Global Humanitarian Logistics Market Size, Share, Growth Analysis By Service Type (Transportation, Warehousing, Inventory Management, Procurement, Others), By Mode of Transportation (Road, Air, Sea, Rail), By Application (Disaster Relief, Refugee Assistance, Health Emergencies, Food Aid, Others), By End User (Government Agencies, NGOs, International Organizations, Military, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177146

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

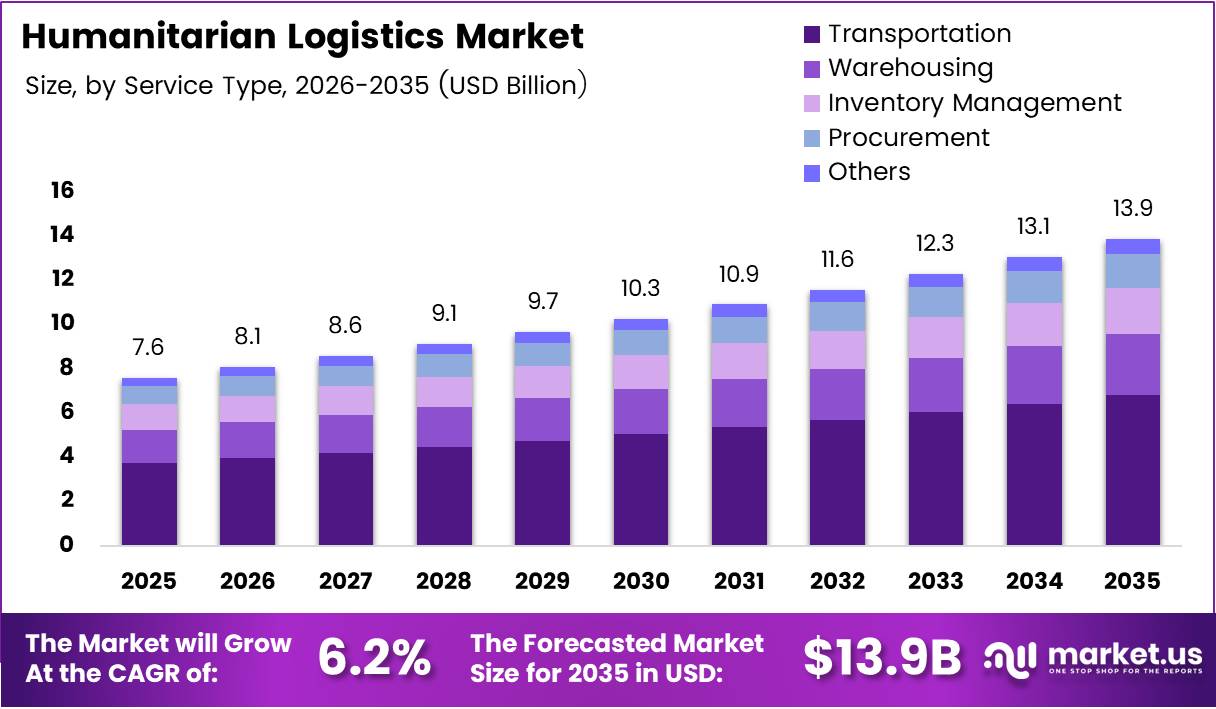

Global Humanitarian Logistics Market size is expected to be worth around USD 13.9 Billion by 2035 from USD 7.6 Billion in 2025, growing at a CAGR of 6.2% during the forecast period 2026 to 2035.

Humanitarian logistics encompasses specialized supply chain operations that deliver critical aid during emergencies and crises. Organizations coordinate transportation, warehousing, procurement, and distribution of relief supplies to affected populations. Therefore, this sector forms the operational backbone of global disaster response and humanitarian assistance programs worldwide.

Climate-driven disasters accelerate demand for rapid response capabilities across vulnerable regions. Governments and international agencies invest heavily in disaster-ready infrastructure and emergency preparedness systems. Consequently, the market experiences sustained expansion driven by increasing crisis frequency and operational complexity requirements.

Technology integration transforms traditional humanitarian supply chain models through digital innovation. Real-time tracking systems and predictive analytics enable optimized resource allocation and delivery efficiency. Moreover, artificial intelligence enhances forecasting accuracy and pre-positioning strategies for emergency inventory management.

Public-private partnerships strengthen infrastructure development and response capabilities across disaster-prone markets. Collaborative frameworks between agencies, NGOs, and logistics providers improve scalability and operational effectiveness. Additionally, these alliances facilitate knowledge transfer and resource sharing during large-scale humanitarian operations.

In August 2025, the US State Department announced US$93 million in funding for UNICEF to provide emergency food aid to nearly a million children, addressing disruptions in global nutrition supply chains. This investment reflects growing government commitment to strengthening humanitarian logistics infrastructure and response mechanisms.

According to HELP Logistics, mobile devices are used or piloted by 88% of humanitarian organizations in logistics operations, demonstrating widespread digital adoption in field deployments. This technology penetration enables real-time communication and coordination during crisis response activities.

According to HELP Logistics, cloud computing is used or piloted by 71% of humanitarian supply chain organizations, reflecting infrastructure modernization trends across the sector. Cloud platforms facilitate data sharing, collaboration, and centralized management of distributed logistics networks during emergency operations.

Key Takeaways

- Global Humanitarian Logistics Market projected to reach USD 13.9 Billion by 2035 from USD 7.6 Billion in 2025

- Market expected to grow at 6.2% CAGR during forecast period 2026-2035

- Transportation segment dominates By Service Type with 49.8% market share in 2025

- Road transportation leads By Mode of Transportation segment holding 48.2% share

- Disaster Relief application accounts for 44.7% share in By Application segment

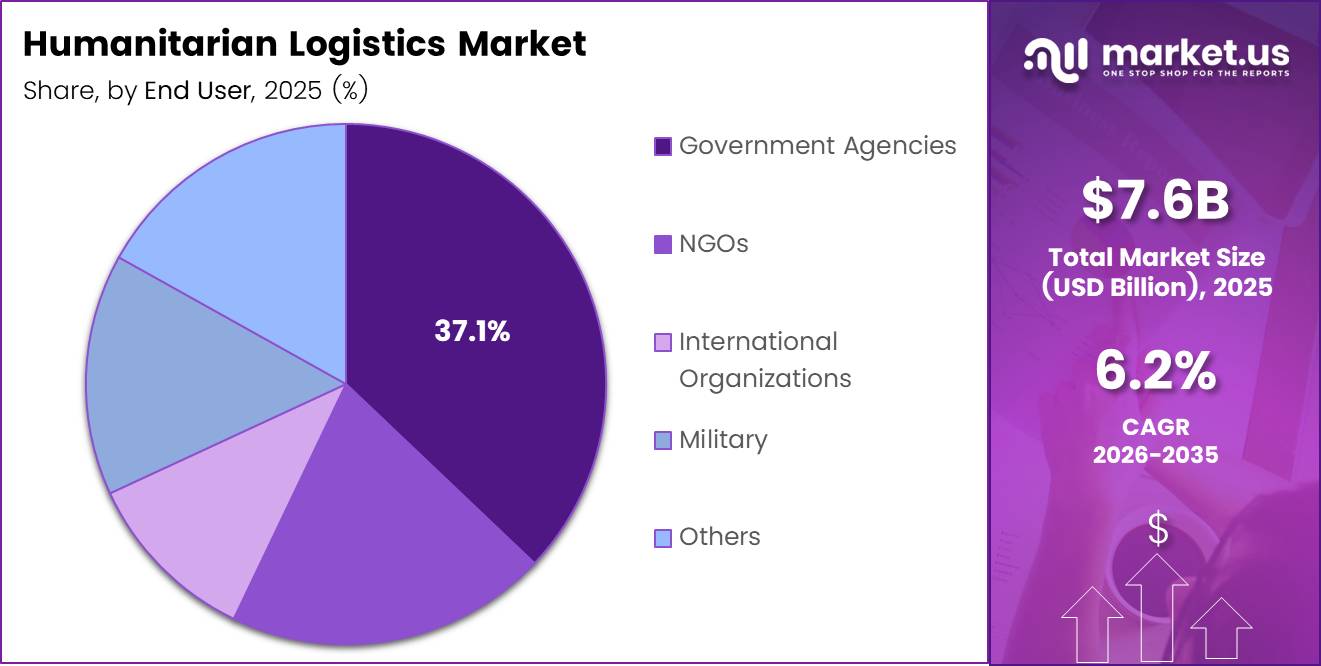

- Government Agencies represent 37.1% of By End User segment

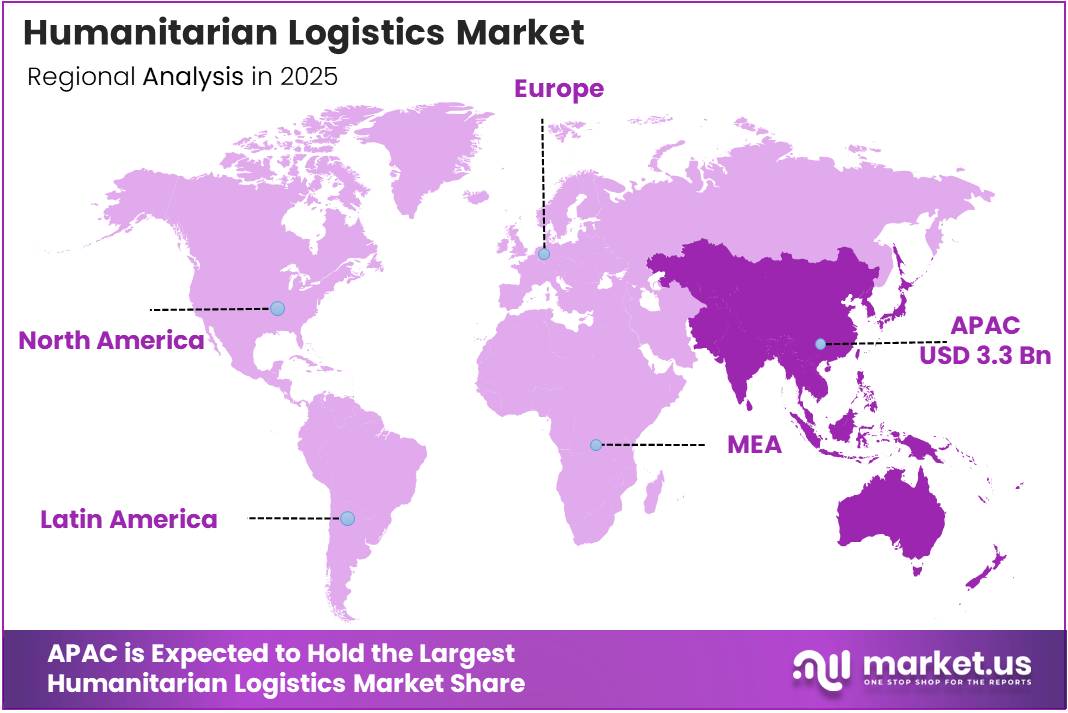

- Asia Pacific region dominates market with 43.8% share valued at USD 3.3 Billion

Service Type Analysis

Transportation dominates with 49.8% due to critical role in rapid emergency aid delivery.

In 2025, Transportation held a dominant market position in the By Service Type segment of Humanitarian Logistics Market, with a 49.8% share. This segment leads because moving relief supplies quickly across disaster zones remains the fundamental priority during crisis response. Organizations prioritize fleet deployment and route optimization to ensure timely aid distribution under challenging conditions.

Warehousing services provide essential storage infrastructure for pre-positioned emergency supplies and disaster-ready inventory stockpiles. Strategic warehouse placement near vulnerable regions reduces response times and enables immediate deployment when crises emerge. Additionally, temperature-controlled facilities support medical supplies and perishable food aid requiring specialized storage conditions.

Inventory Management optimizes stock levels and ensures availability of critical supplies during emergency operations. Advanced tracking systems monitor consumption patterns and automate replenishment processes for sustained relief efforts. Moreover, digital platforms enable real-time visibility across distributed inventory networks supporting coordinated multi-agency responses.

Procurement operations secure essential supplies through global sourcing networks and vendor partnerships during humanitarian missions. Organizations leverage competitive bidding and framework agreements to maximize resource efficiency under budget constraints. Furthermore, local procurement strategies strengthen community engagement while reducing transportation costs and delivery timeframes.

Mode of Transportation Analysis

Road dominates with 48.2% due to flexibility and accessibility in diverse terrain conditions.

In 2025, Road held a dominant market position in the By Mode of Transportation segment of Humanitarian Logistics Market, with a 48.2% share. Trucks and ground vehicles reach remote locations and navigate damaged infrastructure more effectively than alternative transport methods. Therefore, road networks remain the primary distribution channel for last-mile delivery in most humanitarian operations.

Air transportation enables rapid deployment of emergency supplies to isolated regions and disaster zones with infrastructure collapse. Aircraft deliver time-sensitive medical equipment, personnel, and relief materials when ground access becomes impossible. Additionally, helicopter operations support precision drops and evacuations in geographically challenging environments.

Sea freight handles bulk shipments of food aid, construction materials, and large-volume relief supplies for sustained operations. Maritime routes offer cost-effective solutions for transporting heavy cargo to coastal regions and island nations. Moreover, vessel-based logistics support long-term reconstruction efforts following major disasters.

Rail systems provide efficient mass transportation of humanitarian supplies across continental networks where infrastructure remains operational. Trains move large quantities of aid materials with lower environmental impact compared to road transport. Furthermore, rail corridors facilitate predictable delivery schedules for planned relief distribution programs.

Application Analysis

Disaster Relief dominates with 44.7% due to increasing frequency of climate-driven emergencies worldwide.

In 2025, Disaster Relief held a dominant market position in the By Application segment of Humanitarian Logistics Market, with a 44.7% share. Natural disasters including floods, earthquakes, hurricanes, and wildfires generate immediate demand for coordinated emergency response operations. Consequently, organizations maintain dedicated logistics capabilities specifically designed for rapid disaster deployment and crisis management.

Refugee Assistance provides ongoing logistical support for displaced populations requiring shelter, food, medical care, and essential services. Long-term operations demand sustainable supply chains that adapt to evolving needs within refugee camps and settlement areas. Additionally, integration programs require specialized distribution networks supporting education, livelihood, and community development initiatives.

Health Emergencies drive specialized logistics for medical supply distribution, vaccine delivery, and disease outbreak response coordination. Cold chain management and pharmaceutical transportation require stringent protocols ensuring product integrity throughout distribution networks. Moreover, pandemic preparedness programs necessitate scalable infrastructure supporting surge capacity during health crises.

Food Aid operations deliver nutritional assistance to famine-affected regions and food-insecure populations through structured distribution programs. Organizations coordinate bulk procurement, storage, and last-mile delivery ensuring efficient resource utilization and minimal wastage. Furthermore, nutrition programs require specialized handling for therapeutic foods and supplementary feeding supplies.

End User Analysis

Government Agencies dominate with 37.1% due to primary responsibility for national disaster response coordination.

In 2025, Government Agencies held a dominant market position in the By End User segment of Humanitarian Logistics Market, with a 37.1% share. National governments deploy extensive logistics infrastructure for civil defense, emergency management, and public safety operations during crises. Therefore, public sector entities represent the largest single category of humanitarian logistics service consumers worldwide.

NGOs operate extensive field networks delivering targeted humanitarian assistance through specialized programs and community-based interventions. These organizations leverage flexible logistics models adapting quickly to changing crisis conditions and beneficiary needs. Additionally, NGO partnerships enable localized distribution reaching underserved populations in remote areas.

International Organizations including United Nations agencies coordinate large-scale multilateral responses requiring integrated global supply chain management. These entities establish standardized protocols and shared logistics platforms supporting collaborative emergency operations. Moreover, international frameworks facilitate cross-border coordination and resource pooling during complex humanitarian emergencies.

Military forces provide strategic airlift capacity, engineering support, and security enabling logistics operations in conflict zones and high-risk environments. Armed forces deploy specialized assets including helicopters, transport aircraft, and field hospitals during disaster response missions. Furthermore, military logistics expertise supports infrastructure repair and supply route establishment in damaged areas.

Key Market Segments

By Service Type

- Transportation

- Warehousing

- Inventory Management

- Procurement

- Others

By Mode of Transportation

- Road

- Air

- Sea

- Rail

By Application

- Disaster Relief

- Refugee Assistance

- Health Emergencies

- Food Aid

- Others

By End User

- Government Agencies

- NGOs

- International Organizations

- Military

- Others

Drivers

Rising Frequency and Severity of Climate-Driven Disasters Increasing Demand for Rapid Humanitarian Supply Chain Deployment

Climate change accelerates the occurrence of extreme weather events including floods, droughts, hurricanes, and wildfires globally. These disasters create immediate demand for coordinated emergency logistics deploying relief supplies, medical assistance, and shelter materials rapidly. Consequently, humanitarian organizations expand operational capacity and pre-positioning strategies to maintain effective response readiness across vulnerable regions.

According to HELP Logistics, around 88% of respondents confirmed digital transformation improved operational performance in humanitarian supply chains. This widespread performance enhancement demonstrates how technology adoption strengthens disaster response effectiveness and delivery speed. Therefore, organizations increasingly invest in digital tools supporting real-time coordination during climate-driven emergencies.

In February 2025, DHL Group and the UN’s International Organization for Migration forged a global partnership to enhance humanitarian logistics and lifesaving aid projects worldwide. This collaboration reflects growing recognition that climate impacts require strengthened public-private coordination mechanisms. Moreover, such partnerships enable knowledge sharing and resource mobilization supporting scalable emergency response infrastructure development.

Restraints

Severe Infrastructure Damage and Transportation Network Disruptions in Disaster Zones Limiting Aid Distribution Speed

Natural disasters frequently destroy roads, bridges, ports, and airports creating immediate obstacles for humanitarian supply chain operations. Transportation network collapse forces organizations to deploy alternative delivery methods including air drops and off-road vehicles increasing costs. Additionally, damaged infrastructure extends delivery timeframes compromising the effectiveness of time-sensitive emergency assistance programs.

According to HELP Logistics, 54% of organizations cite insufficient IT infrastructure as the biggest digital transformation barrier in humanitarian logistics. This technology gap limits real-time tracking capabilities and coordination effectiveness during crisis response operations. Moreover, inadequate digital infrastructure restricts data sharing across distributed networks hampering collaborative decision-making processes.

According to HELP Logistics, 44% of organizations cite funding shortages as a major barrier to logistics digitalization, while an equal 44% cite lack of trained personnel as adoption obstacles. These resource constraints prevent organizations from implementing advanced technologies that could enhance operational efficiency and response speed significantly.

Growth Factors

Technological Advancements Accelerate Market Expansion Through Enhanced Operational Efficiency and Resource Optimization

Artificial intelligence and predictive analytics enable organizations to forecast disaster impacts and pre-position emergency supplies strategically. Real-time tracking systems provide end-to-end visibility across supply chains improving resource allocation and reducing delivery delays. Therefore, technology integration drives operational efficiency gains that strengthen organizational capacity for managing complex humanitarian operations.

According to sector surveys, over 80% of organizations reported stronger supply chain performance due to improved tools and processes. This performance improvement demonstrates measurable benefits from technology adoption and process optimization initiatives. Consequently, digital transformation investments continue expanding as organizations seek competitive advantages in emergency response capabilities.

According to WFP, corridors delivered about 63% of total procured humanitarian food volume, approximately 1.9 million metric tons, through structured logistics corridors. These organized pathways demonstrate how systematic infrastructure planning enhances distribution efficiency for large-scale relief operations. Moreover, corridor models enable standardized processes reducing operational complexity across multiple deployment locations.

In July 2025, the International Organization for Migration launched a new supply chain hub in Thessaloniki, Greece, to boost global humanitarian response efficiency through automation and real-time tracking. This facility expansion reflects ongoing infrastructure investments strengthening organizational capacity for managing increased demand during humanitarian emergencies.

Emerging Trends

Digital Transformation Reshapes Market Landscape Through Collaborative Platforms and Predictive Technologies

Predictive analytics and AI-based disaster forecasting enable organizations to anticipate crisis impacts and optimize pre-positioned inventory planning. These advanced systems analyze weather patterns, demographic data, and historical trends identifying high-risk regions requiring enhanced preparedness. Therefore, proactive positioning reduces response times when disasters strike improving aid delivery effectiveness significantly.

Multi-agency digital supply chain coordination platforms facilitate real-time information sharing and collaborative decision-making during complex emergencies. These integrated systems connect governments, NGOs, international organizations, and logistics providers enabling synchronized response efforts. Additionally, standardized data formats improve interoperability across diverse organizational systems strengthening overall coordination effectiveness.

According to WFP, the organization supported 1,600 partner organizations with supply chain services through logistics networks and hubs. This extensive collaboration demonstrates growing ecosystem connectivity enabling resource sharing and operational coordination. Moreover, platform-based partnerships reduce duplication while maximizing collective impact during humanitarian operations.

In August 2025, DHL Group launched the DHL Academy of Humanitarian Logistics as part of its GoHelp program’s 20th anniversary, aiming to enhance local capabilities in disaster response. This capacity-building initiative reflects increasing emphasis on knowledge transfer and professional development strengthening sector-wide operational standards.

Regional Analysis

Asia Pacific Dominates the Humanitarian Logistics Market with a Market Share of 43.8%, Valued at USD 3.3 Billion

Asia Pacific demonstrates the highest regional demand driven by frequent natural disasters, dense populations, and extensive geographic vulnerability to climate impacts. The region experiences regular cyclones, earthquakes, floods, and tsunamis requiring substantial humanitarian logistics infrastructure and operational capacity. Moreover, 43.8% market share reflects concentrated investment in emergency preparedness systems valued at USD 3.3 Billion supporting disaster-prone communities across multiple countries.

North America Humanitarian Logistics Market Trends

North America maintains advanced disaster response infrastructure supported by substantial government funding and private sector participation in emergency management. Hurricane-prone coastal regions and wildfire-affected areas drive ongoing investment in pre-positioned supplies and rapid deployment capabilities. Additionally, technology leadership enables innovation in predictive analytics and autonomous delivery systems enhancing operational effectiveness.

Europe Humanitarian Logistics Market Trends

Europe coordinates multilateral humanitarian operations through established international organizations and regional cooperation frameworks supporting global relief efforts. The region serves as a strategic hub for supply chain coordination, warehousing, and donor coordination activities. Furthermore, European agencies prioritize sustainability initiatives incorporating green logistics practices into humanitarian operations.

Latin America Humanitarian Logistics Market Trends

Latin America faces recurring challenges from hurricanes, earthquakes, floods, and volcanic activity requiring robust emergency response systems. Regional organizations collaborate on cross-border coordination improving resource sharing during large-scale disasters. Moreover, localization strategies strengthen community-based logistics networks reducing dependency on international support.

Middle East & Africa Humanitarian Logistics Market Trends

Middle East and Africa regions experience complex humanitarian challenges including conflict-driven displacement, food insecurity, and climate-related disasters. Organizations operate extensive refugee assistance programs requiring sustained logistics support and infrastructure development. Additionally, health emergency responses including disease outbreak management drive specialized medical supply chain capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Kuehne + Nagel International AG operates global logistics networks providing comprehensive humanitarian supply chain solutions including emergency warehousing and transportation management. The company leverages advanced technology platforms enabling real-time tracking and coordinated multi-modal delivery across disaster-affected regions. Moreover, their established infrastructure supports rapid scalability during large-scale humanitarian emergencies requiring immediate response capabilities.

Deutsche Post DHL Group maintains dedicated humanitarian logistics divisions supporting international organizations, NGOs, and government agencies through specialized emergency response services. The company’s GoHelp program has delivered decades of disaster relief expertise strengthening operational partnerships worldwide. Additionally, DHL invests in capacity-building initiatives including training programs that enhance local disaster response capabilities across vulnerable regions.

DB Schenker provides integrated logistics solutions supporting humanitarian operations through comprehensive transportation, warehousing, and supply chain management services. The company’s global network enables efficient coordination of relief supplies across multiple regions during complex emergencies. Furthermore, DB Schenker collaborates with international agencies optimizing delivery efficiency and reducing operational costs through strategic partnerships.

CEVA Logistics delivers specialized project logistics capabilities supporting infrastructure development and large-scale humanitarian assistance programs in challenging environments. The company’s expertise in heavy cargo handling and complex supply chain coordination strengthens operational effectiveness during reconstruction efforts. Moreover, CEVA’s recent expansion through strategic acquisitions enhances service capabilities across diverse humanitarian logistics requirements.

Key players

- Kuehne + Nagel International AG

- Deutsche Post DHL Group

- DB Schenker

- CEVA Logistics

- Agility Logistics

- FedEx Corporation

- UPS (United Parcel Service)

- Maersk Group

- DHL Supply Chain & Global Forwarding

- Bolloré Logistics

- DSV Panalpina A/S

Recent Developments

- July 2025 – Culmen International announced expanded operations in health security and international logistics through the acquisition of TMC Global Professional Services, strengthening humanitarian response capabilities across global markets.

- March 2025 – Scan Global Logistics mentioned in its 2024 annual report the onboarding of new personnel following the acquisition of ITN, strengthening operations in Canada and enhancing North American humanitarian logistics infrastructure.

- December 2025 – CEVA Logistics signed a deal to acquire 100% of Fagioli Holding S.p.A. and its affiliates, enhancing project logistics capabilities supporting large-scale humanitarian infrastructure development and complex cargo operations.

- November 2024 – The World Food Programme launched its 2025 Global Outlook, calling for US$16.9 billion in funding to address food needs for 123 million people, highlighting massive operational scale requirements driving humanitarian logistics demand worldwide.

Report Scope

Report Features Description Market Value (2025) USD 7.6 Billion Forecast Revenue (2035) USD 13.9 Billion CAGR (2026-2035) 6.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Transportation, Warehousing, Inventory Management, Procurement, Others), By Mode of Transportation (Road, Air, Sea, Rail), By Application (Disaster Relief, Refugee Assistance, Health Emergencies, Food Aid, Others), By End User (Government Agencies, NGOs, International Organizations, Military, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Kuehne + Nagel International AG, Deutsche Post DHL Group, DB Schenker, CEVA Logistics, Agility Logistics, FedEx Corporation, UPS (United Parcel Service), Maersk Group, DHL Supply Chain & Global Forwarding, Bolloré Logistics, DSV Panalpina A/S Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Humanitarian Logistics MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Humanitarian Logistics MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Kuehne + Nagel International AG

- Deutsche Post DHL Group

- DB Schenker

- CEVA Logistics

- Agility Logistics

- FedEx Corporation

- UPS (United Parcel Service)

- Maersk Group

- DHL Supply Chain & Global Forwarding

- Bolloré Logistics

- DSV Panalpina A/S