Global Hybrid Powertrain Market Size, Share, Growth Analysis Type (Full Hybrid (HEV), Mild Hybrid (MHEV), Plug-In Hybrid (PHEV)), Vehicle Type (Passenger Cars, Commercial Vehicles), Sales Channel (OEM Sales, Aftermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177963

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

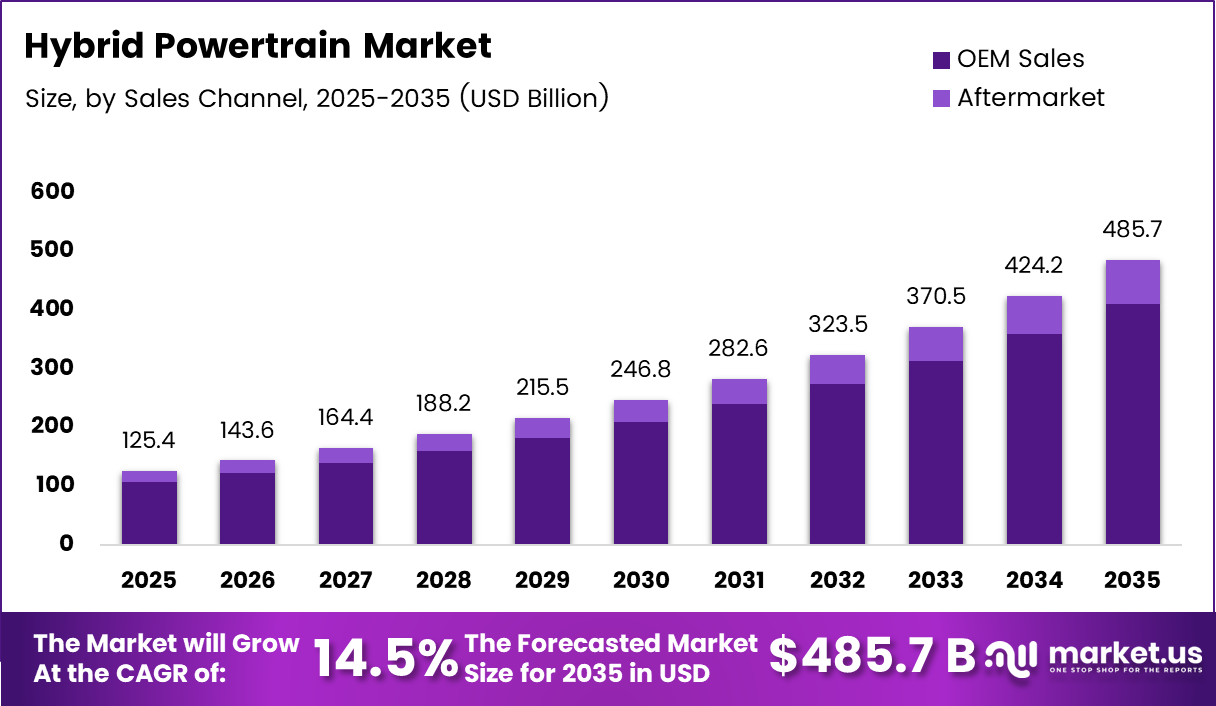

Global Hybrid Powertrain Market size is expected to be worth around USD 485.7 Billion by 2035 from USD 125.4 Billion in 2025, growing at a CAGR of 14.5% during the forecast period 2026 to 2035.

Hybrid powertrains combine conventional internal combustion engines with electric motors to deliver enhanced fuel efficiency and reduced emissions. These advanced systems capture energy during braking and use it to assist propulsion. Therefore, they bridge the gap between traditional vehicles and fully electric platforms.

The market encompasses full hybrid, mild hybrid, and plug-in hybrid configurations. Each technology offers distinct benefits for different vehicle segments and driving patterns. Moreover, manufacturers increasingly adopt modular architectures to deploy hybrid systems across multiple vehicle platforms efficiently.

Rising fuel prices and stringent emission regulations drive automakers toward electrified solutions. Consequently, hybrid powertrains provide an accessible entry point for consumers hesitant about full electrification. Additionally, government incentives in key markets accelerate adoption rates among both individual and fleet buyers.

Urban traffic congestion creates ideal conditions for hybrid technology benefits. Stop-and-go driving maximizes regenerative braking efficiency and electric-only operation capabilities. Furthermore, hybrid vehicles deliver tangible fuel savings in real-world city driving conditions where conventional engines operate inefficiently.

According to Magna, their Etelligent Hybrid systems are scalable from 48V mild hybrid to 800V high voltage configurations. According to Automotivetech, Hyundai’s next-generation 1.6-liter turbo hybrid achieves over 4% fuel efficiency improvement in mid-size SUVs. These technological advancements demonstrate continuous innovation across the powertrain ecosystem.

Commercial vehicle segments represent significant growth opportunities for hybrid technology deployment. Fleet operators prioritize total cost of ownership reductions through improved fuel economy. Additionally, hybrid systems in light commercial vehicles deliver operational benefits in last-mile delivery and urban logistics applications.

Strategic collaborations between automakers and component suppliers accelerate hybrid innovation. Investment in battery technology, energy management systems, and lightweight materials enhances overall system performance. Therefore, the market continues evolving toward more efficient and cost-effective hybrid powertrain solutions.

Key Takeaways

- The global Hybrid Powertrain Market is projected to grow from USD 125.4 Billion in 2025 to USD 485.7 Billion by 2035 at a CAGR of 14.5%.

- Full Hybrid (HEV) systems dominate the Type segment with 49.8% market share in 2025.

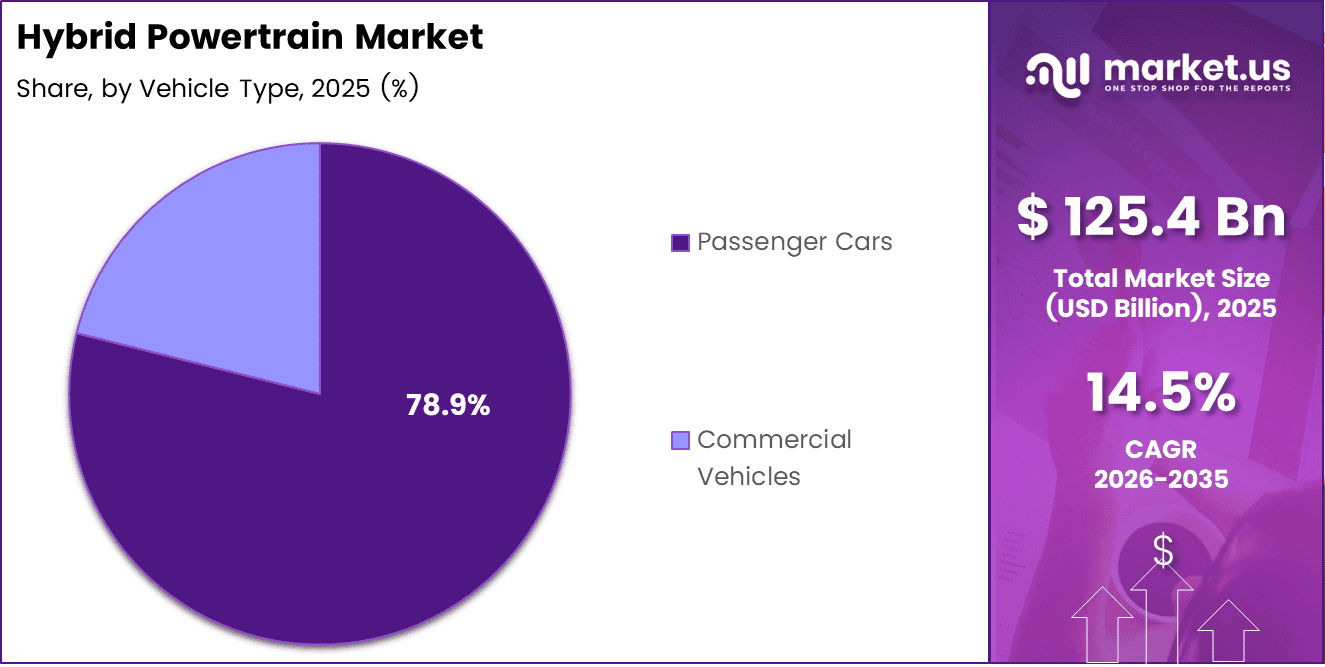

- Passenger Cars represent 78.9% of the Vehicle Type segment, leading hybrid powertrain adoption.

- OEM Sales channel accounts for 84.6% market share, reflecting strong factory integration strategies.

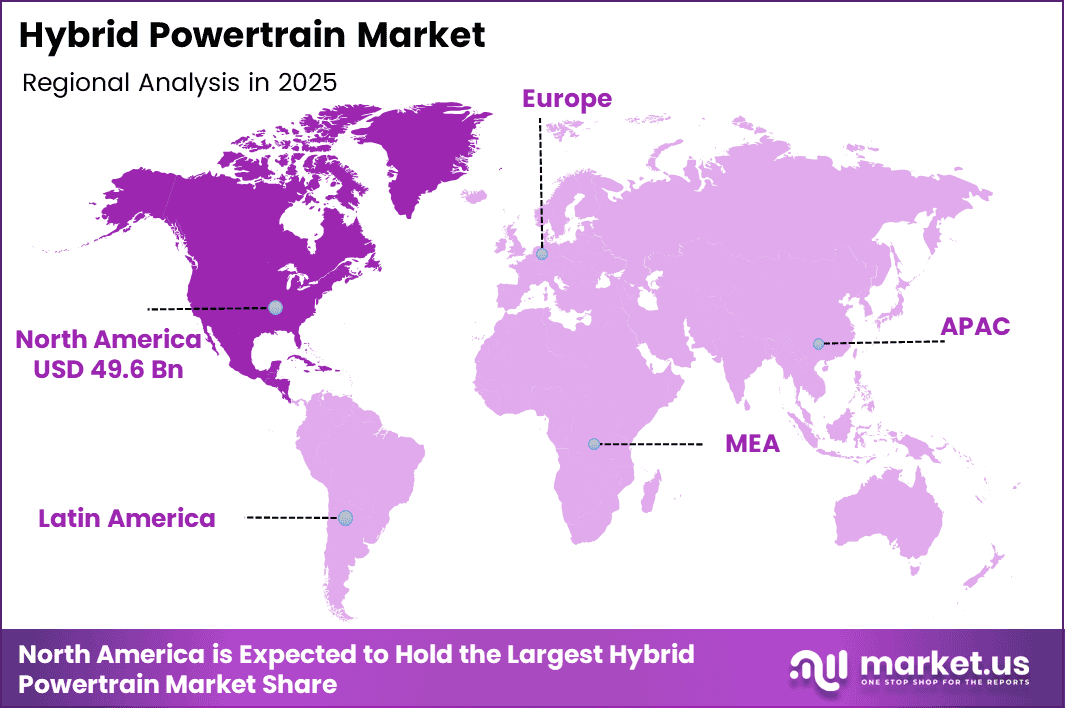

- North America holds 39.6% regional market share, valued at USD 49.6 Billion in 2025.

Type Analysis

Full Hybrid (HEV) dominates with 49.8% due to superior fuel efficiency and established market presence.

In 2025, ‘Full Hybrid (HEV)’ held a dominant market position in the ‘Type’ segment of Hybrid Powertrain Market, with a 49.8% share. These systems enable pure electric driving for short distances and seamlessly switch between power sources. Moreover, full hybrids deliver substantial fuel savings without requiring external charging infrastructure, appealing to mainstream consumers.

Mild Hybrid (MHEV) systems offer cost-effective electrification for mass-market vehicles. These powertrains use smaller battery packs and electric motors to assist combustion engines during acceleration. Additionally, mild hybrids improve fuel economy by 10-15% while maintaining lower production costs compared to full hybrid architectures.

Plug-In Hybrid (PHEV) configurations provide extended electric-only range through larger battery capacities. Drivers can charge batteries externally and operate purely on electricity for daily commutes. Furthermore, PHEVs eliminate range anxiety by retaining combustion engine backup for longer journeys beyond battery capacity.

Vehicle Type Analysis

Passenger Cars dominate with 78.9% due to widespread consumer adoption and diverse model availability.

In 2025, ‘Passenger Cars’ held a dominant market position in the ‘Vehicle Type’ segment of Hybrid Powertrain Market, with a 78.9% share. Sedans, SUVs, and compact vehicles increasingly integrate hybrid technology across all price segments. Therefore, automakers prioritize passenger car hybridization to meet corporate average fuel economy standards and consumer demand for efficiency.

Commercial Vehicles represent growing hybrid adoption in delivery vans, light trucks, and fleet operations. Urban logistics companies deploy hybrid commercial vehicles to reduce operational costs and meet municipal emission requirements. Additionally, hybrid powertrains provide quieter operation for early morning and residential area deliveries.

Sales Channel Analysis

OEM Sales dominate with 84.6% due to factory integration and warranty coverage benefits.

In 2025, ‘OEM Sales’ held a dominant market position in the ‘Sales Channel’ segment of Hybrid Powertrain Market, with an 84.6% share. Manufacturers integrate hybrid systems during vehicle production, ensuring optimal performance and reliability. Moreover, factory-installed powertrains include comprehensive warranty coverage and certified service networks, building consumer confidence.

Aftermarket channels serve retrofit opportunities and replacement component sales for existing hybrid vehicles. Independent service providers and specialized shops supply batteries, motors, and control units for hybrid maintenance. Furthermore, aftermarket solutions enable fleet operators to extend vehicle lifecycles through powertrain upgrades and refurbishment.

Key Market Segments

Type

- Full Hybrid (HEV)

- Mild Hybrid (MHEV)

- Plug-In Hybrid (PHEV)

Vehicle Type

- Passenger Cars

- Commercial Vehicles

Sales Channel

- OEM Sales

- Aftermarket

Drivers

Escalating Fuel Economy Regulations Driving OEM Hybridization Strategies

Governments worldwide implement stringent corporate average fuel economy standards to combat climate change and reduce petroleum dependency. Automakers must achieve fleet-wide emission targets or face substantial financial penalties. Consequently, hybrid powertrains provide cost-effective pathways to regulatory compliance while maintaining consumer-preferred vehicle performance characteristics.

Rising urban traffic congestion creates ideal operating conditions for hybrid powertrain efficiency advantages. Stop-and-go driving patterns maximize regenerative braking energy recovery and electric motor utilization. Moreover, hybrid vehicles deliver significantly better fuel economy in congested metropolitan areas compared to conventional powertrains operating at suboptimal efficiency levels.

Volatile fossil fuel prices drive consumers toward vehicles offering superior fuel economy and lower operating costs. Hybrid powertrains reduce fuel consumption by 20-40% depending on driving conditions and system configuration. Additionally, government incentives including tax rebates and purchase subsidies further improve hybrid vehicle total cost of ownership calculations.

Restraints

High Powertrain Integration and Battery Replacement Costs Limiting Mass Adoption

Hybrid powertrains require significant upfront investment in dual propulsion systems, battery packs, and sophisticated control electronics. Manufacturing costs exceed conventional vehicles by $3,000-$8,000 depending on hybrid system complexity. Therefore, price-sensitive consumers hesitate to pay premium pricing despite long-term fuel savings potential.

Battery pack replacement costs present substantial financial barriers for older hybrid vehicle owners. High-voltage batteries degrade over time and may require replacement costing $2,000-$5,000 after warranty expiration. Moreover, battery disposal and recycling infrastructure remains underdeveloped in many markets, creating environmental concerns.

Complex hybrid architectures integrate mechanical, electrical, and electronic systems requiring specialized diagnostic equipment and technician training. Independent repair shops often lack necessary tools and expertise for hybrid maintenance. Additionally, proprietary control software and component integration increase service complexity and repair costs throughout vehicle lifecycles.

Growth Factors

Expansion of Hybrid Powertrains in Light Commercial and Fleet Vehicles

Fleet operators increasingly adopt hybrid commercial vehicles to reduce total cost of ownership through fuel savings. Delivery vans, shuttle buses, and municipal service vehicles operate in urban environments ideal for hybrid efficiency. Therefore, commercial hybrid deployments accelerate as businesses prioritize sustainability goals and operational cost reductions.

Integration of hybrid systems with advanced driver assistance technologies creates synergistic performance and efficiency improvements. Predictive energy management uses navigation data and traffic information to optimize power source selection. Moreover, autonomous driving features complement hybrid powertrains by smoothing acceleration and braking patterns for maximum regenerative energy capture.

Rising demand for hybrid SUVs and pickup trucks expands market opportunities beyond traditional sedan segments. Consumers desire utility vehicle capabilities combined with improved fuel economy and reduced emissions. Additionally, automakers develop powerful hybrid systems delivering 300+ horsepower while maintaining efficiency, appealing to performance-oriented buyers.

Emerging Trends

Increasing Adoption of Plug-in Hybrid Electric Powertrains Across Premium Segments

Premium automakers prioritize plug-in hybrid technology offering electric-only range exceeding 30-50 miles for daily commuting. Luxury buyers value PHEV capability combining zero-emission driving with unlimited range flexibility. Furthermore, high-voltage architectures enable rapid charging and seamless integration with home energy management systems.

Manufacturers develop compact and lightweight hybrid components to minimize vehicle weight penalties and packaging compromises. Advanced power electronics, high-density batteries, and integrated motor-generator units reduce system mass. Consequently, lighter hybrid powertrains improve overall vehicle dynamics, efficiency, and cargo space compared to earlier generation systems.

Artificial intelligence optimizes energy management by learning individual driving patterns and predicting route requirements. AI-enhanced systems maximize electric operation during suitable conditions while preserving battery capacity for congested areas. Additionally, machine learning algorithms continuously improve efficiency through software updates without requiring hardware modifications.

Regional Analysis

North America Dominates the Hybrid Powertrain Market with a Market Share of 39.6%, Valued at USD 49.6 Billion

North America maintains its position as the global leader in hybrid powertrain adoption, commanding a dominant 39.6% market share valued at USD 49.6 billion. This leadership stems from a convergence of favorable market conditions, including well-established automotive infrastructure, robust manufacturing capabilities, and heightened consumer environmental consciousness. The region’s growth trajectory is significantly bolstered by comprehensive federal and state-level incentive programs, with tax credits reaching up to $7,500 for plug-in hybrid electric vehicles (PHEVs), making sustainable transportation options increasingly accessible to mainstream consumers.

Europe Hybrid Powertrain Market Trends

Europe implements aggressive emission reduction targets through Euro 7 standards and urban low-emission zones. Automakers deploy hybrid systems extensively to meet 95g CO2/km fleet average requirements. Additionally, high fuel prices and dense urban populations create favorable conditions for hybrid vehicle adoption across passenger and commercial segments.

Asia Pacific Hybrid Powertrain Market Trends

Asia Pacific experiences rapid hybrid market growth led by Japan’s technological leadership and China’s electrification policies. Japanese manufacturers pioneered mass-market hybrid vehicles and continue innovation in powertrain efficiency. Furthermore, emerging economies including India and Southeast Asian nations adopt hybrid technology for urban air quality improvement.

Middle East & Africa Hybrid Powertrain Market Trends

Middle East and Africa show gradual hybrid adoption focused on premium vehicle segments and government fleet modernization. Gulf Cooperation Council nations diversify transportation sectors beyond petroleum dependency. Moreover, South African market regulations increasingly favor lower-emission vehicles, stimulating hybrid powertrain interest among urban consumers.

Latin America Hybrid Powertrain Market Trends

Latin America develops hybrid markets through imported vehicles and regional manufacturing initiatives. Brazil leads adoption with flex-fuel hybrid systems combining ethanol capability with electric propulsion. Additionally, Mexico serves as manufacturing hub for hybrid vehicles exported to North American markets while developing domestic demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Toyota Motor Corporation maintains global hybrid powertrain leadership through decades of technological refinement and mass-market deployment. The company pioneered reliable hybrid systems achieving millions of units in production. Moreover, Toyota continuously advances battery technology and electric motor efficiency while expanding hybrid availability across entire vehicle lineups globally.

Honda Motor Co., Ltd. develops innovative two-motor hybrid systems delivering seamless transitions between electric and combustion operation. Honda’s intelligent Multi-Mode Drive technology optimizes performance across diverse driving conditions. Additionally, the company integrates hybrid powertrains in popular models including Accord, CR-V, and Civic, strengthening market position through proven reliability.

Ford Motor Company accelerates hybrid offerings across truck, SUV, and commercial vehicle segments popular with American consumers. Ford’s PowerBoost hybrid delivers class-leading towing capacity while improving fuel economy significantly. Furthermore, the company invests heavily in electrified powertrain development for F-Series trucks and Transit vans serving commercial fleets nationwide.

Hyundai Motor Company advances next-generation hybrid systems featuring modular architectures scalable across vehicle segments. Hyundai’s turbocharged hybrid powertrains combine performance with efficiency in competitive pricing structures. Moreover, the company’s partnership with Kia enables shared technology development reducing costs while accelerating innovation in electrified drivetrains.

Key players

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Ford Motor Company

- Hyundai Motor Company

- General Motors Company

- Volkswagen Group

- BMW AG

- Daimler AG

- Subaru Corporation

- Porsche AG

Recent Developments

- December 2024 – Aramco completed acquisition of 10% stake in Horse Powertrain Limited, strengthening strategic partnerships in advanced powertrain technology development and supporting global automotive electrification initiatives.

- January 2026 – Cummins announced acquisition of Efficient Drivetrains Inc., expanding capabilities in electric and hybrid powertrain systems for commercial vehicle applications including school bus electrification programs across North America.

Report Scope

Report Features Description Market Value (2025) USD 125.4 Billion Forecast Revenue (2035) USD 485.7 Billion CAGR (2026-2035) 14.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Type (Full Hybrid (HEV), Mild Hybrid (MHEV), Plug-In Hybrid (PHEV)), Vehicle Type (Passenger Cars, Commercial Vehicles), Sales Channel (OEM Sales, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Toyota Motor Corporation, Honda Motor Co., Ltd., Ford Motor Company, Hyundai Motor Company, General Motors Company, Volkswagen Group, BMW AG, Daimler AG, Subaru Corporation, Porsche AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Toyota Motor Corporation

- Honda Motor Co., Ltd.

- Ford Motor Company

- Hyundai Motor Company

- General Motors Company

- Volkswagen Group

- BMW AG

- Daimler AG

- Subaru Corporation

- Porsche AG