-round production of tomatoes, which adds to their market dominance.

The crop thrives well under nutrient-controlled water systems, making it a preferred choice for both commercial growers and greenhouse operators. With rising consumer preference for fresh, pesticide-free produce, hydroponically grown tomatoes continue to strengthen their market leadership and drive significant value within the global hydroponics industry.

By Crop Area Analysis

The Hydroponics Market by crop area favors 1000–50000 sq ft. at 56.3%.

In 2024, 1000-50000 sq.ft. held a dominant market position in the By Crop Area segment of the Hydroponics Market, with a 56.3% share. This range is widely adopted by commercial growers and mid-scale greenhouse operators, as it balances production efficiency with manageable operating costs. Facilities within this size range are large enough to support diverse crop varieties, including high-demand vegetables and fruits, while still being flexible in terms of resource allocation and technology integration.

The segment benefits from rising investments in urban and peri-urban farming, where such medium-scale setups are ideal for meeting local food demand. Its scalability and cost-effectiveness continue to reinforce its strong leadership within the hydroponics market landscape.

By Equipment Analysis

LED grow lights capture a 31.2% share in the Hydroponics Market equipment.

In 2024, LED Grow Lights held a dominant market position in the By Equipment segment of the Hydroponics Market, with a 31.2% share. Their efficiency, long lifespan, and ability to provide tailored light spectrums make them highly suitable for indoor and greenhouse farming. LED technology supports optimal photosynthesis while reducing energy consumption compared to traditional lighting systems, which drives its adoption among growers focused on cost savings and sustainability.

The precise control over light intensity and wavelength allows farmers to enhance crop yields and quality throughout the year. With the increasing push for energy-efficient farming practices, LED grow lights have become a vital component, solidifying their leading role within the hydroponics equipment market.

By Farming Method Analysis

Indoor farming leads the Hydroponics Market method, contributing 73.4% dominance.

In 2024, Indoor held a dominant market position in the By Farming Method segment of the Hydroponics Market, with a 73.4% share. Indoor farming provides growers with complete control over temperature, humidity, and lighting, enabling consistent crop production regardless of external climate conditions. This method is widely adopted in urban areas where arable land is limited, supporting year-round cultivation of high-demand crops such as vegetables and herbs.

The ability to maximize space utilization through vertical farming techniques further strengthens the appeal of indoor hydroponics. With growing emphasis on food security and sustainable production close to consumption centers, indoor farming continues to lead the market, reflecting its efficiency and adaptability in modern agriculture.

Key Market Segments

By Type

- Aggregate Systems

- EBB and Flow Systems

- Drip Systems

- Wick Systems

- Liquid Systems

- Deep Water Culture

- Nutrient Film Technique (NFT)

- Aeroponics

By Crop Type

By Crop Area

- Upto 1000 sq.ft.

- 1000-50000 sq.ft.

- Above 50000 sq.ft

By Equipment

- HVAC

- Led Grow Lights

- Control Systems

- Irrigation Systems

- Material Handling Equipment

- Others

By Farming Method

- Indoor

- Outdoor

Driving Factors

Rising Food Demand and Limited Arable Land

One of the biggest driving factors for the hydroponics market is the rising global food demand combined with shrinking arable land. With the world’s population growing steadily, there is increasing pressure to produce more food in less space. Traditional farming often depends on fertile soil and favorable weather, but both are becoming harder to rely on due to climate change and urbanization.

Hydroponics offers a smart solution by allowing crops to grow in nutrient-rich water without the need for soil. This system uses less space and water while producing higher yields. As cities expand and farmland decreases, hydroponics stands out as a sustainable way to meet food needs while ensuring year-round, reliable crop production.

Restraining Factors

High Initial Setup and Maintenance Investment Costs

A key restraining factor in the hydroponics market is the high initial setup and ongoing maintenance costs. Unlike traditional farming, hydroponic systems require advanced equipment such as grow lights, pumps, nutrient delivery systems, and climate control units. The cost of establishing these systems can be a barrier for small-scale farmers or startups with limited budgets.

Even after installation, regular monitoring and skilled labor are needed to ensure the right balance of nutrients, water, and environmental conditions, adding to operational expenses. While the long-term benefits include higher yields and efficient use of resources, the upfront financial commitment often discourages wider adoption, especially in developing regions where access to technology and funding may be limited.

Growth Opportunity

Expanding Urban Farming and Vertical Agriculture Potential

A major growth opportunity for the hydroponics market lies in the expansion of urban farming and vertical agriculture. As cities grow and populations increase, the demand for fresh, local, and pesticide-free food is rising sharply. Hydroponics makes it possible to grow crops in high-rise buildings, warehouses, and other indoor spaces, turning unused urban areas into productive farms.

Vertical farming techniques, combined with hydroponic systems, maximize space by stacking crops in multiple layers, significantly increasing yield per square foot. This approach not only reduces the need for transportation but also ensures a year-round supply close to consumers. With increasing investments and government support for sustainable city farming, urban hydroponics is set to unlock massive future opportunities.

Latest Trends

Integration of Smart Technologies in Hydroponic Farming

One of the latest trends in the hydroponics market is the integration of smart technologies like IoT, AI, and data analytics. Farmers are increasingly adopting sensors and automated systems to monitor water quality, nutrient levels, light intensity, and temperature in real time. These tools help maintain ideal growing conditions, reduce human error, and cut down resource wastage.

AI-powered systems can even predict plant needs and optimize growth cycles, improving yield and quality. Mobile apps and cloud-based platforms make it easier for growers to track and manage their farms remotely. This trend reflects a shift toward precision agriculture, where technology ensures more efficient, sustainable, and scalable hydroponic farming, appealing to both large and small growers.

Regional Analysis

In 2024, the Asia Pacific dominated the Hydroponics Market with a 38.30% share, worth USD 2.9 Bn.

The Hydroponics Market shows varied growth across regions, driven by unique agricultural needs, climate conditions, and investments in advanced farming technologies. Asia Pacific emerged as the dominating region in 2024, holding a 38.30% share and generating USD 2.9 billion in revenue. This leadership is supported by rapid urbanization, limited arable land, and strong government backing for modern farming practices across countries like China, Japan, and India.

Rising demand for fresh, pesticide-free vegetables in densely populated cities has further accelerated hydroponic adoption in this region. North America follows closely with the increasing adoption of controlled environment agriculture, backed by technological advancements and consumer awareness about sustainable produce.

Europe also maintains steady growth, driven by stringent food safety regulations and the growing preference for locally sourced products. Meanwhile, the Middle East & Africa are increasingly turning to hydroponics to address food security challenges caused by arid climates, while Latin America explores opportunities in commercial farming to diversify food supply.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, AeroFarms reinforced its reputation as a leader in indoor vertical farming, focusing on sustainable and scalable hydroponic solutions. The company’s advanced aeroponic and hydroponic systems are designed to maximize crop yield in minimal space, making them a vital contributor to urban agriculture. AeroFarms’ commitment to resource efficiency, especially reducing water and land usage, aligns with the growing global demand for eco-friendly farming practices. Its expansion into new urban centers and partnerships with food distributors highlight its strong positioning in the hydroponics industry.

AmHydro continued to build on its expertise as a dedicated hydroponic system manufacturer, offering growers practical and customizable solutions. The company’s focus on delivering reliable equipment for commercial-scale projects, combined with its knowledge-sharing initiatives and technical training, makes it an essential partner for both new entrants and experienced growers. In 2024, AmHydro’s systems gained attention for their ease of integration and ability to support a diverse range of crops, ensuring consistent demand for its offerings.

Argus Control Systems Limited stood out as a key technology enabler within the hydroponics market, providing advanced environmental control and automation solutions. By offering integrated systems that monitor and adjust temperature, lighting, humidity, and nutrient delivery, Argus empowers growers to achieve precision farming at scale. In 2024, its technology was widely adopted in large greenhouse operations and vertical farming setups, emphasizing the importance of automation in modern agriculture.

Top Key Players in the Market

- AeroFarms

- AmHydro

- Argus Control Systems Limited

- Emirates Hydroponics Farms

- Freight Farms, Inc.

- BrightFarms.

- Heliospectra

- Signify Holding

- Nutrifresh India

- UrbanKisaan

Recent Developments

- In December 2024, Heliospectra launched its MITRA X dynamic multi-channel LED solutions (MITRA X C3 and C4) to provide greenhouse growers with greater control over lighting, crop growth, quality, and energy efficiency.

- In April 2024, Freight Farms launched the Greenery™ 50Hz model, designed specifically for countries or regions where electrical systems use 50 50Hz frequency. This is important because many parts of Europe, Asia, Africa, and elsewhere operate on 50 Hz, so this new version makes their container farms more usable in those locations.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Billion Forecast Revenue (2034) USD 19.1 Billion CAGR (2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Aggregate Systems, EBB and Flow Systems, Drip Systems, Wick Systems, Liquid Systems, Deep Water Culture, Nutrient Film Technique (NFT), Aeroponics), By Crop Type (Tomatoes, Lettuce, Peppers, Cucumbers, Herbs, Others), By Crop Area (Upto 1000 sq.ft., 1000-50000 sq.ft., Above 50000 sq.ft),By Equipment (HVAC, Led Grow Lights, Control Systems, Irrigation Systems, Material Handling Equipment, Others), By Farming Method (Indoor, Outdoor) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AeroFarms, AmHydro, Argus Control Systems Limited, Emirates Hydroponics Farms, Freight Farms, Inc., BrightFarms., Heliospectra, Signify Holding, Nutrifresh India, UrbanKisaan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AeroFarms

- AmHydro

- Argus Control Systems Limited

- Emirates Hydroponics Farms

- Freight Farms, Inc.

- BrightFarms.

- Heliospectra

- Signify Holding

- Nutrifresh India

- UrbanKisaan